Application Integration Market by Offering (Platforms and Services), Integration Type, Application (Customer Relationship Management, Enterprise Resource Planning), Vertical (BFSI, Retail & eCommerce, Automotive) and Region - Global Forecast to 2028

Application Integration Market Summary

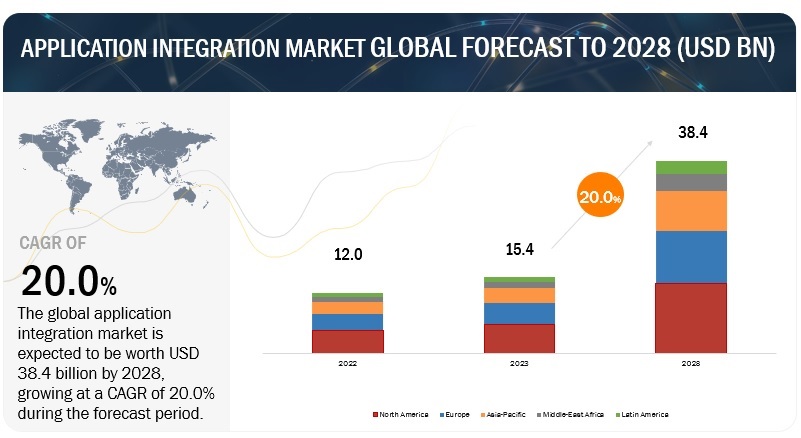

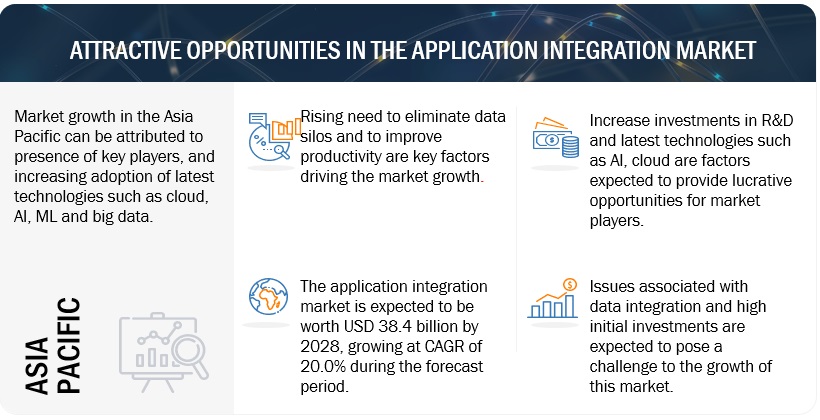

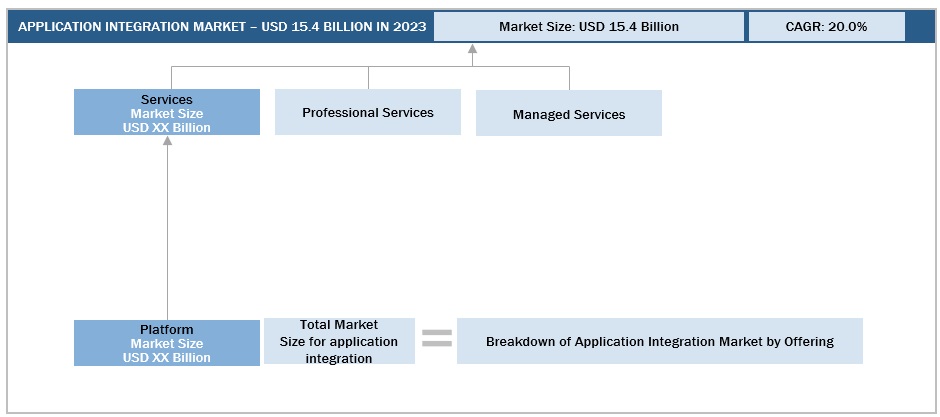

The global application integration market size was estimated at USD 15.4 billion in 2023 and is projected to reach USD 38.4 billion by 2028, growing at a CAGR of 20.0% from 2023 to 2028. Growing demand for B2B integration, improved productivity, and scalability is driving market growth, but the high initial investment is a hindrance to market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Application Integration Market Dynamics

Driver: Rising need to eliminate data silos and improve productivity

A data silo is a collection of information inaccessible to each part of a company's hierarchy. Data silos cause expensive and time-consuming problems for companies. And hence, they must be resolved. Enterprise application integration solutions cater to eliminating data silos and the costs associated with them and enable the productive use of data. To gain a competitive edge, enhance operational efficiencies, and generate new business opportunities simultaneously, cutting down on costs may motivate companies to achieve more with their data. To achieve this, access to enterprise-wide information is vital. This is expected to drive the market for application integration systems.

Restraint: High initial investment

Investments in enterprise applications are elevated right now. As businesses continue to make investments, gaps between their expanding array of applications are affecting their performance. Though, with application integration, their efficiency is increased, as the tools work together, the initial investments for application integration are high for the organizations, limiting the prospects of this market.

Opportunity: Growing demand for B2B integration

To integrate all the complex processes, such as the B2B and electronic data interchange (EDI) processes of an enterprise across their partner communities in a single gateway, a B2B integration platform is necessary. B2B integration software can be used for on-premises or integration services. It can be accessed through hosted cloud services. The Business-to-Business Middleware (B2B Integration) industry will increase at a substantial CAGR during the forecast interval.

Challenge: Data inaccessibility because of its widespread storage

In the case of most tech-savvy companies, some data is stored so that it remains inaccessible to those who could gain an advantage from it. One of the primary reasons for this problem is that cloud apps are not adequately connected and thus leave business data spread across the cloud. The other reason is that some data is stored on-premises in legacy databases or older apps. These factors are proving an obstacle to the growth of enterprises looking to increase their efficiency and boost revenue.

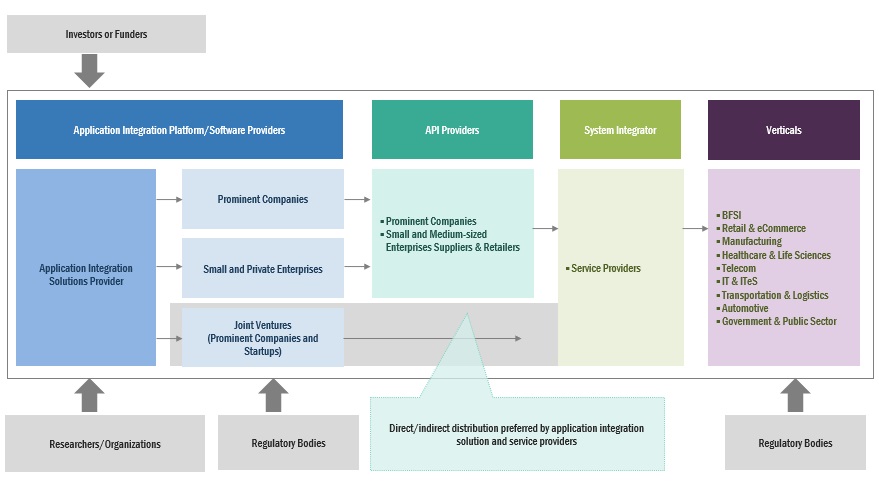

Application Integration Market Ecosystem

Leading companies in the application integration market include a definite provider of application integration solutions and services. These companies have been active in the market for several years and possess a varied product portfolio, innovative technologies, and strong global sales and marketing networks. Prominent companies in this market include Salesforce (US), Informatica (US), SAP (Germany), Oracle (US), SnapLogic (US), Software AG (Germany), IBM (US), Microsoft (US), TIBCO Software (US), Celigo (US), Boomi (US), Adeptia (US), WSO2 (US), DBSync (US), Flowgear (South Africa), InterSystems (US), SEEBURGER (Germany), Workato (US), Magic Software (Israel), OpenLegacy (US), Jitterbit (US), Elastic.io (Germany), Talend (US), Tray.io (US), Cyclr Systems (UK), APIFuse (US), and Zapier (US).

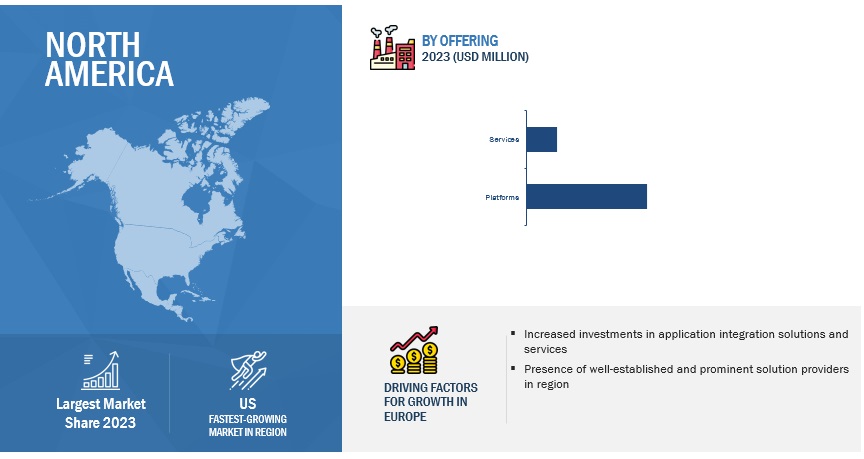

Services segment is expected to grow at a higher rate during the forecast period

Services in this market have been categorized into professional and managed services. Professional services are essential in the management of the entire lifecycle of solutions. Managed services, on the other hand, assess business networks, monitor the health of infrastructure, and perform remote maintenance activities. These services provide security and expert assurance, helping the entire business be more productive. Professional services are further segmented into consulting, integration, support, and maintenance.

Integration Platform as a Service (iPaaS) segment to account for the largest market share during the forecast period

iPaaS allows the building and deploying integrations between cloud and on-premises applications and data. It uses an API-led approach without requiring installing or managing any middleware or hardware. iPaaS includes capabilities such as Application Programming Interface (API) management, data transformation, data integration, and real-time monitoring and integration, offering simplicity, visibility, business agility, and governance with minimal cost and resource requirements. Enterprises and SMEs are moving toward adopting a cloud-based iPaaS solution to benefit from flexibility and robustness in internal business operations.

North America segment to account for the largest market share forecast period

North America is expected to account for the largest global application integration market share. The US contributes the maximum share in the market. Various factors driving the adoption of application integration in this region are the diversification of services delivered and the shift of focus from SaaS to cloud services for infrastructure and platforms. Also, with an increasing number of enterprises and prominent players in the region, the demand for the application integration market is increasing. These enterprises have to manage the increasing number of applications and hence need application integration solutions.

Key Market Players

The Application Integration market vendors have implemented various organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global market are Salesforce (US), Informatica (US), SAP (Germany), Oracle (US), SnapLogic (US), Software AG (Germany), IBM (US), Microsoft (US), TIBCO Software (US), Celigo (US), Boomi (US), Adeptia (US), WSO2 (US), DBSync (US), Flowgear (South Africa), InterSystems (US), SEEBURGER (Germany), Workato (US), Magic Software (Israel), OpenLegacy (US), Jitterbit (US), Elastic.io (Germany), Talend (US), Tray.io (US), Cyclr Systems (UK), APIFuse (US), and Zapier (US). The study includes an in-depth competitive analysis of these key players in the market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

Offering, Integration Type, Application, Vertical, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Salesforce (US), Informatica (US), SAP (Germany), Oracle (US), SnapLogic (US), Software AG (Germany), IBM (US), Microsoft (US), TIBCO Software (US), Celigo (US), Boomi (US), Adeptia (US), WSO2 (US), DBSync (US), Flowgear (South Africa), InterSystems (US), SEEBURGER (Germany), Workato (US), Magic Software (Israel), OpenLegacy (US), Jitterbit (US), Elastic.io (Germany), Talend (US), Tray.io (US), Cyclr Systems (UK), APIFuse (US), and Zapier (US) |

This research report categorizes the application integration market to forecast revenues and analyze trends in each of the following subsegments:

By Offering

- Platforms

-

Services

-

Professional Services

- Consulting

- Integration

- Support and Maintenance

- Managed Services

-

Professional Services

By Integration Type

- Point-To-Point Integration

- Enterprise Application Integration

- Enterprise Service Bus

- Integration Platform as a Service

- Hybrid Integration

By Application

- Customer Relationship Management

- Enterprise Resource Planning

- Human Resource Management System

- Supply Chain Management

- Business Intelligence

- Electronic Health Record Management

- Other Applications

By Vertical

- Banking, Financial Services, and Insurance

- Retail & eCommerce

- Manufacturing

- Healthcare & Life Sciences

- Energy & Utilities

- Automotive

- Transportation and Logistics

- Government & Public Sector

- Other Verticals

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Nordic Region

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Australia and New Zealand

- Southeast Asia

- Rest of Asia Pacific

-

Middle East & Africa

-

Middle East

- UAE

- KSA

- Rest of Middle East

- Africa

-

Middle East

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In March 2023, Oracle extended its collaboration with NVIDIA to allow the functioning of NVIDIA AI applications on the new Oracle Cloud Infrastructure (OCI) Supercluster.

- In September 2022, AWS and Salesforce announced the integration between the Salesforce platform and Amazon SageMaker to enable customers to use ML modeling services on the Salesforce platform.

- In December 2021, IBM announced a global relationship with Mulesoft to deliver increased integrations and solutions around the IBM Z product family to support financial services and other mutual customers.

Frequently Asked Questions (FAQ):

What is Application Integration?

The application integration market consists of pre-built solutions that help connect different applications in multiple configurations to ease data flow throughout the organization and use it beyond the application in which it originated.

Which countries are considered in Europe?

The report includes an analysis of the UK, France, Germany, Italy, Spain, and the Nordic region in Europe.

Which are the key drivers supporting the growth of the Application Integration market?

The key driver supporting the growth of the Application Integration market includes the rising need to eliminate data silos and improve productivity, the growing need for automation of mission-critical business processes, and the rising need to improve time-to-market and boost ROI.

Who are the key vendors in the Application Integration market?

The key vendors operating in the Application Integration market include Salesforce (US), Informatica (US), SAP (Germany), Oracle (US), SnapLogic (US), Software AG (Germany), IBM (US), Microsoft (US), TIBCO Software (US), Celigo (US), Boomi (US), Adeptia (US), WSO2 (US), DBSync (US), Flowgear (South Africa), InterSystems (US), SEEBURGER (Germany), Workato (US), Magic Software (Israel), OpenLegacy (US), Jitterbit (US), Elastic.io (Germany), Talend (US), Tray.io (US), Cyclr Systems (UK), APIFuse (US), and Zapier (US).

What are some of the technological advancements in the market?

Cloud computing is referred to as on-demand access through the internet to computing resources. The resources are applications, physical and virtual servers, data storage, networking capabilities, development tools, and more. These resources are hosted at a remote data center managed by a CSP. Organizations are promptly expanding their application and data footprint to multiple cloud deployments. AI and ML have gained significant focus and are being implemented in various verticals. ML enables users to dive deep into data and produce actionable insights. In data integration,0 ML is utilized for its capability to efficiently and quickly process big data. There is a lack of processing speed for handling large volumes of data with traditional data integration tools. ML can analyze the prominent data structure of all data formats to generate accurate data models and data pipelines with reduced human coding intervention.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising need to eliminate data silos and improve productivity- Growing demand for automation of mission-critical business processes- Rapid adoption of integration tools to boost ROIRESTRAINTS- Limited awareness regarding Enterprise Application Integration (EAI) within organizations- Need for high initial investmentsOPPORTUNITIES- Growth in B2B integrationCHALLENGES- Data inaccessibility due to widespread storage- Difficulty in integrating new application software with traditional IT infrastructure- Incompatibility between third-party integration and product interface

-

5.3 INDUSTRY TRENDSCASE STUDY ANALYSIS- Case study 1: Clal automated life and pension insurance process in Israel through API integration- Case study 2: Nextdoor integrated applications with Workato platform and automated processes- Case study 3: Major international investment banks implemented InterSystems IRIS data platform- Case study 4: Bayer deployed MuleSoft’s Anypoint platform to integrate Salesforce’ Sales and Service Cloud using API-led connectivity- Case study 5: Basecom used Celigo to reduce integration estimates and boost customer experiencePATENT ANALYSIS- Methodology- Document types- Innovation and patent applicationsPRICING ANALYSISPORTER’S FIVE FORCES ANALYSIS- Threat from new entrants- Threat from substitutes- Bargaining power of buyers- Bargaining power of suppliers- Intensity of competitive rivalryKEY STAKEHOLDERS AND BUYING CRITERIA- Key stakeholders in buying process- Buying criteriaTECHNOLOGY ANALYSIS- Adjacent technologies- Related technologiesKEY CONFERENCES & EVENTS, 2023–2024REGULATORY LANDSCAPE- REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSHISTORY OF APPLICATION INTEGRATION- 1990s- 2000s- 2010s- 2020sVALUE CHAIN ANALYSISECOSYSTEM ANALYSIS- Application integration platform/software providers- Application integration service providers- Application integration system integrators- Application integration end users/applicationsAPPLICATION INTEGRATION APPROACHES- API integration- Middleware integration- Database integration- Message-based integrationSTANDARD LEVELS OF APPLICATION INTEGRATION- Presentation-level integration- Business process integration- Data integration- Communication-level integrationBEST PRACTICES IN APPLICATION INTEGRATION- Deploying right integration plans- Using pre-built application connectors- Maintaining data qualityTRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

-

6.1 INTRODUCTIONOFFERINGS: MARKET DRIVERS

-

6.2 PLATFORMSGROWING NEED TO DEVELOP AND SECURE DATA INTEGRATION FLOWS

-

6.3 SERVICESPROFESSIONAL SERVICES- Consulting- Integration- Support and maintenanceMANAGED SERVICES- Increasing use of managed services to help businesses focus on mission-critical processes

-

7.1 INTRODUCTIONINTEGRATION TYPES: MARKET DRIVERS

-

7.2 POINT-TO-POINT INTEGRATIONPOINT-TO-POINT INTEGRATION ELIMINATES USE OF HUNDREDS OF APPS TO MANAGE LARGE VOLUMES OF DATA

-

7.3 ENTERPRISE APPLICATION INTEGRATION (EAI)ENTERPRISE APPLICATION INTEGRATION ENABLES IT COMPANIES AUTOMATE BUSINESS PROCESSES

-

7.4 ENTERPRISE SERVICE BUS (ESB)BUS-BASED EAI MODEL APPROACH SUITABLE FOR INTEGRATING ON-PREMISES APPLICATIONS

-

7.5 INTEGRATION PLATFORM AS A SERVICECLOUD-BASED IPAAS SOLUTIONS HELP ORGANIZATIONS ACHIEVE FLEXIBILITY AND ROBUSTNESS

-

7.6 HYBRID INTEGRATIONGROWING NEED FOR EASIER INTEGRATION OF DATA AND APPLICATIONS ACROSS ON-PREMISES AND MULTI-CLOUD SETTINGS

-

8.1 INTRODUCTIONAPPLICATIONS: MARKET DRIVERS

-

8.2 CUSTOMER RELATIONSHIP MANAGEMENT (CRM)CRM INTEGRATION TO LEAD TO HIGH PRODUCTIVITY AND EFFICIENCY

-

8.3 ENTERPRISE RESOURCE PLANNING (ERP)GROWING DEMAND FOR AUTOMATED BUSINESS PROCESSES TO DRIVE ADOPTION OF ERP SYSTEMS

-

8.4 HUMAN RESOURCE MANAGEMENT SYSTEM (HRMS)GROWING NEED TO ENHANCE EMPLOYEE EXPERIENCE TO LEAD TO ADOPTION OF HRM SYSTEMS

-

8.5 SUPPLY CHAIN MANAGEMENT (SCM)INCREASING NEED TO BOOST EFFICIENCY TO DRIVE ADOPTION OF SUPPLY CHAIN INTEGRATION SOLUTIONS

-

8.6 BUSINESS INTELLIGENCEDATA INTEGRATION OF BI TOOLS TO HELP DELIVER VALUABLE INSIGHTS

-

8.7 ELECTRONIC HEALTH RECORDS (EHR) MANAGEMENTNEED FOR SEAMLESS ACCESS TO MEDICAL RECORDS ACROSS SOFTWARE SOLUTIONS TO DRIVE ADOPTION OF EHRM SYSTEMS

- 8.8 OTHER APPLICATIONS

-

9.1 INTRODUCTIONVERTICALS: APPLICATION INTEGRATION MARKET DRIVERS

-

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)GROWING DEMAND FOR INTEGRATION SOLUTIONS TO BOOST CUSTOMER EXPERIENCEBFSI: APPLICATION INTEGRATION USE CASES- Payment processing- CRM- Fraud detection and prevention- Loan processing- Account and financial reporting

-

9.3 RETAIL & E-COMMERCEDATA INTEGRATION SOLUTIONS TO OPTIMIZE RETAIL PROCESSES AND STREAMLINE OPERATIONSRETAIL & E-COMMERCE: APPLICATION INTEGRATION USE CASES- Inventory management- Marketing automation- Shipping and logistics- Payment processing- Business intelligence

-

9.4 MANUFACTURINGRISING NEED TO AUTOMATE MANUFACTURING PROCESSES TO DRIVE USE OF INTEGRATION SOLUTIONSMANUFACTURING: APPLICATION INTEGRATION USE CASES- Enterprise resource planning (ERP)- Supply chain management (SCM)- Human resource management (HRM)- Anomaly detection

-

9.5 HEALTHCARE & LIFE SCIENCESDATA INTEGRATION SOFTWARE TO SIMPLIFY RETRIEVAL OF HEALTHCARE INFORMATIONHEALTHCARE & LIFE SCIENCES: APPLICATION INTEGRATION USE CASES- Electronic health records (EHRs)- Telehealth integration- Medical device integration- Clinical trial management

-

9.6 ENERGY & UTILITIESRELIANCE OF ENERGY AND UTILITY COMPANIES ON DATA INTEGRATION SOLUTIONS TO ACHIEVE HIGH GROWTHENERGY & UTILITIES: APPLICATION INTEGRATION USE CASES- Meter data management- Geographic information system (GIS) integration

-

9.7 AUTOMOTIVEGROWING DEMAND FOR USER-FRIENDLY SYSTEMS AND SOFTWARE TO BOOST GROWTH OF INTEGRATION SOLUTIONSAUTOMOTIVE: APPLICATION INTEGRATION USE CASES- Infotainment system integration- Smart device integration

-

9.8 TRANSPORTATION & LOGISTICSDATA INTEGRATION SOLUTIONS TO IMPROVE OPERATIONAL EFFICIENCY FOR TRANSPORTATION AND LOGISTICS COMPANIESTRANSPORTATION & LOGISTICS: APPLICATION INTEGRATION USE CASES- Warehouse management- Route optimization- Freight audit and payment

-

9.9 GOVERNMENT & PUBLIC SECTORRISING USE OF MOBILE AND WEB APPLICATIONS IN GOVERNMENT INSTITUTIONS TO DRIVE USE OF INTEGRATION SOLUTIONSGOVERNMENT & PUBLIC SECTOR: APPLICATION INTEGRATION USE CASES- Citizen engagement- Data integration- Emergency response

-

9.10 OTHER VERTICALSOTHER VERTICALS: APPLICATION INTEGRATION USE CASES- Social media integration- Learning management system integration

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Presence of major players contributing to growth of market in USCANADA- Presence of mega-vendors to prove lucrative for growth of application integration market

-

10.3 EUROPEEUROPE: MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Digital transformation initiatives by enterprises to support automation in businessesGERMANY- Growing adoption of AIoT and data analytics to boost digital transformationFRANCE- Increased spending by French government to boost adoption of application integrationITALY- Rising demand for various application integration approachesSPAIN- Boost in investments by Spanish government to create opportunities for marketNORDIC REGION- Partnerships between local and international cloud providers to drive adoption of application integrationREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Spread of IoT and big data to boost growth of application integrationINDIA- Rise in investments to fuel adoption of latest technologiesJAPAN- Rapid technological advancements and increased R&D activities to present opportunities for growth of application integration solutionsAUSTRALIA & NEW ZEALAND- Growing demand for technologies at affordable prices to drive adoption of application integration servicesSOUTHEAST ASIA- Increasing adoption of cloud services to boost market growthREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: APPLICATION INTEGRATION MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST- Increasing demand for digital transformation in changing network ecosystem to drive marketAFRICA- Gradual shift of African businesses toward cloud-based technologies to drive market

-

10.6 LATIN AMERICALATIN AMERICA: MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Growing adoption of IT solutions despite declining economic performance to drive market growthMEXICO- Increasing adoption of application integration solutions to protect critical customer data to drive market growthREST OF LATIN AMERICA

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

- 11.4 MARKET SHARE ANALYSIS OF KEY PLAYERS

- 11.5 COMPETITIVE BENCHMARKING

- 11.6 EVALUATION QUADRANT MATRIX METHODOLOGY FOR KEY PLAYERS

-

11.7 EVALUATION QUADRANT MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.8 EVALUATION QUADRANT MATRIX METHODOLOGY FOR STARTUPS/SMES

-

11.9 EVALUATION QUADRANT MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.10 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

12.1 MAJOR PLAYERSSALESFORCE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewORACLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINFORMATICA- Business overview- Products/Solutions/Services offered- Recent developmentsTIBCO SOFTWARE- Business overview- Products/Solutions/Services offered- Recent developmentsSOFTWARE AG- Business overview- Products/Solutions/Services offered- Recent developmentsTALEND- Business overview- Products/Solutions/Services offered- Recent developmentsSNAPLOGIC- Business overview- Products/Solutions/Services offered- Recent developmentsBOOMIINTERSYSTEMSSEEBURGERMAGIC SOFTWARECELONIS

-

12.2 STARTUPS/SMESCELIGOWSO2ZAPIERWORKATOJITTERBITOPENLEGACYELASTIC.IOTRAY.IODBSYNCCYCLR SYSTEMSFLOWGEARAPIFUSEADEPTIA

- 13.1 INTRODUCTION

-

13.2 DATA INTEGRATION MARKETMARKET DEFINITIONMARKET OVERVIEWDATA INTEGRATION MARKET, BY COMPONENTDATA INTEGRATION MARKET, BY BUSINESS APPLICATIONDATA INTEGRATION MARKET, BY DEPLOYMENT MODEDATA INTEGRATION MARKET, BY ORGANIZATION SIZEDATA INTEGRATION MARKET, BY VERTICALDATA INTEGRATION MARKET, BY REGION

-

13.3 INTEGRATION PLATFORM AS A SERVICE MARKETMARKET DEFINITIONMARKET OVERVIEWINTEGRATION PLATFORM AS A SERVICE MARKET, BY SERVICE TYPEINTEGRATION PLATFORM AS A SERVICE MARKET, BY DEPLOYMENT MODEINTEGRATION PLATFORM AS A SERVICE MARKET, BY ORGANIZATION SIZEINTEGRATION PLATFORM AS A SERVICE MARKET, BY VERTICALINTEGRATION PLATFORM AS A SERVICE MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATE, 2020–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 APPLICATION INTEGRATION MARKET AND GROWTH RATE, 2023–2028 (USD MILLION) (Y-O-Y GROWTH)

- TABLE 4 PATENTS FILED, 2020–2023

- TABLE 5 PATENTS GRANTED IN APPLICATION INTEGRATION MARKET, 2020–2023

- TABLE 6 PORTER’S FIVE FORCES MODEL

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 9 KEY CONFERENCES & EVENTS, 2023–2024

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ECOSYSTEM ANALYSIS

- TABLE 15 APPLICATION INTEGRATION MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 16 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 17 PLATFORMS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 18 PLATFORMS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 20 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 22 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 23 MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 24 MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 25 PROFESSIONAL SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 26 PROFESSIONAL SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 CONSULTING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 28 CONSULTING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 INTEGRATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 30 INTEGRATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 SUPPORT AND MAINTENANCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 32 SUPPORT AND MAINTENANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 MANAGED SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 34 MANAGED SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 MARKET, BY INTEGRATION TYPE, 2017–2022 (USD MILLION)

- TABLE 36 MARKET, BY INTEGRATION TYPE, 2023–2028 (USD MILLION)

- TABLE 37 POINT-TO-POINT INTEGRATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 38 POINT-TO-POINT INTEGRATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 ENTERPRISE APPLICATION INTEGRATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 40 ENTERPRISE APPLICATION INTEGRATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 ENTERPRISE SERVICE BUS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 42 ENTERPRISE SERVICE BUS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 INTEGRATION PLATFORM AS A SERVICE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 44 INTEGRATION PLATFORM AS A SERVICE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 HYBRID INTEGRATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 46 HYBRID INTEGRATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 48 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 49 CUSTOMER RELATIONSHIP MANAGEMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 50 CUSTOMER RELATIONSHIP MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 ENTERPRISE RESOURCE PLANNING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 52 ENTERPRISE RESOURCE PLANNING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 HUMAN RESOURCE MANAGEMENT SYSTEM: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 54 HUMAN RESOURCE MANAGEMENT SYSTEM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 SUPPLY CHAIN MANAGEMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 56 SUPPLY CHAIN MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 BUSINESS INTELLIGENCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 58 BUSINESS INTELLIGENCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 ELECTRONIC HEALTH RECORDS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 60 ELECTRONIC HEALTH RECORDS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 OTHER APPLICATIONS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 62 OTHER APPLICATIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 64 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 65 BFSI: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 66 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 RETAIL & E-COMMERCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 68 RETAIL & E-COMMERCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 MANUFACTURING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 70 MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 72 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 ENERGY & UTILITIES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 74 ENERGY & UTILITIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 AUTOMOTIVE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 76 AUTOMOTIVE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 78 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 GOVERNMENT & PUBLIC SECTOR: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 80 GOVERNMENT & PUBLIC SECTOR: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 OTHER VERTICALS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 82 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 84 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: APPLICATION INTEGRATION MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: MARKET, BY INTEGRATION TYPE, 2017–2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: MARKET, BY INTEGRATION TYPE, 2023–2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 98 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 99 US: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 100 US: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 101 US: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 102 US: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 103 US: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 104 US: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 105 US: MARKET, BY INTEGRATION TYPE, 2017–2022 (USD MILLION)

- TABLE 106 US: MARKET, BY INTEGRATION TYPE, 2023–2028 (USD MILLION)

- TABLE 107 US: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 108 US: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 109 US: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 110 US: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 111 EUROPE: APPLICATION INTEGRATION MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 112 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 113 EUROPE: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 114 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 115 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 116 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 117 EUROPE: MARKET, BY INTEGRATION TYPE, 2017–2022 (USD MILLION)

- TABLE 118 EUROPE: MARKET, BY INTEGRATION TYPE, 2023–2028 (USD MILLION)

- TABLE 119 EUROPE: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 120 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 121 EUROPE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 122 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 123 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 124 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 125 UK: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 126 UK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 127 UK: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 128 UK: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 129 UK: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 130 UK: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 131 UK: MARKET, BY INTEGRATION TYPE, 2017–2022 (USD MILLION)

- TABLE 132 UK: MARKET, BY INTEGRATION TYPE, 2023–2028 (USD MILLION)

- TABLE 133 UK: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 134 UK: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 135 UK: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 136 UK: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 137 GERMANY: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 138 GERMANY: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 139 GERMANY: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 140 GERMANY: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 141 GERMANY: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 142 GERMANY: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 143 GERMANY: MARKET, BY INTEGRATION TYPE, 2017–2022 (USD MILLION)

- TABLE 144 GERMANY: MARKET, BY INTEGRATION TYPE, 2023–2028 (USD MILLION)

- TABLE 145 GERMANY: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 146 GERMANY: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 147 GERMANY: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 148 GERMANY: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 149 ASIA PACIFIC: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 150 ASIA PACIFIC: APPLICATION INTEGRATION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 151 ASIA PACIFIC: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 152 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 153 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 154 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 155 ASIA PACIFIC: MARKET, BY INTEGRATION TYPE, 2017–2022 (USD MILLION)

- TABLE 156 ASIA PACIFIC: MARKET, BY INTEGRATION TYPE, 2023–2028 (USD MILLION)

- TABLE 157 ASIA PACIFIC: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 158 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 159 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 160 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 161 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 162 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 163 CHINA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 164 CHINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 165 CHINA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 166 CHINA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 167 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 168 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 169 CHINA: MARKET, BY INTEGRATION TYPE, 2017–2022 (USD MILLION)

- TABLE 170 CHINA: MARKET, BY INTEGRATION TYPE, 2023–2028 (USD MILLION)

- TABLE 171 CHINA: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 172 CHINA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 173 CHINA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 174 CHINA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 175 JAPAN: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 176 JAPAN: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 177 JAPAN: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 178 JAPAN: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 179 JAPAN: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 180 JAPAN: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 181 JAPAN: MARKET, BY INTEGRATION TYPE, 2017–2022 (USD MILLION)

- TABLE 182 JAPAN: MARKET, BY INTEGRATION TYPE, 2023–2028 (USD MILLION)

- TABLE 183 JAPAN: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 184 JAPAN: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 185 JAPAN: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 186 JAPAN: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 187 AUSTRALIA & NEW ZEALAND: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 188 AUSTRALIA & NEW ZEALAND: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 189 AUSTRALIA & NEW ZEALAND: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 190 AUSTRALIA & NEW ZEALAND: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 191 AUSTRALIA & NEW ZEALAND: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 192 AUSTRALIA & NEW ZEALAND: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 193 AUSTRALIA & NEW ZEALAND: MARKET, BY INTEGRATION TYPE, 2017–2022 (USD MILLION)

- TABLE 194 AUSTRALIA & NEW ZEALAND: MARKET, BY INTEGRATION TYPE, 2023–2028 (USD MILLION)

- TABLE 195 AUSTRALIA & NEW ZEALAND: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 196 AUSTRALIA & NEW ZEALAND: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 197 AUSTRALIA & NEW ZEALAND: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 198 AUSTRALIA & NEW ZEALAND: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: APPLICATION INTEGRATION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: MARKET, BY INTEGRATION TYPE, 2017–2022 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: MARKET, BY INTEGRATION TYPE, 2023–2028 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 213 MIDDLE EAST: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 214 MIDDLE EAST: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 215 KSA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 216 KSA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 217 KSA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 218 KSA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 219 KSA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION

- TABLE 220 KSA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 221 KSA: MARKET, BY INTEGRATION TYPE, 2017–2022 (USD MILLION)

- TABLE 222 KSA: MARKET, BY INTEGRATION TYPE, 2023–2028 (USD MILLION)

- TABLE 223 KSA: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 224 KSA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 225 KSA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 226 KSA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 227 AFRICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 228 AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 229 AFRICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 230 AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 231 AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 232 AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 233 AFRICA: MARKET, BY INTEGRATION TYPE, 2017–2022 (USD MILLION)

- TABLE 234 AFRICA: MARKET, BY INTEGRATION TYPE, 2023–2028 (USD MILLION)

- TABLE 235 AFRICA: ARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 236 AFRICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 237 AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 238 AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 239 LATIN AMERICA: APPLICATION INTEGRATION MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 240 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 241 LATIN AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 242 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 243 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 244 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 245 LATIN AMERICA: MARKET, BY INTEGRATION TYPE, 2017–2022 (USD MILLION)

- TABLE 246 LATIN AMERICA: MARKET, BY INTEGRATION TYPE, 2023–2028 (USD MILLION)

- TABLE 247 LATIN AMERICA: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 248 LATIN AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 249 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 250 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 251 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 252 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 253 BRAZIL: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 254 BRAZIL: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 255 BRAZIL: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 256 BRAZIL: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 257 BRAZIL: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 258 BRAZIL: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 259 BRAZIL: MARKET, BY INTEGRATION TYPE, 2017–2022 (USD MILLION)

- TABLE 260 BRAZIL: MARKET, BY INTEGRATION TYPE, 2023–2028 (USD MILLION)

- TABLE 261 BRAZIL: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 262 BRAZIL: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 263 BRAZIL: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 264 BRAZIL: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 265 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 266 APPLICATION INTEGRATION MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 267 DETAILED LIST OF STARTUPS/SMES

- TABLE 268 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES

- TABLE 269 COMPETITIVE BENCHMARKING FOR KEY PLAYERS

- TABLE 270 PRODUCT LAUNCHES, 2021–2023

- TABLE 271 DEALS, 2021–2023

- TABLE 272 OTHERS, 2021

- TABLE 273 SALESFORCE: BUSINESS OVERVIEW

- TABLE 274 SALESFORCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 276 SALESFORCE: DEALS

- TABLE 277 IBM: BUSINESS OVERVIEW

- TABLE 278 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 280 IBM: DEALS

- TABLE 281 ORACLE: BUSINESS OVERVIEW

- TABLE 282 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 ORACLE: DEALS

- TABLE 284 MICROSOFT: BUSINESS OVERVIEW

- TABLE 285 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 286 MICROSOFT: DEALS

- TABLE 287 SAP: BUSINESS OVERVIEW

- TABLE 288 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 SAP: DEALS

- TABLE 290 INFORMATICA: BUSINESS OVERVIEW

- TABLE 291 INFORMATICA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 INFORMATICA: DEALS

- TABLE 293 TIBCO SOFTWARE: BUSINESS OVERVIEW

- TABLE 294 TIBCO SOFTWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 295 TIBCO SOFTWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 296 SOFTWARE AG: BUSINESS OVERVIEW

- TABLE 297 SOFTWARE AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 298 SOFTWARE AG: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 299 TALEND: BUSINESS OVERVIEW

- TABLE 300 TALEND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 TALEND: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 302 TALEND: DEALS

- TABLE 303 SNAPLOGIC: BUSINESS OVERVIEW

- TABLE 304 SNAPLOGIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 SNAPLOGIC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 306 SNAPLOGIC: DEALS

- TABLE 307 SNAPLOGIC: OTHERS

- TABLE 308 DATA INTEGRATION MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

- TABLE 309 DATA INTEGRATION MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

- TABLE 310 DATA INTEGRATION MARKET, BY BUSINESS APPLICATION, 2015–2020 (USD MILLION)

- TABLE 311 DATA INTEGRATION MARKET, BY BUSINESS APPLICATION, 2021–2026 (USD MILLION)

- TABLE 312 DATA INTEGRATION MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

- TABLE 313 DATA INTEGRATION MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

- TABLE 314 DATA INTEGRATION MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

- TABLE 315 DATA INTEGRATION MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

- TABLE 316 DATA INTEGRATION MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

- TABLE 317 DATA INTEGRATION MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

- TABLE 318 DATA INTEGRATION MARKET, BY REGION, 2015–2020 (USD MILLION)

- TABLE 319 DATA INTEGRATION MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 320 INTEGRATION PLATFORM AS A SERVICE MARKET, BY SERVICE TYPE, 2016–2020 (USD MILLION)

- TABLE 321 INTEGRATION PLATFORM AS A SERVICE MARKET, BY SERVICE TYPE, 2021–2026 (USD MILLION)

- TABLE 322 INTEGRATION PLATFORM AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

- TABLE 323 INTEGRATION PLATFORM AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

- TABLE 324 INTEGRATION PLATFORM AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

- TABLE 325 INTEGRATION PLATFORM AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

- TABLE 326 INTEGRATION PLATFORM AS A SERVICE MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

- TABLE 327 INTEGRATION PLATFORM AS A SERVICE MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

- TABLE 328 INTEGRATION PLATFORM AS A SERVICE MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 329 INTEGRATION PLATFORM AS A SERVICE MARKET, BY REGION, 2021–2026 (USD MILLION)

- FIGURE 1 APPLICATION INTEGRATION MARKET: RESEARCH DESIGN

- FIGURE 2 APPROACHES USED FOR MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 1): SUPPLY-SIDE ANALYSIS OF REVENUE FROM PLATFORMS AND SERVICES

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 1), BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF APPLICATION INTEGRATION VENDORS

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 APPLICATION INTEGRATION MARKET TO WITNESS DIP IN Y-O-Y IN 2022

- FIGURE 10 APPLICATION INTEGRATION MARKET, BY REGION, 2023

- FIGURE 11 GROWING ADOPTION OF ERP, CRM, AND SCM SYSTEMS TO DRIVE GROWTH OF APPLICATION INTEGRATION MARKET DURING FORECAST PERIOD

- FIGURE 12 PLATFORMS SEGMENT TO LEAD MARKET IN 2023

- FIGURE 13 MANAGED SERVICES SEGMENT TO ACHIEVE HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 14 INTEGRATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 HYBRID INTEGRATION SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 16 BFSI SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 CUSTOMER RELATIONSHIP MANAGEMENT AND BFSI SEGMENTS TO ACCOUNT FOR SIGNIFICANT MARKET SHARE IN 2023

- FIGURE 18 APPLICATION INTEGRATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 NUMBER OF PATENTS GRANTED ANNUALLY, 2020–2023

- FIGURE 20 TOP TEN PATENT APPLICANTS WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2020–2023

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 23 HISTORY OF APPLICATION INTEGRATION

- FIGURE 24 VALUE CHAIN ANALYSIS

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS IN APPLICATION INTEGRATION MARKET

- FIGURE 26 SERVICES SEGMENT TO GROW AT HIGHER CAGR BY 2028

- FIGURE 27 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 28 CONSULTING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 HYBRID INTEGRATION SEGMENT TO GROW AT HIGHER CAGR BY 2028

- FIGURE 30 BUSINESS INTELLIGENCE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 31 GOVERNMENT & PUBLIC SECTOR SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 32 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 34 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 35 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 36 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS, 2023

- FIGURE 37 EVALUATION QUADRANT MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 38 EVALUATION QUADRANT MATRIX FOR STARTUPS/SMES, 2023

- FIGURE 39 SALESFORCE: COMPANY SNAPSHOT

- FIGURE 40 IBM: COMPANY SNAPSHOT

- FIGURE 41 ORACLE: COMPANY SNAPSHOT

- FIGURE 42 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 43 SAP: COMPANY SNAPSHOT

- FIGURE 44 INFORMATICA: COMPANY SNAPSHOT

- FIGURE 45 SOFTWARE AG: COMPANY SNAPSHOT

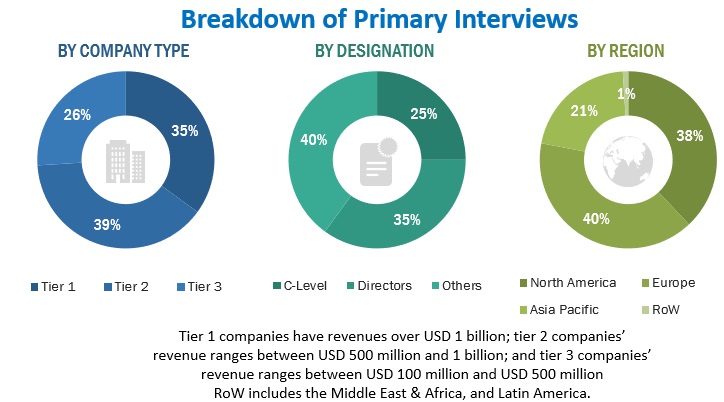

The application integration market study involved using secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva. Other market-related sources, such as journals and white papers from industry associations, were also considered while conducting the secondary research. Primary sources were mainly industry experts from core and related industries, preferred system developers, service providers, System Integrators (SIs), resellers, partners, and organizations related to the various segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents to obtain and verify critical qualitative and quantitative information and assess the market’s prospects. These respondents included key industry participants, subject matter experts, C-level executives of key market players, and industry consultants.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals, such as the Institute of Electrical and Electronics Engineers (IEEE), ScienceDirect, ResearchGate, Academic Journals, Scientific.Net, various telecom and application integration associations/forums, and 3GPP, were also referred. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both markets and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the application integration market. The primary sources from the demand side included application integration end users, network administrators/consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations.

After the complete market engineering process (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the market's competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, both top-down and bottom-up approaches and several data triangulation methods were used to perform the market estimation and forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

|

Company Name |

Designation |

|

IBM |

Media Relations |

|

Oracle Corporation |

Director, Analyst Relations |

|

SAP SE |

Head of Analyst Relations |

|

Software AG |

Senior Vice President Corporate Communications |

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the market size of the application integration market. The first approach involves the estimation of market size by summing up the revenue generated by companies through the sale of application integration components, such as platforms and services.

Application Integration Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Application Integration Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the application integration market was divided into several segments and subsegments. A data triangulation procedure was used wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

The application integration market consists of pre-built solutions that help connect different applications in multiple configurations to ease data flow throughout the organization and use it beyond the application in which it originated.

According to TIBCO Software, application integration refers to making the applications communicate with each other by exchanging data and invoking services they offer. Application integration is fundamentally needed for digital transformation strategy because businesses can operate in new and innovative ways when the applications are integrated and communicate with one another.

Key Stakeholders

- Network Infrastructure Enablers

- Technology Vendors

- Mobile Network Operators (MNOs)

- Independent Software Vendors (ISVs)

- System Integrators (SIs)

- Resellers

- Value-added Resellers (VARs)

- Managed Service Providers (MSPs)

- Compliance Regulatory Authorities

- Government Authorities

- Investment Firms

- Cloud Service Providers

- Application Integration Alliances/Groups

- Original Design Manufacturers (ODMs)

- Original Equipment Manufacturers (OEMs)

- Enterprises/Businesses

Report Objectives

- To determine, segment, and forecast the global application integration market by offering, integration type, application, vertical, and region in terms of value

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

- To strategically analyze macro and micro-markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze industry trends, pricing data, and patents and innovations related to the market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the application integration market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers and acquisitions, new product launches and developments, partnerships, agreements, collaborations, business expansions, and Research and Development (R&D) activities

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Further breakdown of the South Korean application integration market

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Application Integration Market