Asia-Pacific Package Substation Market by Application (Industries, Power, & Infrastructure), by Type (Below 36 kV & 36-150 kV), & by Region (Central Asia, East Asia, South Asia, Southeast Asia, & Rest of Asia-Pacific) - Global Forecast to 2020

[200 Pages Report] The Asia-Pacific package substation market is expected to reach USD 3.04 Billion by 2020, at a CAGR of 7.82% from 2015 to 2020. Package substations are helping industries in minimizing power distribution losses and in effective power distribution. Their usage saves installation time and minimizes spatial requirement. The Asia-Pacific package substation market has been segmented on the basis of application, type, and region. In the package substation market, by application, the industries segment is expected to lead the market during the forecast period. Increasing demand for electricity and increasing investments in the power sector are likely to drive the demand for package substations.

The years considered for the study are:

- Historical Year – 2013

- Base Year – 2014

- Estimated Year – 2015

- Projected Year – 2020

- Forecast Period – 2015 to 2020

Research Methodology

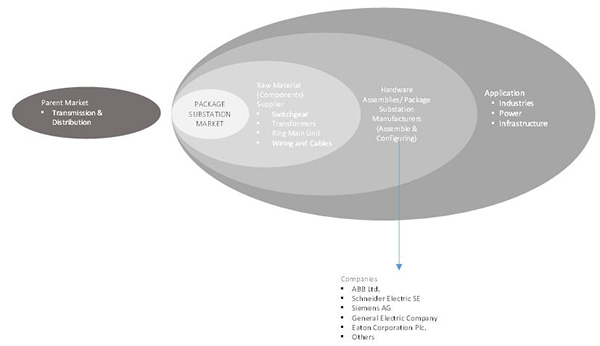

The package substation market valuation for various segments has been arrived by using package substation implementations in various regions and planned investments of operators. Finally, the Asia-Pacific market size has been arrived at by consolidating markets for individual regions. Industry experts have also been contacted for validating the key findings of the report, in order to estimate the market size appropriately. Individual responses and viewpoints have been carefully studied and incorporated in the report. The market size also been validated by both the top-down and bottom-up estimation approaches. In the top-down approach, regional and segmental markets have been derived from the parent market, considering the share of the segments. On the other hand, in the bottom-up approach, individual segment/regional market has been added to arrive at the final parent market.

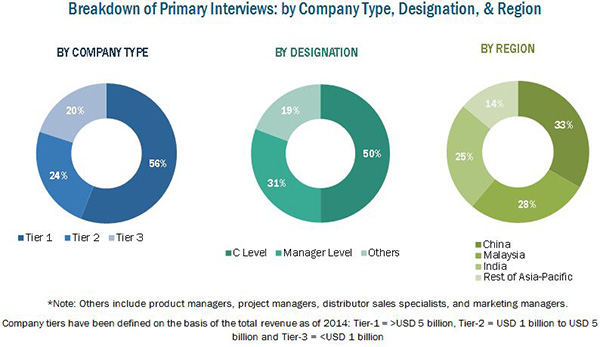

The figure below shows the breakdown of the primaries on the basis of company type, designation, and region, conducted during the research study.

Market Ecosystem:

The package substation market starts with raw material suppliers, which include electronic/electrical components and precision metal works, among others. In the later stage, manufacturing of package substation takes place where all raw materials/components are assembled. This device is then distributed to various industries, utilities, T&D companies, and renewable & transportation sectors.

Stakeholders:

This report includes the following stakeholders:

- Package Substation Manufacturers - These include ABB Ltd. (Switzerland), Schneider Electric SE (France), Siemens AG (Germany), General Electric Company (U.S.), and Eaton Corporation Plc. (Ireland)

- End-Users– These include industries, power, and infrastructure sectors

- State and national regulatory authorities

- Builders and contractors

- Government and industry associations

- State or government owned corporations

Scope of the Report:

The report segments the market on the basis of application, type, and region.

- By Application

- Industries

- Power

- Infrastructure

- By Type

- Below 36 kV

- 36-150 kV

- By Region

- Central Asia

- East Asia

- South Asia

- Southeast Asia

- Rest of Asia-Pacific

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the client's specific needs. The following customization options are available for the report:

- Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

- Product benchmarking for companies operating in the market

The Asia-Pacific package substation market is expected to reach USD 3.04 Billion by 2020, at a CAGR of 7.82% from 2015 to 2020. The growth of this market is attributed to huge electricity demand and modernization of existing power infrastructure in developing countries. Investments for renewable power generation in South Asian countries have been planned to meet the rising power demand, which in turn are going to boost the demand for package substations in Asia-Pacific.

Among various applications for which package substations are employed, the industries segment is expected to be the largest market by 2020. This segment is also expected to witness the highest CAGR during the forecast period, due to increased investments in upgrading the distribution networks in Asia-Pacific in order to meet the growing power demand. Meanwhile, Southeast Asia and South Asia comprise fast growing markets for the industries segment.

Below 36 kV is the largest segment among the type of package substations. The below 36 kV package substation market is expected to have the second highest growth from 2015 to 2020, given its increasing usage for small industrial sectors and residential applications. This market is expected to witness the maximum growth in the Southeast Asia region.

Meanwhile, East Asia is expected to be the largest market for package substation during the forecast period; it is projected to exhibit a moderate CAGR from 2015 to 2020. With electricity demand going up in the region, substantial investments in the power sector have been made, which are expected to boost the demand for package substations. Southeast Asia is projected to become the fastest growing market in the Asia-Pacific region from 2015 to 2020 because of modernization of existing infrastructure in countries such as Malaysia and Indonesia. Asia-Pacific has some key companies including C&S Electric Limited (India), Crompton Greaves Limited (India), TGOOD Electric Co. Ltd. (China), and Toshiba Corporation (Japan) operating in this market.

Package substations have evolved recently, and thus, have a low acceptance level at present. The comparative benefits offered by package substations are highly lucrative for setting up new distribution substations in urban cities. However, their widespread usage as a replacement for old distribution systems is yet to become popular. High cost of ring main units as compared to conventional switchgear is also a factor restraining the growth of the market. Additionally, energy cost is declining with addition of distributed generators in renewables. As a result, profit margins of distribution utilities has reduced, thereby forcing service providers to cut investments in modernized power equipment, such as package substation. The top five players in the package substation market include ABB Ltd. (Switzerland), Schneider Electric SE (France), Siemens AG (Germany), General Electric Company (U.S.), and Eaton Corporation Plc. (Ireland).

Table of Content

1 Introduction

1.1 Objectives of the Study

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Market Scope

2 Research Methodology

2.1 Introduction

2.2 Market Size Estimation

2.3 Breakdown of Primary Interviews

2.3.1 Market Breakdown & Data Triangulation

2.4 Market Size Estimation

2.4.1 Key Data From Secondary Sources

2.4.2 Key Data From Primary Sources

2.4.2.1 Key Industry Insights

2.5 Assumptions

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1 Introduction

5.1.1 Major Advantages

5.2 Market Segmentation

5.2.1 PSS Market By Application

5.2.2 PSS Market By Voltage Level

5.2.3 PSS Market By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Modernization of the Existing Power Infrastructure

5.3.1.2 Capacity Addition & Enhancement Plans

5.3.2 Restraints

5.3.2.1 Low Acceptance Level

5.3.2.2 Declining Energy Costs

5.3.3 Opportunities

5.3.3.1 Developing Renewable Sector

5.3.3.2 Demand for Uninterrupted Power From Transport Sector

5.3.4 Challenges

5.3.4.1 Commodity Price Plunge Resulting in Lowered Demand

5.3.4.2 Low Quality Counterfeits

6 Industry Trends

6.1 Introduction

6.2 Value Chain Analysis

6.3 Standards & Regulations

6.4 Porter’s Five Forces Analysis

6.4.1 Threat of Substitutes

6.4.2 Threat of New Entrants

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivalry

7 Global PSS Market By Voltage Level

7.1 Introduction

7.2 Below 36 KV

7.3 36-150 KV

8 Global PSS Market By Application

8.1 Industries

8.1.1 Oil & Gas

8.1.2 Mining

8.1.3 Others

8.2 Power

8.2.1 T&D Utilities

8.2.2 Renewables

8.2.3 Power Generation

8.3 Infrastructure

9 Global PSS Market, By Geography

9.1 Introduction

9.2 East Asia

9.2.1 China

9.2.1.1 China Market By Voltage Level

9.2.1.2 China Market By Application

9.2.2 Japan

9.2.2.1 Japan Market By Voltage Level

9.2.2.2 Japan Market By Application

9.2.3 South Korea

9.2.3.1 South Korea Market By Voltage Level

9.2.3.2 South Korea Market By Application

9.2.4 Rest of East Asia

9.2.4.1 Rest of East Asia Market By Voltage Level

9.2.4.2 Rest of East Asia Market By Application

9.3 South Asia

9.3.1 India

9.3.1.1 India Market By Voltage Level

9.3.1.2 India Market By Application

9.3.2 Pakistan

9.3.2.1 Pakistan Market By Voltage Level

9.3.2.2 Pakistan Market By Application

9.3.3 Rest of South Asia

9.3.3.1 Rest of South Asia Market By Voltage Level

9.3.3.2 Rest of South Asia Market By Application

9.4 Southeast Asia

9.4.1 Indonesia

9.4.1.1 Indonesia Market By Voltage Level

9.4.1.2 Indonesia Market By Application

9.4.2 Malaysia

9.4.2.1 Malaysia Market By Voltage Level

9.4.2.2 Malaysia Market By Application

9.4.3 Myanmar

9.4.3.1 Myanmar Market By Voltage Level

9.4.3.2 Myanmar Market By Application

9.4.4 The Philippines

9.4.4.1 The Philippines Market By Voltage Level

9.4.4.2 The Philippines Market By Application

9.4.5 Thailand

9.4.5.1 Thailand Market By Voltage Level

9.4.5.2 Thailand Market By Application

9.4.6 Vietnam

9.4.6.1 Vietnam Market By Voltage Level

9.4.6.2 Vietnam Market By Application

9.4.7 Rest of Southeast Asia

9.4.7.1 Rest of Southeast Asia Market By Voltage Level

9.4.7.2 Rest of Southeast Asia Market By Application

9.5 Central Asia

9.5.1 Kazakhstan

9.5.1.1 Kazakhstan Market By Voltage Level

9.5.1.2 Kazakhstan Market By Application

9.5.2 Turkmenistan

9.5.2.1 Turkmenistan Market By Voltage Level

9.5.2.2 Turkmenistan Market By Application

9.5.3 Uzbekistan

9.5.3.1 Uzbekistan Market By Voltage Level

9.5.3.2 Uzbekistan Market By Application

9.5.4 Kyrgyzstan

9.5.4.1 Kyrgyzstan Market By Voltage Level

9.5.4.2 Kyrgyzstan Market By Application

9.5.5 Tajikistan

9.5.5.1 Tajikistan Market By Voltage Level

9.5.5.2 Tajikistan Market By Application

9.6 Rest of Asia-Pacific

9.6.1 Australia

9.6.1.1 Australia Market By Voltage Level

9.6.1.2 Australia Market By Application

9.6.2 New Zealand

9.6.2.1 New Zealand Market By Voltage Level

9.6.2.2 New Zealand Market By Application

10 Competitive Landscape

10.1 Introduction

10.2 Strategic Benchmarking

10.2.1 Technology Integration & Product Enhancement

10.3 Key Players of the Package Substation Market

10.3.1 Regional Analysis

10.3.2 Key Companies’ Focus Area

10.4 Most Active Companies in the PSS Market

11 Company Profiles

11.1 ABB Ltd.

11.2 Schneider Electric SE

11.3 Siemens AG

11.4 General Electric Company

11.5 Eaton Corporation PLC

11.6 Asia Electrical Power Equipment (Shenzhen) Co., Ltd.

11.7 Brilltech Engineers Pvt. Ltd.

11.8 C&S Electric Limited

11.9 Crompton Greaves Ltd.

11.10 Kirloskar Electric Company Ltd.

11.11 Larsen & Toubro

11.12 Littelfuse Inc.

11.13 Lucy Electric

11.14 PLVK Power Engineers & Consultants

11.15 Tgood Electric Co. Ltd.

11.16 Toshiba Corporation

11.17 Xiamen Qihong Machinery Electrical Equipment Co., Ltd.

12 Appendix

List of Tables (151 Tables)

Table 1 Capacity Addition & Enhancement Plans are the Major Drivers of the Market

Table 2 Low Acceptance Level is the Major Restraint of the Market

Table 3 Developing Renewable Sector is Expected to Offer High Growth Opportunities in the Package Substation Market

Table 4 Low-Quality Counterfeits are the Major Challenge to the Market

Table 5 Package Substation Market Size, By Voltage Level, 2013-2020 (USD Million)

Table 6 Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 7 Below 36 KV Package Substation Market Size, By Region, 2013-2020 (USD Million)

Table 8 Below 36 KV Package Substation Market Size, By Region, 2013-2020 (Units)

Table 9 36-150 KV Package Substation Market Size, By Region, 2013-2020 (USD Million)

Table 10 36-150 KV Package Substation Market Size, By Region, 2013-2020 (Units)

Table 11 Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 12 Package Substation Market Size, By Application, 2013-2020 (Units)

Table 13 Industries Market Size, By Region, 2013-2020 (USD Million)

Table 14 Industries Market Size, By Region, 2013-2020 (Units)

Table 15 Oil & Gas Market Size, By Region, 2013-2020 (USD Million)

Table 16 Oil & Gas Market Size, By Region, 2013-2020 (Units)

Table 17 Mining Market Size, By Region, 2013-2020 (USD Million)

Table 18 Mining Market Size, By Region, 2013-2020 (Units)

Table 19 Others Market Size, By Region, 2013-2020 (USD Million)

Table 20 Others Market Size, By Region, 2013-2020 (Units)

Table 21 Power Market Size, By Region, 2013-2020 (USD Million)

Table 22 Power Market Size, By Region, 2013-2020 (Units)

Table 23 T&D Utilities Market Size, By Region, 2013-2020 (USD Million)

Table 24 T&D Utilities Market Size, By Region, 2013-2020 (Units)

Table 25 Renewables Market Size, By Region, 2013-2020 (USD Million)

Table 26 Renewables Market Size, By Region, 2013-2020 (Units)

Table 27 Power Generation Market Size, By Region, 2013-2020 (USD Million)

Table 28 Power Generation Market Size, By Region, 2013-2020 (Units)

Table 29 Infrastructure Market Size, By Region, 2013-2020 (USD Million)

Table 30 Infrastructure Market Size, By Region, 2013-2020 (Units)

Table 31 Asia-Pacific Package Substation Market Size, By Region, 2013-2020 (USD Million)

Table 32 Asia-Pacific Package Substation Market Size, By Region, 2013-2020 (Units)

Table 33 East Asia: Package Substation Market Size, By Country, 2013-2020 (USD Million)

Table 34 East Asia: Package Substation Market Size, By Country, 2013-2020 (Units)

Table 35 East Asia: Package Substation Market Size, By Appplication, 2013-2020 (USD Million)

Table 36 East Asia: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 37 East Asia: Package Substation Market Size, By Voltage Level, 2013-2020 (USD Million)

Table 38 East Asia: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 39 China: Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 40 China: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 41 China: Package Substation Market Size, By Volatge Level, 2013-2020 (USD Million)

Table 42 China: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 43 Japan: Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 44 Japan: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 45 Japan: Package Substation Market Size, By Volatge Level, 2013-2020 (USD Million)

Table 46 Japan: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 47 South Korea: Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 48 South Korea: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 49 South Korea: Package Substation Market Size, By Volatge Level, 2013-2020 (USD Million)

Table 50 South Korea: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 51 Rest of East Asia: Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 52 Rest of East Asia: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 53 Rest of East Asia: Package Substation Market Size, By Volatge Level, 2013-2020 (USD Million)

Table 54 Rest of East Asia: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 55 South Asia: Package Substation Market Size, By Country, 2013-2020 (USD Million)

Table 56 South Asia: Package Substation Market Size, By Country, 2013-2020 (Units)

Table 57 South Asia: Package Substation Market Size, By Appplication, 2013-2020 (USD Million)

Table 58 South Asia: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 59 South Asia: Package Substation Market Size, By Voltage Level, 2013-2020 (USD Million)

Table 60 South Asia: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 61 India: Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 62 India: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 63 India: Package Substation Market Size, By Volatge Level, 2013-2020 (USD Million)

Table 64 India: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 65 Pakistan: Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 66 Pakistan: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 67 Pakistan: Package Substation Market Size, By Volatge Level, 2013-2020 (USD Million)

Table 68 Pakistan: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 69 Rest of South Asia: Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 70 Rest of South Asia: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 71 Rest of South Asia: Package Substation Market Size, By Volatge Level, 2013-2020 (USD Million)

Table 72 Rest of South Asia: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 73 Southeast Asia: Package Substation Market Size, By Country, 2013-2020 (USD Million)

Table 74 Southeast Asia: Package Substation Market Size, By Country, 2013-2020 (Units)

Table 75 Southeast Asia: Package Substation Market Size, By Appplication, 2013-2020(USD Million)

Table 76 Southeast Asia: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 77 Southeast Asia: Package Substation Market Size, By Voltage Level, 2013-2020 (USD Million)

Table 78 Southeast Asia: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 79 Indonesia: Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 80 Indonesia: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 81 Indonesia: Package Substation Market Size, By Volatge Level, 2013-2020 (USD Million)

Table 82 Indonesia: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 83 Thailand: Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 84 Thailand: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 85 Thailand: Package Substation Market Size, By Volatge Level, 2013-2020 (USD Million)

Table 86 Thailand: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 87 Vietnam: Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 88 Vietnam: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 89 Vietnam: Package Substation Market Size, By Volatge Level, 2013-2020 (USD Million)

Table 90 Vietnam: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 91 Myanmar: Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 92 Myanmar: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 93 Myanmar: Package Substation Market Size, By Volatge Level, 2013-2020 (USD Million)

Table 94 Myanmar: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 95 Malaysia: Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 96 Malaysia: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 97 Malaysia: Package Substation Market Size, By Volatge Level, 2013-2020 (USD Million)

Table 98 Malaysia: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 99 The Philippines: Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 100 The Philippines: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 101 The Philippines: Package Substation Market Size, By Volatge Level, 2013-2020 (USD Million)

Table 102 The Philippines: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 103 Rest of Southeast Asia: Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 104 Rest of Southeast Asia: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 105 Rest of Southeast Asia: Package Substation Market Size, By Volatge Level, 2013-2020 (USD Million)

Table 106 Rest of Southeast Asia: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 107 Central Asia: Package Substation Market Size, By Country, 2013-2020 (USD Million)

Table 108 Central Asia: Package Substation Market Size, By Country, 2013-2020 (Units)

Table 109 Central Asia: Package Substation Market Size, By Appplication, 2013-2020 (USD Million)

Table 110 Central Asia: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 111 Central Asia: Package Substation Market Size, By Voltage Level, 2013-2020 (USD Million)

Table 112 Central Asia: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 113 Kazakhstan: Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 114 Kazakhstan: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 115 Kazakhstan: Package Substation Market Size, By Volatge Level, 2013-2020 (USD Million)

Table 116 Kazakhstan: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 117 Uzbekistan: Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 118 Uzbekistan: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 119 Uzbekistan: Package Substation Market Size, By Volatge Level, 2013-2020 (USD Million)

Table 120 Uzbekistan: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 121 Tajikistan: Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 122 Tajikistan: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 123 Tajikistan: Package Substation Market Size, By Volatge Level, 2013-2020 (USD Million)

Table 124 Tajikistan: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 125 Turkmenistan: Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 126 Turkmenistan: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 127 Turkmenistan: Package Substation Market Size, By Volatge Level, 2013-2020 (USD Million)

Table 128 Turkmenistan: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 129 Kyrgystan: Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 130 Kyrgystan: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 131 Kyrgystan: Package Substation Market Size, By Volatge Level, 2013-2020 (USD Million)

Table 132 Kyrgystan: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 133 Rest of Asia-Pacific: Package Substation Market Size, By Country, 2013-2020 (USD Million)

Table 134 Rest of Asia-Pacific: Package Substation Market Size, By Country, 2013-2020 (Units)

Table 135 Rest of Asia-Pacific: Package Substation Market Size, By Appplication, 2013-2020 (USD Million)

Table 136 Rest of Asia-Pacific: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 137 Rest of Asia-Pacific: Package Substation Market Size, By Voltage Level, 2013-2020 (USD Million)

Table 138 Rest of Asia-Pacific: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 139 Australia: Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 140 Australia: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 141 Australia: Package Substation Market Size, By Volatge Level, 2013-2020 (USD Million)

Table 142 Australia: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 143 New Zealand: Package Substation Market Size, By Application, 2013-2020 (USD Million)

Table 144 New Zealand: Package Substation Market Size, By Application, 2013-2020 (Units)

Table 145 New Zealand: Package Substation Market Size, By Volatge Level, 2013-2020 (USD Million)

Table 146 New Zealand: Package Substation Market Size, By Voltage Level, 2013-2020 (Units)

Table 147 Contracts & Agreements, 2014-January 2016

Table 148 Expansions, 2014-2015

Table 149 Mergers & Acquisitions, 2012-2014

Table 150 New Product Developments, 2013-2014

Table 151 Recent Developments

List of Figures (59 Figures)

Figure 1 Package Substation Market Segmentation

Figure 2 Asia-Pacific Package Substation Market: Research Design

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 6 Data Triangulation Methodology

Figure 7 Asia-Pacific Package Substation Market Snapshot (2015 vs 2020): Industries to Lead the Market in the Next Five Years

Figure 8 Asia-Pacific Package Substation Market Size, By Voltage Level, 2015

Figure 9 Asia-Pacific Package Substation Market Size, By Application, 2015

Figure 10 Asia-Pacific Package Substation Market, By Region, 2015

Figure 11 Developments in the Distribution System Offer Lucrative Opportunities

Figure 12 Package Substation Below 36kv is Expected to Grow at A Higher Rate in the Southeast Asia Market

Figure 13 Industries Segment is Expected to Capture the Majority Share in the Southeast Asia Market

Figure 14 East Asia Will Remain the Largest Package Substation Market, 2015

Figure 15 Package Substations Below 36kv Have A Promising Future in Emerging Economies of the Asia-Pacific Region

Figure 16 Southeast Asia Market is Expected to Enter an Exponential Growth Phase in Coming Years

Figure 17 Advantages of Package Substations

Figure 18 Package Substation Market Segmentation: By Application

Figure 19 Package Substation Market Segmentation: By Voltage Level

Figure 20 Package Substation Market Segmentation: By Region

Figure 21 Modernization of Exisiting Power Infrastructure & Industrialization to Ropel the Market Growth

Figure 22 Power Infrastructure Failure Rate

Figure 23 Value Chain Analysis (2013): Major Value is Added During Manufacturing and Assembly Stages

Figure 24 Porter‘S Five Forces Analysis: Package Substation Market

Figure 25 The Industries Segment is Expected to Be the Largest Market (By Value) for Package Substations During the Forecast Period

Figure 26 East Asia is Expected to Be the Largest Consumer of the Industries Application Segment During the Forecast Period

Figure 27 Package Substations Below 36 KV are Expected to Dominate the Market With the Highest Growth Rate & Maximum Share, 2015-2020

Figure 28 Below 36 KV Package Substation Market is Expected to Grow at the Highest CAGR in Southeast Asia By 2020

Figure 29 Southeast Asia is the Highest Growing Market in 36-150 KV Package Substations

Figure 30 Geographic Snapshot (2014) –Growing Markets are Emerging as New Hotspots

Figure 31 South East Asia: the Fastest Growing Package Substation Market, 2015-2020

Figure 32 East Asia: Package Substation Market Overview

Figure 33 South Asia: Package Substation Market Overview

Figure 34 Companies Adopted Contracts & Agreements as the Key Growth Strategy, 2012-2016

Figure 35 ABB Ltd. Accounted for the Maximum Market Share in the Package Substation Market in Asia-Pacific in 2014

Figure 36 Market Evaluation Framework, 2012- 2016

Figure 37 Battle for Market Share: Contracts & Agreements Was the Key Strategy, 2012-2016

Figure 38 ABB Ltd.: Company Snapshot

Figure 39 ABB Ltd.: SWOT Analysis

Figure 40 Schneider Electric SE: Company Snapshot

Figure 41 Schneider Electric SE: SWOT Analysis

Figure 42 Siemens AG: Company Snapshot

Figure 43 Siemens AG: SWOT Analysis

Figure 44 General Electric Company: Company Snapshot

Figure 45 General Electric Company: SWOT Analysis

Figure 46 Eaton Corporation PLC: Company Snapshot

Figure 47 Eaton Corporation PLC: SWOT Analysis

Figure 48 Asia Electrical Power Equipment (Shenzhen) Co., Ltd.: Company Snapshot

Figure 49 Brilltech Engineers Pvt. Ltd.: Company Snapshot

Figure 50 C&S Electric Limited: Company Snapshot

Figure 51 Crompton Greaves Limited: Company Snapshot

Figure 52 Kirloskar Electric Company Ltd.: Company Snapshot

Figure 53 Larsen & Toubro: Company Snapshot

Figure 54 Littelfuse Inc.: Company Snapshot

Figure 55 Lucy Electric: Company Snapshot

Figure 56 PLVK Power Engineers & Consultants: Company Snapshot

Figure 57 Tgood Electric Co., Ltd.: Company Snapshot

Figure 58 Toshiba Corporation: Company Snapshot

Figure 59 Xiamen Qihong Machinery Electrical Equipment Co., Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Asia-Pacific Package Substation Market