Ice Protection Systems Market by Type, Technology (Chemical, Electrical), Platform (Commercial Jets, Military Jets, Helicopters), Application (Engine Inlets, Nacelle, Wings, Tail, Propellers, Windshields, Sensors, Air Data Probes), & Region - Global Forecasts to 2021

[161 Pages Report] The ice protection systems market is estimated to be USD 7.91 Billion in 2016, and is projected to reach USD 10.17 Billion by 2021, at a CAGR of 5.14% from 2016 to 2021. The study on market aims to analyze the ice protection systems market as well as define, describe, and forecast the market on the basis of application, technology, platform, type, and region. The base year considered for the study is 2015, and the forecast period is from 2016 to 2021.

The ice protection systems market is estimated to be USD 7.91 Billion in 2016, and is projected to reach USD 10.17 Billion by 2021, at a CAGR of 5.14% from 2016 to 2021. The major factors expected to fuel the growth of this market include increase in air traffic, new airline business models in emerging economies, and new airport projects in developed economies. The ice protection systems market is characterized by steady technological advances through new product developments. These advances are driven by increased applications in which different deicing fluids and anti-icing equipment are used. The propagation of technology from conventional anti-icing solutions to advanced solutions, such as electro-expulsive separation systems, shape memory alloys, ultrasound technology, and electrical heating will further aid the growth of the market in near future.

Based on application, the market has been divided into engine-inlets, nacelle, wings, windshields, propellers, tail, sensors, and air data probes, among others. The windshield segment of the ice protection systems market is estimated to grow witness highest growth during the forecast period. The chances of ice build-up on windshields is generally the highest as compared to the other parts of the aircraft, which causes increase in the weight of the aircraft and blocks the front view of the pilot. It can result into aerodynamic stall and loss of control of the aircraft. Hence is the prime reason of driving the demand of ice protection systems for windshields.

The commercial jets segment of the market, segmented based on platform, is projected to witness highest growth during the forecast period, due to the active number of fleets globally and increase in air traffic globally. The installation of ice protection systems in any type of aircraft does not guarantee safety of flight in icing cold conditions unless the aircraft has gone through rigorous testing and is certificated to fly in such conditions. There are two types of deicing systems: the FAA certified systems and the non-hazard systems installed in the commercial jets, which protect the aircraft from accident caused by ice formation. Utilization of these systems is expected to drive the demand of ice protection systems.

The electrical segment of the market, segmented based on technology, is projected to be the fastest-growing segment of the market during the forecast period, as thermal pneumatic or pneumatic boots and electro impulse are majorly used for aircraft anti-icing and deicing.

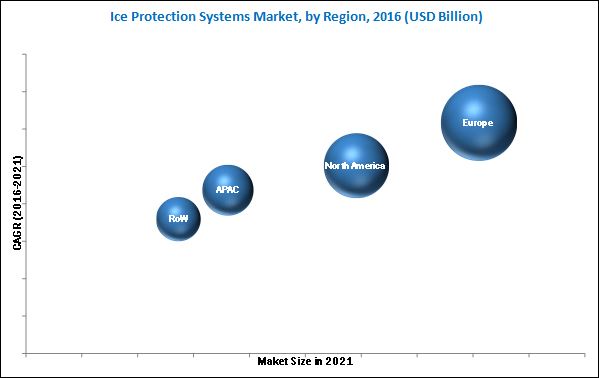

The ice protection systems market in Europe is expected to witness the highest growth during the forecast period, as countries in Europe have been increasing their commercial fleet size due to increased air travel and passenger traffic and defense spending to strengthen their battle operational capacity. This is expected to consequently lead to increased demand of ice protection systems in the region.

High maintenance cost of ice protection systems and limited or seasonal demand of deicing fluids are expected to be some of the major factors that may restrain the growth of the ice protection systems market in the coming years.

Major players in the ice protection systems market include The Dow Chemical Company (U.S.), Clariant (Europe), B/E Aerospace (U.S.), JBT Corporation (U.S.), United Technologies. (U.S.), CAV Ice Protection (U.K.), and Curtiss Wright (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

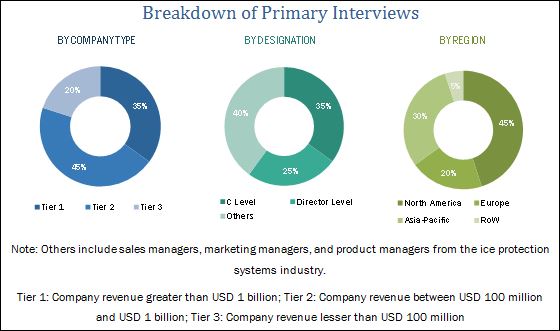

2.1.2.3 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand Side Indicators

2.2.2.1 New Airport Projects

2.2.2.2 Increased Demand for Aircraft Worldwide

2.2.2.3 Air Traffic Growth

2.2.3 Supply Side Indicators

2.2.3.1 Propylene Glycol (PG) Prices, By Region

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 34)

4 Premium Insights (Page No. - 40)

4.1 Attractive Opportunities in the Ice Protection Systems Market, 2016-2021

4.2 Ice Protection Systems Market, By Technology

4.3 Market, By Application

4.4 Market, By Type

4.5 Market, By Platform

4.6 Market, By Region

4.7 Europe: Ice Protection Systems Market, 2016

5 Market Overview (Page No. - 44)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Technology

5.2.2 By Application

5.2.3 By Type

5.2.4 By Platform

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Regions With Extreme Cold Weather Conditions

5.3.1.2 Safety Regulations Authorized By Regulatory Bodies

5.3.1.3 Modernization and Expansion of Existing Airports

5.3.2 Restraints

5.3.2.1 High Maintenance Cost of Ice Protection Systems

5.3.2.2 Seasonal Requirement of Anti-Icing and Deicing Systems

5.3.3 Challenges

5.3.3.1 Treating Glycol Runoff From Airport Deicing Operations

5.3.3.2 Human Error

5.3.3.3 Safety

5.3.4 Burning Issues

5.3.4.1 Optimizing the Use of Aircraft Deicing and Anti-Icing Fluids

5.3.4.2 Development of Environment-Friendly Deicing Fluids

5.3.5 Winning Imperatives

5.3.5.1 Developing Cost-Effective Aircraft Deicing Systems

6 Industry Trends (Page No. - 54)

6.1 Introduction

6.2 Emerging Technology Trends

6.2.1 Anti-Icing Technologies

6.2.1.1 Thermal Electric Anti-Icing

6.2.1.2 Chemical/Weeping Wings

6.2.1.3 Thermal Pneumatic Anti-Icing/Pneumatic Boots

6.2.1.4 Bleed Air Anti-Icing

6.2.1.5 Proactive Anti-Icing

6.2.2 Deicing Technologies

6.2.2.1 Spot Deicing

6.2.2.2 Remote Deicing

6.2.2.3 Infrared Deicing

6.2.2.4 Hot Water Deicing

6.2.2.5 Tempered Steam Technology (TST)

6.2.2.6 Forced Air Deicing

6.2.2.7 Electro Expulsive Separation System (EESP)

6.2.2.8 Electro-Mechanical Expulsion Deicing (EMED)

6.2.2.9 Ultrasound Technology

6.2.2.10 Shape Memory Alloys

6.3 Supply Chain

6.4 Innovations and Patent Registrations

6.5 Key Trend Analysis

7 Ice Protection Systems Market, By Type (Page No. - 64)

7.1 Introduction

7.2 Anti-Icing System

7.3 Deicing Systems

8 Ice Protection System Market, By Application (Page No. - 68)

8.1 Introduction

8.2 Engine Inlets

8.3 Nacelle

8.4 Wings

8.5 Tail

8.6 Propellers

8.7 Windshields

8.8 Sensors

8.9 Air Data Probes

9 Ice Protection System Market, By Technology (Page No. - 76)

9.1 Introduction

9.2 Electrical

9.2.1 Thermal

9.2.2 Electro-Impulse

9.3 Chemical

9.4 Others

9.4.1 Pneumatic Boots

9.4.2 Bleed Air

10 Ice Protection Systems Market, By Platform (Page No. - 82)

10.1 Introduction

10.2 Commercial Jets

10.3 Military Jets

10.4 Helicopters

11 Regional Analysis (Page No. - 87)

11.1 Introduction

11.2 North America

11.2.1 By Type

11.2.2 By Platform

11.2.3 By Application

11.2.4 By Technology

11.2.5 By Country

11.2.5.1 U.S.

11.2.5.1.1 By Type

11.2.5.1.2 By Application

11.2.5.2 Canada

11.2.5.2.1 By Type

11.2.5.2.2 By Application

11.3 Europe

11.3.1 By Type

11.3.2 By Platform

11.3.3 By Application

11.3.4 By Technology

11.3.5 By Country

11.3.5.1 U.K.

11.3.5.1.1 By Type

11.3.5.1.2 By Application

11.3.5.2 France

11.3.5.2.1 By Type

11.3.5.2.2 By Application

11.3.5.3 Russia

11.3.5.3.1 By Type

11.3.5.3.2 By Application

11.3.5.4 Germany

11.3.5.4.1 By Type

11.3.5.4.2 By Application

11.4 Asia-Pacific

11.4.1 By Type

11.4.2 By Platform

11.4.3 By Application

11.4.4 By Technology

11.4.5 By Country

11.4.5.1 China

11.4.5.1.1 By Type

11.4.5.1.2 By Application

11.4.5.2 Japan

11.4.5.2.1 By Type

11.4.5.2.2 By Application

11.4.5.3 South Korea

11.4.5.3.1 By Type

11.4.5.3.2 By Application

11.5 Rest of the World

11.5.1 By Type

11.5.2 By Platform

11.5.3 By Application

11.5.4 By Technology

11.5.5 By Country

11.5.5.1 Brazil

11.5.5.1.1 By Type

11.5.5.1.2 By Application

11.5.5.2 Argentina

11.5.5.2.1 By Type

11.5.5.2.2 By Application

12 Competitive Landscape (Page No. - 117)

12.1 Introduction

12.2 Brand Analysis

12.3 Market Share Analysis

12.4 Competitive Situation and Trends

12.4.1 Contracts

12.4.2 New Product Launches

12.4.3 Acquisitions & Agreements

12.4.4 Expansions

13 Company Profiles (Page No. - 124)

13.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

13.2 Financial Highlights

13.3 The DOW Chemical Company

13.4 Meggit PLC.

13.5 JBT Corporation

13.6 Clariant

13.7 B/E Aerospace, Inc.

13.8 United Technologies Corporation

13.9 Curtiss Wright

13.10 Zodiac Aerospace

13.11 Honeywell International Inc.

13.12 Cav Ice Protection, Inc.

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 151)

14.1 Insights From Ice Protection Systems Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (72 Tables)

Table 1 Key New Airport Projects Across the World (2013-2014)

Table 2 Regions With Extreme Cold Weather Conditions Propel Growth of the IPS Market

Table 3 Seasonal Requirement for Anti-Icing and Deicing Systems Restrains Growth of the IPS Market

Table 4 Human Error is the Major Challenge for the IPS Market

Table 5 Innovations & Patent Registrations (2010-2015)

Table 6 Ice Protection System Market Size, By Type, 2014-2021 (USD Million)

Table 7 Anti-Icing Systems Market Size, By Region, 2014-2021 (USD Million)

Table 8 Deicing Systems Market Size, By Region, 2014-2021 (USD Million)

Table 9 Ice Protection System Market Size, By Application, 2014-2021 (USD Million)

Table 10 Market Size in Engine Inlets, By Region, 2014-2021 (USD Million)

Table 11 Market Size in Nacelle, By Region, 2014-2021 (USD Million)

Table 12 Market Size in Wings, By Region, 2014-2021 (USD Million)

Table 13 Market Size in Tail, By Region, 2014-2021 (USD Million)

Table 14 Market Size in Propellers, By Region, 2014-2021 (USD Million)

Table 15 Market Size in Windshields, By Region, 2014-2021 (USD Million)

Table 16 Market Size in Sensors, By Region, 2014-2021 (USD Million)

Table 17 Market Size in Air Data Probes, By Region, 2014-2021 (USD Million)

Table 18 Market Size, By Technology, 2014-2021 (USD Million)

Table 19 Electrical Ice Protection System Market Size, By Region, 2014-2021 (USD Million)

Table 20 Chemical Ice Protection System Market Size, By Region, 2014-2021 (USD Million)

Table 21 Others Ice Protection System Market Size, By Region, 2014-2021 (USD Million)

Table 22 Ice Protection System Market Size, By Platform, 2014-2021 (USD Million)

Table 23 Market Size for Commercial Jets, By Region, 2014-2021 (USD Million)

Table 24 Market Size for Military Jets, By Region, 2014-2021 (USD Million)

Table 25 Market Size for Helicopters, By Region, 2014-2021 (USD Million)

Table 26 Market Size, By Region, 2014–2021 (USD Million)

Table 27 North America: Ice Protection System Market Size, By Type, 2014-2021 (USD Million)

Table 28 North America: Market Size, By Platform, 2014-2021 (USD Million)

Table 29 North America: Market Size, By Application, 2014-2021 (USD Million)

Table 30 North America: Market Size, By Technology, 2014-2021 (USD Million)

Table 31 North America: Market Size, By Country, 2014-2021 (USD Million)

Table 32 U.S.: Ice Protection System Market Size, By Type, 2014-2021 (USD Million)

Table 33 U.S.: Market Size, By Application, 2014-2021 (USD Million)

Table 34 Canada: Market Size, By Type, 2014-2021 (USD Million)

Table 35 Canada: Market Size, By Application, 2014-2021 (USD Million)

Table 36 Europe: Ice Protection System Market Size, By Type, 2014-2021 (USD Million)

Table 37 Europe: Market Size, By Platform, 2014-2021 (USD Million)

Table 38 Europe: Market Size, By Application, 2014-2021 (USD Million)

Table 39 Europe: Market Size, By Technology, 2014-2021 (USD Million)

Table 40 Europe: Market Size, By Country, 2014-2021 (USD Million)

Table 41 U.K.: Ice Protection System Market Size, By Type, 2014-2021 (USD Million)

Table 42 U.K.: Market Size, By Application, 2014-2021 (USD Million)

Table 43 France: Market Size, By Type, 2014-2021 (USD Million)

Table 44 France: Market Size, By Application, 2014-2021 (USD Million)

Table 45 Russia: Market Size, By Type, 2014-2021 (USD Million)

Table 46 Russia: Market Size, By Application, 2014-2021 (USD Million)

Table 47 Germany: Market Size, By Type, 2014-2021 (USD Million)

Table 48 Germany: Market Size, By Application, 2014-2021 (USD Million)

Table 49 Asia-Pacific: Ice Protection System Market Size, By Type, 2014-2021 (USD Million)

Table 50 Asia-Pacific: Market Size, By Platform, 2014-2021 (USD Million)

Table 51 Asia-Pacific: Market Size, By Application, 2014-2021 (USD Million)

Table 52 Asia-Pacific: Market Size, By Technology, 2014-2021 (USD Million)

Table 53 Asia-Pacific: Market Size, By Country, 2014-2021 (USD Million)

Table 54 China: Market Size, By Type, 2014-2021 (USD Million)

Table 55 China: Market Size, By Application, 2014-2021 (USD Million)

Table 56 Japan: Market Size, By Type, 2014-2021 (USD Million)

Table 57 Japan: Market Size, By Application, 2014-2021 (USD Million)

Table 58 South Korea: Market Size, By Type, 2014-2021 (USD Million)

Table 59 South Korea: Market Size, By Application, 2014-2021 (USD Million)

Table 60 Rest of the World: Ice Protection System Market Size, By Type, 2014-2021 (USD Million)

Table 61 Rest of the World: Market Size, By Platform, 2014-2021 (USD Million)

Table 62 Rest of the World: Market Size, By Application, 2014-2021 (USD Million)

Table 63 Rest of the World: Market Size, By Technology, 2014-2021 (USD Million)

Table 64 Rest of the World: Market Size, By Country, 2014-2021 (USD Million)

Table 65 Brazil: Ice Protection System Market Size, By Type, 2014-2021 (USD Million)

Table 66 Brazil: Market Size, By Application, 2014-2021 (USD Million)

Table 67 Argentina: Ice Protection System Market Size, By Type, 2014-2021 (USD Million)

Table 68 Argentina: Market Size, By Application, 2014-2021 (USD Million)

Table 69 Contracts, January, 2009–November, 2016

Table 70 New Product Launches, February, 2010–November, 2016

Table 71 Acquisitions and Agreements, January, 2012–November, 2015

Table 72 Expansions, November, 2012–October, 2016

List of Figures (65 Figures)

Figure 1 Market Covered: Ice Protection System Market

Figure 2 Research Process Flow

Figure 3 Ice Protection System Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 New Airport Projects: Region Wise Share, 2015

Figure 6 Aircraft Deliveries Worldwide (2015-2034)

Figure 7 Top Ten Countries: Air Passenger Traffic Forecast (2014-2034)

Figure 8 Propylene Glycol (PG) Prices, By Region, 2012-2020 (USD/Ton)

Figure 9 Market Size Estimation Methodology: Bottom-Up Approach

Figure 10 Market Size Estimation Methodology: Top-Down Approach

Figure 11 Data Triangulation

Figure 12 Ice Protection System Market, By Region, 2016-2021 (USD Million)

Figure 13 Market, By Type, 2016-2021 (USD Million)

Figure 14 Market, By Platform, 2016-2021 (USD Million)

Figure 15 Market, By Application, 2016-2021 (USD Million)

Figure 16 Market, By Technology, 2016-2021 (USD Million)

Figure 17 Europe Estimated to Account for the Largest Share of the Ice Protection System Market in 2016

Figure 18 Contracts Was the Key Growth Strategy Adopted By the Market Players From January 2009 to September 2016

Figure 19 Regions With Extreme Cold Weather Conditions Drive Growth of the Market

Figure 20 Electrical Segment Projected to Grow at the Highest CAGR During the Forecast Period

Figure 21 Windshield Segment Projected to Dominate the Ice Protection System Market During the Forecast Period

Figure 22 Deicing Segment Estimated to Lead the Market in 2016

Figure 23 Commercial Jets Segment Projected to Dominate the Market By 2021

Figure 24 Europe Estimated to Account for the Largest Share of the Market in 2016

Figure 25 Russia Estimated to Hold the Largest Share of the European Ice Protection System Market, 2016 (Platform vs Country)

Figure 26 IPS Market Segmentation: By Technology

Figure 27 IPS Market Segmentation: By Application

Figure 28 IPS Market Segmentation: By Type

Figure 29 IPS Market Segmentation: By Platform

Figure 30 IPS Market: Drivers, Restraints, Challenges, Burning Issues, & Winning Imperatives

Figure 31 Airports’ Use of Selected Deicing and Anti-Icing Chemical Capture Techniques in the U.S., 2015

Figure 32 Total Airport Construction Projects in Existing Airports, By Region (As of January 2015)

Figure 33 Anti-Icing vs Deicing: Comparison Chart

Figure 34 Anti-Icing Technologies

Figure 35 Deicing Technologies

Figure 36 OEMS Play the Most Crucial Role in the Supply Chain of the Ice Protection System Market

Figure 37 Ice Protection System Market, By Type

Figure 38 The Windshield Segment is Estimated to Dominate the Market in 2016

Figure 39 The Electrical Segment Estimated to Dominate the Ice Protection System Market in 2016

Figure 40 The Commercial Jets Segment Estimated to Dominate the Market in 2016

Figure 41 North America is Estimated to Dominate the Ice Protection System Market in 2016

Figure 42 North America: Ice Protection System Market Snapshot (2016)

Figure 43 Europe: Ice Protection Systems Market Snapshot (2016)

Figure 44 Asia-Pacific: Ice Protection Systems Market Snapshot (2016)

Figure 45 Top Market Players Adopted Acquisition as A Key Growth Strategy From January, 2009 to November, 2016

Figure 46 Key Players in the Ice Protection Systems Market, By Region, (2015)

Figure 47 Brand Analysis of Top Players in Market (2015)

Figure 48 Market Share Analysis, By Key Players: 2015

Figure 49 Contracts Contributed A Major Share to Overall Developments of the Market Players in Ice Protection Systems Market From 2013 to 2016

Figure 50 Regional Revenue Mix of Top 5 Market Players, 2015

Figure 51 Financial Highlights of Major Players in the Market

Figure 52 The DOW Chemical Company: Company Snapshot

Figure 53 The DOW Chemical Company: SWOT Analysis

Figure 54 Meggit PLC.: Company Snapshot

Figure 55 Meggit PLC.: SWOT Analysis

Figure 56 JBT Corporation: Company Snapshot

Figure 57 JBT Corporation: SWOT Analysis

Figure 58 Clariant: Company Snapshot

Figure 59 Clariant: SWOT Analysis

Figure 60 B/E Aerospace, Inc.: Company Snapshot

Figure 61 B/E Aerospace, Inc.: SWOT Analysis

Figure 62 United Technologies Corporation: Company Snapshot

Figure 63 Curtiss Wright: Company Snapshot

Figure 64 Zodiac Aerospace: Company Snapshot

Figure 65 Honeywell International Inc.: Company Snapshot

The research methodology used to estimate and forecast the ice protection systems market begins with capturing data on key ice protection systems equipment revenues through secondary sources, such as departments of defense, airline industry, journals, and paid databases. The ice protection systems offerings by various companies were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall ice protection systems market size from the revenue of key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as CEOs, VPs, directors, and executives. These data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

Major players in the ice protection systems market include companies, such as the Clariant (Europe), B/E Aerospace (U.S.), JBT Corporation (U.S.), and United Technologies (U.S.), CAV Ice Protection (U.K.), and Curtiss Wright (U.S.), among others. They offer advanced technology systems, products, and services. They also provide a broad range of engineering, technical, communications, and information services.

Target Audience for this Report:

- Military and Defense Organizations

- Ice Protection System Manufacturers

- Subcomponent Manufacturers

- Original Equipment Manufacturers (OEMs)

- Technology Support Providers

- Airline Companies

- Communication Equipment Manufacturers

“Study answers several questions for the stakeholders, primarily which market segments to focus in next two to five years for prioritizing the efforts and investments”.

Scope of the Report

This research report categorizes the ice protection systems market into the following segments and subsegments:

-

By Application

- Engine Inlets

- Nacelle

- Wings

- Tail

- Windshields

- Propellers

- Sensors

- Air Data Probes

-

By Technology

- Electrical

- Chemical

- Others

-

By Type

- Anti-icing

- Deicing

-

By Platform

- Commercial Jets

- Military Jets

- Helicopters

-

By Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per specific needs of a company. The following customization options are available for the report:

- Geographic Analysis

- Further breakdown of the rest of the world market

- Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Ice Protection Systems Market