Battery Sensor Market by Voltage Type (12V, 24V, and 48V), Communication Technology (LIN and CAN), Hybrid Vehicle (HEV and PHEV), Vehicle Type (Passenger Car, LCV and HCV), and Region - Global Forecast to 2025

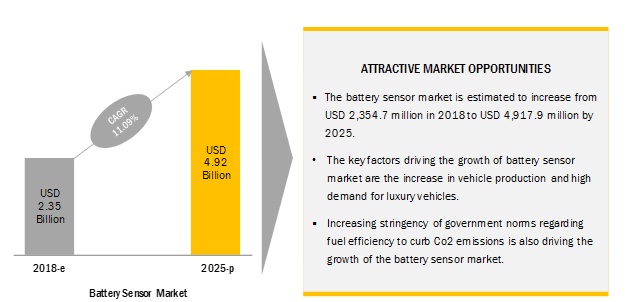

The Battery Sensor Market is estimated to be USD 2.18 billion in 2017 and is projected to reach USD 4.92 billion by 2025, at a CAGR of 11.09% during the forecast period.

The base year for the study is 2017 and the forecast period is 2018–2025. The market is primarily driven by the rising demand for fuel-efficient vehicles, increased vehicle production, and the rising emission concerns.

Rising emission concerns and growing demand for fuel-efficient vehicles are expected to drive the battery sensor market.

Intelligent battery sensor (IBS) is a shunt-type sensor that analyzes the battery pack and provides information about voltage, current, and temperature. It is directly mounted on the negative terminal of the battery in a vehicle. IBS monitors the battery continuously and provides information about 3 main parameters. These 3 parameters are state-of-charge, state-of-function (power ability), and state-of-health (aging) of the battery. The monitoring of the battery helps to identify defects and provides this information to the driver. Hence, vehicle breakdowns due to battery issues can be minimized with the help of IBS.

The growth of the Battery Sensor Market can be attributed to the increasing stringency of emission norms worldwide, rising adoption of electrical & electronic components, increasing vehicle production, and rising demand for luxury vehicles. The market comprises several global market leaders, which makes it highly competitive. Bosch, Continental, HELLA, and NXP are some of the leading market players that are continuously developing new products to expand their automotive battery sensor business at the global level.

The rising adoption of advanced technologies in modern vehicles is expected to create growth opportunities for the battery sensor market. These technologies directly impact the number of vehicle batteries and the sensors present in the batteries. Battery sensors provide the battery’s information such as the temperature, voltage, and current. The number of sensors used in a vehicle depends on advanced technologies installed in the vehicle such as start-stop system. Moreover, sensor manufacturers such as Bosch, Continental, NXP, and others are focusing on advanced sensor technologies to improve the battery experience.

The growth of the market can be attributed to the rising demand for IBS in developing countries such as Mexico, India, China, and others. Also, increasing vehicle production worldwide, government regulations, and the rising demand for fuel-efficient vehicles are fueling the overall growth of the market.

Market Dynamics

Drivers

- Improved battery performance and efficiency

- Vehicle electrification

- Increasing demand for batteries

Restraints

- System malfunction

Opportunities

- Adoption of new technologies

- Rising demand for battery electric vehicles

- Advent of 48V battery system

Challenges

- High cost

Objectives Of The Study

- To analyze the battery sensor market and forecast (2018–2025) its size, in terms of value (USD million)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry challenges)

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To segment the market and forecast its size, by value, based on region (Asia Pacific, Europe, North America, and the Rest of the World (RoW))

- To segment the market and forecast the market size, by value, based on voltage type (12V, 24V, and 48V)

- To segment the market and forecast the market size, by value, based on vehicle type (Passenger Car (PC), Light Commercial Vehicle (LCV), and Heavy Commercial Vehicle (HCV))

- To segment the market and forecast the market size, by value, based on hybrid vehicle type (Hybrid Electric Vehicle (HEV) and Plug-in Hybrid Electric Vehicle (PHEV))

- To segment the market and forecast the market size, by value, based on communication technology (Local Interconnect Network (LIN) and Controller Area Network (CAN))

- To showcase the technological developments impacting the battery sensor market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants

Research Methodology

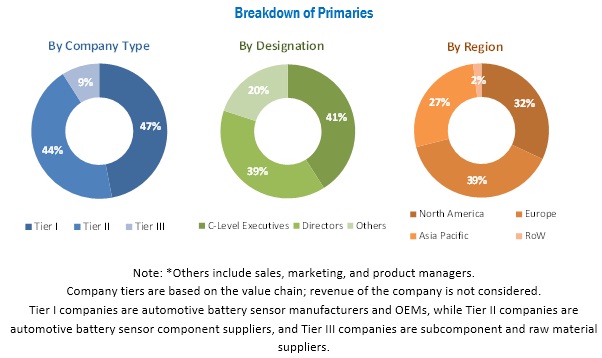

This research study involves the use of secondary sources such as company annual reports/presentations, industry association publications, automotive magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases such as Hoover’s, Bloomberg Businessweek, and Factiva to identify and collect information for an extensive commercial study of the battery sensor market. The primary sources comprise industry experts, engineers, product managers, R&D managers, automobile OEMs, battery sensor manufacturers, battery manufacturers, and sales managers. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject-matter experts, technical experts, battery sensor experts of major market players, and industry consultants to obtain and verify critical qualitative and quantitative information as well as to assess prospects. The following figure illustrates the market research methodology applied to make this report on the market

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the Battery Sensor Market consists of automotive battery sensor technology manufacturers such as HELLA (Germany), Continental (Germany), Bosch (Germany), Furukawa Electric (Japan), NXP (Netherlands), Vishay (US), Texas Instrument (US), Denso (Japan), ams AG (Austria), Inomatic (Germany), and TE Connectivity (Switzerland).

Critical Questions which the report answers:

- Which communication technology type will lead the battery sensor market (LIN and CAN)?

- What are the industry trends of the battery sensor market?

- What would be the impact of government mandates to regularize emission norms?

- What are the technological developments in the battery sensor market?

Target audiencE

- Automotive OEMs

- Companies operating in the automotive battery sensor ecosystem

- Country-level governments and other policymakers

- Country-level industry associations and experts

- Distributors and suppliers of automotive battery sensor components

- Hybrid vehicle manufacturers

- Manufacturers of automotive battery sensor components

- Manufacturers of automotive battery sensor

- Raw material manufacturers

- Raw material suppliers

Scope of the Report

Battery Sensor Market, By Voltage type

- 12V

- 24V

- 48V

Battery Sensor Market, By Communication Technology type

- LIN

- CAN

Battery Sensor Market, By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Battery Sensor Market, By Hybrid Vehicle Type

- HEV

- PHEV

Battery Sensor Market, By Region

- Asia Pacific

- Europe

- North America

- Rest of the World (RoW)

Available Customizations

- Detailed analysis and profiling of additional countries (up to 3)

- Detailed analysis and profiling of additional market players (up to 3)

- Competitive leadership mapping (micro-quadrant)

- Country-level analysis of segments (up to 2)

The value of the battery sensor market is estimated to be USD 2.35 billion in 2018 and is projected to reach USD 4.92 billion by 2025, at a CAGR of 11.09% from 2018 to 2025. The key growth drivers of the market are increasing vehicle production, high demand for fuel-efficient vehicles, stringent emission regulations, and increasing demand for luxury and commercial vehicles.

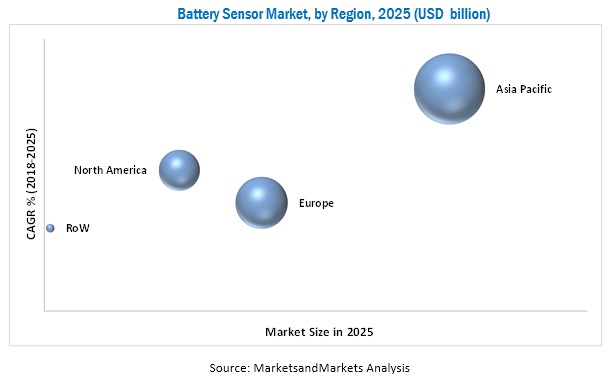

The growing sales of hybrid vehicles in Japan, China, India, and others are driving the market for automotive battery sensors. Automotive manufacturers are focusing on the production of hybrid vehicles to meet the stringent emission norms. Moreover, policies such as exemption from road tax, crowding charge waiver, and free car parks at various places have encouraged consumers to buy hybrid vehicles. In Asia Pacific, the adoption of HEVs is increasing. China, India, and Japan have made significant investments to encourage the adoption of HEVs.

The growth of the battery sensor market in the passenger car segment is attributed to the increased passenger production in several regions. Passenger car production has increased across the globe owing to several factors such as the growing demand for passenger cars, increase in purchasing power, and capacity expansion by OEMs, particularly in emerging economies. Also, the rising demand for luxury vehicles, fuel-efficient passenger cars, stringent CO2 emissions, and improved battery life have fueled the overall growth of the passenger car segment.

The battery sensor market for the 12V battery segment is also expected to grow due to its low-cost benefit. Also, 12V batteries are used in regenerative brake technology, start/stop system, and others. Moreover, the continuous rise in the production of vehicles and stringent emission norms to curb CO2 would prosper the overall growth. Also, 12V automotive batteries are preferred due to the ease of recycling. As per the United States Environmental Protection Agency, 100 million auto batteries are replaced per year, and 99% of them are turned in for recycling. As the 12V batteries are mostly recycled, the cost of a 12V battery is low.

The market for LIN is the largest due to its low-cost benefit. In general, inexpensive silicon is used in this system during manufacturing, which results in the low cost of the system. Battery management system installed with LIN offers various features such as fast data transmitting, data checksum & error detection, configuration flexibility, no arbitration required for optimum operation, temperature situation control, self-synchronization, and others, which is another major factor for the rapid growth of this segment.

The Asia Pacific market is dominated by China and Japan where the automotive industry, with government support, is growing at a faster pace than other countries in the region. Also, the growth of the Asia Pacific market can be attributed to the increasing vehicle production and rising demand for fuel-efficient vehicles in Japan, South Korea, India, and China. Moreover, increasing passenger car production in China and India is the key factor in fostering the growth of 12V batteries in the Asia Pacific region. The growing adoption of IBS in automobiles due to China VI & India VI regulations and the increasing demand for luxury vehicles are also expected to drive the battery sensor market in the region.

Rising demand for fuel-efficient vehicles, increasing vehicle production, high demand for luxury vehicles, and stringent emission norms are creating opportunities for the growth of the Battery Sensor Market

12V

OEMs used 12V batteries in vehicles because of the low adoption of electronic components. Hence, vehicles required low voltage for the operation of electronic components. Today, with the advancements in technology, a 12V intelligent battery sensor is used to monitor the battery status.

24V

A 24-volt battery is installed in vehicles that require more power for the proper functioning of electrical components. It is mostly installed in commercial vehicles, which need more power for the operation of electronic systems.

Passenger Cars

A Passenger Car (PC), as defined by the OICA, is a motor vehicle equipped with at least 4 wheels, comprising not more than 8 seats. The PC segment is the largest, by vehicle type, and includes sedans, hatchbacks, station wagons, Sports Utility Vehicles (SUVs), and Multi-Utility Vehicles (MUVs). This vehicle segment is the most promising market for electric vehicles as it is the largest segment in the automotive industry. The PC segment of the electric vehicle market is growing at a significant rate in emerging economies in the Asia Pacific region. The market growth in the region can be attributed to a rise in the GDP and population, improvement in lifestyle, increased purchasing power of consumers, and development of infrastructure.

Light Commercial Vehicles

Vehicles that have authorized mass between 3.5 tons and 7 tons are called light commercial vehicles. LCVs have come a long way from having bare essential features to full-blown utility vehicles that can be used for passengers as well as commercial purposes.

Heavy Commercial Vehicles

The HCV segment comprises trucks/lorries, buses, and coaches. Vehicles that have authorized mass more than 7 tons are called heavy commercial vehicles. HCVs combine 2 categories of vehicles—heavy trucks and buses and coaches. The nature of these vehicles limits their production volume and growth rates as they are used in specific applications such as logistics, construction, and mining industries

LIN

Local Interconnect Network (LIN) is installed in vehicles to establish communication between different components. It is generally a serial networking system. LIN offers various features such as fast data transmitting, data checksum & error detection, configuration flexibility, no arbitration required for optimum operation, temperature situation control, self-synchronization, and others. LIN is easy to use and install and is also suitable for industrial applications

CAN

A Controller Area Network (CAN) bus is used to maintain communication between various components of a vehicle in short radius region. It is designed to fix the problem of the bulky wiring harness. CAN uses simple wiring harness in-vehicle networks, decreases wiring cost, complexity, and weight. CAN is a peer-to-peer network, i.e., every individual node has permission to read and write data on the CAN bus.

The key factor restraining the growth of the battery sensor market is the system malfunctioning. Also, the IBS technology is relatively new and is developed by a limited number of players. The key challenge associated with IBS is the high cost. The high cost of IBS vis-a-vis other battery sensors restricts its adoption. Moreover, the cost of the IBS varies with the voltage of the battery.

The battery sensor market is dominated by a few global players and several regional players. Some of the key manufacturers operating in the market are HELLA (Germany), Continental (Germany), Bosch (Germany), Furukawa Electric (Japan), NXP (Netherlands), Vishay (US), Texas Instrument (US), Denso (Japan), ams AG (Austria), Inomatic (Germany), and TE Connectivity (Switzerland).

Critical Questions:

- Where will the lead-acid battery take the industry in the long term?

- Will the industry cope with the challenge of the high cost of the battery sensor market?

- How do you see the impact of the 48V in the battery sensor market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for The Study

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Battery Sensor Market

4.2 Asia Pacific to Lead the Global Market in 2025

4.3 Market, By Voltage Type, 2018 vs 2025

4.4 Market, By Vehicle Type, 2018 vs 2025

4.5 Market, By Communication Technology Type

4.6 Market, By Hybrid Vehicle Type

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Improved Battery Performance and Efficiency

5.2.1.2 Vehicle Electrification

5.2.1.3 Increasing Demand for Batteries

5.2.2 Restraints

5.2.2.1 System Malfunction

5.2.3 Opportunities

5.2.3.1 Adoption of New Technologies

5.2.3.2 Rising Demand for Battery Electric Vehicles

5.2.3.3 Advent of 48V Battery System

5.2.4 Challenges

5.2.4.1 High Cost

5.2.5 Impact of Market Dynamics

6 Technological Overview (Page No. - 38)

6.1 Intelligent Battery Sensor

6.2 State of Charge (SOC)

6.3 State of Health (SOH)

6.4 State of Function (SOF)

7 Battery Sensor Market, By Voltage (Page No. - 40)

7.1 Introduction

7.2 12V

7.3 24V

7.4 48V

8 Battery Sensor Market, By Communication Technology (Page No. - 46)

8.1 Introduction

8.2 Local Interconnect Network (LIN)

8.3 Controller Area Network (CAN)

9 Battery Sensor Market, By Vehicle Type (Page No. - 52)

9.1 Introduction

9.2 Heavy Commercial Vehicle (HCV)

9.3 Light Commercial Vehicle (LCV)

9.4 Passenger Car (PC)

10 Battery Sensor Market, By Hybrid Vehicle Type (Page No. - 60)

10.1 Introduction

10.2 Hybrid Electric Vehicle (HEV)

10.3 Plug-In Hybrid Electric Vehicle (PHEV)

11 Battery Sensor Market, By Region (Page No. - 66)

11.1 Introduction

11.2 Asia Pacific

11.2.1 China

11.2.2 India

11.2.3 Japan

11.2.4 South Korea

11.2.5 Others

11.3 Europe

11.3.1 France

11.3.2 Germany

11.3.3 Russia

11.3.4 Spain

11.3.5 Turkey

11.3.6 UK

11.3.7 Others

11.4 North America

11.4.1 Canada

11.4.2 Mexico

11.4.3 US

11.5 RoW

11.5.1 Brazil

11.5.2 Iran

12 Competitive Landscape (Page No. - 94)

12.1 Overview

12.2 Market Ranking Analysis

12.3 Competitive Scenario

12.3.1 New Product Developments

12.3.2 Collaborations/Joint Ventures/Supply Contracts/ Partnerships/Agreements

12.3.3 Expansions, 2017–2018

13 Company Profiles (Page No. - 101)

13.1 Key Players

(Business Overview, Products Offered, Recent Developments, SWOT Analysis)*

13.1.1 Robert Bosch

13.1.2 Continental

13.1.3 Hella

13.1.4 Vishay

13.1.5 Nxp

13.1.6 FurUKawa Electric

13.1.7 Denso

13.1.8 Texas Instruments

13.1.9 TE Connectivity

13.1.10 AMS AG

13.1.11 Inomatic

13.1.12 Mta Spa

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

13.2 Key Players From Other Regions

13.2.1 North America

13.2.1.1 Silicon Labs

13.2.1.2 Microchip

13.2.1.3 Mouser Electronics

13.2.1.4 Analog Devices

13.2.2 Europe

13.2.2.1 Insplorion AB

13.2.2.2 Infineon Technologies

13.2.2.3 Csm Gmbh - Computer-Systeme-Messtechnik

13.2.2.4 Autotec

13.2.2.5 Delphi

13.2.2.6 Avl

13.2.3 Asia Pacific

13.2.3.1 Samsung SDI

13.2.3.2 Renesas

13.2.3.3 Automotive Energy Supply Corporation

13.2.3.4 Panasonic

13.2.4 Rest of the World (RoW)

13.2.4.1 Abertax Technologies

14 Appendix (Page No. - 128)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (70 Tables)

Table 1 Currency Exchange Rates (W.R.T. USD)

Table 2 Battery Sensor Market, By Voltage, 2016–2025 (000’ Units)

Table 3 Market, By Voltage, 2016–2025 (USD Million)

Table 4 12V: Market, By Region, 2016–2025 (000’ Units)

Table 5 12V: Market, By Region, 2016–2025 (USD Million)

Table 6 24V: Market, By Region, 2016–2025 (000’ Units)

Table 7 24V: Market, By Region, 2016–2025 (USD Million)

Table 8 Battery Sensor Market, By Communication Technology, 2016–2025 (000’ Units)

Table 9 LIN: Market, By Region, 2016–2025 (000’ Units)

Table 10 CAN: Market, By Region, 2016–2025 (000’ Units)

Table 11 Market, By Vehicle Type, 2016–2025 (000’ Units)

Table 12 Market, By Vehicle Type, 2016–2025 (USD Million)

Table 13 Hcv: Market, By Region, 2016–2025 (000’ Units)

Table 14 Hcv: Market, By Region, 2016–2025 (USD Million)

Table 15 Lcv: Market, By Region, 2016–2025 (000’ Units)

Table 16 Lcv: Market, By Region, 2016–2025 (USD Million)

Table 17 Pc: Market, By Region, 2016–2025 (000’ Units)

Table 18 Pc: Market, By Region, 2016–2025 (USD Million)

Table 19 Market, By Hybrid Vehicle, 2016–2025 (000’ Units)

Table 20 Market, By Hybrid Vehicle, 2016–2025 (USD Million)

Table 21 Hev: Market, By Voltage, 2016–2025 (000’ Units)

Table 22 Hev: Market, By Voltage, 2016–2025 (USD Million)

Table 23 Phev: Market, By Voltage, 2016–2025 (000’ Units)

Table 24 Phev: Market, By Voltage, 2016–2025 (USD Million)

Table 25 Battery Sensor Market, By Region, 2016–2025 (000’ Units)

Table 26 Market, By Region, 2016–2025 (USD Million)

Table 27 Asia Pacific: Market, By Country, 2016–2025 (000’ Units)

Table 28 Asia Pacific: Market, By Country, 2016–2025 (USD Million)

Table 29 China: Market, By Vehicle Type, 2016–2025 (000’ Units)

Table 30 China: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 31 India: Market, By Vehicle Type, 2016–2025 (000’ Units)

Table 32 India: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 33 Japan: Market, By Vehicle Type, 2016–2025 (000’ Units)

Table 34 Japan: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 35 South Korea: Market, By Vehicle Type, 2016–2025 (000’ Units)

Table 36 South Korea: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 37 Others: Market, By Vehicle Type, 2016–2025 (000’ Units)

Table 38 Others: Battery Sensor Market, By Vehicle Type, 2016–2025 (USD Million)

Table 39 Europe: Market, By Country, 2016–2025 (000’ Units)

Table 40 Europe: Market, By Country, 2016–2025 (USD Million)

Table 41 France: Market, By Vehicle Type, 2016–2025 (000’ Units)

Table 42 France: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 43 Germany: Market, By Vehicle Type, 2016–2025 (000’ Units)

Table 44 Germany: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 45 Russia: Market, By Vehicle Type, 2016–2025 (000’ Units)

Table 46 Russia: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 47 Spain: Market, By Vehicle Type, 2016–2025 (000’ Units)

Table 48 Spain: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 49 Turkey: Market, By Vehicle Type, 2016–2025 (000’ Units)

Table 50 Turkey: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 51 UK: Market, By Vehicle Type, 2016–2025 (000’ Units)

Table 52 UK: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 53 Others: Market, By Vehicle Type, 2016–2025 (000’ Units)

Table 54 Others: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 55 North America: Battery Sensor Market, By Country, 2016–2025 (000’ Units)

Table 56 North America: Market, By Country, 2016–2025 (USD Million)

Table 57 Canada: Market, By Vehicle Type, 2016–2025 (000’ Units)

Table 58 Canada: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 59 Mexico: Market, By Vehicle Type, 2016–2025 (000’ Units)

Table 60 Mexico: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 61 US: Market, By Vehicle Type, 2016–2025 (000’ Units)

Table 62 US: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 63 RoW: Market, By Country, 2016–2025 (000’ Units)

Table 64 RoW: Market, By Country, 2016–2025 (USD Million)

Table 65 Brazil: Market, By Vehicle Type, 2016–2025 (000’ Units)

Table 66 Brazil: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 67 Iran: Market, By Vehicle Type, 2016–2025 (000’ Units)

Table 68 Iran: Battery Sensor Market, By Vehicle Type, 2016–2025 (USD Million)

Table 69 New Product Developments, 2016–2018

Table 70 Collaborations/Joint Ventures/Supply Contracts/Partnerships/ Agreements, 2017–2018

List of Figures (53 Figures)

Figure 1 Battery Sensor Market: Markets Covered

Figure 2 Market: Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Market Size Estimation Methodology for the Market: Bottom-Up Approach

Figure 6 Data Triangulation

Figure 7 Market: Market Dynamics

Figure 8 Market, By Region, 2018–2025 (USD Million)

Figure 9 Market, By Hybrid Vehicle Type, 2018 vs 2025 (USD Million)

Figure 10 Rising Demand for Fuel-Efficient Vehicles is Expected to Drive the Market, 2018–2025 (USD Million)

Figure 11 Market Share, By Region, 2018–2025 (USD Million)

Figure 12 12V Segment to Hold the Largest Market Share, 2018 vs 2025 (USD Million)

Figure 13 Passenger Car Segment to Hold the Largest Market Share, 2018 vs 2025 (USD Million)

Figure 14 LIN to Hold the Largest Market Share, 2018 vs 2025 (Thousand Units)

Figure 15 Hev Segment to Hold the Largest Market Share, 2018 vs 2025 (USD Million)

Figure 16 Battery Sensor Market: Market Dynamics

Figure 17 Hybrid Vehicle Sales, 2017–2025 (Thousand Units)

Figure 18 Global Vehicle Production, 2014–2017 (Million Units)

Figure 19 Battery Electric Vehicle Sales, 2012–2017 (Thousand Units)

Figure 20 Functioning of Intelligent Battery Sensor

Figure 21 Market, By Voltage, 2018 vs. 2025 (USD Million)

Figure 22 12V: Market, By Region, 2018 vs 2025 (USD Million)

Figure 23 24V: Market, By Region, 2018 vs 2025 (USD Million)

Figure 24 Market, By Communication Technology, 2018 vs. 2025 (000’ Units)

Figure 25 LIN: Market, By Region, 2018 vs 2025 (000’ Units)

Figure 26 CAN: Market, By Region, 2018 vs 2025 (000’ Units)

Figure 27 Market, By Vehicle Type, 2018 vs. 2025 (USD Million)

Figure 28 HCV: Market, By Region, 2018 vs 2025 (USD Million)

Figure 29 LCV: Market, By Region, 2018 vs 2025 (USD Million)

Figure 30 PC: Market, By Region, 2018 vs 2025 (USD Million)

Figure 31 Battery Sensor Market, By Hybrid Vehicle, 2018 vs. 2025 (USD Million)

Figure 32 HEV: Market, By Voltage, 2018 vs 2025 (USD Million)

Figure 33 PHEV: Market, By Voltage, 2018 vs 2025 (USD Million)

Figure 34 Market, By Region, 2018 and 2025 (USD Million)

Figure 35 Asia Pacific: Market, 2018 vs. 2025 (USD Million)

Figure 36 Europe: Market, 2018 vs. 2025 (USD Million)

Figure 37 North America: Market, 2018 vs. 2025 (USD Million)

Figure 38 Key Developments By Leading Players in the Market, 2016–2018

Figure 39 Robert Bosch: Company Snapshot

Figure 40 Robert Bosch: SWOT Analysis

Figure 41 Continental: Company Snapshot

Figure 42 Continental: SWOT Analysis

Figure 43 Hella: Company Snapshot

Figure 44 Hella: SWOT Analysis

Figure 45 Vishay: Company Snapshot

Figure 46 Vishay: SWOT Analysis

Figure 47 NXP: Company Snapshot

Figure 48 NXP: SWOT Analysis

Figure 49 Furukawa: Company Snapshot

Figure 50 Denso: Company Snapshot

Figure 51 Texas Instruments: Company Snapshot

Figure 52 TE Connectivity: Company Snapshot

Figure 53 AMS AG: Company Snapshot

Growth opportunities and latent adjacency in Battery Sensor Market