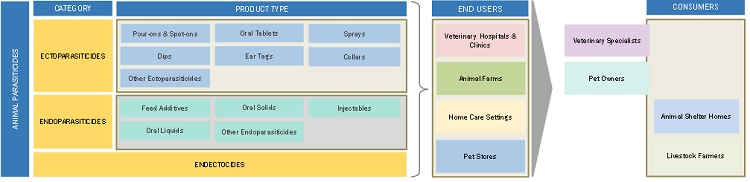

Animal Parasiticides Market by Type (Ectoparasiticides, Endoparasiticides, Endectocides), Animal Type (Dogs, Cats, Horses, Cattle, Pigs, Poultry, Goats), End User (Veterinary Hospitals, Animal farms, Home Care Settings) - Global Forecast to 2027

The global animal parasiticides market in terms of revenue was estimated to be worth $10.6 billion in 2022 and is poised to grow at a CAGR of 5.8% from 2022 to 2027.

The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The market for animal parasiticides is expanding as a result of factors like rising zoonotic disease concerns, rising rates of companion animal ownership, and growing private player investments. The veterinary health industry is anticipated to develop as a result of the rising populations of poultry and dairy animals in emerging regions, since poultry animals are more susceptible to parasite infections. This is also going to attract international investors to that regions.

Global Animal Parasiticides Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Animal Parasiticides Market Dynamics:

Drivers: Growing prevalence of animal diseases

Over the past ten years, a number of chronic diseases have become more common in animals throughout the world. One in six pets in the US is overweight, according to the State of Pet Health report from Banfield Pet Hospital. According to Nationwide Pet Insurance, claims for cancer diagnosis and treatment by pet owners would total over USD 53 million in 2021, making cancer-related disorders one of the most prevalent categories of medical claims. Conditions such as pet obesity, equine lameness, prevalence of diabetes mellitus in dogs and cats and many others will increase the demand for animal health medicine products during the forecast period.

Restraints: Shift toward vegetarianism

Obesity and other chronic diseases are becoming more prevalent on a global scale. Because of this, a lot of individuals are switching from a mostly non-vegetarian diet to a vegetarian one. The US Department of Agriculture releases dietary guidelines on a timely basis. These recommendations promote the use of whole grains, fruits, and vegetables, as well as low-fat milk and its substitutes. According to the Guardian, 125,000 of the 500,000 people who joined the 2021 Veganuary pledge to only eat plant-based foods in January were situated in the UK. Additionally, the consumption of meat has decreased as a result of the rise in bird flu cases and diseases brought on by meat eating, such as swine flu and COVID-19. This is anticipated to limit the expansion of market, to some extent.

Opportunities: Emerging market potential for lucrative development

Ownership of companion animals has steadily increased over the past few years, particularly in developing nations like India, China, Brazil, and other nations in the Asia Pacific and Latin America. Pet ownership is on the rise in these nations due to rapid urbanization and rising disposable incomes. In these countries, many pet owners are now prepared to pay more on their pet care. Regions with emerging countries offer high-growth opportunities for market players in animal parasiticides due to the rise in the population of companion animals, the rising demand for animal food products, the enormous population of livestock animals, and the rising animal health expenditure in emerging nations throughout Asia Pacific and Latin America.

Challenges: Developing resistance to parasiticides

In the animal health industry, parasite resistance to parasiticides is a major problem. To combat this, most farmers and pet owners choose to up the dosage or alter the parasiticides they employ. On the other hand, this could be damaging in the long term and lead to parasite species that are multi-drug resistant. Ticks have developed a greater resistance to pesticides over time. Most parasitic infections show changes in parasite biology, genetics, resilience, and behavior, according to scientific experts. It is really concerning that parasite illnesses have changed. The AVMA recommends that veterinarians and pet owners use the most recent recommendations, medications, and evidence-based practices for parasite prevention.

Animal Parasiticide Ecosystem

The ecosystem of the animal parasiticides market is made up of the components that are present there and specifies these components with a list of the organizations involved. Manufacturers of different animal parasiticides include the businesses engaged in research, product development, optimization, and introduction of such goods. These products and formulations are used to prevent and cure parasite infections in animals. Distributors include third parties and e-commerce sites affiliated with the organization for selling these parasiticides, whereas end users are the areas where animal parasiticides are used to prevent and cure parasite-borne illnesses, The major players in the market for animal parasiticides are these customers.

Ectoparasiticides segment of Animal Parasiticides Market is expected to witness the fastest growth in the forecast period.

The market for animal parasiticides is divided into three types based on type such as Endoparasiticides, Ectoparasiticides, and Endectocides. The market category for Ectoparasiticides is anticipated to grow at the fastest rate between 2022 and 2027. The rise in pet ownership and the number of companion animals in developed nations are additional factors that are expected to boost market expansion throughout the projected period.

The market for companion animals is anticipated to develop at the fastest rate over the projected period.

The market is divided into two segments such as companion animals and livestock animals. The market for animal parasiticides worldwide was dominated by companion animals in 2021. The increased spending on companion animals and increased pet ownership in developed as well emerging countries will mostly be the reason for the rapid growth of this segment in the forecast period.

Veterinary Clinics & Hospitals accounted for the largest share of the animal parasiticides market in 2021.

The market is divided into veterinary practices & hospitals, animal farms, and home care settings based on end users. In 2021, veterinary hospitals and clinics held the highest market share for animal parasiticides. The increased use of animal parasiticides in healthcare facilities, the rise in parasitic diseases, and the rising concern over animal health in developing nations are all factors that contribute to the big proportion of this market.

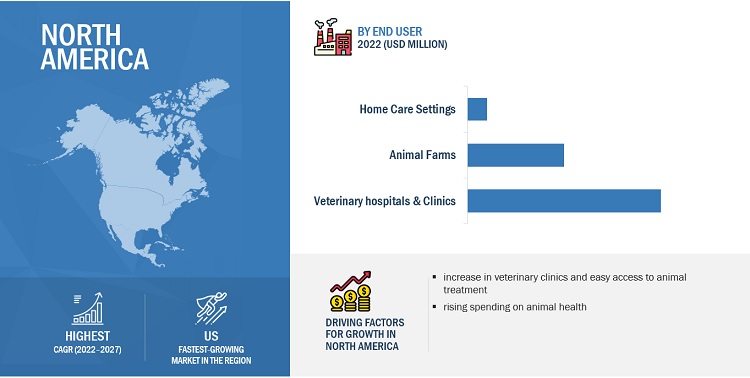

North America accounted for the largest share of the animal parasiticides market in 2021"

The market is divided into five regions based on geography: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2021, North America held the greatest market share for animal parasiticides worldwide. It is anticipated that a major driver impacting the North America market growth would be the significant and expanding animal population in the US and Canada. This is supported by an increase in veterinary clinics and easy access to animal treatment.

The significant market share of North America is related to the region's well-established animal health industry, rising spending on animal health, rising consumption of food items produced from animals, and rising adoption of pets.

To know about the assumptions considered for the study, download the pdf brochure

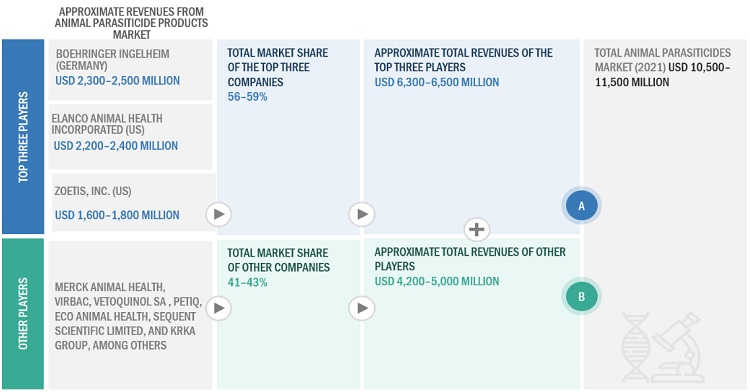

Key players in the animal parasiticides market are Zoetis Inc. (US), Elanco Animal Health Incorporated (US), Virbac (France), Merck & Co., Inc. (US), Boehringer Ingelheim GmbH (Germany), Ceva Santé Animale (France), Vetoquinol S.A. (France), PetIQ, Inc. (US), Norbrook (Ireland), and Bimeda Animal Health (Ireland).

Animal Parasiticides Market Report Scope:

|

Report Metric |

Details |

|

Market Size Available for Years |

2020–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Unit |

Value (USD Million) |

|

Segments Covered |

By Product type, Animal type, End user and Region |

|

Countries Covered |

|

The research report categorizes Animal Parasiticides Market into the following segments and sub-segments:

By Type

- Ectoparasiticides

- Endoparasiticides

- Endectocides

By Animal Type

- Companion Animals

- Livestock Animals

By End User

- Veterinary Clinics & Hospitals

- Animal Farms

- Home Care Settings

By Country

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Australia

- Japan

- India

- Rest of APAC

-

Latin America

- Brazil

- Rest of LATAM

-

Middle East and Africa

- Turkey

- Rest of MEA

Recent Developments:

- In January 2022, Zoetis Inc. received USFDA approval for Simparica Trio, a new label indication for Simparica Trio (sarolaner, moxidectin, and pyrantel chewable tablets) for the prevention of Borrelia burgdorferi infections.

- In July 2022, Virbac launched TENOTRYLTM (enrofloxacin) injectable solution in the USA for cattle and swine.

- In January 2021, Boehringer Ingelheim received marketing authorization from the EMA and European Commission for NexGard COMBO topical solution for cats.

- In May 2021, Elanco animal health launched chewable tablets for fleas and tick protection for cats.

Frequently Asked Questions (FAQ):

What is the projected market value of the global animal parasiticides market?

The global market of animal parasiticides is projected to reach USD 14.1 billion.

What is the estimated growth rate (CAGR) of the global animal parasiticides market for the next five years?

The global animal parasiticides market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% from 2020 to 2025.

What are the major revenue pockets in the animal parasiticides market currently?

The animal parasiticides market is divided into five regions based on geography: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2021, North America held the greatest market share for animal parasiticides worldwide. It is anticipated that a major driver impacting the North America market growth would be the significant and expanding animal population in the US and Canada. This is supported by an increase in veterinary clinics and easy access to animal treatment.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand for animal-derived food products- Increasing investments by private players- Growing concerns of zoonotic diseases- Regulations for preventing spread of animal diseases- Growing companion animal ownership rates- Growing prevalence of animal diseases- Rising animal health expenditureRESTRAINTS- Regulations restricting use of parasiticides for food-producing animals- Shift toward vegetarianism- Novel drug development modelsOPPORTUNITIES- Lucrative growth opportunities in emerging marketsCHALLENGES- Growing resistance to parasiticides- Stringent regulatory approval process for drugs- Diversity in parasite species

-

5.3 PRICING ANALYSISAVERAGE SELLING PRICE OF ANIMAL PARASITICIDES, BY TYPEAVERAGE SELLING PRICE TRENDS

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 PATENT ANALYSISTOP APPLICANTS (COMPANIES/INSTITUTES) FOR ANIMAL PARASITICIDES

- 5.7 VALUE CHAIN ANALYSIS

-

5.8 CASE STUDIES

-

5.9 REGULATORY ANALYSISREGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America- Europe- Asia Pacific and Rest of the World

-

5.10 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTES

- 5.11 ADJACENT MARKET ANALYSIS

- 5.12 KEY CONFERENCES AND EVENTS DURING 2023–2024

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.14 TRADE ANALYSIS

-

5.15 INDUSTRY TRENDSGROWING CONSOLIDATION IN ANIMAL HEALTH INDUSTRYINNOVATIONS IN ANIMAL PARASITICIDES

- 5.16 IMPACT OF INFLATION AND RECESSION ON ANIMAL PARASITICIDES MARKET

- 6.1 INTRODUCTION

-

6.2 ECTOPARASITICIDESPOUR-ONS & SPOT-ONS- Ease of application to support adoptionORAL TABLETS- High medication compliance and ease of administration to drive marketSPRAYS- Low price and convenience to drive marketDIPS- High popularity ensured sustained end-user demandEAR TAGS- Highly effective in controlling flies around cattleCOLLARS- Growing prevalence of infections in companion animals to drive adoptionOTHER ECTOPARASITICIDES

-

6.3 ENDOPARASITICIDESORAL LIQUIDS- Growing demand for meat and milk products to drive marketORAL SOLIDS- Emergence of internal parasitic infections in dogs to drive marketINJECTABLES- Mostly used in food-producing animalsFEED ADDITIVES- Can be administered to large number of animals at onceOTHER ENDOPARASITICIDES

-

6.4 ENDECTOCIDESPOTENTIAL TO TREAT BOTH INTERNAL AND EXTERNAL PARASITE INFECTIONS

- 7.1 INTRODUCTION

-

7.2 COMPANION ANIMALSDOGS- Most adopted companion animalsCATS- High vulnerability to parasitic infections to support market growthHORSES- Rising need for equine parasitic control to drive marketOTHER COMPANION ANIMALS

-

7.3 LIVESTOCKCATTLE- Susceptible to parasitic infestations and diseases due to internal parasitesPIGS- Growing pork consumption to drive demand for parasiticidesPOULTRY- Growing egg consumption in emerging countries to drive demand for parasiticidesSHEEP & GOATS- Growth in consumption of sheep and goat meat to drive marketOTHER LIVESTOCK

- 8.1 INTRODUCTION

-

8.2 VETERINARY HOSPITALS AND CLINICSHIGH ADOPTION OF ANIMAL PARASITICIDES IN VETERINARY HOSPITALS AND CLINICS TO DRIVE MARKET

-

8.3 ANIMAL FARMSINCREASING INCIDENCE OF PARASITIC INFECTIONS IN LIVESTOCK TO SUPPORT MARKET GROWTH

-

8.4 HOME CARE SETTINGSRISING PET OWNERSHIP AND AWARENESS TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAIMPACT OF RECESSION ON ANIMAL PARASITICIDES MARKET IN NORTH AMERICAUS- Rising pet expenditure and increasing meat consumption to drive marketCANADA- Growing pet adoption to support market growth

-

9.3 EUROPEIMPACT OF RECESSION ON ANIMAL PARASITICIDES MARKET IN EUROPEGERMANY- Growing demand for quality animal-derived food products to drive marketUK- Increasing pet ownership to drive marketFRANCE- Presence of major market players to propel market growthSPAIN- Increasing animal health expenditure to drive marketITALY- Need to curb zoonotic diseases in livestock to propel marketREST OF EUROPE

-

9.4 ASIA PACIFICIMPACT OF RECESSION ON ANIMAL PARASITICIDES MARKET IN ASIA PACIFICCHINA- Increasing pet expenditure and companion animal ownership to propel marketAUSTRALIA & NEW ZEALAND- Rising livestock population and increasing awareness about parasitic infections to drive marketJAPAN- Rising pet care expenditure to propel marketINDIA- Rising demand for animal-derived food products to support market growthSOUTH KOREA- Rising investments in animal healthcare infrastructure to propel marketREST OF ASIA PACIFIC

-

9.5 LATIN AMERICAIMPACT OF RECESSION ON ANIMAL PARASITICIDES MARKET IN LATIN AMERICABRAZIL- Growing prevalence of zoonotic diseases to drive marketREST OF LATIN AMERICA

-

9.6 MIDDLE EAST AND AFRICAIMPACT OF RECESSION ON ANIMAL PARASITICIDES MARKET IN MIDDLE EAST AND AFRICATURKEY- Increase in companion animal population to drive marketREST OF MIDDLE EAST AND AFRICA

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES

- 10.3 REVENUE SHARE ANALYSIS FOR KEY PLAYERS IN ANIMAL PARASITICIDES MARKET

- 10.4 MARKET SHARE ANALYSIS

- 10.5 R&D ASSESSMENT OF KEY PLAYERS

-

10.6 COMPANY EVALUATION QUADRANTSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

10.7 COMPETITIVE LEADERSHIP MAPPING FOR SMES AND STARTUPSPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIES

-

10.8 COMPETITIVE BENCHMARKINGOVERALL COMPANY FOOTPRINT

-

10.9 COMPETITIVE SCENARIOPRODUCT LAUNCHES AND APPROVALSDEALSOTHER DEVELOPMENTS

-

11.1 KEY PLAYERSBOEHRINGER INGELHEIM GMBH- Business overview- Products offered- Recent developments- MnM viewZOETIS INC.- Business overview- Products offered- Recent developments- MnM viewELANCO ANIMAL HEALTH INCORPORATED- Business overview- Products offered- Recent developments- MnM viewMERCK & CO., INC- Business overview- Products offered- Recent developments- MnM viewVIRBAC- Business overview- Products offered- Recent developments- MnM viewVETOQUINOL S.A.- Business overview- Products offered- Recent developmentsPETIQ, LLC- Business overview- Products offered- Recent developmentsSEQUENT SCIENTIFIC LIMITED- Business overview- Products offered- Recent developmentsKRKA GROUP- Business overview- Products offeredECO ANIMAL HEALTH GROUP PLC- Business overview- Products offered

-

11.2 OTHER PLAYERSCEVA SANTÉ ANIMALE- Business overview- Products offered- Recent developmentsCHANELLE PHARMA- Business overview- Products offeredBIMEDA ANIMAL HEALTH- Business overview- Products offered- Recent developmentsNORBROOK- Business overview- Products offeredKYORITSU SEIYAKU CORPORATION- Business overview- Products offeredSMARTVET HOLDINGS, INC.- Business overview- Products offeredUCBVET- Business overview- Products offeredCALIER- Business overview- Products offeredABBEY ANIMAL HEALTH PTY LTD.- Business overview- Products offeredBIOGÉNESIS BAGÓ- Business overview- Products offeredPRN PHARMACAL- Business overview- Products offeredLUTIM PHARMA PRIVATE LIMITED- Business overview- Products offeredVETANCO SA- Business overview- Products offeredBRILLIANT BIO PHARMA- Business overview- Products offeredZUCHE PHARMACEUTICALS PVT. LTD.- Business overview- Products offered

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 PARASITICIDES AND RESISTANT PARASITES

- TABLE 2 AVERAGE SELLING PRICE OF ANIMAL PARASITICIDES, BY TYPE (USD)

- TABLE 3 US: RECENT DEVELOPMENTS IN REGULATIONS FOR VETERINARY DRUGS

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC AND REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 PORTER’S FIVE FORCES ANALYSIS: ANIMAL PARASITICIDES MARKET (2021)

- TABLE 8 ANIMAL PARASITICIDES MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TYPES OF ANIMAL PARASITICIDES

- TABLE 10 KEY BUYING CRITERIA FOR TOP THREE TYPES OF ANIMAL PARASITICIDES

- TABLE 11 MAJOR ACQUISITIONS IN ANIMAL PARASITICIDES INDUSTRY (2019–2021)

- TABLE 12 INNOVATIVE ANIMAL PHARMACEUTICAL TRENDS

- TABLE 13 ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 14 ANIMAL PARASITICIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 15 EXAMPLES OF ECTOPARASITICIDES AVAILABLE IN MARKET

- TABLE 16 ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 17 ECTOPARASITICIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 18 POUR-ONS & SPOT-ONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 19 ORAL TABLETS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 20 SPRAYS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 21 DIPS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 22 EAR TAGS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 23 COLLARS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 24 OTHER ECTOPARASITICIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 25 EXAMPLES OF ENDOPARASITICIDES AVAILABLE IN MARKET

- TABLE 26 ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 27 ENDOPARASITICIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 28 ORAL LIQUIDS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 29 ORAL SOLIDS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 30 INJECTABLES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 31 FEED ADDITIVES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 32 OTHER ENDOPARASITICIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 33 EXAMPLES OF ENDECTOCIDES AVAILABLE IN MARKET

- TABLE 34 ENDECTOCIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 35 ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 36 COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 37 COMPANION ANIMAL PARASITICIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 38 COMPANION ANIMAL PARASITICIDES MARKET FOR DOGS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 39 COMPANION ANIMAL PARASITICIDES MARKET FOR CATS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 40 HORSE POPULATION, BY REGION, 2016–2019 (MILLION)

- TABLE 41 COMPANION ANIMAL PARASITICIDES MARKET FOR HORSES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 42 OTHER COMPANION ANIMAL PARASITICIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 43 LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 44 LIVESTOCK PARASITICIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 45 LIVESTOCK PARASITICIDES MARKET FOR CATTLE, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 46 LIVESTOCK PARASITICIDES MARKET FOR PIGS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 47 LIVESTOCK PARASITICIDES MARKET FOR POULTRY, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 48 LIVESTOCK PARASITICIDES MARKET FOR SHEEP & GOATS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 49 OTHER LIVESTOCK PARASITICIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 50 ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 51 ANIMAL PARASITICIDES MARKET FOR VETERINARY HOSPITALS AND CLINICS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 52 ANIMAL PARASITICIDES MARKET FOR ANIMAL FARMS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 53 ANIMAL PARASITICIDES MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 54 ANIMAL PARASITICIDES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 55 NORTH AMERICA: ANIMAL PARASITICIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 56 NORTH AMERICA: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 57 NORTH AMERICA: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 58 NORTH AMERICA: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 59 NORTH AMERICA: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 60 NORTH AMERICA: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 61 NORTH AMERICA: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 62 NORTH AMERICA: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 63 US: PRIVATE CLINICAL PRACTICES, BY ANIMAL TYPE, 2018 VS. 2019 VS. 2020

- TABLE 64 US: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 65 US: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 66 US: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 67 US: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 68 US: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 69 US: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 70 US: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 71 CANADA: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 72 CANADA: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 73 CANADA: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 74 CANADA: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 75 CANADA: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 76 CANADA: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 77 CANADA: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 78 EUROPE: LIVESTOCK POPULATION, BY TYPE, 2011–2021 (MILLION)

- TABLE 79 EUROPE: ANIMAL PARASITICIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 80 EUROPE: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 81 EUROPE: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 82 EUROPE: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 83 EUROPE: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 84 EUROPE: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 85 EUROPE: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 86 EUROPE: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 87 GERMANY: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 88 GERMANY: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 89 GERMANY: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 90 GERMANY: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 91 GERMANY: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 92 GERMANY: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 93 GERMANY: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 94 UK: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 95 UK: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 96 UK: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 97 UK: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 98 UK: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 99 UK: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 100 UK: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 101 FRANCE: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 102 FRANCE: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 103 FRANCE: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 104 FRANCE: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 105 FRANCE: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 106 FRANCE: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 107 FRANCE: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 108 SPAIN: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 109 SPAIN: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 110 SPAIN: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 111 SPAIN: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 112 SPAIN: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 113 SPAIN: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 114 SPAIN: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 115 ITALY: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 116 ITALY: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 117 ITALY: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 118 ITALY: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 119 ITALY: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 120 ITALY: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 121 ITALY: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 122 REST OF EUROPE: COMPANION ANIMAL OWNERSHIP, BY COUNTRY, 2021 (MILLION)

- TABLE 123 REST OF EUROPE: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 124 REST OF EUROPE: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 125 REST OF EUROPE: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 126 REST OF EUROPE: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 127 REST OF EUROPE: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 128 REST OF EUROPE: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 129 REST OF EUROPE: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 130 ASIA PACIFIC: ANIMAL PARASITICIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 131 ASIA PACIFIC: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 132 ASIA PACIFIC: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 133 ASIA PACIFIC: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 134 ASIA PACIFIC: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 135 ASIA PACIFIC: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 136 ASIA PACIFIC: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 137 ASIA PACIFIC: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 138 CHINA: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 139 CHINA: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 140 CHINA: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 141 CHINA: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 142 CHINA: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 143 CHINA: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 144 CHINA: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 145 AUSTRALIA & NEW ZEALAND: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 146 AUSTRALIA & NEW ZEALAND: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 147 AUSTRALIA & NEW ZEALAND: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 148 AUSTRALIA & NEW ZEALAND: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 149 AUSTRALIA & NEW ZEALAND: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 150 AUSTRALIA & NEW ZEALAND: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 151 AUSTRALIA & NEW ZEALAND: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 152 JAPAN: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 153 JAPAN: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 154 JAPAN: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 155 JAPAN: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 156 JAPAN: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 157 JAPAN: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 158 JAPAN: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 159 INDIA: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 160 INDIA: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 161 INDIA: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 162 INDIA: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 163 INDIA: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 164 INDIA: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 165 INDIA: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 166 SOUTH KOREA: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 167 SOUTH KOREA: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 168 SOUTH KOREA: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 169 SOUTH KOREA: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 170 SOUTH KOREA: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 171 SOUTH KOREA: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 172 SOUTH KOREA: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 174 REST OF ASIA PACIFIC: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 177 REST OF ASIA PACIFIC: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 179 REST OF ASIA PACIFIC: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 180 LATIN AMERICA: ANIMAL PARASITICIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 181 LATIN AMERICA: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 182 LATIN AMERICA: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 183 LATIN AMERICA: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 184 LATIN AMERICA: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 185 LATIN AMERICA: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 186 LATIN AMERICA: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 187 LATIN AMERICA: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 188 BRAZIL: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 189 BRAZIL: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 190 BRAZIL: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 191 BRAZIL: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 192 BRAZIL: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 193 BRAZIL: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 194 BRAZIL: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 195 REST OF LATIN AMERICA: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 196 REST OF LATIN AMERICA: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 197 REST OF LATIN AMERICA: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 198 REST OF LATIN AMERICA: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 199 REST OF LATIN AMERICA: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 200 REST OF LATIN AMERICA: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 201 REST OF LATIN AMERICA: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 202 MIDDLE EAST AND AFRICA: ANIMAL PARASITICIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 203 MIDDLE EAST AND AFRICA: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 204 MIDDLE EAST AND AFRICA: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 205 MIDDLE EAST AND AFRICA: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 206 MIDDLE EAST AND AFRICA: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 207 MIDDLE EAST AND AFRICA: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 208 MIDDLE EAST AND AFRICA: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 209 MIDDLE EAST AND AFRICA: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 210 TURKEY: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 211 TURKEY: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 212 TURKEY: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 213 TURKEY: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 214 TURKEY: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 215 TURKEY: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 216 TURKEY: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 217 REST OF MIDDLE EAST AND AFRICA: ANIMAL PARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 218 REST OF MIDDLE EAST AND AFRICA: ECTOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 219 REST OF MIDDLE EAST AND AFRICA: ENDOPARASITICIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 220 REST OF MIDDLE EAST AND AFRICA: ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 221 REST OF MIDDLE EAST AND AFRICA: COMPANION ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 222 REST OF MIDDLE EAST AND AFRICA: LIVESTOCK PARASITICIDES MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 223 REST OF MIDDLE EAST AND AFRICA: ANIMAL PARASITICIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 224 ANIMAL PARASITICIDES MARKET: DEGREE OF COMPETITION

- TABLE 225 OVERALL COMPANY FOOTPRINT

- TABLE 226 COMPANY FOOTPRINT ANALYSIS, BY TYPE

- TABLE 227 COMPANY FOOTPRINT ANALYSIS, BY ANIMAL TYPE

- TABLE 228 COMPANY FOOTPRINT ANALYSIS, BY END USER

- TABLE 229 COMPANY FOOTPRINT ANALYSIS, BY REGION

- TABLE 230 PRODUCT LAUNCHES AND APPROVALS, JANUARY 2019–FEBRUARY 2023

- TABLE 231 DEALS, JANUARY 2019–FEBRUARY 2023

- TABLE 232 OTHER DEVELOPMENTS, JANUARY 2019–FEBRUARY 2023

- TABLE 233 BOEHRINGER INGELHEIM GMBH: BUSINESS OVERVIEW

- TABLE 234 ZOETIS INC.: BUSINESS OVERVIEW

- TABLE 235 ELANCO ANIMAL HEALTH INCORPORATED: BUSINESS OVERVIEW

- TABLE 236 MERCK & CO., INC.: BUSINESS OVERVIEW

- TABLE 237 VIRBAC: BUSINESS OVERVIEW

- TABLE 238 VETOQUINOL S.A.: BUSINESS OVERVIEW

- TABLE 239 PETIQ, LLC: BUSINESS OVERVIEW

- TABLE 240 SEQUENT SCIENTIFIC LIMITED: BUSINESS OVERVIEW

- TABLE 241 KRKA GROUP: BUSINESS OVERVIEW

- TABLE 242 ECO ANIMAL HEALTH GROUP PLC: BUSINESS OVERVIEW

- TABLE 243 CEVA SANTÉ ANIMALE: BUSINESS OVERVIEW

- TABLE 244 CHANELLE PHARMA: BUSINESS OVERVIEW

- TABLE 245 BIMEDA ANIMAL HEALTH: BUSINESS OVERVIEW

- TABLE 246 NORBROOK: BUSINESS OVERVIEW

- TABLE 247 KYORITSU SEIYAKU CORPORATION: BUSINESS OVERVIEW

- TABLE 248 SMARTVET HOLDINGS, INC.: BUSINESS OVERVIEW

- TABLE 249 UCBVET: BUSINESS OVERVIEW

- TABLE 250 CALIER: BUSINESS OVERVIEW

- TABLE 251 ABBEY ANIMAL HEALTH PTY LTD.: BUSINESS OVERVIEW

- TABLE 252 BIOGÉNESIS BAGÓ: BUSINESS OVERVIEW

- TABLE 253 PRN PHARMACAL: BUSINESS OVERVIEW

- TABLE 254 LUTIM PHARMA PRIVATE LIMITED: BUSINESS OVERVIEW

- TABLE 255 VETANCO SA: BUSINESS OVERVIEW

- TABLE 256 BRILLIANT BIO PHARMA: BUSINESS OVERVIEW

- TABLE 257 ZUCHE PHARMACEUTICALS PVT. LTD.: BUSINESS OVERVIEW

- FIGURE 1 ANIMAL PARASITICIDES MARKET SEGMENTATION

- FIGURE 2 ANIMAL PARASITICIDES MARKET, BY REGION

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 PRIMARY SOURCES

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

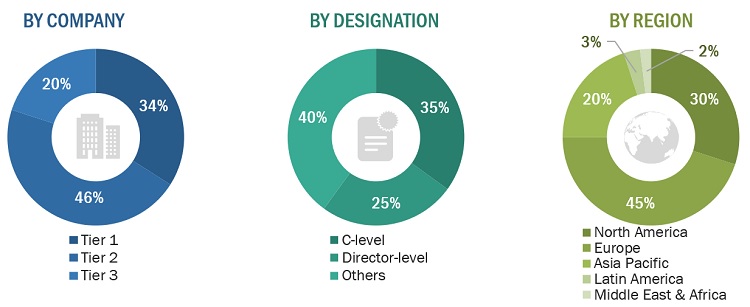

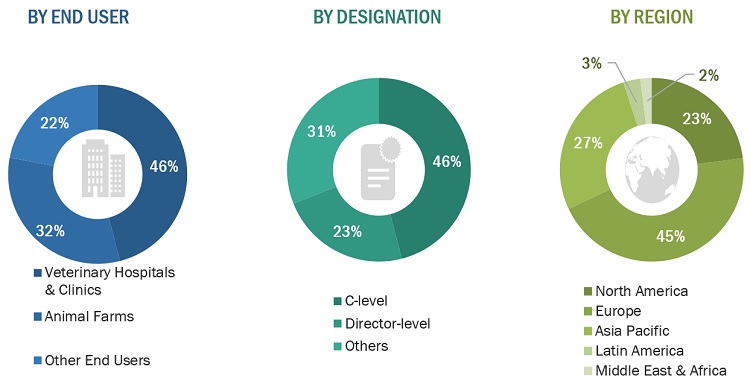

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND-SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 8 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 9 REVENUE SHARE ANALYSIS ILLUSTRATION: ZOETIS INC.

- FIGURE 10 SUPPLY-SIDE ANALYSIS: ANIMAL PARASITICIDES MARKET (2021)

- FIGURE 11 COUNTRY-LEVEL ANALYSIS OF ANIMAL PARASITICIDES MARKET

- FIGURE 12 BOTTOM-UP APPROACH

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ANIMAL PARASITICIDES MARKET (2022–2027): IMPACT ON MARKET GROWTH AND CAGR

- FIGURE 14 CAGR PROJECTIONS

- FIGURE 15 TOP-DOWN APPROACH

- FIGURE 16 MARKET DATA TRIANGULATION METHODOLOGY

- FIGURE 17 ANIMAL PARASITICIDES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 18 ANIMAL PARASITICIDES MARKET, BY ANIMAL TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 19 ANIMAL PARASITICIDES MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 20 GEOGRAPHICAL SNAPSHOT OF ANIMAL PARASITICIDES MARKET

- FIGURE 21 GROWING PREVALENCE OF ANIMAL DISEASES AND RISING DEMAND FOR ANIMAL-DERIVED FOOD PRODUCTS TO DRIVE MARKET

- FIGURE 22 ECTOPARASITICIDES SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC ANIMAL PARASITICIDES MARKET IN 2021

- FIGURE 23 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 24 NORTH AMERICA TO CONTINUE TO DOMINATE ANIMAL PARASITICIDES MARKET IN 2027

- FIGURE 25 DEVELOPING COUNTRIES TO OFFER GROWTH OPPORTUNITIES TO MARKET PLAYERS DURING FORECAST PERIOD

- FIGURE 26 ANIMAL PARASITICIDES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 27 WORLD MILK PRODUCTION ESTIMATES (2021–2030)

- FIGURE 28 WORLD MEAT PRODUCTION ESTIMATES (2021–2030)

- FIGURE 29 EUROPE: PET POPULATION

- FIGURE 30 US: INCREASING PET EXPENDITURE, 2010–2021 (USD BILLION)

- FIGURE 31 EUROPE: ANNUAL VALUE OF PET-RELATED PRODUCTS, 2010–2021 (EUR BILLION)

- FIGURE 32 SUPPLY CHAIN ANALYSIS: ANIMAL PARASITICIDES MARKET

- FIGURE 33 ECOSYSTEM ANALYSIS: ANIMAL PARASITICIDES MARKET

- FIGURE 34 PATENT PUBLICATION TRENDS (JANUARY 2013–FEBRUARY 2023)

- FIGURE 35 TOP APPLICANTS (COMPANIES/INSTITUTES) FOR ANIMAL PARASITICIDE PATENTS (2013–2023)

- FIGURE 36 VALUE CHAIN ANALYSIS: ANIMAL PARASITICIDES MARKET

- FIGURE 37 CASE STUDY: MARKET ASSESSMENT FOR COMPANION ANIMALS

- FIGURE 38 CASE STUDY: OPPORTUNITY ANALYSIS FOR BROAD-SPECTRUM PARASITICIDES

- FIGURE 39 ANIMAL ANTIBIOTICS AND ANTIMICROBIALS MARKET: MARKET OVERVIEW

- FIGURE 40 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TYPES OF ANIMAL PARASITICIDES

- FIGURE 41 PRODUCTION OF MEAT WORLDWIDE, BY TYPE, 2016–2020

- FIGURE 42 LEADING EGG-PRODUCING COUNTRIES WORLDWIDE, 2019

- FIGURE 43 ANIMAL PARASITICIDES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 44 NORTH AMERICA: ANIMAL PARASITICIDES MARKET SNAPSHOT

- FIGURE 45 US: PET ADOPTION DURING COVID-19 PANDEMIC

- FIGURE 46 US: INCREASE IN PET EXPENDITURE, 2011–2021 (USD BILLION)

- FIGURE 47 US: BEEF CONSUMPTION, 2011–2021 (BILLION POUNDS)

- FIGURE 48 NETHERLANDS: NUMBER OF DAIRY COWS, 2011–2020 (THOUSAND)

- FIGURE 49 ASIA PACIFIC: ANIMAL PARASITICIDES MARKET SNAPSHOT

- FIGURE 50 CHINA: CONSUMPTION OF PORK PRODUCTS PER CAPITA, 2011–2021 (KILOGRAMS)

- FIGURE 51 OVERVIEW OF STRATEGIES ADOPTED BY MAJOR PLAYERS IN ANIMAL PARASITICIDES MARKET

- FIGURE 52 REVENUE ANALYSIS FOR KEY PLAYERS IN ANIMAL PARASITICIDES MARKET

- FIGURE 53 ANIMAL PARASITICIDES MARKET SHARE ANALYSIS, BY KEY PLAYER, 2021

- FIGURE 54 ANIMAL PARASITICIDES MARKET: COMPANY EVALUATION MATRIX, 2021

- FIGURE 55 ANIMAL PARASITICIDES MARKET: COMPANY EVALUATION MATRIX FOR SMES AND STARTUPS, 2021

- FIGURE 56 BOEHRINGER INGELHEIM GMBH: COMPANY SNAPSHOT (2021)

- FIGURE 57 ZOETIS INC.: COMPANY SNAPSHOT (2021)

- FIGURE 58 ELANCO ANIMAL HEALTH INCORPORATED: COMPANY SNAPSHOT (2021)

- FIGURE 59 MERCK & CO., INC.: COMPANY SNAPSHOT (2021)

- FIGURE 60 VIRBAC: COMPANY SNAPSHOT (2021)

- FIGURE 61 VETOQUINOL S.A.: COMPANY SNAPSHOT (2021)

- FIGURE 62 PETIQ, LLC: COMPANY SNAPSHOT (2021)

- FIGURE 63 SEQUENT SCIENTIFIC LIMITED: COMPANY SNAPSHOT (2021)

- FIGURE 64 KRKA GROUP: COMPANY SNAPSHOT (2021)

- FIGURE 65 ECO ANIMAL HEALTH GROUP PLC: COMPANY SNAPSHOT (2021)

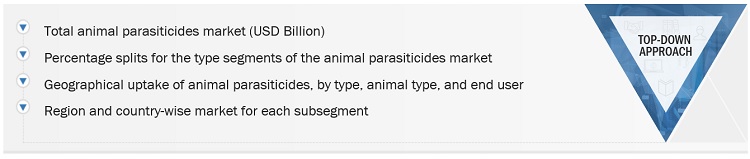

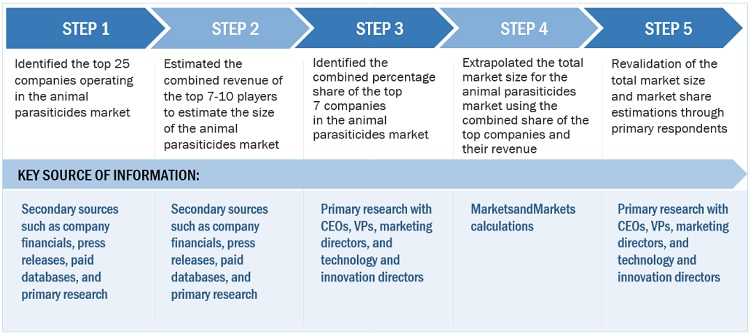

The market size for animal parasiticides was estimated using four main methods in this study. The market, as well as its peer and parent markets, were the subject of extensive research. The subsequent phase involved doing primary research to confirm these conclusions, presumptions, and estimates with industry professionals across the value chain. For the purpose of estimating the value market, top-down and bottom-up strategies were both used. The market size of segments and subsegments was then estimated using market breakdown and data triangulation processes.

Secondary Research

There were several secondary sources used in this study, including directories, databases like Bloomberg Business, Factiva, and Dun & Bradstreet, white papers, annual reports, corporate house documents, investor presentations, and firm SEC filings. In order to find and gather data for the detailed, technical, market-focused, and commercial analysis of the animal parasiticides market, secondary research was carried out. Relevant information on major companies, market classification and segmentation according to industry trends down to the most basic level, and significant changes regarding market and technological views were also obtained. Additionally, utilizing secondary research, a database of the important industry executives was created.

Primary Research

To gather qualitative and quantitative data for this study, a variety of sources from the supply and demand sides were interviewed during the main research phase. CEOs, vice presidents, marketing and sales directors, business development managers, technology and innovation directors of animal parasiticide manufacturing businesses, key opinion leaders, suppliers, and distributors are the main sources on the supply side. Veterinary hospitals and clinics, research facilities, academic institutions, and contract manufacturing companies are some of the main demand-side suppliers.

The breakup of primary research:

Supply Side

To know about the assumptions considered for the study, download the pdf brochure

Demand Side

Market Size Estimation

The market size for animal parasiticides was calculated using data from four different sources, as will be discussed below. Each technique concluded and a weighted average of the four ways was calculated based on the number of assumptions each approach made. The market size for animal parasiticides was calculated using data from four distinct sources, as will be discussed below:

Animal parasiticide market: Bottoms up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Animal parasiticide market: Top down approach

Animal parasiticide market: Revenue Share Analysis

Animal parasiticide market: Country Level Analysis

Data Triangulation

The entire market was split up into a number of segments and subsegments when the market size was determined. Data triangulation and market breakdown processes were used where necessary to complete the entire market engineering process and arrive at the precise statistics for all segments and subsegments.

Approach to derive the market size and estimate market growth

Using secondary data from both paid and unpaid sources, the market rankings for the major players were determined following a thorough analysis of their sales of animal parasiticides. Due to data restrictions, the revenue share in certain cases was determined after a thorough analysis of the product portfolio of big corporations and their individual sales performance. This information was verified at each stage by in-depth interviews with professionals in the field.

Market definition

Animal parasiticides, often known as antiparasitics, are drugs used to stop, reduce and cure internal and external parasite infestations in pets and cattle. Ectoparasiticides, endoparasiticides, and endectocides are the typical subcategories of parasiticides. They come in a variety of deliverable forms, including liquids for oral use, pills, injectables, pour-ons, spot-ons, drenches, ear tags, collars, and sprays. Depending on the kind of parasite, the kind of animal, and the quantity of animals to be treated, a parasiticide is chosen.

Key Stakeholders

- Animal Parasiticide Manufacturers

- Animal Parasiticide Distributors

- Animal Health R&D Companies

- Veterinary Clinics and Hospitals

- Veterinary Pharmaceutical Associations

- Veterinary Research Institutes and Universities

- Venture Capitalists and Investors

- Market Research and Consulting Firms

- Government Associations

Objectives of the Study

- To define, characterize, segment, and forecast the market for animal parasiticides based on type, animal type, end user, and region

- To provide comprehensive information on the key elements affecting the market's growth (such as drivers, restraints, opportunities, and industry-specific challenges)

- To evaluate the market for animal parasiticides in light of the Porter's Five Forces, the regulatory environment, the value chain, the supply chain, the ecosystem, patent protection, and the effects of the recession

- To evaluate micromarkets with regard to their unique growth trends, prospects, and market contributions

- To estimate the market size for animal parasiticides in the Middle East, Africa, Asia Pacific, Latin America, and North America

- To assess market prospects for participants and give information on the competitive environment

- To list prominent market participants and thoroughly assess all of their essential abilities

- To monitor and assess market competition through actions including product introductions and approvals, acquisitions, growth, alliances, and agreements

Available Customizations

MarketsandMarkets provides modifications based on the provided market data to suit the unique requirements of the organization. The report can be customized in the ways shown below:

Product Analysis

- Product matrix, which compares the product portfolios of the major companies in detail

Geographic Analysis

- Further breakdown of the RoE animal parasiticides market into Belgium, Russia, the Netherlands, Switzerland, and other countries

- Further breakdown of the RoLATAM animal parasiticides market into Argentina, Colombia, Chile, and other countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Animal Parasiticides Market