Aquaculture Products Market by Rearing Product Type (Equipment, Chemicals, Pharmaceuticals, Fertilizers), Culture (Freshwater, Marine, Brackish Water), Species (Aquatic Animals, Aquatic Plants), Production Type and Region - Global Forecast to 2027

Aquaculture Products Market Size & Trends Overview

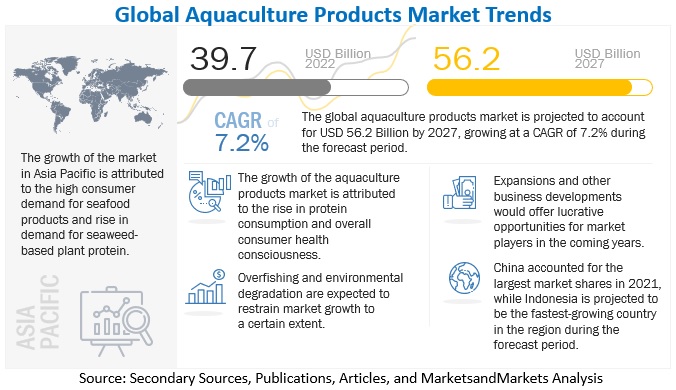

From 2022 to 2027, the global aquaculture products market is expected to rise at a remarkable compound annual growth rate (CAGR) of 7.2%. This rising trend is expected to boost market value from $39.7 billion in 2022 to $56.2 billion by the end of 2027. Aquaculture products are used in the production of aquaculture of aquatic animals and plants, which can be used as a protein source in a range of food and animal feed applications. The demand for aquaculture products is growing in the aquaculture industries, owing to increase consumption of fishmeal in human food and animal feed as it is good source of animal protein.

To know about the assumptions considered for the study, Request for Free Sample Report

Aquaculture Products Market Growth Insights

Drivers: Increased health consciousness and environmental awareness

In recent years, there has been a significant increase in fishmeal consumption, driven by rising health consciousness and environmental awareness among consumers. Fishmeal, a protein-rich feed ingredient derived from wild fish, is considered an important component of many aquatic animal diets, including farmed fish, shrimp, and other aquaculture species. As people become more aware of the health benefits associated with consuming fish-based protein, such as improved cardiovascular health and weight management, demand for fishmeal as a dietary supplement has increased. Additionally, there is a growing awareness of the environmental benefits of consuming fishmeal as a feed ingredient, as it is a sustainable and renewable resource that supports the growth of the aquaculture industry while reducing the environmental impact associated with traditional livestock farming. As a result, fishmeal consumption is expected to continue to rise in the coming years, driven by an increasing demand for healthy and sustainable food sources.

Restraints: Overfishing causing resource exploitation

Overfishing has become a major environmental concern, as it results in the depletion of fish populations and the degradation of marine ecosystems. Overfishing occurs when fishing activities exceed the capacity of fish populations to replenish themselves, leading to a decline in the abundance and diversity of fish species. The exploitation of fish resources has significant economic and social consequences, as many communities around the world rely on fishing for their livelihoods and food security. However, overfishing can lead to reduced catches and the collapse of fish stocks, which can have severe consequences for both marine ecosystems and human well-being. Overfishing also has broader environmental impacts, including the destruction of habitats, the loss of biodiversity, and the alteration of food webs. As such, there is a growing recognition of the need to adopt sustainable fishing practices that promote the conservation of fish resources and the protection of marine ecosystems for future generations.

Opportunities: Increase in incorporation of fishmeal in animal diet

The incorporation of fishmeal in animal diets has been on the rise in recent years, as it is recognized as a valuable source of high-quality protein, essential amino acids, and other important nutrients for animal growth and development. Fishmeal is widely used in animal feed formulations, particularly in the aquaculture industry, where it is an essential component of fish, shrimp, and other aquatic animal diets. However, there is also an increasing trend of incorporating fishmeal into diets for other animals, such as poultry, swine, and dairy cattle, due to its beneficial effects on animal health and performance. In addition to its nutritional benefits, fishmeal is also a sustainable and eco-friendly feed ingredient, as it is produced from the by-products of fish processing, which helps to reduce waste and minimize environmental impact. As such, the incorporation of fishmeal in animal diets is expected to continue to increase in the future, driven by growing demand for high-quality, sustainable animal protein sources.

Challenges: Increase in vegan population

The increase in the vegan population has led to a decline in fish consumption in recent years. Veganism is a lifestyle that seeks to exclude the use of animal products for ethical, environmental, or health reasons. As a result, many vegans do not consume fish or any other animal-based products, opting instead for plant-based sources of protein. This shift in consumer behavior has had a significant impact on the fishing industry, as demand for fish products has declined in many parts of the world. Additionally, the rise in awareness of the environmental impact of fishing has led to more people considering the sustainability of their food choices, which has contributed to the decline in fish consumption. As a result, the fishing industry has had to adapt to changing consumer preferences, and many fishing companies are now exploring alternative seafood products or sustainable fishing practices to address this trend.

Pharmaceuticals by rearing product type in the aquaculture products market is projected to grow at the highest CAGR during the forecast period

The market growth of pharmaceuticals used for aquatic animal health has been increasing in recent years. The demand for aquatic animal health products has been driven by the growing aquaculture industry, which has expanded rapidly in response to the increasing demand for seafood. The use of pharmaceuticals in aquaculture is critical in maintaining the health and welfare of aquatic animals, and preventing and treating diseases that can lead to significant economic losses. The aquaculture industry has witnessed the development of a variety of pharmaceutical products, including vaccines, antibiotics, probiotics, and parasiticides, which have improved the overall health and productivity of aquatic animals. Additionally, the growing concern for food safety and environmental sustainability has driven the development of new pharmaceuticals with fewer environmental impacts and residues in seafood products. As such, the market for pharmaceuticals used for aquatic animal health is expected to continue to grow in the future, driven by the increasing demand for sustainable and safe seafood products.

In 2022, FeedVax (Argentina) announced funding from Conservation International Ventures. The company is working on an oral vaccine that it claims will eliminate the need for animal handling, and it plans to start with tilapia farmers in Brazil.

Seaweed by aquatic plant type in species segment is estimated to dominate over the forecasted period

Seaweed, also known as marine macroalgae, is a highly nutritious and versatile food source that is widely consumed in many parts of the world. It is rich in essential vitamins, minerals, and antioxidants and is also low in fat and calories, making it an ideal food for health-conscious consumers. The use of seaweed in food products has expanded beyond traditional Asian cuisine to a wide range of applications, such as snacks, salads, soups, and even as a natural food coloring agent. Furthermore, the environmental benefits of seaweed cultivation, including its ability to absorb carbon dioxide and improve water quality, have led to its increased adoption as a sustainable food source. In addition to its use in the food industry, seaweed is also being explored for its potential in the production of biofuels, pharmaceuticals, and other industrial applications. As such, the market is expected to continue to grow in the coming years, driven by increasing consumer demand for healthy, sustainable, and eco-friendly food products.

The finfishes segment by aquatic animal species type dominated the aquaculture products market with an estimated value of USD 1,869.2 million in 2022

There are several factors that are driving the increased market growth of finfishes. Firstly, the rising global population and the growing demand for protein-rich foods have led to an increased consumption of fish as a healthy and sustainable protein source. Additionally, advances in aquaculture technologies have made it easier and more cost-effective to produce finfishes, leading to greater supply and lower prices for consumers. Furthermore, the increasing awareness of the health benefits associated with consuming fish, such as its high omega-3 content, has also contributed to the growth of the market. Finally, the rise of e-commerce and online marketplaces has made it easier for consumers to access a wider variety of finfishes from different parts of the world, further driving market growth. Overall, these factors are expected to continue to fuel the growth of the finfish market in the coming years.

To know about the assumptions considered for the study, download the pdf brochure

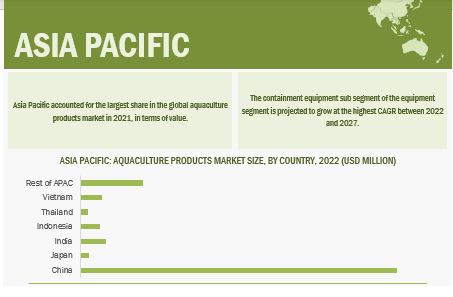

Asia Pacific is projected to be the fastest growing region in aquaculture products market, in 2022; it is anticipated to grow at a significant CAGR

The Asia Pacific aquaculture market is expected to grow rapidly, driven by countries such as China, India, Japan, and Vietnam. Over the last decade, overall investment in the region has increased significantly, particularly in China and India. The recent government investment has also boosted the market significantly in India and China. In recent years, the region has also seen an increase in seafood consumption. The perceived benefits to people's health and environment play a significant role in the region's adoption of seafood diets. Furthermore, growing health concerns due to COVID-19 have prompted people to increase protein in their diets.

Key Players in Aquaculture Products Market

The key players in this market include Pentair PLC (US), AKVA Group (Norway), Xylem Inc. (US), Aquaculture Equipment Ltd (UK), and Aquaculture System Technologies LLC (US).

Aquaculture Products Market Scope

|

Report Metric |

Details |

|

Market Valuation in 2022 |

USD 39.7 Billion |

|

Revenue Forecast in 2027 |

USD 56.2 Billion |

|

Surge rate |

CAGR of 7.2% |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD Billion) |

|

Regions covered |

North America, Asia Pacific, Europe, South America, and RoW |

|

Companies studied |

|

This research report categorizes the aquaculture products market, based on rearing product type, culture, species, production type, and region

Target Audience

- Aquaculture

- Fisheries

- Intermediate suppliers, such as traders and distributors of aquaculture based food and feed

- Aquaculture based food and feed exporting companies

- Government and aquaculture research organizations

-

Associations, regulatory bodies, and other industry-related bodies:

- Food and Agriculture Organization (FAO)

- European Food Safety Authority (EFSA)

- The Association of American Feed Control Officials

- Food Standards Australia New Zealand

- US Food and Drug Administration (FDA) (US)

- World Health Organization (WHO)

Aquaculture products Market Segmentation

By Rearing Product Type

-

Equipment

- Containment Equipment

- Water pump and filters

- Water circulating and aerating equipment

- Cleaning equipment

- Feeders

- Other equipment

- Chemicals

- Pharmaceuticals

- Fertilizers

By Production type

- Small Scale

- Medium & Large Scale

By Culture

- Freshwater

- Brackish water

- Marine

By Species

-

Aquatic animal

- Finfishes

- Mollusks

- Crustaceans

- Other aquatic animals

-

Aquatic plant

- Seaweed

- Microalgae

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In October 2021, Xylem expanded its regional footprint with the acquisition of Anadolu Flygt. The acquisition has enabled the company to serve a broader range of countries in the region and accelerate Xylem's growth in the Middle East market with an expanded suite of digital water solutions and proven systems for sustainable water use.

- In September 2020, AKVA group and Vikings signed a design and cooperation agreement for the design of a number of land-based salmon farms in the Middle East AKVA group provides extensive experience in the design, construction, and operation of modern land-based fish farming.

- In May 2020, Sperre was acquired by the AKVA Group. Sperre is located in the Norwegian subsea cluster Notodden. The company has extensive experience in developing and manufacturing a variety of advanced ROV solutions for aquaculture, oil service, and marine industries.

Frequently Asked Questions (FAQ):

Which region is projected to have the fastest growth in the aquaculture products market?

Asia Pacific is projected to be the fastest growing region in the aquaculture products market with a significant CAGR during the forecast period; it is also estimated to have a significant value in 2022. Major player present in the Asia Pacific aquaculture products market are Pioneer Group (China).

What is the current size of the global aquaculture products market? What are the market drivers?

The global aquaculture products market is estimated to be valued at USD 39.7 billion in 2022. It is projected to reach USD 56.2 billion by 2027, recording a CAGR of 7.2% during the forecast period.

High demand for cheaper protein source and high nutritive value of seafood are some of the drivers fueling the market growth.

Which are the key players in the market, and how intense is the competition?

Key players in this market include Pentair PLC, AKVA Group, Xylem Inc., Aquaculture Ltd, and Aquaculture System Technologies LLC. Since aquaculture products is a fast-growing market, with a lot of unexplored potential, the existing players are fixated on expanding their production capacities, while startups are being established rapidly. The aquaculture products market can be classified as a competitive market as it has a mix of both large and small number players and none of them account for a major part of the market share. The large players are present at the global level, and unorganized players are present at the local level in several countries.

What are the restraining factors limiting growth in the aquaculture products market?

The extreme resource exploitation due to overfishing is limiting the growth in the market. Overfishing cause species depletion in natural habitats causing disruption in food chain causing harm to the surrounding flora and fauna.

Which rearing product type is projected to dominate the aquaculture products market?

Equipment segment in the rearing product type is projected to dominate the aquaculture products market. The use of range of equipment such and water filters, pumps and aeration systems in fisheries and aquaculture as well as integration of smart innovations such as automation and AI in aquaculture equipment to further drive growth for equipment segment in rearing product type.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

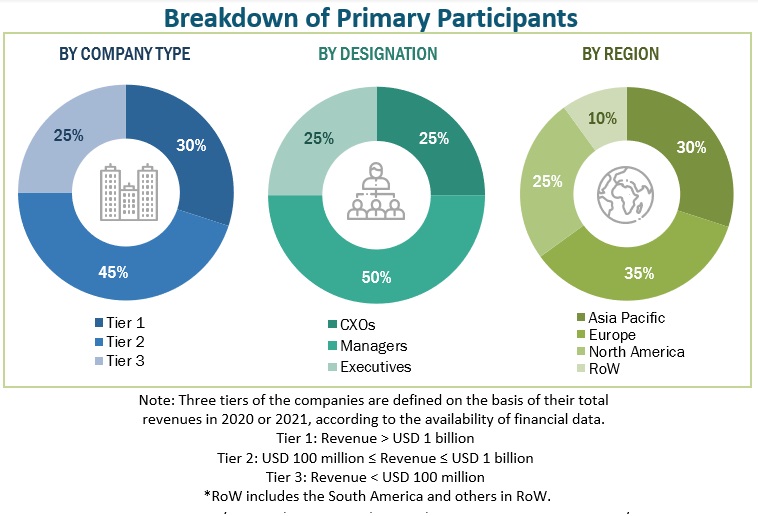

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the aquaculture products market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information and assess prospects. The following figure depicts the research design applied in drafting this report on the aquaculture market.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the aquaculture products market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- Both the top-down and bottom-up approaches were used to estimate and validate the total size of the aquaculture products market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The revenues of major aquaculture products-based food and feed manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- All macroeconomic and microeconomic factors affecting the growth of the aquaculture market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for aquaculture products on the basis of rearing product type, production type, species, culture, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the aquaculture products market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe region for aquaculture products market into Sweden, Ireland, Germany, and Switzerland.

- Further breakdown of the Asia Pacific region for aquaculture market into Australia & New Zealand, South Korea and Singapore.

- Further breakdown of other countries in the RoW market for aquaculture market into Middle East and Africa

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aquaculture Products Market

Interested in purchasing the report, but I have a doubt. Does it have data for shrimp in China

Interested in purchasing, would like to know which marine fish data is covered in the report