Resuscitation Devices Market by Product (Defibrillator, Endotracheal & Tracheostomy Tube, Masks, Airways, Laryngoscopes, Resuscitators, Ventilators), Patient Type (Neonatal, Adult), End User (Hospital, Ambulance, ICU), Volume & Region - Global Forecasts to 2025

Updated on : February 21, 2023

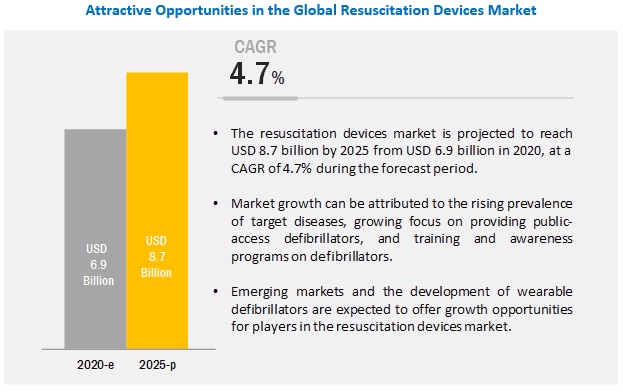

The global resuscitation devices market in terms of revenue was estimated to be worth $6.9 billion in 2020 and is poised to reach $8.7 billion by 2025, growing at a CAGR of 4.7% from 2020 to 2025. Factors such as the rising prevalence of target diseases, increasing demand for emergency care, growing focus on providing public-access defibrillators, high incidence of preterm births, and training and awareness programs on defibrillators are driving the growth of the market.

On the other hand, issues associated with the use of automated external defibrillators and the harmful effects of certain products on neonates are expected to restrain the growth of this market during the forecast period.

The airway management devices segment accounted for the largest share of the resuscitation devices market

On the basis of products, the resuscitation devices market is segmented into external defibrillators, airway management devices, convective warming blankets, and other resuscitation devices. In 2019, the airway management devices segment dominated this market owing to factors such as the high incidence of COPD and a large number of asthma and bronchitis cases.

Hospitals, ASCs, and cardiac centers are the largest end users of resuscitation devices

Based on end users, the market is segmented into hospitals, ambulatory surgical centers (ASCs), and cardiac centers; pre-hospital care settings; and other end users. The hospitals, ASCs, and cardiac centers segment accounted for the largest share of the global resuscitation devices market in 2019. The large share of this end-user segment can be attributed to the growing trend of bulk purchasing, increasing number of donations with regard to the purchase/implementation of defibrillators, growing number of trauma cases and road accidents across the globe, and the launch of training programs to efficiently undertake and operate lifesaving defibrillation procedures.

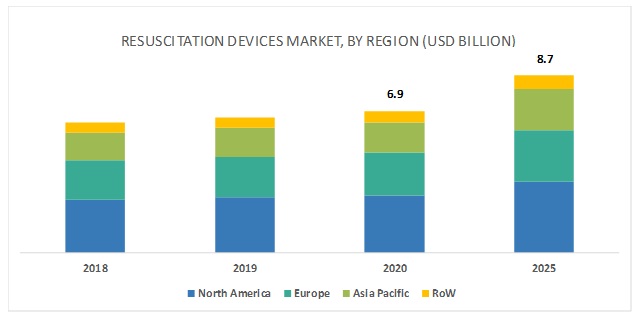

North America accounted for the largest share of the resuscitation devices market

In 2019, North America accounted for the largest share of the market. The rising geriatric population, increasing incidence of cardiac and respiratory diseases, and continuous technological advancements and product innovations are the major factors driving the growth of the market in North America.

Prominent players in the resuscitation devices market include Koninklijke Philips N.V. (Netherlands), Medtronic plc (Ireland), ZOLL Medical Corporation (US), ResMed Inc. (US), Physio-Control (acquired by Stryker Corporation) (US), Drägerwerk AG & Co. KGaA (Germany), Smiths Medical (US), Ambu (Denmark), Cardinal Health (US), Mindray Medical (China), Nihon Kohden (Japan), Teleflex (US), Salter Labs (US), GE Healthcare (US), Roper Technologies (US), Vyaire Medical (US), Intersurgical (UK), 3M (US), Flexicare (UK), and KARL STORZ (Germany).

Resuscitation Devices Market Report Scope:

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Value (USD Billion) & Volume (Million Units) |

|

Segments Covered |

Product, Patient Type, End User, and Region |

|

Geographies Covered |

North America (US & Canada), Europe (Germany, France, UK, Spain, Italy, and RoE), APAC (China, India, Japan, Australia, and RoAPAC), and the RoW |

|

Companies Covered |

Koninklijke Philips N.V. (Netherlands), Medtronic (Ireland), ZOLL Medical Corporation (US), Physio-Control (US), Drägerwerk AG & Co. KGaA (Germany), Cardinal Health (US), Smiths Medical (US), Mindray Medical (China), Nihon Kohden (Japan), Teleflex (US), ResMed Inc. (US), Ambu (Denmark), Salter Labs (US), GE Healthcare (US), Verathon (US), Vyaire Medical (US), Intersurgical (UK), 3M (US), Flexicare (UK), and KARL STORZ (Germany). |

This research report categorizes the resuscitation devices market into following segments & sub-segments:

By Product

-

Airway Management Devices

-

Ventilators

- ICU Ventilators

- Portable Ventilators

- Endotracheal Tubes

- Resuscitators

- Tracheostomy Tubes

- Laryngeal Mask Airways

- Laryngoscopes

- Nasopharyngeal Airways

- Oropharyngeal Airways

-

Ventilators

-

External Defibrillators

- Semi-automated External Defibrillators

- Fully Automated External Defibrillators

- Wearable Cardioverter Defibrillators

- Convective Warming Blankets

- Other Resuscitation Devices

By Patient Type

- Adult Patients

- Pediatric Patients

By End User

- Hospitals, Ambulatory Surgical Centers, and Cardiac Centers

- Pre-hospital Care Settings

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Australia

- Rest of Asia Pacific

- Rest of the World

Recent Developments:

- In 2019, Koninklijke Philips N.V. (Netherlands) launched its HeartStart Intrepid Monitor/Defibrillator with IntelliSpace Connect.

- In 2019, ZOLL Medical Corporation (US) acquired Cardiac Science (US) to strengthen its product portfolio.

- In 2017, Medtronic plc (Ireland) invested over USD 2.25 billion on R&D, up from USD 2.19 billion in 2016. Its strong focus on R&D helps it to launch new and advanced airway management devices.

Key Questions Addressed by the Report:

- What are the growth opportunities related to the adoption of resuscitation devices across major regions in the future?

- Emerging countries have immense opportunities for the growth and adoption of resuscitation devices. Will this scenario continue in the next five years?

- Where will all the advancements in products offered by various companies take the industry in the mid- to long-term?

- What are the new trends and advancements in the resuscitation devices market? Are there any new products being developed for resuscitation devices in the medical industry?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.2 Research Approach

2.2.1 Secondary Data

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Data

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown and Data Triangulation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 33)

4.1 Resuscitation Devices Market Overview

4.2 Market, By Type, 2020 vs. 2025

4.3 Market, By End User, 2020 vs. 2025

4.4 Market: Geographic Growth Opportunities

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Demand for Emergency Care

5.2.1.2 Rising Prevalence of Target Diseases

5.2.1.3 Growing Focus on Providing Public-Access Defibrillators and Rising Awareness Programs on Their Use

5.2.1.4 High Incidence of Preterm Births

5.2.1.5 Growth in Investments, Funds, and Grants By Government Bodies for Improving Emergency Care Infrastructure

5.2.2 Restraints

5.2.2.1 Issues Related to the Use of Automated External Defibrillators

5.2.2.2 Harmful Effects of Certain Products on Neonates

5.2.2.3 Lack of Awareness About Sudden Cardiac Arrest in Developing Nations

5.2.3 Opportunities

5.2.3.1 Growth Potential in Emerging Countries

5.2.4 Trends

5.2.4.1 Increasing Pricing Pressure on Market Players

5.2.5 Challenges

5.2.5.1 Stringent Regulations for Medical Devices

5.2.5.1.1 Regulations for Medical Devices in the US

5.2.5.1.2 Regulations for Medical Devices Outside the US

6 Resuscitation Devices Market, By Product (Page No. - 45)

6.1 Introduction

6.2 Airway Management Devices

6.2.1 Ventilators

6.2.1.1 Icu Ventilators

6.2.1.1.1 Increasing Demand for Critical Care is Driving the Adoption of Icu Ventilators

6.2.1.2 Portable Ventilators

6.2.1.2.1 Increasing Demand for Homecare is Driving the Adoption of Portable Ventilators

6.2.2 Endotracheal Tubes

6.2.2.1 Growing Number of Surgical Procedures is Expected to Drive the Demand for Endotracheal Tubes

6.2.3 Resuscitators

6.2.4 Tracheostomy Tubes

6.2.4.1 Introduction of Advanced and Ergonomic Products Will Drive Market Growth

6.2.5 Laryngeal Mask Airways

6.2.5.1 Increasing Usage of Lmas Outside Operating Room Settings—A Key Factor Driving Market Growth

6.2.6 Laryngoscopes

6.2.7 Nasopharyngeal Airways

6.2.7.1 Possibility of Complications has Reduced the Overall Use of Nasopharyngeal Airways

6.2.8 Oropharyngeal Airways

6.2.8.1 Risks Associated With Opas to Restrain Market Growth

6.3 External Defibrillators

6.3.1 Semi-Automated External Defibrillators

6.3.1.1 Launch of Technologically Advanced Devices to Support Market Growth

6.3.2 Fully Automated External Defibrillators

6.3.2.1 Increasing Installation of These Devices in Public Places to Drive Market Growth

6.3.3 Wearable Cardioverter Defibrillators

6.3.3.1 Concerns Associated With the Use of Wcds are Expected to Hamper Their Adoption

6.4 Convective Warming Blankets

6.4.1 Rising Adoption of Convective Warming Blankets Among Hospitals to Drive Market Growth

6.5 Other Resuscitation Devices

7 Resuscitation Devices Market, By Patient Type (Page No. - 67)

7.1 Introduction

7.2 Adult Patients

7.2.1 High Prevalence of Respiratory Disorders Among Adult Patients to Support Market Growth

7.3 Pediatric Patients

7.3.1 Growing Incidence of Preterm Births to Drive the Demand for Pediatric Resuscitation Devices

8 Resuscitation Devices Market, By End User (Page No. - 71)

8.1 Introduction

8.2 Hospitals, Ambulatory Surgical Centers, and Cardiac Centers

8.2.1 Growing Number of Surgical Procedures and Preterm Births to Drive the Growth of This End-User Segment

8.3 Pre-Hospital Care Settings

8.3.1 Rising Number of Emergency Visits to Drive the Demand for Resuscitation Devices in Pre-Hospital Settings

8.4 Other End Users

9 Resuscitation Devices Market, By Region (Page No. - 76)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Increasing Number of New Product Approvals and High Adoption Rate of Aeds in the Country to Boost Market Growth

9.2.2 Canada

9.2.2.1 Rising Incidence of Target Diseases to Drive Market Growth in Canada

9.3 Europe

9.3.1 Germany

9.3.1.1 Germany is the Largest Market for Resuscitation Devices in Europe

9.3.2 France

9.3.2.1 Increase in the Number of Awareness Campaigns in the Country to Aid the Adoption of Resuscitation Devices

9.3.3 UK

9.3.3.1 Increasing Awareness Related to the Importance of Resuscitation Devices to Drive Market Growth in the UK

9.3.4 Italy

9.3.4.1 High Prevalence of Sudden Out-Of-Hospital Cardiac Arrest as Well as In-Hospital Cardiac Arrest to Drive the Demand for Aeds in Italy

9.3.5 Spain

9.3.5.1 Awareness Programs Pertaining to the Importance of Resuscitation Devices to Support Market Growth in Spain

9.3.6 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.1.1 Rising Prevalence of Target Diseases to Drive Market Growth in China

9.4.2 India

9.4.2.1 Increasing Presence of Global Market Players to Improve the Availability of Advanced Resuscitation Devices in India

9.4.3 Japan

9.4.3.1 Growing Focus of Market Players on Expanding Their Product Offerings in Japan to Drive Market Growth

9.4.4 Australia

9.4.4.1 Government Measures to Make Aeds Available at Public Sites Supporting Market Growth in Australia

9.4.5 Rest of Asia Pacific

9.5 Rest of the World

10 Competitive Landscape (Page No. - 127)

10.1 Introduction

10.2 Market Share Analysis, 2018

10.2.1 External Defibrillators Market

10.2.2 Airway Management Devices Market

10.2.3 Convective Warming Blankets Market

10.3 Competitive Leadership Mapping (Overall Market)

10.4 Vendor Inclusion Criteria

10.5 Vendor Dive

10.5.1 Visionary Leaders

10.5.2 Innovators

10.5.3 Dynamic Differentiators

10.5.4 Emerging Companies

10.6 Competitive Scenario

10.6.1 Recent Product Launches and Approvals

10.6.2 Recent Agreements and Acquisitions

10.6.3 Recent Expansions

11 Company Profiles (Page No. - 136)

(Business Overview, Products Offered, Recent Developments, MnM View)*

11.1 Koninklijke Philips N.V.

11.2 Medtronic Plc

11.3 Zoll Medical (A Part of Asahi Kasei)

11.4 Physio-Control (A Part of Stryker Corporation)

11.5 Drägerwerk Ag & Co. KGaA

11.6 Cardinal Health

11.7 Smiths Medical (A Division of Smiths Group Plc)

11.8 Mindray Medical

11.9 Nihon Kohden

11.10 Teleflex

11.11 Resmed, Inc.

11.12 Ambu

11.13 Salter Labs

11.14 GE Healthcare

11.15 Verathon (A Part of Roper Technologies)

11.16 Vyaire Medical

11.17 Intersurgical

11.18 3M Company

11.19 Flexicare

11.20 KARL STORZ

*Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 181)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (145 Tables)

Table 1 Population Aged 60 Years and Over, By Region (In Million)

Table 2 Prevalence of Copd and Asthma in 2016 (Million)

Table 3 Resuscitation Devices Market, By Product, 2018–2025 (USD Million)

Table 4 Airway Management Devices Market, By Type, 2018–2025 (USD Million)

Table 5 Airway Management Devices Market, By Region, 2018–2025 (USD Million)

Table 6 Ventilators Market, By Type, 2018–2025 (USD Million)

Table 7 Ventilators Market, By Region, 2018–2025 (USD Million)

Table 8 Ventilators Market, By Region, 2018–2025 (Million Units)

Table 9 Icu Ventilators Market, By Region, 2018–2025 (USD Million)

Table 10 Portable Ventilators Market, By Region, 2018–2025 (USD Million)

Table 11 Endotracheal Tubes Market, By Region, 2018–2025 (USD Million)

Table 12 Endotracheal Tubes Market, By Region, 2018–2025 (Million Units)

Table 13 Resuscitators Market, By Region, 2018–2025 (USD Million)

Table 14 Resuscitators Market, By Region, 2018–2025 (Million Units)

Table 15 Tracheostomy Tubes Market, By Region, 2018–2025 (USD Million)

Table 16 Tracheostomy Tubes Market, By Region, 2018–2025 (Million Units)

Table 17 Laryngeal Mask Airways Market, By Region, 2018–2025 (USD Million)

Table 18 Laryngeal Mask Airways Market, By Region, 2018–2025 (Million Units)

Table 19 Laryngoscopes Market, By Region, 2018–2025 (USD Million)

Table 20 Laryngoscopes Market, By Region, 2018–2025 (Million Units)

Table 21 Nasopharyngeal Airways Market, By Region, 2018–2025 (USD Million)

Table 22 Nasopharyngeal Airways Market, By Region, 2018–2025 (Million Units)

Table 23 Oropharyngeal Airways Market, By Region, 2018–2025 (USD Million)

Table 24 Oropharyngeal Airways Market, By Region, 2018–2025 (Million Units)

Table 25 External Defibrillators Market, By Region, 2018–2025 (USD Million)

Table 26 External Defibrillators Market, By Type, 2018–2025 (USD Million)

Table 27 External Defibrillators Market, By Region, 2018–2025 (Million Units)

Table 28 Semi-Automated External Defibrillators Market, By Region, 2018–2025 (USD Million)

Table 29 Fully Automated External Defibrillators Market, By Region, 2018–2025 (USD Million)

Table 30 Wearable Cardioverter Defibrillators Market, By Region, 2018–2025 (USD Million)

Table 31 Convective Warming Blankets Market, By Region, 2018–2025 (USD Million)

Table 32 Other Resuscitation Devices Market, By Region, 2018–2025 (USD Million)

Table 33 Market, By Patient Type, 2018–2025 (USD Million)

Table 34 Market for Adult Patients, By Region, 2018–2025 (USD Million)

Table 35 Market for Pediatric Patients, By Region, 2018–2025 (USD Million)

Table 36 Market, By End User, 2018–2025 (USD Million)

Table 37 Market for Hospitals, Ambulatory Surgical Centers, and Cardiac Centers, By Region, 2018–2025 (USD Million)

Table 38 Resuscitation Devices Market for Pre-Hospital Care Settings, By Region, 2018–2025 (USD Million)

Table 39 Market for Other End Users, By Region, 2018–2025 (USD Million)

Table 40 Market, By Region, 2018–2025 (USD Million)

Table 41 North America: Market, By Country, 2018–2025 (USD Million)

Table 42 North America: Market, By Product, 2018–2025 (USD Million)

Table 43 North America: Airway Management Devices Market, By Type, 2018–2025 (USD Million)

Table 44 North America: Ventilators Market, By Type, 2018–2025 (USD Million)

Table 45 North America: External Defibrillators Market, By Type, 2018–2025 (USD Million)

Table 46 North America: Market, By Patient Type, 2018–2025 (USD Million)

Table 47 North America: Market, By End User, 2018–2025 (USD Million)

Table 48 US: Market, By Product, 2018–2025 (USD Million)

Table 49 US: Airway Management Devices Market, By Type, 2018–2025 (USD Million)

Table 50 US: Ventilators Market, By Type, 2018–2025 (USD Million)

Table 51 US: External Defibrillators Market, By Type, 2018–2025 (USD Million)

Table 52 US: Resuscitation Devices Market, By Patient Type, 2018–2025 (USD Million)

Table 53 US: Market, By End User, 2018–2025 (USD Million)

Table 54 Canada: Market, By Product, 2018–2025 (USD Million)

Table 55 Canada: Airway Management Devices Market, By Type, 2018–2025 (USD Million)

Table 56 Canada: Ventilators Market, By Type, 2018–2025 (USD Million)

Table 57 Canada: External Defibrillators Market, By Type, 2018–2025 (USD Million)

Table 58 Canada: Resuscitation Devices Market, By Patient Type, 2018–2025 (USD Million)

Table 59 Canada: Market, By End User, 2018–2025 (USD Million)

Table 60 Europe: Market, By Country, 2018–2025 (USD Million)

Table 61 Europe: Market, By Product, 2018–2025 (USD Million)

Table 62 Europe: Airway Management Devices Market, By Type, 2018–2025 (USD Million)

Table 63 Europe: Ventilators Market, By Type, 2018–2025 (USD Million)

Table 64 Europe: External Defibrillators Market, By Type, 2018–2025 (USD Million)

Table 65 Europe: Market, By Patient Type, 2018–2025 (USD Million)

Table 66 Europe: Market, By End User, 2018–2025 (USD Million)

Table 67 Germany: Market, By Product, 2018–2025 (USD Million)

Table 68 Germany: Airway Management Devices Market, By Type, 2018–2025 (USD Million)

Table 69 Germany: Ventilators Market, By Type, 2018–2025 (USD Million)

Table 70 Germany: External Defibrillators Market, By Type, 2018–2025 (USD Million)

Table 71 Germany: Resuscitation Devices Market, By Patient Type, 2018–2025 (USD Million)

Table 72 Germany: Market, By End User, 2018–2025 (USD Million)

Table 73 France: Market, By Product, 2018–2025 (USD Million)

Table 74 France: Airway Management Devices Market, By Type, 2018–2025 (USD Million)

Table 75 France: Ventilators Market, By Type, 2018–2025 (USD Million)

Table 76 France: External Defibrillators Market, By Type, 2018–2025 (USD Million)

Table 77 France: Market, By Patient Type, 2018–2025 (USD Million)

Table 78 France: Market, By End User, 2018–2025 (USD Million)

Table 79 UK: Market, By Product, 2018–2025 (USD Million)

Table 80 UK: Airway Management Devices Market, By Type, 2018–2025 (USD Million)

Table 81 UK: Ventilators Market, By Type, 2018–2025 (USD Million)

Table 82 UK: External Defibrillators Market, By Type, 2018–2025 (USD Million)

Table 83 UK: Market, By Patient Type, 2018–2025 (USD Million)

Table 84 UK: Market, By End User, 2018–2025 (USD Million)

Table 85 Italy: Resuscitation Devices Market, By Product, 2018–2025 (USD Million)

Table 86 Italy: Airway Management Devices Market, By Type, 2018–2025 (USD Million)

Table 87 Italy: Ventilators Market, By Type, 2018–2025 (USD Million)

Table 88 Italy: External Defibrillators Market, By Type, 2018–2025 (USD Million)

Table 89 Italy: Market, By Patient Type, 2018–2025 (USD Million)

Table 90 Italy: Market, By End User, 2018–2025 (USD Million)

Table 91 Spain: Market, By Product, 2018–2025 (USD Million)

Table 92 Spain: Airway Management Devices Market, By Type, 2018–2025 (USD Million)

Table 93 Spain: Ventilators Market, By Type, 2018–2025 (USD Million)

Table 94 Spain: External Defibrillators Market, By Type, 2018–2025 (USD Million)

Table 95 Spain: Resuscitation Devices Market, By Patient Type, 2018–2025 (USD Million)

Table 96 Spain: Market, By End User, 2018–2025 (USD Million)

Table 97 RoE: Market, By Product, 2018–2025 (USD Million)

Table 98 RoE: Airway Management Devices Market, By Type, 2018–2025 (USD Million)

Table 99 RoE: Ventilators Market, By Type, 2018–2025 (USD Million)

Table 100 RoE: External Defibrillators Market, By Type, 2018–2025 (USD Million)

Table 101 RoE: Market, By Patient Type, 2018–2025 (USD Million)

Table 102 RoE: Market, By End User, 2018–2025 (USD Million)

Table 103 APAC: Market, By Country, 2018–2025 (USD Million)

Table 104 APAC: Market, By Product, 2018–2025 (USD Million)

Table 105 APAC: Airway Management Devices Market, By Type, 2018–2025 (USD Million)

Table 106 APAC: Ventilators Market, By Type, 2018–2025 (USD Million)

Table 107 APAC: External Defibrillators Market, By Type, 2018–2025 (USD Million)

Table 108 APAC: Market, By Patient Type, 2018–2025 (USD Million)

Table 109 APAC: Market, By End User, 2018–2025 (USD Million)

Table 110 China: Resuscitation Devices Market, By Product, 2018–2025 (USD Million)

Table 111 China: Airway Management Devices Market, By Type, 2018–2025 (USD Million)

Table 112 China: Ventilators Market, By Type, 2018–2025 (USD Million)

Table 113 China: External Defibrillators Market, By Type, 2018–2025 (USD Million)

Table 114 China: Market, By Patient Type, 2018–2025 (USD Million)

Table 115 China: Market, By End User, 2018–2025 (USD Million)

Table 116 India: Market, By Product, 2018–2025 (USD Million)

Table 117 India: Airway Management Devices Market, By Type, 2018–2025 (USD Million)

Table 118 India: Ventilators Market, By Type, 2018–2025 (USD Million)

Table 119 India: External Defibrillators Market, By Type, 2018–2025 (USD Million)

Table 120 India: Market, By Patient Type, 2018–2025 (USD Million)

Table 121 India: Market, By End User, 2018–2025 (USD Million)

Table 122 Japan: Market, By Product, 2018–2025 (USD Million)

Table 123 Japan: Airway Management Devices Market, By Type, 2018–2025 (USD Million)

Table 124 Japan: Ventilators Market, By Type, 2018–2025 (USD Million)

Table 125 Japan: External Defibrillators Market, By Type, 2018–2025 (USD Million)

Table 126 Japan: Market, By Patient Type, 2018–2025 (USD Million)

Table 127 Japan: Resuscitation Devices Market, By End User, 2018–2025 (USD Million)

Table 128 Australia: Market, By Product, 2018–2025 (USD Million)

Table 129 Australia: Airway Management Devices Market, By Type, 2018–2025 (USD Million)

Table 130 Australia: Ventilators Market, By Type, 2018–2025 (USD Million)

Table 131 Australia: External Defibrillators Market, By Type, 2018–2025 (USD Million)

Table 132 Australia: Market, By Patient Type, 2018–2025 (USD Million)

Table 133 Australia: Market, By End User, 2018–2025 (USD Million)

Table 134 RoAPAC: Market, By Product, 2018–2025 (USD Million)

Table 135 RoAPAC: Airway Management Devices Market, By Type, 2018–2025 (USD Million)

Table 136 RoAPAC: Ventilators Market, By Type, 2018–2025 (USD Million)

Table 137 RoAPAC: External Defibrillators Market, By Type, 2018–2025 (USD Million)

Table 138 RoAPAC: Resuscitation Devices Market, By Patient Type, 2018–2025 (USD Million)

Table 139 RoAPAC: Market, By End User, 2018–2025 (USD Million)

Table 140 RoW: Market, By Product, 2018–2025 (USD Million)

Table 141 RoW: Airway Management Devices Market, By Type, 2018–2025 (USD Million)

Table 142 RoW: Ventilators Market, By Type, 2018–2025 (USD Million)

Table 143 RoW: External Defibrillators Market, By Type, 2018–2025 (USD Million)

Table 144 RoW: Market, By Patient Type, 2018–2025 (USD Million)

Table 145 RoW: Resuscitation Devices Market, By End User, 2018–2025 (USD Million)

List of Figures (36 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Bottom-Up Approach: Supply-Side Analysis

Figure 4 Bottom-Up Approach: Supply-Side Segmental Analysis

Figure 5 Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Resuscitation Devices Market, By Product, 2020 vs. 2025 (USD Million)

Figure 8 Market Share, By End User, 2020 vs. 2025

Figure 9 Geographical Snapshot of the Market

Figure 10 Rising Prevalence of Chronic Respiratory Diseases Will Drive Market Growth

Figure 11 Airway Management Devices Segment to Hold the Largest Market Share From 2020 to 2025

Figure 12 Hospitals, Ascs, and Cardiac Centers Will Continue to Dominate the Market in 2025

Figure 13 Asia Pacific is the Fastest-Growing Market for Resuscitation Devices

Figure 14 Market: Drivers, Restraints, Opportunities, Challenges, and Trends

Figure 15 North America: Resuscitation Devices Market Snapshot

Figure 16 APAC: Market Snapshot

Figure 17 Key Developments By Leading Players in the Resuscitation Devices Market, 2016–2019

Figure 18 Market Share, By Key Player, 2018

Figure 19 External Defibrillators Market Share, By Key Player, 2018

Figure 20 Airway Management Devices Market Share, By Key Player, 2018

Figure 21 Convective Warming Blankets Market: Ranking of Key Players, 2018

Figure 22 Market: Global Competitive Leadership Mapping, 2019

Figure 23 Koninklijke Philips N.V.: Company Snapshot (2018)

Figure 24 Medtronic: Company Snapshot (2019)

Figure 25 Asahi Kasei Group: Company Snapshot (2018)

Figure 26 Stryker Corporation: Company Snapshot (2018)

Figure 27 Drägerwerk Ag & Co. KGaA: Company Snapshot (2018)

Figure 28 Cardinal Health: Company Snapshot (2019)

Figure 29 Smiths Group: Company Snapshot (2018)

Figure 30 Nihon Kohden: Company Snapshot (2018)

Figure 31 Teleflex: Company Snapshot (2018)

Figure 32 Resmed, Inc.: Company Snapshot (2019)

Figure 33 Ambu: Company Snapshot (2018)

Figure 34 GE Healthcare: Company Snapshot (2018)

Figure 35 Roper Technologies: Company Snapshot (2018)

Figure 36 3M Company: Company Snapshot (2018)

The study involved four major activities in estimating the current size of the resuscitation devices market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

This research involved the use of various secondary sources, directories, databases such as Bloomberg Businessweek and Factiva, white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for this extensive, technical, market-oriented, and commercial study of the resuscitation devices market. It was also used to obtain important information about key market players, market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives.

Primary Research

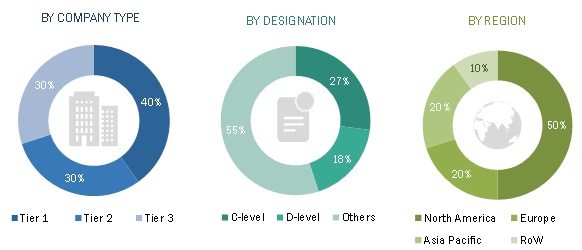

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the resuscitation devices market. The primary sources from the demand side include paramedics, emergency healthcare professionals, firefighting professionals, and OR and ICU personnel, among others. The following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the resuscitation devices market.

Report Objectives

- To define, describe, and forecast the market on the basis of product, patient type, end user, and region

- To provide detailed information about the major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the market revenue in terms of value and volume with respect to four regional segments, namely, North America, Europe, the Asia Pacific, and the Rest of The World

- To strategically analyze the market structure and profile the key players in the resuscitation devices market and comprehensively analyze their core competencies

- To track and analyze company developments, such as agreements, contracts, collaborations, partnerships, acquisitions, expansions, and product launches & enhancements, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company‘s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolios of the top five companies in the market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Further Split of the RoW Resuscitation Devices Market

- Market size and growth rate estimates for LATAM and MEA

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Resuscitation Devices Market