Composite Materials Market for Automotive by Material Type (PMC, MMC, & CMC), Application & their Sub-Components (Structural, Powertrain, Interior, Exterior, & Others), Vehicle Type (PC, LCV, HCV, & Rolling Stock), & by Region-Global Forecast to 2020

[167 Pages Report] The automotive composite materials market size, by value, is projected to grow at a CAGR of 12.94% from 2015 to 2020, and reach USD 11.26 Billion by 2020. The report considers 2014 as the base year and 2015 to 2020 as forecast period. The report segments the automotive composite materials market into different materials types, namely, polymer matrix composites (PMC), metal matrix composites (CMC), and ceramic matrix composites (CMC). The study also covers various applications and their subcomponents in the report namely, structural (chassis and body-in-white), powertrain (engine, suspension, and others), interiors (dash board, door panel, and others), exteriors (door module, hood, bumper, and others), and other applications (switches & modules and other electrical components). Of all the different composite materials used to manufacture automobile components, PMC is the most widely used, as polymer composites can directly reduce the weight of a vehicle body and chassis by up to 50%, which subsequently reduces the vehicles fuel consumption.

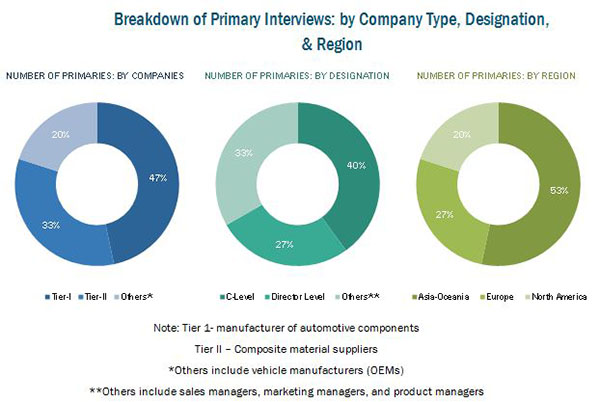

The research methodology used in the report involves various secondary sources including encyclopedias, directories, and databases to identify and collect information useful for an extensive, commercial market study. The primary sourcesexperts from related industries and suppliershave been interviewed to obtain and verify critical information as well as to assess the future prospects of the automotive composite materials market. The bottom-up approach has been used to estimate and validate the size of the global market. In this approach, country-level, vehicle type-wise production statistics has been taken into account, which is then correlated with average vehicle weight & share of lightweight materials in the overall weight. This country-level market size, in terms of volume, of composite materials for each vehicle type is then multiplied with the country-level average OE price (AOP) of composite materials required for each material type. This results in the country-level market size, in terms of value. The summation of the country-level market gives the regional market and further summation of the regional market provides the global automotive composite materials market.

This study covers different stakeholders including composite material producers, raw material suppliers for automotive components, automotive component manufacturers, automotive original equipment manufacturers (OEM), research institutes and government organizations, traders, distributors and suppliers of composite materials, the automobile industry as an end-use industry and regional automobile associations, and manufacturers of rolling stock & locomotives, among others.

The target audience of the study includes manufacturers of automotive composite materials, raw material suppliers of the composite materials, original equipment manufacturers (OEMs), dealers and distributors of automotive composite components, and Industry associations.

Study answers several questions for the stakeholders, primarily which market segments to focus in next two to five years for prioritizing efforts and investments.

Scope of the Report

The composite materials market has been broadly categorized into the following segments and sub-segments:

- By Manufacturing Process

- Lay-up Process

- Compression Molding Process

- Resin Transfer Molding (RTM) Process

- Filament Winding Process

- Injection Molding Process

- Pultrusion Process

- Vacuum Infusion

- Other Processes

- By Material Type

- Polymer Matrix Composite (PMC)

- Carbon Fiber Reinforced Plastic (CFRP)

- Glass Fiber Reinforced Plastic (GFRP)

- Natural Fiber Reinforced Plastic (NFRP)

- Metal Matrix Composite (MMC)

- Ceramic Matrix Composite (CMC)

- Polymer Matrix Composite (PMC)

- By Application

- Structural

- Powertrain

- Interior

- Exterior

- Other Applications

- By Region

- Asia-Oceania

- North America

- Europe

- RoW

With the given market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

- Automotive Composite Materials Market, By Advanced Composite Fiber Type

- Automotive Composite Materials Market, By Other Countries of Major Regions

- Locomotive Rolling Stock Composite Materials Market, By Material

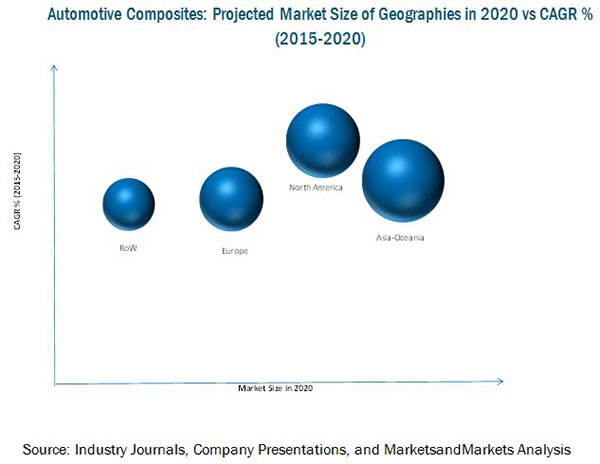

The composite materials market size is projected to grow at a promising CAGR of 12.94% during the forecast period of 2015 to 2020, and will reach USD 11.26 Billion by 2020. Government regulations and mandates regarding fuel efficiency, rising demand for fuel efficient vehicles, and major OEMs partnering with composite material manufacturers are some of the drivers fueling growth in sales of automotive composite materials globally.

The highest growing application in terms of value for composite materials in the automotive sector is structural components. The polymer matrix composite is the major material which is used in this application due to its high strength and lightweight properties. Structural application is followed by the powertrain application where due to the advancements in powertrain technologies, the use of composite materials has increased to a great extent.

In terms of composite materials used in the automobiles, the polymer matrix composite (PMC) materials is the largest market followed by metal matrix composites (MMC). The advancements in manufacturing technologies of these materials has increased their penetration in the growing markets including India and China which are also the largest vehicle producing countries. The growth in the MMC materials is mainly due to the high strength and lightweight properties of this material. Apart from these properties, the low cost as compared to PMC is one of the major drivers for the increasing MMC market.

The automotive industry in Asia-Oceania has emerged as a hub for automotive production in recent times, given the changing end-user preferences, increasing per capita income of the middle class population, and cost advantages for OEMs. The region is inclined towards compact and cost-effective passenger cars. Factors such as low production cost, availability of economic labor, lenient emission and safety norms, and government initiatives for foreign direct investment (FDI), have resulted in substantial growth for the automotive industry in the region. The rise in automotive production is positively impacting the automotive composite materials market in the region.

In North America and Europe, stringent EPA standards and Euro norms have led to an increased use for polymer matrix composites in vehicle applications.

Some of the major restraints considered in the study are the technological constraints and the high cost of these materials. Technological constraints, such as difficulty in manufacturing metal matrix such as magnesium and its alloys to suit a specific need, have been hindering the market growth of these materials. Metallic processing and joining techniques are not suitable for these composite materials. On the other hand, the high cost of materials such as carbon and glass fiber reinforced composites, are hindering extensive usage of these materials. Hence, the adoption of CFRP is restricted to high-end cars, such as Bugatti, BMW, McLaren, and racing cars.

Toray Industries (Japan) is one of the major composite materials suppliers. The company is vigorously expanding across the globe to strengthen its foothold in the market. For instance, company acquired the European carbon fiber fabric and prepeg business of Saati S.p.A (Italy) in December 2014. Along with this, company expanded its production facilities in France, Japan, and Thailand.

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definitions

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Package Size

1.6 Limitation

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.3 Data From Secondary Sources

2.4 Primary Data

2.4.1 Sampling Techniques & Data Collection Methods

2.4.2 Primary Participants

2.5 Factor Analysis

2.5.1 Introduction

2.5.2 Demand Side Analysis

2.5.2.1 Increase in the Global Population

2.5.2.2 Impact of Gdp on Total Vehicle Sales

2.5.2.3 Infrastructure: Roadways

2.5.2.4 Infrastructure: Rail Network

2.5.3 Supply Side Analysis

2.5.3.1 Influence of Safety Regulations

2.6 Market Size Estimation

2.7 Data Triangulation

2.8 Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 38)

5 Market Overview (Page No. - 46)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Material Type

5.2.1 By Application & Components

5.2.2 By Locomotive & Rolling Stock

5.2.3 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Government Regulations & Mandates Pertaining to Fuel Efficiency and Emissions

5.3.1.2 Reduced Delta Factor (Process Time, Cost, & Quality)

5.3.2 Restraints

5.3.2.1 Technological Constraints

5.3.2.2 High Cost of Composite Materials

5.3.3 Opportunities

5.3.3.1 Shifting Focus Towards Electric Vehicles

5.3.3.2 Emerging Economies From Southeast Asia

5.3.4 Challenge

5.3.4.1 Manufacturing of Low-Cost Composite Materials

5.3.4.2 Recyclability

5.4 Burning Issues

5.4.1 Penetration of Composite Materials in Entry-Level Passenger Cars & Commercial Vehicles

5.5 Supply Chain Analysis for Automotive Composite Materials

5.6 Average (OE) Selling Price (ASP) Analysis

5.7 Porters Five Forces Analysis

5.7.1 Threat of Substitutes

5.7.2 Threat of New Entrants

5.7.3 Bargaining Power of Suppliers

5.7.4 Bargaining Power of Buyers

5.7.5 Intensity of Competitive Rivalry

6 Composite Materials, By Manufacturing Process (Page No. - 60)

6.1 Introduction

6.2 Manufacturing Processes

6.2.1 Lay-Up Process

6.2.2 Compression Molding Process

6.2.3 Resin Transfer Molding (RTM) Process

6.2.4 Filament Winding Process

6.2.5 Injection Molding Process

6.2.6 Pultrusion Process

6.2.7 Vacuum Infusion

6.2.8 Other Processes

7 Composite Materials Market, By Material & Vehicle Type (Page No. - 64)

7.1 Introduction

7.2 Polymer Matrix Composites (PMC)

7.2.1 PMC Market By Material Type & Vehicle Type

7.2.1.1 Carbon Fiber Reinforced Polymer (CFRP)Market, By Vehicle Type

7.2.1.2 Glass Fiber Reinforced Polymer (GFRP) Market, By Vehicle Type

7.2.1.3 Natural Fiber Reinforced Polymer (NFRP) Market, By Vehicle Type

7.3 Metal Matrix Composite (MMC)

7.3.1 MMC Market By Vehicle Type

7.4 Ceramic Matrix Composite (CMC)

7.4.1 CMC Market By Vehicle Type

8 Composite Materials Market, By Application & Components (Page No. - 77)

8.1 Introduction

8.1.1 Market for Automotive Composites, By Application

8.2 Structural

8.2.1 Structural Composite Materials Market, By Components & Material Type

8.3 Powertrain

8.3.1 Powertrain Composite Materials Market, By Components & Material Type

8.4 Interior

8.4.1 Interior Composite Materials Market, By Components & Material Type

8.5 Exterior

8.5.1 Exterior Composite Materials Market, By Components & Material Type

8.6 Other Applications

8.6.1 Other Applications Composite Materials Market, By Components & Material Type

9 Rolling Stock Composite Materials Market, By Region (Page No. - 92)

9.1 Introduction

9.2 Rolling Stock Composite Materials Market, By Region

10 Composite Materials Market, By Region (Page No. - 96)

10.1 Introduction

10.2 Markets Covered

10.2.1 North America

10.2.1.1 Pest Analysis

10.2.1.1.1 Political Factors

10.2.1.1.2 Economic Factors

10.2.1.1.3 Social Factors

10.2.1.1.4 Technological Factors

10.2.1.2 U.S.

10.2.1.3 Canada

10.2.1.4 Mexico

10.2.2 Europe

10.2.2.1 Pest Analysis

10.2.2.1.1 Political Factors

10.2.2.1.2 Economic Factors

10.2.2.1.3 Social Factors

10.2.2.1.4 Technological Factors

10.2.2.2 U.K.

10.2.2.3 Germany

10.2.2.4 France

10.2.3 Asia-Oceania

10.2.3.1 Pest Analysis

10.2.3.1.1 Political Factors

10.2.3.1.2 Economic Factors

10.2.3.1.3 Social Factors

10.2.3.1.4 Technological Factors

10.2.3.2 China

10.2.3.3 Japan

10.2.3.4 India

10.2.3.5 South Korea

10.2.4 Rest of the World (RoW)

10.2.4.1 Pest Analysis

10.2.4.1.1 Political Factors

10.2.4.1.2 Economic Factors

10.2.4.1.3 Social Factors

10.2.4.1.4 Technological Factors

10.2.4.2 Brazil

10.2.4.3 Russia

11 Competitive Landscape (Page No. - 124)

11.1 Overview

11.2 Competitive Situation & Trends

11.3 Battle for Market Share: Merger & Acquisitions, Joint Ventures, Collaborations, & Agreements Was the Key Strategy

11.4 Mergers & Acquisitions, Agreements, Partnerships, Collaborations, & Joint Ventures

11.5 Expansions

11.6 New Product Launches & Developments

12 Company Profiles (Page No. - 130)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 Toray Industries, Inc.

12.3 Cytec Industries Inc.

12.4 SGL Carbon SE

12.5 Teijin Ltd.

12.6 Koninklijke Ten Cate NV

12.7 Johns Manville

12.8 Mitsubishi Rayon Co. Ltd.

12.9 Owens Corning

12.10 Johnson Controls Inc.

12.11 Jushi Group Co. Ltd.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 157)

13.1 Insights of Industry Experts

13.2 Other Developments

13.3 Discussion Guide

13.4 Introducing RT: Real Time Market Intelligence

13.5 Available Customizations

13.5.1 Automotive Composite Materials Market, By Advanced Composite Fiber Type

13.5.2 Automotive Composite Materials Market, By Other Countries of Major Regions

13.5.3 Locomotive & Rolling Stock Composite Materials Market, By Material

13.6 Related Reports

List of Tables (71 Tables)

Table 1 Overview of Fuel Economy Regulation Specifications for Passenger Cars

Table 2 ASP Analysis of Composite Materials (USD/Kg), 2014

Table 3 Automotive Composite Materials Market Size, By Material Type, 2013-2020 (TMT)

Table 4 Market Size, By Material Type, 20132020 (USD Million)

Table 5 Automotive Composite Materials Market Size, By Vehicle Type, 2013-2020 (TMT)

Table 6 Market Size, By Vehicle Type, 20132020 (USD Million)

Table 7 PMC Market Size, By Material Type, 20132020 (TMT)

Table 8 PMC Market Size, By Material Type, 20132020 (USD Million)

Table 9 PMC Market Size, By Vehicle Type, 20132020 (TMT)

Table 10 PMC Market Size, By Vehicle Type, 20132020 (USD Million)

Table 11 CFRP Market Size, By Vehicle Type, 20132020 (TMT)

Table 12 CFRP Market Size, By Vehicle Type, 20132020 (USD Million)

Table 13 GFRP Market Size, By Vehicle Type, 20132020 (TMT)

Table 14 GFRP Market Size, By Vehicle Type, 20132020 (USD Million)

Table 15 NFRP Market Size, By Vehicle Type, 20132020 (TMT)

Table 16 NFRP Market Size, By Vehicle Type, 20132020 (USD Million)

Table 17 MMC Market Size, By Vehicle Type, 20132020 (TMT)

Table 18 MMC Market Size, By Vehicle Type, 20132020 (USD Million)

Table 19 CMC Market Size, By Vehicle Type, 20132020 (TMT)

Table 20 CMC Market Size, By Vehicle Type, 20132020 (USD Million)

Table 21 Automotive Composite Materials Market Size, By Application, 20132020 (TMT)

Table 22 Market Size, By Application, 20132020 (USD Million)

Table 23 Structural Composite Materials Market Size, By Components & Material Type, 20132020 (TMT)

Table 24 Structural Composite Materials Market Size, By Components & Material Type, 20132020 (USD Million)

Table 25 Powertrain Composite Materials Market Size, By Components & Material Type, 20132020 (TMT)

Table 26 Powertrain Composite Materials Market Size, By Components & Material Type, 20132020 (USD Million)

Table 27 Interior Composite Materials Market Size, By Component & Material Type, 20132020 (TMT)

Table 28 Interior Composite Materials Market Size, By Components & Material Type, 20132020 (USD Million)

Table 29 Exterior Composite Materials Market Size, By Components & Material Type, 20132020 (TMT)

Table 30 Exterior Composite Materials Market Size, By Components & Material Type, 20132020 (USD Million)

Table 31 Other Applications Composite Materials Market Size, By Components & Material Type, 20132020 (TMT)

Table 32 Other Applications Composite Materials Market Size, By Components & Material Type, 20132020 (USD Million)

Table 33 Rolling Stock Composite Materials Market Size, By Region, 20132020 (TMT)

Table 34 Rolling Stock Composite Materials Market Size, By Region, 20132020 (USD Million)

Table 35 Automotive Composite Materials Market Size, By Region, 20132020 (TMT)

Table 36 Automotive Composite Materials Market Size, By Region, 20132020 (USD Million)

Table 37 North America: Automotive Composite Materials Market Size, By Country, 20132020 (TMT)

Table 38 North America: Market Size, By Country, 20132020 (USD Million)

Table 39 U.S.: Automotive Composite Materials Market Size, By Material Type, 20132020 (TMT)

Table 40 U.S.: Market Size, By Material Type, 20132020 (USD Million)

Table 41 Canada: Automotive Composite Materials Market Size, By Material Type, 20132020 (TMT)

Table 42 Canada: Market Size, By Material Type, 20132020 (USD Million)

Table 43 Mexico: Automotive Composite Materials Market Size, By Material Type, 20132020 (TMT)

Table 44 Mexico: Market Size, By Material Type, 20132020 (USD Million)

Table 45 Europe: Automotive Composite Materials Market Size, By Country, 20132020 (TMT)

Table 46 Europe: Market Size, By Country, 20132020 (USD Million)

Table 47 U.K.: Automotive Composite Materials Market Size, By Material Type, 20132020 (TMT)

Table 48 U.K.: Market Size, By Material Type, 20132020 (USD Million)

Table 49 Germany: Automotive Composite Materials Market Size, By Material Type, 20132020 (TMT)

Table 50 Germany: Market Size, By Material Type, 20132020 (USD Million)

Table 51 France: Automotive Composite Materials Market Size, By Material Type, 20132020 (TMT)

Table 52 France: Market Size, By Material Type, 20132020 (USD Million)

Table 53 Asia-Oceania: Automotive Composite Materials Market Size, By Country, 20132020, (TMT)

Table 54 Asia-Oceania: Market Size, By Country, 20132020 (USD Million)

Table 55 China: Automotive Composite Materials Market Size, By Material Type, 20132020 (TMT)

Table 56 China: Market Size, By Material Type, 20132020 (USD Million)

Table 57 Japan: Automotive Composite Materials Market Size, By Material Type, 20132020 (TMT)

Table 58 Japan: Market Size, By Material Type, 20132020 (USD Million)

Table 59 India: Automotive Composite Materials Market Size, By Material Type, 20132020 (TMT)

Table 60 India: Market Size, By Material Type, 20132020 (USD Million)

Table 61 South Korea: Automotive Composite Materials Market Size, By Material Type, 20132020 (TMT)

Table 62 South Korea: Market Size, By Material Type, 20132020 (USD Million)

Table 63 RoW: Automotive Composite Materials Market Size, By Country, 20132020 (TMT)

Table 64 RoW: Market Size, By Country, 20132020 (USD Million)

Table 65 Brazil: Automotive Composite Materials Market Size, By Material Type, 20132020 (TMT)

Table 66 Brazil: Market Size, By Material Type, 20132020 (USD Million)

Table 67 Russia: Automotive Composite Materials Market Size, By Material Type, 20132020 (TMT)

Table 68 Russia: Market Size, By Material Type, 20132020 (USD Million)

Table 69 Mergers & Acquisitions, Agreements, Partnerships, Collaborations, & Joint Ventures, 20142015

Table 70 Expansions, 2015

Table 71 New Product Launches & Developments, 2015

List of Figures (58 Figures)

Figure 1 Composite Materials Market: Markets Covered

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Significant Growth in Global Population (Million), 20042014

Figure 6 Gross Domestic Product Vs. Total Vehicle Sales

Figure 7 Roadways Infrastructure: Road Network (Km), By Country, 2011

Figure 8 Rail Network, 2012

Figure 9 Economic Factors

Figure 10 Market Size Estimation Methodology: Bottom-Up Approach

Figure 11 Automotive Composite Materials Market Opportunities

Figure 12 Asia-Oceania Projected to Be the Largest Market for Automotive Composite Materials, 20152020 (USD Billion)

Figure 13 China: the Largest Market for Automotive Composite Materials From 2015 to 2020

Figure 14 Passenger Car Segment Estimated to Be the Largest Market for PMC, 2015 (USD Billion)

Figure 15 Interior Segment Projected to Grow at the Highest CAGR From 2015 to 2020 (USD Billion)

Figure 16 Locomotive & Rolling Stock Composite Materials Market: Asia-Oceania Projected to Be the Largest Market From 2015 to 2020 (USD Million)

Figure 17 Automotive Composite Material Market, By Material Type

Figure 18 Market Segmentation, By Application & Components

Figure 19 Market Segmentation, By Region

Figure 20 Composite Materials Market Dynamics

Figure 21 Key Countries: Impact of Regulations on the Composite Materials Market

Figure 22 Electric Vehicle (EV) Sales, By Region, 20122014 (000 Units)

Figure 23 Automotive Composite Materials: Supply Chain Analysis

Figure 24 Automotive Composite Materials Market: Porters Five Forces Analysis

Figure 25 CMC to Be the Highest Growing Market During the Forecast Period (USD Million)

Figure 26 GFRP to Hold the Largest Market for Automotive Composite Materials in 2015, (USD Million)

Figure 27 Passenger Cars Dominating the MMC Market With Maximum Market Share in 2015, (USD Million)

Figure 28 HCV Vehicle Segment is Projected to Grow at A Highest CAGR From 2015 to 2020 (USD Million)

Figure 29 Weighing Factor for Different Materials

Figure 30 Interior Application is Estimated to Grow at the Highest CAGR During the Forecast Period (USD Million)

Figure 31 PMC to Hold the Major Market in the Structural Application, 2015 (USD Million)

Figure 32 CMC is Projected to Grow at the Fastest CAGR During the Forecast Period

Figure 33 PMC are Estimated to Lead the Interior Composite Materials Market During the Forecast Period

Figure 34 MMC are Set to Grow at A Rapid Rate in the Exterior Application During the Forecast Period

Figure 35 PMC Hold the Largest Market Share, in Terms of Value, in the Other Application Segment During the Forecast Period

Figure 36 Change in National Nox and Pm-10 Emissions for Baseline, By Mode

Figure 37 North America Estimated to Grow at the Highest CAGR During the Forecast Period (USD Million)

Figure 38 Automotive Composite Materials Market Snapshot, By Country, 2015, (USD Million)

Figure 39 North America: Fastest-Growing Automotive Composite Materials Market

Figure 40 Asia-Oceania: Largest Market for Automotive Composite Materials

Figure 41 Companies Adopted Regional Expansion as the Key Growth Strategy, 20122015

Figure 42 Toray Industries Grew at the Highest Rate From 2010 to 2014

Figure 43 Regional Expansion is the Key Strategy Adopted By Market Players

Figure 44 Region-Wise Revenue Mix of Five Major Players

Figure 45 Toray Industries, Inc.: Company Snapshot

Figure 46 Toray Industries Inc.: SWOT Analysis

Figure 47 Cytec Industries Inc.: Company Snapshot

Figure 48 Cytec Industries Inc.: SWOT Analysis

Figure 49 SGL Carbon SE: Company Snapshot

Figure 50 SGL Carbon SE: SWOT Analysis

Figure 51 Teijin Ltd.: Company Snapshot

Figure 52 Teijin Ltd.: SWOT Analysis

Figure 53 Koninklijke Ten Cate NV: Company Snapshot

Figure 54 Koninklijke Ten Cate NV: SWOT Analysis

Figure 55 Johns Manville: Company Snapshot

Figure 56 Mitsubishi Rayon Co. Ltd.: Company Snapshot

Figure 57 Owens Corning.: Company Snapshot

Figure 58 Johnson Controls Inc.: Company Snapshot

Growth opportunities and latent adjacency in Composite Materials Market