Aluminum Rolled Products Market by Grade (1xxx, 3xxx, 5xxx and 6xxx), End-Use Industry (Automotive & Transportation, Building & Construction, Packaging, Consumer Durables, Others) and Region (NA, Europe, APAC, MEA, SA) - Global Forecast to 2025

Updated on : April 17, 2024

Aluminum Rolled Products Market

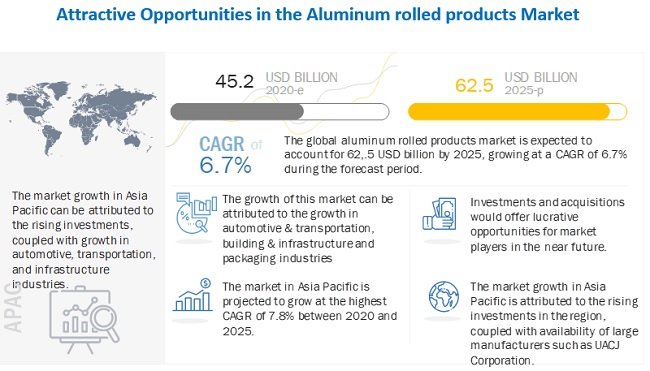

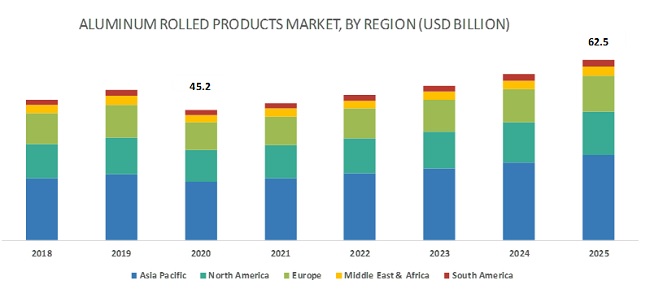

The global Aluminum Rolled Products Market size was valued at USD 45.2 billion in 2020 and is projected to reach USD 62.5 billion by 2025, growing at 6.7% cagr from 2020 to 2025. Growth in automotive & transportation, building & construction and other industries has fuel the growth of the market. China, India, Japan, US, and Germany are the major countries leading in the market. However, the recent outbreak of Covid-19 is expected to impact the market severely.

To know about the assumptions considered for the study, Request for Free Sample Report

The 6xxx series grade is expected to lead the aluminum rolled products market during the forecast period.

Based on grade, the market is segregated into 1xxx Series (1050, and others), 3xxx Series (3003, and others), 5xxx Series (5005, and others), and 6xxx Series. Among these 6xxx Series accounted for the largest share and is also expected to grow at a highest CAGR during the forecast period. This growth is attributed towards its properties such as Ultra-high tensile strength, coupled with the light weight of the 6xxx Series which enhances its usage in automotive & transportation industry. 1xxx Series (1050, and others) is expected to register second highest CAGR during the forecast period.

The automotive & transportation industry is expected to account for the largest share of the aluminum rolled products market during the forecast period

Based on end-use industry, the global aluminum rolled products market is segregated into Automotive and Transportation (Automotive, Aerospace, Train and Ship building), Building and Infrastructure (Building Facades, Doors and Windows), Packaging, Consumer Durables, and Others. Other industries include machinery equipment, electricals & electronics, military equipment, tools & mould, and energy (windmills, et.c). Growth in automotive & transportation industry especially in developing countries such as China, India and others is expected to drive the growth of aluminum rolle products market. Automotive & transportation industry is also expected to register highest CAGR during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific is projected to be the largest consumer of the aluminum rolled products market

Based on region, the aluminum rolled products market is segregated into Asia Pacific, the Middle East & Africa, North America, Europe, and South America. Among these, the Asia Pacific accounted for the largest share in 2019 and is also expected to register highest CAGR during the forecast period. Availability of various large manufacturers such as UACJ Corporatation, coupled with growth in building & construction industry is expected to drive the growth of aluminum rolled products market in Asia Pacific. The availability of labor and raw materials at low-cost in the region are added advantages for these companies. The rapidly increasing population and urbanization are other factors expected to fuel the growth of the market.

Aluminum Rolled Products Market Players

Companies such as Novelis Inc. (US), Constellium SE (France), Arconic Rolled Products Corporation (US), UACJ Corporation (Japan), and Norsk Hydro ASA (Norway) are the major players in the aluminum rolled products market. These players have been adopting strategies such as acquisitions, expansion, new product launches, and agreements that have helped them expand their businesses in untapped and potential markets.

Aluminum Rolled Products Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Volume (Kilo Tons) and Value (USD Million) |

|

Segments covered |

Grade, End-use Industry, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies covered |

Novelis Inc. (US), Constellium SE (France), Arconic Rolled Products Corporation (US), UACJ Corporation (Japan), and Norsk Hydro ASA (Norway) are some of the leading companies considered for the study. |

Based on Grade

- 1xxx Series (1050, and others)

- 3xxx Series (3003, and others)

- 5xxx Series (5005, and others)

- 6xxx Series

Based on End-Use Industry

- Automotive & Transportation

- Automotive

- Aerospace

- Train

- Ship building

- Building & Infrastructure

- Building Facades

- Doors & Windows

- Packaging

- Consumer Durables

- Others

Based on region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In April 2020, Novelis Inc., a world leader in aluminum rolling and recycling, completed its acquisition of Aleris Corporation, a global supplier of rolled aluminum products. As a result, Novelis is now even better positioned to meet increasing customer demand for aluminum by expanding its innovative product portfolio, creating a more skilled and diverse workforce, and deepening its commitment to safety, sustainability, quality, and partnership.

- In February 2019, Arconic Rolled Products Corporation announced an investment of approximately USD 100 million into the expansion of its hot mill capabilities and addition of downstream equipment capabilities for the manufacture of industrial and automotive aluminum products in its Tennessee Operations facility near Knoxville, Tennessee, US. This investment added the capacity needed to meet the growing demand for industrial products and automotive aluminum sheets.

- In September 2018, Constellium SE and Boeing signed a multi-year agreement for the supply of advanced aluminum rolled products.

Frequently Asked Questions (FAQ):

Which is the dominating grade in the aluminum rolled products market?

6xxx series is the dominant grade in the aluminum rolled products market.

What the drivers influencing the growth of aluminum rolled products market?

Growing vehicles production, regulations for fuel effieiency and emissions are the drivers responsible for the growth of the market.

Which region is going to dominate in aluminum rolled products market?

Asia Pacific region is expected to lead the aluminum rolled products market. It is also expected to register highest CAGR during the forecast period.

What will be the future product mix of the aluminum rolled products (scrap and new)?

Aluminum is 100% recyclable material, so it is expected that scrap is the future product mix of aluminum.

What are the prime strategies of leaders in the aluminum rolled products market?

Large players are adopting inorganic strategies such as acquisitions, and expansions. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 ALUMINUM ROLLED PRODUCTS MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 MARKET DEFINITION AND SCOPE

2.2 BASE NUMBER CALCULATION

FIGURE 2 BASE NUMBER CALCULATION APPROACH 1

FIGURE 3 BASE NUMBER CALCULATION APPROACH 2

2.3 FORECAST NUMBER CALCULATION

2.4 MARKET ENGINEERING PROCESS

2.4.1 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.4.2 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.6 ASSUMPTIONS

2.7 RESEARCH DATA

2.7.1 SECONDARY DATA

2.7.1.1 Key data from secondary sources

2.7.2 PRIMARY DATA

2.7.2.1 Key data from primary sources

2.7.2.2 Key industry insights

2.7.2.3 Breakdown of primary interviews

3 EXECUTIVE SUMMARY (Page No. - 31)

TABLE 1 ALUMINUM ROLLED PRODUCTS MARKET SNAPSHOT

FIGURE 7 6XXX SERIES EXPECTED TO LEAD THE ALUMINUM ROLLED PRODUCTS MARKET GROWTH DURING THE FORECAST PERIOD

FIGURE 8 AUTOMOTIVE & TRANSPORTATION SEGMENT EXPECTED TO GROW AT THE HIGHEST CAGR BETWEEN 2020 AND 2025

4 PREMIUM INSIGHTS (Page No. - 34)

4.1 ATTRACTIVE OPPORTUNITIES IN ALUMINUM ROLLED PRODUCTS MARKET

FIGURE 9 GROWTH OF AUTOMOTIVE & TRANSPORTATION INDUSTRY IS A MAJOR FACTOR DRIVING THE ALUMINUM ROLLED PRODUCTS MARKET

4.2 ALUMINUM ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY

FIGURE 10 AUTOMOTIVE & TRANSPORTATION SEGMENT EXPECTED TO GROW AT THE HIGHEST RATE DURING FORECAST PERIOD

4.3 ALUMINUM ROLLED PRODUCTS MARKET, BY REGION

FIGURE 11 ASIA PACIFIC ACCOUNTED FOR THE LARGEST SHARE OF THE ALUMINUM ROLLED PRODUCTS MARKET IN 2019

4.4 ALUMINUM ROLLED PRODUCTS MARKET, BY GRADE & COUNTRY

FIGURE 12 6XXX SERIES GRADE AND CHINA LED THE ALUMINUM ROLLED PRODUCTS MARKET IN ASIA PACIFIC IN 2019

4.5 MACROECONOMIC INDICATORS (COVID-19)

4.5.1 COVID-19

4.5.2 COVID-19 IMPACT ON THE ALUMINUM INDUSTRY

4.5.2.1 Impact on supply and demand:

4.5.2.2 Smelters and refineries:

4.5.3 CONCLUSION

5 MARKET OVERVIEW (Page No. - 39)

5.1 MARKET DYNAMICS

FIGURE 13 MARKET DYNAMICS: ALUMINUM ROLLED PRODUCTS MARKET

5.1.1 DRIVERS

5.1.1.1 Increasing demand from end-use industries

5.1.1.2 Technological advancements in the aluminum industry

5.1.1.3 Improved driving dynamics

5.1.2 RESTRAINTS

5.1.2.1 High capital investments required

5.1.2.2 Effects of COVID-19 on end-use industries

5.1.3 OPPORTUNITIES

5.1.3.1 Growth in demand for recycled and value-added aluminum products

5.1.3.2 Demand for aluminum in emerging economies

5.1.4 CHALLENGES

5.1.4.1 Greenhouse gas emissions

5.2 PORTER'S FIVE FORCES ANALYSIS

FIGURE 14 PORTER'S FIVE FORCES ANALYSIS

5.2.1 BARGAINING POWER OF SUPPLIERS

5.2.2 THREAT OF NEW ENTRANTS

5.2.3 THREAT OF SUBSTITUTES

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 INTENSITY OF COMPETITIVE RIVALRY

6 ALUMINUM ROLLED PRODUCTS MARKET, BY GRADE (Page No. - 45)

6.1 INTRODUCTION

FIGURE 15 6XXX SERIES GRADE TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD (USD MILLION)

TABLE 2 ALUMINUM ROLLED PRODUCTS MARKET, BY GRADE, 2018–2025 (KILO TONS)

TABLE 3 ALUMINUM ROLLED PRODUCTS MARKET, BY GRADE, 2018–2025 (USD MILLION)

6.2 1XXX SERIES (1050, AND OTHERS)

6.2.1 DUE TO THE SOFT AND DUCTILE NATURE OF THE 1XXX SERIES, IT IS PREDOMINANTLY USED IN THE PACKAGING INDUSTRY FOR ALUMINUM CANS, FOIL, AND OTHER APPLICATIONS

TABLE 4 1XXX SERIES (1050, AND OTHERS): ALUMINUM ROLLED PRODUCTS MARKET, BY REGION, 2018–2025 (KILO TONS)

TABLE 5 1XXX SERIES (1050, AND OTHERS): ALUMINUM ROLLED PRODUCTS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3 3XXX SERIES (3003, AND OTHERS)

6.3.1 INCREASE IN TENSILE STRENGTH THROUGH ADDITION OF MANGANESE ENHANCES THE USEFULNESS OF THE 3XXX SERIES IN THE BUILDING & CONSTRUCTION INDUSTRY

TABLE 6 3XXX SERIES (3003, AND OTHERS): ALUMINUM ROLLED PRODUCTS MARKET, BY REGION, 2018–2025 (KILO TONS)

TABLE 7 3XXX SERIES (3003, AND OTHERS): ALUMINUM ROLLED PRODUCTS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.4 5XXX SERIES (5005, AND OTHERS)

6.4.1 GOOD WELDABILITY AND HIGH TENSILE STRENGTH PROMOTES THE USAGE OF THE 5XXX SERIES IN THE AUTOMOTIVE & TRANSPORTATION AND BUILDING & CONSTRUCTION INDUSTRIES

TABLE 8 5XXX SERIES (5005, AND OTHERS): ALUMINUM ROLLED PRODUCTS MARKET, BY REGION, 2018–2025 (KILO TONS)

TABLE 9 5XXX SERIES (5005, AND OTHERS): ALUMINUM ROLLED PRODUCTS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.5 6XXX SERIES

6.5.1 ULTRA-HIGH TENSILE STRENGTH, COUPLED WITH THE LIGHT WEIGHT OF THE 6XXX SERIES, MAKES THIS ALLOY USEFUL FOR APPLICATIONS IN THE AUTOMOTIVE & TRANSPORTATION INDUSTRY

TABLE 10 6XXX SERIES: ALUMINUM ROLLED PRODUCTS MARKET, BY REGION, 2018–2025 (KILO TONS)

TABLE 11 6XXX SERIES: ALUMINUM ROLLED PRODUCTS MARKET, BY REGION, 2018–2025 (USD MILLION)

7 ALUMINUM ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY (Page No. - 52)

7.1 INTRODUCTION

FIGURE 16 AUTOMOTIVE & TRANSPORTATION TO LEAD MARKET GROWTH DURING THE FORECAST PERIOD (USD MILLION)

TABLE 12 ALUMINUM ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2018–2025 (KILO TONS)

TABLE 13 ALUMINUM ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

7.2 AUTOMOTIVE & TRANSPORTATION

7.2.1 THE LIGHT WEIGHT OF ALUMINUM ENHANCES ITS USEFULNESS IN THE AUTOMOTIVE & TRANSPORTATION MARKET

TABLE 14 AUTOMOTIVE & TRANSPORTATION: ALUMINUM ROLLED PRODUCTS MARKET, BY REGION, 2018–2025 (KILO TONS)

TABLE 15 AUTOMOTIVE & TRANSPORTATION: ALUMINUM ROLLED PRODUCTS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 16 AUTOMOTIVE: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- VEHICLE TYPE, 2018–2025 (KILO TONS)

TABLE 17 AUTOMOTIVE: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 18 AUTOMOTIVE: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- COMPONENT, 2018–2025 (KILO TONS)

TABLE 19 AUTOMOTIVE: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- COMPONENT, 2018–2025 (USD MILLION)

TABLE 20 ALUMINUM ROLLED PRODUCTS IN BATTERY PACKS OF EV, BY REGION, 2018–2025 (KILO TONS)

TABLE 21 ALUMINUM ROLLED PRODUCTS IN BATTERY PACKS OF EV, BY REGION, 2018–2025 (USD MILLION)

7.3 BUILDING & INFRASTRUCTURE

7.3.1 INVESTMENT IN INFRASTRUCTURE IS THE MAJOR FACTOR RESPONSIBLE FOR THE GROWTH OF THE MARKET

TABLE 22 BUILDING & INFRASTRUCTURE: ALUMINUM ROLLED PRODUCTS MARKET, BY REGION, 2018–2025 (KILO TONS)

TABLE 23 BUILDING & INFRASTRUCTURE: ALUMINUM ROLLED PRODUCTS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.4 PACKAGING

7.4.1 PROPERTIES SUCH AS LIGHT WEIGHT, IMPERMEABILITY, AND HIGH FLEXIBILITY ENHANCE THE USEFULNESS OF ALUMINUM ROLLED PRODUCTS IN THE PACKAGING INDUSTRY

TABLE 24 PACKAGING INDUSTRY: ALUMINUM ROLLED PRODUCTS MARKET, BY REGION, 2018–2025 (KILO TONS)

TABLE 25 PACKAGING INDUSTRY: ALUMINUM ROLLED PRODUCTS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.5 CONSUMER DURABLES

7.5.1 HIGH TENSILE STRENGTH AND FORMABILITY ARE THE FACTORS RESPONSIBLE FOR THE GROWTH OF ALUMINUM ROLLED PRODUCTS IN THE CONSUMER DURABLES INDUSTRY

TABLE 26 CONSUMER DURABLES: ALUMINUM ROLLED PRODUCTS MARKET, BY REGION, 2018–2025 (KILO TONS)

TABLE 27 CONSUMER DURABLES: ALUMINUM ROLLED PRODUCTS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.6 OTHERS

7.6.1 GROWTH IN THE ELECTRICALS & ELECTRONICS AND OTHER INDUSTRIES IS EXPECTED TO DRIVE THE GROWTH OF THE MARKET

TABLE 28 OTHERS: ALUMINUM ROLLED PRODUCTS, BY REGION, 2018–2025 (KILO TONS)

TABLE 29 OTHERS: ALUMINUM ROLLED PRODUCTS MARKET, BY REGION, 2018–2025 (USD MILLION)

8 REGIONAL ANALYSIS (Page No. - 64)

8.1 INTRODUCTION

TABLE 30 INTERIM ECONOMIC OUTLOOK FORECAST, 2019-2021

FIGURE 17 ASIA PACIFIC PROJECTED TO BE THE FASTEST-GROWING MARKET FOR ALUMINUM ROLLED PRODUCTS DURING THE FORECAST PERIOD

TABLE 31 ALUMINUM ROLLED PRODUCTS MARKET, BY REGION, 2018–2025 (KILO TONS)

TABLE 32 ALUMINUM ROLLED PRODUCTS MARKET, BY REGION, 2018–2025 (USD MILLION)

8.2 ASIA PACIFIC

FIGURE 18 ASIA PACIFIC ALUMINUM ROLLED PRODUCTS MARKET SNAPSHOT

TABLE 33 ASIA PACIFIC: ALUMINUM ROLLED PRODUCTS MARKET, BY COUNTRY, 2018–2025 (KILO TONS)

TABLE 34 ASIA PACIFIC: ALUMINUM ROLLED PRODUCTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 35 ASIA PACIFIC: ALUMINUM ROLLED PRODUCTS MARKET, BY GRADE, 2018–2025 (KILO TONS)

TABLE 36 ASIA PACIFIC: ALUMINUM ROLLED PRODUCTS MARKET, BY GRADE, 2018–2025 (USD MILLION)

TABLE 37 ASIA PACIFIC: ALUMINUM ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2018–2025 (KILO TONS)

TABLE 38 ASIA PACIFIC: ALUMINUM ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 39 ASIA PACIFIC: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- VEHICLE TYPE, 2018–2025 (KILO TONS)

TABLE 40 ASIA PACIFIC: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 41 ASIA PACIFIC: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- COMPONENTS, 2018–2025 (KILO TONS)

TABLE 42 ASIA PACIFIC: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- COMPONENTS, 2018–2025 (USD MILLION)

8.2.1 CHINA

8.2.1.1 COVID-19 outbreak in China to reduce aluminum rolled products demand in 2020, with gradual recovery expected post-2021

8.2.2 JAPAN

8.2.2.1 Presence of large manufacturers in the country is a major driver for the growth of the market

8.2.3 INDIA

8.2.3.1 Growth in construction activities, infrastructural investments expected to drive the aluminum rolled products market in India

8.2.4 SOUTH KOREA

8.2.4.1 High consumption of aluminum in construction, infrastructure industries driving aluminum rolled products in South Korea

8.2.5 AUSTRALIA

8.2.5.1 Aluminum demand in Australia mainly stems from the building & construction, transportation, and packaging industries

8.2.6 REST OF ASIA PACIFIC

8.2.6.1 Increasing investment and industrialization expected to drive the aluminum rolled products market in Rest of Asia Pacific

8.3 EUROPE

FIGURE 19 EUROPE ALUMINUM ROLLED PRODUCTS MARKET SNAPSHOT

TABLE 43 EUROPE: ALUMINUM ROLLED PRODUCTS MARKET, BY COUNTRY, 2018–2025 (KILO TONS)

TABLE 44 EUROPE: ALUMINUM ROLLED PRODUCTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 45 EUROPE: ALUMINUM ROLLED PRODUCTS MARKET, BY GRADE, 2018–2025 (KILO TONS)

TABLE 46 EUROPE: ALUMINUM ROLLED PRODUCTS MARKET, BY GRADE, 2018–2025 (USD MILLION)

TABLE 47 EUROPE: ALUMINUM ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2018–2025 (KILO TONS)

TABLE 48 EUROPE: ALUMINUM ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 49 EUROPE: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- VEHICLE TYPE, 2018–2025 (KILO TONS)

TABLE 50 EUROPE: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 51 EUROPE: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- COMPONENTS, 2018–2025 (KILO TONS)

TABLE 52 EUROPE: ALUMINUM ROLLED PRODUCTS MARKET,BY AUTOMOTIVE- COMPONENTS, 2018–2025 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 Growth in the infrastructure industry and technological advancements are expected to drive the market

8.3.2 ITALY

8.3.2.1 Severity of COVID-19 pandemic in Italy hampered economic growth and is expected to affect the demand for aluminum rolled products

8.3.3 RUSSIA

8.3.3.1 Growth in the construction industry is expected to drive the Russian market

8.3.4 FRANCE

8.3.4.1 Government initiatives are driving the market for aluminum rolled products in France

8.3.5 SPAIN

8.3.5.1 Rising demand for canned and processed food in the country

8.3.6 UK

8.3.6.1 Increasing demand for aluminum rolled products from the building & construction and transportation industries

8.3.7 REST OF EUROPE

8.3.7.1 The growth in automotive, building, and infrastructure activities in the Rest of Europe is expected to drive the growth of the market

8.4 NORTH AMERICA

FIGURE 20 NORTH AMERICA ALUMINUM ROLLED PRODUCTS MARKET SNAPSHOT

TABLE 53 NORTH AMERICA: ALUMINUM ROLLED PRODUCTS MARKET, BY COUNTRY, 2018–2025 (KILO TONS)

TABLE 54 NORTH AMERICA: ALUMINUM ROLLED PRODUCTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 55 NORTH AMERICA: ALUMINUM ROLLED PRODUCTS MARKET, BY GRADE, 2018–2025 (KILO TONS)

TABLE 56 NORTH AMERICA: ALUMINUM ROLLED PRODUCTS MARKET, BY GRADE, 2018–2025 (USD MILLION)

TABLE 57 NORTH AMERICA: ALUMINUM ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2018–2025 (KILO TONS)

TABLE 58 NORTH AMERICA: ALUMINUM ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 59 NORTH AMERICA: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- VEHICLE TYPE, 2018–2025 (KILO TONS)

TABLE 60 NORTH AMERICA: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 61 NORTH AMERICA: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- COMPONENTS, 2018–2025 (KILO TONS)

TABLE 62 NORTH AMERICA: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- COMPONENTS, 2018–2025 (USD MILLION)

8.4.1 US

8.4.1.1 Growth in demand for packaging, coupled with government initiatives, are driving the US market

8.4.2 MEXICO

8.4.2.1 Growth of infrastructural development is expected to fuel the aluminum rolled products market in Mexico

8.4.3 CANADA

8.4.3.1 Increasing investments and infrastructural developments are expected to drive the market for aluminum rolled products in Canada

8.5 MIDDLE EAST & AFRICA

FIGURE 21 MIDDLE EAST & AFRICA ALUMINUM ROLLED PRODUCTS MARKET SNAPSHOT

TABLE 63 MIDDLE EAST & AFRICA: ALUMINUM ROLLED PRODUCTS MARKET, BY COUNTRY, 2018–2025 (KILO TONS)

TABLE 64 MIDDLE EAST & AFRICA: ALUMINUM ROLLED PRODUCTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA: ALUMINUM ROLLED PRODUCTS MARKET, BY GRADE, 2018–2025 (KILO TONS)

TABLE 66 MIDDLE EAST & AFRICA: ALUMINUM ROLLED PRODUCTS MARKET, BY GRADE, 2018–2025 (USD MILLION)

TABLE 67 MIDDLE EAST & AFRICA: ALUMINUM ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2018–2025 (KILO TONS)

TABLE 68 MIDDLE EAST & AFRICA: ALUMINUM ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 69 MIDDLE EAST & AFRICA: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- VEHICLE TYPE, 2018–2025 (KILO TONS)

TABLE 70 MIDDLE EAST & AFRICA: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 71 MIDDLE EAST & AFRICA: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- COMPONENTS, 2018–2025 (KILO TONS)

TABLE 72 MIDDLE EAST & AFRICA: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- COMPONENTS, 2018–2025 (USD MILLION)

8.5.1 UAE

8.5.1.1 Government investments and increase in construction activities to drive the demand for aluminum rolled products in the UAE

8.5.2 SAUDI ARABIA

8.5.2.1 Infrastructural investment is expected to drive the growth of the market in Saudi Arabia

8.5.3 IRAN

8.5.3.1 Increasing investments and favorable government policies are expected to drive the market in Iran

8.5.4 SOUTH AFRICA

8.5.4.1 Beverage industry plays a key role in the growth of metal packaging

8.5.5 REST OF MIDDLE EAST & AFRICA

8.5.5.1 Attractive investment destination due to proximity to the Europe region

8.6 SOUTH AMERICA

FIGURE 22 SOUTH AMERICA: ALUMINUM ROLLED PRODUCTS MARKET SNAPSHOT

TABLE 73 SOUTH AMERICA: ALUMINUM ROLLED PRODUCTS MARKET, BY COUNTRY, 2018–2025 (KILO TONS)

TABLE 74 SOUTH AMERICA: ALUMINUM ROLLED PRODUCTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 75 SOUTH AMERICA: ALUMINUM ROLLED PRODUCTS MARKET, BY GRADE, 2018–2025 (KILO TONS)

TABLE 76 SOUTH AMERICA: ALUMINUM ROLLED PRODUCTS MARKET, BY GRADE, 2018–2025 (USD MILLION)

TABLE 77 SOUTH AMERICA: ALUMINUM ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2018–2025 (KILO TONS)

TABLE 78 SOUTH AMERICA: ALUMINUM ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 79 SOUTH AMERICA: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- VEHICLE TYPE, 2018–2025 (KILO TONS)

TABLE 80 SOUTH AMERICA: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 81 SOUTH AMERICA: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- COMPONENTS, 2018–2025 (KILO TONS)

TABLE 82 SOUTH AMERICA: ALUMINUM ROLLED PRODUCTS MARKET, BY AUTOMOTIVE- COMPONENTS, 2018–2025 (USD MILLION)

8.6.1 BRAZIL

8.6.1.1 Government focus on infrastructure spending and stringent environment norms driving the growth of the market

8.6.2 ARGENTINA

8.6.2.1 Government investments in infrastructural developments are expected to drive the growth of the market

8.6.3 REST OF SOUTH AMERICA

8.6.3.1 Increasing investments in infrastructural developments expected to drive aluminum rolled products market in Rest of South America

9 COMPETITIVE LANDSCAPE (Page No. - 105)

9.1 INTRODUCTION

9.2 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

9.2.1 MARKET SHARE ANALYSIS

FIGURE 23 MARKET SHARE ANALYSIS OF TOP PLAYERS IN THE ALUMINUM ROLLED PRODUCTS MARKET

9.2.2 PRODUCT FOOTPRINT

FIGURE 24 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE ALUMINUM ROLLED PRODUCTS MARKET

9.2.3 STAR

9.2.4 EMERGING LEADERS

9.2.5 PERVASIVE

9.2.6 STARTING BLOCKS

9.3 COMPANY EVALUATION MATRIX

FIGURE 25 ALUMINUM ROLLED PRODUCTS MARKET: COMPANY EVALUATION MATRIX, 2019

10 COMPANY PROFILES (Page No. - 108)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Threat from Competition, Current Focus and Strategies, Right to Win, and MnM view)*

10.1 NOVELIS INC.

FIGURE 26 NOVELIS INC.: COMPANY SNAPSHOT

10.2 ARCONIC ROLLED PRODUCTS CORPORATION

FIGURE 27 ARCONIC ROLLED PRODUCTS CORPORATION: COMPANY SNAPSHOT

10.3 CONSTELLIUM SE

FIGURE 28 CONSTELLIUM SE: COMPANY SNAPSHOT

10.4 UACJ CORPORATION

FIGURE 29 UACJ CORPORATION: COMPANY SNAPSHOT

10.5 NORSK HYDRO ASA

FIGURE 30 NORSK HYDRO ASA: COMPANY SNAPSHOT

10.6 GRANGES AB

FIGURE 31 GRANGES AB: COMPANY SNAPSHOT

10.7 ALUMINUM CORPORATION OF CHINA LIMITED

FIGURE 32 ALUMINUM CORPORATION OF CHINA LIMITED: COMPANY SNAPSHOT

10.8 CHINA HONGQIAO GROUP LIMITED

FIGURE 33 CHINA HONGQIAO GROUP LTD: COMPANY SNAPSHOT

10.9 SHANDONG XINFA HUAXIN ALUMINUM CO. LTD.

10.10 HAI PHONG ALUMINUM ENAMEL FACTORY

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Threat from Competition, Current Focus and Strategies, Right to Win, and MnM view might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 134)

11.1 INDUSTRY EXPERTS

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

11.4 AVAILABLE CUSTOMIZATIONS

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size for the aluminum rolled products market. Exhaustive secondary research was undertaken to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as directories, and databases, such as D&B Hoovers, Bloomberg, the World Bank, IMF, The World Factbook, World Aluminum, OICA, CRU Group, The Aluminum Association, EUROCONSTRUCT, Factiva, and other government & private websites and associations related to the aluminum sector were referred to identify and collect information for this study. Secondary sources include aluminum rolled products manufacturers, annual reports, press releases & investor presentations of companies, whitepapers, certified publications, articles by recognized authors, gold standard & silver standard websites, associations, regulatory bodies, trade directories, and databases.

Primary Research

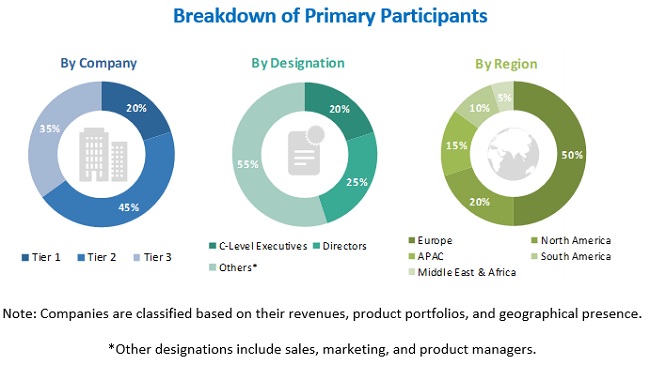

The aluminum rolled products market comprises several stakeholders, such as core and related industries and suppliers, manufacturers, distributors, technology developers, alliances, and organizations related to all segments of the value chain of this industry. The demand side of this market is characterized by the developments in the automotive, transportation, building, infrastructure, and other industries. The supply side is characterized by market consolidation activities undertaken by aluminum rolled products producers. Several primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation:

Both, the top-down and bottom-up approaches were used to estimate and validate the total size of the aluminum rolled products market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and aluminum rolled products market size, in terms of volume and value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation:

After arriving at the overall aluminum rolled products market size—using the market size estimation process explained above—the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Report Objectives:

- To estimate and forecast the size of the aluminum rolled products market in terms of volume (kilo tons) and value (USD million)

- To define, describe, and forecast the size of the aluminum rolled products market based on grade, end-use industry, and region

- To forecast the size of various segments of the market based on five major regions—Asia Pacific, North America, Europe, the Middle East & Africa, and South America, along with major countries in each region

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and draw a competitive landscape of market leaders

- To strategically profile key players and comprehensively analyze their core competencies

- To analyze competitive developments such as expansions, acquisitions, new product developments/launches, and investments in the global aluminum rolled products market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Regional Analysis

- A further breakdown of the regional aluminum rolled products market to the country level by grade

Country Information

- Regional market split by major countries

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Aluminum Rolled Products Market