Airway Management Devices Market by Type (Endotracheal tubes, Tracheostomy tube, Oropharyngeal, Nasopharyngeal, Laryngoscopes, Resuscitators), Application (Anesthesia, Emergency medicine), End User (Hospitals, Home care settings) - Global Forecast to 2028

Market Growth Outlook Summary

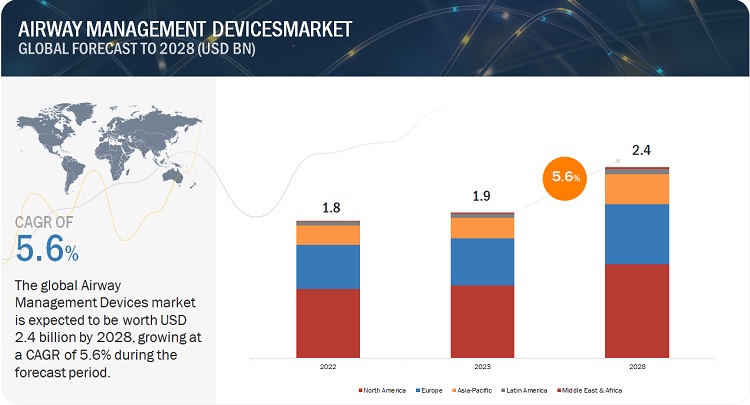

The global airway management devices market, valued at US$1.8 billion in 2022, stood at US$1.9 billion in 2023 and is projected to advance at a resilient CAGR of 5.6% from 2023 to 2028, culminating in a forecasted valuation of US$2.4 billion by the end of the period. The growth in this market is attributed to the increasing demand for airway management devices in developing countries, the rise in surgical procedures, and the growing prevalence of chronic respiratory diseases such as asthma and COPD. However, the lack of reimbursement policies in emerging countries may challenge market growth. Conversely, the increasing demand for intensive care units presents growth opportunities for the market.

Attractive Opportunities in the Airway Management Devices Market

To know about the assumptions considered for the study, Request for Free Sample Report

Airway Management Devices Market Dynamics

DRIVER: Rising incidence of pre-term births globally

Preterm birth is when a baby is born too early, before 37 weeks of pregnancy have been completed. Globally, there has been a rise in the number of premature births in recent years. Babies with breathing issues may need a mechanical ventilator to help them in breathing. These babies may also develop irregular breathing, apnea, asthma, and other respiratory diseases. Considering these points, the high and rising incidence of pre-term births drives the global demand for airway management devices. To meet the demand of different sizes and shapes of airway management products, vendors are offering products according to infants and pediatric patients’ requirements.

Restraint: Lack of reimbursement policies across emerging countries

Emerging countries have low adoption for expensive airway management devices, due to ineffective reimbursement policies or lack of public health insurance coverage. Such ineffective policies, people need to spend out of pockets which hampers the financial condition of the poor across developing countries, with a lack of support for universal health coverage. Such situations have made countries vulnerable to the risk of chronic diseases. Owing to the high out-of-pocket costs of healthcare, the adoption of expensive medical devices such as video laryngoscopes and advanced surgical procedures is low across emerging countries, that has become a key restraint in the market.

OPPORTUNITY: Rising growth potential in developing countries

Developing countries such as China, India, and Brazil are expected to provide potential growth opportunities to players operating in the market. This is primarily attributed to the large target patient population in India and China. China’s one-child policy has significantly reduced the working-age population in the country and resulted in significant growth in its old age population. Moreover, countries such as India and Malaysia have become medical tourism hubs. The cost of surgical procedures across these developing countries is far less than in developed countries such as the US, Germany, France, and the UK. The resultant rise in surgeries will contribute to the demand for anesthesia procedures and airway management.

CHALLENGE: Dearth of skilled professionals

Airway management procedures such as tracheostomy, endotracheal intubation, and cricothyrotomy procedures require highly skilled anesthetists and trained nurses. The lack of knowledge regarding the right choice of immediate treatment can adversely affect the patient’s condition, can increase the recovery time, and can surge the direct and indirect expenses. Shortage of anesthetists and paramedics has become one of the key concerns for countries across the globe. The shortage has directly impacted the efficiency and capabilities of healthcare settings to provide surgical and emergency care, further hindering the demand for airway management devices used across these procedures.

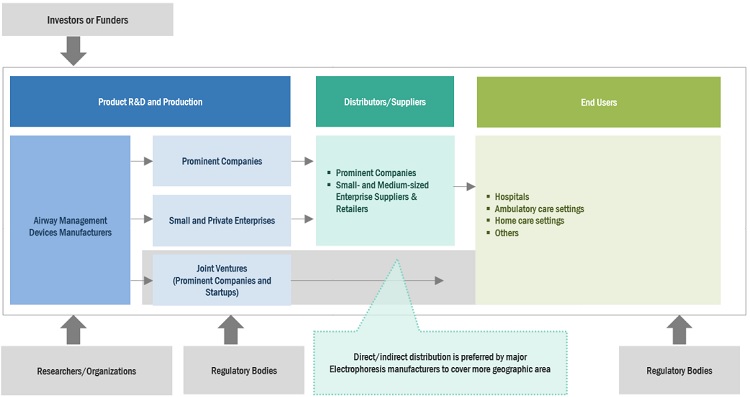

Airway Management Devices Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of airway management devices. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Medtronic (Ireland), ICU Medical, Inc. (US), Teleflex Incorporated (US), Ambu A/S (Denmark), ConvaTec Group Plc (UK

In 2022, infraglottic segment to observe highest growth rate of the airway management devices market, by type

Based on the type, the infraglottic segment is expected to observe highest growth during the forecast period. Factors attributing high growth is due to rise in prevalence of cardiovascular diseases, chronic respiratory diseases, and respiratory tract infections are increasing the incidence of acute respiratory failure, thereby driving the demand of intubation procedures and infraglottic devices globally.

In 2022, anesthesia segment is expected to account for the largest share of the airway management devices market, by application.

By application, the anesthesia segment accounted for the largest share during the forecast period. Factors attributing to the large segment of this market include the rising number of surgical interventions. Moreover, the growing need for maintaining a safe breathing passage to lower the risk of anesthesia-related complications during surgery is also driving the use of airway management devices during anesthesia procedures.

The pediatric patient segment of airway management devices market is expected to grow at the highest rate during the forecast period.

The pediatric/neonatal patients segment is expected to grow at the highest CAGR in the market during the forecast period. The rising number of pre-term births globally are driving a rapid demand for airway management across pediatric/neonatal patients.

In 2022, Hospitals segment accounted for the largest share of the airway management devices market, by end user.

The hospital segment accounted for the largest market share during the forecast period. The high share of this segment can be attributed to the increasing number of hospitals and infrastructural & economic development, especially in developing countries. Moreover, the increasing surgical procedure during any surgery also supports high growth in the hospitals segment.

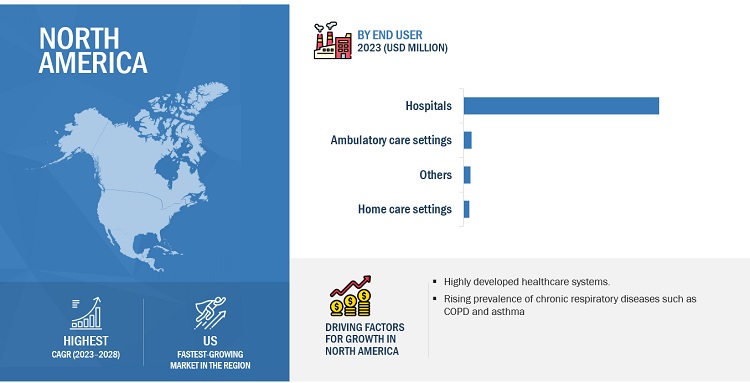

In 2022, North America to dominate in airway management devices market

The global market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa. North America is expected to dominate during the forecast period, primarily due to presence of highly developed healthcare system, the increasing prevalence of chronic respiratory diseases, and favorable reimbursement policies for airway management devices.

To know about the assumptions considered for the study, download the pdf brochure

The airway management devices market is dominated by players such Medtronic (Ireland), ICU Medical, Inc. (US), Teleflex Incorporated (US), Ambu A/S (Denmark), ConvaTec Group Plc (UK).

Airway Management Devices Market Report Scope

|

Report Metrics |

Details |

|

Market Revenue in 2022 |

$1.8 billion |

|

Projected Revenue in 2028 |

$2.4 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 5.6% |

|

Market Driver |

Rising incidence of pre-term births globally |

|

Market Opportunity |

Rising growth potential in developing countries |

This research report categorizes the airway management devices market to forecast revenue and analyze trends in each of the following submarkets:

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

By Product

- Imfraglottic Devices

- Supraglottic Devices

- Laryngoscopes

- Resuscitators

- Cricothyrotomy kits

- Other Airway Management Devices

By Patient Age

- Adult Patients

- Pediatric Patients/Neonates

By Application

- Anesthesia

- Emergency Medicine

- Other applications

By End User

- Hospitals

- Ambulatory care settings

- Home care settings

- Others

Recent Developments

- In 2022, SunMed Holdings (US) announced a strategic partnership with Securisyn Medical LLC (US) to enhance ventilated patient safety and broader smooth tube and catheter security.

- In 2022, Coloplast A/S acquired Atos Medical to add a new chronic business segment – ENT & Respiratory Care, which will run as a separate strategic unit, operating on shared Coloplast infrastructure.

- In 2022, ICU Medical, Inc. acquired Smiths Medical (US), which includes a syringe and ambulatory infusion devices, vascular access, and vital care products. When combined with ICU Medical’s existing businesses, it created a leading infusion therapy company.

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global airway management devices market between 2023 and 2028?

The global airway management devices market is projected to grow from USD 1.9 billion in 2023 to USD 2.4 billion by 2028, demonstrating a robust CAGR of 5.6%.

What are the key factors driving the airway management devices market?

Key factors driving the airway management devices market include the rising prevalence of chronic respiratory diseases such as asthma and COPD, the increasing number of surgeries, and the growing demand for intensive care units in hospitals.

What are the main challenges facing the airway management devices market?

The main challenges include the lack of reimbursement policies in emerging countries and the shortage of skilled professionals to perform complex airway management procedures.

Which regions are expected to show growth in the airway management devices market?

Developing regions such as Asia-Pacific, particularly countries like China, India, and Brazil, are expected to provide significant growth opportunities due to increasing healthcare infrastructure and rising patient populations.

What are the key products used in airway management?

Key products in airway management include supraglottic devices, infraglottic devices, laryngoscopes, resuscitators, and cricothyrotomy kits.

How does the rising number of surgical procedures impact the airway management devices market?

The rising number of surgical procedures, particularly those requiring anesthesia, significantly drives the demand for airway management devices to ensure patient safety and prevent complications during surgery.

What role do hospitals play in the airway management devices market?

Hospitals account for the largest share of the airway management devices market, with an increasing number of surgical procedures and ICU admissions driving the demand for these devices.

What is the impact of preterm births on the airway management devices market?

The rising incidence of preterm births globally drives the demand for airway management devices, as premature infants often require respiratory support due to underdeveloped lungs.

How is the pediatric segment influencing the airway management devices market?

The pediatric segment is expected to grow at the highest rate during the forecast period, driven by the rising number of preterm births and the growing demand for airway management devices tailored to pediatric and neonatal patients.

What advancements in technology are influencing the airway management devices market?

Technological advancements, such as the development of video laryngoscopes and automation in airway management devices, are improving procedural efficiency and patient outcomes, further driving market growth.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing prevalence of chronic respiratory diseases- Growing demand for emergency and intensive care- Growing incidence of pre-term births globally- Government support for improving emergency care infrastructureRESTRAINTS- Lack of reimbursement policies across developing countriesOPPORTUNITIES- Growing demand for single-use airway management devices- Increased growth potential in emerging countriesCHALLENGES- Harmful effects of airway management devices on neonatal patients- Dearth of skilled professionals for airway management procedures- Increasing pricing pressure on key market players

- 6.1 INTRODUCTION

-

6.2 INDUSTRY TRENDSUSE OF ECO-FRIENDLY AND BIODEGRADABLE POLYMERS IN AIRWAY MANAGEMENT DEVICE MANUFACTURING

-

6.3 DEMAND SIDE ANALYSISGROWING ADOPTION OF ADVANCED INTUBATION TUBE HOLDERS

-

6.4 REGULATORY ANALYSISNORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- Japan- China- India

-

6.5 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 6.6 VALUE CHAIN ANALYSIS

-

6.7 ECOSYSTEM ANALYSISROLE IN ECOSYSTEM

-

6.8 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR AIRWAY MANAGEMENT DEVICESJURISDICTION AND TOP APPLICANT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 INFRAGLOTTIC AIRWAY DEVICESENDOTRACHEAL TUBES- Endotracheal tubes to be most useful devices for airway managementTRACHEOSTOMY TUBES- Increased use in ICUs to ensure high adoption of tracheostomy tubes

-

7.3 SUPRAGLOTTIC AIRWAY DEVICESLARYNGEAL MASK AIRWAY DEVICES- Laryngeal mask airway devices to hold largest market share during forecast periodOROPHARYNGEAL AIRWAY DEVICES- Oropharyngeal airway devices to be used in unconscious or unresponsive patientsNASOPHARYNGEAL AIRWAY DEVICES- Easy and effective stimulation of gag reflex to propel segmentOTHER SUPRAGLOTTIC AIRWAY DEVICES

-

7.4 LARYNGOSCOPESCONVENTIONAL LARYNGOSCOPES- Low prices and long history of use to drive segmentVIDEO LARYNGOSCOPES- High prices of video laryngoscopes to hinder access in developing countries

-

7.5 RESUSCITATORSRESUSCITATORS TO BE PREFERRED FOR PEDIATRIC PATIENTS/NEONATES

-

7.6 CRICOTHYROTOMY KITSRISING NUMBER OF TRAFFIC ACCIDENTS AND RELATED HEAD AND NECK INJURIES TO PROPEL MARKET

- 7.7 OTHER AIRWAY MANAGEMENT DEVICES

- 8.1 INTRODUCTION

-

8.2 ADULT PATIENTSADULTS PATIENTS TO HOLD LARGEST SHARE OF AIRWAY MANAGEMENT DEVICES MARKET DURING STUDY PERIOD

-

8.3 PEDIATRIC PATIENTS/NEONATESAGE-RELATED DIFFERENCES IN ANATOMY AND PHYSIOLOGY TO HINDER AIRWAY MANAGEMENT

- 9.1 INTRODUCTION

-

9.2 ANESTHESIAANESTHESIA TO HOLD LARGEST SHARE OF AIRWAY MANAGEMENT DEVICES APPLICATIONS MARKET DURING STUDY PERIOD

-

9.3 EMERGENCY MEDICINERESUSCITATORS AND SUPRAGLOTTIC AIRWAY MANAGEMENT DEVICES TO BE USED IN INITIAL PHASES OF EMERGENCY CARE

- 9.4 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 HOSPITALSOPERATING ROOMS- Rising number of surgeries to drive demand for airway management devices in operating roomsEMERGENCY CARE DEPARTMENTS- Increased number of emergencies and trauma care patients to propel marketINTENSIVE CARE UNITS- Rising disease prevalence and growing need for monitoring to fuel segment

-

10.3 AMBULATORY CARE CENTERSHIGH COSTS IN HOSPITAL OUTPATIENT DEPARTMENTS TO INCREASE FOCUS ON AMBULATORY CARE

-

10.4 HOME CARE SETTINGSRISING AWARENESS AND ACCEPTANCE OF HOME CARE TO BOOST MARKET

- 10.5 OTHER END USERS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: IMPACT OF ECONOMIC RECESSIONUS- US to dominate North American airway management devices market during forecast periodCANADA- Growing government focus on local manufacturing of medical devices to propel market

-

11.3 EUROPEEUROPE: IMPACT OF ECONOMIC RECESSIONGERMANY- Germany dominated European airway management devices market in 2022FRANCE- Presence of advanced and well-established healthcare system to fuel marketUK- High prevalence of respiratory disorders to drive demand for airway management devices in healthcare settingsITALY- Rising surgical volumes to augment demand for general anesthesia and airway managementSPAIN- Aging population and increasing prevalence of respiratory diseases to aid marketREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: IMPACT OF ECONOMIC RECESSIONJAPAN- Strong healthcare system and favorable reimbursement policies to support marketCHINA- Growing number of healthcare facilities and policy reforms to stimulate marketINDIA- Increasing prevalence of respiratory diseases and pre-term births to drive demand for airway management devicesREST OF ASIA PACIFIC

-

11.5 LATIN AMERICAFAVORABLE REIMBURSEMENT SCENARIOS AND HEALTHCARE DEVELOPMENT INITIATIVES TO BOOST MARKETLATIN AMERICA: IMPACT OF ECONOMIC RECESSION

-

11.6 MIDDLE EAST & AFRICAIMPROVING HEALTH INFRASTRUCTURE AND MANDATORY HEALTH INSURANCE TO SUPPORT MARKETMIDDLE EAST & AFRICA: IMPACT OF ECONOMIC RECESSION

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS IN AIRWAY MANAGEMENT DEVICES MARKET

- 12.4 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- 12.5 MARKET SHARE ANALYSIS

-

12.6 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.7 COMPANY EVALUATION QUADRANT FOR START-UPS/SMESPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIES

-

12.8 COMPANY PRODUCT FOOTPRINTTYPE FOOTPRINTEND USER FOOTPRINTREGIONAL FOOTPRINT

-

12.9 COMPETITIVE SCENARIOKEY PRODUCT LAUNCHES AND APPROVALSKEY DEALSOTHER KEY DEVELOPMENTS

-

13.1 KEY PLAYERSMEDTRONIC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewICU MEDICAL, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTELEFLEX INCORPORATED- Business overview- Products/Services/Solutions offered- MnM viewAMBU A/S- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCONVATEC GROUP PLC- Business overview- Products/Services/Solutions offered- MnM viewKARL STORZ SE & CO. KG- Business overview- Products/Services/Solutions offered- Recent developmentsFLEXICARE (GROUP) LIMITED- Business overview- Products/Services/Solutions offeredINTERSURGICAL LTD.- Business overview- Products/Services/Solutions offered- Recent developmentsSUNMED LLC- Business overview- Products/Services/Solutions offered- Recent developmentsVYAIRE- Business overview- Products/Services/Solutions offered- Recent developmentsVBM MEDIZINTECHNIK GMBH- Business overview- Products/Services/Solutions offered- Recent developmentsVERATHON INC.- Business overview- Products/Services/Solutions offered- Recent developmentsSOURCEMARK- Business overview- Products/Services/Solutions offered- Recent developmentsMERCURY ENTERPRISES- Business overview- Products/Services/Solutions offered- Recent developmentsATOS MEDICAL- Business overview- Products/Services/Solutions offered- Recent developmentsP3 MEDICAL- Business overview- Products/Services/Solutions offeredHENAN TUOREN MEDICAL DEVICE CO., LTD.- Business overview- Products/Services/Solutions offeredMEDEREN NEOTECH LTD.- Business overview- Products/Services/Solutions offeredBOMIMED- Business overview- Products/Services/Solutions offeredMEDIS MEDICAL (UK) LTD.- Business overview- Products/Services/Solutions offered

-

13.2 OTHER PLAYERSOLYMPUS CORPORATIONARMSTRONG MEDICAL LTD. (EAKIN HEALTHCARE GROUP)NIHON KOHDEN CORPORATIONSHENZHEN HUGEMED MEDICAL TECHNICAL DEVELOPMENT CO., LTD.VENNER MEDICAL MEDIZINTECHNIK

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 2 RISK ASSESSMENT: AIRWAY MANAGEMENT DEVICES MARKET

- TABLE 3 MARKET DYNAMICS: AIRWAY MANAGEMENT DEVICES MARKET

- TABLE 4 POPULATION AGED 65 YEARS AND ABOVE, BY REGION (%)

- TABLE 5 COMPARISON OF SURGERY COSTS: INDIA VS. US

- TABLE 6 US: FDA CLASSIFICATION OF AIRWAY MANAGEMENT DEVICES

- TABLE 7 US: REGULATORY PROCESS FOR MEDICAL DEVICES

- TABLE 8 JAPAN: CLASSIFICATION OF MEDICAL DEVICES AND REVIEWING BODIES

- TABLE 9 NMPA MEDICAL DEVICE CLASSIFICATION

- TABLE 10 PORTER’S FIVE FORCES ANALYSIS

- TABLE 11 AIRWAY MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 12 AIRWAY MANAGEMENT DEVICES MARKET FOR INFRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 13 AIRWAY MANAGEMENT DEVICES MARKET FOR INFRAGLOTTIC AIRWAY DEVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 14 AIRWAY MANAGEMENT DEVICES MARKET FOR INFRAGLOTTIC AIRWAY DEVICES, BY REGION, 2021–2028 (MILLION UNITS)

- TABLE 15 ENDOTRACHEAL TUBES OFFERED BY KEY MARKET PLAYERS

- TABLE 16 ENDOTRACHEAL TUBES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 17 ENDOTRACHEAL TUBES MARKET, BY REGION, 2021–2028 (MILLION UNITS)

- TABLE 18 TRACHEOSTOMY TUBES OFFERED BY KEY MARKET PLAYERS

- TABLE 19 TRACHEOSTOMY TUBES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 TRACHEOSTOMY TUBES MARKET, BY REGION, 2021–2028 (MILLION UNITS)

- TABLE 21 AIRWAY MANAGEMENT DEVICES MARKET FOR SUPRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 22 AIRWAY MANAGEMENT DEVICES MARKET FOR SUPRAGLOTTIC AIRWAY DEVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 23 AIRWAY MANAGEMENT DEVICES MARKET FOR SUPRAGLOTTIC AIRWAY MANAGEMENT DEVICES, BY REGION, 2021–2028 (MILLION UNITS)

- TABLE 24 LARYNGEAL MASK AIRWAY DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 25 LARYNGEAL MASK AIRWAY DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 LARYNGEAL MASK AIRWAY DEVICES MARKET, BY REGION, 2021–2028 (MILLION UNITS)

- TABLE 27 OROPHARYNGEAL AIRWAY DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 28 OROPHARYNGEAL AIRWAY DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 OROPHARYNGEAL AIRWAY DEVICES MARKET, BY REGION, 2021–2028 (MILLION UNITS)

- TABLE 30 NASOPHARYNGEAL AIRWAY DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 31 NASOPHARYNGEAL AIRWAY DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 NASOPHARYNGEAL AIRWAY DEVICES MARKET, BY REGION, 2021–2028 (MILLION UNITS)

- TABLE 33 OTHER SUPRAGLOTTIC AIRWAY DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 34 OTHER SUPRAGLOTTIC AIRWAY DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 OTHER SUPRAGLOTTIC AIRWAY DEVICES MARKET, BY REGION, 2021–2028 (MILLION UNITS)

- TABLE 36 AIRWAY MANAGEMENT DEVICES MARKET FOR LARYNGOSCOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 37 AIRWAY MANAGEMENT DEVICES MARKET FOR LARYNGOSCOPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 AIRWAY MANAGEMENT DEVICES MARKET FOR LARYNGOSCOPES MARKET, BY REGION, 2021–2028 (MILLION UNITS)

- TABLE 39 CONVENTIONAL LARYNGOSCOPES OFFERED BY KEY MARKET PLAYERS

- TABLE 40 CONVENTIONAL LARYNGOSCOPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 CONVENTIONAL LARYNGOSCOPES MARKET, BY REGION, 2021–2028 (MILLION UNITS)

- TABLE 42 VIDEO LARYNGOSCOPES OFFERED BY KEY MARKET PLAYERS

- TABLE 43 VIDEO LARYNGOSCOPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 VIDEO LARYNGOSCOPES MARKET, BY REGION, 2021–2028 (MILLION UNITS)

- TABLE 45 RESUSCITATORS OFFERED BY KEY MARKET PLAYERS

- TABLE 46 AIRWAY MANAGEMENT DEVICES MARKET FOR RESUSCITATORS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 AIRWAY MANAGEMENT DEVICES MARKET FOR RESUSCITATORS, BY REGION, 2021–2028 (MILLION UNITS)

- TABLE 48 CRICOTHYROTOMY KITS OFFERED BY KEY MARKET PLAYERS

- TABLE 49 AIRWAY MANAGEMENT DEVICES MARKET FOR CRICOTHYROTOMY KITS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 AIRWAY MANAGEMENT DEVICES MARKET FOR CRICOTHYROTOMY KITS, BY REGION, 2021–2028 (MILLION UNITS)

- TABLE 51 OTHER AIRWAY MANAGEMENT DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 52 AIRWAY MANAGEMENT DEVICES MARKET FOR OTHER AIRWAY MANAGEMENT DEVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 53 AIRWAY MANAGEMENT DEVICES MARKET, BY PATIENT AGE, 2021–2028 (USD MILLION)

- TABLE 54 AIRWAY MANAGEMENT DEVICES MARKET FOR ADULT PATIENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 AIRWAY MANAGEMENT DEVICES MARKET FOR PEDIATRIC PATIENTS/NEONATES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 56 AIRWAY MANAGEMENT DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 57 AIRWAY MANAGEMENT DEVICES MARKET FOR ANESTHESIA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 AIRWAY MANAGEMENT DEVICES MARKET FOR EMERGENCY MEDICINE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 AIRWAY MANAGEMENT DEVICES MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 60 AIRWAY MANAGEMENT DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 61 AIRWAY MANAGEMENT DEVICES MARKET FOR HOSPITALS, BY DEPARTMENT, 2021–2028 (USD MILLION)

- TABLE 62 AIRWAY MANAGEMENT DEVICES MARKET FOR HOSPITALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 63 US: INCREASE IN NUMBER OF SURGICAL PROCEDURES PERFORMED

- TABLE 64 OPERATING ROOMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 EMERGENCY CARE DEPARTMENTS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 66 INTENSIVE CARE UNITS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 67 AIRWAY MANAGEMENT DEVICES MARKET FOR AMBULATORY CARE CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 68 AIRWAY MANAGEMENT DEVICES MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 69 AIRWAY MANAGEMENT DEVICES MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 70 AIRWAY MANAGEMENT MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: AIRWAY MANAGEMENT DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: AIRWAY MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: AIRWAY MANAGEMENT DEVICES MARKET FOR INFRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: AIRWAY MANAGEMENT DEVICES MARKET FOR SUPRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: AIRWAY MANAGEMENT DEVICES MARKET FOR LARYNGOSCOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: AIRWAY MANAGEMENT DEVICES MARKET, BY PATIENT AGE, 2021–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: AIRWAY MANAGEMENT DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: AIRWAY MANAGEMENT DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: AIRWAY MANAGEMENT DEVICES MARKET FOR HOSPITALS, BY DEPARTMENT, 2021–2028 (USD MILLION)

- TABLE 80 US: AIRWAY MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 81 US: AIRWAY MANAGEMENT DEVICES MARKET FOR INFRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 82 US: AIRWAY MANAGEMENT DEVICES MARKET FOR SUPRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 83 US: AIRWAY MANAGEMENT DEVICES MARKET FOR LARYNGOSCOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 84 US: AIRWAY MANAGEMENT DEVICES MARKET, BY PATIENT AGE, 2021–2028 (USD MILLION)

- TABLE 85 US: AIRWAY MANAGEMENT DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 86 US: AIRWAY MANAGEMENT DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 87 US: AIRWAY MANAGEMENT DEVICES MARKET FOR HOSPITALS, BY DEPARTMENT, 2021–2028 (USD MILLION)

- TABLE 88 CANADA: AIRWAY MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 89 CANADA: AIRWAY MANAGEMENT DEVICES MARKET FOR INFRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 90 CANADA: AIRWAY MANAGEMENT DEVICES MARKET FOR SUPRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 91 CANADA: AIRWAY MANAGEMENT DEVICES MARKET FOR LARYNGOSCOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 92 CANADA: AIRWAY MANAGEMENT DEVICES MARKET, BY PATIENT AGE, 2021–2028 (USD MILLION)

- TABLE 93 CANADA: AIRWAY MANAGEMENT DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 94 CANADA: AIRWAY MANAGEMENT DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 95 CANADA: AIRWAY MANAGEMENT DEVICES MARKET FOR HOSPITALS, BY DEPARTMENT, 2021–2028 (USD MILLION)

- TABLE 96 EUROPE: AIRWAY MANAGEMENT DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 97 EUROPE: AIRWAY MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 98 EUROPE: AIRWAY MANAGEMENT DEVICES MARKET FOR INFRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 99 EUROPE: AIRWAY MANAGEMENT DEVICES MARKET FOR SUPRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 100 EUROPE: AIRWAY MANAGEMENT DEVICES MARKET FOR LARYNGOSCOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 101 EUROPE: AIRWAY MANAGEMENT DEVICES MARKET, BY PATIENT AGE, 2021–2028 (USD MILLION)

- TABLE 102 EUROPE: AIRWAY MANAGEMENT DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 103 EUROPE: AIRWAY MANAGEMENT DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 104 EUROPE: AIRWAY MANAGEMENT DEVICES MARKET FOR HOSPITALS, BY DEPARTMENT, 2021–2028 (USD MILLION)

- TABLE 105 GERMANY: AIRWAY MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 106 GERMANY: AIRWAY MANAGEMENT DEVICES MARKET FOR INFRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 107 GERMANY: AIRWAY MANAGEMENT DEVICES MARKET FOR SUPRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 108 GERMANY: AIRWAY MANAGEMENT DEVICES MARKET FOR LARYNGOSCOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 109 GERMANY: AIRWAY MANAGEMENT DEVICES MARKET, BY PATIENT AGE, 2021–2028 (USD MILLION)

- TABLE 110 GERMANY: AIRWAY MANAGEMENT DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 111 GERMANY: AIRWAY MANAGEMENT DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 112 GERMANY: AIRWAY MANAGEMENT DEVICES MARKET FOR HOSPITALS, BY DEPARTMENT, 2021–2028 (USD MILLION)

- TABLE 113 FRANCE: AIRWAY MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 114 FRANCE: AIRWAY MANAGEMENT DEVICES MARKET FOR INFRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 115 FRANCE: AIRWAY MANAGEMENT DEVICES MARKET FOR SUPRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 116 FRANCE: AIRWAY MANAGEMENT DEVICES MARKET FOR LARYNGOSCOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 117 FRANCE: AIRWAY MANAGEMENT DEVICES MARKET, BY PATIENT AGE, 2021–2028 (USD MILLION)

- TABLE 118 FRANCE: AIRWAY MANAGEMENT DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 119 FRANCE: AIRWAY MANAGEMENT DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 120 FRANCE: AIRWAY MANAGEMENT DEVICES MARKET FOR HOSPITALS, BY DEPARTMENT, 2021–2028 (USD MILLION)

- TABLE 121 UK: AIRWAY MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 122 UK: AIRWAY MANAGEMENT DEVICES MARKET FOR INFRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 123 UK: AIRWAY MANAGEMENT DEVICES MARKET FOR SUPRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 124 UK: AIRWAY MANAGEMENT DEVICES MARKET FOR LARYNGOSCOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 UK: AIRWAY MANAGEMENT DEVICES MARKET, BY PATIENT AGE, 2021–2028 (USD MILLION)

- TABLE 126 UK: AIRWAY MANAGEMENT DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 127 UK: AIRWAY MANAGEMENT DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 128 UK: AIRWAY MANAGEMENT DEVICES MARKET FOR HOSPITALS, BY DEPARTMENT, 2021–2028 (USD MILLION)

- TABLE 129 ITALY: AIRWAY MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 130 ITALY: AIRWAY MANAGEMENT DEVICES MARKET FOR INFRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 131 ITALY: AIRWAY MANAGEMENT DEVICES MARKET FOR SUPRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 132 ITALY: AIRWAY MANAGEMENT DEVICES MARKET FOR LARYNGOSCOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 133 ITALY: AIRWAY MANAGEMENT DEVICES MARKET, BY PATIENT AGE, 2021–2028 (USD MILLION)

- TABLE 134 ITALY: AIRWAY MANAGEMENT DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 135 ITALY: AIRWAY MANAGEMENT DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 136 ITALY: AIRWAY MANAGEMENT DEVICES MARKET FOR HOSPITALS, BY DEPARTMENT, 2021–2028 (USD MILLION)

- TABLE 137 SPAIN: AIRWAY MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 138 SPAIN: AIRWAY MANAGEMENT DEVICES MARKET FOR INFRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 139 SPAIN: AIRWAY MANAGEMENT DEVICES MARKET FOR SUPRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 140 SPAIN: AIRWAY MANAGEMENT DEVICES MARKET FOR LARYNGOSCOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 141 SPAIN: AIRWAY MANAGEMENT DEVICES MARKET, BY PATIENT AGE, 2021–2028 (USD MILLION)

- TABLE 142 SPAIN: AIRWAY MANAGEMENT DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 143 SPAIN: AIRWAY MANAGEMENT DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 144 SPAIN: AIRWAY MANAGEMENT DEVICES MARKET FOR HOSPITALS, BY DEPARTMENT, 2021–2028 (USD MILLION)

- TABLE 145 REST OF EUROPE: AIRWAY MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 146 REST OF EUROPE: AIRWAY MANAGEMENT DEVICES MARKET FOR INFRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 147 REST OF EUROPE: AIRWAY MANAGEMENT DEVICES MARKET FOR SUPRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 148 REST OF EUROPE: AIRWAY MANAGEMENT DEVICES MARKET FOR LARYNGOSCOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 149 REST OF EUROPE: AIRWAY MANAGEMENT DEVICES MARKET, BY PATIENT AGE, 2021–2028 (USD MILLION)

- TABLE 150 REST OF EUROPE: AIRWAY MANAGEMENT DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 151 REST OF EUROPE: AIRWAY MANAGEMENT DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 152 REST OF EUROPE: AIRWAY MANAGEMENT DEVICES MARKET FOR HOSPITALS, BY DEPARTMENT, 2021–2028 (USD MILLION)

- TABLE 153 ASIA PACIFIC: AIRWAY MANAGEMENT DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 154 ASIA PACIFIC: AIRWAY MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 155 ASIA PACIFIC: AIRWAY MANAGEMENT DEVICES MARKET FOR INFRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 156 ASIA PACIFIC: AIRWAY MANAGEMENT DEVICES MARKET FOR SUPRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 157 ASIA PACIFIC: AIRWAY MANAGEMENT DEVICES MARKET FOR LARYNGOSCOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 158 ASIA PACIFIC: AIRWAY MANAGEMENT DEVICES MARKET, BY PATIENT AGE, 2021–2028 (USD MILLION)

- TABLE 159 ASIA PACIFIC: AIRWAY MANAGEMENT DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 160 ASIA PACIFIC: AIRWAY MANAGEMENT DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 161 ASIA PACIFIC: AIRWAY MANAGEMENT DEVICES MARKET FOR HOSPITALS, BY DEPARTMENT, 2021–2028 (USD MILLION)

- TABLE 162 JAPAN: AIRWAY MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 163 JAPAN: AIRWAY MANAGEMENT DEVICES MARKET FOR INFRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 164 JAPAN: AIRWAY MANAGEMENT DEVICES MARKET FOR SUPRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 165 JAPAN: AIRWAY MANAGEMENT DEVICES MARKET FOR LARYNGOSCOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 166 JAPAN: AIRWAY MANAGEMENT DEVICES MARKET, BY PATIENT AGE, 2021–2028 (USD MILLION)

- TABLE 167 JAPAN: AIRWAY MANAGEMENT DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 168 JAPAN: AIRWAY MANAGEMENT DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 169 JAPAN: AIRWAY MANAGEMENT DEVICES MARKET FOR HOSPITALS, BY DEPARTMENT, 2021–2028 (USD MILLION)

- TABLE 170 CHINA: AIRWAY MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 171 CHINA: AIRWAY MANAGEMENT DEVICES MARKET FOR INFRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 172 CHINA: AIRWAY MANAGEMENT DEVICES MARKET FOR SUPRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 173 CHINA: AIRWAY MANAGEMENT DEVICES MARKET FOR LARYNGOSCOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 174 CHINA: AIRWAY MANAGEMENT DEVICES MARKET, BY PATIENT AGE, 2021–2028 (USD MILLION)

- TABLE 175 CHINA: AIRWAY MANAGEMENT DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 176 CHINA: AIRWAY MANAGEMENT DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 177 CHINA: AIRWAY MANAGEMENT DEVICES MARKET FOR HOSPITALS, BY DEPARTMENT, 2021–2028 (USD MILLION)

- TABLE 178 INDIA: AIRWAY MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 179 INDIA: AIRWAY MANAGEMENT DEVICES MARKET FOR INFRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 180 INDIA: AIRWAY MANAGEMENT DEVICES MARKET FOR SUPRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 181 INDIA: AIRWAY MANAGEMENT DEVICES MARKET FOR LARYNGOSCOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 182 INDIA: AIRWAY MANAGEMENT DEVICES MARKET, BY PATIENT AGE, 2021–2028 (USD MILLION)

- TABLE 183 INDIA: AIRWAY MANAGEMENT DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 184 INDIA: AIRWAY MANAGEMENT DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 185 INDIA: AIRWAY MANAGEMENT DEVICES MARKET FOR HOSPITALS, BY DEPARTMENT, 2021–2028 (USD MILLION)

- TABLE 186 REST OF ASIA PACIFIC: AIRWAY MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 187 REST OF ASIA PACIFIC: AIRWAY MANAGEMENT DEVICES MARKET FOR INFRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 188 REST OF ASIA PACIFIC: AIRWAY MANAGEMENT DEVICES MARKET FOR SUPRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 189 REST OF ASIA PACIFIC: AIRWAY MANAGEMENT DEVICES MARKET FOR LARYNGOSCOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 190 REST OF ASIA PACIFIC: AIRWAY MANAGEMENT DEVICES MARKET, BY PATIENT AGE, 2021–2028 (USD MILLION)

- TABLE 191 REST OF ASIA PACIFIC: AIRWAY MANAGEMENT DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 192 REST OF ASIA PACIFIC: AIRWAY MANAGEMENT DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 193 REST OF ASIA PACIFIC: AIRWAY MANAGEMENT DEVICES MARKET FOR HOSPITALS, BY DEPARTMENT, 2021–2028 (USD MILLION)

- TABLE 194 LATIN AMERICA: AIRWAY MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 195 LATIN AMERICA: AIRWAY MANAGEMENT DEVICES MARKET FOR INFRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 196 LATIN AMERICA: AIRWAY MANAGEMENT DEVICES MARKET FOR SUPRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 197 LATIN AMERICA: AIRWAY MANAGEMENT DEVICES MARKET FOR LARYNGOSCOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 198 LATIN AMERICA: AIRWAY MANAGEMENT DEVICES MARKET, BY PATIENT AGE, 2021–2028 (USD MILLION)

- TABLE 199 LATIN AMERICA: AIRWAY MANAGEMENT DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 200 LATIN AMERICA: AIRWAY MANAGEMENT DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 201 LATIN AMERICA: AIRWAY MANAGEMENT DEVICES MARKET FOR HOSPITALS, BY DEPARTMENT, 2021–2028 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: AIRWAY MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: AIRWAY MANAGEMENT DEVICES MARKET FOR INFRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: AIRWAY MANAGEMENT DEVICES MARKET FOR SUPRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: AIRWAY MANAGEMENT DEVICES MARKET FOR LARYNGOSCOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: AIRWAY MANAGEMENT DEVICES MARKET, BY PATIENT AGE, 2021–2028 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: AIRWAY MANAGEMENT DEVICES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: AIRWAY MANAGEMENT DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: AIRWAY MANAGEMENT DEVICES MARKET FOR HOSPITALS, BY DEPARTMENT, 2021–2028 (USD MILLION)

- TABLE 210 AIRWAY MANAGEMENT DEVICES MARKET: TYPE FOOTPRINT

- TABLE 211 AIRWAY MANAGEMENT DEVICES MARKET: END USER FOOTPRINT

- TABLE 212 AIRWAY MANAGEMENT DEVICES MARKET: REGIONAL FOOTPRINT

- TABLE 213 KEY PRODUCT LAUNCHES AND APPROVALS, JANUARY 2019–APRIL 2023

- TABLE 214 KEY DEALS, JANUARY 2019–APRIL 2023

- TABLE 215 OTHER KEY DEVELOPMENTS, JANUARY 2019–APRIL 2023

- TABLE 216 MEDTRONIC: COMPANY OVERVIEW

- TABLE 217 ICU MEDICAL, INC.: COMPANY OVERVIEW

- TABLE 218 TELEFLEX INCORPORATED: COMPANY OVERVIEW

- TABLE 219 AMBU A/S: COMPANY OVERVIEW

- TABLE 220 CONVATEC GROUP PLC: COMPANY OVERVIEW

- TABLE 221 KARL STORZ SE & CO. KG: COMPANY OVERVIEW

- TABLE 222 FLEXICARE (GROUP) LIMITED: COMPANY OVERVIEW

- TABLE 223 INTERSURGICAL LTD.: COMPANY OVERVIEW

- TABLE 224 SUNMED LLC: COMPANY OVERVIEW

- TABLE 225 VYAIRE: COMPANY OVERVIEW

- TABLE 226 VBM MEDIZINTECHNIK GMBH: COMPANY OVERVIEW

- TABLE 227 VERATHON INC.: COMPANY OVERVIEW

- TABLE 228 SOURCEMARK: COMPANY OVERVIEW

- TABLE 229 MERCURY ENTERPRISES: COMPANY OVERVIEW

- TABLE 230 ATOS MEDICAL: COMPANY OVERVIEW

- TABLE 231 P3 MEDICAL: COMPANY OVERVIEW

- TABLE 232 HENAN TUOREN MEDICAL DEVICE CO., LTD: COMPANY OVERVIEW

- TABLE 233 MEDEREN NEOTECH LTD: COMPANY OVERVIEW

- TABLE 234 BOMIMED: COMPANY OVERVIEW

- TABLE 235 MEDIS MEDICAL (UK) LTD.: COMPANY OVERVIEW

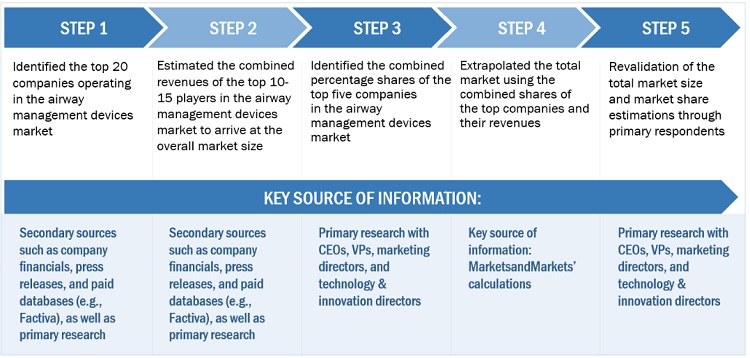

- FIGURE 1 RESEARCH DESIGN

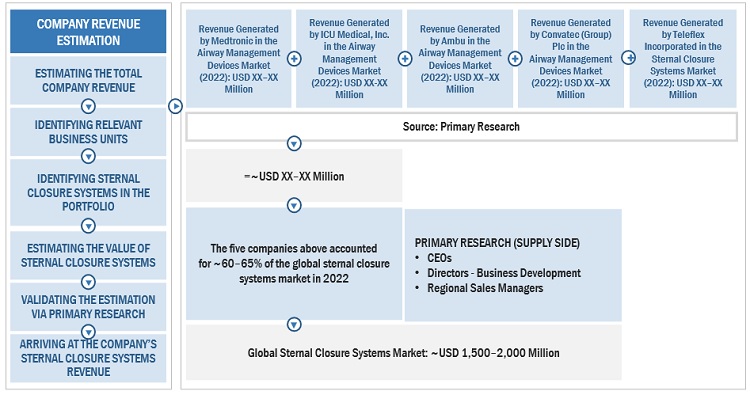

- FIGURE 2 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 3 AIRWAY MANAGEMENT DEVICES MARKET: COMPANY REVENUE ESTIMATION

- FIGURE 4 CAGR PROJECTIONS

- FIGURE 5 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN AIRWAY MANAGEMENT MARKET (2023–2028)

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- FIGURE 7 AIRWAY MANAGEMENT DEVICES MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 8 AIRWAY MANAGEMENT DEVICES MARKET FOR INFRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 AIRWAY MANAGEMENT DEVICES MARKET FOR SUPRAGLOTTIC AIRWAY DEVICES, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 AIRWAY MANAGEMENT DEVICES MARKET FOR LARYNGOSCOPES, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 AIRWAY MANAGEMENT DEVICES MARKET, BY PATIENT AGE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 AIRWAY MANAGEMENT DEVICES MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 AIRWAY MANAGEMENT DEVICES MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 AIRWAY MANAGEMENT DEVICES MARKET FOR HOSPITALS, BY DEPARTMENT, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 GEOGRAPHICAL ANALYSIS: AIRWAY MANAGEMENT DEVICES MARKET

- FIGURE 16 INCREASING CASES OF CHRONIC RESPIRATORY DISEASES AND GROWING DEVELOPMENTS IN HEALTHCARE INFRASTRUCTURE TO DRIVE MARKET

- FIGURE 17 INFRAGLOTTIC AIRWAY DEVICES SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2022

- FIGURE 18 INDIA TO REGISTER HIGHEST REVENUE GROWTH DURING FORECAST PERIOD

- FIGURE 19 NORTH AMERICA TO DOMINATE AIRWAY MANAGEMENT DEVICES MARKET DURING STUDY PERIOD

- FIGURE 20 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 21 AIRWAY MANAGEMENT DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 NUMBER OF PRE-TERM BIRTHS (DEVELOPED, LATIN AMERICAN, AND CARIBBEAN COUNTRIES), 1990–2025

- FIGURE 23 VALUE CHAIN ANALYSIS OF AIRWAY MANAGEMENT DEVICES MARKET

- FIGURE 24 AIRWAY MANAGEMENT DEVICES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 PATENT PUBLICATION TRENDS (JANUARY 1, 2011– APRIL 4, 2023)

- FIGURE 26 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTIONS) FOR AIRWAY MANAGEMENT DEVICES (JANUARY 1, 2011– APRIL 4, 2023)

- FIGURE 27 TOP APPLICANT COUNTRIES/REGIONS FOR AIRWAY MANAGEMENT DEVICES (JANUARY 1, 2011– APRIL 4, 2023)

- FIGURE 28 AGE-ADJUSTED PREVALENCE OF COPD (2011–2020)

- FIGURE 29 AIRWAY MANAGEMENT DEVICES MARKET: GEOGRAPHICAL SNAPSHOT (2022)

- FIGURE 30 NORTH AMERICA: AIRWAY MANAGEMENT DEVICES MARKET SNAPSHOT

- FIGURE 31 EUROPE: AIRWAY MANAGEMENT DEVICES MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: AIRWAY MANAGEMENT DEVICES MARKET SNAPSHOT

- FIGURE 33 REVENUE ANALYSIS OF TOP PLAYERS IN AIRWAY MANAGEMENT DEVICES MARKET

- FIGURE 34 AIRWAY MANAGEMENT DEVICES MARKET SHARE, BY KEY PLAYER, 2022

- FIGURE 35 AIRWAY MANAGEMENT DEVICES MARKET: COMPANY EVALUATION QUADRANT (2022)

- FIGURE 36 AIRWAY MANAGEMENT DEVICES MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES (2022)

- FIGURE 37 MEDTRONIC: COMPANY SNAPSHOT (2022)

- FIGURE 38 ICU MEDICAL, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 39 TELEFLEX INCORPORATED: COMPANY SNAPSHOT (2022)

- FIGURE 40 AMBU A/S: COMPANY SNAPSHOT (2022)

- FIGURE 41 CONVATEC GROUP PLC: COMPANY SNAPSHOT (2022)

- FIGURE 42 ROPER TECHNOLOGIES: COMPANY SNAPSHOT (2022)

- FIGURE 43 COLOPLAST GROUP: COMPANY SNAPSHOT (2022)

The objective of the study is analyze the key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies. To track companies developments such as acquisitions, product launches, expansions, collaborations, agreements and partnerships of the leading players, the competitive landscape of the electrophoresis market to analyzes market players on various parameters within the broad categories of business and product strategy. Revenue share analysis were used to estimate the market size. To estimate the market size of segments and subsegments the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), annual reports, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the electrophoresis market. A database of the key industry leaders was also prepared using secondary research.

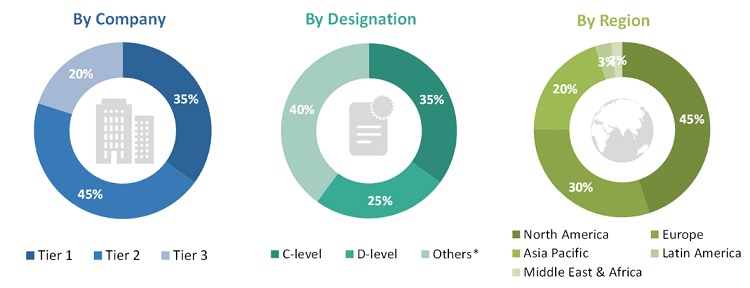

Collecting Primary Data

The primary research data was conducted after acquiring knowledge about the airway management devices market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand side (such clinical laboratories, hospitals, and academic & research institutes) and supply-side (such as included various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing and product development teams, product manufacturers, wholesalers, channel partners, and distributors) across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Approximately 40% of the primary interviews were conducted with stakeholders from the demand side while those from the supply side accounted for the remaining 60%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

Breakdown of Primary Participants:

Note 1: *Others include sales managers, marketing managers, and product managers.

Note 2: Tiers are defined based on a company’s total revenue as of 2022: Tier 1=> USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3=< USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Total Market Size: Global Airway Management Devices Market

The total size of the market was arrived at after data triangulation from various approaches, as mentioned below. After completing each approach, a weighted average of the three approaches was taken based on the level of assumptions used in each approach.

Approach 1: Airway Management Devices Market - Revenue Share Analysis

- Revenues for individual companies were gathered from public sources and databases for each market segment.

- Shares of the airway management products of the leading players were gathered respectively from secondary sources to the extent available. In certain cases, shares have been ascertained after a detailed analysis of various parameters, including product portfolio, market positioning, and geographic reach.

- Individual shares or revenue estimates were validated through Interviews with Experts.

- The market size was then extrapolated to obtain the global market. It was further validated through Interviews with Experts.

The following figure shows an illustrative representation of the overall market size estimation process employed for this study.

Market Size Estimation: Revenue Share Analysis

Source: Annual Reports, SEC Filings, Investor Presentations, Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Airway Management Devices Market: Company Revenue Estimation

Source: Annual Reports, SEC Filings, Investor Presentations, Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Approach 2: Primary Interviews

- As a part of the primary research process, individual respondents’ insights on the market size and market growth were taken during the interview (regional and global, as applicable).

- All the responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Market Definition

Healthcare professionals use airway management devices to clear or bypass obstructed airways to maintain and restore ventilation. An obstructed airway can usually result from anesthesia, respiratory infections, anatomical abnormalities, trauma, or foreign matter that blocks the breathing passage.

Key Stakeholders

- Manufacturing Companies of Airway Management Devices

- Hospitals

- Group Purchase Organizations

- Ambulatory Care Centers

- Assisted Living Facilities/Home Healthcare Service Providers.

- Healthcare Insurance Providers

- Market Research and Consulting Firms

- Venture Capitalists and Investors

Report Objective

- To define, describe, segment, and forecast the airway management devices market by type, application, patient age, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market with respect to the five key regions (along with countries), namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as product launches & enhancements, expansions, mergers & acquisitions, partnerships, contracts, and collaborations

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of the Asia Pacific market into South Korea, Australia, and others

- Further breakdown of the Latin American market into Brazil, Mexico, and others

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Airway Management Devices Market