Application Control Market by Component (Solution, Services), Access Point (Desktops/ Laptops, Mobiles/Tablets, Servers), Organization Size (SMES, Large Enterprises), Vertical, Region - Global Forecast to 2020

[152 Pages Report] The application control market size is estimated to grow from USD 1.25 Billion in 2015 to USD 1.90 Billion by 2020, at a Compound Annual Growth Rate (CAGR) of 8.7% from 2015 to 2020.

Application control is a security practice to restrict the unauthorized and unwanted applications from executing on endpoints to guard the organizations endpoint environment. The report aims at estimating the market size and future growth potential of the application control market across different segments, such as components, access points, organization size, verticals, and regions. The base year considered for the study is 2014 and the forecast period is 2015 to 2020. The rise in the adoption of the Bring Your Own Device (BYOD) trend and the usage of mobile devices to access organizational data and applications are propelling the market to grow in the next five years.

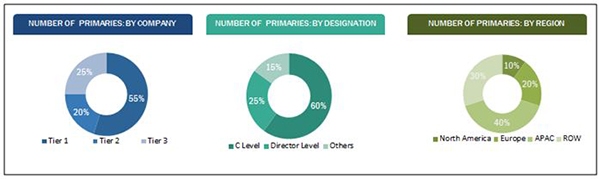

The research methodology used to estimate and forecast the application control market begins with capturing data on key vendor revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global application control market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and sub-segments, which were then verified through primary research by conducting extensive interviews with key people, such as CEOs, VPs, Directors, and executives. This data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary is depicted in the below figure:

The application control ecosystem comprises security solution and service providers such as Symantec Corporation, Intel Security, Trend Micro, Check Point Software Technologies Ltd., CyberArk, Carbon Black, AppSense, Digital Guardian, and others; system integrators such as CSC and HP, and various consulting firms such as Accenture, Deloitte, and Ernst & Young who sell these application control solutions to end users to cater to their unique business requirements and security needs.

Key target audience

- Cybersecurity vendors

- IT security providers

- Managed security service providers

- Reseller and distributors

- Consulting firms

- System integrators

Scope of the Report

The research report segments the application control market to following submarkets:

By Component:

- Solution

- Services

- Managed Services

- Professional Services

By Access Points:

- Desktops/Laptops

- Servers

- Mobiles/Tablets

- Others

By Organization size:

- Small and Medium Enterprises

- Large Enterprises

By Vertical:

- Government & Defense

- Banking, Financial Services, and Insurance (BFSI)

- IT & Telecom

- Healthcare

- Retail

- Oil & Gas

- Others

By Region:

- North America

- Europe

- Asia-Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America market

- Further breakdown of the Europe market

- Further breakdown of the APAC market

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets forecasts the application control market size to grow from USD 1.25 Billion in 2015 to USD 1.90 Billion by 2020, at a Compound Annual Growth Rate (CAGR) of 8.7% from 2015 to 2020. The major factors driving the growth of the market are the need to protect data against internal and external threats and the limitations of traditional security solutions to secure applications and data running on corporate endpoints. Furthermore, due to a rise in the demand for integrated security solutions, the market finds huge opportunity to proliferate in the next five years.

The scope of this report covers the application control market by component, access point, organization size, vertical, and region. The application control solution market is expected to hold the largest market share and is projected to dominate the application control market from 2015 to 2020, due to the growing need for multi-layered and integrated security solutions. Application control services segment is expected to play a key role in changing the security landscape and grow at the highest growth rate during the forecast period, as these services assist organizations in implementing, integrating, and monitoring the application control environment through established industry-best practices.

Application control for desktops/laptops access points would dominate the market and is expected to contribute the largest market share, whereas application control for mobiles/tablets access points would grow at the highest rate during the forecast period. Large enterprises in the application control market are expected to contribute the largest market share and would also grow at the highest rate during the forecast period.

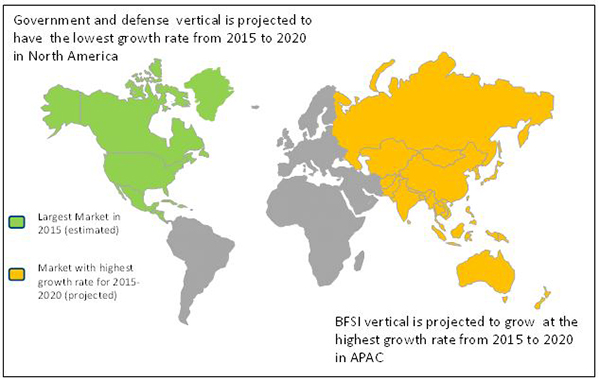

The application control solutions are being increasingly adopted in various verticals, such as government and defense; Banking, Financial Services, and Insurance (BFSI); and healthcare, which have led to the growth of the market across the globe. The BFSI vertical is expected to grow at the highest rate from 2015 to 2020, in the application control market. The market is also projected to witness growth in the healthcare, retail, and IT & telecom verticals during the forecast period.

North America is expected to hold the largest market share and dominate the application control market from 2015 to 2020, due to the presence of a large number of security vendors. Asia-Pacific (APAC) offers potential growth opportunities, due to a rise in the Bring Your Own Device (BYOD) trend in small and medium enterprises and large enterprises, which has led to a rise in the usage of portable devices and safeguarding of those endpoints against potential targeted threats.

The impact on end user experience and shadow IT risks are restraining the growth of the market. The major vendors in the application control market include Symantec Corporation, Intel Security (McAfee), Trend Micro Inc., CyberArk, Check Point Software Technologies Ltd., Carbon Black Inc., Digital Guardian, and AppSense, among others. These players adopted various key strategies such as new product developments, product innovations, mergers and acquisitions, partnerships, collaborations, and business expansion to cater to the needs of the market.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Market Opportunities in the Global Application Control Market

4.2 Application Control Market, By Component

4.3 Application Control Global Market

4.4 Lifecycle Analysis, By Region 2015

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 By Component

5.3.2 By Access Point

5.3.3 By Organization Size

5.3.4 By Vertical

5.3.5 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Need to Protect Data Against Threats

5.4.1.2 Enforcement of Application Usage and Data Security Policies

5.4.1.3 Limitation of Traditional Security Solutions

5.4.2 Restraints

5.4.2.1 Impact on End User Experience

5.4.2.2 Shadow It Risks

5.4.3 Opportunities

5.4.3.1 Rise in Demand for Integrated Security Solutions

5.4.3.2 Increase in Adoption of Byod Trend Among Organizations

5.4.4 Challenges

5.4.4.1 Educating End Users About Advanced and Targeted Threats

5.5 Regulatory Implications

5.6 Innovation Spotlight

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Strategic Benchmarking

6.3.1 Strategic Benchmarking: Technology Integration and Product Enhancement

6.4 Demand Overview

7 Application Control Market Analysis, By Component (Page No. - 51)

7.1 Introduction

7.2 Solutions

7.3 Services

7.3.1 Professional Services

7.3.2 Managed Services

8 Market Analysis, By Access Point (Page No. - 59)

8.1 Introduction

8.2 Desktops/Laptops

8.3 Servers

8.4 Mobiles/Tablets

8.5 Others

9 Market Analysis, By Organization Size (Page No. - 65)

9.1 Introduction

9.2 Small and Medium Enterprises

9.3 Large Enterprises

10 Application Control Market Analysis, By Vertical (Page No. - 69)

10.1 Introduction

10.2 Government and Defense

10.3 BFSI

10.4 IT and Telecom

10.5 Healthcare

10.6 Retail

10.7 Oil and Gas

10.8 Others

11 Geographic Analysis (Page No. - 85)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia-Pacific (APAC)

11.5 Middle East and Africa (MEA)

11.6 Latin America

12 Competitive Landscape (Page No. - 105)

12.1 Overview

12.2 Competitive Situation and Trends

12.2.1 New Product Launches

12.2.2 Mergers and Acquisitions

12.2.3 Partnerships, Agreements and Collaborations

12.2.4 Business Expansions

13 Company Profiles (Page No. - 112)

13.1 Introduction

13.2 Symantec Corporation

13.2.1 Business Overview

13.2.2 Products and Services Offered

13.2.3 Recent Developments

13.2.4 MnM View

13.2.4.1 Key Strategies

13.2.4.2 SWOT Analysis

13.3 Intel Security (Mcafee)

13.3.1 Business Overview

13.3.2 Products and Services Offered

13.3.3 Recent Developments

13.3.4 MnM View

13.3.4.1 Key Strategies

13.3.4.2 SWOT Analysis

13.4 Trend Micro, Inc.

13.4.1 Business Overview

13.4.2 Products and Services Offered

13.4.3 Recent Developments

13.4.4 MnM View

13.4.4.1 Key Strategies

13.4.4.2 SWOT Analysis

13.5 Cyberark Software Ltd. (Viewfinity)

13.5.1 Business Overview

13.5.2 Products and Services Offered

13.5.3 Recent Developments

13.5.4 MnM View

13.5.4.1 Key Strategies

13.5.4.2 SWOT Analysis

13.6 Check Point Software Technologies Ltd.

13.6.1 Business Overview

13.6.2 Products and Services Offered

13.6.3 Recent Developments

13.6.4 MnM View

13.6.4.1 Key Strategies

13.6.4.2 SWOT Analysis

13.7 Appsense

13.7.1 Business Overview

13.7.2 Products and Services Offered

13.7.3 Recent Developments

13.8 Digital Guardian

13.8.1 Business Overview

13.8.2 Products and Services Offered

13.8.3 Recent Developments

13.9 Carbon Black, Inc. (Bit9 + Carbon Black)

13.9.1 Business Overview

13.9.2 Products and Services Offered

13.9.3 Recent Developments

13.10 Heat Software (Lumension Security)

13.10.1 Business Overview

13.10.2 Products and Services Offered

13.10.3 Recent Developments

13.11 Arellia

13.11.1 Business Overview

13.11.2 Products and Services Offered

13.11.3 Recent Developments

14 Appendix (Page No. - 143)

14.1 Other Develpoments

14.1.1 Other Develpoments: New Product Launches

14.1.2 Other Develpoments: Mergers and Acquisitions

14.1.3 Other Develpoments: Partnerships, Agreements and Collaborations

14.2 Industry Experts

14.3 Discussion Guide

14.4 Introduction RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

List of Tables (76 Tables)

Table 1 Application Control Market Size and Growth, 20132020 (USD Million, Y-O-Y %)

Table 2 Application Control Market Size, By Component, 20132020 (USD Million)

Table 3 Drivers: Impact Analysis

Table 4 Restraints: Impact Analysis

Table 5 Opportunities: Impact Analysis

Table 6 Challenges: Impact Analysis

Table 7 Innovation Spotlight: Latest Application Control Innovations

Table 8 Application Control Market Size, By Component, 20132020 (USD Million)

Table 9 Solutions: Market Size, By Region, 20132020 (USD Million)

Table 10 Application Control Market Size, By Service, 20132020 (USD Million)

Table 11 Services: Market Size, By Region, 20132020 (USD Million)

Table 12 Professional Services: Market Size, By Region, 20132020 (USD Million)

Table 13 Managed Services: Market Size, By Region, 20132020 (USD Million)

Table 14 Application Control Market Size, By Access Point, 20132020 (USD Million)

Table 15 Desktops/Laptops: Market Size, By Region, 20132020 (USD Million)

Table 16 Servers: Market Size, By Region, 20132020 (USD Million)

Table 17 Mobiles/Tablets: Market Size, By Region, 20132020 (USD Million)

Table 18 Others: Application Control Market Size, By Region, 20132020 (USD Million)

Table 19 Application Control Market Size, By Organization Size, 20132020 (USD Million)

Table 20 Small and Medium Enterprises: Market Size, By Region, 20132020 (USD Million)

Table 21 Large Enterprises: Market Size, By Region, 20132020 (USD Million)

Table 22 Application Control Market Size, By Vertical, 20132020 (USD Million)

Table 23 Government and Defense: Market Size, By Region, 20132020 (USD Million)

Table 24 Government and Defense: Market Size, By Component, 20132020 (USD Million)

Table 25 Government and Defense: Market Size, By Service, 20132020 (USD Million)

Table 26 BFSI: Market Size, By Region, 20132020 (USD Million)

Table 27 BFSI: Market Size, By Component, 20132020 (USD Million)

Table 28 BFSI: Market Size, By Service, 20132020 (USD Million)

Table 29 IT and Telecom: Market Size, By Region, 20132020 (USD Million)

Table 30 IT & Telecom: Market Size, By Component, 20132020 (USD Million)

Table 31 IT & Telecom: Market Size, By Service, 20132020 (USD Million)

Table 32 Healthcare: Market Size, By Region, 20132020 (USD Million)

Table 33 Healthcare: Market Size, By Component, 20132020 (USD Million)

Table 34 Healthcare: Market Size, By Service, 20132020 (USD Million)

Table 35 Retail: Market Size, By Region, 20132020 (USD Million)

Table 36 Retail: Market Size, By Component, 20132020 (USD Million)

Table 37 Retail: Market Size, By Service, 20132020 (USD Million)

Table 38 Oil and Gas: Market Size, By Region, 20132020 (USD Million)

Table 39 Oil and Gas: Market Size, By Component, 20132020 (USD Million)

Table 40 Oil and Gas: Market Size, By Service, 20132020 (USD Million)

Table 41 Others: Market Size, By Region, 20132020 (USD Million)

Table 42 Others: Market Size, By Component, 20132020 (USD Million)

Table 43 Others: Market Size, By Service, 20132020 (USD Million)

Table 44 Application Control Market Size, By Region, 20132020 (USD Million)

Table 45 North America: Market Size, By Component, 20132020 (USD Million)

Table 46 North America: Market Size, By Service, 20132020 (USD Million)

Table 47 North America: Market Size, By Access Point, 20132020 (USD Million)

Table 48 North America: Market Size, By Organization Size, 20132020 (USD Million)

Table 49 North America: Market Size, By Vertical, 20132020 (USD Million)

Table 50 Europe: Market Size, By Component, 20132020 (USD Million)

Table 51 Europe: Market Size, By Service, 20132020 (USD Million)

Table 52 Europe: Market Size, By Access Point, 20132020 (USD Million)

Table 53 Europe: Market Size, By Organization Size, 20132020 (USD Million)

Table 54 Europe: Market Size, By Vertical, 20132020 (USD Million)

Table 55 Asia-Pacific: Market Size, By Component, 20132020 (USD Million)

Table 56 Asia-Pacific: Market Size, By Service, 20132020 (USD Million)

Table 57 Asia-Pacific: Market Size, By Access Point, 20132020 (USD Million)

Table 58 Asia-Pacific: Market Size, By Organization Size, 20132020 (USD Million)

Table 59 Asia-Pacific: Market Size, By Vertical, 20132020 (USD Million)

Table 60 Middle East and Africa: Applicaton Control Market Size, By Component, 20132020 (USD Million)

Table 61 Middle East and Africa: Market Size, By Service, 20132020 (USD Million)

Table 62 Middle East and Africa: Market Size, By Access Point, 20132020 (USD Million)

Table 63 Middle East and Africa: Market Size, By Organization Size, 20132020 (USD Million)

Table 64 Middle East and Africa: Market Size, By Vertical, 20132020 (USD Million)

Table 65 Latin America: Market Size, By Component, 20132020 (USD Million)

Table 66 Latin America: Market Size, By Service, 20132020 (USD Million)

Table 67 Latin America: Market Size, By Access Point, 20132020 (USD Million)

Table 68 Latin America: Market Size, By Organization Size, 20132020 (USD Million)

Table 69 Latin America: Market Size, By Vertical, 20132020 (USD Million)

Table 70 New Product Launches, 2015-2016

Table 71 Mergers and Acquisitions, 2015-2014

Table 72 Partnerships, Agreements, and Collaborations, 2015-2016

Table 73 Business Expansions, 2013-2016

Table 74 Other Develpoments: New Product Launches, 2014-2013

Table 75 Other Develpoments: Mergers and Acquisitions, 2013-2014

Table 76 Other Develpoments: Partnerships, Agreements and Collaborations, 2013-2015

List of Figures (52 Figures)

Figure 1 Global Application Control Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 7 Professional Services Segment Expected to Grow at the Highest CAGR During the Forecast Period

Figure 8 Mobiles/Tablets Access Point Segment Expected to Grow at the Highest CAGR From 2015 to 2020

Figure 9 Large Enterprises Segment Expected to Grow at the Highest CAGR From 2015 to 2020

Figure 10 BFSI Vertical to Grow at the Highest CAGR From 2015 to 2020

Figure 11 North America Estimated to Hold the Largest Share of the Application Control Market in 2015

Figure 12 The Need to Protect Data Against Threats is Expected to Boost the Market

Figure 13 Services Segment Expected to Grow at the Highest CAGR During the Forecast Period

Figure 14 Government & Defense Vertical to Hold the Largest Share of the Market in 2015

Figure 15 Asia-Pacific has Immense Opportunities for the Growth of the Application Control Market

Figure 16 Evolution of the Endpoint Security( Application Control) Market

Figure 17 Application Control Market, By Component

Figure 18 Market, By Access Point

Figure 19 Market, By Organization Size

Figure 20 Market, By Vertical

Figure 21 Market, By Region

Figure 22 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 23 Market: Value Chain

Figure 24 Strategic Benchmarking: Technology Integration and Product Enhancement

Figure 25 Demand Overview: Number of Cyber Attacks, By Top Vertical, January 2015 January 2016

Figure 26 Services Segment to Grow at the Highest Rate During the Forecast Period

Figure 27 Mobiles/Tablets Access Point Segment Expected to Grow at the Highest CAGR During the Forecast Period

Figure 28 Large Enterprises Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 29 BFSI Vertical Expected to Grow at the Highest CAGR During the Forecast Period

Figure 30 North America to Hold the Largest Market Share in the Global Application Control Market During the Forecast Period

Figure 31 Regional Snapshot: Asia-Pacific is the Emerging Region in the Market

Figure 32 North America Market Snapshot: Presence of Key Application Control Vendors is A Major Factor Contributing Towards the Growth of the Market

Figure 33 Asia-Pacific Market Snapshot: Rising Byod Adoption Among Organizations is A Major Factor Contributing Towards the Growth of the Application Control Market

Figure 34 Top 5 Companies Adopted New Product Launch as the Key Growth Strategy From 2013 to 2016

Figure 35 Battle for Market Share: Partnerships, Agreements and Collaborations Was the Key Strategy of the Leading Market Players

Figure 36 Market Evaluation Framework: Significant Number of New Partnerships, Agreements, and Collaborations Have Fuelled the Growth of the Market From 2013 to 2016

Figure 37 Geographic Revenue Mix of Top Players

Figure 38 Symantec Corporation: Company Snapshot

Figure 39 Symantec Corporation: SWOT Analysis

Figure 40 Intel Security: Company Snapshot

Figure 41 Intel Security: SWOT Analysis

Figure 42 Trend Micro, Inc.: Company Snapshot

Figure 43 Trend Micro Inc.: SWOT Analysis

Figure 44 Cyberark Software Ltd.: Company Snapshot

Figure 45 Cyberark Software Ltd.: SWOT Analysis

Figure 46 Check Point Software Technologies Ltd.: Company Snapshot

Figure 47 Check Point Software Technologies Ltd.: SWOT Analysis

Figure 48 Appsense: Company Snapshot

Figure 49 Digital Guardian: Company Snapshot

Figure 50 Carbon Black, Inc.: Company Snapshot

Figure 51 Heat Software: Company Snapshot

Figure 52 Arellia: Company Snapshot

Growth opportunities and latent adjacency in Application Control Market