Antimony Market by Product Type (Trioxides, Alloys), Application (Flame Retardants, Plastic Additives. Lead-Acid Batteries, Glass & Ceramics), End-Use Industry (Chemical, Automotive, Electrical & Electronics), and Region - Global Forecast to 2023

Antimony Market Size And Forecast

[111 Pages Report] The antimony market was valued at USD 1.64 billion in 2017 and is projected to reach USD 2.37 billion by 2023, at a CAGR of 6.0% during the forecast period. Increased demand for antimony trioxide (ATO) in flame retardant and plastic additives application is driving the demand for antimony, globally. The years considered for estimating the market size of antimony have been listed below:

Market Dynamics

Drivers

- Growing demand for Increasing fire safety regulations

- Growing use in plastic additive application

Opportunities

- Exploration of newly developed antimony reserves

- Recycling of antimony

Challenges

- Overcoming geo-political tensions

Increasing implementation of stringent regulations regarding fire safety

Fire safety regulations are getting stringent across the globe, leading to the development of innovative flame retardants. The development of flame retardants is strongly influenced by the stringent legal frameworks and industry standards. Fire safety regulations are varied across different regions, depending on the corresponding national regulations for health and environmental security. Such regulations are, especially, stringent in Europe and North America.

Objectives of the Study:

- To define, describe, and forecast the antimony market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To identify and estimate the antimony market size on the basis of product type, end-use industry, and application

- To analyze significant regional trends in North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa (MEA), along with their major countries

- To strategically analyze the market with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze the opportunities for stakeholders and competitive landscape of the market leaders

- To strategically profile and analyze the key market players and their core competencies*

Various secondary sources such as Factiva, Hoovers, and Manta have been used to gain insights of the antimony market. Experts from leading companies manufacturing antimony have been interviewed to verify and collect critical information and to assess trends in the antimony market during the forecast period. Top-down, bottom-up, and data triangulation approaches have been implemented to calculate exact values of the overall parent and each market segments.

To know about the assumptions considered for the study, download the pdf brochure

The market for antimony has a diversified and established ecosystem comprising upstream players, such as raw material suppliers and downstream stakeholders, manufacturers, vendors, and end users of antimony, as well as various government organizations. Leading players operating in the antimony market include AMG Advanced Metallurgical Group (Netherland), Mandalay Resources (Canada), United States Antimony Corporation (USAC) (US), Korea Zinc (South Korea), and Recyclex (France).

Major Market Developments

- In May 2018, United States Antimony Corporation progressed on the construction of the leach plant for the Los Juarez gold-silver-antimony deposit in Queretaro, Mexico. It is one of the largest and most expensive projects operated by USAC. Testing and shake-down of the plant is anticipated in Q4 2018.

- In June 2017, Tri-Star Resources Plc along with Strategic & Precious Metals Processing LLC (SPMP) has signed a multi-year agreement with Traxys Europe SA to supply antimony and antimony gold concentrates to its Oman Antimony Roaster. The agreement provides SPMP access to the global expertise provided by Traxys on minor metal concentrate sourcing and supply chain logistics management

- In April 2017, specialty chemicals company LANXESS acquired the US-based company Chemtura, one of the world’s leading suppliers of flame retardant and lubricant additives. The acquisition would help the company increase its production of flame retardant materials and make it easily available to its customers..

Key Target Audience

- Manufacturers of antimony

- Suppliers of raw materials

- Distributors and suppliers of antimony

- End-use industries

- Industry associations

“This study answers several questions for the stakeholders, primarily, which market segments to focus on in the next two to five years for prioritizing their efforts and investments.”

Scope of the Report

This research report categorizes the antimony market based on type, application, end-use industry, and region. It forecasts revenue growth and analyzes trends in each of the submarkets.

Antimony Market by Product Type:

- Trioxides

- Alloys

- Others

Antimony Market by Application:

- Flame retardant

- Plastic additives

- Lead acid batteries

- Glass & ceramics

- Others

Antimony Market by End-Use Industry:

- Chemical

- Automotive

- Electrical & electronics

- Others

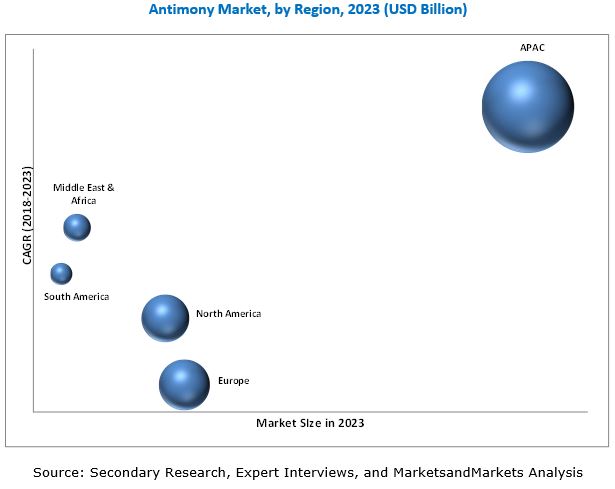

Antimony Market, by Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa (MEA)

- South America

Each region has been further segmented into key countries in that region.

Critical questions which the report answers

- What are the upcoming trends for MCA in developing nations?

- Which are the key players in the market and how intense is the competition?

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the North America antimony market

- Further breakdown of the Europe antimony market

- Further breakdown of the Asia Pacific antimony market

- Further breakdown of the Middle East & Africa antimony market

- Further breakdown of the South America antimony market

Company Information

- Detailed analysis and profiling of additional market players

The antimony market size is projected to reach USD 2.37 billion by 2023, at a CAGR of 6.0% between 2018 and 2023. The growth of the antimony market can be attributed to the increasing use of antimony in the chemical industry. In the chemical industry, antimony is prominently used in flame synergist, catalyst, and stabilizer. The automotive industry is the second-largest end-use industry of antimony. Antimony is used in lead acid batteries in the automotive sector.

The flame retardant segment is projected to be the largest application segment of the antimony market during the forecast period, in terms of both value and volume, owing to the high demand for antimony trioxide as a flame synergist in plastics, furniture, mattresses, fabrics, and others.

China is the major exporter of antimony. Antimony shipments from China are sometimes delayed owing to stringent scrutiny on exports through the border with Vietnam. The geopolitical situation along the borders of China and Vietnam often leads to the shutdown of antimony exports on the Vietnam-China border. This border area is also a popular smuggling route, which further attracts more scrutiny. The Vietnam-China border is, thus, under multiple layers of scrutiny and suppliers find it difficult to export. Thus, overcoming geopolitical tensions to enable smoother supply of antimony is a big challenge for stakeholders in the antimony market

APAC is the largest market for antimony. The market in the region is driven by the high demand in flame retardant, plastic additives, and automotive lead acid batteries applications. In APAC, China, Australia, Tajikistan, and Myanmar are the major producers of antimony. The largest reserves of antimony are found in China. Around 70% of antimony is produced by China. The Chinese government is continuously tightening environmental regulations and beefing up its monitoring capabilities regarding antimony production, import, and export.

Antimony is used in various applications such as flame retardants, lead acid batteries, plastics additives catalyst, glass & ceramics and others.

Flame Retardant

Flame retardants are used for reducing the hazardous effect of fire mishaps. Flame retardants stop the fire by interacting with the fire cycle in the gaseous phase and stop the chemical chain reaction. Antimony trioxide often works in synergy with halogenated flame retardants. These flame retardants are used in flame retarding furniture, mattresses, fabrics, plastics, circuit boards, and wiring.

Lead Acid Batteries

Antimony is used as an alloying agent with lead in certain parts of a battery where strength, corrosion resistance, and creep resistance are required. Antimony provides strength to lead and simplifies and speeds up the casting of grids. They are used in some countries in automotive batteries. However, the use of antimony in automotive batteries is declining owing to high maintenance and emergence of new technologies such as lithium-ion battery.

Plastic Additives

Plastics additives are chemicals which are used to polymerize, process, or to modify the properties of plastics. Antimony is used as stabilizer and catalyst in plastics additives

Antimony is used as a stabilizer in many common plastics that are susceptible to degradation by heat and ultraviolet light (UV). For instance, antimony is used as a stabilizer in PVC production. PVC is used in commodity plastics, food wrap, water bottles, artificial leather, toys, electrical wire & cable insulation, and drainage and water supply pipe. Antimony mercaptides are used as heat stabilizers for PVC.

Antimony in the form of trioxide or triacetate is used as a polycondensation catalyst in the polymerization of PET. PET is used widely in commodity plastic used in bottles, films, food packaging, and many other products. It can also be used with germanium dioxide, as catalysts for PET.

Glass & Ceramics

Antimony is used as a fining agent/decolorant/antisolarant for high-quality transparent glass. For this application, antimony is used in the form of antimony oxide and sodium antimonate. They are used in the display screen of cathode ray tube (CRT) used in computers and television receivers. Antimony is also used as an opacifier in the ceramic industry.

Critical questions the report answers:

- What are the upcoming hot bets for antimony market?

- How market dynamics is changing for different forms in different applications?

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

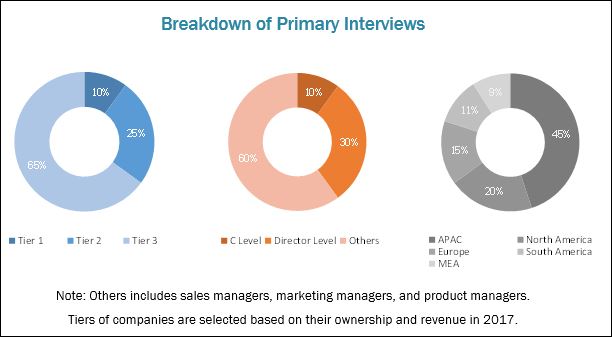

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Antimony Market

4.2 Antimony Market, By Application

4.3 Antimony, By End-Use Industry and Region

4.4 Antimony Market, By Product Type

4.5 Antimony Market, By Country

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Fire Safety Regulations

5.2.1.2 Growing Use in Plastic Additive Application

5.2.2 Restraints

5.2.2.1 Environmental and Health Concerns Restricting the Growth of Antimony Market

5.2.2.2 High Prices of Antimony

5.2.2.3 Declining Use of Antimonial Lead

5.2.2.4 Reduced Production in China

5.2.3 Opportunities

5.2.3.1 Exploration of Newly Discovered Antimony Reserves

5.2.3.2 Recycling of Antimony

5.2.4 Challenges

5.2.4.1 Overcoming Geopolitical Tensions

5.3 Porter’s Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Bargaining Power of Buyers

5.3.3 Threat of New Entrants

5.3.4 Threat of Substitutes

5.3.5 Intensity of Competitive Rivalry

6 Antimony Market, By Product Type (Page No. - 37)

6.1 Introduction

6.2 Trioxides

6.3 Alloys

6.4 Others

7 Antimony Market, By Application (Page No. - 42)

7.1 Introduction

7.2 Flame Retardants

7.3 Lead-Acid Batteries

7.4 Plastic Additives

7.4.1 Stabilizers

7.4.2 Catalysts

7.5 Glass & Ceramics

7.6 Others

8 Antimony Market, By End-Use Industry (Page No. - 50)

8.1 Introduction

8.2 Chemical

8.3 Automotive

8.4 Electrical & Electronics

8.5 Others

9 Antimony Market, By Region (Page No. - 57)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Belgium

9.3.2 France

9.3.3 Russia

9.3.4 Turkey

9.3.5 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.2 Japan

9.4.3 South Korea

9.4.4 Rest of APAC

9.5 South America

9.5.1 Brazil

9.5.2 Peru

9.5.3 Argentina

9.5.4 Rest of South America

9.6 Middle East & Africa

9.6.1 South Africa

9.6.2 UAE

9.6.3 Saudi Arabia

9.6.4 Rest of Mea

10 Company Profiles (Page No. - 75)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis)*

10.1 AMG Advanced Metallurgical Group

10.2 Mandalay Resources Ltd

10.3 United States Antimony Corporation

10.4 Korea Zinc

10.5 Recyclex

10.6 Nihon Seiko Co., Ltd.

10.7 Umicore

10.8 Hunan Chenzhou Mining Group Co., Ltd

10.9 Huachang Antimony Industry

10.10 Geopromining, Ltd.

10.11 Consolidated Murchison Mine

10.12 Belmont Metals

10.13 American Elements

10.14 Tri-Star Resources PLC

10.15 Amspec Chemical Corporation

10.16 Lanxess

10.17 Hsikwangshan Twinkling Star Co. Ltd.

10.18 Hubei Yongcheng Antimony Industry Co. Ltd.

10.19 Cambrian Mining PLC

10.20 Yunnan Muli Antimony Industry Co., Ltd

10.21 Suzuhiro Chemical Co., Ltd.

10.22 Nyacol Nano Technologies, Inc.

10.23 Lambert Metals International Limited

10.24 Campine

10.25 Atomized Products Group, Inc.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 104)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Introducing RT: Real-Time Market Intelligence

11.5 Available Customizations

11.6 Related Reports

11.7 Author Details

List of Tables (62 Tables)

Table 1 Antimony Market Size, By Product Type, 2016–2023 (USD Million)

Table 2 Antimony Market Size, By Product Type, 2016-2023 (Kiloton)

Table 3 Antimony Trioxides Market Size, By Region, 2016–2023 (USD Million)

Table 4 Antimony Trioxides Market Size, By Region, 2016-2023 (Kiloton)

Table 5 Alloys Antimony Market Size, By Region, 2016–2023 (USD Million)

Table 6 Alloys Antimony Market Size, By Region, 2016–2023 (Kiloton)

Table 7 Other Antimony Market Size, By Region, 2016–2023 (USD Million)

Table 8 Other Antimony Market Size, By Region, 2016–2023 (Kiloton)

Table 9 Antimony Market Size, By Application, 2016–2023 (USD Million)

Table 10 Antimony Market Size, By Application, 2016–2023 (Kiloton)

Table 11 Antimony Market Size in Flame Retardant Application, By Region, 2016–2023 (USD Million)

Table 12 Antimony Market Size in Flame Retardant Application, By Region, 2016–2023 (Kiloton)

Table 13 Antimony Market Size in Lead-Acid Batteries Application, By Region, 2016–2023 (USD Million)

Table 14 Antimony Market Size in Lead-Acid Batteries Application, By Region, 2016–2023 (Kiloton)

Table 15 Antimony Market Size in Plastic Additives Application, By Region, 2016–2023 (USD Million)

Table 16 Antimony Market Size in Plastic Additives Application, By Region, 2016–2023 (Kiloton)

Table 17 Antimony Market Size in Glass & Ceramics Application, By Region, 2016–2023 (USD Million)

Table 18 Antimony Market Size in Glass & Ceramics Application, By Region, 2016–2023 (Kiloton)

Table 19 Antimony Market Size in Other Applications, By Region, 2016–2023 (USD Million)

Table 20 Antimony Market Size in Other Applications, By Region, 2016–2023 (Kiloton)

Table 21 Antimony Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 22 Antimony Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 23 Antimony Market Size in Chemical Industry, By Region, 2016–2023 (USD Million)

Table 24 Antimony Market Size in Chemical Industry, By Region, 2016–2023 (Kiloton)

Table 25 Antimony Market Size in Automotive Industry, By Region, 2016–2023 (USD Million)

Table 26 Antimony Market Size in Automotive Industry, By Region, 2016–2023 (Kiloton)

Table 27 Antimony Market Size in Electrical & Electronics Industry, By Region, 2016–2023 (USD Million)

Table 28 Antimony Market Size in Electrical & Electronics Industry, By Region, 2016–2023 (Kiloton)

Table 29 Antimony Market Size in Other End-Use Industry, By Region, 2016–2023 (USD Million)

Table 30 Antimony Market Size in Other End-Use Industry, By Region, 2016–2023 (Kiloton)

Table 31 Antimony Market Size, By Region, 2016–2023 (USD Million)

Table 32 Antimony Market Size, By Region, 2016–2023 (Kiloton)

Table 33 North America: By Market Size, By Product Type, 2016–2023 (USD Million)

Table 34 North America: By Market Size, By Product Type, 2016–2023 (Kiloton)

Table 35 North America: By Market Size, By Application, 2016–2023 (USD Million)

Table 36 North America: By Market Size, By Application, 2016–2023 (Kiloton)

Table 37 North America: By Market Size, By Country, 2016–2023 (USD Million)

Table 38 North America: By Market Size, By Country, 2016–2023 (Kiloton)

Table 39 Europe: By Market Size, By Product Type, 2016–2023 (USD Million)

Table 40 Europe: By Market Size, By Product Type, 2016–2023 (Kiloton)

Table 41 Europe: By Market Size, By Application, 2016–2023 (USD Million)

Table 42 Europe: By Market Size, By Application, 2016–2023 (Kiloton)

Table 43 Europe: By Market Size, By Country, 2016–2023 (USD Million)

Table 44 Europe: By Market Size, By Country, 2016–2023 (Kiloton)

Table 45 APAC: By Market Size, By Product Type, 2016–2023 (USD Million)

Table 46 APAC: By Market Size, By Product Type, 2016–2023 (Kiloton)

Table 47 APAC: By Market Size, By Application, 2016–2023 (USD Million)

Table 48 APAC: By Market Size, By Application, 2016–2023 (Kiloton)

Table 49 APAC: By Market Size, By Country, 2016–2023 (USD Million)

Table 50 APAC: By Market Size, By Country, 2016–2023 (Kiloton)

Table 51 South America: By Market Size, By Product Type, 2016–2023 (USD Million)

Table 52 South America: By Market Size, By Product, 2016–2023 (Kiloton)

Table 53 South America: By Market Size, By Application, 2016–2023 (USD Million)

Table 54 South America: By Market Size, By Application, 2016–2023 (Kiloton)

Table 55 South America: By Market Size, By Country, 2016–2023 (USD Million)

Table 56 South America: By Market Size, By Country, 2016–2023 (Kiloton)

Table 57 MEA: By Market Size, By Product Type, 2016–2023 (USD Million)

Table 58 MEA: By Market Size, By Product, 2016–2023 (Kiloton)

Table 59 MEA: By Market Size, By Application, 2016–2023 (USD Million)

Table 60 MEA: By Market Size, By Application, 2016–2023 (Kiloton)

Table 61 MEA: By Market Size, By Country, 2016–2023 (USD Million)

Table 62 MEA: By Market Size, By Country, 2016–2023 (Kiloton)

List of Figures (36 Figures)

Figure 1 Antimony: Market Segmentation

Figure 2 Antimony Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Antimony Market: Data Triangulation

Figure 6 Flame Retardant Application to Lead Overall Antimony Market Between 2018 and 2023

Figure 7 Chemical End-Use Industry to Lead the Antimony Market Between 2018 and 2023

Figure 8 China to Be the Fastest-Growing Antimony Market During Forecast Period

Figure 9 Antimony Trioxide to Dominate Overall Antimony Market Between 2018 and 2023

Figure 10 APAC to Lead the Antimony Market Between 2018 and 2023

Figure 11 Increased Demand in Flame Retardant Application to Drive Antimony Market Between 2018 and 2023

Figure 12 Flame Retardant Application to Dominate Overall Antimony Market Between 2018 and 2023

Figure 13 Chemical Segment Dominated the Antimony Market in 2017

Figure 14 Antimony Trioxide to Dominate Overall Antimony Market Between 2018 and 2023

Figure 15 China to Be the Fastest-Growing Market During the Forecast Period

Figure 16 Overview of Factors Governing the Antimony Market

Figure 17 Porter’s Five Forces Analysis: Antimony Market

Figure 18 Trioxides to Dominate Overall Antimony Market Between 2018 and 2023

Figure 19 APAC to Lead the Trioxides Market Segment Between 2018 and 2023

Figure 20 Flame Retardant Application to Dominate Overall Antimony Market Between 2018 and 2023

Figure 21 APAC to Lead Antimony Market in Flame Retardant Application

Figure 22 Chemical Industry to Lead the Antimony Market Between 2018 and 2023

Figure 23 APAC to Be the Fastest-Growing Antimony Market in Chemical Industry, 2018–2023

Figure 24 China to Be the Fastest-Growing Antimony Market Between 2018 and 2023

Figure 25 North America: By Market Snapshot

Figure 26 Europe: By Market Snapshot

Figure 27 APAC: By Market Snapshot

Figure 28 AMG Advanced Metallurgical Group: Company Snapshot

Figure 29 AMG Advanced Metallurgical Group: SWOT Analysis

Figure 30 Mandalay Resources Ltd: Company Snapshot

Figure 31 United States Antimony Corporation: Company Snapshot

Figure 32 AMG Advanced Metallurgical Group: SWOT Analysis

Figure 33 Korea Zinc: Company Snapshot

Figure 34 Recyclex: Company Snapshot

Figure 35 Nihon Seiko Co., Ltd.: Company Snapshot

Figure 36 Umicore: Company Snapshot

Growth opportunities and latent adjacency in Antimony Market