Antiblock Additive Market by Product Type (Organic, Inorganic), Polymer Type (LLDPE, LDPE, HDPE, BOPP, PVC), Application (Food, Pharmaceutical, Industrial, Medical, Agriculture) - Global Forecast to 2021

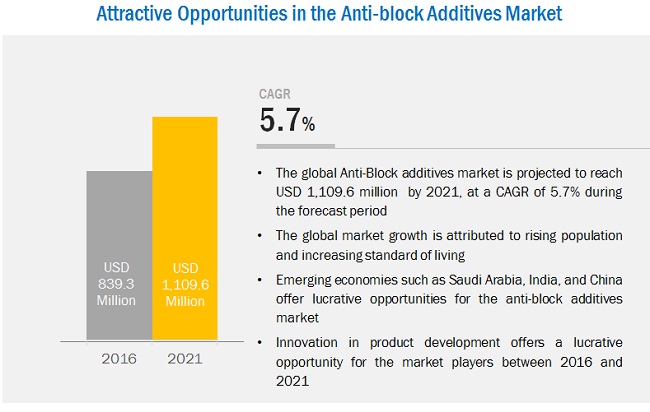

The antiblock additive market was valued at USD 795.3 million in 2015 and is projected to reach USD 1,109.6 million by 2021, at a CAGR of 5.7% from 2016 to 2021. The measures to prevent film sheets from sticking together are termed as antiblocking. These additives are added to the polymers in a concentration of 1,000 ppm to 6,000 ppm, during the extrusion phase, to avoid the blocking or adhesion of layers. The dosage of antiblocks varies according to the film thickness, film grade, additive used, and extrusion conditions. In this report, 2015 has been considered as the base year and the forecast period is from 2016 to 2021.

Market Dynamics

Drivers

- Global focus on increasing agrocultural productivity

- Rising demand for antiblock additives in Asia-Pacific

- Advancements in technology and packaging materials

Restraints

- High loading of inorganic antiblocks affecting the properties of film

Opportunities

- Untapped opportunities in emerging markets in packaging

Advancements in Technology and Packaging Materials

The plastics industry is growing rapidly due to its use in a broad range of industries. The increasing consumer awareness to develop new age and environmentally friendly products have led to the undertaking of new technologies in the packaging industry. The use of nanocomposites as packaging fillers, non-thermal processing and light protective packaging, modified atmosphere packaging (MAP), active packaging technologies such as oxygen scavengers, moisture absorbers, ethanol emitters, flavor releasing/absorbing systems, time-temperature indicators, and multi-layer films are some of the latest technologies adopted in the packaging industry.

Objectives of this study:

- To estimate and forecast the antiblock additive market size, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, restraints, and opportunities) influencing the growth of the market

- To define, describe, and forecast the market size on the basis of product type, polymer type, application, and region

- To forecast the size of the market and submarkets with respect to five main regions, namely, Asia-Pacific, North America, Europe, the Middle East & Africa, and Central & South America

- To track and analyze recent developments such as acquisitions, contracts & agreements, and investments in the market

- To strategically profile key market players and comprehensively analyze their growth strategies

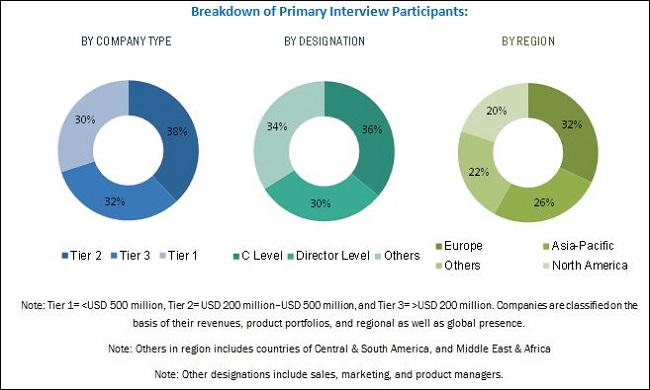

This research study involves extensive use of secondary sources, directories, and databases (such as Hoovers, Bloomberg BusinessWeek, and Factiva) to identify and collect information useful for this technical, market-oriented, and commercial study of the antiblock additive market. Primary sources mainly include several industry experts from core and related industries, and preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the industrys supply chain. After arriving at the overall market size, the market has been split into several segments and subsegments. The figure below illustrates the breakdown of primary interviews based on company, designation, and region conducted during the research study:

To know about the assumptions considered for the study, download the pdf brochure

Key market players profiled in the report are W.R. Grace & Co. (U.S.), Specialty Minerals Inc. (U.S.), Honeywell International Inc. (U.S.), and Fine Organics (India) that manufacture different types of antiblock additive. Furthermore, products manufactured by these companies are used by masterbatch companies such as Ampacet Corporation (U.S.), A. Schulman Inc. (U.S.), Polyone Corporation (U.S.), and Wells Plastic Ltd. (U.K.), among others.

Major Market Developments

- In April 2017, Croda International Plc. (U.K.) announced the expansion of its Chocques manufacturing facility (Northern France) with an investment of USD 19.98 million. This will increase the alkoxylation production capacity of the site by 20% and cater to the demand from various industries in Europe.

- In January 2017, Evonik Industries AG (Germany) completed the transaction to acquire the specialty additives business of Air Products and Chemicals, Inc. (U.S.) for USD 3.8 billion. The process to acquire the specialty & coating additive business of Air Products started in May 2016. The acquisition will position the Evonik's position in the global specialty additives market.

- In February 2017, Honeywell International Inc. (U.S.) signed a technology sharing agreement with Zhejiang Petrochemical Co. Ltd. (China), a manufacturer of aromatic hydrocarbons, polymers, and polyester fibers. A range of process technologies in the form of design, license, catalyst and key equipment along with automation systems is being supplied by Honeywell.

The target audience for the antiblock additive market report is as follows:

- Antiblock additive manufacturers

- Antiblock additive suppliers and distributors

- Raw material suppliers

- Service providers

- Government bodies

Scope of the Report

This report categorizes the global antiblock additive market on the basis of product type, polymer type, application, and region.

Antiblock additive market, by product type:

- Organic

- Inorganic

Antiblock additive market, by polymer type:

- LLDPE

- LDPE

- HDPE

- BOPP

- PVC

- Others (including polyamide, cast polypropylene, and polyethylene terephthalate)

Antiblock additive market, by application:

- Packaging

- Food

- Pharmaceutical

- Others

- Non-packaging

- Agriculture

- Medical

- Others

Antiblock additive market, by region:

- North America

- Asia-Pacific

- Europe

- Middle East & Africa

- Central & South America

Critical questions which the report answers

- What are new product which additives companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options (not limited to) are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country, additional product type, polymer type, and/or application

Country Information

- Additional country information (up to three)

Company Information

- Detailed analysis and profiles of additional market players (up to five)

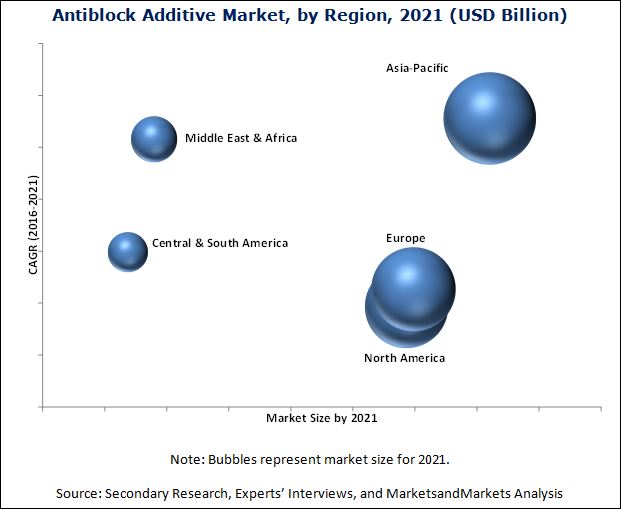

The global antiblock additive market was valued at USD 839.3 million in 2016 and is projected to reach USD 1,109.6 million by 2021, at a CAGR of 5.7% during the forecast period. The growth of the antiblock additive market in the next five years is projected to be the highest in Asia-Pacific, and the Middle East & Africa. Growing food and pharmaceutical packaging, along with increased focus on agricultural output in the Asia-Pacific region is projected to fuel the demand for antiblock additive.

Based on product type, the antiblock additive market has been segmented into organic and inorganic. The antiblock additive market is led by the inorganic segment, in terms of value, mainly due to its cost-effectiveness and ease of availability.

Based on polymer type, the antiblock additive market has been segmented into LLDPE, LDPE, HDPE, BOPP, PVC, and others. The LLDPE segment is estimated to account for the largest share of the antiblock additive market in 2021, in terms of value. LLDPE polymer type is preferred by plastic film & sheet manufacturers due to its low cost, high tensile strength, and easy applicability in almost every application.

Based on application, the food packaging segment is expected to grow at the highest CAGR, in terms of value, during the forecast period due to increasing consumer awareness for convenience and ready-to-eat packaged food. The increasing disposable income of people and their high spending power has led to high demand for packaged food.

Asia-Pacific is projected to be the fastest-growing antiblock additive market, in terms of value, during the forecast period due to rapidly growing packaging application, in countries such as Japan, India, and South Korea. Furthermore, improving economic condition and infrastructural developments are primarily responsible for high demand for antiblock additive. In addition, increasing focus on improving agricultural output has led to increased use of antiblock additive in the region.

Construction & mining, metal production, and cement production applications to drive the growth of Industrial lubricants market

Packaging

Packaging is a process for preserving and protecting the quality and shelf-life of different products, such as electronic goods, medicines & drugs, processed & semi-processed foods, and hardware items. The major drivers that aid the growth of the packaging industry are rapid urbanization, changing consumer lifestyles, economic trends, rising health awareness among the different classes of consumers, and development in packaging material & technology. The various properties of plastics, such as durability, low cost, resistance to corrosion, water & chemicals, and low thermal conductivity, make it suitable for use in various applications. The rise in the use of plastics in heavy and light packaging drives the demand for antiblock additive in various end-use applications in the packaging segment.

Non-Packaging

In the non-packaging applications, antiblocks find its use in various segments such as agriculture films, medical, and paints & coatings. The usage of plastic films is rising in agriculture to combat the increasing pest menace. High manufacturing cost of modified agricultural films with special characteristics such as UV ray protection has caused the prices of films to rise. Consequently, revenue earned from such films has risen globally as well. The North American and European markets are expected to remain saturated, and thus the market for films is expected to grow at a slow pace. Moreover, the increasing construction activities in the developing nations such as China, India, and Brazil are the key drivers of the growth of plastic films, leading to an increase in the use of antiblocks used in such films.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming product type of antiblock additives?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

High dosage levels of inorganic antiblock additive is the major factor restraining the growth of the antiblock additive market. Increase in inorganic antiblock concentration levels significantly increases density, affects optical properties of plastic film, and increases haze. This has driven manufacturers to use newer alternatives, which deliver optimum clarity and high resistance to blocking.

Some of the key players in the antiblock additive market are Honeywell International Inc. (U.S.), W.R. Grace & Co. (U.S.), Specialty Minerals Inc. (U.S.), Imerys S.A. (France), and Fine Organics (India). W.R. Grace and Imerys are among the top players leading the antiblock additive market. Imerys has been mainly focusing on acquisition as part of its strategic developmental activity. In January 2017, the company acquired the mineral-based solution producer Damolin A/S (Denmark), thus strengthening its reach in the European market of animal feed, cat litter, and oil and chemical absorbents.

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Market Scope

1.2.2 Years Considered for the Study

1.3 Currency

1.4 Package Size

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Significant Opportunities in Antiblock Additive Market (20162021)

4.2 Antiblock Additive Market, By Region

4.3 Asia-Pacific Antiblock Additive Market Share, By Major Country and Polymer Type, 2015

4.4 Antiblock Additive Market Attractiveness, 20162021

4.5 Antiblock Additive Market, By Application, and Region, 2015

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Impact Analysis for Short, Medium, and Long Term

5.2.2 Drivers

5.2.2.1 Global Focus on Increasing Agricultural Productivity

5.2.2.2 Rising Demand for Antiblock Additive in Asia-Pacific

5.2.2.3 Advancements in Technology and Packaging Materials

5.2.3 Restraints

5.2.3.1 High-Loading of Inorganic Antiblocks Affecting the Properties of Film

5.2.4 Opportunities

5.2.4.1 Untapped Opportunities in Emerging Markets for Packaging

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Porters Five Forces Analysis

6.2.1 Threat of New Entrants

6.2.2 Threat of Substitutes

6.2.3 Bargaining Power of Suppliers

6.2.4 Bargaining Power of Buyers

6.2.5 Intensity of Competitive Rivalry

6.3 Industry Outlook

6.3.1 Agriculture Industry

7 Antiblock Additive Market, By Product Type (Page No. - 49)

7.1 Introduction

7.2 Organic Antiblock Additive

7.3 Inorganic Antiblock Additive

8 Antiblock Additive Market, By Polymer Type (Page No. - 56)

8.1 Introduction

8.2 LLDPE

8.3 LDPE

8.4 HDPE

8.5 BOPP

8.6 PVC

8.7 Others

9 Antiblock Additive Market, By Application (Page No. - 66)

9.1 Introduction

9.2 Packaging

9.2.1 Food

9.2.2 Pharmaceutical

9.2.3 Industrial

9.2.4 Other Packaging

9.3 Non-Packaging

9.3.1 Agriculture Films

9.3.2 Medical

9.3.3 Other Non-Packaging

10 Antiblock Additive Market, By Region (Page No. - 78)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 Inorganic Antiblocks Dominates Asia-Pacific Antiblock Additive Market

10.2.2 PVC Based Antiblock Additive to Witness Highest CAGR

10.2.3 Food Packaging Dominates Asia-Pacific Antiblock Additive Market

10.2.4 Country Level Analysis

10.2.4.1 China

10.2.4.2 Japan

10.2.4.3 India

10.2.4.4 South Korea

10.2.4.5 Taiwan

10.2.4.6 Indonesia

10.2.4.7 Australia

10.3 Europe

10.3.1 Inorganic Segment Accounts for Largest Share of European Antiblock Additive Market

10.3.2 BOPP Based Antiblocks to Be the Fastest-Growing Segment in European Antiblock Additive Market

10.3.3 Packaging Accounts for Largest Share of European Antiblock Additive Market

10.3.4 Country Level Analysis

10.3.4.1 Germany

10.3.4.2 France

10.3.4.3 U.K.

10.3.4.4 Italy

10.3.4.5 Spain

10.3.4.6 Russia

10.3.4.7 Netherlands

10.5 North America

10.5.1 Organic Antiblocks to Witness Highest Growth in North American Antiblock Additive Market

10.5.2 LLDPE Accounts for Largest Share of North American Antiblock Additive Market

10.5.3 Food Packaging to Witness Highest CAGR in North American Antiblock Additive Market

10.5.4 Country Level Analysis

10.5.4.1 U.S.

10.5.4.2 Canada

10.5.4.3 Mexico

10.6 Middle East & Africa

10.6.1 Organic Antiblocks to Be the Fastest-Growing Segment in the Middle East & Africa Antiblock Additive Market

10.6.2 LLDPE-Based Antiblocks to Be Fastest-Growing Polymer Type in the Middle East & Africa Antiblock Additive Market

10.6.3 Packaging Application Dominates the Middle East & Africa Antiblock Additive Market

10.6.4 Country-Level Analysis

10.6.4.1 Iran

10.6.4.2 South Africa

10.6.4.3 Saudi Arabia

10.6.4.4 UAE

10.7 Central & South America

10.7.1 Inorganic Product Type Dominates the Central & South American Antiblock Additive Market

10.7.2 LLDPE to Witness Highest CAGR in Central & South American Antiblock Additive Market

10.7.3 Packaging Application to Account for the Largest Share in the Central & South American Antiblock Additive Market

10.7.4 Country-Level Analysis

10.7.4.1 Brazil

10.7.4.2 Argentina

11 Competitive Landscape (Page No. - 127)

11.1 Introduction

11.1.1 Dynamic

11.1.2 Innovator

11.1.3 Vanguard

11.1.4 Emerging

11.2 Overview

11.3 Product Offerings (For 17 Companies)

11.4 Business Strategy (For 17 Companies)

*Top 17 Companies Analyzed for This Study are W.R. Grace & Company (U.S.), Specialty Minerals Inc. (U.S.), Honeywell International Inc. (U.S.), Fine Organics (India), BYK Additives & Instruments (Germany), Imerys S.A. (France), Croda International PLC. (U.K.), Elementis PLC (U.K.), Shamrock Technologies Inc. (U.S.), Evonik Industries AG (Germany), Omya International AG (Switzerland), Momentive Performance Materials Inc. (U.S.), Hoffman Mineral GmbH (Germany), Bayshore Industrial, LLC (U.S.), J.M. Huber Corporation (U.S.), Unimin Corporation (U.S.), Quarzwerke Group (Germany)

12 Company Profiles (Page No. - 131)

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

12.1 Croda International PLC

12.2 Evonik Industries AG

12.3 Imerys SA

12.4 J.M. Huber Corporation

12.5 W.R. Grace & Company

12.6 Elementis PLC

12.7 Honeywell International Inc.

12.8 BYK Additives & Instruments

12.9 Fine Organics

12.10 Specialty Minerals Inc.

12.11 Other Key Market Players

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 159)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (117 Tables)

Table 1 Contribution of Agriculture to Gdp, By Country, 2015

Table 2 Antiblock Additive Market Size, By Product Type, 20142021 (Kiloton)

Table 3 Organic Antiblock Additive Market Size, By Region, 20142021 (Kiloton)

Table 4 Inorganic Antiblock Additive Market Size, By Region, 20142021 (Kiloton)

Table 5 Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 6 Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 7 LLDPE Based Antiblock Additive Market Size, By Region, 20142021 (USD Million)

Table 8 LLDPE Based Antiblock Additive Market Size, By Region, 20142021 (Kiloton)

Table 9 LDPE Based Antiblock Additive Market Size, By Region, 20142021 (USD Million)

Table 10 LDPE Based Antiblock Additive Market Size, By Region, 20142021 (Kiloton)

Table 11 HDPE Based Antiblock Additive Market Size, By Region, 20142021 (USD Million)

Table 12 HDPE Based Antiblock Additive Market Size, By Region, 20142021 (Kiloton)

Table 13 BOPP Based Antiblock Additive Market Size, By Region, 20142021 (USD Million)

Table 14 BOPP Based Antiblock Additive Market Size, By Region, 20142021 (Kiloton)

Table 15 PVC Based Antiblock Additive Market Size, By Region, 20142021 (USD Million)

Table 16 PVC Based Antiblock Additive Market Size, By Region, 20142021 (Kiloton)

Table 17 Other Antiblock Additive Market Size, By Region, 20142021 (USD Million)

Table 18 Other Antiblock Additive Market Size, By Region, 20142021 (Kiloton)

Table 19 Antiblock Additive Market Size, By Application, 20142021 (USD Million)

Table 20 Antiblock Additive Market Size, By Application, 20142021 (Kiloton)

Table 21 Antiblock Additive Market Size for Food Packaging, By Region, 20142021 (USD Million)

Table 22 Antiblock Additive Market Size for Food Packaging, By Region, 20142021 (Kiloton)

Table 23 Antiblock Additive Market Size for Pharmaceutical Packaging, By Region, 20142021 (USD Million)

Table 24 Antiblock Additive Market Size for Pharmaceutical Packaging, By Region, 20142021 (Kiloton)

Table 25 Antiblock Additive Market Size for Industrial Packaging, By Region, 20142021 (USD Million)

Table 26 Antiblock Additive Market Size for Industrial Packaging, By Region, 20142021 (Kiloton)

Table 27 Antiblock Additive Market Size for Other Packaging, By Region, 20142021 (USD Million)

Table 28 Antiblock Additive Market Size for Other Packaging, By Region, 20142021 (Kiloton)

Table 29 Antiblock Additive Market Size for Agriculture Films, By Region, 20142021 (USD Million)

Table 30 Antiblock Additive Market Size for Agriculture Films, By Region, 20142021 (Kiloton)

Table 31 Antiblock Additive Market Size for Medical, By Region, 20142021 (USD Million)

Table 32 Antiblock Additive Market Size for Medical, By Region, 20142021 (Kiloton)

Table 33 Antiblock Additive Market Size for Other Non-Packaging, By Region, 20142021 (USD Million)

Table 34 Antiblock Additive Market Size for Other Non-Packaging, By Region, 20142021 (Kiloton)

Table 35 Antiblock Additive Market Size, By Region, 20142021 (USD Million)

Table 36 Antiblock Additive Market Size, By Region, 20142021 (Kiloton)

Table 37 Asia-Pacific: Antiblock Additive Market Size, By Product Type, 20142021 (Kiloton)

Table 38 Asia-Pacific: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 39 Asia-Pacific: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 40 Asia-Pacific: Antiblock Additive Market Size, By Application, 20142021 (USD Million)

Table 41 Asia-Pacific: Antiblock Additive Market Size, By Application, 20142021 (Kiloton)

Table 42 Asia-Pacific: Antiblock Additive Market Size, By Country, 20142021 (USD Million)

Table 43 Asia-Pacific: Antiblock Additive Market Size, By Country, 20142021 (Kiloton)

Table 44 China: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 45 China: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 46 Japan: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 47 Japan: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 48 India: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 49 India: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 50 South Korea: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 51 South Korea: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 52 Taiwan: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 53 Taiwan: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 54 Indonesia: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 55 Indonesia: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 56 Australia: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 57 Australia: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 58 Europe: Antiblock Additive Market Size, By Product Type, 20142021 (Kiloton)

Table 59 Europe: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 60 Europe: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 61 Europe: Antiblock Additive Market Size, By Application, 20142021 (USD Million)

Table 62 Europe: Antiblock Additive Market Size, By Application, 20142021 (Kiloton)

Table 63 Europe: Antiblock Additive Market Size, By Country, 20142021 (USD Million)

Table 64 Europe: Antiblock Additive Market Size, By Country, 20142021 (Kiloton)

Table 65 Germany: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 66 Germany: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 67 France: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 68 France: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 69 U.K.: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 70 U.K.: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 71 Italy: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 72 Italy: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 73 Spain: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 74 Spain: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 75 Russia: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 76 Russia: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 77 Netherlands: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 78 Netherlands: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 79 North America: Antiblock Additive Market Size, By Product Type, 20142021 (Kiloton)

Table 80 North America: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 81 North America: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 82 North America: Antiblock Additive Market Size, By Application, 20142021 (USD Million)

Table 83 North America: Antiblock Additive Market Size, By Application, 20142021 (Kiloton)

Table 84 North America: Antiblock Additive Market Size, By Country, 20142021 (USD Million)

Table 85 North America: Antiblock Additive Market Size, By Country, 20142021 (Kiloton)

Table 86 U.S.: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 87 U.S.: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 88 Canada: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 89 Canada: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 90 Mexico: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 91 Mexico: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 92 Middle East & Africa: Antiblock Additive Market Size, By Product Type, 20142021 (Kiloton)

Table 93 Middle East & Africa: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 94 Middle East & Africa: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 95 Middle East & Africa: Antiblock Additive Market Size, By Application, 20142021 (USD Million)

Table 96 Middle East & Africa: Antiblock Additive Market Size, By Application, 20142021 (Kiloton)

Table 97 Middle East & Africa: Antiblock Additive Market Size, By Country, 20142021 (USD Million)

Table 98 Middle East & Africa: Antiblock Additive Market Size, By Country, 20142021 (Kiloton)

Table 99 Iran: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 100 Iran: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 101 South Africa: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 102 South Africa: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 103 Saudi Arabia: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 104 Saudi Arabia: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 105 UAE: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 106 UAE: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 107 Central & South America: Antiblock Additive Market Size, By Product Type, 20142021 (Kiloton)

Table 108 Central & South America: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 109 Central & South America: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 110 Central & South America: Antiblock Additive Market Size, By Application, 20142021 (USD Million)

Table 111 Central & South America: Antiblock Additive Market Size, By Application, 20142021 (Kiloton)

Table 112 Central & South America: Antiblock Additive Market Size, By Country, 20142021 (USD Million)

Table 113 Central & South America: Antiblock Additive Market Size, By Country, 20142021 (Kiloton)

Table 114 Brazil: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 115 Brazil: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

Table 116 Argentina: Antiblock Additive Market Size, By Polymer Type, 20142021 (USD Million)

Table 117 Argentina: Antiblock Additive Market Size, By Polymer Type, 20142021 (Kiloton)

List of Figures (33 Figures)

Figure 1 Antiblock Additive: Market Segmentation

Figure 2 Antiblock Additive Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Anti-Block Additive: Data Triangulation

Figure 6 Inorganic Type to Dominate Antiblock Additive Market, 2016-2021

Figure 7 LLDPE Constitutes A Majority Share in the Antiblock Additive Market, 2016-2021

Figure 8 Packaging Industry to Constitute A Major Share in Antiblock Additive Market, 2016-2021

Figure 9 Asia-Pacific to Register Highest CAGR in Antiblock Additive Market

Figure 10 Long-Term Prospects for Antiblock Additive Market Between 2016 and 2021

Figure 11 Asia-Pacific to Be Key Market for Antiblock Additive, 20162021

Figure 12 LLDPE Antiblock Additive Accounted for Largest Market Share in 2015

Figure 13 Asia-Pacific to Be the Fastest-Growing Region, 20162021

Figure 14 Packaging Accounted for the Larger Share Across All Regions, 2015

Figure 15 Overview of Factors Governing the Antiblock Additive Market

Figure 16 Porters Five Forces Analysis

Figure 17 Inorganic Additive to Dominate the Antiblock Additive Market

Figure 18 Asia-Pacific to Drive the Demand for Organic Antiblock Additive Market

Figure 19 Asia-Pacific to Drive the Demand for Inorganic Antiblock Additive

Figure 20 LLDPE to Dominate Antiblock Additive Market During Forecast Period

Figure 21 Asia-Pacific Dominated the Demand for LLDPE Based Antiblock Additive Market in 2016

Figure 22 Packaging Application to Dominate Antiblock Additive Market During Forecast Period

Figure 23 Regional Snapshot (20162021): Asia-Pacific Countries Emerging as New Hotspot for Antiblock Additive Market

Figure 24 Asia-Pacific Market Snapshot: China to Dominate Antiblock Additive Market

Figure 25 Dive Chart

Figure 26 Croda International PLC: Company Snapshot

Figure 27 Evonik Industries AG: Company Snapshot

Figure 28 Imerys SA: Company Snapshot

Figure 29 W.R. Grace & Company: Company Snapshot

Figure 30 Elementis PLC: Company Snapshot

Figure 31 Honeywell International Inc.: Company Snapshot

Figure 32 BYK Additives & Instruments: Company Snapshot

Figure 33 Specialty Minerals Inc.: Company Snapshot

Growth opportunities and latent adjacency in Antiblock Additive Market