Application Delivery Controller Market by Type (Hardware-based, Virtual), Service (Integration and Implementation; Training, Support, and Maintenance), Organization Size (SME, Large Enterprise), Vertical and Region - Global Forecast to 2028

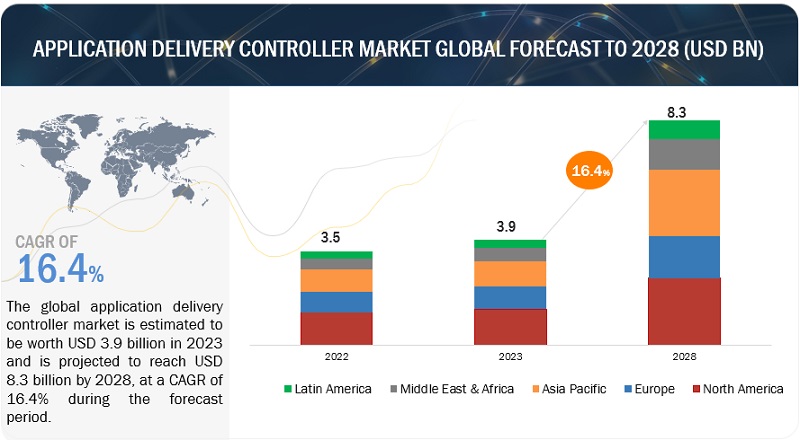

The global Application Delivery Controller Market size was valued at $3.9 billion in 2023 and is anticipated to reach over $8.3 billion in 2028, with a robust CAGR of 16.4% during the forecast period. The base year for estimation is 2022, with data available for the years 2017 to 2028.

The application delivery controller market is being propelled by a convergence of transformative factors reshaping the digital landscape. The surge in cloud adoption and the proliferation of modern application architectures, including microservices and containers, demand efficient application delivery solutions. The escalating expectations of users for seamless, secure, and high-performance experiences drive the need for ADCs that optimize traffic distribution and ensure responsive applications. The rising complexity of cyber threats necessitates ADCs with integrated security features like Web Application Firewalls to safeguard applications. In a world marked by remote work trends and the expansion of IoT technologies, ADCs play a pivotal role in facilitating smooth, reliable, and secure application interactions. As organizations navigate these shifts, the Application Delivery Controller market evolves, driven by the pursuit of enhanced performance, security, and user satisfaction in a rapidly advancing digital era.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Application Delivery Controller Market Growth Dynamics

Driver: Demand for seamless application performance and security propels the ADC market

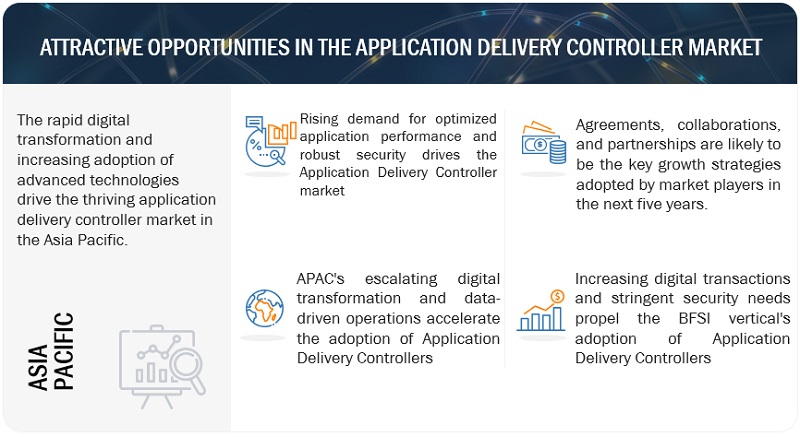

The increasing adoption of cloud-native architectures, rising demand for seamless application performance, and the need for robust security mechanisms are key drivers. As digital transformation accelerates, ADCs play a critical role in optimizing application delivery, enhancing user experiences, and safeguarding sensitive data. Additionally, the surge in remote work and the growing complexity of cyber threats underscore the significance of ADCs in ensuring reliable and secure application interactions. This dynamic landscape fuels the growth of the ADC market, shaping a future where efficient, secure, and responsive application delivery remains paramount.

Restraint: Economic constraints may hinder the widespread adoption of advanced Application Delivery Controller solutions

While the demand for optimal application performance and security remains high, budget limitations can hinder the adoption of advanced ADC solutions. The costs associated with acquiring, implementing, and maintaining these technologies can pose challenges for businesses, particularly smaller enterprises. Economic uncertainties, budget allocation complexities, and the need to balance various IT priorities can delay or limit the adoption of ADC solutions.

Opportunity: ADCs seize opportunities in digital transformation, IoT traffic management, and fortified application security

The increasing emphasis on digital transformation and cloud migration presents a ripe opportunity for ADC solutions to optimize application delivery in these evolving environments. As the Internet of Things (IoT) gains momentum, ADCs can capitalize on managing the diverse data traffic generated by interconnected devices. Moreover, the growing awareness of cybersecurity threats highlights the demand for ADCs with integrated security features like Web Application Firewalls to fortify applications against vulnerabilities. As businesses explore new avenues for expansion and innovation, ADCs stand ready to address challenges in application performance, security, and scalability, positioning themselves as pivotal enablers for enhanced user experiences in an interconnected digital ecosystem.

Challenge: Modern ADCs grapple with challenges of diverse application complexity, evolving cyber threats, and seamless integration with DevOps workflows

The complexity of modern applications, including microservices and hybrid cloud deployments, poses a challenge for ADCs to efficiently manage and optimize diverse traffic patterns. As cyber threats become more sophisticated, the need for robust security measures integrated within ADC solutions, such as Web Application Firewalls (WAFs), is paramount. Moreover, the rapid pace of technology advancements necessitates ADC solutions that can seamlessly integrate with DevOps processes to ensure continuous delivery. Balancing performance, security, and scalability while meeting the unique requirements of various industries also presents challenges. As organizations navigate these hurdles, the evolution of ADC solutions is crucial to address these complex challenges and deliver streamlined application experiences in a fast-paced digital environment.

Application Delivery Controller Market Ecosystem

The major players in the application delivery controller market are F5 Networks, Citrix Systems, A10 Networks, Fortinet, Radware, and so on. The application delivery controller market is driven by prominent companies that have established themselves as leaders in the industry. These companies are well-established, financially stable, and have a proven track record of providing innovative solutions and services in application delivery controller. Their diverse product portfolio spans infrastructure, solutions, applications, and services, enabling them to cater to the market’s evolving needs. With state-of-the-art technologies and extensive capabilities, these companies are at the forefront of driving the advancement of application delivery controller technology.

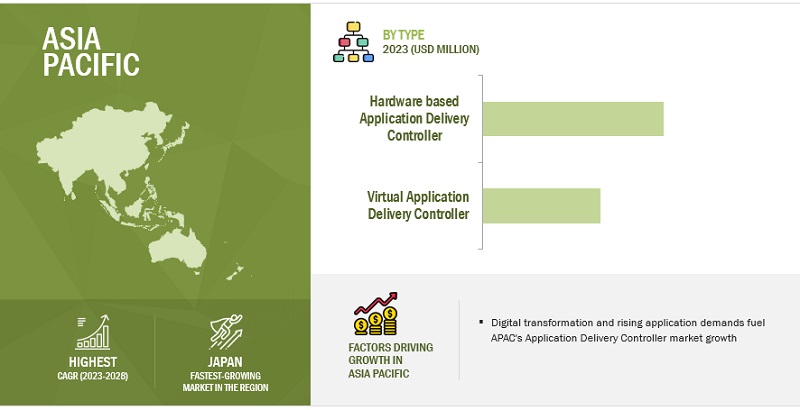

By type, the virtual application delivery controller has a higher CAGR in the application delivery controller market during the forecast period.

The virtual application delivery controller segment is poised to witness robust growth with a higher Compound Annual Growth Rate during the forecast period. This growth trajectory can be attributed to several factors driving the preference for virtual solutions. As organizations increasingly embrace cloud-native and hybrid environments, the flexibility and agility offered by virtual ADCs become highly advantageous. Virtual ADCs enable businesses to dynamically scale resources based on demand, making them well-suited for the evolving requirements of modern applications. The ease of deployment and cost-effectiveness associated with virtual solutions resonates with organizations seeking efficient ways to enhance their application delivery capabilities. The virtual application delivery controller's ability to seamlessly integrate with cloud platforms and accommodate evolving technology trends positions it as a pivotal solution for organizations striving to optimize application performance and security. As digital landscapes continue to evolve, the virtual ADC segment is positioned to leverage these advantages, driving its accelerated growth and influencing the overall trajectory of the application delivery controller market.

The BFSI vertical to hold a larger market size during the forecast period.

As the BFSI industry undergoes rapid digital transformation, the demand for seamless, secure, and high-performance application delivery is paramount. ADCs play a pivotal role in optimizing customer-facing applications such as online banking platforms and mobile apps, ensuring consistent performance even during peak usage. The robust security features offered by ADCs, including Web Application Firewalls (WAFs) and SSL offloading, align with the industry's stringent data protection and compliance requirements. The BFSI sector's increasing reliance on digital channels, fintech innovations, and data-driven analytics further amplifies the need for efficient and reliable application delivery. As the BFSI vertical continues to embrace technological advancements, ADCs play an instrumental role in supporting its digital evolution, enabling enhanced user experiences and ensuring the highest standards of security and performance.

Asia Pacific to grow at a higher CAGR during the forecast period.

As Asia Pacific experiences a surge in digital transformation and technology adoption, the demand for seamless application delivery and enhanced user experiences is on the rise. The region's burgeoning e-commerce sector, increasing mobile connectivity, and expanding digital services are contributing to the need for efficient ADC solutions that optimize performance and security. The dynamic growth of cloud computing, IoT technologies, and the shift towards hybrid and multi-cloud environments further accentuate the significance of ADCs in managing diverse data traffic and ensuring responsive application delivery. With organizations across Asia Pacific seeking to stay competitive in the digital age, ADCs provide the means to meet customer expectations while navigating the complexities of modern application landscapes. The Asia Pacific region is poised for accelerated ADC adoption, underscoring its pivotal role in driving market growth and technological advancement.

Key Market Players:

The major application delivery controller companies in this market are F5 Networks (US), Citrix Systems (US), A10 Networks (US), Fortinet (US), Radware (Israel), Barracuda Networks (US), Total Uptime (US), Array Networks(US), Kemp Technologies (US), Cloudflare (US), Broadcom Communication (US), Riverbed (Germany), Evanssion (UAE), NFWare (US), and Snapt (US).

Scope of the Report:

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

By type, service, organization size, and vertical |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

F5 Networks (US), Citrix Systems (US), A10 Networks (US), Fortinet (US), Radware (Israel), Barracuda Networks (US), Total Uptime (US), Array Networks(US), Kemp Technologies (US), Cloudflare (US), Broadcom Communication (US), Riverbed (Germany), Evanssion (UAE), NFWare (US), and Snapt (US) |

This research report categorizes the Application Delivery Controller Market to forecast revenues and analyze trends in each of the following submarkets:

Application Delivery Controller Market By Type:

- Hardware-based application delivery controller

- Virtual application delivery controller

Application Delivery Controller Industry By Service :

- Implementation and Integration

- Training, support, and maintenance

Application Delivery Controller Market By Organization Size:

- Large enterprises

- Small and Medium-sized Enterprises (SMEs)

Application Delivery Controller Industry By Vertical:

- BFSI

- IT and telecom

- Government and public sector

- Healthcare and life sciences

- Manufacturing

- Retail and consumer goods

- Energy and utilities

- Media and entertainment

- Others (education, travel, and hospitality)

Application Delivery Controller Market By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- Australia and New Zealand (ANZ)

- Japan

- China

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

-

MEA

- Kingdom of Saudi Arabia (KSA)

- South Africa

- United Arab Emirates (UAE)

- Rest of MEA

Recent Developments in Application Delivery Controller Market

- April 2023 - To provide security and resilience for hybrid cloud environments, A10 Networks unveiled a combined solution that combines the Thunder Application Delivery Controller (ADC) and the brand-new A10 Next-Generation Web Application Firewall (WAF).

- November 2021 - TD SYNNEX collaborated with Qualys, which enables TD SYNNEX resellers to have access to Qualys' cloud-based security and compliance solutions. It improves threat detection, lowers business compliance costs, and streamlines security operations. Qualys' presence is strengthened through this alliance and widens its access to the network of TD SYNNEX's partners.

- April 2021 - With Citrix's cloud-based digital workplace products, such as Citrix Virtual Apps and Citrix ADC, OneMain built flexible and hybrid work styles and acquired the agility to address continuously changing business requirements.

- March 2021 - In order to provide thorough protection on a single platform across all environments, Radware has announced that it has integrated extra application security into its Alteon series of Application Delivery Controllers (ADCs). A Web Application Firewall (WAF) to defend against web-based assaults, a Bot Manager to stop harmful automated threats, and Application Programming Interface (API) security to safeguard APIs and give full visibility on API-targeted threats are all included in Alteon's new Integrated Application security.

Frequently Asked Questions (FAQ):

What is an Application Delivery Controller (ADC)?

An application delivery controller is a specialized networking device or software solution that optimizes the delivery of web applications and services to end-users. It acts as an intermediary between clients (such as users' web browsers) and application servers, managing and distributing application traffic, ensuring efficient load balancing, enhancing security, and optimizing overall application performance. ADCs provide functionalities like traffic management, content compression, SSL offloading, caching, and application-level security features such as Web Application Firewalls (WAFs). By intelligently distributing and managing incoming traffic across multiple servers, ADCs enhance the availability, scalability, and reliability of applications, resulting in improved user experiences and streamlined IT operations.

What is the market size of the application delivery controller market?

The global application delivery controller market is estimated to be worth USD 3.9 billion in 2023 and is projected to reach USD 8.3 billion by 2028, at a CAGR of 16.4% during the forecast period.

What are the major drivers in the application delivery controller market?

The rapid pace of digital transformation, the proliferation of cloud-native architectures, and the growing complexity of modern applications are all driving the Application Delivery Controller (ADC) market. Organizations are seeking solutions that can ensure seamless application performance, optimize traffic distribution, and bolster security measures to meet the demands of a highly interconnected and dynamic digital landscape. Additionally, as remote work and online transactions become increasingly integral to business operations, ADCs play a crucial role in providing reliable and secure application experiences. These technological advancements and changing user behaviors are propelling the ADC market forward as organizations recognize the need for efficient, agile, and robust solutions to navigate the complexities of modern application delivery.

Who are the major players operating in the application delivery controller market?

The major players in the application delivery controller market are F5 Networks (US), Citrix Systems (US), A10 Networks (US), Fortinet (US), Radware (Israel), Barracuda Networks (US), Total Uptime (US), Array Networks(US), Kemp Technologies (US), Cloudflare (US), Broadcom Communication (US), Riverbed (Germany), Evanssion (UAE), NFWare (US), and Snapt (US).

Which key technology trends prevail in the application delivery controller market?

The rapid adoption of cloud-native architectures and the emergence of multi-cloud strategies are driving the need for ADC solutions that seamlessly handle application delivery across diverse cloud environments. The prevalence of microservices and containerization is challenging ADCs to dynamically manage traffic patterns within agile and distributed architectures. Security integration remains a critical trend, prompting ADCs to incorporate advanced security features such as Web Application Firewalls (WAFs) to safeguard against evolving cyber threats. ADCs are also aligning with DevOps practices, leveraging automation and APIs to integrate smoothly into continuous delivery pipelines. The rise of artificial intelligence and machine learning is enabling ADCs to optimize application performance by predicting and adapting to fluctuating traffic patterns. As edge computing gains traction, ADCs play a pivotal role in optimizing content delivery and reducing latency. These trends collectively underscore the evolving role of ADCs in ensuring seamless, secure, and high-performance application delivery in an increasingly interconnected digital landscape.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rapid digital transformation- Increase in internet trafficRESTRAINTS- Limited bandwidth and lack of access to high-speed internetOPPORTUNITIES- Rise in adoption of AI, IoT, and software-defined technologies- Greater involvement expected between value-added resellers and application delivery controller vendorsCHALLENGES- Compatibility issues with existing network infrastructure

-

5.3 INDUSTRY TRENDSVALUE CHAIN ANALYSISECOSYSTEM ANALYSISPORTER’S FIVE FORCES ANALYSIS- Threat of new entrants- Threat of substitutes- Bargaining power of suppliers- Bargaining power of buyers- Intensity of competitive rivalryTECHNOLOGY ANALYSIS- Adjacent technologies- Related technologiesTRENDS/DISRUPTIONS IMPACTING CUSTOMERS/BUYERS- Cloud adoption- Application security- Hybrid environments- Microservices and containers- AI and automationPATENT ANALYSIS- MethodologyAVERAGE SELLING PRICE ANALYSIS- Feature set- Performance and scalability- Market competition- Deployment model- Customer segmentation- Support and maintenance- Geographical variations- Pricing modelsCASE STUDY ANALYSIS- NetRefer’s IT team chose Incapsula Web Application Firewall to tackle security issues and boost performance- Fastly’s Edge Cloud Platform enabled Ticketmaster to support varied delivery and security needs of business units- Divio deployed Cloudflare’s Zero Trust Network Access solution to streamline manual access configuration process- Sky Italia adopted Akamai’s Aspera to optimize content management workflow and improve storage upload rate- Amazon CloudFront helped King deliver its game content to global users- Gaijin Entertainment adopted Lumen Technologies’ solutions to enhance network scalability and reliabilityKEY CONFERENCES & EVENTSKEY STAKEHOLDERS AND BUYING CRITERIA- Key stakeholders in buying process- Buying criteriaREGULATORY LANDSCAPE- Regulatory bodies, government agencies, and other organizations

-

6.1 INTRODUCTIONTYPES: MARKET DRIVERS

-

6.2 HARDWARE-BASED APPLICATION DELIVERY CONTROLLERFOCUS ON REDUCING COMPLEXITIES OF INFRASTRUCTURE MANAGEMENT TO DRIVE MARKET

-

6.3 VIRTUAL APPLICATION DELIVERY CONTROLLERREAL-TIME SCALABILITY OF VIRTUAL APPLICATION DELIVERY CONTROLLERS TO BOOST DEMAND

-

7.1 INTRODUCTIONSERVICES: MARKET DRIVERS

-

7.2 INTEGRATION & IMPLEMENTATIONGROWING NEED TO LEVERAGE EXISTING WORKFLOWS TO ENABLE ORGANIZATIONS TO ADOPT APPLICATION DELIVERY CONTROLLER SOLUTIONS

-

7.3 TRAINING, SUPPORT, AND MAINTENANCERISING EMPHASIS ON UNDERSTANDING MARKET TRENDS, CHANGING BUSINESS CONDITIONS, AND CLIENT INSIGHTS TO PROPEL GROWTH

-

8.1 INTRODUCTIONORGANIZATION SIZE: MARKET DRIVERS

-

8.2 SMESLIMITED BUDGET AND NEED FOR BETTER METHODS TO RESOLVE COMPLEXITIES TO DRIVE ADOPTION OF APPLICATION DELIVERY CONTROLLERS

-

8.3 LARGE ENTERPRISESDEMAND FOR FLEXIBLE, SCALABLE, AND CONVENIENT SERVICES FROM LARGE ENTERPRISES TO ENCOURAGE MARKET EXPANSION

-

9.1 INTRODUCTIONVERTICALS: MARKET DRIVERS

-

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)RISING NEED FOR DEVELOPMENT AND REFORMS TO FUEL ADOPTION OF APPLICATION DELIVERY CONTROLLERS IN BFSI VERTICAL

-

9.3 IT & TELECOMNEED FOR UNDISRUPTED CONNECTIVITY IN IT & TELECOM VERTICAL TO DRIVE DEMAND FOR APPLICATION DELIVERY CONTROLLER SOLUTIONS

-

9.4 GOVERNMENT & PUBLIC SECTORGROWING CYBER THREATS AND NEED TO ENSURE HIGH AVAILABILITY OF CRITICAL INFRASTRUCTURE TO FUEL DEMAND

-

9.5 RETAIL & CONSUMER GOODSNEED FOR CUSTOMERS TO EXPERIENCE HASSLE-FREE ONLINE SHOPPING TO BOOST MARKET

-

9.6 MANUFACTURINGFOCUS ON ENSURING DATA VISIBILITY AND SECURITY TO ENCOURAGE ADOPTION OF APPLICATION DELIVERY CONTROLLERS

-

9.7 ENERGY & UTILITIESGROWING NEED TO REDUCE LOAD ON POWER AND STREAMLINE IT INFRASTRUCTURE TO PROPEL DEMAND

-

9.8 MEDIA & ENTERTAINMENTDEMAND FOR SECURE AND RELIABLE VIDEO CONTENT TO DRIVE USE OF APPLICATION DELIVERY CONTROLLERS

-

9.9 HEALTHCARE & LIFE SCIENCESGROWING NEED TO REDUCE DOWNTIME AND SECURE PATIENT DATA TO BOOST MARKET EXPANSION

- 9.10 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: APPLICATION DELIVERY CONTROLLER MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Growing reliance on cloud services and need for seamless remote work experiences to drive marketCANADA- Adoption of cloud-based applications and emphasis on cybersecurity to boost market growth

-

10.3 EUROPEEUROPE: MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Growing need for scalable and secure application delivery and regulatory compliance to fuel demandGERMANY- Pursuit of operational efficiency, stringent data privacy adherence, and reliable application delivery solutions to spur growthFRANCE- Integration of digital technologies across diverse sectors, coupled with stringent data protection compliance requirements, to drive demandREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTAUSTRALIA & NEW ZEALAND- Rapid adoption of cloud-native applications, coupled with strong focus on cybersecurity, to boost growthCHINA- Swift adoption of cloud-native applications to propel market growthJAPAN- Rising demand for scalable, secure application delivery solutions to drive growthREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTUAE- Rapid growth in e-commerce, coupled with regulatory focus on data protection, to spur market expansionSOUTH AFRICA- Quest for efficient, secure application delivery solutions to fuel growthKSA- Rapid expansion of digital services combined with commitment to data protection solutions to propel growthREST OF MIDDLE EAST & AFRICA

-

10.6 LATIN AMERICALATIN AMERICA: MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Rapid expansion of digital services to drive marketMEXICO- Growth of digital economy to spur demand for application delivery controllersREST OF LATIN AMERICA

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS FOR KEY PLAYERS

- 11.4 HISTORICAL REVENUE ANALYSIS

-

11.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

11.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

11.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

12.1 KEY PLAYERSF5 NETWORKS- Business overview- Solutions/Services offered- Recent developments- MnM viewCITRIX SYSTEMS- Business overview- Solutions/Services offered- Recent developments- MnM viewA10 NETWORKS- Business overview- Solutions/Services offered- Recent developments- MnM viewFORTINET- Business overview- Products/Services offered- Recent developments- MnM viewRADWARE- Business overview- Products/Services offered- Recent developments- MnM viewCLOUDFLARE- Business overview- Products/Services offered- Recent developments- MnM viewWEBSCALE- Business overview- Products/Services offered- Recent developments- MnM viewARRAY NETWORKS- Business overview- Products/Services offered- Recent developments- MnM viewKEMP TECHNOLOGIES- Business overview- Products/Services offered- Recent developments- MnM viewBROADCOM- Business overview- Products/Services offered- Recent developments- MnM view

-

12.2 STARTUPS/SMESBARRACUDA NETWORKSTOTAL UPTIME TECHNOLOGIESEVANSSIONNFWARESNAPT

- 13.1 INTRODUCTION

-

13.2 NETWORK MANAGEMENT SYSTEM MARKETMARKET DEFINITIONNETWORK MANAGEMENT SYSTEM MARKET, BY COMPONENTNETWORK MANAGEMENT SYSTEM MARKET, BY SOLUTIONNETWORK MANAGEMENT SYSTEM MARKET, BY SERVICENETWORK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPENETWORK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZENETWORK MANAGEMENT SYSTEM MARKET, BY END USERNETWORK MANAGEMENT SYSTEM MARKET, BY VERTICALNETWORK MANAGEMENT SYSTEM MARKET, BY REGION

-

13.3 WAN OPTIMIZATION MARKETMARKET DEFINITIONWAN OPTIMIZATION MARKET, BY COMPONENTWAN OPTIMIZATION MARKET, BY END USER- Small & medium-sized enterprises- Large enterprisesWAN OPTIMIZATION MARKET, BY VERTICAL- Banking, financial services, and insurance- Healthcare- Information technology and telecom- Manufacturing- Retail- Media & entertainment- Energy- EducationWAN OPTIMIZATION MARKET, BY REGION- Europe

-

13.4 SOFTWARE-DEFINED PERIMETER MARKETMARKET DEFINITIONSOFTWARE-DEFINED PERIMETER MARKET, BY CONNECTIVITY- Controller- Gateway- End pointSOFTWARE-DEFINED PERIMETER MARKET, BY DEPLOYMENT MODE- On-premises- CloudSOFTWARE-DEFINED PERIMETER MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2020–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 4 IMPACT OF PORTER’S FIVE FORCES ON MARKET

- TABLE 5 DETAILED LIST OF CONFERENCES & EVENTS, 2023–2024

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 12 MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 13 HARDWARE-BASED MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 14 HARDWARE-BASED MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 15 VIRTUAL MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 16 VIRTUAL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 17 MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 18 APPLICATION DELIVERY CONTROLLER MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 19 SMES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 20 SMES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 LARGE ENTERPRISES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 22 LARGE ENTERPRISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 24 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 25 BFSI: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 26 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 IT & TELECOM: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 28 IT & TELECOM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 GOVERNMENT & PUBLIC SECTOR: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 30 GOVERNMENT & PUBLIC SECTOR: APPLICATION DELIVERY CONTROLLER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 32 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 MANUFACTURING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 34 MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 ENERGY & UTILITIES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 36 ENERGY & UTILITIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 38 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 40 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 OTHER VERTICALS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 42 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 APPLICATION DELIVERY CONTROLLER MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 44 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 46 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 48 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 50 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 52 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 53 US: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 54 US: APPLICATION DELIVERY CONTROLLER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 55 US: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 56 US: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 57 US: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 58 US: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 59 CANADA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 60 CANADA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 61 CANADA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 62 CANADA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 63 CANADA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 64 CANADA: APPLICATION DELIVERY CONTROLLER MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 65 EUROPE: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 66 EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 67 EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 68 EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 69 EUROPE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 70 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 71 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 72 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 73 UK: APPLICATION DELIVERY CONTROLLER MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 74 UK: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 75 UK: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 76 UK: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 77 UK: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 78 UK: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 79 GERMANY: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 80 GERMANY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 81 GERMANY: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 82 GERMANY: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 83 GERMANY: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 84 GERMANY: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 85 FRANCE: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 86 FRANCE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 87 FRANCE: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 88 FRANCE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 89 FRANCE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 90 FRANCE: APPLICATION DELIVERY CONTROLLER MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 92 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 99 AUSTRALIA & NEW ZEALAND: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 100 AUSTRALIA & NEW ZEALAND: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 101 AUSTRALIA & NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 102 AUSTRALIA & NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 103 AUSTRALIA & NEW ZEALAND: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 104 AUSTRALIA & NEW ZEALAND: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 105 CHINA: APPLICATION DELIVERY CONTROLLER MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 106 CHINA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 107 CHINA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 108 CHINA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 109 CHINA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 110 CHINA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 111 JAPAN: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 112 JAPAN: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 113 JAPAN: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 114 JAPAN: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 115 JAPAN: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 116 JAPAN: APPLICATION DELIVERY CONTROLLER MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 125 UAE: APPLICATION DELIVERY CONTROLLER MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 126 UAE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 127 UAE: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 128 UAE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 129 UAE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 130 UAE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 131 SOUTH AFRICA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 132 SOUTH AFRICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 133 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 134 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 135 SOUTH AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 136 SOUTH AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 137 KSA: APPLICATION DELIVERY CONTROLLER MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 138 KSA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 139 KSA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 140 KSA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 141 KSA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 142 KSA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 143 LATIN AMERICA: APPLICATION DELIVERY CONTROLLER MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 144 LATIN AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 145 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 146 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 147 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 148 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 149 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 150 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 151 BRAZIL: APPLICATION DELIVERY CONTROLLER MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 152 BRAZIL: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 153 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 154 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 155 BRAZIL: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 156 BRAZIL: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 157 MEXICO: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 158 MEXICO: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 159 MEXICO: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 160 MEXICO: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 161 MEXICO: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 162 MEXICO: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 163 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 164 APPLICATION DELIVERY CONTROLLER MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 165 OVERALL COMPANY FOOTPRINT

- TABLE 166 COMPETITIVE BENCHMARKING

- TABLE 167 PRODUCT LAUNCHES, 2018–2022

- TABLE 168 DEALS, 2016–2021

- TABLE 169 F5 NETWORKS: BUSINESS OVERVIEW

- TABLE 170 F5 NETWORKS: SOLUTIONS/SERVICES OFFERED

- TABLE 171 F5 NETWORKS: PRODUCT LAUNCHES

- TABLE 172 F5 NETWORKS: DEALS

- TABLE 173 CITRIX SYSTEMS: BUSINESS OVERVIEW

- TABLE 174 CITRIX SYSTEMS: SOLUTIONS/SERVICES OFFERED

- TABLE 175 CITRIX SYSTEMS: PRODUCT LAUNCHES

- TABLE 176 CITRIX SYSTEMS: DEALS

- TABLE 177 A10 NETWORKS: BUSINESS OVERVIEW

- TABLE 178 A10 NETWORKS: SOLUTIONS/SERVICES OFFERED

- TABLE 179 A10 NETWORKS: DEALS

- TABLE 180 FORTINET: BUSINESS OVERVIEW

- TABLE 181 FORTINET: PRODUCTS/SERVICES OFFERED

- TABLE 182 FORTINET: PRODUCT LAUNCHES

- TABLE 183 FORTINET: DEALS

- TABLE 184 RADWARE: BUSINESS OVERVIEW

- TABLE 185 RADWARE: PRODUCTS/SERVICES OFFERED

- TABLE 186 RADWARE: DEALS

- TABLE 187 CLOUDFLARE: BUSINESS OVERVIEW

- TABLE 188 CLOUDFLARE: PRODUCTS/SERVICES OFFERED

- TABLE 189 CLOUDFLARE: DEALS

- TABLE 190 WEBSCALE: BUSINESS OVERVIEW

- TABLE 191 WEBSCALE: PRODUCTS/SERVICES OFFERED

- TABLE 192 WEBSCALE: DEALS

- TABLE 193 ARRAY NETWORKS: BUSINESS OVERVIEW

- TABLE 194 ARRAY NETWORKS: PRODUCTS/SERVICES OFFERED

- TABLE 195 ARRAY NETWORKS: PRODUCT LAUNCHES

- TABLE 196 KEMP TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 197 KEMP TECHNOLOGIES: PRODUCTS/SERVICES OFFERED

- TABLE 198 KEMP TECHNOLOGIES: DEALS

- TABLE 199 BROADCOM: BUSINESS OVERVIEW

- TABLE 200 BROADCOM: PRODUCTS/SERVICES OFFERED

- TABLE 201 BROADCOM: DEALS

- TABLE 202 NETWORK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 203 NETWORK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 204 NETWORK MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

- TABLE 205 NETWORK MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 206 NETWORK MANAGEMENT SYSTEM MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 207 NETWORK MANAGEMENT SYSTEM MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 208 NETWORK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD MILLION)

- TABLE 209 NETWORK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 210 NETWORK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 211 NETWORK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 212 NETWORK MANAGEMENT SYSTEM MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 213 NETWORK MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 214 NETWORK MANAGEMENT SYSTEM MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 215 NETWORK MANAGEMENT SYSTEM MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 216 NETWORK MANAGEMENT SYSTEM MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 217 NETWORK MANAGEMENT SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 218 WAN OPTIMIZATION MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

- TABLE 219 SMALL & MEDIUM-SIZED ENTERPRISES: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 220 LARGE ENTERPRISES: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 221 BANKING, FINANCIAL SERVICES, AND INSURANCE: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 222 HEALTHCARE: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 223 INFORMATION TECHNOLOGY AND TELECOM: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 224 MANUFACTURING: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 225 RETAIL: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 226 MEDIA & ENTERTAINMENT: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 227 ENERGY: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 228 EDUCATION: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 229 EUROPE: WAN OPTIMIZATION MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

- TABLE 230 EUROPE: WAN OPTIMIZATION MARKET, BY SOLUTION, 2018–2025 (USD MILLION)

- TABLE 231 EUROPE: WAN OPTIMIZATION MARKET, BY SERVICE, 2018–2025 (USD MILLION)

- TABLE 232 EUROPE: WAN OPTIMIZATION MARKET, BY END USER, 2018–2025 (USD MILLION)

- TABLE 233 EUROPE: WAN OPTIMIZATION MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

- TABLE 234 EUROPE: WAN OPTIMIZATION MARKET, BY VERTICAL, 2018–2025 (USD MILLION)

- TABLE 235 EUROPE: WAN OPTIMIZATION MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

- TABLE 236 SOFTWARE-DEFINED PERIMETER MARKET, BY CONNECTIVITY, 2017–2024 (USD MILLION)

- TABLE 237 CONTROLLER: SOFTWARE-DEFINED PERIMETER MARKET, BY REGION, 2017–2024 (USD MILLION)

- TABLE 238 GATEWAY: SOFTWARE-DEFINED PERIMETER MARKET, BY REGION, 2017–2024 (USD MILLION)

- TABLE 239 END POINT: SOFTWARE-DEFINED PERIMETER MARKET, BY REGION, 2017–2024 (USD MILLION)

- TABLE 240 SOFTWARE-DEFINED PERIMETER MARKET, BY DEPLOYMENT MODE, 2017–2024 (USD MILLION)

- TABLE 241 ON-PREMISES: SOFTWARE-DEFINED PERIMETER MARKET, BY REGION, 2017–2024 (USD MILLION)

- TABLE 242 NORTH AMERICA: ON-PREMISES MARKET, BY COUNTRY, 2017–2024 (USD MILLION)

- TABLE 243 CLOUD: SOFTWARE-DEFINED PERIMETER MARKET, BY REGION, 2017–2024 (USD MILLION)

- TABLE 244 NORTH AMERICA: SOFTWARE-DEFINED PERIMETER MARKET, BY COMPONENT, 2017–2024 (USD MILLION)

- TABLE 245 NORTH AMERICA: SOFTWARE-DEFINED PERIMETER MARKET, BY SOLUTION, 2017–2024 (USD MILLION)

- TABLE 246 NORTH AMERICA: SOFTWARE-DEFINED PERIMETER MARKET, BY SERVICE, 2017–2024 (USD MILLION)

- TABLE 247 NORTH AMERICA: SOFTWARE-DEFINED PERIMETER MARKET, BY CONNECTIVITY, 2017–2024 (USD MILLION)

- TABLE 248 NORTH AMERICA: SOFTWARE-DEFINED PERIMETER MARKET, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

- TABLE 249 NORTH AMERICA: SOFTWARE-DEFINED PERIMETER MARKET, BY DEPLOYMENT MODE, 2017–2024 (USD MILLION)

- TABLE 250 NORTH AMERICA: SOFTWARE-DEFINED PERIMETER MARKET, BY USER TYPE, 2017–2024 (USD THOUSAND)

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 MARKET: BOTTOM-UP AND TOP-DOWN APPROACHES

- FIGURE 3 RECESSION IMPACT ANALYSIS, 2018–2028

- FIGURE 4 APPLICATION DELIVERY CONTROLLER MARKET, 2021–2028 (USD MILLION)

- FIGURE 5 MARKET: MAJOR SUBSEGMENTS

- FIGURE 6 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 7 RAPID DIGITAL TRANSFORMATION TO DRIVE DEMAND FOR AND ADOPTION OF APPLICATION DELIVERY CONTROLLERS

- FIGURE 8 BFSI SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 9 HARDWARE-BASED APPLICATION DELIVERY CONTROLLER SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2023

- FIGURE 10 AREAS OF PROFITABLE INVESTMENTS IN TERMS OF MARKET SIZE AND GROWTH

- FIGURE 11 APPLICATION DELIVERY CONTROLLER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 12 VALUE CHAIN ANALYSIS

- FIGURE 13 PORTER’S FIVE FORCES MODEL

- FIGURE 14 TOTAL NUMBER OF PATENTS GRANTED, 2018–2022

- FIGURE 15 TOP 10 PATENT APPLICANTS, 2018–2022

- FIGURE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 17 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 18 VIRTUAL APPLICATION DELIVERY CONTROLLER SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 19 SMES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 20 RETAIL & CONSUMER GOODS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 23 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 24 HISTORICAL REVENUE ANALYSIS, 2020–2022

- FIGURE 25 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023

- FIGURE 26 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2023

- FIGURE 27 F5 NETWORKS: COMPANY SNAPSHOT

- FIGURE 28 CITRIX SYSTEMS: COMPANY SNAPSHOT

- FIGURE 29 A10 NETWORKS: COMPANY SNAPSHOT

- FIGURE 30 FORTINET: COMPANY SNAPSHOT

- FIGURE 31 RADWARE: COMPANY SNAPSHOT

- FIGURE 32 CLOUDFLARE: COMPANY SNAPSHOT

- FIGURE 33 BROADCOM: COMPANY SNAPSHOT

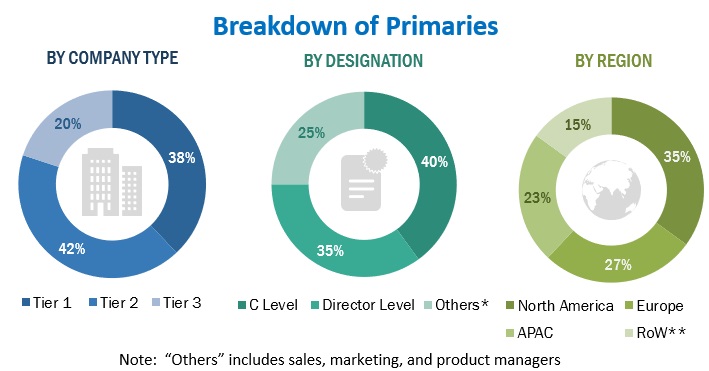

The research study involved four major activities in estimating the application delivery controller market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for the study. These included journals, annual reports, press releases, investor presentations of companies and white papers, certified publications, and articles from recognized associations and government publishing sources. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the application delivery controller market. The primary sources from the demand side included consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the application delivery controller market. The first approach involved estimating the market size by summating companies’ revenue generated through application delivery controller solutions.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the application delivery controller market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology-top-down approach

Data Triangulation

The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

An application delivery controller is a specialized networking device or software solution that optimizes the delivery of web applications and services to end-users. It acts as an intermediary between clients (such as users' web browsers) and application servers, managing and distributing application traffic, ensuring efficient load balancing, enhancing security, and optimizing overall application performance. ADCs provide functionalities like traffic management, content compression, SSL offloading, caching, and application-level security features such as Web Application Firewalls. By intelligently distributing and managing incoming traffic across multiple servers, ADCs enhance the availability, scalability, and reliability of applications, resulting in improved user experiences and streamlined IT operations.

Key Stakeholders

- Application delivery controller vendors

- Managed service providers

- System integrators

- Consulting service providers

- Resellers and distributors

- Research organizations

- Enterprise users

- Technology providers

- Venture capitalists, private equity firms, and startup companies

The main objectives of this study are as follows:

- To define, describe, and forecast the application delivery controller market based on segments based on type, service, organization size, and vertical with regions covered.

- To forecast the size of the market segments with respect to five regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To provide detailed information on the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the global market.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the global application delivery controller market.

- To profile the key market players, such as top and emerging vendors; provide a comparative analysis based on their business overviews, product offerings, and business strategies; and illustrate the market’s competitive landscape.

- To track and analyze competitive developments in the market, such as new product launches, product enhancements, partnerships, acquisitions, and agreements and collaborations.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Application Delivery Controller Market

Exhaustive coverage on the topic.

What is the future of software application delivery and open source application delivery?