Automatic Dependent Surveillance Broadcast (ADS-B) Market by Type (On-Board, Ground Stations), Fit (Line, Retrofit), Platform (Fixed, Rotary), Component (Transponder, Receiver), Application (TMA, Airborne Surveillance), and Region - Global Forecast to 2022

The Automatic Dependent Surveillance Broadcast Market is projected to grow from USD 427.8 Million in 2016 to USD 1,316.9 Million by 2022, at a CAGR of 20.61% during the forecast period. The objective of this study is to analyze, define, describe, and forecast the ADS-B market on the basis of type, application, fit, component, platform, and region. The report also provides a competitive landscape of this market and company profiles based on their financial positions, product portfolios, growth strategies, and an in-depth analysis of their core competencies and market shares to anticipate the degree of competition prevailing in the market. This report also tracks and analyzes competitive developments such as partnerships, contracts, expansions, mergers & acquisitions, new product developments, and research & development (R&D) activities in the ADS-B market. The base year considered for this study is 2015 and the forecast period is from 2016 to 2022.

The Automatic Dependent Surveillance-Broadcast market is projected to grow from USD 427.8 Million in 2016 to USD 1,316.9 Million by 2022, at a CAGR of 20.61% during the forecast period. Implementation of ADS-B in aircraft serves to be one of the most significant factors driving the growth of the ADS-B market. Modernization of air traffic management infrastructure and development of new airports globally are additional factors propelling the demand for ADS-B. Increasing volume of UAVs in airspace has further led to the need for integrating unmanned aerial vehicles with air traffic control systems, which, in turn, is anticipated to drive the growth of the Automatic Dependent Surveillance-Broadcast market.

The ADS-B market has been segmented on the basis of type, application, fit, component, platform, and region. Based on type, the market has been segmented into ADS-B Out, ADS-B In, and ADS-B ground stations. Among all types, the ADS-B In segment is projected to grow at the highest CAGR from 2016 to 2022. This growth is mainly driven by additional safety features and situational awareness that ADS-B In provides to aircraft pilots.

Based on application, the Automatic Dependent Surveillance-Broadcast market has been classified into Terminal Maneuvering Area (TMA) surveillance and airborne surveillance. The TMA surveillance segment accounted for the largest share of the ADS-B market in 2016. TMA surveillance includes services such as Non Radar Airspace (NRA) Surveillance, Radar Airspace (RAD) Surveillance, and On Airport Surface (APT) Surveillance. Increasing airspace congestion and the growing demand for construction of new airports have led to the development of efficient and safe TMA surveillance systems.

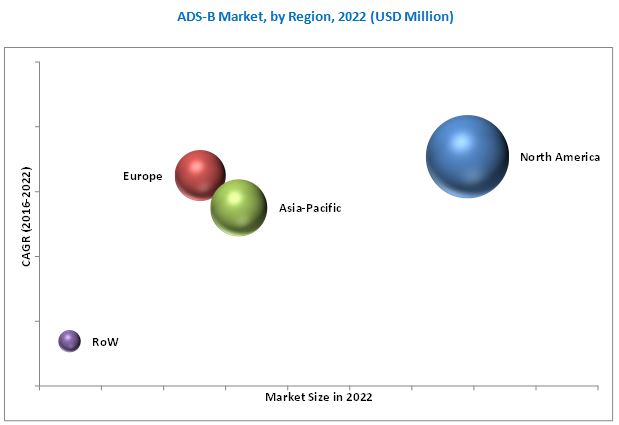

Based on region, North America is projected to lead the ADS-B market from 2016 to 2022, owing to the FAA mandate for ADS-B installation on all aircraft and the presence of component integrators, Original Equipment Manufacturers (OEMs), and subcomponent manufacturers in this region. These factors are driving the growth of the North America ADS-B market. Major aircraft manufacturers have already included ADS-B in their new manufactured aircraft as a forward fit option. Other aircraft owners are retrofitting ADS-B systems onboard their aircraft.

Implementation of ADS-B ground infrastructure at a national level is expected to restrain the growth of the ADS-B market. Key players operating in this market include Honeywell International, Inc. (U.S.), L3 Technologies, Inc. (U.S.), Esterline Technologies Corporation (U.S.), Garmin Ltd. (Switzerland), Rockwell Collins, Inc. (U.S.), Indra Sistemas, S.A. (Spain), Harris Corporation (U.S.), Thales Group (France), Avidyne Corporation (U.S.), and Trig Avionics Ltd. (U.K.) among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Study Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

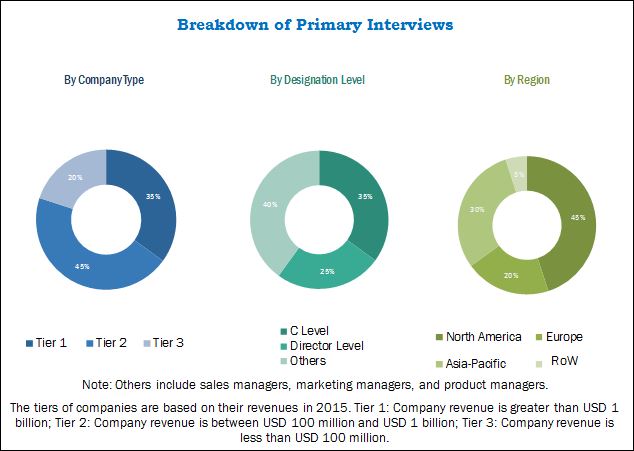

2.1.2.2 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Indicators

2.2.2.1 Increasing Air Passenger Traffic

2.2.2.2 High Growth in the Aviation Sector

2.2.3 Supply-Side Indicators

2.2.3.1 Satellite-Based Navigation Systems

2.3 Market Size Estimation

2.4 Key Industry Insights

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Market Breakdown and Data Triangulation

2.6 Research Assumptions

3 Executive Summary (Page No. - 34)

4 Premium Insights (Page No. - 38)

4.1 Attractive Market Opportunities in the Automatic Dependent Surveillance Broadcast Market

4.2 Automatic Dependent Surveillance-Broadcast Out (ADS-B Out), By Region

4.3 Transponder Component Segment, By Region

4.4 ADS-B Fit Market, By Region

4.5 ADS-B Market, By Component

4.6 Asia-Pacific: ADS-B Market, By Component

4.7 ADS-B Market, By Region

4.8 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 42)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Automatic Dependent Surveillance Broadcast Market, By Type

5.2.2 Automatic Dependent Surveillance Broadcast Market, By Application

5.2.3 Automatic Dependent Surveillance Broadcast Market, By Component

5.2.4 Automatic Dependent Surveillance Broadcast Market, By Platform

5.2.5 Automatic Dependent Surveillance Broadcast Market By Fit

5.2.6 ADS-B Market,By Region

5.3 Market Dynamics

5.4 Drivers

5.4.1 FAA Mandate for ADS-B Out and Rebate for Operators

5.4.1.1 Increase in Airspace Congestion and Modernization of Air Traffic Management Infrastructure

5.4.1.2 Development of New Airports

5.4.1.3 ADS-B for UAVs

5.4.2 Restraints

5.4.2.1 Cost and Affordability for Small Aircraft Operators

5.4.3 Opportunities

5.4.3.1 ADS-B Implementation By Various Countries Worldwide

5.4.3.1.1 Australia

5.4.3.1.2 Europe

5.4.3.1.3 Hong Kong

5.4.3.1.4 Indonesia

5.4.3.1.5 Singapore

5.4.3.1.6 Sri Lanka

5.4.3.1.7 Vietnam

5.4.3.1.8 Taiwan

5.4.3.2 ADS-B in - an Economical Alternative for Tcas and Acas

5.4.4 Challenges

5.4.4.1 Quantifying the Benefits of ADS-B

5.4.4.2 ADS-B Ground Infrastructure

6 Industry Trends (Page No. - 56)

6.1 Introduction

6.2 Evolution of ADS-B Transponder

6.3 Mode S (1090 Mhz ES) Transponder vs UAT (978 Mhz) Transponder

6.4 Regulations and Mandates

6.4.1 ADS-B Mandate, By Region

6.4.2 Retrofit & Forward Fit Mandate, By Country

6.5 Key Subcomponent Manufacturers

6.6 Emerging Trends

6.6.1 Miniaturization of ADS-B Universal Access Transceiver (UAT)

6.6.2 Mode S Transponder With Extended Squitter (ES)

6.6.3 Decoders

6.6.4 Gps Sensors

6.6.5 ADS-B Ground-Based Receivers

6.7 Innovation & Patent Registrations

7 Automatic Dependent Surveillance-Broadcast (ADS-B) Market, By Type (Page No. - 64)

7.1 Introduction

7.2 On-Board (Platform)

7.2.1 Automatic Dependent Surveillance –Broadcast in (ADS-B In)

7.2.2 Automatic Dependent Surveillance–Broadcast Out (ADS-B Out)

7.3 ADS-B Ground Stations

8 Automatic Dependent Surveillance-Broadcast (ADS-B) Market, By Application (Page No. - 69)

8.1 Introduction

8.2 Terminal Manoeuvring Airspace (TMA) Surveillance

8.3 Airborne Surveillance

9 Automatic Dependent Surveillance-Broadcast (ADS-B) Market, By Fit (Page No. - 74)

9.1 Introduction

9.2 Line Fit

9.3 Retrofit

10 Automatic Dependent Surveillance-Broadcast (ADS-B) Market, By Component (Page No. - 78)

10.1 Introduction

10.2 Transponder

10.3 Receiver

10.4 Antenna

10.5 ADS-B Ground Receivers

11 Automatic Dependent Surveillance-Broadcast (ADS-B) (On-Board) Market, By Platform (Page No. - 83)

11.1 Introduction

11.2 Fixed Wing

11.2.1 Commercial Aviation

11.2.2 Business Jets

11.2.3 Unmanned Aerial Vehicles (UAV)

11.3 Rotary Wing

12 Regional Analysis (Page No. - 88)

12.1 Introduction

12.2 North America

12.2.1 By Type

12.2.2 By Application

12.2.3 By Component

12.2.4 By Platform

12.2.4.1 By Fixed Wing

12.2.5 By Fit

12.2.5.1 By Line Fit

12.2.5.2 By Retrofit

12.2.6 By Country

12.2.6.1 U.S.

12.2.6.1.1 By Type

12.2.6.1.2 By Platform

12.2.6.1.3 By Fixed Wing

12.2.6.1.4 By Fit

12.2.6.2 Canada

12.2.6.2.1 By Type

12.2.6.2.2 By Platform

12.2.6.2.3 By Fixed Wing

12.2.6.2.4 By Fit

12.3 Europe

12.3.1 By Type

12.3.2 By Application

12.3.3 By Component

12.3.4 By Platform

12.3.4.1 By Fixed Wing

12.3.5 By Fit

12.3.5.1 By Line Fit

12.3.5.2 By Retrofit

12.3.6 By Country

12.3.6.1 U.K.

12.3.6.1.1 By Type

12.3.6.1.2 By Platform

12.3.6.1.3 By Fixed Wing

12.3.6.1.4 By Fit

12.3.6.2 Germany

12.3.6.2.1 By Type

12.3.6.2.2 By Platform

12.3.6.2.3 By Fixed Wing

12.3.6.2.4 By Fit

12.3.6.3 Ireland

12.3.6.3.1 By Type

12.3.6.3.2 By Platform

12.3.6.3.3 By Fixed Wing

12.3.6.3.4 By Fit

12.3.6.4 France

12.3.6.4.1 By Type

12.3.6.4.2 By Platform

12.3.6.4.3 By Fixed Wing

12.3.6.4.4 By Fit

12.3.6.5 Rest of Europe

12.3.6.5.1 By Type

12.3.6.5.2 By Platform

12.3.6.5.3 By Fixed Wing

12.3.6.5.4 By Fit

12.4 Asia-Pacific

12.4.1 By Type

12.4.2 By Application

12.4.3 By Component

12.4.4 By Platform

12.4.4.1 By Fixed Wing

12.4.5 By Fit

12.4.5.1 By Line Fit

12.4.5.2 By Retrofit

12.4.6 By Country

12.4.6.1 China

12.4.6.1.1 By Type

12.4.6.1.2 By Platform

12.4.6.1.3 By Fixed Wing

12.4.6.1.4 By Fit

12.4.6.2 Australia

12.4.6.2.1 By Type

12.4.6.2.2 By Platform

12.4.6.2.3 By Fixed Wing

12.4.6.2.4 By Fit

12.4.6.3 India

12.4.6.3.1 By Type

12.4.6.3.2 By Platform

12.4.6.3.3 By Fixed Wing

12.4.6.3.4 By Fit

12.4.6.4 Japan

12.4.6.4.1 By Type

12.4.6.4.2 By Platform

12.4.6.4.3 By Fixed Wing

12.4.6.4.4 By Fit

12.4.6.5 Rest of Asia-Pacific

12.4.6.5.1 By Type

12.4.6.5.2 By Platform

12.4.6.5.3 By Fixed Wing

12.4.6.5.4 By Fit

12.5 Rest of the World

12.5.1 By Type

12.5.2 By Application

12.5.3 By Component

12.5.4 By Platform

12.5.4.1 By Fixed Wing

12.5.5 By Fit

12.5.5.1 By Line Fit

12.5.5.2 By Retrofit

12.5.6 By Country

12.5.6.1 GCC Countries

12.5.6.1.1 By Type

12.5.6.1.2 By Platform

12.5.6.1.3 By Fixed Wing

12.5.6.1.4 By Fit

12.5.6.2 Brazil

12.5.6.2.1 By Type

12.5.6.2.2 By Platform

12.5.6.2.3 By Fixed Wing

12.5.6.2.4 By Fit

12.5.6.3 South Africa

12.5.6.3.1 By Type

12.5.6.3.2 By Platform

12.5.6.3.3 By Fixed Wing

12.5.6.3.4 By Fit

13 Competitive Landscape (Page No. - 132)

13.1 Overview

13.2 Rank Analysis, By Key Players

13.3 Competitive Benchmarking

13.4 Competitive Situation & Trends

13.4.1 Contracts

13.4.2 New Product Launches

13.4.3 Agreements & Partnerships

13.4.4 Acquisitions

14 Company Profiles (Page No. - 146)

(Overview, Products & Services, Strategies & Insights, Developments and MnM View)*

14.1 Introduction

14.2 Financial Highlights

14.3 Honeywell International, Inc.

14.4 L-3 Technologies, Inc.

14.5 Esterline Technologies Corporation

14.6 Garmin Ltd.

14.7 Rockwell Collins, Inc.

14.8 Indra Sistemas, S.A.

14.9 Harris Corporation

14.10 Thales Group

14.11 Avidyne Corporation

14.12 Trig Avionics Ltd.

14.13 Freeflight Systems

14.14 Aspen Avionics, Inc.

*Details on Overview, Products & Services, Strategies & Insights, Developments and MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 185)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

15.6 Author Details

List of Tables (109 Tables)

Table 1 Total Airport Construction Investments, By Region, January 2015

Table 2 Position Squitter

Table 3 Innovation & Patent Registrations, 2002-2013

Table 4 Automatic Dependent Surveillance Broadcast Market Size, By Type, 2014-2022 (USD Million)

Table 5 Automatic Dependent Surveillance Broadcast Market Size, By Application, 2014-2022 (USD Million)

Table 6 Automatic Dependent Surveillance Broadcast Market Size, By Fit, 2014-2022 (USD Million)

Table 7 Automatic Dependent Surveillance Broadcast Market Size, By Line Fit, 2014-2022 (USD Million)

Table 8 Automatic Dependent Surveillance Broadcast Market Size, By Retrofit, 2014-2022 (USD Million)

Table 9 Automatic Dependent Surveillance Broadcast Market Size, By Component, 2014-2022 (USD Million)

Table 10 Automatic Dependent Surveillance Broadcast Market Size, By Platform, 2014-2022 (USD Billion)

Table 11 Automatic Dependent Surveillance Broadcast Market Size, By Fixed Wing Segment, 2014-2022 (USD Billion)

Table 12 Automatic Dependent Surveillance Broadcast Market Size, By Region, 2014-2022 (USD Million)

Table 13 North America ADS-B Market Size, By Type, 2014-2022 (USD Million)

Table 14 North America ADS-B Market Size, By Application, 2014-2022 (USD Million)

Table 15 North America Automatic Dependent Surveillance Broadcast Market Size, By Component, 2014 - 2022 (USD Million)

Table 16 North America Automatic Dependent Surveillance Broadcast Market Size, By Platform, 2014-2022 (USD Million)

Table 17 North America ADS-B Market Size, By Fixed Wing, 2014-2022 (USD Million)

Table 18 North America Automatic Dependent Surveillance Broadcast Market Size, By Fit, 2014-2022 (USD Million)

Table 19 North America Automatic Dependent Surveillance Broadcast Market Size, By Line Fit, 2014-2022 (USD Million)

Table 20 North America Automatic Dependent Surveillance Broadcast Market Size, By Retrofit, 2014-2022 (USD Million)

Table 21 North America Automatic Dependent Surveillance Broadcast MarketSize, By Country, 2014-2022 (USD Million)

Table 22 U.S. Automatic Dependent Surveillance Broadcast MarketSize, By Type, 2014-2022 (USD Million)

Table 23 U.S. Automatic Dependent Surveillance Broadcast MarketSize, By Platform, 2014-2022 (USD Million)

Table 24 U.S. Automatic Dependent Surveillance Broadcast MarketSize, By Fixed Wing, 2014-2022 (USD Million)

Table 25 U.S. Automatic Dependent Surveillance Broadcast MarketSize, By Fit, 2014-2022 (USD Million)

Table 26 Canada Automatic Dependent Surveillance Broadcast MarketSize, By Type, 2014-2022 (USD Million)

Table 27 Canada Automatic Dependent Surveillance Broadcast Market Size, By Platform, 2014-2022 (USD Million)

Table 28 Canada Automatic Dependent Surveillance Broadcast Market Size, By Fixed Wing, 2014-2022 (USD Million)

Table 29 Canada Automatic Dependent Surveillance Broadcast Market Size, By Fit, 2014-2022 (USD Million)

Table 30 Europe Automatic Dependent Surveillance Broadcast Market Size, By Type, 2014-2022 (USD Million)

Table 31 Europe Automatic Dependent Surveillance Broadcast Market Size, By Application, 2014-2022 (USD Million)

Table 32 Europe Automatic Dependent Surveillance Broadcast MarketSize, By Component, 2014-2022 (USD Million)

Table 33 Europe Automatic Dependent Surveillance Broadcast Market Size, By Platform, 2014-2022 (USD Million)

Table 34 Europe Automatic Dependent Surveillance Broadcast Market Size, By Fixed Wing, 2014-2022 (USD Million)

Table 35 Europe Automatic Dependent Surveillance Broadcast Market Size, By Fit, 2014-2022 (USD Million)

Table 36 Europe Automatic Dependent Surveillance Broadcast Market Size, By Line Fit, 2014-2022 (USD Million)

Table 37 Europe Automatic Dependent Surveillance Broadcast Market Size, By Retrofit, 2014-2022 (USD Million)

Table 38 Europe ADS-B Market Size, By Country, 2014-2022 (USD Million)

Table 39 U.K. ADS-B Market Size, By Type, 2014-2022 (USD Million)

Table 40 U.K. ADS-B Market Size, By Platform, 2014-2022 (USD Billion)

Table 41 U.K. ADS-B Market Size, By Fixed Wing, 2014-2022 (USD Billion)

Table 42 U.K. ADS-B Market Size, By Fit, 2014-2022 (USD Billion)

Table 43 Germany ADS-B Market Size, By Type, 2014-2022 (USD Million)

Table 44 Germany ADS-B Market Size, By Platform, 2014-2022 (USD Billion)

Table 45 Germany ADS-B Market Size, By Fixed Wing, 2014-2022 (USD Billion)

Table 46 Germany ADS-B Market Size, By Fit, 2014-2022 (USD Million)

Table 47 Ireland ADS-B Market Size, By Type, 2014-2022 (USD Million)

Table 48 Ireland ADS-B Market Size, By Platform, 2014-2022 (USD Million)

Table 49 Ireland ADS-B Market Size, By Fixed Wing, 2014-2022 (USD Million)

Table 50 Ireland ADS-B Market Size, By Fit, 2014-2022 (USD Million)

Table 51 France ADS-B Market Size, By Type, 2014-2022 (USD Million)

Table 52 France ADS-B Market Size, By Platform, 2014-2022 (USD Million)

Table 53 France ADS-B Market Size, By Fixed Wing, 2014-2022 (USD Million)

Table 54 France ADS-B Market Size, By Fit, 2014-2022 (USD Million)

Table 55 Rest of Europe ADS-B Market Size, By Type, 2014-2022 (USD Million)

Table 56 Rest of Europe ADS-B Market Size, By Platform, 2014-2022 (USD Million)

Table 57 Rest of Europe ADS-B Market Size, By Fixed Wing, 2014-2022 (USD Million)

Table 58 Rest of Europe ADS-B Market Size, By Fit, 2014-2022 (USD Million)

Table 59 Asia-Pacific ADS-B Market Size, By Type, 2014-2022 (USD Million)

Table 60 Asia-Pacific ADS-B Market Size, By Application, 2014-2022 (USD Million)

Table 61 Asia-Pacific ADS-B Market Size, By Component, 2014-2022 (USD Million)

Table 62 Asia-Pacific ADS-B Market Size, By Platform, 2014-2022 (USD Million)

Table 63 Asia-Pacific ADS-B Market Size, By Fixed Wing, 2014-2022 (USD Million)

Table 64 Asia-Pacific ADS-B Market Size, By Fit, 2014-2022 (USD Million)

Table 65 Asia-Pacific ADS-B Market Size, By Line Fit, 2014-2022 (USD Million)

Table 66 Asia-Pacific ADS-B Market Size, By Retrofit, 2014-2022 (USD Million)

Table 67 Asia-Pacific ADS-B Market Size, By Country, 2014-2022 (USD Million)

Table 68 China ADS-B Market Size, By Type, 2014-2022 (USD Million)

Table 69 China ADS-B Market Size, By Platform, 2014-2022 (USD Million)

Table 70 China ADS-B Market Size, By Fixed Wing, 2014-2022 (USD Million)

Table 71 China ADS-B Market Size, By Fit, 2014-2022 (USD Million)

Table 72 Australia ADS-B Market Size, By Type, 2014-2022 (USD Million)

Table 73 Australia ADS-B Market Size, By Platform, 2014-2022 (USD Million)

Table 74 Australia ADS-B Market Size, By Fixed Wing, 2014-2022 (USD Million)

Table 75 Australia ADS-B Market Size, By Fit, 2014-2022 (USD Million)

Table 76 India ADS-B Market Size, By Type, 2014-2022 (USD Million)

Table 77 India ADS-B Market Size, By Platform, 2014-2022 (USD Million)

Table 78 India ADS-B Market Size, By Fixed Wing, 2014-2022 (USD Million)

Table 79 India ADS-B Market Size, By Fit, 2014-2022 (USD Million)

Table 80 Japan ADS-B Market Size, By Type, 2014-2022 (USD Million)

Table 81 Japan ADS-B Market Size, By Platform, 2014-2022 (USD Million)

Table 82 Japan ADS-B Market Size, By Fixed Wing, 2014-2022 (USD Million)

Table 83 Japan: ADS-B Market Size, By Fit, 2014-2022 (USD Million)

Table 84 Rest of Asia-Pacific ADS-B Market Size, By Type, 2014-2022 (USD Million)

Table 85 Rest of Asia-Pacific ADS-B Market Size, By Platform, 2014-2022 (USD Million)

Table 86 Rest of Asia-Pacific ADS-B Market Size, By Fixed Wing, 2014-2022 (USD Million)

Table 87 Rest of Asia-Pacific ADS-B Market Size, By Fit, 2014-2022 (USD Million)

Table 88 Rest of the World ADS-B Market Size, By Type, 2014-2022 (USD Million)

Table 89 Rest of the World ADS-B Market Size, By Application, 2014-2022 (USD Million)

Table 90 Rest of the World ADS-B Market Size, By Component, 2014 - 2022 (USD Million)

Table 91 Rest of the World ADS-B Market Size, By Platform, 2014-2022 (USD Million)

Table 92 Rest of the World ADS-B Market Size, By Fixed Wing, 2014-2022 (USD Million)

Table 93 Rest of the World ADS-B Market Size, By Fit, 2014-2022 (USD Million)

Table 94 Rest of the World ADS-B Market Size, By Line Fit, 2014-2022 (USD Million)

Table 95 Rest of the World ADS-B Market Size, By Retrofit, 2014-2022 (USD Million)

Table 96 Rest of the World ADS-B Market Size, By Country, 2014-2022 (USD Million)

Table 97 GCC Countries ADS-B Market Size, By Type, 2014-2022 (USD Million)

Table 98 GCC Countries ADS-B Market Size, By Platform, 2014-2022 (USD Million)

Table 99 GCC Countries ADS-B Market Size, By Fixed Wing, 2014-2022 (USD Million)

Table 100 GCC Countries ADS-B Market Size, By Fit, 2014-2022 (USD Million)

Table 101 Brazil ADS-B Market Size, By Type, 2014-2022 (USD Million)

Table 102 Brazil ADS-B Market Size, By Platform, 2014-2022 (USD Million)

Table 103 Brazil ADS-B Market Size, By Fixed Wing, 2014-2022 (USD Million)

Table 104 Brazil ADS-B Market Size, By Fit, 2014-2022 (USD Million)

Table 105 South Africa ADS-B Market Size, By Type, 2014-2022 (USD Million)

Table 106 South Africa ADS-B Market Size, By Platform, 2014-2022 (USD Million)

Table 107 South Africa ADS-B Market Size, By Fixed Wing, 2014-2022 (USD Million)

Table 108 South Africa ADS-B Market Size, By Fit, 2014-2022 (USD Million)

Table 109 Rank Analysis of Key Players in the ADS-B Market

List of Figures (71 Figures)

Figure 1 ADS-B Market Segmentation

Figure 2 Research Process Flow

Figure 3 ADS-B Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Global Air Passenger Growth (%), 2005-2015

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Triangulation

Figure 9 Assumptions of the Research Study

Figure 10 ADS-B Market, By Type, 2016 & 2022 (USD Million)

Figure 11 The Transponder Component Segment to Lead the ADS-B Market From 2016 to 2022

Figure 12 North America ADS-B Market Projected to Grow at the Highest CAGR During the Forecast Period

Figure 13 Contracts: Key Strategy Adopted By Companies in the ADS-B Market Between April 2012 and January 2017

Figure 14 FAA Mandates on ADS-B Out Drives the ADS-B Market

Figure 15 North America Anticipated to Account for the Largest Market Share in 2016 and 2022

Figure 16 The Transponder Component Segment in North America Projected to Grow at the Highest CAGR From 2016 to 2022

Figure 17 ADS-B Fit Market in North America Projected to Grow at the Highest CAGR During the Forecast Period

Figure 18 The Receiver Segment Projected to Grow at the Highest CAGR During the Forecast Period

Figure 19 ADS-B Ground Receivers Segment Estimated to Have the Highest Market Share in 2016

Figure 20 North America Accounted for the Largest Market Share in 2016

Figure 21 FAA Mandate on ADS-B Out Expected to Drive the Growth of the North America ADS-B Market

Figure 22 ADS-B Market Segmentation

Figure 23 ADS-B Market, By Type

Figure 24 ADS-B Market, By Application

Figure 25 ADS-B Market, By Component

Figure 26 ADS-B Market, By Platform

Figure 27 ADS-B Market, By Fit

Figure 28 ADS-B Market Dynamics

Figure 29 Air Passenger Traffic (Domestic & International)

Figure 30 Average Delay Per Flight at European Airports

Figure 31 UAV Market for Military Application

Figure 32 Evolution of Transponder From Mode A to Mode S Extended Squitter (1090 Mhz ES)

Figure 33 ADS-B Out Solutions for Aircraft Flying at and Above 18,000 FL

Figure 34 Europe Anticipated to Pass ADS-B Mandate Following North America and Australia

Figure 35 Retrofitting: Complying With Future Airspace Mandates

Figure 36 Subcomponent Manufacturers of ADS-B

Figure 37 ADS-B in is Projected to Grow at A Highest CAGR Between 2016 and 2022)

Figure 38 ADS-B Market, By Application, 2016 & 2022 (USD Million)

Figure 39 Line Fit Segment is Projected to Grow at A Highest CAGR Between 2016 and 2022)

Figure 40 Receivers is Projected to Grow at A Highest CAGR Between 2016 and 2022

Figure 41 The Fixed Wing Segment is Projected Grow at A Higher CAGR During the Forecast Period

Figure 42 ADS-B Market: Regional Snapshot (2016)

Figure 43 North America ADS-B Market Snapshot

Figure 44 Europe ADS-B Market Snapshot

Figure 45 Asia-Pacific ADS-B Market Snapshot

Figure 46 Rest of the World ADS-B Market Snapshot

Figure 47 Companies Adopted Contract as the Key Growth Strategy From April 2012 to January 2017

Figure 48 Competitive Benchmarking: ADS-B Market

Figure 49 Agreements & Partnerships is an Upcoming Strategy Adopted By Market Players in the ADS-B Market

Figure 50 Leading Companies in ADS-B Market, By Region

Figure 51 Contracts Emerging as A Significant Strategy Adopted By Key Players in the ADS-B Market

Figure 52 Contracts: April 2012 to January 2017

Figure 53 New Product Launches: April 2012 to January 2017

Figure 54 Agreements & Partnerships: April, 2012 to January, 2017

Figure 55 Acquisitions: April 2012 to January 2017

Figure 56 Regional Revenue Mix of Top Market Players, 2015

Figure 57 Financial Highlights of Top Market Players

Figure 58 Honeywell International, Inc.: Company Snapshot

Figure 59 Honeywell International Inc: SWOT Analysis

Figure 60 L-3 Technologies, Inc.: Company Snapshot

Figure 61 L-3 Communications Holdings, Inc.: SWOT Analysis

Figure 62 Esterline Technologies Corporation: Company Snapshot

Figure 63 Esterline Technologies Corporation: SWOT Analysis

Figure 64 Garmin Ltd.: Company Snapshot

Figure 65 Garmin Ltd.: SWOT Analysis

Figure 66 Rockwell Collins, Inc.: Company Snapshot

Figure 67 Rockwell Collins, Inc.: SWOT Analysis

Figure 68 Indra Sistemas, S.A.: Company Snapshot

Figure 69 Harris Corporation: Company Snapshot

Figure 70 Harris Corporation: SWOT Analysis

Figure 71 Thales Group: Company Snapshot

The research methodology used to estimate and forecast the Automatic Dependent Surveillance Broadcast Market includes the study of data and revenue of key market players through secondary resources, such as annual reports, Yahoo Finance, Federal Aviation Administration (FAA), International Civil Aviation Organization (ICAO), International Air Transport Association (IATA), and Stockholm International Peace Research Institute (SIPRI). The bottom-up procedure was employed to arrive at the overall size of the Automatic Dependent Surveillance Broadcast Market on the basis of the revenues of key players operating in the market. After arriving at the overall market size, the Automatic Dependent Surveillance Broadcast Market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key industry experts, such as CEOs, VPs, directors, executives, and engineers. These data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The breakdown of profiles of primaries is shown in the figure given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem

The ADS-B value chain includes component suppliers such as Honeywell International, Inc. (U.S.), L3 Technologies, Inc. (U.S.), Esterline Technologies Corporation (U.S.), Garmin Ltd. (Switzerland), Rockwell Collins, Inc. (U.S.), Indra Sistemas, S.A. (Spain), Harris Corporation (U.S.), Thales Group (France), Avidyne Corporation (U.S.), and Trig Avionics Ltd. (U.K.), among others. Boeing Company (U.S.), Airbus Group (France), Gulfstream Aerospace Corporation (U.S.), Bombardier Inc. (Canada), and Embraer SA (Brazil) are some of the aircraft manufacturers using ADS-B developed by varied component suppliers listed above. Contracts and agreements & partnerships are key strategies adopted by major players operating in the ADS-B market.

Target Audience for this Report

- Manufacturers of ADS-B Systems

- Original Equipment Manufacturers (OEMs)

- Subcomponent Manufacturers

- Technology Support Providers

- Government and Certification Bodies

- Aircraft Manufacturer Associations

“This study answers several questions for stakeholders, primarily, which market segments they need to focus upon during the next two to five years to prioritize their efforts and investments.”

Scope of the Report:

Automatic Dependent Surveillance-Broadcast Market, By Type

- ADS-B Out

- ADS-B In

- ADS-B Ground Stations

Automatic Dependent Surveillance-Broadcast Market, By Application

- Terminal Maneuvering Area Surveillance

- Airborne Surveillance

Automatic Dependent Surveillance-Broadcast Market, By Fit

- Line Fit

- Retrofit

Automatic Dependent Surveillance-Broadcast Market, By Component

- Transponder

- Receiver

- Antenna

- ADS-B Ground Receivers

- Others

Automatic Dependent Surveillance-Broadcast Market, By Platform

- Fixed Wing

- Rotary Wing

Automatic Dependent Surveillance-Broadcast Market, By Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Available Customizations

Along with market data, MarketsandMarkets offers customizations as per the specific needs of a company. The following customization options are available for this report:

-

Geographic Analysis

- Further breakdown of the Rest of the World (RoW) ADS-B market

-

Company Information

- Detailed analysis and profiles of additional market players (up to five)

- Additional Level Segmentation

Growth opportunities and latent adjacency in Automatic Dependent Surveillance Broadcast (ADS-B) Market