Magnesium Alloys Market by Alloy Type (Cast Alloys, Wrought Alloys), End-use Industry (Automotive & Transportation, Electronic, Aerospace & Defense, Power Tools), and Region (APAC, Europe, North America) - Global Forecast to 2023

Magnesium Alloys Market Size And Forecast

The magnesium alloys market is projected to reach USD 2.37 Billion by 2023, at a CAGR of 12.7%. The base year considered for the study is 2017, and the market size is projected for the period between 2018 and 2023. The increase in the use of magnesium alloys in the automotive & transportation and electronics end-use industries is expected to drive the market in the coming years.

Magnesium Alloys Market Report Objectives of the Study

The report analyzes the global magnesium alloys market, in terms of volume (kilotons) and value (USD million). The report also estimates the size and growth potential of the magnesium alloy market across different segments, such as end-use industries, alloy type, and region. It forecasts the market size for five regions, namely APAC, North America, Europe, Middle East & Africa, and Latin America. The study also covers market opportunities and competitive landscape for stakeholders and market leaders.

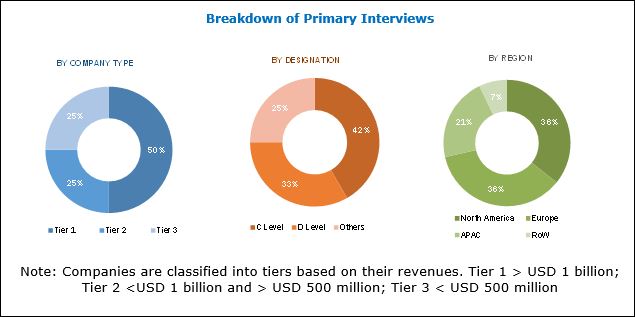

The research methodology used to estimate and forecast the magnesium alloys market begins with gathering data on key company revenues and raw material costs through secondary sources, such as International Magnesium Association, American Foundry Society, Factiva, D&B Hoovers, Manta, and others. Product offerings are also taken into consideration to determine the market segmentation. The bottom-up approach was used to arrive at the overall size of the magnesium alloys market from the revenue of key players. After arriving at the total market size, the overall market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with CEOs, VPs, directors, and key executives from related industries. Data triangulation and market breakdown procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the magnesium alloys market. The breakdown of profiles of primary interviewees is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Key manufacturers of magnesium alloys include Magnesium Elektron (UK), Ka Shui International Holdings Ltd. (China), Magontec (Australia), US Magnesium LLC (US), Nanjing Yunhai Special Metals Co. Ltd., and Meridian Lightweight Technologies (US).

Target Audience in Magnesium Alloys Market

- Magnesium Alloys Manufacturers

- Raw Material Suppliers

- Distributors & Suppliers

- Industry Associations

“This study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years to prioritize efforts and investments.”

Magnesium Alloys Market Rpeort Scope

The research report segments the magnesium alloys market into the following submarkets:

By Alloy Type

- Cast Alloys

- Wrought Alloys

By End-use Industry:

- Automotive & Transportation

- Electronics

- Aerospace & Defense

- Power Tools

-

Others

- Medical

- Sporting Goods

By Region

- North America

- Europe

- APAC

- Middle East & Africa

- Latin America

Magnesium Alloys Market Report Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for this report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the North American magnesium alloys market

- Further breakdown of the European magnesium alloy market

- Further breakdown of the Asia Pacific magnesium alloys market

- Further breakdown of the Middle East & African magnesium alloy market

- Further breakdown of the Latin American magnesium alloys market

- Detailed analysis and profiling of additional market players

The magnesium alloys market is estimated at USD 1.30 Billion in 2018 and is projected to reach USD 2.37 Billion by 2023, at a CAGR of 12.7% during the forecast period. The growth of the market can be attributed to the high demand for magnesium alloys from the automotive & transportation, electronics, aerospace & defense, medical, and power tools industries. The market has witnessed significant growth over the last few years, due to the increased demand for magnesium alloys for lightweight automotive parts.

The magnesium alloy market is segmented on the basis of alloy type, end-use industry, and region. Based on alloy type, the market is segmented into cast alloys and wrought alloys. Cast alloys is projected to be the largest and fastest-growing segment of the market during the forecast period, owing to its large-scale applications in automotive & transportation, electronics, and other industries. Wrought alloys is estimated to be the second-largest alloy type in the magnesium alloys market in 2017 owing to its increasing applications in electronics, and aerospace & defense industries.

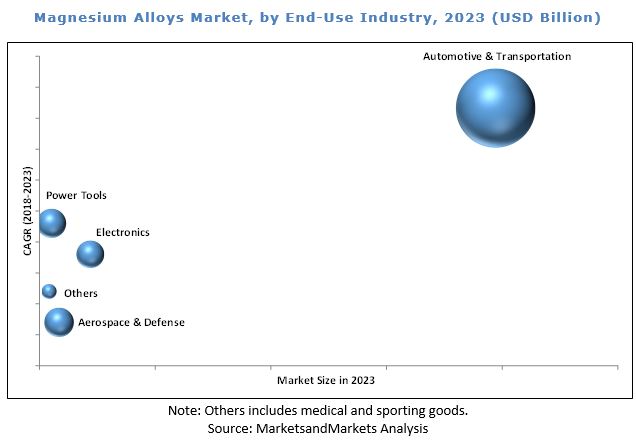

Based on end-use industry, the magnesium alloys market is segmented into automotive & transportation, electronics, aerospace & defense, power tools, and others. Aerospace & defense is estimated to be the largest segment of the magnesium alloy market in 2018, owing to the growing demand for magnesium alloys from body structure and powertrain applications. The electronics industry is the second-largest consumer of magnesium alloys. The penetration of magnesium alloys is increasing rapidly in the electronics industry due to its increasing use in 3Cs (cellphones, computers, and consumer electronics).

APAC is estimated to be the largest market for magnesium alloys in 2017. China and South Korea are the major markets for magnesium alloys due to the rising demand for magnesium alloys from the powertrain, body structure, cellphones, computers, and consumer electronics applications in these countries. These countries have also shown a rapid increase in the number of smartphone users in the recent past that is expected to continue over the forecast period.

Uncertainty of magnesium prices and issues related to weldability and corrosion resistance are the major restraints for the growth of this market. The main opportunity for the market is the growing demand for magnesium alloys from the medical (biomedical) and aerospace & defense industries. The growing market for electric vehicles is also a potential opportunity for the magnesium alloy market.

Key Players in Magnesium Alloys Market

Magnesium Elektron (UK), Nanjing Yunhai Special Metals Co. Ltd. (China), Ka Shui International Holdings Ltd. (China), US Magnesium (US), Meridian Lightweight Technologies (US), Shanghai Regal Magnesium Ltd. Co. (China), and Magontec (Australia) are some of the leading players in the magnesium alloys market. Magnesium Elektron (UK) has been focusing on maintaining its position in the market by tapping various global markets. The company had been involved in strategies such as new product launches, expansions, and joint ventures to increase its market share around the globe. The company has adopted new product developments as its major growth strategy in recent years.

Frequently Asked Questions (FAQ):

How big is the Magnesium Alloys Market industry?

The magnesium alloys market is estimated at USD 1.30 Billion in 2018 and is projected to reach USD 2.37 Billion by 2023, at a CAGR of 12.7% between 2018 and 2023.

Who leading market players in Magnesium Alloys industry?

Some of the key players operating in the magnesium alloys market include Magnesium Elektron (UK), Nanjing Yunhai Special Metals Co. Ltd. (China), Ka Shui International Holdings Ltd. (China), US Magnesium (US), Meridian Lightweight Technologies (US), Shanghai Regal Magnesium Ltd. Co. (China), and Magontec (Australia). These players have adopted various organic and inorganic strategies over the last five years to achieve growth in the magnesium alloys market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Magnesium Alloys Market

4.2 Magnesium Alloy Market, By Alloy Type

4.3 Magnesium Alloys Market, By End-Use Industry

4.4 Magnesium Alloy Market in the Automotive & Transportation Industry, By Application

4.5 Magnesium Alloys Market, By End-Use Industry and Region

4.6 Magnesium Alloy Market, By Country

5 Market Overview (Page No. - 33)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Growing Use of Magnesium Alloys in the Automotive Industry

5.1.1.2 Advantages of Magnesium Alloys Over Other Alloys

5.1.2 Restraints

5.1.2.1 Uncertainty of Magnesium Price

5.1.2.2 Issues Related to Weldability and Corrosion Resistance

5.1.3 Opportunities

5.1.3.1 Potential Use of Magnesium Alloys in the Medical (Biomedical) and Aerospace & Defense Industries

5.1.3.2 Growing Market for Electric Vehicles

5.1.3.3 Development of New Processes Such as Thixomolding and New Rheocasting

5.1.4 Challenges

5.1.4.1 Engineering Barriers Such as Formability at Room Temperature and Difficulty in Forging

5.2 Porter’s Five Forces Analysis

5.2.1 Threat of New Entrants

5.2.2 Threat of Substitutes

5.2.3 Bargaining Power of Suppliers

5.2.4 Bargaining Power of Buyers

5.2.5 Intensity of Competitive Rivalry

6 Macroeconomic Overview and Key Trends (Page No. - 40)

6.1 Introduction

6.2 Trends and Forecast of GDP

6.3 Trends in the Aerospace Industry

6.4 Trends in the Automotive Industry

7 Magnesium Alloys Market, By Alloy Type (Page No. - 43)

7.1 Introduction

7.2 Cast Alloy

7.3 Wrought Alloy

8 Magnesium Alloy Market, By End-Use Industry (Page No. - 47)

8.1 Introduction

8.2 Automotive & Transportation

8.2.1 Body Structure

8.2.2 Powertrain

8.2.3 Interior

8.2.4 Chassis

8.3 Electronics

8.4 Aerospace & Defense

8.4.1 Commercial Helicopters

8.4.2 Military Helicopters

8.4.3 Fighter Aircraft

8.5 Power Tools

8.6 Others

8.6.1 Medical

8.6.2 Sporting Goods

9 Magnesium Alloys Market, By Region (Page No. - 59)

9.1 Introduction

9.2 North America

9.2.1 By End-Use Industry

9.2.2 By Type

9.2.3 By Country

9.2.3.1 US

9.2.3.2 Canada

9.3 Europe

9.3.1 By End-Use Industry

9.3.2 By Type

9.3.3 By Country

9.3.3.1 Germany

9.3.3.2 UK

9.3.3.3 France

9.3.3.4 Spain

9.3.3.5 Italy

9.3.3.6 Russia

9.3.3.7 Rest of Europe

9.4 APAC

9.4.1 By End-Use Industry

9.4.2 By Type

9.4.3 By Country

9.4.3.1 China

9.4.3.2 Japan

9.4.3.3 India

9.4.3.4 South Korea

9.4.3.5 Indonesia

9.4.3.6 Rest of APAC

9.5 MEA

9.5.1 By End-Use Industry

9.5.2 By Type

9.5.3 By Country

9.5.3.1 South Africa

9.5.3.2 Saudi Arabia

9.5.3.3 Egypt

9.5.3.4 Rest of the Mea

9.6 Latin America

9.6.1 By End-Use Industry

9.6.2 By Type

9.6.3 By Country

9.6.3.1 Brazil

9.6.3.2 Mexico

9.6.3.3 Argentina

9.6.3.4 Rest of Latin America

10 Competitive Landscape (Page No. - 87)

10.1 Overview

10.2 Market Ranking

10.2.1 Nanjing Yunhai Special Metals Co. Ltd.

10.2.2 Magnesium Elektron

10.2.3 Meridian Lightweight Technologies China

10.3 Recent Developments

10.3.1 Expansions

10.3.2 Agreements, Partnerships & Joint Ventures

10.3.3 New Product Launches

11 Company Profiles (Page No. - 91)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

11.1 Magnesium Elektron

11.2 Ka Shui International Holdings Ltd.

11.3 Magontec

11.4 U.S. Magnesium LLC

11.5 Nanjing Yunhai Special Metals Co. Ltd.

11.6 Meridian Lightweight Technologies

11.7 Advanced Magnesium Alloys Corporation (AMACOR)

11.8 Shanghai Regal Magnesium Limited Company

11.9 Shanxi Yinguang Huasheng Magnesium Co. Ltd.

11.10 Shanxi Credit Magnesium Co. Ltd.

11.11 Other Key Players

11.11.1 Dynacast

11.11.2 Shanxi Fugu Tianyu Mineral Industry

11.11.3 Posco

11.11.4 China Magnesium Corporation Limited

11.11.5 Dead Sea Magnesium

11.11.6 Spartan Light Metal Products

11.11.7 Smiths Advanced Metals

11.11.8 Rima Group

11.11.9 Yee Dongguan Science and Technology Co. Ltd.

11.11.10 Taiyuan Tongxiang Magnesium Co. Ltd.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 111)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (80 Tables)

Table 1 Magnesium Alloys Market Size, 2016–2023 (Volume and Value)

Table 2 Trends and Forecast of GDP, By Country, 2017–2022 (USD Billion)

Table 3 New Airplanes Market, By Region, 2016

Table 4 Automotive Production, By Region/Country, 2011–2015 (Thousand Units)

Table 5 Magnesium Alloys Market Size, By Type, 2016–2023 (USD Million)

Table 6 Magnesium Alloy Market Size, By Type, 2016–2023 (Kiloton)

Table 7 Cast Alloy Market Size, By Region, 2016–2023 (USD Million)

Table 8 Cast Alloy Market Size, By Region, 2016–2023 (Kiloton)

Table 9 Wrought Alloy Market Size, By Region, 2016–2023 (USD Million)

Table 10 Wrought Alloy Market Size, By Region, 2016–2023 (Kiloton)

Table 11 Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 12 Magnesium Alloy Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 13 Magnesium Alloys Market Size in Automotive & Transportation End-Use Industry, By Application, 2016–2023 (USD Million)

Table 14 Magnesium Alloy Market Size in Automotive & Transportation End-Use Industry, By Application, 2016–2023 (Kiloton)

Table 15 Market Size in Automotive & Transportation End-Use Industry, By Region, 2016–2023 (USD Million)

Table 16 Market Size in Automotive & Transportation End-Use Industry, By Region, 2016–2023 (Kiloton)

Table 17 Magnesium Alloys Market Size in Electronics End-Use Industry, By Region, 2016–2023 (USD Million)

Table 18 Magnesium Alloy Market Size in Electronics End-Use Industry, By Region, 2016–2023 (Kiloton)

Table 19 Market Size in Aerospace & Defense End-Use Industry, By Region, 2016–2023 (USD Million)

Table 20 Market Size in Aerospace & Defense End-Use Industry, By Region, 2016–2023 (Kiloton)

Table 21 Magnesium Alloys Market Size in Power Tools End-Use Industry, By Region, 2016–2023 (USD Million)

Table 22 Magnesium Alloy Market Size in Power Tools End-Use Industry, By Region, 2016–2023 (Kiloton)

Table 23 Market Size in Other End-Use Industries, By Region, 2016–2023 (USD Million)

Table 24 Market Size in Other End-Use Industries, By Region, 2016–2023 (Kiloton)

Table 25 Magnesium Alloys Market Size, By Region, 2016–2023 (USD Million)

Table 26 Magnesium Alloy Market Size, By Region, 2016–2023 (Kiloton)

Table 27 North America: Magnesium Alloys Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 28 North America: Magnesium Alloy Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 29 North America: Market Size, By Type, 2016–2023 (USD Million)

Table 30 North America: Market Size, By Type, 2016–2023 (Kiloton)

Table 31 North America: Market Size, By Country, 2016–2023 (USD Million)

Table 32 North America: Market Size, By Country, 2016–2023 (Kiloton)

Table 33 US: Magnesium Alloys Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 34 US: Magnesium Alloy Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 35 Canada: Magnesium Alloy Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 36 Canada: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 37 Europe: Magnesium Alloys Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 38 Europe: Magnesium Alloy Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 39 Europe: Market Size, By Type, 2016–2023 (USD Million)

Table 40 Europe: Market Size, By Type, 2016–2023 (Kiloton)

Table 41 Europe: Market Size, By Country, 2016–2023 (USD Million)

Table 42 Europe: Market Size, By Country, 2016–2023 (Kiloton)

Table 43 Germany: Magnesium Alloys Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 44 Germany: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 45 UK: Magnesium Alloy Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 46 UK: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 47 APAC: Magnesium Alloys Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 48 APAC: Magnesium Alloy Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 49 APAC: Market Size, By Type, 2016–2023 (USD Million)

Table 50 APAC: Market Size, By Type, 2016–2023 (Kiloton)

Table 51 APAC: Market Size, By Country, 2016–2023 (USD Million)

Table 52 APAC: Market Size, By Country, 2016–2023 (Kiloton)

Table 53 China: Magnesium Alloys Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 54 China: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 55 Japan: Magnesium Alloy Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 56 Japan: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 57 MEA: Magnesium Alloys Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 58 MEA: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 59 MEA: Market Size, By Type, 2016–2023 (USD Million)

Table 60 MEA: Market Size, By Type, 2016–2023 (Kiloton)

Table 61 MEA: Market Size, By Country, 2016–2023 (USD Million)

Table 62 MEA: Magnesium Alloy Market Size, By Country, 2016–2023 (Kiloton)

Table 63 South Africa: Magnesium Alloys Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 64 South Africa: Magnesium Alloy Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 65 Saudi Arabia: Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 66 Saudi Arabia: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 67 Latin America: Magnesium Alloys Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 68 Latin America: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 69 Latin America: Market Size, By Type, 2016–2023 (USD Million)

Table 70 Latin America: Market Size, By Type, 2016–2023 (Kiloton)

Table 71 Latin America: Market Size, By Country, 2016–2023 (USD Million)

Table 72 Latin America: Market Size, By Country, 2016–2023 (Kiloton)

Table 73 Brazil: Magnesium Alloys Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 74 Brazil: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 75 Mexico: Magnesium Alloy Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 76 Mexico: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 77 Nanjing Yunhai Special Metals Co. Ltd.: the Largest Company in the Magnesium Alloys Market

Table 78 Expansions, 2015—2018

Table 79 Agreements, Partnerships & Joint Ventures, 2015—2018

Table 80 New Product Launches, 2015—2018

List of Figures (36 Figures)

Figure 1 Magnesium Alloys: Market Segmentation

Figure 2 Magnesium Alloys Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Cast Alloy to Register the Higher CAGR in the Magnesium Alloy Market

Figure 6 Automotive & Transportation to Be the Largest End-Use Industry of Magnesium Alloys

Figure 7 APAC to Be the Fastest-Growing Market for Magnesium Alloys

Figure 8 Growth Opportunities in the Magnesium Alloys Market Between 2018 and 2023

Figure 9 Cast Alloy to Lead the Magnesium Alloys Market

Figure 10 Automotive & Transportation to Dominate the Magnesium Alloys Market

Figure 11 Body Structure Application to Dominate the Magnesium Alloy Market in the Automotive & Transportation Industry

Figure 12 APAC Led the Magnesium Alloy Market

Figure 13 China to Register the Highest CAGR in the Magnesium Alloys Market

Figure 14 Overview of the Factors Governing the Magnesium Alloy Market

Figure 15 Magnesium Alloys Market: Porter’s Five Forces Analysis

Figure 16 Cast Alloy to Be the Dominating Alloy Type Between 2018 and 2023

Figure 17 Automotive & Transportation to Be the Fastest-Growing End-Use Industry of Magnesium Alloys During the Forecast Period

Figure 18 Europe to Lead the Magnesium Alloy Market in the Automotive & Transportation End-Use Industry

Figure 19 APAC to Account for the Major Share in the Magnesium Alloys Market in the Electronics End-Use Industry

Figure 20 North America to Dominate the Magnesium Alloy Market in the Aerospace & Defense End-Use Industry

Figure 21 China to Register the Highest CAGR in the Global Magnesium Alloy Market

Figure 22 North America: Magnesium Alloy Market Snapshot

Figure 23 Europe: Magnesium Alloys Market Snapshot

Figure 24 APAC: Magnesium Alloy Market Snapshot

Figure 25 South Africa to Be the Largest Magnesium Alloys Market in the Mea

Figure 26 Brazil to Dominate the Magnesium Alloy Market

Figure 27 Companies Adopted Agreements & Joint Ventures as the Key Growth Strategy Between 2015 and 2018

Figure 28 Magnesium Elektron: Company Snapshot

Figure 29 Magnesium Elektron: SWOT Analysis

Figure 30 Ka Shui International Holdings Ltd: Company Snapshot

Figure 31 Ka Shui International Holdings Ltd.: SWOT Analysis

Figure 32 Magontec: Company Snapshot

Figure 33 Magontec: SWOT Analysis

Figure 34 U.S. Magnesium LLC: SWOT Analysis

Figure 35 Nanjing Yunhai Special Metals Co. Ltd.: Company Snapshot

Figure 36 Nanjing Yunhai Special Metals Co. Ltd.: SWOT Analysis

Growth opportunities and latent adjacency in Magnesium Alloys Market