Aluminum-extruded Products Market by Product Type (Mill-finished, Powder-coated, and Anodized), End-use Industry (Construction, Automotive, Electrical & Electronics, Mass Transport, and Machinery & Equipment), Alloy Type, and Region - Global Forecast to 2021

Aluminum-extruded Products Market is estimated to grow USD 47.61 Billion by 2021, at a CAGR of 6.67%. The base year considered for the study is 2015 and the market size is projected from 2016 to 2021.

The key objective of the global aluminum-extruded products report is to provide companies with a summary of the latest trends and lucrative business expansion opportunities for aluminum-extruded product manufacturers, suppliers, and distributors. The report also demonstrates the key business strategies and principles adopted by the key players around the world. The segments considered for this report are based on aluminum-extruded product type, alloy type, end-use industry, and region. This report is intended for the following:

- Create greater awareness about aluminum-extruded products and how they are distributed by companies

- Increase access to information about the aluminum-extruded products business principles for other institutions that are planning to start the business

- Promote the use of the aluminum-extruded products in the end-use industries such as construction, automotive, electric & electronics, and mass transport

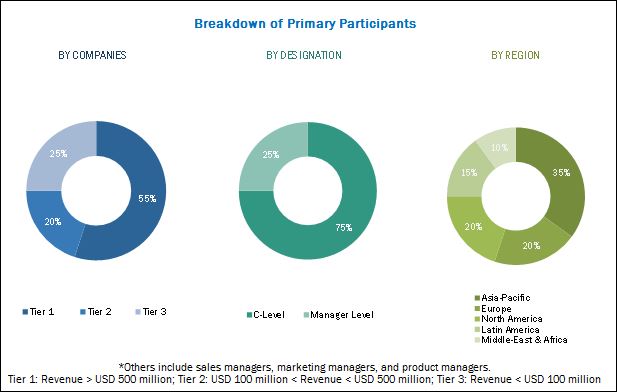

The research methodology used to forecast the market size focused on the bottom-up approach. The total market size of aluminum-extruded products was calculated based on the shares of the various products and types derived. Providing weightage for the shares and calculation were done on the basis of extensive primary interviews and secondary research from a variety of sources such as European Aluminum-extruded Manufactures Association, North American Aluminum-extruded Manufacturers Association, and National Aluminum-extruded. Primary research involved in this report includes extensive interviews with key people such as CEOs, VPs, directors, and executives. After arriving at the overall market size, the total market was split into several segments and sub-segments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The breakdown of profiles of primary sources is depicted in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

The global aluminum-extruded products ecosystem comprises aluminum-extruded products manufacturers, vendors, and service providers such as United Company Rusal (Russia), Alcoa Inc. (U.S.), Aluminum Corporation of China Limited (China), Rio Tinto Plc (U.K.), BHP Billiton Ltd. (Australia), Norsk Hydro ASA (Norway), Centaury Aluminum Corporation (U.S.), China Hongquiao Group Limited (China), Aluminum Bahrain B.S.C (Bahrain), and Hindalco Industries Limited (India).

Target audience

- Aluminum-extruded products manufacturers

- OEMs

- Manufacturing organizations

- Automotive manufacturers

- Construction organizations

Scope of the Aluminum-extruded Products Market Report

This research report segments aluminum-extruded products into the following submarkets:

By Product Type:

- Mill-finished

- Powder-coated

- Anodized

By End-use Industry:

- Construction

- Automotive

- Electric and electronics

- Machinery & equipment

- Mass transport

- Others (energy, telecom, and consumer durables)

By Alloy Type:

- 1000 series aluminum

- 2000 series aluminum alloy

- 3000 series aluminum alloy

- 5000 series aluminum alloy

- 6000 series aluminum alloy

- 7000 series aluminum alloy

By Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of markets for different recycled product types

Geographic Analysis

- Further analysis of the aluminum-extruded products market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

MarketsandMarkets projects that the aluminum-extruded products market will grow from USD 34.48 Billion in 2016 to USD 47.61 Billion by 2021, at an estimated CAGR of 6.67%. The market for aluminum-extruded products is growing due to increase in demand from end-use industries such as construction, machinery & equipment, automotive, and mass transport. The growth of this market is fueled by the growth of its end-use industries. Along with the same, the rise in demand for sustainable & recyclable aluminum material has fueled the market for aluminum-extruded products. Emerging economies such as India, South Africa, Brazil, and oil-centric GCC (Gulf Cooperation Countries) possess a great potential for the aluminum-extruded products market.

This market is segmented on the basis of type, end-use industry, alloy type, and region. In terms of product type, mill-finished aluminum-extruded products accounted for the largest market share in 2015, in terms of value; this is projected to grow at the highest CAGR during the forecast period. This growth is attributed to the increasing demand of the mill-finished aluminum-extruded products in the construction and automotive industries.

In terms of end-use industry, the market is segmented into construction, automotive, mass transport, machinery & equipment, electrical & electronics, and others (energy, telecom, and consumer durables). The construction segment is projected accounted for the largest share in the 2015. However, the automotive segment projected to grow at the highest CAGR during the forecast period. The demand of light-weight cars to achieve high fuel-efficiency will propel the market for aluminum-extruded products in the country.

In terms of region, the market for aluminum-extruded products is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The Asia-Pacific region is projected to grow at the highest CAGR among all the regions by 2021. This is mainly due to emerging economies such as China, Southeast Asian countries, and India; urbanization; industrialization; and stable PEST (political, economic, social, and technological) conditions.

Aluminum-extruded products are light-weight but perform efficiently under extreme conditions such as heat, humidity, abrasion, and vibrations. However, the lack of awareness regarding aluminum-extruded products poses as a potential restraint in the aluminum-extruded products market. Hence, many constructions do not consider the lucrativeness of using aluminum-extruded products, which includes reduction of heat flow, energy efficiency, and cost-effectiveness.

Strategies such as mergers & acquisitions and agreements & expansions were largely adopted by most of the players in this market. Companies such as United Company Rusal (Russia), Alcoa Inc. (U.S.), Aluminum Corporation of China Limited (China), Rio Tinto Plc (U.K.), BHP Billiton Ltd. (Australia), Norsk Hydro ASA (Norway), Centaury Aluminum Corporation (U.S.), China Hongquiao Group Limited (China), Aluminum Bahrain B.S.C (Bahrain), and Hindalco Industries Limited (India) have adopted this strategy. Along with the same, these players have a strong distribution network and influencing presence in developed as well as developing economies.

Frequently Asked Questions (FAQ):

How big is the Aluminum-extruded Products Market?

Aluminum-extruded Products Market is estimated to grow USD 47.61 Billion by 2021, at a CAGR of 6.67%.

Who leading market players in Aluminum-extruded Products Market ?

Companies such as United Company Rusal (Russia), Alcoa Inc. (U.S.), Aluminum Corporation of China Limited (China), Rio Tinto Plc (U.K.), BHP Billiton Ltd. (Australia), Norsk Hydro ASA (Norway), Centaury Aluminum Corporation (U.S.), China Hongquiao Group Limited (China), Aluminum Bahrain B.S.C (Bahrain), and Hindalco Industries Limited (India) have adopted this strategy.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Geographic Scope

1.3.2 Years Considered for the Study

1.4 Currency Considered

1.5 Market Size

1.6 Stakeholders

1.7 Limitations

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Market Share Estimation

2.5 Research Assumptions

3 Executive Summary (Page No. - 28)

3.1 Aluminum-extruded Products Market

3.2 The Mill-Finished Aluminum-extruded Products to Dominate the Market in 2016

3.3 Asia-Pacific Market Projected to Grow at the Highest Rate From 2016 to 2021

3.4 Leading Market Players Adopted Investments & Expansions as the Key Strategy

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Aluminum-extruded Products Market

4.2 China is Estimated to Capture the Largest Share in the Asia-Pacific Aluminum-extruded Products Market in 2016 in Terms of Value

4.3 Asia-Pacific Estimated to Dominate the Aluminum-extruded Products Market From 2016-2021, in Terms of Value

4.4 Aluminum-extruded Products Market, By End-Use Industry, 2016 vs 2021

4.5 Asia-Pacific Aluminum-extruded Products Market Held the Largest Market Size in 2016 and 2021

4.6 Aluminum-extruded Products Market Life Cycle Analysis, By Region, 2015

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 The Evolution of Aluminum-extruded Products Market

5.3 Market Segmentation

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Growth in Demand From End-Use Industries

5.4.1.2 Technological Advancements in the Aluminum Industry

5.4.2 Restraints

5.4.2.1 High Initial Capital Investments Required

5.4.2.2 Magnesium Alloy Replacing Aluminum Alloys

5.4.3 Opportunities

5.4.3.1 Growth in Demand for Recycled and Value-Added Aluminum Products

5.4.3.2 Demand for Aluminum in Emerging Economies

5.4.4 Challenges

5.4.4.1 Greenhouse Gas Emissions

6 Aluminum-extruded Products Market, By Product Type (Page No. - 46)

6.1 Introduction

6.2 Mill-Finished

6.3 Anodized

6.4 Powder-Coated

7 Aluminum-extruded Products Market, By Alloy Type (Page No. - 50)

7.1 Introduction

7.2 1000 Series Aluminum

7.3 2000 Series Aluminum Alloys

7.4 3000 Series Aluminum Alloys

7.5 5000 Series Aluminum Alloys

7.6 6000 Series Aluminum Alloys

7.7 7000 Series Aluminum Alloys

8 Aluminum-extruded Products Market, By End-Use Industry (Page No. - 53)

8.1 Introduction

8.2 Transportation & Logistics

8.3 Construction

8.4 Automotive

8.5 Electrical & Electronics

8.6 Other End-Use Industries

9 Aluminum-extruded Products Market, By Region (Page No. - 58)

9.1 Introduction

9.2 North America

9.2.1 North America: Aluminum-extruded Products Market, By Country

9.2.2 North America: Market, By Product Type

9.2.3 North America: Market, By End-Use Industry

9.2.3.1 U.S.

9.2.3.1.1 U.S.: Aluminum-extruded Products Market, By Product Type

9.2.3.1.2 U.S.: Market, By End-Use Industry

9.2.3.2 Canada

9.2.3.2.1 Canada: Aluminum-extruded Products Market, By Product Type

9.2.3.2.2 Canada: Market, By End-Use Industry

9.2.3.3 Mexico

9.2.3.3.1 Mexico: Aluminum-extruded Products Market, By Product Type

9.2.3.3.2 Mexico: Market, By End-Use Industry

9.3 Europe

9.3.1 Europe: Aluminum-extruded Products Market, By Country

9.3.2 Europe: Market, By Product Type

9.3.3 Europe: Market, By End-Use Industry

9.3.3.1 Germany

9.3.3.1.1 Germany: Aluminum-extruded Products Market, By Product Type

9.3.3.1.2 Germany: Market, By End-Use Industry

9.3.3.2 France

9.3.3.2.1 France: Aluminum-extruded Products Market, By Product Type

9.3.3.2.2 France: Market, By End-Use Industry

9.3.3.3 U.K.

9.3.3.3.1 U.K.: Aluminum-extruded Products Market, By Product Type

9.3.3.3.2 U.K.: Market, By End-Use Industry

9.3.3.4 Italy

9.3.3.4.1 Italy: Aluminum-extruded Products Market, By Product Type

9.3.3.4.2 Italy: Market, By End-Use Industry

9.3.3.5 Russia

9.3.3.5.1 Russia: Economic Indicators

9.3.3.5.2 Russia: Aluminum-extruded Products Market, By Product Type

9.3.3.5.3 Russia: Market, By End-Use Industry

9.3.3.6 Rest of Europe

9.3.3.6.1 Rest of Europe: Aluminum-extruded Products Market, By Product Type

9.3.3.6.2 Rest of Europe: Market, By End-Use Industry

9.4 Asia-Pacific

9.4.1 Asia-Pacific: Aluminum-extruded Products Market, By Country

9.4.2 Asia-Pacific: Market, By Product Type

9.4.3 Asia-Pacific: Market, By End-Use Industry

9.4.3.1 China

9.4.3.1.1 China: Aluminum-extruded Products Market, By Product Type

9.4.3.1.2 China: Market, By End-Use Industry

9.4.3.2 India

9.4.3.2.1 India: Aluminum-extruded Products Market, By Product Type

9.4.3.2.2 India: Market, By End-Use Industry

9.4.3.3 Japan

9.4.3.3.1 Japan: Aluminum-extruded Products Market, By Product Type

9.4.3.3.2 Japan: Market, By End-Use Industry

9.4.3.4 South Korea

9.4.3.4.1 South Korea: Aluminum-extruded Products Market, By Product Type

9.4.3.4.2 South Korea: Market, By End-Use Industry

9.4.3.5 Australia

9.4.3.5.1 Australia: Aluminum-extruded Products Market, By Product Type

9.4.3.5.2 Australia: Market, By End-Use Industry

9.4.3.6 Rest of Asia-Pacific

9.4.3.6.1 Rest of Asia-Pacific: Aluminum-extruded Products Market, By Product Type

9.4.3.6.2 Rest of Asia-Pacific: Market, By End-Use Industry

9.5 Middle East & Africa (MEA)

9.5.1 Middle East & Africa: Aluminum-extruded Products Market, By Country

9.5.2 Middle East & Africa: Market, By Product Type

9.5.3 Middle East & Africa: Market, By End-Use Industry

9.5.3.1 South Africa

9.5.3.1.1 South Africa: Aluminum-extruded Products Market, By Product Type

9.5.3.1.2 South Africa: Market, By End-Use Industry

9.5.3.2 UAE

9.5.3.2.1 UAE: Aluminum-extruded Products Market, By Product Type

9.5.3.2.2 UAE: Market, By End-Use Industry

9.5.3.3 Turkey

9.5.3.3.1 Turkey: Aluminum-extruded Products Market, By Product Type

9.5.3.3.2 Turkey: Market, By End-Use Industry

9.5.3.4 Rest of Middle East & Africa

9.5.3.4.1 Rest of Middle East & Africa: Aluminum-extruded Products Market, By Product Type

9.5.3.4.2 Rest of Middle East & Africa: Market, By End-Use Industry

9.6 Latin America

9.6.1 Latin America: Aluminum-extruded Products Market, By Country

9.6.2 Latin America: Market, By Product Type

9.6.3 Latin America: Market, By End-Use Industry

9.6.3.1 Brazil

9.6.3.1.1 Brazil: Aluminum-extruded Products Market, By Product Type

9.6.3.1.2 Brazil: Market, By End-Use Industry

9.6.3.2 Argentina

9.6.3.2.1 Argentina: Aluminum-extruded Products Market, By Product Type

9.6.3.2.2 Argentina: Market, By End-Use Industry

9.6.3.3 Rest of Latin America

9.6.3.3.1 Rest of Latin America: Aluminum-extruded Products Market, By Product Type

9.6.3.3.2 Rest of Latin America: Market, By End-Use Industry

10 Competitive Landscape (Page No. - 133)

10.1 Overview

10.1.1 Expansions & Investments: Key Growth Strategy, 2011–2016

10.2 Key Players of Aluminum Extruded Products Market

10.3 Competitive Situation & Trends

10.4 Expansions & Investments: Key Strategy

10.4.1 Expansions & Investments

10.4.2 Joint Ventures, Agreements, and Contracts

10.4.3 Mergers & Acquisitions

10.4.4 New Product Launches

11 Company Profiles (Page No. - 139)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 Introduction

11.2 United Company Rusal

11.3 Alcoa Inc.

11.4 Aluminum Corporation of China Limited

11.5 RIO Tinto PLC

11.6 BHP Billiton Ltd.

11.7 Norsk Hydro ASA

11.8 Century Aluminum Company

11.9 China Hongquiao Group Limited

11.10 Aluminum Bahrain B.S.C.

11.11 Hindalco Indsutries Limited

*Details Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 163)

12.1 Industry Insights

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (128 Tables)

Table 1 Aluminum-extruded Products Market Size, By Product Type, 2014–2021 (USD Billion)

Table 2 Market Size, By Product Type, 2014–2021 (MT)

Table 3 Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 4 Market Size, By End-Use Industry, 2014–2021 (MT)

Table 5 Market Size, By Region, 2014–2021 (USD Million)

Table 6 Market Size, By Region, 2014–2021 (KT)

Table 7 North America: Aluminum-extruded Products Market Size, By Country, 2016–2021 (USD Million)

Table 8 North America: Market Size, By Country, 2016–2021 (KT)

Table 9 North America: Market Size, By Product Type, 2014–2021 (USD Million)

Table 10 North America: Aluminum-extruded Products Market Size, By Product Type, 2014–2021 (KT)

Table 11 North America: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 12 North America: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 13 U.S.: Aluminum-extruded Products Market Size, By Product Type, 2014–2021 (USD Million)

Table 14 U.S.: Market Size, By Product Type, 2014–2021 (KT)

Table 15 U.S.: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 16 U.S.: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 17 Canada: Aluminum-extruded Products Market Size, By Product Type, 2014–2021 (USD Million)

Table 18 Canada: Market Size, By Product Type, 2014–2021 (KT)

Table 19 Canada: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 20 Canada: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 21 Mexico: Market Size, By Product Type, 2014–2021 (USD Million)

Table 22 Mexico: Market Size, By Product Type, 2014–2021 (KT)

Table 23 Mexico: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 24 Mexico: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 25 Europe: Market Size, By Country, 2014–2021 (USD Million)

Table 26 Europe: Market Size, By Country, 2014–2021 (KT)

Table 27 Europe: Market Size, By Product Type, 2014–2021 (USD Million)

Table 28 Europe: Market Size, By Product Type, 2014–2021 (KT)

Table 29 Europe: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 30 Europe: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 31 Germany: Aluminum-extruded Products Market Size, By Product Type, 2014–2021 (USD Million)

Table 32 Germany: Market Size, By Product Type, 2014–2021 (KT)

Table 33 Germany: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 34 Germany: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 35 France: Market Size, By Product Type, 2014–2021 (USD Million)

Table 36 France: Market Size, By Product Type, 2014–2021 (KT)

Table 37 France: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 38 France: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 39 U.K.: Market Size, By Product Type, 2014–2021 (USD Million)

Table 40 U.K.: Market Size, By Product Type, 2014–2021 (KT)

Table 41 U.K.: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 42 U.K.: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 43 Italy: Market Size, By Product Type, 2014–2021 (USD Million)

Table 44 Italy: Market Size, By Product Type, 2014–2021 (KT)

Table 45 Italy: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 46 Italy: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 47 Russia: Market Size, By Product Type, 2014–2021 (USD Million)

Table 48 Russia: Market Size, By Product Type, 2014–2021 (KT)

Table 49 Russia: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 50 Russia: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 51 Rest of Europe: Market Size, By Product Type, 2014–2021 (USD Million)

Table 52 Rest of Europe: Market Size, By Product Type, 2014–2021 (KT)

Table 53 Rest of Europe: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 54 Rest of Europe: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 55 Asia-Pacific: Market Size, By Country, 2014–2021 (USD Million)

Table 56 Asia-Pacific: Market Size, By Country, 2014–2021 (KT)

Table 57 Asia-Pacific: Market Size, By Product Type, 2014–2021 (USD Million)

Table 58 Asia-Pacific: Market Size, By Product Type, 2014–2021 (KT)

Table 59 Asia-Pacific: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 60 Asia-Pacific: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 61 China: Market Size, By Product Type, 2014–2021 (USD Million)

Table 62 China: Aluminum-extruded Products Market Size, By Product Type, 2014–2021 (KT)

Table 63 China: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 64 China: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 65 India: Aluminum-extruded Products Market Size, By Product Type, 2014–2021 (USD Million)

Table 66 India: Market Size, By Product Type, 2014–2021 (KT)

Table 67 India: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 68 India: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 69 Japan: Aluminum-extruded Products Market Size, By Product Type, 2014–2021 (USD Million)

Table 70 Japan: Market Size, By Product Type, 2014–2021 (KT)

Table 71 Japan: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 72 Japan: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 73 South Korea: Aluminum-extruded Products Market Size, By Product Type, 2014–2021 (USD Million)

Table 74 South Korea: Market Size, By Product Type, 2014–2021 (KT)

Table 75 South Korea: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 76 South Korea: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 77 Australia: Aluminum-extruded Products Market Size, By Product Type, 2014–2021 (USD Million)

Table 78 Australia: Market Size, By Product Type, 2014–2021 (KT)

Table 79 Australia: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 80 Australia: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 81 Rest of Asia-Pacific: Aluminum-extruded Products Market Size, By Product Type, 2014–2021 (USD Million)

Table 82 Rest of Asia-Pacific: Market Size, By Product Type, 2014–2021 (KT)

Table 83 Rest of Asia-Pacific: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 84 Rest of Asia-Pacific: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 85 Middle East & Africa: Aluminum-extruded Products Market Size, By Product Country, 2014–2021 (USD Million)

Table 86 Middle East & Africa: Market Size, By Country, 2014–2021 (KT)

Table 87 Middle East & Africa: Market Size, By Product Type, 2014–2021 (USD Million)

Table 88 Middle East & Africa: Market Size, By Product Type, 2014–2021 (KT)

Table 89 Middle East & Africa: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 90 Middle East & Africa: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 91 South Africa: Aluminum-extruded Products Market Size, By Product Type, 2014–2021 (USD Million)

Table 92 South Africa: Market Size, By Product Type, 2014–2021 (KT)

Table 93 South Africa: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 94 South Africa: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 95 UAE: Aluminum-extruded Products Market Size, By Product Type, 2014–2021 (USD Million)

Table 96 UAE: Market Size, By Product Type, 2014–2021 (KT)

Table 97 UAE: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 98 UAE: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 99 Turkey: Aluminum-extruded Products Market Size, By Product Type, 2014–2021 (USD Million)

Table 100 Turkey: Market Size, By Product Type, 2014–2021 (KT)

Table 101 Turkey: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 102 Turkey: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 103 Rest of Middle East & Africa: Aluminum-extruded Products Market Size, By Product Type, 2014–2021 (USD Million)

Table 104 Rest of Middle East & Africa: Market Size, By Product Type, 2014–2021 (KT)

Table 105 Rest of Middle East & Africa: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 106 Rest of Middle East & Africa: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 107 Latin America: Aluminum-extruded Products Market Size, By Country, 2014–2021 (USD Million)

Table 108 Latin America: Market Size, By Country, 2014–2021 (KT)

Table 109 Latin America: Market Size, By Product Type, 2014–2021 (USD Million)

Table 110 Latin America: Market Size, By Product Type, 2014–2021 (KT)

Table 111 Latin America: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 112 Latin America: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 113 Brazil: Aluminum-extruded Products Market Size, By Product Type, 2014–2021 (USD Million)

Table 114 Brazil: Market Size, By Product Type, 2014–2021 (KT)

Table 115 Brazil: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 116 Brazil: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 117 Argentina: Aluminum-extruded Products Market Size, By Product Type, 2014–2021 (USD Million)

Table 118 Argentina: Market Size, By Product Type, 2014–2021 (KT)

Table 119 Argentina: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 120 Argentina: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 121 Rest of Latin America: Aluminum-extruded Products Market Size, By Product Type, 2014–2021 (USD Million)

Table 122 Rest of Latin America: Market Size, By Product Type, 2014–2021 (KT)

Table 123 Rest of Latin America: Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 124 Rest of Latin America: Market Size, By End-Use Industry, 2014–2021 (KT)

Table 125 Expansions & Investments, 2011–2015

Table 126 Joint Ventures, Agreements, and Contracts 2011–2015

Table 127 Mergers & Acquisitions, 2011–2015

Table 128 New Product Launches, 2011–2015

List of Figures (47 Figures)

Figure 1 Aluminum-extruded Products Market

Figure 2 Geographic Scope

Figure 3 Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Asia-Pacific Projected to Dominate the Market Due to Rising Demand From End-Use Industries During the Forecast Period

Figure 7 Aluminum-extruded Products Market Snapshot (2016 vs 2021)

Figure 8 Asia-Pacific to Be the Fastest-Growing Regional Market in Terms of Value During the Forecast Period

Figure 9 Key Strategies of Various Competitors, 2011–2016

Figure 10 Emerging Economies Offer Attractive Opportunities in the Aluminum-extruded Products Market

Figure 11 Construction Industry Captures the Largest Market Share of End-Use Industry of Aluminum-extruded Products in Asia-Pacific, 2016

Figure 12 India is Projected to Be the Fastest-Growing Country-Level Market for Aluminum-extruded Products During the Forecast Period

Figure 13 Construction Segment Dominated the Market During the Forecast Period

Figure 14 Asia-Pacific Dominated the Market During the Forecast Period

Figure 15 Aluminum-extruded Products Market in Asia-Pacific to Experience High Growth During the Forecast Period

Figure 16 Evolution of Aluminum Systems

Figure 17 Market Segmentation: Aluminum-extruded Products Market

Figure 18 Rising Demand From End Use Industry is the Key Driver for Aluminum-extruded Products Market

Figure 19 Aluminum Reduces the Overall Weight of A Car

Figure 20 Market Size, By Product Type, 2016 vs 2021 (MT)

Figure 21 Market Size, By End-Use Industry, 2016 vs 2021 (USD Billion)

Figure 22 Market Snapshot: India is Projected to Be the Fastest-Growing Market (2016–2021)

Figure 23 North America: Market Snapshot

Figure 24 European Market Snapshot: the U.K. is Projected to Be the Fastest-Growing Market From 2016 to 2021

Figure 25 Asia-Pacific: Market Snapshot

Figure 26 Indian Automotive Industry, 2011–2015 (USD Billion)

Figure 27 Middle East & Africa Region Snapshot

Figure 28 South Africa Automotive Market in 2015

Figure 29 Companies Adopted Expansions & Investments and Contracts, Joint Ventures & Agreements as Key Growth Strategies From 2011 T0 2016

Figure 30 Companies Empahsized on Expansions & Investments as Their Key Strategy to Expand the Business Operations

Figure 31 Expansions & Investments: the Key Strategy From 2011 to 2016

Figure 32 Geographic Revenue Mix of Top Five Market Players

Figure 33 United Company Rusal: Company Snapshot

Figure 34 United Company Rusal PLC: SWOT Analysis

Figure 35 Alcoa Inc.: Company Snapshot

Figure 36 Alcoa Inc.: SWOT Analysis

Figure 37 Aluminum Corporation of China Limited: Company Snapshot

Figure 38 Aluminum Corporation of China Limited:SWOT Analysis

Figure 39 RIO Tinto PLC: Company Snapshot

Figure 40 RIO Tinto: SWOT Analysis

Figure 41 BHP Billiton Group: Company Snapshot

Figure 42 BHP Billiton Group:SWOT Analysis

Figure 43 Norsk Hydro ASA: Company Snapshot

Figure 44 Century Aluminum Company: Company Snapshot

Figure 45 China Hongquiao Group Limited: Company Snapshot

Figure 46 Aluminum Bahrain B.S.C.: Company Snapshot

Figure 47 Hindalco Industries Limited: Company Snapshot

Growth opportunities and latent adjacency in Aluminum-extruded Products Market