Aliphatic Hydrocarbon Solvents & Thinners Market by Type (Varnish Makers’& Painters’ Naphtha, Mineral Spirits, Hexane, Heptane, Paraffinic Solvent, Pentane, and Solvent 140), Application, Region - Global Forecast to 2025

Updated on : June 18, 2024

Aliphatic Hydrocarbon Solvents and Thinners Market

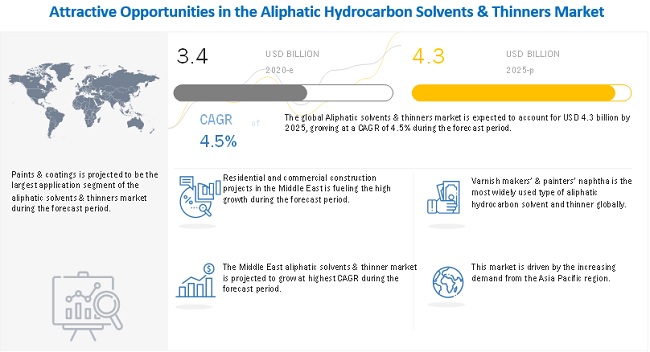

The Aliphatic Hydrocarbon Solvents and Thinners Market was valued at USD 3.4 billion in 2020 and is projected to reach USD 4.3 billion by 2025, growing at 4.5% cagr from 2020 to 2025. Surging demand for paints & coatings from decorative, automotive, industrial, and protective paints & coatings industries is fueling the growth of the market across the globe. Increasing demand for residential and commercial buildings from emerging economies acts as an opportunity for the growth of the aliphatic hydrocarbon solvents & thinners market worldwide.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Aliphatic Hydrocarbon Solvents & Thinners Market

The pandemic is estimated to have huge impact on the end-use industries of aliphatic solvents which is expected to reflect during the forecast period, especially in the year 2020-2021. The various impact of COVID-19 are as follows:

- Impact on the automotive industry: The demand for cars and commercial vehicles is expected to see decline throughout 2020 and 2021. More than 80% of automobile production in North America has come to a halt due to the COVID-19 pandemic. Europe and Asia Pacific are witnessing a similar situation. Companies such as Ford, General Motors, Fiat Chrysler Automobiles, Honda, and Tesla have stopped production temporarily. Even if these companies resume production after the pandemic subsides, economic instability and reduction in the purchasing power of consumers will have an adverse effect on the automotive industry.

- Impact on construction & infrastructure industries: The impact of COVID-19 on the construction industry is projected to vary in different regions across the world. The IMF has predicted that there will be heavy layoffs in the construction sector and other industries in the US. In Europe, the building & construction industry is anticipated to contract by 60%–70% in 2020.

Aliphatic Hydrocarbon Solvents and Thinners Market Dynamics

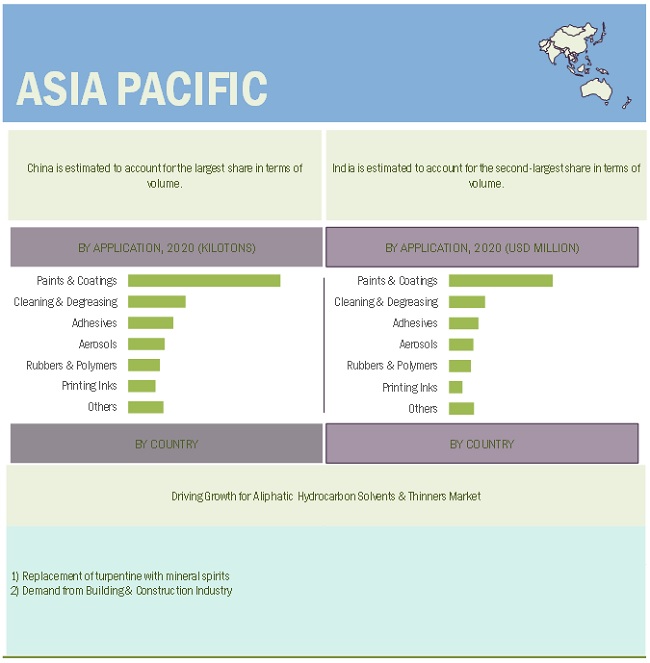

Driver: Replacement of turpentine with mineral spirits

Turpentine is extensively used in the painting and art industries but is known to release noxious vapors and has a strong odor. Mineral spirits are common aliphatic solvents that perform the same function as turpentine without releasing any vapors or odors. Turpentine is a skin, eye, mucous membrane, and upper respiratory tract irritant in humans. It can also cause skin sensitization and affect the central nervous system, gastrointestinal, and urinary tract. These factors lead to the replacement of turpentine with mineral spirits or odorless mineral spirits, driving the aliphatic hydrocarbon solvent & thinners market

Restraint: Manufacturers switching to green solvents

Personnel working in aliphatic solvents & thinners manufacturing units are in constant contact with solvents, which may cause damage to their nervous, reproductive, and respiratory systems. Restrictive regulations on the use of solvents have made organic solvents an attractive option for manufacturers of aliphatic solvents & thinners. The green solvents segment is expected to witness growth in the coming years such as ethanol, glycerol, ethyl acetate, and d-Limonene are used in cosmetics, lotions, soaps, paints, coatings, pharmaceuticals, adhesives, and others.

Opportunity: Growth opportunities from emerging economies in the Middle East

There has been significant growth in real estate activities along with rapid industrialization in the Middle East. Countries such as Saudi Arabia and the UAE want to reduce their dependence on the oil industry for economic growth and focus on other industries. Thus, the construction industry has witnessed major growth in the Middle East. The construction industry requires paints & coatings, cleaning & degreasing agents, and adhesives, which, in turn, is leading to the demand for aliphatic solvents & thinners.

Challenge: Environmental Regulations

The European Union (Paints, Varnishes, Vehicle Refinishing Products, and Activities) Regulations 2012 specify various rules concerning the use of paints, varnishes, and vehicle refinishing products. A certificate of compliance is required for the use of these products. Similarly, the US Environment Protection Agency (EPA), with the help of local authorities, inspects activities at facilities where aliphatic solvents & thinners are manufactured as they contain volatile organic compounds (VOCs) that are hazardous to health and the environment. In the presence of nitrous oxide, VOCs react to form ozone, which is a greenhouse gas and a risk to human and crop health.

Based on application, the paints & coatings segment of the aliphatic hydrocarbon solvents & thinners market is projected to grow at the highest CAGR in terms of both value and volume from 2020 to 2025

Based on application, the paints & coatings segment of the market is projected to grow at the highest CAGR during the forecast period in terms of value and volume.

Aliphatic hydrocarbon solvents & thinners are primarily used as thinners in paints & coatings as the mix of solvents used in this industry are continually changing, and these satisfy increasing demands for enhanced performance. Increased demand for paints & coatings from various end-use industries, such as decorative, automotive, industrial, and protective paints & coatings industries is driving the growth of the paints & coatings segment of the aliphatic hydrocarbon solvents & thinners market across the globe.

The Asia Pacific region is projected to lead the aliphatic hydrocarbon solvents & thinners market during the forecast period in terms of both value and volume

The Asia Pacific region is estimated to be the largest market for aliphatic hydrocarbon solvents & thinners in 2020. China, India, Japan, and South Korea are the primary consumers of aliphatic hydrocarbon solvents & thinners in this region. Rise in urbanization, population, and increase in the income of the middle-class population of the region have resulted in increased demand for residential and commercial buildings in the Asia Pacific, thereby contributing to the growth of the aliphatic hydrocarbon solvents & thinners market in this region.

To know about the assumptions considered for the study, download the pdf brochure

Aliphatic Hydrocarbon Solvents and Thinners Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2016–2025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Value (USD Billion) and Volume (KT) |

|

Segments Covered |

Type, Application, and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

|

Companies Covered |

ExxonMobil Chemical, Inc. (US), SK Global Chemical Co., Ltd. (South Korea), Royal Dutch Shell Plc. (Netherlands), Calumet Specialty Products Partners, L.P. (US), Gotham Industries (Canada), Gulf Chemicals and Industrial Oils Co., (Saudi Arabia). |

This research report categorizes the aliphatic hydrocarbon solvents & thinners market based on type, application, and region.

On the basis of type, the aliphatic hydrocarbon solvents & thinners market has been segmented as follows:

- Varnish Makers’ & Painters’ Naphtha

- Mineral Spirits

- Hexane

- Heptane

- Others (Paraffinic Solvent, Pentane, and Solvent 140)

On the basis of application, the aliphatic hydrocarbon solvents & thinners market has been segmented as follows:

- Paints & Coatings

- Cleaning & Degreasing

- Adhesives

- Aerosols

- Rubbers & polymers

- Printing inks

- Others (Agrochemicals, Pharmaceuticals, and Automotive)

On the basis of region, the aliphatic hydrocarbon solvents & thinners market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In September 2020, Lyondellbasell Industries Holdings B.V. (Netherlands) entered into an agreement with Liaoning Bora Enterprise Group (China) and established a new polyolefin complex in the Liaoning province of northeastern China. The facility has a capacity of 1.1 million metric tons per annum, a flexible naphtha/LPG cracker, an associated polyethylene production capacity of 800,000 metric tons per annum, and 600,000 metric tons per annum of polypropylene.

- In May 2019, Calumet Specialty Product Partners, L.P acquired Biosynthetic Technologies, LLC. The acquisition of Biosynthetic Technologies, LLC, and its technological capabilities, is in alignment with Calumet’s Specialty Products’ focused growth strategy. Furthermore, the company also announced opening a new R&D facility in Indianapolis. This development is expected to create synergy to offer a competitive edge in the aliphatic hydrocarbon solvents & thinners market in the North America region.

Frequently Asked Questions (FAQ):

What is the estimated size of the aliphatic hydrocarbon solvents & thinners market in 2020?

The global size of the market is $3.4 billion in 2020

What are the different applications of aliphatic hydrocarbon solvents & thinners?

The market growth is primarily due to the demand from various industries across the globe. PCM has the ability to store and release a large amount of heat/energy while maintaining a constant temperature. It has tremendous potential to meet the increasing need for energy in cooling and heating applications across various industries including construction, fixed refrigeration, textiles, packaging, electronics, and others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 SCOPE OF THE STUDY

1.3.1 REGIONAL SCOPE

1.3.2 MARKETS COVERED

FIGURE 1 ALIPHATIC SOLVENTS & THINNERS MARKET SEGMENTATION

1.3.3 YEARS CONSIDERED IN THE REPORT

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 ALIPHATIC SOLVENTS & THINNERS MARKET: RESEARCH DESIGN

2.1.1 KEY DATA FROM SECONDARY SOURCES

2.1.2 KEY DATA FROM PRIMARY SOURCES

2.1.2.1 Key industry insights

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

2.2 MARKET SIZE ESTIMATION

FIGURE 4 BOTTOM-UP APPROACH

FIGURE 5 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 6 ALIPHATIC SOLVENTS & THINNERS MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

TABLE 1 ALIPHATIC SOLVENTS & THINNERS MARKET

FIGURE 7 VARNISH MAKERS’ & PAINTERS’ NAPHTHA SEGMENT PROJECTED TO LEAD THE ALIPHATIC SOLVENTS & THINNERS MARKET IN 2019, IN TERMS OF VALUE

FIGURE 8 PAINTS & COATINGS SEGMENT PROJECTED TO LEAD THE ALIPHATIC SOLVENTS & THINNERS MARKET DURING FORECAST PERIOD, IN TERMS OF VALUE

FIGURE 9 ASIA PACIFIC ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF THE ALIPHATIC SOLVENTS & THINNERS MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE OPPORTUNITIES IN THE ALIPHATIC SOLVENTS & THINNERS MARKET

FIGURE 10 THE ALIPHATIC SOLVENTS & THINNERS MARKET IS PROJECTED TO WITNESS MODERATE GROWTH DURING THE FORECAST PERIOD

4.2 ALIPHATIC SOLVENTS & THINNERS MARKET, BY TYPE

FIGURE 11 VARNISH MAKERS’ & PAINTERS’ NAPHTHA TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION

FIGURE 12 PAINTS & COATINGS APPLICATION SEGMENT TO LEAD THE ALIPHATIC SOLVENTS & THINNERS MARKET DURING THE FORECAST PERIOD

4.4 ASIA PACIFIC ALIPHATIC SOLVENTS & THINNERS MARKET

FIGURE 13 VARNISH MAKERS’ & PAINTERS’ NAPHTHA SEGMENT TO ACCOUNT FOR THE LARGEST SHARE IN ASIA PACIFIC IN 2020

4.5 ALIPHATIC SOLVENTS & THINNERS MARKET GROWTH

FIGURE 14 MIDDLE EAST TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 HIGH GROWTH IN THE PAINTS & COATINGS INDUSTRY TO BE THE MAJOR DRIVER FOR THE MARKET OVER THE FORECAST PERIOD

5.2.1 DRIVERS

5.2.1.1 Replacement of turpentine with mineral spirits

5.2.1.2 Growth in the paints & coatings industry

5.2.1.3 High demand from the Asia Pacific region

5.2.2 RESTRAINTS

5.2.2.1 Manufacturers switching to green solvents

5.2.3 OPPORTUNITIES

5.2.3.1 Growth opportunities from emerging economies in the Middle East

5.2.4 CHALLENGES

5.2.4.1 Environmental regulations

5.2.5 ECONOMIC DISRUPTION DUE TO THE COVID-19 PANDEMIC ACROSS END-USE INDUSTRIES

5.2.5.1 Automotive Industry

5.2.5.2 Construction & Infrastructure Industry

6 INDUSTRY TRENDS (Page No. - 50)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 16 SUPPLY CHAIN ANALYSIS

6.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES ANALYSIS

6.3.1 THREAT 0F NEW ENTRANTS

6.3.2 THREAT OF SUBSTITUTES

6.3.3 BARGAINING POWER OF BUYERS

6.3.4 BARGAINING POWER OF SUPPLIERS

6.3.5 INTENSITY OF COMPETITIVE RIVALRY

7 ALIPHATIC SOLVENTS & THINNERS MARKET, BY TYPE (Page No. - 53)

7.1 INTRODUCTION

FIGURE 18 ALIPHATIC SOLVENTS & THINNERS, BY TYPE

7.1.1 DISRUPTION DUE TO COVID-19

7.2 MARKET SIZE AND PROJECTION

7.2.1 VARNISH MAKERS’ & PAINTERS’ NAPHTHA TO LEAD THE ALIPHATIC SOLVENTS & THINNERS MARKET, BY TYPE

TABLE 2 ALIPHATIC SOLVENTS & THINNERS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 3 ALIPHATIC SOLVENTS & THINNERS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 4 ALIPHATIC SOLVENTS & THINNERS MARKET, BY TYPE, 2016–2019 (KILOTONS)

TABLE 5 ALIPHATIC SOLVENTS & THINNERS MARKET, BY TYPE, 2020–2025 (KILOTONS)

FIGURE 19 ALIPHATIC SOLVENTS & THINNERS MARKET, BY TYPE, 2020 & 2025 (USD MILLION)

7.3 VARNISH MAKERS’ & PAINTERS’ NAPHTHA

7.3.1 VARNISH MAKERS’ & PAINTS’ NAPHTHA IS ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE OF THE MARKET

TABLE 6 ALIPHATIC SOLVENTS & THINNERS MARKET FOR VARNISH MAKERS' & PAINTERS’ NAPHTHA, BY REGION, 2016–2019 (USD MILLION)

TABLE 7 ALIPHATIC SOLVENTS & THINNERS MARKET FOR VARNISH MAKERS' & PAINTERS’ NAPHTHA, BY REGION,2020–2025 (USD MILLION)

TABLE 8 ALIPHATIC SOLVENTS & THINNERS MARKET FOR VARNISH MAKERS' & PAINTERS’ NAPHTHA, BY REGION, 2016–2019 (KILOTONS)

TABLE 9 ALIPHATIC SOLVENTS & THINNERS MARKET FOR VARNISH MAKERS' & PAINTERS’ NAPHTHA, BY REGION, 2020–2025 (KILOTONS)

7.4 MINERAL SPIRITS

7.4.1 MINERAL SPIRITS TYPE SEGMENT ACCOUNTED FOR THE SECOND LARGEST SHARE IN THE PROCESS OIL MARKET

TABLE 10 ALIPHATIC SOLVENTS & THINNERS MARKET FOR MINERAL SPIRITS, BY REGION, 2016–2019 (USD MILLION)

TABLE 11 ALIPHATIC SOLVENTS & THINNERS MARKET FOR MINERAL SPIRITS, BY REGION, 2020–2025 (USD MILLION)

TABLE 12 ALIPHATIC SOLVENTS & THINNERS MARKET FOR MINERAL SPIRITS, BY REGION, 2016–2019 (KILOTONS)

TABLE 13 ALIPHATIC SOLVENTS & THINNERS MARKET FOR MINERAL SPIRITS, BY REGION, 2020–2025 (KILOTONS)

7.5 HEXANE

7.5.1 GROWING DEMAND FROM PAINTS & COATINGS INDUSTRY IS EXPECTED TO FUEL THE GROWTH OF HEXANE SEGMENT MARKET

TABLE 14 ALIPHATIC SOLVENTS & THINNERS MARKET FOR HEXANE, BY REGION, 2016–2019 (USD MILLION)

TABLE 15 ALIPHATIC SOLVENTS & THINNERS MARKET FOR HEXANE, BY REGION, 2020–2025 (USD MILLION)

TABLE 16 ALIPHATIC SOLVENTS & THINNERS MARKET FOR HEXANE, BY REGION, 2016–2019 (KILOTONS)

TABLE 17 ALIPHATIC SOLVENTS & THINNERS MARKET FOR HEXANE, BY REGION, 2020–2025 (KILOTONS)

7.6 HEPTANE

7.6.1 ASIA PACIFIC TO LEAD THE HEPTANE SEGMENT MARKET DURING THE FORECAST PERIOD

TABLE 18 ALIPHATIC SOLVENTS & THINNERS MARKET FOR HEPTANE, BY REGION, 2016–2019 (USD MILLION)

TABLE 19 ALIPHATIC SOLVENTS & THINNERS MARKET FOR HEPTANE, BY REGION, 2020–2025 (USD MILLION)

TABLE 20 ALIPHATIC SOLVENTS & THINNERS MARKET FOR HEPTANE, BY REGION, 2016–2019 (KILOTONS)

TABLE 21 ALIPHATIC SOLVENTS & THINNERS MARKET FOR HEPTANE, BY REGION, 2020–2025 (KILOTONS)

7.7 OTHER TYPES

TABLE 22 ALIPHATIC SOLVENTS & THINNERS MARKET FOR OTHER TYPES, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 ALIPHATIC SOLVENTS & THINNERS MARKET FOR OTHER TYPES, BY REGION, 2020–2025 (USD MILLION)

TABLE 24 ALIPHATIC SOLVENTS & THINNERS MARKET FOR OTHER TYPES, BY REGION, 2016–2019 (KILOTONS)

TABLE 25 ALIPHATIC SOLVENTS & THINNERS MARKET FOR OTHER TYPES, BY REGION, 2020–2025 (KILOTONS)

8 ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION (Page No. - 66)

8.1 INTRODUCTION

FIGURE 20 ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION

8.1.1 IMPACT OF COVID-19 ON THE END-USE INDUSTRIES

8.2 MARKET SIZE AND PROJECTION

8.2.1 PAINTS & COATINGS APPLICATION TO LEAD THE ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION

FIGURE 21 ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020 & 2025 (USD MILLION)

TABLE 26 ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 27 ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 28 ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 29 ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

8.3 PAINTS & COATINGS

8.3.1 PAINTS & COATINGS IS THE LARGEST AND THE FASTEST-GROWING APPLICATION SEGMENT

TABLE 30 ALIPHATIC SOLVENTS & THINNERS MARKET FOR PAINTS & COATINGS, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 ALIPHATIC SOLVENTS & THINNERS MARKET FOR PAINTS & COATINGS, BY REGION, 2020–2025 (USD MILLION)

TABLE 32 ALIPHATIC SOLVENTS & THINNERS MARKET FOR PAINTS & COATINGS, BY REGION, 2016–2019 (KILOTONS)

TABLE 33 ALIPHATIC SOLVENTS & THINNERS MARKET FOR PAINTS & COATINGS, BY REGION, 2020–2025 (KILOTONS)

8.4 CLEANING & DEGREASING

8.4.1 CLEANING & DEGREASING APPLICATION ACCOUNTED FOR THE SECOND-LARGEST SHARE

TABLE 34 ALIPHATIC SOLVENTS & THINNERS MARKET FOR CLEANING & DEGREASING, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 ALIPHATIC SOLVENTS & THINNERS MARKET FOR CLEANING & DEGREASING, BY REGION, 2020–2025 (USD MILLION)

TABLE 36 ALIPHATIC SOLVENTS & THINNERS MARKET FOR CLEANING & DEGREASING, BY REGION, 2016–2019 (KILOTONS)

TABLE 37 ALIPHATIC SOLVENTS & THINNERS MARKET FOR CLEANING & DEGREASING, BY REGION, 2020–2025 (KILOTONS)

8.5 ADHESIVES

8.5.1 SOUTH AMERICA IS THE FASTEST GROWING REGION IN ADHESIVES APPLICATION SEGMENT DURING THE FORECAST PERIOD

TABLE 38 ALIPHATIC SOLVENTS & THINNERS MARKET FOR ADHESIVES, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 ALIPHATIC SOLVENTS & THINNERS MARKET FOR ADHESIVES, BY REGION, 2020–2025 (USD MILLION)

TABLE 40 ALIPHATIC SOLVENTS & THINNERS MARKET FOR ADHESIVES, BY REGION, 2016–2019 (KILOTONS)

TABLE 41 ALIPHATIC SOLVENTS & THINNERS MARKET FOR ADHESIVES, BY REGION, 2020–2025 (KILOTONS)

8.6 AEROSOLS

8.6.1 ASIA PACIFIC TO LEAD THE AEROSOLS SEGMENT DURING THE FORECAST PERIOD

TABLE 42 ALIPHATIC SOLVENTS & THINNERS MARKET FOR AEROSOLS, BY REGION, 2016–2019 (USD MILLION)

TABLE 43 ALIPHATIC SOLVENTS & THINNERS MARKET FOR AEROSOLS, BY REGION, 2020–2025 (USD MILLION)

TABLE 44 ALIPHATIC SOLVENTS & THINNERS MARKET FOR AEROSOLS, BY REGION, 2016–2019 (KILOTONS)

TABLE 45 ALIPHATIC SOLVENTS & THINNERS MARKET FOR AEROSOLS, BY REGION, 2020–2025 (KILOTONS)

8.7 RUBBERS & POLYMERS

8.7.1 ASIA PACIFIC IS ESTIMATED TO BE THE LARGEST MARKET IN RUBBER & POLYMER APPLICATION SEGMENT IN 2019

TABLE 46 ALIPHATIC SOLVENTS & THINNERS MARKET FOR RUBBERS & POLYMERS, BY REGION, 2016–2019 (USD MILLION)

TABLE 47 ALIPHATIC SOLVENTS & THINNERS MARKET FOR RUBBERS & POLYMERS, BY REGION, 2020–2025 (USD MILLION)

TABLE 48 ALIPHATIC SOLVENTS & THINNERS MARKET FOR RUBBERS & POLYMERS, BY REGION, 2016–2019 (KILOTONS)

TABLE 49 ALIPHATIC SOLVENTS & THINNERS MARKET FOR RUBBERS & POLYMERS, BY REGION, 2020–2025 (KILOTONS)

8.8 PRINTING INKS

8.8.1 EUROPE TO EXHIBIT NEGATIVE GROWTH IN PRINTING INKS SEGMENT DURING THE FORECAST SYSTEM

TABLE 50 ALIPHATIC SOLVENTS & THINNERS MARKET FOR PRINTING INKS, BY REGION, 2016–2019 (USD MILLION)

TABLE 51 ALIPHATIC SOLVENTS & THINNERS MARKET FOR PRINTING INKS, BY REGION, 2020–2025 (USD MILLION)

TABLE 52 ALIPHATIC SOLVENTS & THINNERS MARKET FOR PRINTING INKS, BY REGION, 2016–2019 (KILOTONS)

TABLE 53 ALIPHATIC SOLVENTS & THINNERS MARKET FOR PRINTING INKS, BY REGION, 2020–2025 (KILOTONS)

8.9 OTHER APPLICATIONS

TABLE 54 ALIPHATIC SOLVENTS & THINNERS MARKET FOR OTHER APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 55 ALIPHATIC SOLVENTS & THINNERS MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

TABLE 56 ALIPHATIC SOLVENTS & THINNERS MARKET FOR OTHER APPLICATIONS, BY REGION, 2016–2019 (KILOTONS)

TABLE 57 ALIPHATIC SOLVENTS & THINNERS MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2025 (KILOTONS)

9 ALIPHATIC SOLVENTS & THINNERS MARKET, BY REGION (Page No. - 82)

9.1 INTRODUCTION

FIGURE 22 REGIONAL SNAPSHOT: ASIA PACIFIC TO LEAD THE ALIPHATIC SOLVENTS & THINNERS MARKET DURING THE FORECAST PERIOD

TABLE 58 ALIPHATIC SOLVENTS & THINNERS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 59 ALIPHATIC SOLVENTS & THINNERS MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 60 ALIPHATIC SOLVENTS & THINNERS MARKET, BY REGION, 2016–2019 (KILOTONS)

TABLE 61 ALIPHATIC SOLVENTS & THINNERS MARKET, BY REGION, 2020–2025 (KILOTONS)

9.2 ASIA PACIFIC

9.2.1 IMPACT OF COVID-19 ON THE ASIA PACIFIC MARKET

FIGURE 23 ASIA PACIFIC: ALIPHATIC SOLVENTS & THINNERS MARKET SNAPSHOT

TABLE 62 ASIA PACIFIC: ALIPHATIC SOLVENTS & THINNERS MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 63 ASIA PACIFIC: ALIPHATIC SOLVENTS & THINNERS MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 64 ASIA PACIFIC: ALIPHATIC SOLVENTS & THINNERS MARKET, BY COUNTRY, 2016–2019 (KILOTONS)

TABLE 65 ASIA PACIFIC ALIPHATIC SOLVENTS & THINNERS MARKET, BY COUNTRY, 2020–2025 (KILOTONS)

TABLE 66 ASIA PACIFIC: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 67 ASIA PACIFIC: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 68 ASIA PACIFIC: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 69 ASIA PACIFIC: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.2.2 CHINA

9.2.2.1 China is projected to be the largest market during the forecast period in the Asia Pacific market

TABLE 70 CHINA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 71 CHINA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 72 CHINA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 73 CHINA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.2.3 INDIA

9.2.3.1 India is projected to grow at the highest CAGR during the forecast period in the Asia Pacific market

TABLE 74 INDIA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 75 INDIA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 76 INDIA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 77 INDIA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.2.4 SOUTH KOREA

9.2.4.1 Increasing demand from the paint & coating industry has fueled the growth of the market in South Korea

TABLE 78 SOUTH KOREA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 79 SOUTH KOREA ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 80 SOUTH KOREA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 81 SOUTH KOREA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.2.5 JAPAN

9.2.5.1 Paints & coatings to form the largest application in Japan in 2020

TABLE 82 JAPAN: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 83 JAPAN: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 84 JAPAN: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 85 JAPAN: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.2.6 THAILAND

9.2.6.1 Increasing demand for paints & coatings is driving the market in Thailand

TABLE 86 THAILAND: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 87 THAILAND: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 88 THAILAND: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 89 THAILAND: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.2.7 INDONESIA

9.2.7.1 The adhesives application segment is estimated to emerge as a key market in Indonesia

TABLE 90 INDONESIA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 91 INDONESIA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 92 INDONESIA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 93 INDONESIA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.2.8 REST OF ASIA PACIFIC

TABLE 94 REST OF ASIA PACIFIC: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 95 REST OF ASIA PACIFIC: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 96 REST OF ASIA PACIFIC: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 97 REST OF ASIA PACIFIC: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.3 EUROPE

9.3.1 IMPACT OF COVID-19 ON THE EUROPEAN MARKET

FIGURE 24 EUROPE: ALIPHATIC SOLVENTS & THINNERS MARKET SNAPSHOT

TABLE 98 EUROPE: ALIPHATIC SOLVENTS & THINNERS MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 99 EUROPE: ALIPHATIC SOLVENTS & THINNERS MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 100 EUROPE: ALIPHATIC SOLVENTS & THINNERS MARKET, BY COUNTRY, 2016–2019 (KILOTONS)

TABLE 101 EUROPE: ALIPHATIC SOLVENTS & THINNERS MARKET, BY COUNTRY, 2020–2025 (KILOTONS)

TABLE 102 EUROPE: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 103 EUROPE: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 104 EUROPE: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 105 EUROPE: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.3.2 UK

9.3.2.1 The UK is projected to be the largest market during the forecast period in Europe aliphatic solvents & thinners market

TABLE 106 UK: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 107 UK ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 108 UK: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 109 UK: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.3.3 FRANCE

9.3.3.1 Printing inks application segment to exhibit negative growth during the forecast period

TABLE 110 FRANCE: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 111 FRANCE: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 112 FRANCE: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 113 FRANCE ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.3.4 GERMANY

9.3.4.1 Paints & coatings to lead the German market during the forecast period

TABLE 114 GERMANY: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 115 GERMANY: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 116 GERMANY: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 117 GERMANY: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.3.5 ITALY

9.3.5.1 Paints & coatings application is projected to be the fastest-growing market in the Italian market

TABLE 118 ITALY: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 119 ITALY ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 120 ITALY: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 121 ITALY ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.3.6 TURKEY

9.3.6.1 Printing inks application segment to exhibit negative growth during the forecast period in the Turkish market

TABLE 122 TURKEY: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 123 TURKEY ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 124 TURKEY: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 125 TURKEY: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.3.7 REST OF EUROPE

TABLE 126 REST OF EUROPE: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 127 REST OF EUROPE: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 128 REST OF EUROPE: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 129 REST OF EUROPE: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.4 NORTH AMERICA

9.4.1 COVID-19 IMPACT ON THE NORTH AMERICAN MARKET

FIGURE 25 NORTH AMERICA: ALIPHATIC SOLVENTS & THINNERS MARKET SNAPSHOT

TABLE 130 NORTH AMERICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 131 NORTH AMERICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 132 NORTH AMERICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY COUNTRY, 2016–2019 (KILOTONS)

TABLE 133 NORTH AMERICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY COUNTRY, 2020–2025 (KILOTONS)

TABLE 134 NORTH AMERICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 135 NORTH AMERICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 136 NORTH AMERICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 137 NORTH AMERICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.4.2 US

9.4.2.1 The US is projected to be the largest market during the forecast period in North America

TABLE 138 US: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 139 US: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 140 US: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 141 US: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.4.3 CANADA

9.4.3.1 Paints & coatings application is projected to be the fastest-growing market in Canada

TABLE 142 CANADA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 143 CANADA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 144 CANADA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 145 CANADA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.4.4 MEXICO

9.4.4.1 Mexico is projected to grow at the highest CAGR during the forecast period in North America

TABLE 146 MEXICO: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 147 MEXICO: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 148 MEXICO: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 149 MEXICO: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.5 MIDDLE EAST & AFRICA

9.5.1 IMPACT OF COVID-19 ON THE MIDDLE EASTERN & AFRICAN MARKET

FIGURE 26 MIDDLE EAST & AFRICA: ALIPHATIC SOLVENTS & THINNERS MARKET SNAPSHOT

TABLE 150 MIDDLE EAST & AFRICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 151 MIDDLE EAST & AFRICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 152 MIDDLE EAST & AFRICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY COUNTRY, 2016–2019 (KILOTONS)

TABLE 153 MIDDLE EAST & AFRICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY COUNTRY, 2020-2025 (KILOTONS)

TABLE 154 MIDDLE EAST & AFRICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 155 MIDDLE EAST & AFRICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 156 MIDDLE EAST & AFRICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 157 MIDDLE EAST & AFRICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020-2025 (KILOTONS)

9.5.2 SAUDI ARABIA

9.5.2.1 Saudi Arabia is projected to be the largest market during the forecast period in the Middle East & Africa

TABLE 158 SAUDI ARABIA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 159 SAUDI ARABIA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 160 SAUDI ARABIA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 161 SAUDI ARABIA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.5.3 UAE

9.5.3.1 UAE is projected to be the second-largest market during the forecast period in the Middle East & Africa

TABLE 162 UAE: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 163 UAE: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 164 UAE: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 165 UAE: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.5.4 QATAR

9.5.4.1 The paints & coatings application segment is estimated to lead the market in Qatar

TABLE 166 QATAR: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 167 QATAR: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 168 QATAR: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 169 QATAR: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.5.5 KUWAIT

9.5.5.1 Paints & coatings application is projected to be the fastest-growing market in Kuwait

TABLE 170 KUWAIT ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 171 KUWAIT ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 172 KUWAIT: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 173 KUWAIT: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.5.6 SOUTH AFRICA

9.5.6.1 The paints & coatings application segment is estimated to lead the South African market

TABLE 174 SOUTH AFRICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 175 SOUTH AFRICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 176 SOUTH AFRICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 177 SOUTH AFRICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.5.7 REST OF THE MIDDLE EAST & AFRICA

TABLE 178 REST OF THE MIDDLE EAST & AFRICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 179 REST OF THE MIDDLE EAST & AFRICA ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 180 REST OF THE MIDDLE EAST & AFRICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 181 REST OF THE MIDDLE EAST & AFRICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.6 SOUTH AMERICA

9.6.1 IMPACT OF COVID-19 ON THE SOUTH AMERICAN MARKET

FIGURE 27 SOUTH AMERICA: ALIPHATIC SOLVENTS & THINNERS MARKET SNAPSHOT

TABLE 182 SOUTH AMERICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 183 SOUTH AMERICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 184 SOUTH AMERICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY COUNTRY, 2016–2019 (KILOTONS)

TABLE 185 SOUTH AMERICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY COUNTRY, 2020–2025 (KILOTONS)

TABLE 186 SOUTH AMERICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 187 SOUTH AMERICA ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 188 SOUTH AMERICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 189 SOUTH AMERICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.6.2 BRAZIL

9.6.2.1 Brazil is projected to be the largest market during the forecast period in South America

TABLE 190 BRAZIL: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 191 BRAZIL ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 192 BRAZIL: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 193 BRAZIL: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.6.3 ARGENTINA

9.6.3.1 Paints & coatings application to lead the Argentinian aliphatic solvents & thinners market during the forecast period

TABLE 194 ARGENTINA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 195 ARGENTINA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 196 ARGENTINA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 197 ARGENTINA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

9.6.4 REST OF SOUTH AMERICA

TABLE 198 REST OF SOUTH AMERICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 199 REST OF SOUTH AMERICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 200 REST OF SOUTH AMERICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2016–2019 (KILOTONS)

TABLE 201 REST OF SOUTH AMERICA: ALIPHATIC SOLVENTS & THINNERS MARKET, BY APPLICATION, 2020–2025 (KILOTONS)

10 COMPETITIVE LANDSCAPE (Page No. - 160)

10.1 OVERVIEW

FIGURE 28 COMPANIES IN THE ALIPHATIC SOLVENTS & THINNERS MARKET ADOPTED ORGANIC GROWTH AND INORGANIC GROWTH STRATEGIES BETWEEN 2015 AND 2020

10.2 COMPETITIVE LANDSCAPE MAPPING, 2020

10.2.1 VISIONARY LEADERS

10.2.2 INNOVATORS

10.2.3 DYNAMIC DIFFERENTIATORS

10.2.4 EMERGING COMPANIES

FIGURE 29 ALIPHATIC SOLVENTS & THINNERS MARKET (GLOBAL) COMPETITIVE LANDSCAPE MAPPING, 2020

10.3 COMPETITIVE BENCHMARKING

10.3.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 30 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN ALIPHATIC SOLVENTS & THINNERS MARKET

10.3.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 31 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN ALIPHATIC SOLVENTS & THINNERS MARKET

10.4 EMERGING COMPANIES MATRIX, 2020

10.4.1 LEADERS

10.4.2 CONTENDERS

10.4.3 PACESETTERS

10.4.4 MASTERS

FIGURE 32 ALIPHATIC SOLVENTS & THINNERS MARKET: EMERGING COMPANIES COMPETITIVE LEADERSHIP MAPPING, 2020

10.5 MARKET RANKING ANALYSIS

FIGURE 33 ALIPHATIC SOLVENTS & THINNERS MARKET RANKING, BY COMPANIES, 2019

10.6 COMPETITIVE SITUATIONS & TRENDS

10.6.1 ACQUISITIONS

TABLE 202 ACQUISITIONS, 2014–2020

10.6.2 NEW PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 203 NEW PRODUCT LAUNCHES & DEVELOPMENTS, 2014–2020

10.6.3 EXPANSIONS

TABLE 204 EXPANSIONS, 2014–2020

10.6.4 AGREEMENTS & CONTRACTS

TABLE 205 AGREEMENTS & CONTRACTS, 2014–2020

11 COMPANY PROFILES (Page No. - 172)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MNM View)*

11.1 EXXONMOBIL CHEMICAL, INC.

FIGURE 34 EXXONMOBIL CHEMICAL INC.: COMPANY SNAPSHOT

FIGURE 35 EXXONMOBIL CHEMICAL: SWOT ANALYSIS

11.2 SK GLOBAL CHEMICAL CO. LTD.

FIGURE 36 SK HOLDINGS CO., LTD: COMPANY SNAPSHOT

FIGURE 37 SK GLOBAL CHEMICAL CO. LTD: SWOT ANALYSIS

11.3 ROYAL DUTCH SHELL PLC

FIGURE 38 ROYAL DUTCH SHELL PLC: COMPANY SNAPSHOT

FIGURE 39 ROYAL DUTCH SHELL PLC: SWOT ANALYSIS

11.4 CALUMET SPECIALTY PRODUCTS PARTNERS, L.P.

FIGURE 40 CALUMET SPECIALTY PRODUCTS PARTNERS, L.P.: COMPANY SNAPSHOT

FIGURE 41 CALUMET SPECIALTY PRODUCT PARTNERS, L.P: SWOT ANALYSIS

11.5 GOTHAM INDUSTRIES

11.6 GULF CHEMICALS AND INDUSTRIAL OILS COMPANY

11.7 RECOCHEM INC.

11.8 HCS GROUP

11.9 W.M. BARR

11.10 HONEYWELL INTERNATIONAL INC.

FIGURE 42 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

11.11 BASF SE

FIGURE 43 BASF SE: COMPANY SNAPSHOT

11.12 LYONDELLBASELL INDUSTRIES N.V.

FIGURE 44 LYONDELLBASELL INDUSTRIES N.V.: COMPANY SNAPSHOT

11.13 GANGA RASAYANIE (P) LTD

11.14 NOCO ENERGY CORPORATION

11.15 GADIV PETROCHEMICAL INDUSTRIES LTD.

11.16 HUNT REFINING COMPANY

11.17 OTHER COMPANIES

11.17.1 PURE CHEMICALS CO.

11.17.2 HERITAGE CRYSTAL CLEAN

11.17.3 SOLVCHEM INC.

11.17.4 RB PRODUCTS, INC.

11.17.5 SAFRA CO.LTD

11.17.6 PHILLIPS 66

11.17.7 KANDLA ENERGY & CHEMICAL LIMITED

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MNM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 200)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

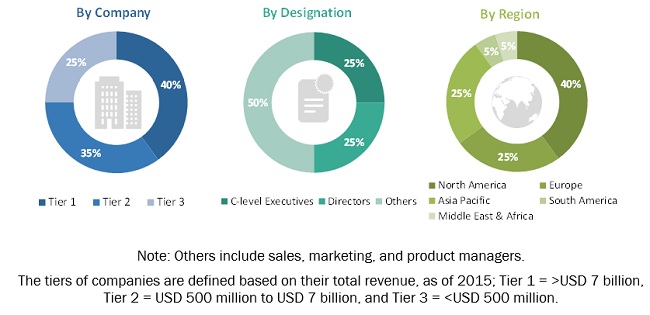

The study involved 4 major activities in estimating the current size of the aliphatic hydrocarbon solvents & thinners market. Exhaustive secondary research was undertaken to collect information on the aliphatic hydrocarbon solvents & thinners market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the aliphatic hydrocarbon solvents & thinners value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments of the aliphatic hydrocarbon solvents & thinners market.

Secondary Research

As a part of the secondary research process, various secondary sources, such as Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet, have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, a monetary chain of the market, total pool of players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments undertaken from both, market- and technology oriented perspectives.

Primary Research

The aliphatic hydrocarbon solvents & thinners market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain.

As a part of the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the aliphatic hydrocarbon solvents & thinners market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the aliphatic hydrocarbon solvents & thinners market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries. Following is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the aliphatic hydrocarbon solvents & thinners market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market size for aliphatic hydrocarbon solvents & thinners products

- To understand the structure of the aliphatic hydrocarbon solvents & thinners products market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the 5 regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze competitive developments, such as mergers & acquisitions, expansions & investments, partnerships, and new product launches, in the aliphatic hydrocarbon solvents & thinners market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Regional Analysis

- Further breakdown of the Asia Pacific, North America, and Middle East & Africa aliphatic hydrocarbon solvents & thinners market

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Growth opportunities and latent adjacency in Aliphatic Hydrocarbon Solvents & Thinners Market

Report title not mentioned

General information on Aliphatic Hydrocarbon Solvents And Thinners Market