Amniotic Products Market by Type (Cryopreserved Amniotic Membranes, Dehydrated Amniotic Membranes), Application (Wound Care, Ophthalmology, Orthopedics), End User (Hospital & Ambulatory Surgical Centers) & Region - Global Forecast to 2028

Market Growth Outlook Summary

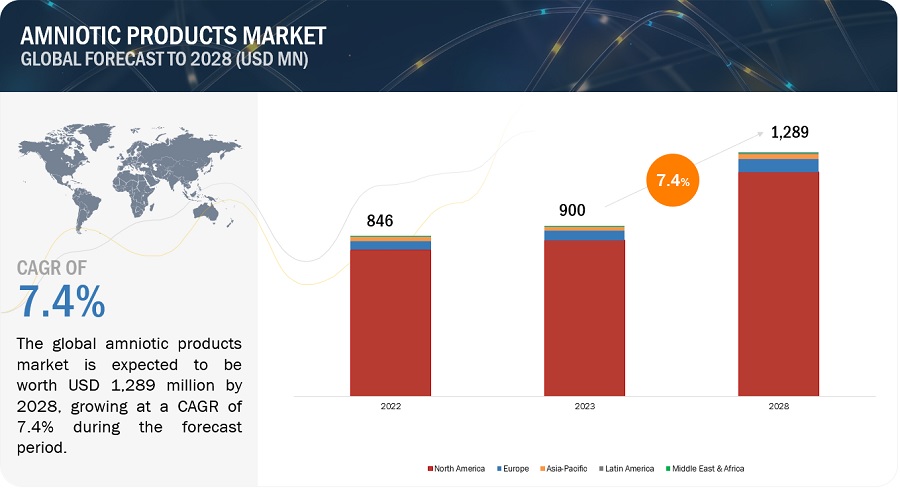

The global amniotic products market, valued at US$846 million in 2022, stood at US$900 million in 2023 and is projected to advance at a resilient CAGR of 7.4% from 2023 to 2028, culminating in a forecasted valuation of US$1,289 million by the end of the period. The growth of this market is majorly driven by Growth in the target patient population and Rising incidence of burn injuries and increasing number of traumatic wounds. However, Complications and limitations associated with the use of amniotic membranes may restrain the growth of this market.

Amniotic Products Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Amniotic Products Market Dynamics

DRIVER: Growth in the target patient population

Physical health conditions, such as chronic diseases, have a negative effect on the wound healing process. For instance, diabetes and obesity can result in an increased incidence of ulcerations, such as leg or foot ulcers, which would require wound treatment and incur exorbitant medical expenses.

As per the IDF 2021, 537 million adults (20-79 years) are living with diabetes (1 in 10). This number is estimated to rise to 643 million by 2030 and 783 million by 2045. Diabetic foot ulcers occur because of major complications of diabetes. Nearly 15% of the total diabetic population suffers from diabetic foot ulcers (Source: Cellular and Molecular Basis of Wound Healing in Diabetes by Brem H., Journal of Clinical Investigation). An article published in the Journal of Foot and Ankle Research estimates that more than 10% of people with type 2 diabetes mellitus are highly prone to foot ulcers, with a lifetime risk of 15%. Thus, the increasing incidence of diabetes will correspondingly drive the demand for wound care products. As the wound healing process is slower in diabetes, advanced wound care products such as amniotic membranes are required for treatment.

Amniotic membranes are also useful in the management of many ocular conditions. Amniotic membranes are widely used for eye surgeries and the treatment of an increasing number of ocular surface pathologies such as ulcers of the cornea or conjunctiva, or in other cases, severe dry eyes.

According to the American Academy of Ophthalmology, the annual incidence of corneal ulcers in the US ranges between 30,000 and 75,000.

According to the National Eye Institute, by 2050, the number of people with cataracts in the US is estimated to double from 24.4 million to about 50 million.

The growth of the target patient population and the subsequent increase in the number of target medical procedures is expected to play a key role in the increased adoption of amniotic products.

Obesity leads to various critical conditions, wounds, and infections, which lead to surgeries and infectious wounds. Such conditions, along with comorbidities like diabetes, lead to non-healing/long-term chronic wounds. Such wounds are highly susceptible to developing infections more than once and need wound care treatments and devices for enhanced wound healing and successful recovery.

Obesity is now termed a worldwide epidemic; approximately 57.8% of all adults will be obese by 2030 (Source: WHO, 2020). Similarly, more than 1 billion people worldwide are obese 650 million adults, 340 million adolescents and 39 million children. This number is still increasing. WHO estimates that by 2025, approximately 167 million people adults and children will become less healthy because they are overweight or obese. (Source: WHO, 2022).

As per the World Obesity Atlas 2022, estimation, one billion people globally, including 1 in 5 women and 1 in 7 men, will be living with obesity by 2030. Moreover, according to the WHO, as of 2019, an estimated 38.2 million children under the age of five years were reportedly overweight/obese. Obesity is an epidemic in low- and middle-income countries as well. In 2019, the prevalence of childhood obesity in Africa increased by approximately 24% since 2000. Considering this constantly increasing trend of obesity across all age groups and genders, it is anticipated that the associated wounds, infections, and critical illnesses/surgeries will also increase. This will result in the increasing demand for amniotic products during the forecast period.

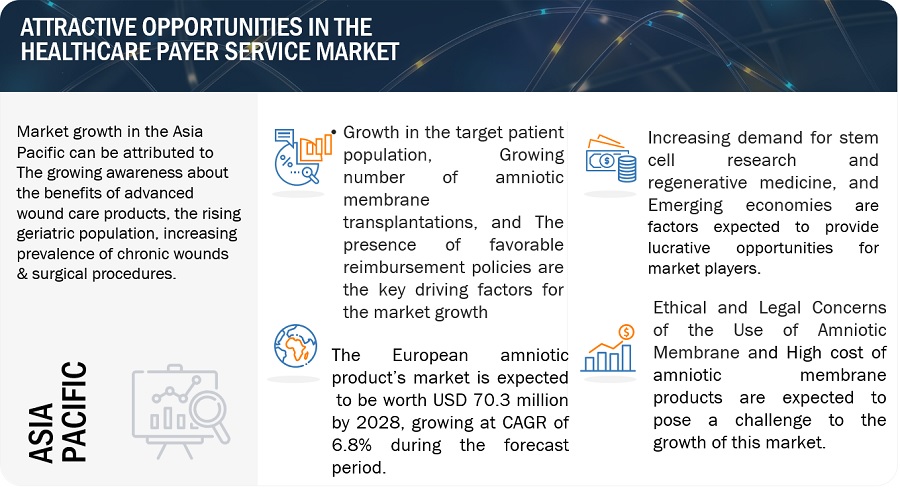

OPPORTUNITY: Emerging economies

Emerging countries such as China, India, South Korea, Brazil, and Mexico offer significant growth opportunities to major players functioning in the amniotic products industry. This can be attributed to low regulatory barriers, improvements in healthcare infrastructure, growing patient population, and rising healthcare expenditure. Moreover, regulatory policies in the Asia Pacific region are more adaptive and business-friendly in comparison to those of developed countries. This factor, in addition to the increasing competition in mature markets, has drawn key players in the market to focus on the emerging economies.

China is a prominent market for amniotic products, owing to its recent infrastructural improvements, rapid economic growth, rising domestic demand, and public-private initiatives to support healthcare research. Similarly, the Indian market reported an increasing prevalence of target diseases and a fast-growing healthcare industry, coupled with a shift towards advanced treatment options.

- In China, the population suffering from diabetes is projected to reach 140.5 million by 2030 from 116.4 million in 2019.

- Diabetes prevalence in % of the population ages 20 to 79 in China was 10.6% in 2021 (Source: The World Bank).

- The China' healthcare expenditure per capita was increased from USD 539.62 in 2019 to USD 583.43 in 2020 (Source: The World Bank).

- The India' healthcare expenditure per capita was increased from USD 44.9 in 2010 to USD 56.63 in 2020 (Source: The World Bank).

- To capitalize on the growth opportunities offered, prominent players in the market are focusing on enhancing their presence in emerging countries.

- In January 2020, LifeCell International Pvt. Ltd. (India) received accreditation from the American Association of Tissue Banks (AATB) for its birth tissue products. The company plans to launch Amchoplast in India. Amchoplast is a minimally manipulated and aseptically processed dehydrated human amnion-chorion tissue allograft used for wound healing applications as it enhances the healing mechanism, reduces scar tissue formation, and modulates inflammation of the wound.

- Compared to Europe and North America, the Asia Pacific and Latin America are relatively untapped markets for amniotic products and have huge growth potential. Owing to this, various players are focusing on increasing their presence in these regions.

CHALLENGE: High cost of amniotic membrane products

The high cost of amniotic products and their associated treatments can be a significant concern for patients, healthcare providers, and healthcare systems. As per the article published by American Optometric Association, Amniotic membranes can cost from USD 300 to USD 900 per device which can be a significant problem for patients. Similarly, purchase price for the physician can range from USD 125 to USD 900 (Source: Modern Optometry 2021). Likewise, the average 1 year per patient medical cost of DFUs is estimated at USD 28,000 where amniotic membranes are being used to improve healing rates in diabetic foot ulcers. Some of the other factors contribute to the high cost which are listed below.

Processing and Manufacturing: Amniotic products require specialized processing and manufacturing techniques to preserve their biological properties and ensure safety. These processes involve extensive quality control, testing, and regulatory compliance, which can increase the overall cost of production.

Donor Screening and Testing: Donor screening and testing are essential to ensure the safety and quality of amniotic products. Extensive testing for infectious diseases and genetic abnormalities adds to the cost of processing and manufacturing.

Storage and Logistics: Proper storage and transportation of amniotic products require specific conditions, such as controlled temperatures and specialized packaging. These requirements increase the cost of storage, distribution, and logistics.

Research and Development: The development of amniotic products involves significant research and development efforts, including preclinical studies and clinical trials. The costs associated with research, obtaining regulatory approvals, and ensuring compliance with applicable regulations contribute to the overall cost.

Limited Supply: The availability of amniotic products is often limited due to the challenges associated with donor tissue procurement and processing. Limited supply and high demand can drive up the cost of these products.

Regulatory Compliance: Compliance with regulatory requirements and quality standards adds to the cost of manufacturing and distribution. Meeting the necessary regulatory standards and maintaining ongoing compliance require dedicated resources and infrastructure.

Reimbursement Challenges: Reimbursement for amniotic products and their associated treatments can be challenging. Insurance coverage and reimbursement policies may vary, and obtaining adequate reimbursement for these products can be complex, potentially increasing the cost burden for patients and healthcare providers.

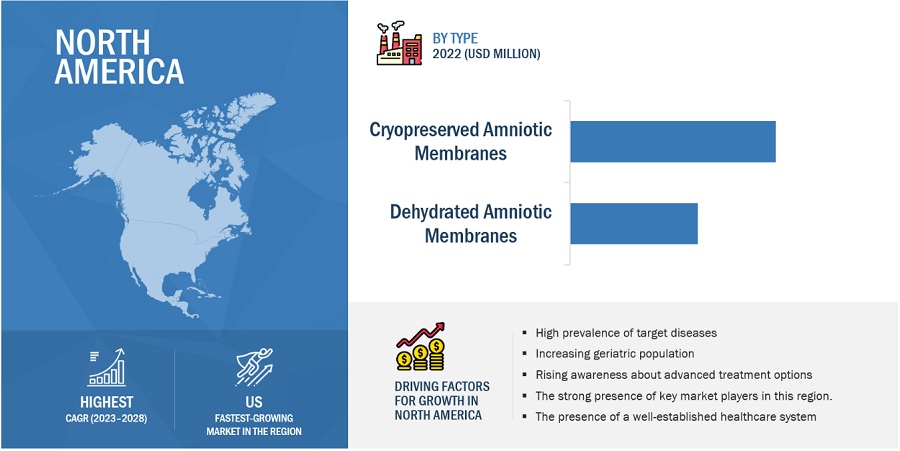

US accounted for the largest share of the North American amniotic products industry

Based on the region, the North American amniotic products market is segmented into US and Canada. In 2022, the US accounted for the largest share of the North American market. Growth in this market can be attributed to presence of stringent regulatory standard, rising healthcare expenditure, the increasing number of surgical procedures performed in the US, the rising geriatric population, the high prevalence of chronic wounds and diabetes, and the strong presence of amniotic product manufacturers.

Japan registered the highest growth rate in Asia Pacific amniotic products industry.

The APAC amniotic products market is segmented into Japan, China, India, and Rest of Apac. In 2022, China accounted for the highest growth rate of the Asian market. The high growth rate of Japan can be attributed to the presence of a well-established healthcare sector and the rapidly increasing geriatric population. An increase in the number of elderly people gives rise to various orthopedic and ophthalmological diseases which is highly susceptible to several diseases and disorders. Therefore, growth in this population segment will directly drive the demand for effective and efficient wound care biologics, including amniotic products.

The UK in European amniotic products industry to witness the growth rate during the forecast period.

The Europe amniotic products market is segmented into Germany, France, the UK, and the Rest of Europe. Germany is registered the highest growth rate during the forecast period. The major factors contributing to the growth of this market are the high prevalence of diabetes and venous ulcers, rising in ophthalmic, orthopedic & wound cases in the UK, increasing R&D activities, strategic developments by key players, and the growing geriatric population.

To know about the assumptions considered for the study, download the pdf brochure

Some of the major players operating in this market are mimedx (US), Organogenesis Inc. (US), Smith+Nephew (UK), Integra LifeSciences (US). In 2022, mimedx (US), held the leading position in the market. The company’s large share can be attributed to its broad range of amniotic-based products. Smith+Nephew (UK), held the second position in the amniotic products market in 2022.

Amniotic Products Market Report Scope

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$900 million |

|

Projected Revenue Size by 2028 |

$1,289 million |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 7.4% |

|

Market Driver |

Growth in the target patient population |

|

Market Opportunity |

Emerging economies |

This research report categorizes the amniotic products market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Cryopreserved Amniotic Membrane

- Dehydrated Amniotic Membrane

By Application

- Wound Care

- Orthopedics

- Ophthalmology

- Other Applications

By End User

- Hospitals, & Ambulatory Surgical Centers

- Other End Users

By Region

- North America

- Europe

- Apac

- Latin America

- Middle East & Africa

Recent Developments of Amniotic Products Market

- In 2021, The company VIVEX Biologics (US) launched Cygnus Matrix Disks with the latest configuration of the Cygnus family of amniotic tissue allografts.

- In 2021, MiMedx (US) received approval from the Japanese Ministry of Health, Labour, and Welfare for the commercialization of EPIFIX in Japan.

- In 2021, The company Celularity Inc. (US) entered into an exclusive distribution agreement for the commercial distribution rights for orthopedic surgery and sports medicine products with Arthrex, Inc. (US).

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global amniotic products market between 2023 and 2028?

The global amniotic products market is projected to grow from USD 900 million in 2023 to USD 1,289 million by 2028, demonstrating a robust CAGR of 7.4%.

What are the key factors driving the amniotic products market?

Key drivers of the amniotic products market include the growing patient population with chronic diseases like diabetes and obesity, rising incidence of burn injuries, traumatic wounds, and increased demand for advanced wound care products.

What challenges does the amniotic products market face?

The primary challenges include the high cost of amniotic membrane products, limited supply, donor screening/testing requirements, and reimbursement challenges that can increase the cost burden on patients and healthcare providers.

Which regions are expected to show growth in the amniotic products market?

Emerging markets such as China, India, Brazil, South Korea, and Mexico are expected to show significant growth due to improving healthcare infrastructure, growing patient population, and rising healthcare expenditure.

What are the key applications of amniotic products?

Amniotic products are used in wound healing, tissue repair, and ophthalmic surgeries, particularly for treating diabetic foot ulcers, burn injuries, corneal ulcers, and other chronic wounds.

How is the rising prevalence of diabetes affecting the amniotic products market?

The increasing prevalence of diabetes, which leads to conditions like diabetic foot ulcers, is driving the demand for advanced wound care products like amniotic membranes that facilitate faster and more effective healing.

What is the impact of the obesity epidemic on the amniotic products market?

Obesity, which leads to an increase in non-healing and chronic wounds, is contributing to a higher demand for wound care treatments like amniotic products, particularly in managing infections and surgical recovery.

How has the global recession impacted the amniotic products market?

The global recession has led to reduced healthcare budgets and increased price sensitivity, impacting the demand for amniotic products as healthcare providers seek cost-effective alternatives and patients delay elective procedures.

Which key players are active in the amniotic products market?

Key players in the amniotic products market include MiMedx Group, Organogenesis, Integra LifeSciences, Stryker, and TissueTech, among others, who are focused on expanding their presence in emerging markets and advancing their product portfolios.

What opportunities exist for the amniotic products market in emerging economies?

Emerging economies such as China, India, and Brazil offer significant growth opportunities for amniotic product manufacturers, with low regulatory barriers, growing patient populations, and rising healthcare expenditure driving market expansion.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growth in target patient population- Rising incidence of burn injuries and increasing number of traumatic wounds- Wound care awareness programs and increasing funding for wound care treatment and management- Increasing number of amniotic membrane transplantations- Increasing number of ophthalmology, cosmetic, and orthopedic surgeries- Strategic collaborations and partnerships- Favorable reimbursement policiesOPPORTUNITIES- Untapped opportunities in emerging economies- Implementation of 21st Century Cures Act (US)- Increasing demand for stem cell research and regenerative medicineCHALLENGES- Complications and limitations associated with use of amniotic membranes- Ethical and legal concerns of using amniotic membranes- High cost of amniotic membrane products- Competition from alternative therapiesTRENDS- Increasing clinical trials for stem cell and chimeric antigen receptor-T cell therapies- Expanding applications and rising focus on standardization and regulation of amniotic products

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND REVENUE POCKETS FOR AMNIOTIC PRODUCT MANUFACTURERSREVENUE SHIFT IN AMNIOTIC PRODUCTS MARKET

- 5.4 PRICING ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 VALUE CHAIN ANALYSIS

-

5.7 ECOSYSTEM ANALYSISROLE IN ECOSYSTEM

- 5.8 TECHNOLOGY ANALYSIS

-

5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

-

5.11 REGULATORY LANDSCAPENORTH AMERICAEUROPEEMERGING ECONOMIES

-

5.12 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

- 6.1 INTRODUCTION

-

6.2 AMNIOTIC MEMBRANESCRYOPRESERVED AMNIOTIC MEMBRANES- Cryopreserved amniotic membranes to dominate amniotic membranes market during forecast periodDEHYDRATED AMNIOTIC MEMBRANES- Logistical advantages of dehydrated amniotic membranes over cryopreserved amniotic membranes to drive demand

- 7.1 INTRODUCTION

- 7.2 PRIMARY NOTES

-

7.3 WOUND CARERISING INCIDENCE OF ULCERS, TRAUMATIC AND SURGICAL WOUNDS, AND BURNS TO DRIVE MARKET

-

7.4 ORTHOPEDICSBENEFITS OFFERED BY AMNIOTIC PRODUCTS FOR ORTHOPEDIC APPLICATIONS TO DRIVE MARKET

-

7.5 OPHTHALMOLOGYLIGHTWEIGHT, THIN, AND ELASTIC NATURE OF AMNIOTIC MEMBRANES TO DRIVE DEMAND IN OPHTHALMOLOGY

- 7.6 OTHER APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 HOSPITALS & AMBULATORY SURGERY CENTERSINCREASING NUMBER OF SURGICAL PROCEDURES TO DRIVE MARKET

- 8.3 OTHER END USERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- Growing geriatric population and high prevalence of chronic wounds and diabetes to drive marketCANADA- Rising prevalence of target diseases to drive marketRECESSION IMPACT ON NORTH AMERICA

-

9.3 EUROPEGERMANY- Increasing incidence of diabetes to drive marketUK- High prevalence of diabetes activities to drive marketFRANCE- Government support to drive demand for amniotic productsREST OF EUROPERECESSION IMPACT ON EUROPE

-

9.4 ASIA PACIFICCHINA- Increasing incidence of diabetes and growth in geriatric population to drive marketJAPAN- Growing geriatric population to drive marketREST OF ASIA PACIFICRECESSION IMPACT ON ASIA PACIFIC

-

9.5 LATIN AMERICAINCREASING PREVALENCE OF DIABETES TO DRIVE MARKET

-

9.6 MIDDLE EAST & AFRICAGROWTH IN HEALTHCARE INFRASTRUCTURE AND GOVERNMENT INITIATIVES TO DRIVE MARKET

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 MARKET SHARE ANALYSIS, 2022

- 10.4 REVENUE SHARE ANALYSIS, 2022

-

10.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 SMALL AND MEDIUM-SIZED ENTERPRISE/STARTUP EVALUATION QUADRANTPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 10.7 COMPETITIVE BENCHMARKING

-

10.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

- 10.9 COMPANY FOOTPRINT ANALYSIS

-

11.1 KEY PLAYERSMIMEDX GROUP, INC.- Business overview- Products offered- Recent developments- MnM viewSMITH+NEPHEW- Business overview- Products offered- Recent developments- MnM viewORGANOGENESIS INC.- Business overview- Products offered- Recent developments- MnM viewINTEGRA LIFESCIENCES- Business overview- Products offered- Recent developments- MnM viewSTRYKER- Business overview- Products offered- Recent developmentsAPPLIED BIOLOGICS- Business overview- Products offeredCELULARITY INC.- Business overview- Products offered- Recent developmentsCORZA OPHTHALMOLOGY- Business overview- Products offered- Recent developmentsLUCINA BIOSCIENCES- Business overview- Products offeredNEXT BIOSCIENCES- Business overview- Products offeredSKYE BIOLOGICS HOLDINGS, LLC- Business overview- Products offeredSURGENEX- Business overview- Products offered

-

11.2 OTHER PLAYERSBIOTISSUE- Products offered- Recent developmentsVENTRIS MEDICAL, LLC- Products offeredSTIMLABS LLC- Products offered- Recent developmentsVIVEX BIOLOGICS, INC.- Products offered- Recent developmentsLIFECELL- Products offered- Recent developmentsNUVISION BIOTHERAPIES LTD- Products offered- Recent developmentsGENESIS BIOLOGICS, INC.- Products offeredSURGILOGIX- Products offeredTIDES MEDICAL- Products offeredORTHOFIX US LLC- Products offered- Recent developmentsALLOSOURCE- Products offeredMERAKRIS THERAPEUTICS, INC.- Products offeredMTF BIOLOGICS- Products offered

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 GLOBAL PREVALENCE OF DIABETES

- TABLE 2 WOUND CARE AWARENESS INITIATIVES

- TABLE 3 FUNDING FOR REGENERATIVE MEDICINE RESEARCH BY NIH UNDER 21ST CENTURY CURES ACT

- TABLE 4 FUNDING INITIATIVES FROM CORPORATE PARTNERSHIPS IN 2022 (USD MILLION)

- TABLE 5 FUNDING FROM CORPORATE PARTNERSHIPS IN 2021 (USD MILLION)

- TABLE 6 NUMBER OF AMNIOTIC MEMBRANE TRANSPLANTATIONS PERFORMED IN UNIVERSITY EYE HOSPITAL TÜBINGEN, GERMANY

- TABLE 7 MEDICARE ALLOWABLE AMOUNTS (USD)

- TABLE 8 STRATEGIC DEVELOPMENTS IN ASIA PACIFIC

- TABLE 9 NIH FUNDING FOR CELL-BASED RESEARCH, 2016–2021 (USD MILLION)

- TABLE 10 PRICES OF AMNIOTIC PRODUCTS

- TABLE 11 ROLE OF KEY PLAYERS IN ECOSYSTEM

- TABLE 12 IMPORT DATA FOR EXTRACTS OF GLANDS OR OTHER ORGANS OR OF THEIR SECRETIONS FOR ORGANO-THERAPEUTIC USE, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 13 EXPORT DATA FOR EXTRACTS OF GLANDS OR OTHER ORGANS OR OF THEIR SECRETIONS FOR ORGANO-THERAPEUTIC USE, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 14 AMNIOTIC PRODUCTS MARKET: IMPACT OF PORTER’S FIVE FORCES

- TABLE 15 AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 16 CRYOPRESERVED AMNIOTIC MEMBRANES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 17 DEHYDRATED AMNIOTIC MEMBRANES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 18 AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 19 AMNIOTIC PRODUCTS MARKET FOR WOUND CARE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 AMNIOTIC PRODUCTS MARKET FOR ORTHOPEDICS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 AMNIOTIC PRODUCTS MARKET FOR OPHTHALMOLOGY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 22 ESTIMATED NUMBER OF COLORECTAL CANCER CASES AND DEATHS IN US IN 2020, BY AGE

- TABLE 23 AMNIOTIC PRODUCTS MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 24 AMNIOTIC PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 25 AMNIOTIC PRODUCTS MARKET FOR HOSPITALS & ASCS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 AMNIOTIC PRODUCTS MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 AMNIOTIC PRODUCTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 NORTH AMERICA: AMNIOTIC PRODUCTS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 NORTH AMERICA: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 32 US: KEY MACRO INDICATORS

- TABLE 33 US: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 34 US: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 35 US: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 36 INCIDENCE OF DIABETES IN CANADA, 2019 VS. 2029

- TABLE 37 CANADA: KEY MACRO INDICATORS

- TABLE 38 CANADA: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 39 CANADA: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 40 CANADA: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 41 EUROPE: HEALTHCARE EXPENDITURE, BY COUNTRY (% OF GDP)

- TABLE 42 PREVALENCE OF DIABETES IN EUROPE, 2019 VS. 2045

- TABLE 43 EUROPE: AMNIOTIC PRODUCTS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 EUROPE: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 45 EUROPE: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 46 EUROPE: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 47 GERMANY: KEY MACRO INDICATORS

- TABLE 48 GERMANY: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 49 GERMANY: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 50 GERMANY: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 51 UK: KEY MACRO INDICATORS

- TABLE 52 UK: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 53 UK: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 54 UK: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 55 FRANCE: KEY MACRO INDICATORS

- TABLE 56 FRANCE: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 57 FRANCE: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 58 FRANCE: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 59 REST OF EUROPE: HEALTHCARE EXPENDITURE, BY COUNTRY, 2010 VS. 2021 (% OF GDP)

- TABLE 60 REST OF EUROPE: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 61 REST OF EUROPE: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 62 REST OF EUROPE: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 63 ASIA PACIFIC: AMNIOTIC PRODUCTS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 64 ASIA PACIFIC: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 65 ASIA PACIFIC: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 66 ASIA PACIFIC: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 67 CHINA: KEY MACRO INDICATORS

- TABLE 68 CHINA: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 69 CHINA: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 70 CHINA: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 71 JAPAN: KEY MACRO INDICATORS

- TABLE 72 JAPAN: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 73 JAPAN: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 74 JAPAN: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 75 REST OF ASIA PACIFIC: DIABETES PREVALENCE (% OF POPULATION AGED 20–79), BY COUNTRY, 2021

- TABLE 76 REST OF ASIA PACIFIC: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 77 REST OF ASIA PACIFIC: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 78 REST OF ASIA PACIFIC: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 79 LATIN AMERICA: DIABETES PREVALENCE (% OF POPULATION AGED 20–79), BY COUNTRY, 2021

- TABLE 80 LATIN AMERICA: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 81 LATIN AMERICA: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 82 LATIN AMERICA: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 83 MIDDLE EAST & AFRICA: DIABETES PREVALENCE (% OF POPULATION AGED 20–79), BY COUNTRY, 2021

- TABLE 84 MIDDLE EAST & AFRICA: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 85 MIDDLE EAST & AFRICA: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 86 MIDDLE EAST & AFRICA: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 87 OVERVIEW OF STRATEGIES ADOPTED BY KEY AMNIOTIC PRODUCT MARKET PLAYERS

- TABLE 88 AMNIOTIC PRODUCTS MARKET: DEGREE OF COMPETITION (2022)

- TABLE 89 AMNIOTIC PRODUCTS MARKET: DETAILED LIST OF KEY SMALL AND MEDIUM-SIZED ENTERPRISES/STARTUPS

- TABLE 90 PRODUCT LAUNCHES

- TABLE 91 DEALS

- TABLE 92 OTHERS

- TABLE 93 COMPANY FOOTPRINT ANALYSIS

- TABLE 94 COMPANY PRODUCT FOOTPRINT

- TABLE 95 COMPANY REGIONAL FOOTPRINT

- TABLE 96 MIMEDX GROUP, INC.: COMPANY OVERVIEW

- TABLE 97 SMITH+NEPHEW: COMPANY OVERVIEW

- TABLE 98 ORGANOGENESIS INC.: COMPANY OVERVIEW

- TABLE 99 INTEGRA LIFESCIENCES: COMPANY OVERVIEW

- TABLE 100 STRYKER: COMPANY OVERVIEW

- TABLE 101 APPLIED BIOLOGICS: COMPANY OVERVIEW

- TABLE 102 CELULARITY INC.: COMPANY OVERVIEW

- TABLE 103 CORZA OPHTHALMOLOGY: COMPANY OVERVIEW

- TABLE 104 LUCINA BIOSCIENCES: COMPANY OVERVIEW

- TABLE 105 NEXT BIOSCIENCES: COMPANY OVERVIEW

- TABLE 106 SKYE BIOLOGICS HOLDINGS, LLC: COMPANY OVERVIEW

- TABLE 107 SURGENEX: COMPANY OVERVIEW

- FIGURE 1 AMNIOTIC PRODUCTS MARKET SEGMENTATION

- FIGURE 2 AMNIOTIC PRODUCTS MARKET: RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 AMNIOTIC PRODUCTS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 AMNIOTIC PRODUCTS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 AMNIOTIC PRODUCTS MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 GROWING TARGET PATIENT POPULATION TO DRIVE MARKET

- FIGURE 14 CRYOPRESERVED AMNIOTIC MEMBRANES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 15 US ACCOUNTED FOR LARGEST MARKET SHARE IN NORTH AMERICA IN 2022

- FIGURE 16 US AND UK TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 17 AMNIOTIC PRODUCTS MARKET: DRIVERS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 ARTICLES RELATED TO AMNIOTIC PRODUCTS PUBLISHED DURING 2010–2021

- FIGURE 19 STEM CELL RESEARCH FUNDING FROM 2011 TO 2020

- FIGURE 20 DIRECT DISTRIBUTION: STRATEGY PREFERRED BY PROMINENT COMPANIES

- FIGURE 21 VALUE CHAIN ANALYSIS: MAJOR VALUE-ADDED DURING DEVELOPMENT PHASE

- FIGURE 22 KEY PLAYERS IN AMNIOTIC PRODUCTS ECOSYSTEM

- FIGURE 23 NORTH AMERICA: AMNIOTIC PRODUCTS MARKET SNAPSHOT

- FIGURE 24 ASIA PACIFIC: AMNIOTIC PRODUCTS MARKET SNAPSHOT

- FIGURE 25 AMNIOTIC PRODUCTS MARKET: REVENUE ANALYSIS OF TOP FOUR MARKET PLAYERS, 2020–2022

- FIGURE 26 AMNIOTIC PRODUCTS MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 27 AMNIOTIC PRODUCTS MARKET: SMALL AND MEDIUM-SIZED ENTERPRISE/ STARTUP EVALUATION MATRIX, 2022

- FIGURE 28 MIMEDX GROUP, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 29 SMITH+NEPHEW: COMPANY SNAPSHOT (2022)

- FIGURE 30 ORGANOGENESIS INC.: COMPANY SNAPSHOT (2022)

- FIGURE 31 INTEGRA LIFESCIENCES: COMPANY SNAPSHOT (2022)

- FIGURE 32 STRYKER: COMPANY SNAPSHOT (2022)

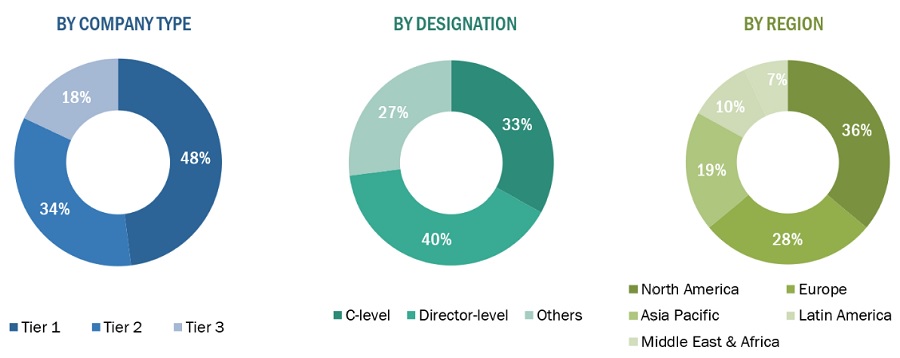

The study involved four major activities in estimating the current size of the amniotic products market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the global market scenario through secondary research. Primary interviews were conducted from both the demand (Physicians. Ophthalmologists, Orthopedic Surgeons) and supply sides (amniotic product’s manufacturers and distributors).

The following is a breakdown of the primary respondents:

Breakdown of Primary Participants:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2. Tiers of companies are defined based on their total revenue. As of 2020: Tier 1 = >USD 5 billion, Tier 2 = USD 500 million to USD 5 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the amniotic products market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the amniotic products industry.

Report Objectives

- To define, describe, and forecast the global amniotic products market based on types, applications, end users, and region.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, opportunities, challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of market segments with respect to four main regions—North America, Europe, Asia Pacific, Latin America, Middle East & Africa

- To strategically profile key players and comprehensively analyze their product portfolios, market shares, and core competencies3.

- To track and analyze competitive developments such as acquisitions, agreements, new product launches, and partnerships in the amniotic products market. market m

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Product Analysis: Product matrix, which gives a detailed comparison of the product portfolios of each company.

- Geographic Analysis: Further breakdown of the European amniotic products market into specific countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Amniotic Products Market