Alloy Market for Automotive by Alloy Type (Steel, Aluminum, Magnesium, and Others), Area of Application (Structural, Powertrain, Exterior and Others), Vehicle Type (Passenger Car, LCV and HCV), & by Region - Global Forecast to 2021

[145 Pages Report] The automotive alloy market is mainly driven by stringent emission norms, increasing government legislation for reduction of weight of a vehicle, and growing research and development on fuel economy, around the globe. The global automotive alloy market is projected to grow at the CAGR of 7.69% to reach the market size of USD 177.47 Billion by 2021. The base year for the study is 2015, and the forecast period is from 2016 to 2021. The report segments the automotive alloy market based on alloy type, vehicle type, area of application, and region. Alloys of steel, aluminium, magnesium, copper, nickel, titanium among others are covered in the report.

Continuous growth in socio-economic conditions has fueled growth in sales of lightweight vehicles in the passenger car and LCV segments across the globe. The global automotive alloy market is being driven by the rising prices of fuel, government legislation, and efficient driving experience, especially in North America and Europe, and rapid urbanization around the world.

The research methodology used in the report involves various secondary sources including paid databases and directories. Experts from related industries and suppliers have been interviewed to understand the future trends of the automotive alloy market. The model mapping with respect to weight specifications has been done for the passenger car, LCV and HCV segments at country level. The vehicle production at country level has been considered for the study. The bottom-up approach has been used to estimate the market size, in which country-wise vehicle production, and vehicle sales statistics has been taken into account.

The production of vehicles has been considered to arrive at the market size, in terms of volume, for a given period. This country-wise market size, in terms of volume, of vehicles is then multiplied with the country-wise average price of alloy required in all the applications in manufacturing of a vehicle. This results in the country-wise market size, in terms of value. The summation of the country-wise market gives the regional markets and further summation of the regional market provides the global automotive alloy market.

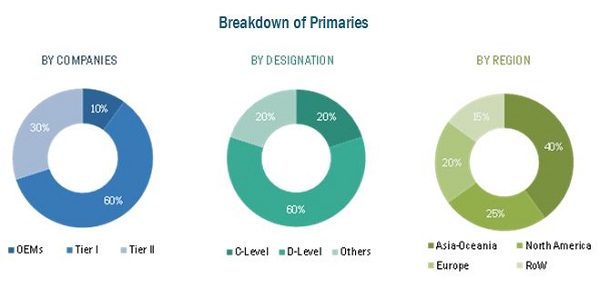

The figure below shows the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The automotive alloy ecosystem consists of alloy manufacturers such as ArcelorMittal SA (Luxembourg), Alcoa Inc. (U.S.), Novelis Inc. (U.S.), UACJ Corporation (Japan), Norsk Hydro ASA (Norway), ThyssenKrupp AG (Germany), Kobe Steel, Ltd. (Japan), AMG Advanced Metallurgical Group NV (Netherlands), and Constellium NV (Netherlands), and Massey Ferguson Ltd (U.S.). Global automotive vehicle manufacturers associations like OICA (International Organization of Motor Vehicle Manufacturers) and regional automotive vehicle manufacturers association such as SIAM (Society of Indian Automobile Manufacturers), CAAM (China Association of Automobile Manufacturers), KAMA (Korea Automobile Manufacturers Association), JAMA (Japan Automobile Manufacturers Association ), EAMA (European Automobile Manufacturers Association), NAAMSA (National Association of Automobile Manufacturers of South Africa), AMIA (Mexican Association of the Automotive Industry), CAA (Canadian Automobile Association), among others.

Target Audience

- Alloy manufacturers

- Vehicle parts manufacturers

- Vehicle manufacturers

- Investment firms

- Equity research firms

- Private equity firms

Scope of the Report

-

By Alloy Type

- Steel

- Aluminium

- Magnesium

- Others

-

By Vehicle Type

- Passenger car

- Light commercial vehicle

- Heavy commercial vehicel

-

By area of Application

- Structural

- Powertrain

- Exterior

- Others

-

By Region

- Asia-Oceania

- North America

- Europe

- RoW

Available Customizations

- Automotive lightweight material market, by type

- Automotive aluminium market, by type

- Automotive steel market, by type

The global automotive alloy market size is projected to grow at a promising CAGR of 7.69% during the forecast period, to reach USD 177.47 Billion by 2021. Increasing production of automobiles coupled with increasing need to reduce a vehicle’s weight are the major factors driving this growth.

The market for aluminium is estimated to witness a high growth owing to increasing adoption of aluminium in multiple automotive applications by globally established OEMs. The rising average weight of the vehicle due to integration of various systems has led to OEMs to consider using lighter materials for the vehicles. The demand for lightweight materials by OEMs has directly influenced the suppliers of raw materials and increased competition in the market. For instance, Novelis Inc. (U.S.) developed the Advanz 7000-series of aluminium products which can be used to manufacture automotive components such as bumper systems, and door intrusion beams, among others.

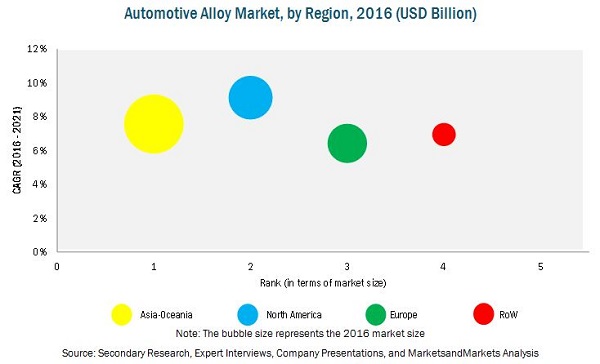

The Asia-Oceania region includes emerging economies such as India, China, Indonesia, and Thailand, among others. Increase in disposable income coupled with rise in population levels has driven the demand for automobiles in this region. The geographical advantages of Asia-Oceania region and government support for industrialization have reduced the production costs.

The size of the market for alloys used in LCVs, in terms of value, is projected to grow at a fast pace in the automotive alloy market during the forecast period due to increasing adoption of aluminium, especially in the North American region. The passenger car segment is estimated to be the largest market for alloys because of the increasing demand for transportation and new hybrid and electric automotive models.

Automotive OEMs have been spending heavily on the research and development of new alloys for powertrain applications to reduce the weight without reducing the strength of the components. This has led the alloy manufacturers to develop innovative aluminium applications in the powertrain.

The major restraints considered in the study include high cost and engineering barriers. These factors could negatively affect the demand for adoption of lightweight alloys.

ArcelorMittal S.A. is one of the largest suppliers of steel to the automotive industry with approximately 13.3 Million tonnes of flat steel deliveries, generating revenue of USD 12.6 Billion from sales to automotive manufacturers in 2014. However, owing to stringent regulations governing vehicular emissions, OEMs are focusing on using lightweight materials, especially aluminium, to reduce weight. This has increased the competition for the company as OEMs have started to shift from steel to aluminium. The company has invested in developing new steel products which can compete with aluminium in the automotive industry. The company plans to invest USD 20 million to establish a research and development center in Brazil. The company also supplied its lightweight products to Honda Motor Company (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand Side Analysis

2.4.2.1 Impact of Disposable Income on Total Vehicle Sales

2.4.2.2 Infrastructure: Roadways

2.4.3 Supply Side Analysis

2.4.3.1 Rising Demand for Hybrid and Electric Vehicles

2.5 Market Size Estimation

2.6 Data Triangulation

2.7 Assumptions

3 Executive Summary

4 Premium Insights

4.1 Automotive Alloy Market

4.2 Automotive Alloys Market Growth, By Country

4.3 Automotive Alloy Market, By Type, 2016 (USD Billion)

4.4 Automotive Alloys Market, By Area of Application, 2016 (USD Billion)

4.5 Automotive Alloys Market, By Vehicle Type, 2016 vs 2021, (USD Billion)

4.6 Automotive Alloys Market, By Region, 2016 vs 2021, (USD Billion)

4.7 Life Cycle Analysis

5 Market Overview

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growing Vehicle Production

5.3.1.2 Regulations for Fuel Efficiency & Emissions

5.3.1.3 Improved Driving Dynamics

5.3.2 Restraints

5.3.2.1 High Cost

5.3.3 Opportunities

5.3.3.1 Growing Market for Electric Vehicles

5.3.3.2 Integration of New Systems for Comfort & Safety

5.3.4 Challenges

5.3.4.1 Engineering Barriers

5.4 Value Chain Analysis

5.5 Porter’s Five Forces Analysis

5.5.1 Threat of New Entrants

5.5.2 Threat of Substitutes

5.5.3 Bargaining Power of Buyers

5.5.4 Bargaining Power of Suppliers

5.5.5 Intensity of Competitive Rivalry

6 Global Automotive Alloys Market, By Alloy Type

6.1 Introduction

6.2 Steel

6.3 Aluminium

6.4 Magnesium

6.5 Others

7 Automotive Alloy Market, By Vehicle Type

7.1 Introduction

7.2 Passenger Cars

7.3 Light Commercial Vehicles

7.4 Heavy Commercial Vehicles

8 Automotive Alloy Market, By Area of Application

8.1 Introduction

8.2 Structural

8.3 Powertrain

8.4 Exterior

8.5 Others

9 Automotive Alloys Market, By Region

9.1 Introduction

9.2 Market Analysis, By Region

9.2.1 North America

9.2.1.1 The U.S.

9.2.1.2 Canada

9.2.1.3 Mexico

9.2.2 Europe

9.2.2.1 The U.K.

9.2.2.2 Germany

9.2.2.3 France

9.2.3 Asia-Oceania

9.2.3.1 China

9.2.3.2 Japan

9.2.3.3 India

9.2.3.4 South Korea

9.2.4 RoW

9.2.4.1 Brazil

9.2.4.2 Russia

10 Competitive Landscape

10.1 Competitive Situation & Trends

10.2 Expansions

10.3 Agreements, Partnerships & Joint Ventures

10.4 Mergers & Acquisitions, Supply Contracts & Others

10.5 New Product Developments

11 Company Profiles

11.1 Introduction

11.2 Arcelormittal SA

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Recent Developments

11.2.4 SWOT Analysis

11.2.5 MnM View

11.3 Alcoa Inc.

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 Novelis, Inc.

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 Recent Developments

11.4.4 SWOT Analysis

11.4.5 MnM View

11.5 UACJ Corporation

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Recent Developments

11.5.4 MnM View

11.6 Norsk Hydro ASA

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Recent Developments

11.6.4 SWOT Analysis

11.6.5 MnM View

11.7 Thyssenkrupp AG

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Recent Developments

11.7.4 SWOT Analysis

11.7.5 MnM View

11.8 Kobe Steel, Ltd.

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 Recent Developments

11.8.4 MnM View

11.9 AMG Advanced Metallurgical Group

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 Recent Developments

11.9.4 MnM View

11.10 Constellium N.V.

11.10.1 Business Overview

11.10.2 Products Offered

11.10.3 Recent Developments

11.10.4 MnM View

11.11 Nippon Steel & Sumitomo Metal Corp.

11.11.1 Business Overview

11.11.2 Products Offered

11.11.3 Recent Developments

11.11.4 MnM View

12 Appendix

12.1 Key Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

List of Tables (77 Tables)

Table 1 Government Incentives for Electric Vehicles

Table 2 Overview of Emission and Fuel Economy Regulation Specifications for LCVs

Table 3 Value Chain: Automotive Alloy Market

Table 4 Global Automotive Alloy Market, By Alloy Type, 2014-2021(Thousand Metric Tons)

Table 5 Global Automotive Alloy Market, By Alloy Type, 2014-2021 (USD Billion)

Table 6 Global Automotive Steel Market, By Region, 2014-2021 (Thousand Metric Tons)

Table 7 Global Automotive Steel Market, By Region, 2014-2021 (USD Billion)

Table 8 Global Automotive Aluminium Alloy Market, By Region, 2014-2021 (Thousand Metric Tons)

Table 9 Global Automotive Aluminium Alloy Market, By Region, 2014-2021 (USD Billion)

Table 10 Global Automotive Magnesium Alloy Market, By Region, 2014-2021 (Thousand Metric Tons)

Table 11 Global Automotive Magnesium Alloy Market, By Region, 2014-2021 (USD Billion)

Table 12 Global Other Automotive Alloys Market, By Region, 2014-2021 (Thousand Metric Tons)

Table 13 Global Other Automotive Alloys Market, By Region, 2014-2021 (USD Billion)

Table 14 Global Automotive Alloy Market, By Vehicle Type, 2014-2021 (Thousand Metric Tons)

Table 15 Global Automotive Alloy Market, By Vehicle Type, 2014-2021 (USD Billion)

Table 16 Passenger Car Automotive Alloy Market, By Type, 2014-2021 (Thousand Metric Tons)

Table 17 Passenger Car Alloy Market, By Type, 2014-2021 (USD Billion)

Table 18 Light Commercial Vehicle Alloy Market, By Type, 2014-2021 (Thousand Metric Tons)

Table 19 Light Commercial Vehicle Alloy Market, By Type, 2014-2021 (USD Billion)

Table 20 Heavy Commercial Vehicle Alloy Market, By Type, 2014-2021 (Thousand Metric Tons)

Table 21 Heavy Commercial Vehicle Alloy Market Alloy Market, By Type, 2014-2021 (USD Billion)

Table 22 Global Automotive Alloy Market, By Area of Application, 2014–2021 (Thousand Metric Tons)

Table 23 Global Automotive Alloy Market, By Area of Application, 2014–2021 (USD Billion)

Table 24 Automotive Structural Alloy Market, By Type, 2014–2021 (Thousand Metric Tons)

Table 25 Automotive Structural Alloy Market, By Type, 2014–2021 (USD Billion)

Table 26 Automotive Powertrain Alloy Market, By Type, 2014–2021 (Thousand Metric Tons)

Table 27 Automotive Powertrain Alloy Market, By Type, 2014–2021 (USD Billion)

Table 28 Automotive Exterior Alloy Market, By Type, 2014–2021 (Thousand Metric Tons)

Table 29 Automotive Exterior Alloy Market, By Type, 2014–2021 (USD Billion)

Table 30 Automotive Other Applications Alloy Market, By Type, 2014–2021 (Thousand Metric Tons)

Table 31 Automotive Other Applications Alloy Market, By Type, 2014–2021 (USD Billion)

Table 32 Global Automotive Alloy Market, By Region, 2014-2021 (Thousand Metric Tons)

Table 33 Global Automotive Alloy Market, By Region Type, 2014-2021 (USD Billion)

Table 34 North American Automotive Alloy Market Size, By Country, 2014-2021 (Thousand Metric Tons)

Table 35 North America: Automotive Alloy Market Size, By Country, 2014-2021 (USD Billion)

Table 36 North America: Automotive Alloy Market Size, By Vehicle Type, 2014-2021 (Thousand Metric Tons)

Table 37 North America: Automotive Alloy Market Size, By Vehicle Type, 2014-2021 (USD Billion)

Table 38 U.S.: Automotive Alloy Market Size, By Alloy Type, 2014-2021 (Thousand Metric Tons)

Table 39 U.S.: Automotive Alloy Market Size, By Alloy Type, 2014-2021 (USD Billion)

Table 40 Canada: Automotive Alloy Market, By Alloy Type, 2014-2021 (Thousand Metric Tons)

Table 41 Canada: Automotive Alloy Market Size, By Alloy Type, 2014-2021 (USD Billion)

Table 42 Mexico: Automotive Alloy Market, By Alloy Type, 2014-2021 (Thousand Metric Tons)

Table 43 Mexico: Automotive Alloy Market, By Alloy Type, 2014-2021 (USD Billion)

Table 44 Europe: Automotive Alloy Market, By Country, 2014-2021 (Thousand Metric Tons)

Table 45 Europe: Automotive Alloy Market, By Country, 2014-2021 (USD Billion)

Table 46 Europe: Automotive Alloy Market, By Vehicle Type, 2014-2021 (Thousand Metric Tons)

Table 47 Europe: Automotive Alloy Market, By Vehicle Type, 2014-2021 (USD Billion)

Table 48 U.K.: Automotive Alloy Market, By Alloy Type, 2014-2021 (Thousand Metric Tons)

Table 49 U.K.: Automotive Alloy Market, By Alloy Type, 2014-2021 (USD Billion)

Table 50 Germany: Automotive Alloy Market, By Alloy Type, 2014-2021 (Thousand Metric Tons)

Table 51 Germany: Automotive Alloy Market, By Alloy Type, 2014-2021 (USD Billion)

Table 52 France: Automotive Alloy Market, By Alloy Type, 2014-2021 (Thousand Metric Tons)

Table 53 France: Automotive Alloy Market, By Alloy Type, 2014-2021 (USD Billion)

Table 54 Asia-Oceania: Automotive Alloy Market, By Country, 2014-2021 (Thousand Metric Tons)

Table 55 Asia-Oceania: Automotive Alloy Market, By Country, 2014-2021 (USD Billion)

Table 56 Asia-Oceania: Automotive Alloy Market, By Vehicle Type, 2014-2021 (Thousand Metric Tons)

Table 57 Asia-Oceania: Automotive Alloy Market, By Vehicle Type, 2014-2021 (USD Billion)

Table 58 China: Automotive Alloy Market, By Alloy Type, 2014-2021 (Thousand Metric Tons)

Table 59 China: Automotive Alloy Market, By Alloy Type, 2014-2021 (USD Billion)

Table 60 Japan: Automotive Alloy Market, By Alloy Type, 2014-2021 (Thousand Metric Tons)

Table 61 Japan: Automotive Alloy Market, By Alloy Type, 2014-2021 (USD Billion)

Table 62 India: Automotive Alloy Market, By Alloy Type, 2014-2021 (Thousand Metric Tons)

Table 63 India: Automotive Alloy Market, By Alloy Type, 2014-2021 (USD Billion)

Table 64 South Korea: Automotive Alloy Market, By Alloy Type, 2014-2021 (Thousand Metric Tons)

Table 65 South Korea: Automotive Alloy Market, By Alloy Type, 2014-2021 (USD Billion)

Table 66 RoW: Automotive Alloy Market, By Country Type, 2014-2021 (Thousand Metric Tons)

Table 67 RoW: Automotive Alloy Market, By Country Type, 2014-2021 (USD Billion)

Table 68 RoW: Automotive Alloy Market, By Vehicle Type, 2014-2021 (Thousand Metric Tons)

Table 69 RoW: Automotive Alloy Market, By Vehicle Type Type, 2014-2021 (USD Billion)

Table 70 Brazil: Automotive Alloy Market, By Alloy Type, 2014-2021 (Thousand Metric Tons)

Table 71 Brazil: Automotive Alloy Market, By Alloy Type, 2014-2021 (USD Billion)

Table 72 Russia: Automotive Alloy Market, By Alloy Type, 2014-2021 (Thousand Metric Tons)

Table 73 Russia: Automotive Alloy Market, By Alloy Type, 2014-2021 (USD Billion)

Table 74 Expansions, 2013-2015

Table 75 Agreements, Partnerships & Joint Ventures, 2013-2015

Table 76 Mergers & Acquisitions, Supply Contracts & Others, 2013-2015

Table 77 New Product Developments, 2013-2015

List of Figures (59 Figures)

Figure 1 Research Design

Figure 2 Research Methodology Model

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Impact of Disposable Income on Vehicle Sales, 2014

Figure 5 Roadways Infrastructure: Road Network (Km), By Country, 2011

Figure 6 Global Automotive Alloy Market, By Type: Bottom-Up Approach

Figure 7 Asia-Oceania Projected to Be the Largest Market for Automotive Alloys During the Forecast Period

Figure 8 Automotive Alloy Market: Key Countries

Figure 9 Demand for Lightweight Solutions Estimated to Drive the Market Adoption of Aluminium Alloys

Figure 10 Application of Aluminium Estimated to Be the Largest in Powertrain Segment, in 2016

Figure 11 Passenger Cars Estimated to Be the Largest Market for Automotive Alloys

Figure 12 Attractive Market Opportunities in Automotive Alloy Market

Figure 13 Canada, Mexico, and U.S. to Be the Fastest Growing Markets for Automotive Alloys, 2016–2021

Figure 14 Demand for Automotive Steel Expected to Decline Owing to Higher Weight

Figure 15 Powertrain to Dominate the Automotive Alloy Market During the Forecast Period

Figure 16 Passenger Car Segment to Dominate the Automotive Alloys Market

Figure 17 Growing Vehicle Production in Asia Oceania and North America is Projected to Drive the Automotive Alloy Market

Figure 18 Alloy Life Cycle Analysis in Automobiles, 2016

Figure 19 Global Automotive Alloy Market

Figure 20 Weight Reduction to Improve Vehicle Efficiency is A Major Driver for Automotive Alloy Market

Figure 21 Growing Vehicle Production, By Region

Figure 22 Europe: Increasing Average Weight of Passenger Cars vs Co2 Emissions

Figure 23 Porters Five Forces Analysis

Figure 24 Automotive Alloys Market, By Alloy Type, 2015 (USD Billion)

Figure 25 Automotive Steel Market, By Region, 2016 vs 2021 (USD Billion)

Figure 26 Automotive Aluminium Market, By Region, 2016 vs 2021 (USD Billion)

Figure 27 Automotive Magnesium Market, By Region, 2016 vs 2021 (USD Billion)

Figure 28 Global Automotive Alloy Market: the Passenger Car Segment Estimated to Hold the Largest Share

Figure 29 Passenger Car Alloy Market: Steel Estimated to Be the Dominant Alloy Market During the Forecast Period

Figure 30 Global LCV Alloy Market Outlook, 2016–2021 (USD Billion)

Figure 31 Global HCV Alloy Market: Steel Estimated to Dominate the Market During the Forecast Period

Figure 32 Powertrain and Structural Areas are Estimated to Hold the Maximum Market Share in Automotive Alloys Market

Figure 33 Steel is Estimated to Hold the Maximum Market Size in Structural Applications

Figure 34 Automotive Powertrain Alloy Market: 2014–2021 (USD Billion)

Figure 35 Aluminium Estimated to Grow at the Highest CAGR in Exterior Applications

Figure 36 Automotive Alloy Market, By Region Snapshot, 2016 (USD Billion)

Figure 37 North American Market Snapshot (2016): Projected to Grow at the Highest CAGR From 2016 to 2021

Figure 38 Europe Market Snapshot (2016): France Projected to Grow at the Highest CAGR From 2016 to 2021

Figure 39 Asia-Oceania Market Snapshot (2016): Largest Market for Automotive Alloys

Figure 40 Companies Have Adopted Expansions as the Key Growth Strategy, 2010-2015

Figure 41 Market Evaluation Frame Work: Expansions has Fuelled the Demand for Automotive Alloy Market, 2013 – 2015

Figure 42 Alcoa, Inc. Grew at the Fastest Rate Between 2010 and 2014

Figure 43 Battle for Market Share: Expansion Was the Key Strategy

Figure 44 Region-Wise Revenue Mix of Five Market Players

Figure 45 Arcelormittal SA: Company Snapshot

Figure 46 Arcelormittal SA: SWOT Analysis

Figure 47 Alcoa Inc.: Company Snapshot

Figure 48 Alcoa Inc.: SWOT Analysis

Figure 49 Novelis Inc.: Company Snapshot

Figure 50 Novelis Inc: SWOT Analysis

Figure 51 UACJ Corporation: Company Snapshot

Figure 52 Norsk Hydro ASA: Company Snapshot

Figure 53 Norsk Hydro ASA: SWOT Analysis

Figure 54 Thyssenkrupp AG: Company Snapshot

Figure 55 Thyssenkrupp AG: SWOT Analysis

Figure 56 Kobe Steel, Ltd.: Company Snapshot

Figure 57 AMG Advanced Metallurgical Group: Company Snapshot

Figure 58 Constellium N.V.: Company Snapshot

Figure 59 Nippon Steel & Sumitomo Metal Corp.: Company Snapshot

Growth opportunities and latent adjacency in Alloy Market