Acetonitrile Market by Type (Derivative, Solvent), Application (Organic Synthesis, Analytical Applications, Extraction), End-use Industry (Pharmaceutical, Analytical industry, Agrochemical), Region - Global Forecast to 2028

Updated on : August 22, 2025

Acetonitrile Market

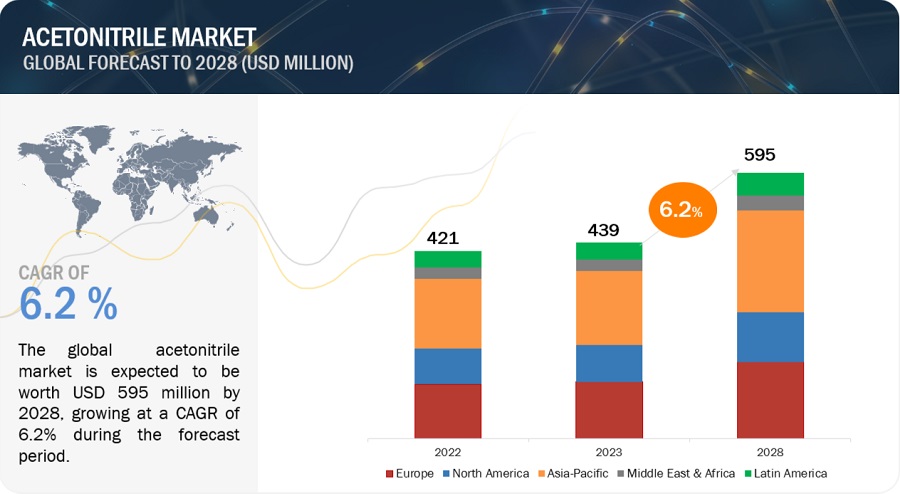

The global acetonitrile market was valued at USD 439 million in 2023 and is projected to reach USD 595 million by 2028, growing at 6.2% cagr from 2023 to 2028. Acetonitrile, also known as cyanomethane or methyl cyanide, is a colorless liquid. Acetonitrile is an organic nitrile primarily produced as a by-product of acrylonitrile. It is widely used in the pharmaceutical industry as a reaction solvent, reagent, or extraction solvent. The acetonitrile market is expected to witness considerable growth during the forecast period, owing to the increasing production of engineered drugs, generic pharmaceuticals, and pesticides across the globe.

Acetonitrile Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in Acetonitrile Market

Acetonitrile Market Dynamics

Driver: Acetonitrile’s versatile properties as a chemical building block driving the demand in the pharmaceutical industry

Acetonitrile's versatile properties and role as a chemical building block make it a highly sought-after compound in the pharmaceutical industry. Acetonitrile acts as a versatile chemical building block in the synthesis of pharmaceutical intermediates. Its unique structure allows it to undergo various chemical transformations, such as nucleophilic addition and substitution reactions. These reactions are essential for creating complex molecular structures found in pharmaceutical compounds. Acetonitrile-derived intermediates can be further modified to produce active pharmaceutical ingredients (APIs), the key components of pharmaceutical formulations.

Restraint: Increasing demand for substitute product prionil

The acetonitrile shortage of 2008 and the imbalance in acrylonitrile and acetonitrile relationship has led to the introduction of a substitute for acetonitrile called Prionil. Prionil from Ascend Performance Materials (US) is a colorless liquid used in the manufacturing of amides, amines, ketones, and acids. It is also known as ethyl cyanide, propionitrile, or propanenitrile. Prionil has similar solvency properties to acetonitrile, and it is also cost-effective. It is used as a solvent in various industries, including pharmaceuticals and agrochemicals, among others. The increasing demand for Prionil acts as a restraint for the acetonitrile market.

Opportunity: Increasing demand from various applications

Acetonitrile's purity, low residue formation, and solvent properties have found applications in the electronics industry. It is used in cleaning processes to remove contaminants and residues from semiconductor surfaces during chip manufacturing. The controlled and precise nature of acetonitrile as a cleaning agent contributes to the production of high-quality and reliable electronic components. The increasing consumption of acetonitrile in applications other than the pharmaceutical and analytical industry has boosted the growth of the acetonitrile market.

Challenge: Environmental concerns and toxicity issues associated with acetonitrile usage

While acetonitrile offers diverse applications and benefits, its usage has raised notable environmental and health concerns. These concerns revolve around its potential impact on ecosystems, human health, and workplace safety. Understanding these issues is crucial for adopting responsible practices. Developed countries, including Germany, the US, and Japan, are focusing on increased use of environmentally friendly products instead of petroleum-based products. The European Union (EU) has been more insistent than the US and Japanese governments regarding the same. It insists on the use of bio-based materials, encouraging recyclability of vehicle components, or making the automotive manufacturers responsible for disposal at the end of the vehicle’s service life. Although the requirements in North America are not stringent for automotive manufacturers, they are in other markets around the world. In addition, the European Union has emphasized using recyclable and biodegradable parts for automotive. This would boost the use of acetonitrile during the forecast period. These regulations are expected to increase the use of Acetonitrile in automotive, building & construction, electrical & electronics, and other applications.

Acetonitrile Market Ecosystem

Extraction application of acetonitrile to register the third largest market share in the acetonitrile market.

Acetonitrile is a polar solvent, which makes it more electronegative than carbon. This property of acetonitrile makes it the most preferred choice of organic nitrile for the extraction of fatty acids, animal and vegetable oils, unsaturated petroleum hydrocarbons, and others. During the forecasted years, the extraction segment is expected to witness the highest CAGR.

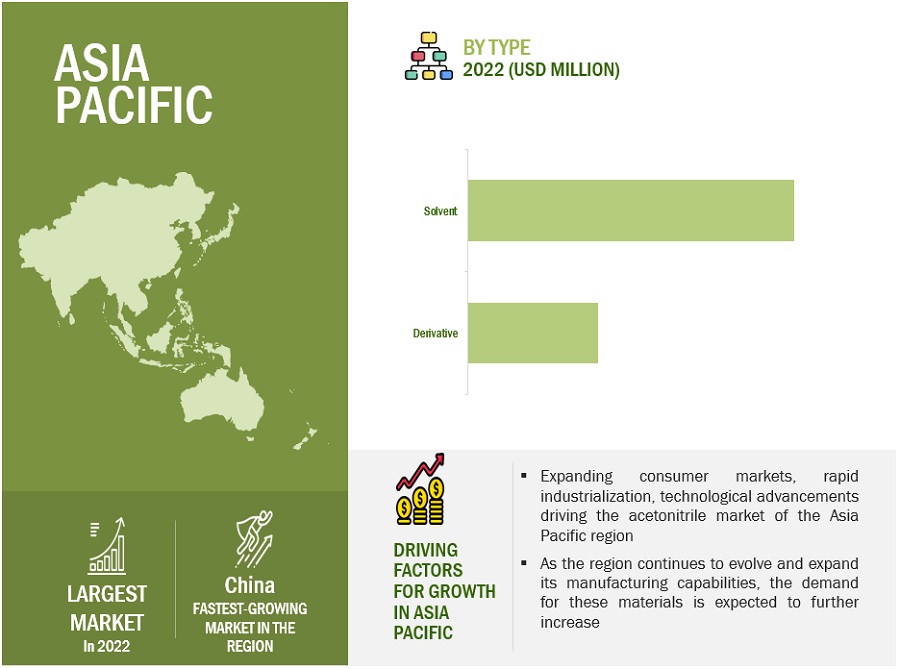

Based on type, the derivative segment is anticipated to register the highest CAGR in the acetonitrile market.

During forecasted years, the derivative type of acetonitrile is expected to show highest growth across the world. The derivative type acetonitrile is finding a wide range of applications in analytical applications, pharmaceutical, and other end-use industries. Due to extending research & developments in various end-use sectors, the analytical grade acetonitrile in the derivative form is expected to show significant growth in the future.

Agrochemical end-use industry of acetonitrile to register third largest market share in the acetonitrile market.

Acetonitrile is used in the agrochemical industry as a raw material. It is mainly used as an agricultural pesticide. Acetonitrile is used in pesticides, along with other compounds, for the extraction of fatty acids and vegetable oils or pesticide residue. The agrochemical segment is projected to grow with moderate CAGR during the forecast period.

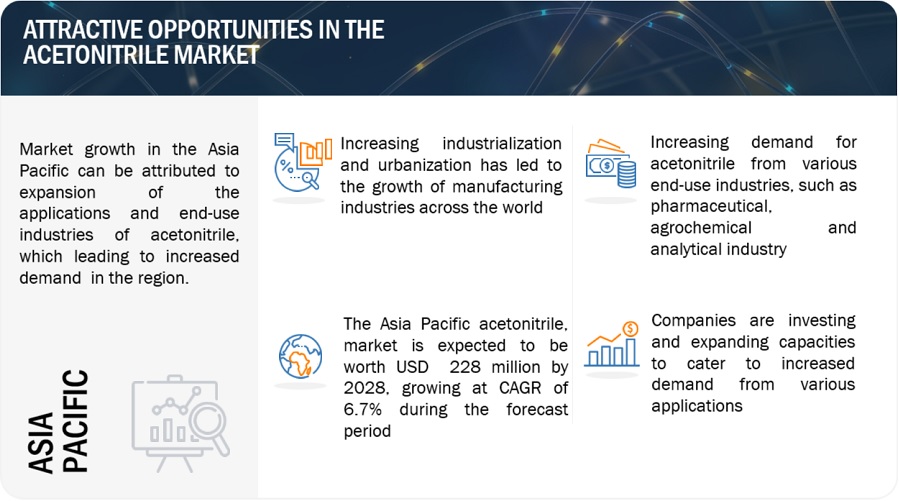

Asia Pacific to hold the largest market share of acetonitrile market during the forecast period.

The Asia Pacific is a major market for acetonitrile. The increasing production of acetonitrile to cater to the domestic requirements for pharmaceutical medicaments and the rising number of exports of HPLC-grade acetonitrile are factors fuelling the demand for acetonitrile in the region. Moreover, the rise in population and the growing number of end-use industries in the Asia Pacific region has also led to the growth of acetonitrile, thereby propelling the growth of the Asia Pacific acetonitrile market. Also, the increasing focus on the development of better-quality medicines and pesticides has also led to an increase in demand for acetonitrile. Japan, China, and India are the major countries contributing to the growth of the Asia-Pacific acetonitrile market.

To know about the assumptions considered for the study, download the pdf brochure

Acetonitrile Market Players

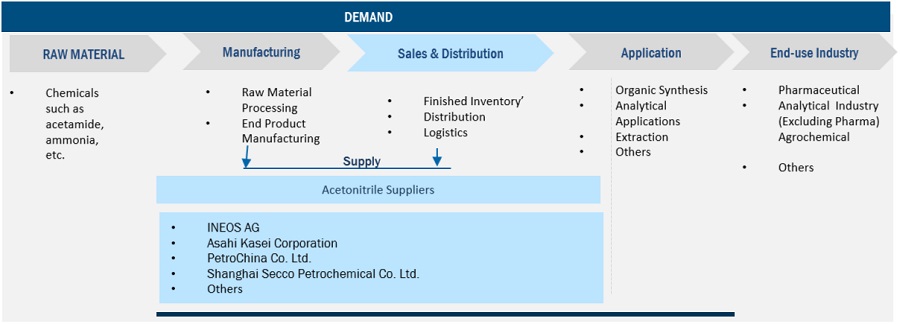

The acetonitrile market is dominated by a few globally established players such as INEOS AG (Switzerland.), Asahi Kasei Corporation (Japan), Nova Molecular Technologies (US), PetroChina Co. Ltd. (China), Formosa Plastic Corporation (Taiwan), ShengHong Petrochemical Group Co., Ltd. (China), Avantor Performance Materials LLC (US), Imperial Chemical Corporation (Taiwan), Tedia Company Inc. (US), Avantor Performance Materials, LLC (US), Shanghai Secco Petrochemical Company Limited (China), Qingdao Shida Chemical Co., Ltd. (China), and Nantong Acetic Acid Chemical Co., Ltd. (China), among others, are the key manufacturers that secured major contracts in the last few years. The major focus was given to the contracts and new product development due to the changing requirements across the world.

These companies are pursuing a variety of inorganic and organic strategies in order to gain a foothold in the acetonitrile market. The research includes a detailed competitive analysis of these key players in the acetonitrile market, including recent developments, company profiles, and key market strategies.

Acetonitrile Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 439 million |

|

Revenue Forecast in 2028 |

USD 595 million |

|

CAGR |

6.2% |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD billion/million), Volume (Kiloton) |

|

Segments Covered |

By Type, By Application, By End-use Industry, and by Region |

|

Geographies covered |

Europe, North America, Asia Pacific, Latin America, the Middle East, and Africa |

|

Companies covered |

INEOS AG (Switzerland.), Asahi Kasei Corporation (Japan), Nova Molecular Technologies (US), PetroChina Co. Ltd. (China), ShengHong Petrochemical Group Co., Ltd. (China), Formosa Plastic Corporation (Taiwan), Avantor Performance Materials LLC (US), Imperial Chemical Corporation (Taiwan), Tedia Company Inc. (US), Avantor Performance Materials, LLC (US), Shanghai Secco Petrochemical Company Limited (China), Qingdao Shida Chemical Co., Ltd. (China), and Nantong Acetic Acid Chemical Co., Ltd. (China). |

The study categorizes the acetonitrile market based on type, application, end-use industry, and region.

Acetonitrile Market By Type:

- Derivative

- Solvent

Acetonitrile Market By Application:

- Organic Synthesis

- Analytical Applications

- Extraction

- Others

Acetonitrile Market By End-use Industry:

- Pharmaceutical

- Analytical Industry

- Agrochemical

- Other

Acetonitrile Market By Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Recent Developments

- In July 2022, PetroChina launched a $4.52 billion program to expand a subsidiary refinery in southern China into an integrated petrochemicals complex.

- In April 2022, INOES AG has planned to invest in the world-scale acetonitrile manufacturing facility in Koln, Germany. This new facility aims to enhance the supply position of the company in the European region, along with catering to the healthcare sector of the region.

- In March 2022, Tedia Company, Inc. partnered with New York-based Newbold Enterprises Fairfield. This partnership is aiming towards the strategic expansion of Tedia’s capacity and capabilities.

- In August 2021, Nova Molecular Technologies, Inc. expanded its high purity-solvents business by opening a new facility in South Carolina, US. Full construction of this new facility is expected to be done by 2024.

- In October 2020, Nova Molecular Technologies, Inc. announced the plans for expansion of operations in the Sumter Country. This expansion includes an investment of USD 14.9 million, aiming to increase manufacturing operations.

Frequently Asked Questions (FAQ):

Which are the major companies in the acetonitrile market? What are their major strategies to strengthen their market presence?

Some of the key players in the acetonitrile market are INEOS AG (Switzerland.), Asahi Kasei Corporation (Japan), Nova Molecular Technologies (US), PetroChina Co. Ltd. (China), Formosa Plastic Corporation (Taiwan), ShengHong Petrochemical Group Co., Ltd. (China), Avantor Performance Materials LLC (US), Imperial Chemical Corporation (Taiwan), Tedia Company Inc. (US), Avantor Performance Materials, LLC (US), Shanghai Secco Petrochemical Company Limited (China), Qingdao Shida Chemical Co., Ltd. (China) are some of the key manufacturers that secured expansions, acquisitions, and deals in the last few years.

What are the drivers and opportunities for the acetonitrile market?

The versatile properties of acetonitrile make it suitable to be used in a wide range of applications, and growing applications in various end-use industries can be a driver and opportunity, respectively.

Which region is expected to hold the highest market share?

In 2022, Asia Pacific dominated the global acetonitrile market, showcasing strong demand for acetonitrile from this region.

What is the total CAGR expected to be recorded for the acetonitrile market during 2023-2028?

The CAGR is expected to record a CAGR of 6.2% from 2023-2028.

How is the acetonitrile market aligned?

The market is growing at a significant pace. The market is a potential market, and many manufacturers are planning business strategies to expand their existing business. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTIONS

-

5.2 MARKET DYNAMICSDRIVERS- Most-used organic solvent in HPLC applications- Extensive use in pharmaceutical industry due to versatile propertiesRESTRAINTS- Acrylonitrile-acetonitrile by-product relationship- Increasing demand for substitute product PrionilOPPORTUNITIES- Increasing use of acetonitrile in different applicationsCHALLENGES- Environmental concerns and toxicity issues associated with acetonitrile usage- Requirement of technically skilled staff to handle and use acetonitrile

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE TREND FOR END-USE INDUSTRIES, BY KEY PLAYERS

- 5.6 AVERAGE SELLING PRICE, BY TYPE

- 5.7 AVERAGE SELLING PRICE, BY APPLICATION

- 5.8 AVERAGE SELLING PRICE TREND

-

5.9 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.10 TECHNOLOGY ANALYSIS

-

5.11 ECOSYSTEM: ACETONITRILE MARKET

- 5.12 VALUE CHAIN ANALYSIS

- 5.13 CASE STUDY ANALYSIS

- 5.14 TRENDS AND DISRUPTIONS IMPACTING BUSINESS

-

5.15 KEY MARKETS FOR IMPORT/EXPORTCHINAUSUKJAPAN

-

5.16 TARIFF AND REGULATIONSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS IN ACETONITRILE MARKET

- 5.17 KEY CONFERENCES & EVENTS, 2023–2024

-

5.18 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP APPLICANTS' ANALYSISPATENTS BY BASF SEPATENTS BY INCYTE CORP.PATENTS BY JANSSEN PHARMACEUTICALSTOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 6.1 INTRODUCTION

-

6.2 ORGANIC SYNTHESISINCREASING USE OF ACETONITRILE AS A RAW MATERIAL FOR VARIOUS CHEMICALS TO DRIVE MARKET

-

6.3 ANALYTICAL APPLICATIONSEXTENSIVE USE IN MULTIPLE END-USE INDUSTRIES TO DRIVE MARKET

-

6.4 EXTRACTIONGROWING APPLICATION DUE TO VERSATILE AND COMPATIBILITY PROPERTIES TO DRIVE MARKET

- 6.5 OTHERS

- 7.1 INTRODUCTION

-

7.2 DERIVATIVEEXTENSIVE USE IN PHARMACEUTICAL INDUSTRY TO DRIVE MARKETACETONITRILE MARKET, BY REGION

-

7.3 SOLVENTEXTENSIVE USE DUE TO EXCELLENT SOLVENCY AND LOW BOILING POINTACETONITRILE MARKET, BY REGION

- 8.1 INTRODUCTION

-

8.2 PHARMACEUTICALWISE USE IN MEDICINES AND SULFA PYRIMIDINE TO DRIVE MARKETACETONITRILE MARKET IN PHARMACEUTICAL END-USE INDUSTRY, BY REGION

-

8.3 ANALYTICAL INDUSTRYCONTINUOUS DEVELOPMENT AND INNOVATION TO DRIVE MARKETACETONITRILE MARKET IN ANALYTICAL END-USE INDUSTRY, BY REGION

-

8.4 AGROCHEMICALRISING DEMAND FOR AGROCHEMICALS TO DRIVE MARKETACETONITRILE MARKET IN AGROCHEMICAL END-USE INDUSTRY, BY REGION

-

8.5 OTHERSACETONITRILE MARKET IN OTHER END-USE INDUSTRIES, BY REGION

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAIMPACT OF RECESSION IN NORTH AMERICANORTH AMERICA: ACETONITRILE MARKET, BY TYPENORTH AMERICA: ACETONITRILE MARKET, BY APPLICATIONNORTH AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRYNORTH AMERICA: ACETONITRILE MARKET, BY COUNTRY- US- Canada

-

9.3 EUROPEIMPACT OF RECESSION IN EUROPEEUROPE: ACETONITRILE MARKET, BY TYPEEUROPE: ACETONITRILE MARKET, BY APPLICATIONEUROPE: ACETONITRILE MARKET, BY END-USE INDUSTRYEUROPE: ACETONITRILE MARKET, BY COUNTRY- Germany- France- UK- Italy- Russia- Spain- Rest of Europe

-

9.4 ASIA PACIFICIMPACT OF RECESSION IN ASIA PACIFICASIA PACIFIC: ACETONITRILE MARKET, BY TYPEASIA PACIFIC: ACETONITRILE MARKET, BY APPLICATIONASIA PACIFIC: ACETONITRILE MARKET, BY END-USE INDUSTRYASIA PACIFIC: ACETONITRILE MARKET, BY COUNTRY- China- India- Japan- South Korea- Australia- Rest of Asia Pacific

-

9.5 MIDDLE EAST & AFRICAIMPACT OF RECESSION IN MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY TYPEMIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY APPLICATIONMIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRYMIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY COUNTRY- South Africa- UAE- Saudi Arabia- Rest of Middle East & Africa

-

9.6 LATIN AMERICAIMPACT OF RECESSION IN LATIN AMERICALATIN AMERICA: ACETONITRILE MARKET, BY TYPELATIN AMERICA: ACETONITRILE MARKET, BY APPLICATIONLATIN AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRYLATIN AMERICA: ACETONITRILE MARKET, BY COUNTRY- Mexico- Brazil- Argentina- Rest of Latin America

- 10.1 INTRODUCTION

- 10.2 MARKET SHARE ANALYSIS

- 10.3 MARKET RANKING

- 10.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- 10.5 COMPANY PRODUCT FOOTPRINT

- 10.6 COMPANY TYPE FOOTPRINT

- 10.7 COMPANY APPLICATION FOOTPRINT

- 10.8 COMPANY END-USE INDUSTRY FOOTPRINT

- 10.9 COMPANY REGION FOOTPRINT

-

10.10 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSPERVASIVE PLAYERSPARTICIPANTSEMERGING LEADERS

- 10.11 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

10.12 COMPANY EVALUATION MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.13 COMPETITIVE SCENARIO

-

11.1 KEY COMPANIESINEOS AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewASAHI KASEI CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewFORMOSA PLASTIC CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewIMPERIAL CHEMICAL CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewPETROCHINA CO. LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSHENGHONG PETROCHEMICAL GROUP CO., LTD- Business overview- Products/Solutions/Services offered- MnM viewNOVA MOLECULAR TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTEDIA COMPANY, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAVANTOR PERFORMANCE MATERIALS, LLC- Business overview- Products/Solutions/Services offered- MnM viewSHANGHAI SECCO PETROCHEMICAL COMPANY LIMITED- Business overview- Products/Solutions/Services offered- MnM viewQINGDAO SHIDA CHEMICAL CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewNANTONG ACETIC ACID CHEMICAL CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewALKYL AMINES CHEMICAL CO., LTD.- Business overview- Products/Solutions/Services offered- MnM view

-

11.2 OTHER COMPANIESBALAJI AMINES LTD.TAEKWANG INDUSTRIAL CO., LTD.CONNECT CHEMICALS GMBHCONCORD TECHNOLOGY (TIANJIN) CO., LTD.BIOSOLVE CHIMIEGFS CHEMICALS, INC.HUNAN CHEM. EUROPE BVALFA AESARHONEYWELL RESEARCH CHEMICALSMITSUBISHI CHEMICAL CORPORATIONPHARMCO-AAPERROBINSON BROTHERSSTANDARD REAGENTS PVT. LTD.KISHIDA CHEMICAL CO., LTD.ANQOREJINDAL SPECIALITY CHEMICALSFUSHUN SHUNENG CHEMICAL CO., LTD.SHANDONG JINCHENG PHARMACEUTICAL GROUP CO., LTD.

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORT

- 12.5 AUTHOR DETAILS

- TABLE 1 ACETONITRILE MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 ACETONITRILE MARKET: COMPANIES AND THEIR ROLE IN ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICE TREND FOR END-USE INDUSTRIES, BY KEY PLAYERS (USD/KG)

- TABLE 4 ACETONITRILE AVERAGE SELLING PRICE TREND IN ACETONITRILE MARKET, BY REGION

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

- TABLE 6 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- TABLE 7 COMPARATIVE STUDY OF ACETONITRILE MANUFACTURING PROCESSES

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 CURRENT STANDARD CODES FOR ACETONITRILE

- TABLE 13 DETAILED LIST OF CONFERENCES & EVENTS, 2023–2024

- TABLE 14 ACETONITRILE MARKET: GLOBAL PATENTS

- TABLE 15 ACETONITRILE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 16 ACETONITRILE MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 17 ACETONITRILE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 18 ACETONITRILE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 19 ACETONITRILE MARKET IN ORGANIC SYNTHESIS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 20 ACETONITRILE MARKET IN ORGANIC SYNTHESIS, BY REGION, 2018–2022 (KILOTON)

- TABLE 21 ACETONITRILE MARKET IN ORGANIC SYNTHESIS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 ACETONITRILE MARKET IN ORGANIC SYNTHESIS, BY REGION, 2023–2028 (KILOTON)

- TABLE 23 ACETONITRILE MARKET IN ANALYTICAL APPLICATIONS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 24 ACETONITRILE MARKET IN ANALYTICAL APPLICATIONS, BY REGION, 2018–2022 (KILOTON)

- TABLE 25 ACETONITRILE MARKET IN ANALYTICAL APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 ACETONITRILE MARKET IN ANALYTICAL APPLICATIONS, BY REGION, 2023–2028 (KILOTON)

- TABLE 27 ACETONITRILE MARKET IN EXTRACTION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 28 ACETONITRILE MARKET IN EXTRACTION, BY REGION, 2018–2022 (KILOTON)

- TABLE 29 ACETONITRILE MARKET IN EXTRACTION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 ACETONITRILE MARKET IN EXTRACTION, BY REGION, 2023–2028 (KILOTON)

- TABLE 31 ACETONITRILE MARKET IN OTHERS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 32 ACETONITRILE MARKET IN OTHERS, BY REGION, 2018–2022 (KILOTON)

- TABLE 33 ACETONITRILE MARKET IN OTHERS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 ACETONITRILE MARKET IN OTHERS, BY REGION, 2023–2028 (KILOTON)

- TABLE 35 ACETONITRILE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 36 ACETONITRILE MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 37 ACETONITRILE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 38 ACETONITRILE MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 39 ACETONITRILE DERIVATIVE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 40 ACETONITRILE DERIVATIVE MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 41 ACETONITRILE DERIVATIVE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 ACETONITRILE DERIVATIVE MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 43 ACETONITRILE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 44 ACETONITRILE MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 45 ACETONITRILE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 ACETONITRILE MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 47 ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 48 ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 49 ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 50 ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 51 ACETONITRILE MARKET IN PHARMACEUTICAL END-USE INDUSTRY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 52 ACETONITRILE MARKET IN PHARMACEUTICAL END-USE INDUSTRY, BY REGION, 2018–2022 (KILOTON)

- TABLE 53 ACETONITRILE MARKET IN PHARMACEUTICAL END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 ACETONITRILE MARKET IN PHARMACEUTICAL END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 55 ACETONITRILE MARKET IN ANALYTICAL END-USE INDUSTRY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 56 ACETONITRILE MARKET IN ANALYTICAL END-USE INDUSTRY, BY REGION, 2018–2022 (KILOTON)

- TABLE 57 ACETONITRILE MARKET IN ANALYTICAL END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 ACETONITRILE MARKET IN ANALYTICAL END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 59 ACETONITRILE MARKET IN AGROCHEMICAL END-USE INDUSTRY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 60 ACETONITRILE MARKET IN AGROCHEMICAL END-USE INDUSTRY, BY REGION, 2018–2022 (KILOTON)

- TABLE 61 ACETONITRILE MARKET IN AGROCHEMICAL END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 ACETONITRILE MARKET IN AGROCHEMICAL END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 63 ACETONITRILE MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 64 ACETONITRILE MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2022 (KILOTON)

- TABLE 65 ACETONITRILE MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 ACETONITRILE MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2023–2028 (KILOTON)

- TABLE 67 ACETONITRILE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 68 ACETONITRILE MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 69 ACETONITRILE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 ACETONITRILE MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 71 NORTH AMERICA: ACETONITRILE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 72 NORTH AMERICA: ACETONITRILE MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 73 NORTH AMERICA: ACETONITRILE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: ACETONITRILE MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 75 NORTH AMERICA: ACETONITRILE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: ACETONITRILE MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 77 NORTH AMERICA: ACETONITRILE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: ACETONITRILE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 79 NORTH AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 81 NORTH AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 83 NORTH AMERICA: ACETONITRILE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: ACETONITRILE MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 85 NORTH AMERICA: ACETONITRILE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: ACETONITRILE MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 87 US: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 88 US: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 89 US: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 90 US: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 91 CANADA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 92 CANADA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 93 CANADA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 94 CANADA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 95 EUROPE: ACETONITRILE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 96 EUROPE: ACETONITRILE MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 97 EUROPE: ACETONITRILE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: ACETONITRILE MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 99 EUROPE: ACETONITRILE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 100 EUROPE: ACETONITRILE MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 101 EUROPE: ACETONITRILE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 102 EUROPE: ACETONITRILE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 103 EUROPE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 104 EUROPE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 105 EUROPE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 106 EUROPE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 107 EUROPE: ACETONITRILE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 108 EUROPE: ACETONITRILE MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 109 EUROPE: ACETONITRILE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 110 EUROPE: ACETONITRILE MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 111 GERMANY: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 112 GERMANY: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 113 GERMANY: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 114 GERMANY: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 115 FRANCE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 116 FRANCE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 117 FRANCE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 118 FRANCE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 119 UK: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 120 UK: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 121 UK: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 122 UK: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 123 ITALY: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 124 ITALY: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 125 ITALY: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 126 ITALY: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 127 RUSSIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 128 RUSSIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 129 RUSSIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 130 RUSSIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 131 SPAIN: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 132 SPAIN: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 133 SPAIN: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 134 SPAIN: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 135 REST OF EUROPE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 136 REST OF EUROPE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 137 REST OF EUROPE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 138 REST OF EUROPE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 139 ASIA PACIFIC: ACETONITRILE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 140 ASIA PACIFIC: ACETONITRILE MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 141 ASIA PACIFIC: ACETONITRILE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 142 ASIA PACIFIC: ACETONITRILE MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 143 ASIA PACIFIC: ACETONITRILE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 144 ASIA PACIFIC: ACETONITRILE MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 145 ASIA PACIFIC: ACETONITRILE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: ACETONITRILE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 147 ASIA PACIFIC: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 148 ASIA PACIFIC: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 149 ASIA PACIFIC: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 150 ASIA PACIFIC: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 151 ASIA PACIFIC: ACETONITRILE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 152 ASIA PACIFIC: ACETONITRILE MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 153 ASIA PACIFIC: ACETONITRILE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 154 ASIA PACIFIC: ACETONITRILE MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 155 CHINA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 156 CHINA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 157 CHINA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 158 CHINA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 159 INDIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 160 INDIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 161 INDIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 162 INDIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 163 JAPAN: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 164 JAPAN: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 165 JAPAN: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 166 JAPAN: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 167 SOUTH KOREA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 168 SOUTH KOREA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 169 SOUTH KOREA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 170 SOUTH KOREA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 171 AUSTRALIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 172 AUSTRALIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 173 AUSTRALIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 174 AUSTRALIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 175 REST OF ASIA PACIFIC: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 177 REST OF ASIA PACIFIC: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 179 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 181 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 183 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 185 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 187 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 189 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 191 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 193 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 195 SOUTH AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 196 SOUTH AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 197 SOUTH AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 198 SOUTH AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 199 UAE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 200 UAE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 201 UAE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 202 UAE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 203 SAUDI ARABIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 204 SAUDI ARABIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 205 SAUDI ARABIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 206 SAUDI ARABIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 207 REST OF MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 208 REST OF MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 209 REST OF MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 210 REST OF MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 211 LATIN AMERICA: ACETONITRILE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 212 LATIN AMERICA: ACETONITRILE MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 213 LATIN AMERICA: ACETONITRILE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 214 LATIN AMERICA: ACETONITRILE MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 215 LATIN AMERICA: ACETONITRILE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 216 LATIN AMERICA: ACETONITRILE MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 217 LATIN AMERICA: ACETONITRILE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 218 LATIN AMERICA: ACETONITRILE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 219 LATIN AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 220 LATIN AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 221 LATIN AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 222 LATIN AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 223 LATIN AMERICA: ACETONITRILE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 224 LATIN AMERICA: ACETONITRILE MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 225 LATIN AMERICA: ACETONITRILE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 226 LATIN AMERICA: ACETONITRILE MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 227 MEXICO: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 228 MEXICO: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 229 MEXICO: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 230 MEXICO: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 231 BRAZIL: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 232 BRAZIL: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 233 BRAZIL: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 234 BRAZIL: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 235 ARGENTINA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 236 ARGENTINA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 237 ARGENTINA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 238 ARGENTINA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 239 REST OF LATIN AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 240 REST OF LATIN AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 241 REST OF LATIN AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 242 REST OF LATIN AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 243 DEGREE OF COMPETITION: ACETONITRILE MARKET

- TABLE 244 COMPANY PRODUCT FOOTPRINT

- TABLE 245 COMPANY TYPE FOOTPRINT

- TABLE 246 COMPANY APPLICATION FOOTPRINT

- TABLE 247 COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 248 COMPANY REGION FOOTPRINT

- TABLE 249 ACETONITRILE MARKET: KEY STARTUPS/SMES

- TABLE 250 ACETONITRILE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 251 ACETONITRILE MARKET: DEALS, 2018–2023

- TABLE 252 ACETONITRILE MARKET: OTHERS, 2018–2023

- TABLE 253 INEOS AG: COMPANY OVERVIEW

- TABLE 254 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

- TABLE 255 FORMOSA PLASTIC CORPORATION: COMPANY OVERVIEW

- TABLE 256 IMPERIAL CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 257 PETROCHINA CO. LTD.: COMPANY OVERVIEW

- TABLE 258 SHENGHONG PETROCHEMICAL GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 259 NOVA MOLECULAR TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 260 TEDIA COMPANY, INC.: COMPANY OVERVIEW

- TABLE 261 AVANTOR PERFORMANCE MATERIALS, LLC: BUSINESS OVERVIEW

- TABLE 262 SHANGHAI SECCO PETROCHEMICAL COMPANY LIMITED: BUSINESS OVERVIEW

- TABLE 263 QINGDAO SHIDA CHEMICAL CO., LTD.: BUSINESS OVERVIEW

- TABLE 264 NANTONG ACETIC ACID CHEMICAL CO., LTD.: BUSINESS OVERVIEW

- TABLE 265 ALKYL AMINES CHEMICAL CO., LTD.: BUSINESS OVERVIEW

- TABLE 266 BALAJI AMINES LTD.: COMPANY OVERVIEW

- TABLE 267 TAEKWANG INDUSTRIAL CO., LTD. COMPANY OVERVIEW

- TABLE 268 CONNECT CHEMICALS GMBH: COMPANY OVERVIEW

- TABLE 269 CONCORD TECHNOLOGY (TIANJIN) CO., LTD.: COMPANY OVERVIEW

- TABLE 270 BIOSOLVE CHIMIE: COMPANY OVERVIEW

- TABLE 271 GFS CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 272 HUNAN CHEM. EUROPE BV: COMPANY OVERVIEW

- TABLE 273 ALFA AESAR.: COMPANY OVERVIEW

- TABLE 274 HONEYWELL RESEARCH CHEMICALS: COMPANY OVERVIEW

- TABLE 275 MITSUBISHI CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 276 PHARMCO-AAPER: COMPANY OVERVIEW

- TABLE 277 ROBINSON BROTHERS: COMPANY OVERVIEW

- TABLE 278 STANDARD REAGENTS PVT. LTD.: COMPANY OVERVIEW

- TABLE 279 KISHIDA CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 280 ANQORE: COMPANY OVERVIEW

- TABLE 281 JINDAL SPECIALITY CHEMICALS: COMPANY OVERVIEW

- TABLE 282 FUSHUN SHUNENG CHEMICAL CO., LTD: COMPANY OVERVIEW

- TABLE 283 SHANDONG JINCHENG PHARMACEUTICAL GROUP CO., LTD: COMPANY OVERVIEW

- FIGURE 1 ACETONITRILE MARKET SEGMENTATION

- FIGURE 2 ACETONITRILE MARKET: RESEARCH DESIGN

- FIGURE 3 MAJOR FACTORS RESPONSIBLE FOR GLOBAL RECESSION AND THEIR IMPACT ON ACETONITRILE MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 ACETONITRILE MARKET: DATA TRIANGULATION

- FIGURE 7 SOLVENT TYPE LED ACETONITRILE MARKET IN 2022

- FIGURE 8 ANALYTICAL APPLICATIONS DOMINATED ACETONITRILE MARKET IN 2022

- FIGURE 9 PHARMACEUTICAL INDUSTRY TO DOMINATE MARKET

- FIGURE 10 ASIA PACIFIC LED ACETONITRILE MARKET IN 2022

- FIGURE 11 SIGNIFICANT GROWTH POTENTIAL IN ACETONITRILE MARKET BETWEEN 2023 AND 2028

- FIGURE 12 SOLVENT TYPE AND ASIA PACIFIC WERE LARGEST SEGMENTS

- FIGURE 13 ANALYTICAL APPLICATION SEGMENT DOMINATED ACETONITRILE MARKET IN 2022

- FIGURE 14 PHARMACEUTICAL WAS LARGEST END-USE INDUSTRY OF ACETONITRILE MARKET IN 2022

- FIGURE 15 CHINA TO BE FASTEST-GROWING ACETONITRILE MARKET DURING 2023–2028

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ACETONITRILE MARKET

- FIGURE 17 ACETONITRILE MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 18 AVERAGE SELLING PRICE TREND FOR TOP 3 END-USE INDUSTRIES (USD/KG), BY KEY PLAYERS

- FIGURE 19 AVERAGE SELLING PRICES BY TYPE (USD/KG)

- FIGURE 20 AVERAGE SELLING PRICE TREND FOR APPLICATIONS (USD/KG)

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

- FIGURE 22 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- FIGURE 23 VALUE CHAIN ANALYSIS: ACETONITRILE MARKET

- FIGURE 24 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 25 GLOBAL PATENT PUBLICATION TREND: 2018-2023

- FIGURE 26 ACETONITRILE MARKET: LEGAL STATUS OF PATENTS

- FIGURE 27 GLOBAL JURISDICTION ANALYSIS

- FIGURE 28 UPM KYMMENE CORP. REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 29 ANALYTICAL APPLICATION SEGMENT TO LEAD ACETONITRILE MARKET BETWEEN 2023 AND 2028

- FIGURE 30 ASIA PACIFIC TO LEAD ORGANIC SYNTHESIS SEGMENT DURING FORECAST PERIOD

- FIGURE 31 ASIA PACIFIC TO LEAD ANALYTICAL APPLICATIONS SEGMENT DURING FORECAST PERIOD

- FIGURE 32 SOLVENT SEGMENT TO LEAD ACETONITRILE MARKET DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC TO LEAD DERIVATIVE SEGMENT DURING FORECAST PERIOD

- FIGURE 34 ASIA PACIFIC TO BE LARGEST SOLVENT ACETONITRILE MARKET

- FIGURE 35 PHARMACEUTICAL INDUSTRY TO LEAD ACETONITRILE MARKET DURING FORECAST PERIOD

- FIGURE 36 ASIA PACIFIC TO LEAD ACETONITRILE MARKET IN PHARMACEUTICAL INDUSTRY

- FIGURE 37 ASIA PACIFIC TO BE LARGEST ACETONITRILE MARKET IN ANALYTICAL INDUSTRY

- FIGURE 38 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA: ACETONITRILE MARKET SNAPSHOT

- FIGURE 40 EUROPE: ACETONITRILE MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: ACETONITRILE MARKET SNAPSHOT

- FIGURE 42 SHARES OF TOP COMPANIES IN ACETONITRILE MARKET

- FIGURE 43 RANKING OF TOP FIVE PLAYERS IN ACETONITRILE MARKET

- FIGURE 44 ACETONITRILE MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- FIGURE 45 ACETONITRILE MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2022

- FIGURE 46 INOES AG: COMPANY SNAPSHOT

- FIGURE 47 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 FORMOSA PLASTIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 PETROCHINA CO. LTD: COMPANY SNAPSHOT

- FIGURE 50 AVANTOR PERFORMANCE MATERIALS, LLC: COMPANY SNAPSHOT

- FIGURE 51 ALKYL AMINES CHEMICAL CO., LTD.: COMPANY SNAPSHOT

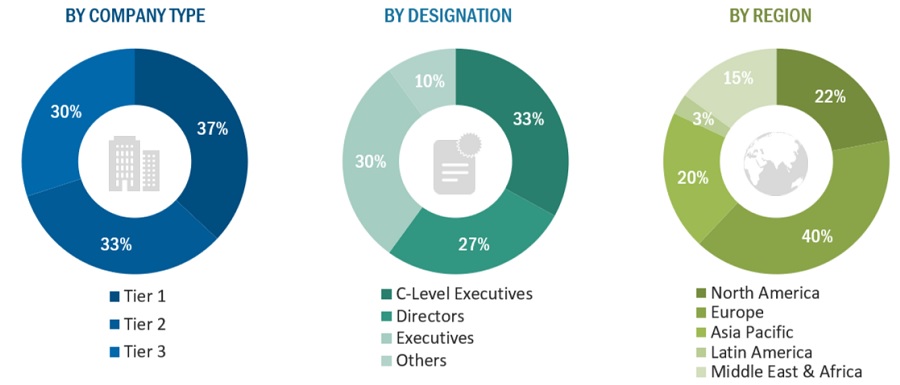

The study involves two major activities in estimating the current market size for the acetonitrile market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering acetonitrile and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the acetonitrile market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the acetonitrile market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from acetonitrile industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using the acetonitrile industry, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of acetonitrile and future outlook of their business which will affect the overall market.

The Breakup of Primary Research :

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

INOES AG |

Product Development Head |

|

Asahi Kasei Corporation |

Director |

|

Avantor Performance Materials LLC |

Consultant |

|

Nova Molecular Technologies |

Sales Head |

Market Size Estimation

The research methodology used to estimate the size of the acetonitrile market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in acetonitrile in different type applications of the acetonitrile at a regional level. Such procurements provide information on the demand aspects of the acetonitrile industry for each application. For each application, all possible segments of the acetonitrile market were integrated and mapped.

Acetonitrile Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Acetonitrile Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Acetonitrile is a colorless liquid with the chemical formula CH3CN. Acetonitrile is a by-product of acrylonitrile and is majorly used as a solvent in various applications. It is also used as an intermediate or raw material in various applications. The major end-use industry of acetonitrile includes pharmaceutical, analytical, agrochemical, and others. It is widely used as a solvent in various chemical processes and also as a starting material for the synthesis of chemical compounds.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the size of the global acetonitrile based on type, application, end-use industry, and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Latin America, Middle East & Africa, along with major countries in each region

- Europe, Asia Pacific, Latin America, Middle East & Africa, along with major countries in each region restraints, opportunities, and challenges) influencing the growth of the market

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the acetonitrile market

- To analyze technological advancements and product launches in the market

- To strategically analyze micro markets with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with a market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the acetonitrile market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market

Growth opportunities and latent adjacency in Acetonitrile Market