Wi-Fi 6 Market by (Wireless Access Points, Mesh Routers, Home Gateways, Wireless Controllers, System on Chip), Applications (Immersive, HD Video Streaming, Smart Devices, Industry 4.0, Telemedicine, Public Wi-Fi & Dense Environments) – Forecast to 2030

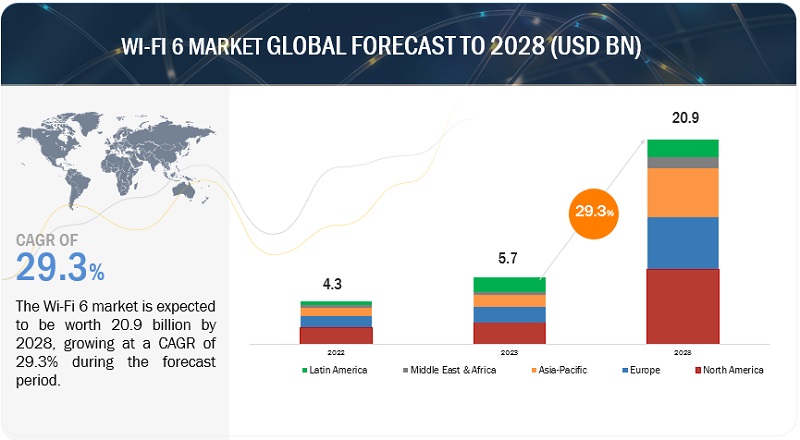

[298 Pages Report] The Wi-Fi 6 market is estimated at USD 5.7 billion in 2023 to USD 20.9 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 29.3%. One of the major factors driving the growth of the Wi-Fi 6 market is the growing popularity of smart homes, cloud computing, and virtual reality. Also, the emergence of the Internet of Things (IoT) and the implementation of smart office technologies require robust and reliable wireless connectivity. Wi-Fi 6's ability to handle numerous IoT devices simultaneously positions it as an essential enabler for IoT-driven business innovations.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Wi-Fi 6 Market Dynamics

Driver: Rise in the adoption of IoT devices

IoT uses embedded technology to allow objects to perceive their surroundings, such as pressure, humidity, temperature, and motion. It works with network technologies to connect IoT devices and the cloud to transfer data as needed. This market is important for connecting things, and it has become a widely accepted standard of connectivity in a variety of physical contexts, including homes, businesses, schools, hospitals, and airports. Wireless Broadband Alliance (WBA) has recently revealed a survey stating that eighty three percent of service providers and equipment manufacturers and enterprises worldwide will have deployed Wi-Fi 6/6E or plan to do so before the end of 2022.

Restraint: Contention loss and co-channel interference

Wi-Fi 6, a cutting-edge wireless networking standard (also known as 802.11ax), the organizations face two critical factors impacting network performance and efficiency that includes: contention loss and co-channel interference. Contention loss arises when multiple devices compete for access to the same channel, resulting in data collisions and subsequent retransmissions, leading to increased latency and reduced overall network throughput. And, co-channel interference, emerges when multiple access points in the vicinity employ the same channel, resulting in overlapping signals and performance degradation. In busy environments or crowded areas, this interference can be especially detrimental to network efficiency.

Opportunity: Increasing deployment of public Wi-Fi

The growing proliferation and widespread adoption of public Wi-Fi networks in various business and commercial settings present a lucrative opportunity for enterprises to leverage Wi-Fi 6 (802.11ax) technology. As the demand for seamless connectivity and high-speed internet continues to rise, businesses recognize the need to cater to their customers and patrons with reliable, efficient, and secure wireless networks. Wi-Fi 6’s advanced features, including Orthogonal Frequency Division Multiple Access (OFDMA) and Multi-User Multiple Input Multiple Output (MU-MIMO), enable enterprises to accommodate numerous devices concurrently while maintaining optimal performance and reducing latency. Furthermore, businesses are seeking robust and scalable wireless solutions with the ever-expanding Internet of Things (IoT) ecosystem and the rise of smart cities. Wi-Fi 6's ability to handle massive IoT deployments positions it as the preferred choice for enterprises aiming to provide cutting-edge IoT services and applications in public spaces.

Challenge: Data security and privacy concerns

Data security and privacy concerns pose significant challenges that require proactive measures. One of the primary challenges is the potential for unauthorized access to sensitive information. Without proper encryption and authentication protocols, hackers can intercept and exploit data transmitted over Wifi networks, leading to data breaches and financial losses. Moreover, the proliferation of Internet of Things (IoT) devices in business environments introduces additional vulnerabilities, as these devices may lack robust security measures and can serve as entry points for cyber attackers. In this scenario, Wi-Fi solutions and associated services offer secure, reliable, high–speed internet access. Any disruption to enterprise processes can significantly affect the entire business. As a result, several enterprises are reluctant to adopt Wi-Fi solutions and services. Hence, proper security and privacy are needed to successfully deploy Wi-Fi solutions and associated services. The factors mentioned above are some of the major challenges that may affect the market’s growth.

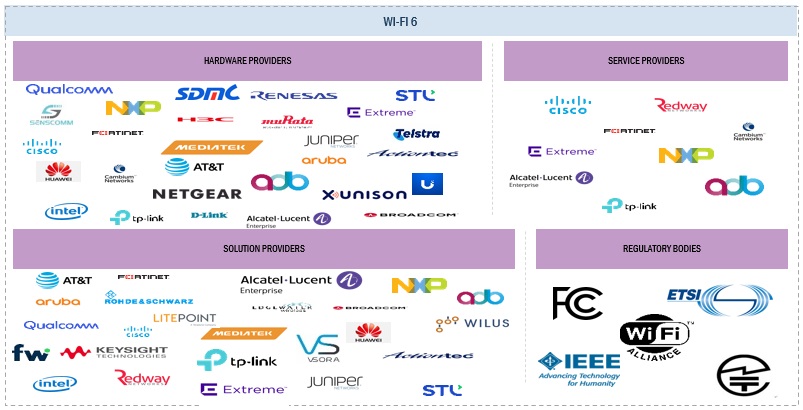

Wi-Fi 6 Market Ecosystem

Prominent companies in this market include well-established, financially stable Wi-Fi 6 hardware providers, solutions, services providers, and regulatory bodies. These companies have been operating in the market for several years and possess a diversified product portfolio and state-of-the-art technologies. Prominent companies in this market include Qualcomm (US), NXP (Netherlands), AT&T (US), and STL (India).

By vertical, the educated segment to hold the largest market size during the forecast period

Educational institutions will likely experience an influx of new wireless devices faster than any other sector. With students returning to schools, colleges, and universities, institutions need to be prepared to handle hundreds or even thousands of new devices in addition to all legacy devices. Wi-Fi 6 can significantly improve indoor and outdoor Wi-Fi performance, which benefits schools with a desire to offer excellent wireless connections. The demand for reliable and secure internet access has increased, especially with the advent of eLearning and online exam practices. Wi-Fi 6 solutions and services empower students and staff members to access the internet from diverse devices and locations. Moreover, Wi-Fi 6 caters to the increasing connectivity requirements of expanding online education, learning activities, and business operations.

By location type, the outdoor segment is expected to register the fastest growth rate during the forecast period.

The outdoor Wi-Fi 6 solution is when Wi-Fi access is provided outside of a building. Outdoor Wi-Fi 6 is usually used as an extension of the internal WLAN network of an organization to give users a continuous Wi-Fi 6 service. Scenarios for outdoor Wi-Fi 6 include the outdoor areas of a school, college, university, holiday park, hospital, hotel, or shopping center. Outdoor Wi-Fi 6 operates in the 2.4 or 5GHz frequency and can achieve theoretical throughputs of up to 1.7Gbps – true throughputs depend on client devices and the quality of WAP. Outdoor APs are often deployed with sectored antennas focusing on the wireless coverage of a specific area, thus providing a stronger and faster Wi-Fi 6 connection.

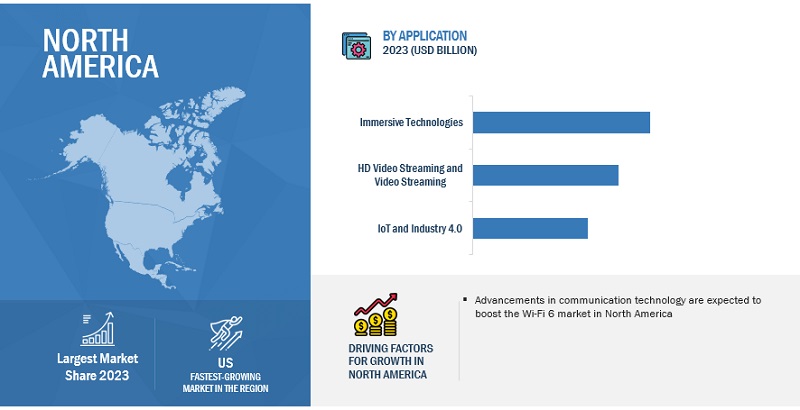

North America is expected to hold the largest market size during the forecast period

North America is expected to dominate the Wi-Fi 6 market and continue to do so for the forecast period. It is due to its expanding start-up culture, aided by establishing SMEs and expanding large corporations' R&D efforts. Using integrated enterprises and business solutions drives North America’s growth, offering significantly more flexible and agile business processes and operations.

Market Players:

The major players in the Wi-Fi 6 market are Cisco Systems Inc. (US), Qualcomm Technologies Inc. (US), Broadcom Inc (US), Intel Corporation (US), Huawei technologies (China), NETGEAR Inc (US), Juniper Networks Inc (US), Extreme Networks Inc. (US), Ubiquiti Inc. (US), Fortinet Inc. (US), Aruba Networks (US), NXP Semiconductors (Netherlands), AT&T (US), D–Link Corporation (Taiwan), Alcatel Lucent Enterprise (France), TP–Link Corporation Limited (China), MediaTek Inc. (Taiwan), Telstra (Australia), Murata Manufacturing Co., Ltd. (Japan), Sterlite Technologies Limited (India), Renesas Electronics (Japan), H3C Technologies Co., Ltd. (China), Keysight Technologies (US), LitePoint (US), Rohde & Schwarz (Germany), Cambium Networks, Ltd. (US), Senscomm Semiconductors Co., Ltd. (China), XUNISON (Ireland), Redway Networks Ltd. Company (England), VSORA SAS (France), WILUS Inc. (South Korea), Federated Wireless, Inc. (US), Actiontec Electronics (US), ADB Global (Switzerland), SDMC Technology (China), and Edgewater Wireless (Canada). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their footprint in the Wi-Fi 6 market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Billion |

|

Segments covered |

Offering (Hardware, Solutions, and Services), Location Type, Application, Vertical, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. |

|

Companies covered |

Cisco Systems Inc. (US), Qualcomm Technologies Inc. (US), Broadcom Inc (US), Intel Corporation (US), Huawei technologies (China), NETGEAR Inc (US), Juniper Networks Inc (US), Extreme Networks Inc. (US), Ubiquiti Inc. (US), Fortinet Inc. (US), Aruba Networks (US), NXP Semiconductors (Netherlands), AT&T (US), D–Link Corporation (Taiwan), Alcatel Lucent Enterprise (France), TP–Link Corporation Limited (China), MediaTek Inc. (Taiwan), Telstra (Australia), Murata Manufacturing Co., Ltd. (Japan), Sterlite Technologies Limited (India), Renesas Electronics (Japan), H3C Technologies Co., Ltd. (China), Keysight Technologies (US), LitePoint (US), Rohde & Schwarz (Germany), Cambium Networks, Ltd. (US), Senscomm Semiconductors Co., Ltd. (China), XUNISON (Ireland), Redway Networks Ltd. Company (England), VSORA SAS (France), WILUS Inc. (South Korea), Federated Wireless, Inc. (US), Actiontec Electronics (US), ADB Global (Switzerland), SDMC Technology (China), and Edgewater Wireless (Canada). |

This research report categorizes the Wi-Fi 6 market to forecast revenues and analyze trends in each of the following submarkets:

Based on Offering:

-

Hardware

- Wireless Access Points

- Mesh Routers

- Home Gateways

- Wireless Controllers

- System on Chip

- Other Hardware

- Solutions

-

Services

-

Professional Services

- Consulting

- Deployment & Integration

- Support & Maintenance

- Managed Services

-

Professional Services

Based on Location Type:

- Indoor

- Outdoor

Based on Application:

- Immersive Technologies

- HD Video Streaming and Video Streaming

- Smart Home Devices

- IoT and Industry 4.0

- Telemedicine

- Public Wi-Fi and Dense Environments

- Other Applications

Based on Vertical:

- Retail and Ecommerce

- Government and Public Sector

- Manufacturing

- Media and Entertainment

- Healthcare and Life Sciences

- Transportation and Logistics

- Travel and Hospitality

- Education

- Residential

- Other Verticals

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia and New Zealand

- South Korea

- Southeast Asia

- Rest of Asia Pacific

-

Middle East & Africa

- KSA

- UAE

- South Africa

- Rest of Middle East

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In April 2023, Halford partnered with Juniper Networks to provide AI-driven wired and wireless access solutions in its stores, garages, and offices.

- In February 2023, Cisco and Federated Wireless collaborated to integrate Automated Frequency Coordination (AFC) solution into its wireless 6 GHz-capable access points.

- In December 2022, Skyworks partnered with Broadcom to deliver power efficiency for Wi-Fi 6/6E devices.

Frequently Asked Questions (FAQ):

What is the definition of the Wi-Fi 6 market?

What is the market size of the Wi-Fi 6 market?

The Wi-Fi 6 market is estimated at USD 5.7 billion in 2023 and is projected to reach USD 20.9 billion by 2028, at a CAGR of 29.3% from 2023 to 2028.

What are the major drivers in the Wi-Fi 6 market?

The major drivers in Wi-Fi 6 market are the rising adoption of the increasing number of internet users, the rise in the adoption of IoT devices, and the growing need for faster and more secure networks.

Who are the key players operating in the Wi-Fi 6 market?

The key market players profiled in the Wi-Fi 6 market are Cisco Systems Inc. (US), Qualcomm Technologies Inc. (US), Broadcom Inc (US), Intel Corporation (US), Huawei technologies (China), NETGEAR Inc (US), Juniper Networks Inc (US), Extreme Networks Inc. (US), Ubiquiti Inc. (US), Fortinet Inc. (US), Aruba Networks (US), NXP Semiconductors (Netherlands), AT&T (US), D–Link Corporation (Taiwan), Alcatel Lucent Enterprise (France), TP–Link Corporation Limited (China), MediaTek Inc. (Taiwan), Telstra (Australia), Murata Manufacturing Co.

What are the key technology trends prevailing in Wi-Fi 6 market?

The integration of Wi-Fi 6 with Target Wake Time (TWT), Orthogonal frequency-division multiple access (OFDMA), and Multi-link operation for advanced data analytics and predictive insights.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing number of internet users- Rising adoption of IoT devices- Growing need for faster and secure networkRESTRAINTS- Contention loss and co-channel interferenceOPPORTUNITIES- Increasing deployment of public Wi-FiCHALLENGES- Data security and privacy concerns

-

5.3 INDUSTRY TRENDSBRIEF HISTORY OF WI-FI 6 TECHNOLOGY- Brief history of Wi-Fi 6 technologyECOSYSTEM/MARKET MAPCASE STUDY ANALYSIS- Case study 1: Southstar Drug improved performance of real-time applications with Huawei Wi-Fi 6- Case study 2: BEXCO utilized Cisco DNA Assurance and Wi-Fi 6 for high-speed wireless service- Case study 3: Vestavia Hills City Schools adopted Aruba Networks’ Wi-Fi 6 solutions to enable learning without limits- Case study 4: Fujitsu deployed Broadcom’s Wi-Fi 6 solution for smooth wireless network experienceVALUE CHAIN ANALYSIS- Government regulatory authorities- Wi-Fi solution providers- Service providers- System Integrators (SIs)- Original Equipment Manufacturers (OEMs)- Customer Premises Equipment (CPE)/connectivity hardware providers- Mobile Network Operators (MNOs)REGULATORY LANDSCAPE- REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America- Europe- Asia Pacific- Middle East & Africa- Latin AmericaPATENT ANALYSISKEY CONFERENCES & EVENTS, 2023–2024PRICING ANALYSIS- Average selling price of key players- Average selling price trendPORTER’S FIVE FORCES MODEL- Threat from new entrants- Threat from substitutes- Bargaining power of buyers- Bargaining power of suppliers- Intensity of competitive rivalryKEY STAKEHOLDERS & BUYING CRITERIA- Key stakeholders in buying criteria- Buying criteriaTRENDS AND DISRUPTIONS IMPACTING BUYERS/CLIENTS’ BUSINESSESETHICS AND IMPLICATIONS OF WI-FI 6- Bias and fairness- Privacy and security- Intellectual property- Accountability and responsibility- Societal and economic impactTECHNOLOGY ANALYSIS- Related technologies- Adjacent technologiesTECHNOLOGY ROADMAP OF WI-FI 6- Short-term roadmap (2023–2025):- Mid-term roadmap (2026–2028):- Long-term roadmap (2029–2030):BEST PRACTICES OF WI-FI 6 MARKETCURRENT AND EMERGING BUSINESS MODELS- SaaS Model- Consulting Services Model- Revenue Sharing Model- Managed Services Model

-

6.1 INTRODUCTIONOFFERINGS: WI-FI 6 MARKET DRIVERS

-

6.2 HARDWAREWIRELESS ACCESS POINTS- Need to transmit wireless signals and connect multiple users to single centralized access point to drive marketMESH ROUTERS- Mesh routers to improve speed, coverage, and reliability of devices within networkHOME GATEWAYS- Need to prevent unauthorized access to private network and simplify coordination of things to drive marketWIRELESS CONTROLLERS- Wireless controllers to provide centralized administration and access points’ control and facilitate configuration, monitoring, and troubleshootingSYSTEM ON CHIP- Wi-Fi systems on chip to enable compact and efficient design and improve performance and power efficiencyOTHER HARDWARE

-

6.3 SOLUTIONNEED FOR RELIABILITY AND SCALABILITY, QUICK UPLOADS AND DOWNLOADS, REDUCED LATENCY, AND LONGER BATTERY LIFE TO DRIVE MARKET

-

6.4 SERVICESWI-FI 6 SERVICES TO HELP OFFLOAD BURDEN OF MANAGING NETWORK INFRASTRUCTURE AND FOCUS ON CORE BUSINESSPROFESSIONAL SERVICES- Services to help in surveying, analyzing, consulting, network planning, designing, implementing, training, and supporting- Consulting- Deployment & integration- Support & maintenanceMANAGED SERVICES- Managed services to offer 24x7 remote monitoring to companies with budget constraints and lack of technical expertise

-

7.1 INTRODUCTIONLOCATION TYPES: WI-FI 6 MARKET DRIVERS

-

7.2 INDOORINDOOR POSITIONING IN WLAN TO OFFER COST-EFFECTIVENESS AND REASONABLE POSITIONING ACCURACY

-

7.3 OUTDOORENHANCING OUTDOOR CONNECTIVITY WITH WI-FI 6 TO IMPROVE PERFORMANCE AND ACCESSIBILITY TO DRIVE MARKET

-

8.1 INTRODUCTIONAPPLICATIONS: WI-FI 6 MARKET DRIVERS

-

8.2 IMMERSIVE TECHNOLOGIESNEED FOR IMPROVED SECURITY FEATURES AND TRANSMISSION OF SENSITIVE DATA TO DRIVE DEMAND FOR IMMERSIVE TECHNOLOGIES

-

8.3 HD VIDEO STREAMING & VIDEO CONFERENCINGWI-FI 6 IN VIDEO STREAMING TO DELIVER VIDEO CONTENT AND COMMUNICATE WITHOUT PHYSICAL CONNECTION

-

8.4 SMART HOME DEVICESWI-FI 6'S FASTER SPEEDS TO ENABLE FASTER COMMUNICATION BETWEEN DEVICES

-

8.5 IOT & INDUSTRY 4.0IOT & INDUSTRY 4.0 TO IMPROVE PRODUCTIVITY, EFFICIENCY, AND FLEXIBILITY IN MANUFACTURING

-

8.6 TELEMEDICINEWI-FI 6 IN TELEMEDICINE TO ENABLE TRANSMISSION OF MEDICAL IMAGES AND VIDEOS AND CONDUCT TELEHEALTH CONSULTATIONS

-

8.7 PUBLIC WI-FI & DENSE ENVIRONMENTSWI-FI 6 TO INCREASE PRODUCTIVITY IN PUBLIC PLACES BY PROVIDING RELIABLE AND FAST CONNECTION

- 8.8 OTHER APPLICATIONS

-

9.1 INTRODUCTIONVERTICALS: WI-FI 6 MARKET DRIVERS

-

9.2 EDUCATIONADVENT OF ELEARNING AND ONLINE EXAM PRACTICES TO DRIVE DEMAND FOR RELIABLE AND SECURE INTERNET ACCESSEDUCATION: WI-FI 6 USE CASES- Easier communication- Improved resources for teacher- Mobile learning

-

9.3 HEALTHCARE & LIFE SCIENCESWI-FI 6 TO PROVIDE MORE EFFICIENT AND RELIABLE PATIENT CARE AND IMPROVE DATA HANDLING AND STORINGHEALTHCARE & LIFE SCIENCES: WI-FI 6 USE CASES- Telemedicine- Mobile health applications- Electronic healthcare records

-

9.4 RETAIL & ECOMMERCEINCREASED CAPACITY AND IMPROVED LATENCY OF WI-FI 6 TO HELP RETAILERS COLLECT CUSTOMER DATA TO ANALYZE SHOPPING PATTERNSRETAIL & ECOMMERCE: WI-FI 6 USE CASES- Analyzing customer shopping patterns- Provide location-based advertisements and personalized offers

-

9.5 GOVERNMENT & PUBLIC SECTORWI-FI 6 TO OFFER HIGH-PERFORMANCE, SECURE, AND CONTINUOUSLY MONITORED NETWORKING ENVIRONMENT TO GOVERNMENTGOVERNMENT & PUBLIC SECTOR: WI-FI 6 USE CASES- Public Wi-Fi- Emergency communication- Smart cities

-

9.6 TRAVEL & HOSPITALITYWI-FI 6 TO OFFER ACCURATE INDOOR LOCATION TRACKING, EFFICIENT GEOFENCING, IMPROVED VOICE QUALITY, AND SEAMLESS ROAMINGTRAVEL & HOSPITALITY SECTOR: WI-FI 6 USE CASES- Telephony- Location services- IP-CCTV

-

9.7 TRANSPORTATION & LOGISTICSWI-FI 6 TO PROVIDE REAL-TIME VEHICLE TRACKING, FASTER TICKET PURCHASES, AND INCREASED CAPACITY FOR BUSY TRANSPORTATIONTRANSPORTATION & LOGISTICS: WI-FI 6 USE CASES- Online ticketing- Fleet management

-

9.8 MANUFACTURINGWI-FI 6 TO ENHANCE MACHINE-TO-MACHINE COMMUNICATION, IMPROVE MANAGEMENT, AND MAKE TIMELY DECISIONSMANUFACTURING: WI-FI 6 USE CASES- Machine-to-machine communication- Inventory tracking- Predictive maintenance

-

9.9 MEDIA & ENTERTAINMENTWI-FI 6 TO GATHER VALUABLE DATA ON AUDIENCE BEHAVIOR AND ENHANCE HD VIDEO STREAMING EXPERIENCEMEDIA & ENTERTAINMENT: WI-FI 6 USE CASES- HD video streaming- Gaming- Over-the-Top (OTT) streaming- Audience analytics and engagement

-

9.10 RESIDENTIALWI-FI 6 TO SUPPORT HEALTH MONITORING DEVICES AND MANY SECURITY DEVICES WITHOUT COMPROMISING PERFORMANCERESIDENTIAL: WI-FI 6 USE CASES- Elderly care- Home automation- Security

-

9.11 OTHER VERTICALSMOBILE BANKINGWIRELESS POINT-OF-SALE (POS) SYSTEMSMART GRIDASSET MANAGEMENT- Real-time data analysis

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTNORTH AMERICA: WI-FI 6 MARKET DRIVERSUS- High technological awareness and presence of multiple big tech corporations to drive demand for Wi-Fi 6 solutionsCANADA- Government initiatives and need for faster speed, better performance, and improved battery life to drive market

-

10.3 EUROPEEUROPE: RECESSION IMPACTEUROPE: WI-FI 6 MARKET DRIVERSUK- Increasing use of cloud-based services, need for high-speed internet, and availability of Wi-Fi 6E devices to drive marketGERMANY- Increasing adoption of cutting-edge technology and development of advanced technologies to drive demand for Wi-Fi 6 solutionsFRANCE- Need for faster connection and adoption of Wi-Fi 6 by government to propel marketSPAIN- Growing demand for smart home appliances and government initiatives to grow awareness about Wi-Fi 6 to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: WI-FI 6 MARKET DRIVERSCHINA- Need for enhanced performance and faster speed and adoption of advanced technologies to drive marketJAPAN- Need for faster and more reliable internet connections and investment from government to drive marketAUSTRALIA AND NEW ZEALAND- Need for improved gaming and video streaming experiences and enhanced performance of smart home devices to drive marketSOUTH KOREA- Highly advanced mobile market and active initiatives from government to encourage adoption of Wi-Fi 6 to drive marketSOUTHEAST ASIA- Modification of regulations by IMDA and initiatives by leading companies to drive demand for Wi-Fi 6 solutionsREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: WI-FI 6 MARKET DRIVERSKSA- Development of wireless technology and adoption of Wi-Fi 6 over cellular data connections to drive marketUAE- Government's focus on digital transformation and eCommerce industry's rapid expansion to drive marketSOUTH AFRICA- Need for mobility and adoption of cloud-based technologies to boost demand for Wi-Fi 6 solutionsREST OF MIDDLE EAST & AFRICA

-

10.6 LATIN AMERICALATIN AMERICA: RECESSION IMPACTLATIN AMERICA: WI-FI 6 MARKET DRIVERSBRAZIL- Need to provide uninterrupted connectivity and adoption of national 6GHz plan to boost demand for Wi-Fi 6 solutionsMEXICO- Increasing use of wireless devices and advancements in social media to drive marketREST OF LATIN AMERICA

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 HISTORICAL REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS OF KEY PLAYERS

- 11.5 COMPETITIVE BENCHMARKING

- 11.6 EVALUATION MATRIX METHODOLOGY FOR KEY PLAYERS

-

11.7 EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.8 EVALUATION MATRIX METHODOLOGY FOR STARTUPS/SMES

-

11.9 EVALUATION MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.10 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

11.11 WI-FI 6 PRODUCT BENCHMARKINGPROMINENT WI-FI 6 HARDWARE DEVICES- Qualcomm FastConnect 6900- Cisco Catalyst 9130AX- Broadcom BCM43684- Huawei WiFi AX3- Juniper AP24PROMINENT WI-FI 6 TESTING PLATFORMS- Rohde & Schwarz WLAN IEEE 802.11ax testing- Keysight WaveTest 6- LitePoint IQxel-MW 7G

- 11.12 VALUATION AND FINANCIAL METRICS OF KEY WI-FI 6 VENDORS

-

12.1 MAJOR PLAYERSCISCO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewQUALCOMM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBROADCOM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHUAWEI- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJUNIPER NETWORKS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNETGEAR- Business overview- Products/Solutions/Services offered- Recent developmentsINTEL- Business overview- Products/Solutions/Services offered- Recent developmentsEXTREME NETWORKS- Business overview- Products/Solutions/Services offered- Recent developmentsUBIQUITI NETWORKS- Business overview- Products/Solutions/Services offered- Recent developmentsFORTINET- Business overview- Products/Solutions/Services offered- Recent developmentsARUBA NETWORKS- Business overview- Products/Solutions/Services offered- Recent developmentsNXP SEMICONDUCTORS- Business overview- Products/Solutions/Services offered- Recent developments

-

12.2 OTHER PLAYERSAT&TD-LINKALCATEL-LUCENTTP-LINKMEDIATEKTELSTRAMURATA MANUFACTURINGSTERLITE TECHNOLOGIESRENESAS ELECTRONICSH3C TECHNOLOGIESKEYSIGHT TECHNOLOGIESROHDE & SCHWARZLITEPOINT

-

12.3 STARTUPS/SMESCAMBIUM NETWORKSSENSCOMM SEMICONDUCTORXUNISONREDWAY NETWORKSVSORAWILUS INC.FEDERATED WIRELESSACTIONTEC ELECTRONICSADB GLOBALSDMC TECHNOLOGYEDGEWATER WIRELESS SYSTEMS

- 13.1 INTRODUCTION

-

13.2 SD-WAN MARKETMARKET DEFINITIONMARKET OVERVIEWSD-WAN MARKET, BY COMPONENTSD-WAN MARKET, BY DEPLOYMENT MODESD-WAN MARKET, BY ORGANIZATION SIZESD-WAN MARKET, BY END USERSD-WAN MARKET, BY REGION

-

13.3 WI-FI AS A SERVICE MARKETMARKET DEFINITIONMARKET OVERVIEWWI-FI AS A SERVICE MARKET, BY SOLUTIONWI-FI AS A SERVICE MARKET, BY LOCATION TYPEWI-FI AS A SERVICE MARKET, BY ORGANIZATION SIZEWI-FI AS A SERVICE MARKET, BY VERTICALWI-FI AS A SERVICE MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2020–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 ASSUMPTIONS

- TABLE 4 WI-FI 6 MARKET: ECOSYSTEM

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 TOP TWENTY PATENT OWNERS (US) IN LAST TEN YEARS

- TABLE 10 DETAILED LIST OF CONFERENCES & EVENTS, 2023–2024

- TABLE 11 AVERAGE SELLING PRICE RANGES OF SUBSCRIPTION-BASED WI-FI 6 SERVICES

- TABLE 12 WI-FI 6 MARKET: PORTER’S FIVE FORCES MODEL ANALYSIS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 14 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 15 WI-FI 6 MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 16 WI-FI 6 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 17 OFFERING: WI-FI 6 MARKET, BY HARDWARE, 2019–2022 (USD MILLION)

- TABLE 18 OFFERING: WI-FI 6 MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 19 HARDWARE: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 20 HARDWARE: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 WIRELESS ACCESS POINTS: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 22 WIRELESS ACCESS POINTS: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 MESH ROUTERS: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 MESH ROUTERS: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 HOME GATEWAYS: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 26 HOME GATEWAYS: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 WIRELESS CONTROLLERS: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 WIRELESS CONTROLLERS: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 SYSTEM ON CHIP: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 SYSTEM ON CHIP: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 OTHER HARDWARE: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 OTHER HARDWARE: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 SOLUTION: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 SOLUTION: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 OFFERING: WI-FI 6 MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 36 OFFERING: WI-FI 6 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 37 SERVICES: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 38 SERVICES: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 PROFESSIONAL SERVICES: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 PROFESSIONAL SERVICES: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 PROFESSIONAL SERVICES: WI-FI 6 MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 42 PROFESSIONAL SERVICES: WI-FI 6 MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 43 CONSULTING: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 44 CONSULTING: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 DEPLOYMENT & INTEGRATION: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 46 DEPLOYMENT & INTEGRATION: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 SUPPORT & MAINTENANCE: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 SUPPORT & MAINTENANCE: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 MANAGED SERVICES: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 50 MANAGED SERVICES: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 WI-FI 6 MARKET, BY LOCATION TYPE, 2019–2022 (USD MILLION)

- TABLE 52 WI-FI 6 MARKET, BY LOCATION TYPE, 2023–2028 (USD MILLION)

- TABLE 53 INDOOR: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 54 INDOOR: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 OUTDOOR: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 OUTDOOR: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 WI-FI 6 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 58 WI-FI 6 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 59 IMMERSIVE TECHNOLOGIES: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 IMMERSIVE TECHNOLOGIES: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 HD VIDEO STREAMING & VIDEO CONFERENCING: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 62 HD VIDEO STREAMING & VIDEO CONFERENCING: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 SMART HOME DEVICES: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 64 SMART HOME DEVICES: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 IOT AND INDUSTRY 4.0: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 IOT AND INDUSTRY 4.0: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 TELEMEDICINE: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 68 TELEMEDICINE: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 PUBLIC WI-FI & DENSE ENVIRONMENTS: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 70 PUBLIC WI-FI & DENSE ENVIRONMENTS: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 OTHER APPLICATIONS: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 OTHER APPLICATIONS: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 WI-FI 6 MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 74 WI-FI 6 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 75 EDUCATION: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 76 EDUCATION: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 HEALTHCARE & LIFE SCIENCES: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 78 HEALTHCARE & LIFE SCIENCES: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 RETAIL & ECOMMERCE: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 80 RETAIL & ECOMMERCE: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 GOVERNMENT & PUBLIC SECTOR: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 82 GOVERNMENT & PUBLIC SECTOR: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 TRAVEL & HOSPITALITY: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 84 TRAVEL & HOSPITALITY: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 TRANSPORTATION & LOGISTICS: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 86 TRANSPORTATION & LOGISTICS: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 MANUFACTURING: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 88 MANUFACTURING: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 MEDIA & ENTERTAINMENT: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 90 MEDIA & ENTERTAINMENT: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 RESIDENTIAL: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 92 RESIDENTIAL: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 93 OTHER VERTICALS: WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 94 OTHER VERTICALS: WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 WI-FI 6 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 96 WI-FI 6 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: WI-FI 6 MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 98 NORTH AMERICA: WI-FI 6 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: WI-FI 6 MARKET, BY HARDWARE, 2019–2022 (USD MILLION)

- TABLE 100 NORTH AMERICA: WI-FI 6 MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 101 NORTH AMERICA: WI-FI 6 MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 102 NORTH AMERICA: WI-FI 6 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 104 NORTH AMERICA: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 105 NORTH AMERICA: WI-FI 6 MARKET, BY LOCATION TYPE, 2019–2022 (USD MILLION)

- TABLE 106 NORTH AMERICA: WI-FI 6 MARKET, BY LOCATION TYPE, 2023–2028 (USD MILLION)

- TABLE 107 NORTH AMERICA: WI-FI 6 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 108 NORTH AMERICA: WI-FI 6 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 109 NORTH AMERICA: WI-FI 6 MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 110 NORTH AMERICA: WI-FI 6 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 111 NORTH AMERICA: WI-FI 6 MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 112 NORTH AMERICA: WI-FI 6 MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 113 US: WI-FI 6 MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 114 US: WI-FI 6 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 115 US: WI-FI 6 MARKET, BY HARDWARE, 2019–2022 (USD MILLION)

- TABLE 116 US: WI-FI 6 MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 117 US: WI-FI 6 MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 118 US: WI-FI 6 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 119 US: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 120 US: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 121 US: WI-FI 6 MARKET, BY LOCATION TYPE, 2019–2022 (USD MILLION)

- TABLE 122 US: WI-FI 6 MARKET, BY LOCATION TYPE, 2023–2028 (USD MILLION)

- TABLE 123 US: WI-FI 6 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 124 US: WI-FI 6 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 125 US: WI-FI 6 MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 126 US: WI-FI 6 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 127 CANADA: WI-FI 6 MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 128 CANADA: WI-FI 6 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 129 CANADA: WI-FI 6 MARKET, BY HARDWARE, 2019–2022 (USD MILLION)

- TABLE 130 CANADA: WI-FI 6 MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 131 CANADA: WI-FI 6 MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 132 CANADA: WI-FI 6 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 133 CANADA: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 134 CANADA: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 135 CANADA: WI-FI 6 MARKET, BY LOCATION TYPE, 2019–2022 (USD MILLION)

- TABLE 136 CANADA: WI-FI 6 MARKET, BY LOCATION TYPE, 2023–2028 (USD MILLION)

- TABLE 137 CANADA: WI-FI 6 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 138 CANADA: WI-FI 6 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 139 CANADA: WI-FI 6 MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 140 CANADA: WI-FI 6 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 141 EUROPE: WI-FI 6 MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 142 EUROPE: WI-FI 6 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 143 EUROPE: WI-FI 6 MARKET, BY HARDWARE, 2019–2022 (USD MILLION)

- TABLE 144 EUROPE: WI-FI 6 MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 145 EUROPE: WI-FI 6 MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 146 EUROPE: WI-FI 6 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 147 EUROPE: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 148 EUROPE: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 149 EUROPE: WI-FI 6 MARKET, BY LOCATION TYPE, 2019–2022 (USD MILLION)

- TABLE 150 EUROPE: WI-FI 6 MARKET, BY LOCATION TYPE, 2023–2028 (USD MILLION)

- TABLE 151 EUROPE: WI-FI 6 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 152 EUROPE: WI-FI 6 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 153 EUROPE: WI-FI 6 MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 154 EUROPE: WI-FI 6 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 155 EUROPE: WI-FI 6 MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 156 EUROPE: WI-FI 6 MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 157 UK: WI-FI 6 MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 158 UK: WI-FI 6 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 159 UK: WI-FI 6 MARKET, BY HARDWARE, 2019–2022 (USD MILLION)

- TABLE 160 UK: WI-FI 6 MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 161 UK: WI-FI 6 MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 162 UK: WI-FI 6 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 163 UK: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 164 UK: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 165 UK: WI-FI 6 MARKET, BY LOCATION TYPE, 2019–2022 (USD MILLION)

- TABLE 166 UK: WI-FI 6 MARKET, BY LOCATION TYPE, 2023–2028 (USD MILLION)

- TABLE 167 UK: WI-FI 6 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 168 UK: WI-FI 6 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 169 UK: WI-FI 6 MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 170 UK: WI-FI 6 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 171 ASIA PACIFIC: WI-FI 6 MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 172 ASIA PACIFIC: WI-FI 6 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 173 ASIA PACIFIC: WI-FI 6 MARKET, BY HARDWARE, 2019–2022 (USD MILLION)

- TABLE 174 ASIA PACIFIC: WI-FI 6 MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 175 ASIA PACIFIC: WI-FI 6 MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 176 ASIA PACIFIC: WI-FI 6 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 177 ASIA PACIFIC: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 178 ASIA PACIFIC: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 179 ASIA PACIFIC: WI-FI 6 MARKET, BY LOCATION TYPE, 2019–2022 (USD MILLION)

- TABLE 180 ASIA PACIFIC: WI-FI 6 MARKET, BY LOCATION TYPE, 2023–2028 (USD MILLION)

- TABLE 181 ASIA PACIFIC: WI-FI 6 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 182 ASIA PACIFIC: WI-FI 6 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 183 ASIA PACIFIC: WI-FI 6 MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 184 ASIA PACIFIC: WI-FI 6 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 185 ASIA PACIFIC: WI-FI 6 MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 186 ASIA PACIFIC: WI-FI 6 MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 187 CHINA: WI-FI 6 MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 188 CHINA: WI-FI 6 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 189 CHINA: WI-FI 6 MARKET, BY HARDWARE, 2019–2022 (USD MILLION)

- TABLE 190 CHINA: WI-FI 6 MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 191 CHINA: WI-FI 6 MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 192 CHINA: WI-FI 6 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 193 CHINA: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 194 CHINA: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 195 CHINA: WI-FI 6 MARKET, BY LOCATION TYPE, 2019–2022 (USD MILLION)

- TABLE 196 CHINA: WI-FI 6 MARKET, BY LOCATION TYPE, 2023–2028 (USD MILLION)

- TABLE 197 CHINA: WI-FI 6 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 198 CHINA: WI-FI 6 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 199 CHINA: WI-FI 6 MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 200 CHINA: WI-FI 6 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: WI-FI 6 MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: WI-FI 6 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: WI-FI 6 MARKET, BY HARDWARE, 2019–2022 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: WI-FI 6 MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: WI-FI 6 MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: WI-FI 6 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: WI-FI 6 MARKET, BY LOCATION TYPE, 2019–2022 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: WI-FI 6 MARKET, BY LOCATION TYPE, 2023–2028 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: WI-FI 6 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: WI-FI 6 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: WI-FI 6 MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: WI-FI 6 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: WI-FI 6 MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: WI-FI 6 MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 217 KSA: WI-FI 6 MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 218 KSA: WI-FI 6 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 219 KSA: WI-FI 6 MARKET, BY HARDWARE, 2019–2022 (USD MILLION)

- TABLE 220 KSA: WI-FI 6 MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 221 KSA: WI-FI 6 MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 222 KSA: WI-FI 6 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 223 KSA: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 224 KSA: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 225 KSA: WI-FI 6 MARKET, BY LOCATION TYPE, 2019–2022 (USD MILLION)

- TABLE 226 KSA: WI-FI 6 MARKET, BY LOCATION TYPE, 2023–2028 (USD MILLION)

- TABLE 227 KSA: WI-FI 6 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 228 KSA: WI-FI 6 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 229 KSA: WI-FI 6 MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 230 KSA: WI-FI 6 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 231 LATIN AMERICA: WI-FI 6 MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 232 LATIN AMERICA: WI-FI 6 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 233 LATIN AMERICA: WI-FI 6 MARKET, BY HARDWARE, 2019–2022 (USD MILLION)

- TABLE 234 LATIN AMERICA: WI-FI 6 MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 235 LATIN AMERICA: WI-FI 6 MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 236 LATIN AMERICA: WI-FI 6 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 237 LATIN AMERICA: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 238 LATIN AMERICA: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 239 LATIN AMERICA: WI-FI 6 MARKET, BY LOCATION TYPE, 2019–2022 (USD MILLION)

- TABLE 240 LATIN AMERICA: WI-FI 6 MARKET, BY LOCATION TYPE, 2023–2028 (USD MILLION)

- TABLE 241 LATIN AMERICA: WI-FI 6 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 242 LATIN AMERICA: WI-FI 6 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 243 LATIN AMERICA: WI-FI 6 MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 244 LATIN AMERICA: WI-FI 6 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 245 LATIN AMERICA: WI-FI 6 MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 246 LATIN AMERICA: WI-FI 6 MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 247 BRAZIL: WI-FI 6 MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 248 BRAZIL: WI-FI 6 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 249 BRAZIL: WI-FI 6 MARKET, BY HARDWARE, 2019–2022 (USD MILLION)

- TABLE 250 BRAZIL: WI-FI 6 MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 251 BRAZIL: WI-FI 6 MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 252 BRAZIL: WI-FI 6 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 253 BRAZIL: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 254 BRAZIL: WI-FI 6 MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 255 BRAZIL: WI-FI 6 MARKET, BY LOCATION TYPE, 2019–2022 (USD MILLION)

- TABLE 256 BRAZIL: WI-FI 6 MARKET, BY LOCATION TYPE, 2023–2028 (USD MILLION)

- TABLE 257 BRAZIL: WI-FI 6 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 258 BRAZIL: WI-FI 6 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 259 BRAZIL: WI-FI 6 MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 260 BRAZIL: WI-FI 6 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 261 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 262 WI-FI 6 MARKET: DEGREE OF COMPETITION

- TABLE 263 DETAILED LIST OF STARTUPS/SMES

- TABLE 264 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 265 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 266 PRODUCT LAUNCHES, 2020–2023

- TABLE 267 DEALS, 2021–2023

- TABLE 268 COMPARATIVE ANALYSIS OF PROMINENT WI-FI 6 HARDWARE DEVICES

- TABLE 269 COMPARATIVE ANALYSIS OF PROMINENT WI-FI 6 TESTING PLATFORMS

- TABLE 270 CISCO: COMPANY OVERVIEW

- TABLE 271 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 273 CISCO: DEALS

- TABLE 274 QUALCOMM: COMPANY OVERVIEW

- TABLE 275 QUALCOMM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 QUALCOMM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 277 BROADCOM: COMPANY OVERVIEW

- TABLE 278 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 BROADCOM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 280 BROADCOM: DEALS

- TABLE 281 HUAWEI: COMPANY OVERVIEW

- TABLE 282 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 HUAWEI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 284 HUAWEI: DEALS

- TABLE 285 JUNIPER NETWORKS: BUSINESS OVERVIEW

- TABLE 286 JUNIPER NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 287 JUNIPER NETWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 288 JUNIPER NETWORKS: DEALS

- TABLE 289 NETGEAR: COMPANY OVERVIEW

- TABLE 290 NETGEAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 NETGEAR: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 292 NETGEAR: DEALS

- TABLE 293 INTEL: COMPANY OVERVIEW

- TABLE 294 INTEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 295 INTEL: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 296 INTEL: DEALS

- TABLE 297 EXTREME NETWORKS: COMPANY OVERVIEW

- TABLE 298 EXTREME NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 299 EXTREME NETWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 300 EXTREME NETWORKS: DEALS

- TABLE 301 UBIQUITI NETWORKS: BUSINESS OVERVIEW

- TABLE 302 UBIQUITI NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 303 UBIQUITI NETWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 304 FORTINET: COMPANY OVERVIEW

- TABLE 305 FORTINET: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 306 FORTINET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 307 FORTINET: DEALS

- TABLE 308 ARUBA NETWORKS: BUSINESS OVERVIEW

- TABLE 309 ARUBA NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 ARUBA NETWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 311 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 312 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 NXP SEMICONDUCTORS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 314 SD-WAN MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 315 SD-WAN MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 316 SOLUTIONS: SD-WAN MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 317 SOLUTIONS: SD-WAN MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 318 SERVICES: SD-WAN MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 319 SERVICES: SD-WAN MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 320 SD-WAN MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 321 SD-WAN MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 322 SD-WAN MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 323 SD-WAN MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 324 SD-WAN MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 325 SD-WAN MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 326 SD-WAN MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 327 SD-WAN MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 328 SD-WAN MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 329 SD-WAN MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 330 WI-FI AS A SERVICE MARKET, BY SOLUTION, 2017–2020 (USD MILLION)

- TABLE 331 WI-FI AS A SERVICE MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

- TABLE 332 WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2017–2020 (USD MILLION)

- TABLE 333 WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2021–2026 (USD MILLION)

- TABLE 334 WI-FI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

- TABLE 335 WI-FI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

- TABLE 336 WI-FI AS A SERVICE MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

- TABLE 337 WI-FI AS A SERVICE MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

- TABLE 338 WI-FI AS A SERVICE MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 339 WI-FI AS A SERVICE MARKET, BY REGION, 2021–2026 (USD MILLION)

- FIGURE 1 WI-FI 6 MARKET SEGMENTATION

- FIGURE 2 WI-FI 6 MARKET: RESEARCH DESIGN

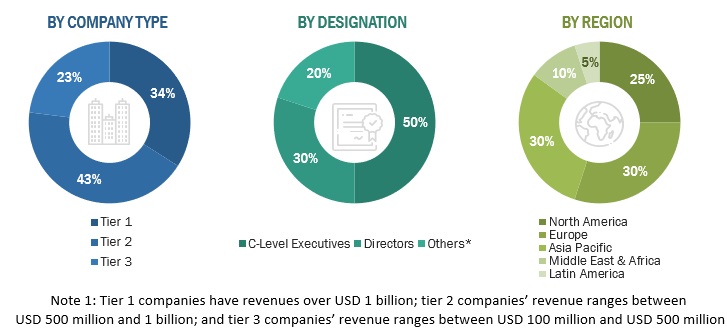

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

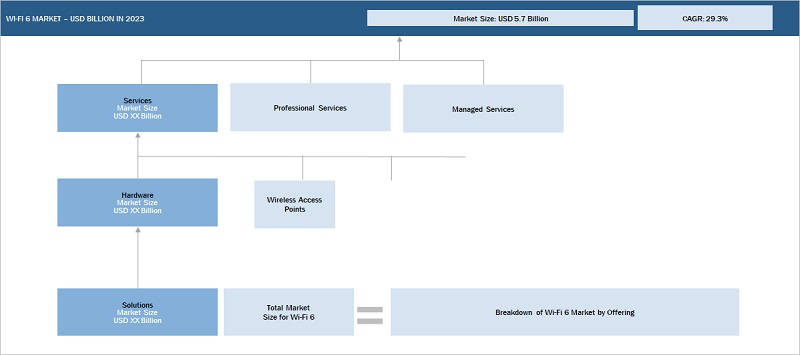

- FIGURE 4 APPROACHES USED FOR MARKET SIZE ESTIMATION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1: SUPPLY-SIDE ANALYSIS OF REVENUE FROM PLATFORMS AND SERVICES

- FIGURE 6 BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF WI-FI 6 VENDORS

- FIGURE 8 TOP-DOWN APPROACH

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 10 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 11 WI-FI 6 MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 12 WI-FI 6 MARKET, 2023–2028 (USD MILLION)

- FIGURE 13 WI-FI 6 MARKET, BY REGION, 2023

- FIGURE 14 INCREASING DEMAND FOR CONNECTED DEVICES AND RISING NUMBER OF INTERNET USERS TO DRIVE WI-FI 6 MARKET

- FIGURE 15 HARDWARE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 16 INDOOR SEGMENT TO HOLD LARGER MARKET SHARE IN 2023

- FIGURE 17 HD VIDEO STREAMING & VIDEO CONFERENCING SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 18 EDUCATION SEGMENT TO LEAD MARKET IN 2023

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: WI-FI 6 MARKET

- FIGURE 20 BRIEF HISTORY OF WI-FI 6

- FIGURE 21 WI-FI 6 MARKET: MARKET MAP

- FIGURE 22 WI-FI 6 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 NUMBER OF PATENTS GRANTED, 2013–2022

- FIGURE 24 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

- FIGURE 25 PORTER’S FIVE FORCES MODEL: WI-FI 6 MARKET

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 28 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 SYSTEM ON CHIP SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 CONSULTING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 OUTDOOR SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 32 TELEMEDICINE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 HEALTHCARE & LIFE SCIENCES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 36 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 37 EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 38 EVALUATION MATRIX FOR KEY PLAYERS, 2023

- FIGURE 39 EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 40 EVALUATION MATRIX FOR STARTUPS/SMES, 2023

- FIGURE 41 VALUATION AND FINANCIAL METRICS OF KEY WI-FI 6 VENDORS

- FIGURE 42 CISCO: COMPANY SNAPSHOT

- FIGURE 43 QUALCOMM: COMPANY SNAPSHOT

- FIGURE 44 BROADCOM: COMPANY SNAPSHOT

- FIGURE 45 HUAWEI: COMPANY SNAPSHOT

- FIGURE 46 JUNIPER NETWORKS: COMPANY SNAPSHOT

- FIGURE 47 NETGEAR: COMPANY SNAPSHOT

- FIGURE 48 INTEL: COMPANY SNAPSHOT

- FIGURE 49 EXTREME NETWORKS: COMPANY SNAPSHOT

- FIGURE 50 UBIQUITI NETWORKS: COMPANY SNAPSHOT

- FIGURE 51 FORTINET: COMPANY SNAPSHOT

- FIGURE 52 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

The Wi-Fi 6 market study extensively used secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva. Other market-related sources, such as journals and white papers from industry associations, were also considered while conducting the secondary research. Primary sources were mainly industry experts from core and related industries, preferred system developers, service providers, System Integrators (SIs), resellers, partners, and organizations related to the various segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents to obtain and verify critical qualitative and quantitative information and assess the market’s prospects. These respondents included key industry participants, subject matter experts, C-level executives of key market players, and industry consultants.

Secondary Research

The market for the companies offering Wi-Fi 6 solutions and services for various industry verticals is arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolio of major companies in the ecosystem and rating them based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies, white papers, journals, and certified publications and articles from recognized authors, directories, and databases. Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both the market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Wi-Fi 6 market. The primary sources from the demand side included Wi-Fi 6 end users, network administrators/consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations. After the complete market engineering process (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the market’s competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies. In the complete market engineering process, both top-down and bottom-up approaches and several data triangulation methods were used to estimate and forecast the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

The break-up of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the Wi-Fi 6 market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of Wi-Fi 6 offerings, such as hardware, solutions, and services.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Wi-Fi 6 market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Wi-Fi 6 Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Wi-Fi 6 Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the Wi-Fi 6 market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

According to Cisco, the next generation of the Wi-Fi standard is Wi-Fi 6, also known as 802.11ax, the latest step in a journey of nonstop innovation. The standard builds on the strengths of 802.11ac while adding efficiency, flexibility, and scalability that allows new and existing networks to increase speed and capacity with next-generation applications. The Institute of Electrical and Electronics Engineers (IEEE) proposed the Wi-Fi 6 standards so it can couple the freedom and high speed of Gigabit Ethernet wireless with the reliability and predictability found in licensed radio.

Key Stakeholders

- Wi-Fi 6 solution providers

- Wi-Fi 6 service providers

- Wireless service providers

- Information Technology (IT) solution providers

- Telecom providers

- Cloud service providers

- Network solution providers

- System integrators

- Independent service providers

- Consultants/consultancies/advisory firms

- Training providers

Report Objectives

- To determine and forecast the global Wi-Fi 6 market by offering (hardware, solutions, and services), location type, application, vertical, and region from 2023 to 2030, and analyze the various macroeconomic and microeconomic factors that affect the market growth.

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the Wi-Fi 6 market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall Wi-Fi 6 market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the Wi-Fi 6 market.

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market's competitive landscape.

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Wi-Fi 6 Market