Asia-Pacific Submersible Pump Market by Type (Borewell & Openwell), by Industry (Chemical, Construction, Energy and Power, Water and Sewage, and Others), by Application (Industrial, Agriculture, and Domestic), and by Country - Trends and Forecasts to 2014 - 2019

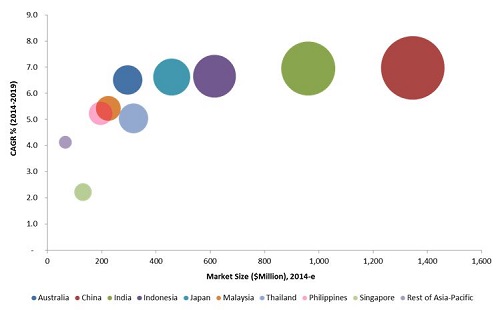

[165 Pages Report] The APAC submersible pumps market is projected to grow at a CAGR of 6.4% from 2014 to 2019, to be valued at $18.9 billion. China was the single-largest market for submersible pumps in 2013, holding 29.1% share, and is set to continue its dominance till 2019. It is likely to emerge as the fastest growing market during the forecast period, exhibiting a CAGR of 7.0% from 2014 to 2019, followed by India at 6.9% and Indonesia at 6.7% during the same period.

The Asia-Pacific submersible pumps market has been segmented on the basis of type, application, industry, and country in terms of value and volume. The market segments by type include openwell and borewell. The market segments by application include industrial, agriculture, and domestic. The industrial application segment has been further divided into construction, oil & gas, water & sewage, chemical and other industries. The country-wise segmentation includes Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, Thailand, and Rest of Asia-Pacific.

The submersible pumps market is primarily driven by increasing urbanization, deepwater exploration activities, and decline in fresh water resources among others. Submersible pumps have become a pivotal part of the crude production process, contributing to the increasing efficiency of crude oil production. The drivers of the submersible pumps market include increasing deep and ultra-deep offshore drilling activities and the growing number of maturing oilfields.

These drivers are focused at reinforcing the growth of submersible pumps in the future. Impact of these drivers is firm and positive in the long-term. However, the market requires handling critical challenges such as submersible motor failure, high troubleshooting cost and presence of excess air at a pump intake.

This report provides an analysis of key companies and competitive analysis of developments recorded in the industry during the past three years. Market drivers, restraints, opportunities, burning issues and latest industry trends of the market have been discussed in detail. The leading players in the market such as Baker Hughes Inc. (U.S.), General Electric Company (U.S.), Schlumberger Ltd. (U.S.), Weatherford International Ltd. (Switzerland), Halliburton (U.S.), Grundfos Group (Denmark), Sulzer AG (Switzerland), KSB Group (Germany), and Walrus Pump Co., Ltd. (Taiwan) have been profiled in this report.

APAC Submersible Pumps Market Size, by Country, 2014-2019 ($Million)

E-Estimated, Bubble Size=Projected Market Size of 2019

Source: MarketsandMarkets Analysis

In 2014, China is estimated to be the largest market for submersible pumps in Asia-Pacific, and is projected to remain till 2019. The key players of the submersible pumps market undertake various contracts and agreements (including joint ventures, collaborations, and partnerships) to increase their share in the market. The leading submersible pump companies are expanding rapidly in fast-growing markets such as China, India, and Indonesia by opening new sales and service facilities, expanding manufacturing capacities, and establishing specialized R&D centers.

Scope of the Report

This report focuses on the Asia-Pacific submersible pumps market, which has been segmented on the basis of type, application, industry, and country.

On the basis of type

- Openwell

- Borewell

On the basis of application

- Industrial

- Agriculture

- Domestic

On the basis of industry

- Construction

- Oil & Gas

- Water & Sewage

- Chemical

- Others

On the basis of country

- Australia

- China

- India

- Indonesia

- Japan

- Malaysia

- Philippines

- Singapore

- Thailand

- Rest of Asia-Pacific

The Asia-Pacific submersible pumps market is expected to grow at a CAGR of 6.4% from 2014 to 2019. Rising urban population and the consequent demand for water & sewage treatment are the key drivers of the submersible pumps market in Asia-Pacific.

With continuing industrialization in the fast-growing economies of the region, there has been heavy spending on the construction of related infrastructure, generating demand for submersible pumps. The migration of people from rural to urban areas is also stimulating the demand for submersible pumps in the region, for the water & sewage industry.

The submersible pumps market is primarily driven by increasing urbanization, deepwater exploration activities, and decline in the fresh water resources among others. Submersible pumps have become a pivotal part of the crude production process, contributing to the increasing efficiency of crude oil production. The drivers of the submersible pumps market include increasing deep and ultra-deep offshore drilling activities and the rising number of maturing oilfields.

The Asia-Pacific submersible pumps market based on type include openwell and borewell submersible pumps. The market on the basis of application has been segmented into industrial, agriculture, and domestic. The industrial application segment has been further divided into construction, oil & gas, water & sewage, chemical, and other industries. The country-wise segmentation includes Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, Thailand, and Rest of Asia-Pacific.

This report provides a detailed analysis of key companies and competitive analysis of developments recorded in the industry in the past three years. Market drivers, restraints, opportunities, burning issues, and the latest industry trends have also been discussed in detail. The leading players in the market such as Baker Hughes Inc. (U.S.), General Electric Company (U.S.), Schlumberger Ltd. (U.S.), Weatherford International Ltd. (Switzerland), Halliburton (U.S.), Grundfos Group (Denmark), Sulzer AG (Switzerland), KSB Group (Germany), and Walrus Pump Co., Ltd. (Taiwan) among others have been profiled in this report.

APAC Submersible Pumps Market Size, by Country 2014 - 2019 ($Million)

E-Estimated, Bubble Size=Projected Market Size in 2019

Source: Secondary Research and MarketsandMarkets Analysis

China is estimated to be the largest market for submersible pumps in Asia-Pacific in 2014, and is expected to dominate till 2019. The key players of the Asia-Pacific submersible pumps market have undertaken various contracts and agreements (including joint ventures, collaborations, and partnerships) to increase their share in the market. The leading companies are expanding rapidly in fast-growing markets such as China, India, and Indonesia by opening new sales and service facilities and expanding manufacturing capacities.

China is projected to emerge as the fastest growing market during the forecast period, growing at a CAGR of 7.0% from 2014 to 2019, followed by the India and Indonesia at growth rates of 6.9% and 6.7% during the forecast period, respectively.

Table Of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered For the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Growing Urbanization

2.2.3 Demand for Artificial Lift Methods

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 30)

4.1 China & India: Fastest Growing Submersible Pumps Markets during the Forecast Period

4.2 Indonesia & Thailand Command More Than Half of the Market Share In 2013

4.3 Growing Submersible Pumps Markets of Asia-Pacific

4.4 Life Cycle Analysis, By Country

4.5 APAC Submersible Pump Market, By Industry

5 Market Overview (Page No. - 35)

5.1 Market Evolution

5.2 Market Segmentation

5.2.1 By Industry

5.2.2 By Application

5.2.3 By Country

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Urbanized Population

5.3.1.2 Increasing Industrialization

5.3.1.3 Increasing Deepwater Exploration Activities

5.3.1.4 Growing Infrastructure Investments

5.3.2 Restraint

5.3.2.1 Submersible Motor Failure & High Troubleshooting Cost

5.3.3 Opportunities

5.3.3.1 Reclamation & Redevelopment of Fields

5.3.3.2 Growing Subsea Operations

5.3.4 Challenge

5.3.4.1 Application of Submersible Pump While Presence of Excess Air at a Pump Intake Is A Challenge

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porterís Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.1.1 Mature Technology

6.3.2 Threat of Substitutes

6.3.2.1 Competition from Other Lift Types In The Oil & Gas Market

6.3.3 Bargaining Power of Suppliers

6.3.3.1 Low Cost Of Switching Suppliers

6.3.3.2 Non-Concentration of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.4.1 Concentration of Buyers In The Market

6.3.5 Intensity Of Rivalry

6.3.5.1 Many Equal-Sized Competitors

6.3.5.2 Slow Technology Change

7 Asia-Pacific Submersible Pumps Market, By Type (Page No. - 49)

7.1 Introduction

7.2 Submersible Pump Market Overview

7.2.1 Borewell

7.2.2 Openwell

7.3 Regional Analysis

7.3.1 Borewell

7.3.2 Openwell

7.4 Country Analysis

7.4.1 China

7.4.2 India

7.4.3 Indonesia

7.4.4 Japan

7.4.5 Rest of Asia-Pacific

8 Asia-Pacific Submersible Pumps Market, By Application (Page No. - 64)

8.1 Introduction

8.2 Industrial

8.3 Agriculture

8.4 Domestic

9 Asia-Pacific Submersible Pumps Market, By Industry (Page No. - 73)

9.1 Introduction

9.2 Construction

9.3 Oil & Gas

9.4 Water & Sewage

9.5 Chemical

9.6 Others

10 Asia-Pacific Submersible Pumps Market, By Region (Page No. - 84)

10.1 Introduction

10.2 Australia

10.3 China

10.4 India

10.5 Indonesia

10.6 Japan

10.7 Malaysia

10.8 Thailand

10.9 Philippines

10.10 Singapore

10.11 Rest Of Asia-Pacific

11 Competitive Landscape (Page No. - 101)

11.1 Overview

11.2 Market Share Analysis, By Key Players

11.3 Competitive Situation & Trends

11.4 Contracts & Agreements

11.5 Mergers & Acquisitions

11.6 New Product Developments

11.7 Other Expansions

12 Company Profiles (Page No. - 110)

12.1 Introduction (Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MNM View)*

12.2 Baker Hughes

12.3 General Electric Company

12.4 Halliburton Company

12.5 Schlumberger Limited

12.6 Weatherford International Ltd.

12.7 Atlas Copco

12.8 Flowserve Corporation

12.9 Grundfos Group

12.10 KSB Group

12.11 National Oilwell Varco, Inc.

12.12 Sulzer AG

12.13 Wilo SE

12.14 Walrus Pumps Co. Ltd.

*Details On Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MNM View Might Not Be Captured In Case Of Unlisted Companies.

13 Appendix (Page No. - 153)

13.1 Insights of Industry Experts

13.2 Other Developments

13.3 Discussion Guide

13.4 Introducing RT: Real Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List Of Tables (70 Tables)

Table 1 Asia-Pacific Urbanization Prospects

Table 2 Increasing Urbanization, Industrialization & Infrastructure Investments Are Propelling the Growth of The Submersible Pumps Market

Table 3 Submersible Motor Failure and High Troubleshooting Cost Restrain Market Growth

Table 4 Reclamation & Redevelopment Of Oilfield & Growing Subsea Operation Are Opportunities For The Submersible Pumps Market

Table 5 Application of Submersible Pump While Presence of Excess Air at a Pump Intake Is a Challenge

Table 6 Submersible Pumps Market Size, By Region, 2012-2019 (Million Units)

Table 7 Submersible Pumps Market Size, By Region, 2012-2019 ($Million)

Table 8 Submersible Pumps Market Size, By Type, 2012-2019 (Million Units)

Table 9 Borewell Submersible Pumps Market Size, By Region, 2012-2019 (Million Units)

Table 10 Openwell Submersible Pumps Market Size, By Region, 2012-2019 (Million Units)

Table 11 Asia-Pacific: Submersible Pumps Market Size, By Type, 2012-2019 (Million Units)

Table 12 Asia-Pacific: Submersible Pumps Market Size, By Type, 2012-2019 ($Million)

Table 13 Asia-Pacific: Submersible Pumps Market Size, By Country, 2012-2019 (Million Units)

Table 14 Asia-Pacific: Submersible Pumps Market Size, By Country, 2012-2019 ($ Million)

Table 15 Asia-Pacific: Borewell Submersible Pumps Market Size, By Country, 2012-2019 (Million Units)

Table 16 Asia-Pacific: Borewell Submersible Pumps Market Size, By Country, 2012-2019 ($Million)

Table 17 Asia-Pacific: Openwell Submersible Pumps Market Size, By Country, 2012-2019 (Million Units)

Table 18 Asia-Pacific: Openwell Submersible Pumps Market Size, By Country, 2012-2019 ($Million)

Table 19 China: Submersible Pumps Market Size, By Type, 2012-2019 (Million Units)

Table 20 China: Submersible Pumps Market Size, By Type, 2012-2019 ($Million)

Table 21 India: Submersible Pumps Market Size, By Type, 2012-2019 (Million Units)

Table 22 India: Submersible Pumps Market Size, By Type, 2012-2019 ($Million)

Table 23 Indonesia: Submersible Pumps Market Size, By Type, 2012-2019 (Million Units)

Table 24 Indonesia: Submersible Pumps Market Size, By Type, 2012-2019 ($Million)

Table 25 Japan: Submersible Pumps Market Size, By Type, 2012-2019 (Million Units)

Table 26 Japan: Submersible Pumps Market Size, By Type, 2012-2019 ($Million)

Table 27 Rest for Asia-Pacific: Submersible Pumps Market Size, By Type, 2012-2019 (Million Units)

Table 28 Rest of Asia-Pacific: Submersible Pumps Market Size, By Type, 2012-2019 ($Million)

Table 29 Global Submersible Pumps Market Size, By Application, 2012 - 2019 ($Million)

Table 30 Asia-Pacific Submersible Pumps Market Size, By Application, 2012-2019 ($Million)

Table 31 Industrial Application Market Size, By Region, 2012-2019 ($Million)

Table 32 Asia-Pacific: Industrial Application Market Size, By Country, 2012-2019 ($Million)

Table 33 Agriculture Application Market Size, By Region, 2012-2019 ($Million)

Table 34 Asia-Pacific Agriculture Application Market Size, By Country, 2012-2019 ($Million)

Table 35 Domestic Application Market Size, By Region, 2012-2019 ($Million)

Table 36 Asia-Pacific Domestic Application Market Size, By Country, 2012-2019 ($Million)

Table 37 Asia-Pacific Submersible Pumps Market Size, By Industry, 2012-2019 ($Million)

Table 38 Construction Industry Market Size, By Region, 2012-2019, ($ Million)

Table 39 Asia-Pacific Construction Industry Market Size, By Country, 2012-2019 ($Million)

Table 40 Oil & Gas Industry Market Size, By Region, 2012-2019, ($ Million)

Table 41 Asia-Pacific Oil & Gas Industry Market Size, By Country, 2012-2019 ($Million)

Table 42 Water & Sewage Industry Market Size, By Region, 2012-2019, ($ Million)

Table 43 Asia-Pacific Water & Sewage Industry Market Size, By Country, 2012-2019 ($Million)

Table 44 Asia-Pacific Chemical Industry Market Size, By Country, 2012-2019 ($Million)

Table 45 Asia-Pacific Other Industry Market Size, By Country, 2012-2019 ($Million)

Table 46 Asia-Pacific Submersible Pumps Market Size, By Country, 2012-2019 ($Million)

Table 47 Australia: Submersible Pumps Market Size, By Application, 2012-2019 ($Million)

Table 48 Australia: Submersible Pumps Market Size, By Industry, 2012-2019 ($Million)

Table 49 China: Submersible Pumps Market Size, By Application, 2012-2019 ($Million)

Table 50 China: Submersible Pumps Market Size, By Industry, 2012-2019 ($Million)

Table 51 India: Submersible Pumps Market Size, By Application, 2012-2019 ($Million)

Table 52 India: Submersible Pumps Market Size, By Industry, 2012-2019 ($Million)

Table 53 Indonesia: Submersible Pumps Market Size, By Application, 2012-2019 ($ Million)

Table 54 Indonesia Submersible Pumps Market Size, By Industry, 2012-2019 ($Million)

Table 55 Japan: Submersible Pumps Market Size, By Application, 2012-2019 ($Million)

Table 56 Japan: Submersible Pumps Market Size, By Industry, 2012-2019 ($Million)

Table 57 Malaysia: Submersible Pumps Market Size, By Application, 2012-2019 ($Million)

Table 58 Malaysia: Submersible Pumps Market Size, By Industry, 2012-2019 ($Million)

Table 59 Thailand: Submersible Pumps Market Size, By Application, 2012-2019 ($Million)

Table 60 Thailand Submersible Pumps Market Size, By Industry, 2012-2019 ($Million)

Table 61 Philippines: Submersible Pumps Market Size, By Application, 2012-2019 ($Million)

Table 62 Philippines: Submersible Pumps Market Size, By Industry, 2012-2019 ($Million)

Table 63 Singapore: Submersible Pumps Market Size, By Application, 2012-2019 ($Million)

Table 64 Singapore: Submersible Pumps Market Size, By Industry, 2012-2019 ($Million)

Table 65 Rest Of Asia-Pacific: Submersible Pumps Market Size, By Application, 2012-2019 ($Million)

Table 66 Rest Of Asia-Pacific: Submersible Pumps Market Size, By Industry, 2012-2019 ($Million)

Table 67 Contracts & Agreements, 2014

Table 68 Mergers & Acquisitions, 2014

Table 69 New Product Developments, 2014

Table 70 Other Expansions, 2014

List Of Figures (53 Figures)

Figure 1 Markets Covered: Submersible Pumps Market

Figure 2 Asia-Pacific Submersible Pumps Market: Research Design

Figure 3 More Than Half Of Asia-Pacificís Population Is Set To Become Urban By 2020

Figure 4 Artificial Lift Market In Asia-Pacific To Grow At A CAGR Of 10% During The Forecast Period

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Data Triangulation Methodology

Figure 7 Asia-Pacific Well Count, 2013

Figure 8 Snapshot: Industrial Application Market Is Expected To Grow At The Fastest Rate During The Forecast Period

Figure 9 China Dominated the Submersible Pumps Market In 2013

Figure 10 Construction & Water and Sewage Are the Most Promising Future Markets

Figure 11 National Oilwell Varco Is the Most Active In Signing Mergers & Acquisitions, 2010-2014

Figure 12 Attractive Market Opportunities in the Asia-Pacific Submersible Pumps Market

Figure 13 Industrial Application To Grow At A Higher Rate In The Submersible Pumps Market

Figure 14 China Will Remain the Largest & Fastest Growing Market During The Forecast Period

Figure 15 China Is Expected To Grow Faster Than Other Countries

Figure 16 India Was the Second-Fastest Growing Market In 2013

Figure 17 Construction Is Expected To Remain the Fastest Growing Industry

Figure 18 Submersible Pumps Increasingly Becoming A Part Of Oil Wells & Water Wells

Figure 19 Market Segmentation of Submersible Pumps

Figure 20 Segmentation of the Submersible Pumps Market, By Industry

Figure 21 Segmentation of the Submersible Pumps Market, By Application

Figure 22 Segmentation of the Submersible Pumps Market, By Country

Figure 23 Market Dynamics of Submersible Pumps

Figure 24 Infrastructure Investments In The Asia-Pacific Countries From 2006 To 2024

Figure 25 Value Chain Analysis: Major Value Is Added During Installation, Operation & Post-Sales Phase

Figure 26 Porterís Five Forces Analysis: Intensity Of Rivalry Is Moderate To High In The Asia-Pacific Submersible Pumps Market

Figure 27 Asia-Pacific: Submersible Pumps Market Size, By Type, 2013 (Million Units)

Figure 28 Indian Market Is Expected To Grow At the Fastest Pace For Borewell Type During The Forecast Period

Figure 29 Asia-Pacific Submersible Pumps Market Size, By Application, 2013

Figure 30 The Industrial Application Market Is The Expected To Grow At The Highest Rate During The Forecast Period

Figure 31 Asia-Pacific Submersible Pumps Market, By Industry, 2013

Figure 32 The Water And Sewage Market Is Expected To Grow At The Fastest Pace During The Forecast Period

Figure 33 Asia-Pacific Submersible Pumps Market Share (By Value), By Country, 2013

Figure 34 Large Economies of Asia-Pacific Possess The Most Growth Potential For Submersible Pumps Market

Figure 35 China To Be The Fastest Growing Market, 2014-2019

Figure 36 Companies Adopted Contracts & Agreement as the Key Growth Strategy In The Past Three Years

Figure 37 National Oilwell Varco Grew At the Highest Rate during 2010-2013

Figure 38 Halliburton Held the Major Share in the Submersible Pump Market, 2013

Figure 39 Market Evaluation Framework

Figure 40 Battle For Market Share: Contracts & Agreement Is The Key Strategy

Figure 41 Regional Revenue Mix of the Top 5 Market Players

Figure 42 Baker Hughes: Company Snapshot

Figure 43 General Electric Company: Company Snapshot

Figure 44 Halliburton Company: Company Snapshot

Figure 45 Schlumberger Limited: Company Snapshot

Figure 46 Weatherford International: Company Snapshot

Figure 47 Atlas Copco: Company Snapshot

Figure 48 Flowserve Corporation: Company Snapshot

Figure 49 Grundfos Group: Company Snapshot

Figure 50 KSB Group: Company Snapshot

Figure 51 National Oilwell Varco, Inc.: Company Snapshot

Figure 52 Sulzer AG: Company Snapshot

Figure 53 Wilo SE : Business Overvie

Growth opportunities and latent adjacency in Asia-Pacific Submersible Pump Market