Airborne SATCOM Market by Installation Type (New Installation, Upgrade), Application (Government & Defense, Commercial), Platform (Fixed Wing, Rotary Wing, UAVs), Frequency, Component and Region -Global Forecast to 2027

Updated on : Oct 22, 2024

The Airborne SATCOM market is experiencing significant growth driven by rising demand for reliable and high-speed communication in aviation and military operations. Technological advancements in satellite communication systems, such as improved bandwidth, enhanced data transmission capabilities, and the integration of advanced antennas, are enabling more efficient and seamless connectivity. As airlines and defense organizations increasingly prioritize passenger experience and operational efficiency, the need for robust airborne SATCOM solutions continues to expand. Furthermore, the growing trend towards digitalization and the use of connected devices in aircraft are expected to propel the market further, fostering innovations that enhance communication capabilities in various airborne applications.

The Airborne SATCOM Market size is projected to grow from USD 5.4 billion in 2022 to USD 7.3 billion by 2027, growing at a CAGR of 6.5% from 2022 to 2027. The market is driven by factors such as increased use of ultra-compact SATCOM terminals for UAVs and need to enhance passenger experience.

To know about the assumptions considered for the study, Request for Free Sample Report

Drivers: Need for customized SATCOM on the move solutions

Modernization of aircraft communication systems is required to increase the safety of aircraft and minimize flight delays. It also enables improved routing decisions for aircraft, enhanced pilot communication, and improved efficiency. North America and Europe have been focusing on modernizing and overhauling their aircraft communication systems by using customized SATCOM on-the-move solutions. Modernization programs involve the incorporation of new technologies and components in aircraft and aviation infrastructure to communicate effectively with air traffic managers, perform multidimensional aircraft tracking, and improve aircraft navigation by generating images of the approaching external topography. Such programs need airborne SATCOM for improved communication capabilities.

Airborne SATCOM can also be installed in the existing fleet as a part of retrofitting or upgrading activities. For instance, the Single European Sky ATM Research (SESAR) is an airspace modernization program adopted by European countries to improve their Air Traffic Management (ATM). This program involves the installation of innovative SATCOM on-the-move solutions to eliminate inefficiencies associated with European air traffic management. The various programs to modernize aircraft communication systems across the globe are expected to contribute to the increased demand for airborne SATCOM. In January 2022, for military and government manned and unmanned aircraft, Eclipse Global Connectivity, Smiths Interconnect, and ST Engineering iDirect collaborated to create an integrated Airborne Intelligence, Surveillance, and Reconnaissance (A-ISR) satellite communications (SATCOM) capability. The new Ka-band solution will initially meet the beyond-line-of-sight communication requirements for an EMEA government unmanned platform. It will work across military and civil frequencies.

Restraints: High costs of development and maintenance of infrastructure to support SATCOM antennae

The high cost incurred in the development and maintenance of earth station infrastructure is one of the major factors hindering market growth. Most required components are typically custom-fabricated or purchased from commercial off-the-shelf (COTS) vendors—in both cases, expensive. Besides, the design, development, and construction of antennae and their components several hours of work by trained personnel is required. An important barrier to entrance is the level of competence necessary. Additionally, large investments are needed in the R&D, production, system integration, manufacturing and assembly phases of these systems' value chains. Moreover, SATCOM services are employed by extremely complex defensive systems, making any instance of system breakdown unpleasant. They need to be robust, energy-efficient, highly precise, and reliable in addition to having a large detection range. Companies in this sector must therefore create extremely useful and effective ground facilities if they want to maintain market leadership and remain competitive. This results into large expenditures on infrastructure and testing, as well as partnerships with academic institutions, research organisations, and other businesses.

Opportunities: Increased use of ultra-compact SATCOM terminals for UAVs

The mounting of SATCOM terminals on UAVs is a relatively new phenomenon that creates various opportunities for manufacturers to innovate and design ultra-compact SATCOM terminals. For example, Thales has developed a multi-platform SATCOM terminal for small and medium tactical UAVs capable of high-speed data transmission rates using the Ku- and X-bands. The new product, named AVIATOR UAV 200, is the world’s smallest and lightest Inmarsat UAV SATCOM solution. It delivers greater operational flexibility for tactical UAVs in several applications such as border security enforcement, public safety, commercial use, and scientific research. Advanced SATCOM terminals provide government and defense agencies better connectivity, access to beyond-line-of-sight situational data, and live streaming of imagery and video in various applications such as reconnaissance, surveillance, mapping, and infrastructure inspection.

In December 2021, three of Pipistrel's new aircraft, the fixed-wing Surveyor and both unmanned Nuuva platforms, the V300 and smaller V20, benefited from a Honeywell innovation in compact satellite communications technology, which will bring the safety, connectivity and efficiency trusted for decades. In April 2022, Inmarsat partnered with Unmanned Systems Technology (“UST”) to demonstrate its expertise in this field. Inmarsat Velaris, the company's newest product, provides uncrewed aviation with ubiquitous connectivity and safety services. Velaris will allow unmanned aircraft to integrate into commercial airspace securely and seamlessly due to the ultra-reliable ELERA L-band satellite network and Inmarsat's experience as a global leader in air traffic communications.

Challenges: Challenges faced due to cybersecurity

Incidents of cybersecurity breaches have increased across the world in the past few years. Security is the most significant area of technical concern for most organizations deploying IoT systems and now 5G networks, with multiple devices connected across networks, platforms, and devices. This is also true for satellites, given the size and scope, as well as the number of earth station access points. IoT proliferation means if one single device is not encrypted or the communication is not protected, cybercriminals can manipulate it and potentially a whole network of connected devices. It is not just the devices themselves that need to be protected, but it is also every stage of data transmission too. According to IOActive, these design vulnerabilities could allow hackers to intercept, block, manipulate, and even take full control of critical communication systems, thereby affecting operations of airborne SATCOM used on ground, airborne, and marine platforms. Various security measures have been undertaken by major airborne SATCOM manufacturers to safeguard their communication systems. According to a Threatpost article, the Russian invasion of Ukraine has coincided with the jamming of airplane navigation systems and hacks on SATCOM networks that empower critical infrastructure. In March 2022, European Union Aviation Safety Agency (EASA) warned about the satellite jamming and spoofing attacks across a broad swath of Eastern Europe that could affect air navigation systems. The FBI (Federal Bureau of Investigation) and the US Cybersecurity and Infrastructure Security Agency (CISA) issued a new alert to warn SATCOM networks about potential cyber threats. The warning comes as Western intelligence agencies began an inquiry into possible Russian-sponsored attacks on satellite internet providers. The FBI and CISA have issued a set of suggestions to help SATCOM network operators and customers improve their cybersecurity.

Based on installation type, the upgrade segment has second largest share in 2022

Based on installation type, the commercial segment is expected to lead the Airborne SATCOM Industry from 2022 to 2027. Frequent upgrades of old aircraft fleet are expected to drive this segment.

Based on application, the government & defense segment is expected to have second highest CAGR in the forecasted period.

Based on application, the government & defense segment is projected to grow from USD 1,747 million in 2022 to USD 2,300 million in 2027 at CAGR of 5.7%. The increased need to provide advanced situational awareness to armed force for ISR missions and growing aircraft rescue missions to drive the government & Defense segment.

The Asia Pacific market is projected to contribute the highest CAGR from 2022 to 2027

The Asia Pacific is projected to grow at highest CAGR of 7.4% in 2022-2027. The growth in this region is due to increased military spending by the government, modernization of current SATCOM systems, and increased focus on In-flight connectivity services for commercial aircraft are driving this market.

To know about the assumptions considered for the study, download the pdf brochure

Top Airborne SATCOM Companies - Key Market Players

The Airborne SATCOM Companies are dominated by a few globally established players such as Thales Group (France), General Dynamics Corporation (US), Collins Aerospace (US), Gilat Satellite Networks (Israel) and Raytheon Intelligence and Space (US). The report covers various industry trends and new technological innovations in the Airborne SATCOM market for the period, 2018-2027.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Monetary Unit |

Value (USD) |

|

Segments Covered |

Platform, Component, Application, Frequency, and Installation Type |

|

Regions Covered |

North America, Europe, Asia Pacific, Latim America, Middle East & Africa |

|

Companies Covered |

L3 Harris Corporation (US), Thales Group (France), Honeywell International Inc (US), Collins Aerospace (US), Israel Aerospace Industries (IAI), Cobham Aerospace communications (France), Gilat Satellite Networks (Israel) and General Dynamics Mission Systems (US) are some of the leading companies covered in the report. The report covers top 25 companies globally. |

This research report categorizes the airborne SATCOM market based on platform, component, application, installation type, frequency, and region.

Based on Platform

- Fixed Wing

- Commercial Aircraft

- Narrow Body Aircraft (NBA)

- Wide Body Aircraft (WBA)

- Regional Transport Aircraft (RTA)

-

Military Aircraft

- Fighter & Combat Aircraft

- Transport Aircraft

- Special Mission Aircraft

-

Business Aviation & General Aviation

- Business Jets

- Light Aircraft

-

Rotary Wing

- Commercial Helicopter

- Military Helicopter

-

Unmanned Aerial Vehicles (UAV)

- Fixed Wing UAVs

- Fixed Wing Hybrid VTOL UAVs

- Rotary Wing UAVs

Based on Component

-

SATCOM Terminals

- Antennas

- Radio Frequency Units

- Networking Data Units

- Antenna Subsystems

-

Transceivers

- Receivers

- Transmitters

- Airborne Radio

- Modems & Routers

- SATCOM Radomes

- Other Components

Based on Application:

-

Government & Defense

- ISR Missions

- Emergency Response & Public Safety

- Border Protection & Surveillance

- Command, Control & Communications On-the-Move

-

Commercial

- In-flight connectivity

- Real-time Data Gathering

- Telemedicine

Based on Frequency:

- VHF/UHF-Band

- L- Band

- S- Band

- C- Band

- X- Band

- Ku- Band

- Ka- Band

- EHF/SHF- Band

- Multi-Band

- Q-Band

Based on Installation:

- New Installation

- Upgrade

Based on Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In May 2022, Southwest Airlines Co. chose Viasat's next-generation Ka-band satellite in-flight connectivity (IFC) technology to be factory-installed on all new aircraft deliveries beginning this autumn.

- In April 2022, Boeing received the 1,000th Tri-band radome from General Dynamics Mission Systems for line-fit installation on commercial and military aircraft. These radomes cover the aircraft's antennae, allowing passengers to enjoy reliable in-flight SATCOM, including Wi-Fi internet access and live television. The Boeing Tri-band radome is used on Boeing 737, 777, 787 Dreamliner, and C-17 aircraft to provide Ku and K/Ka wideband commercial and military satellite communications.

- In March 2022, TopSky Air Traffic Control (ATC), Thales' innovative Air Traffic Management (ATM) system, were chosen by Dubai Aviation Engineering Projects (DAEP) to improve the safety, capacity, and efficiency of air navigation services.

- In January 2022, Collins Aerospace received an Iridium Certus Developmental Over the Air License for its new Active Low Gain Antenna (ALGA) and a High Gain Antenna from Iridium (HGA). Collins received the newest license for its new Iridium Certus airborne satellite communications (SATCOM) technology, which is slated to be ready in 2022.

- In January 2022, Gilat Satellite Networks Ltd. expanded its commercial aviation strategic collaboration with Intelsat, the world's biggest integrated satellite and terrestrial network, based in McLean, Virginia.

Frequently Asked Questions (FAQ):

What is the current size of the airborne SATCOM market?

The market size of airbone SATCOM market is USD 5.4 million in 2022 to USD 7.3 million in 2027 at a CAGR of 6.5%.

What are key dynamics such as drivers and opportunities that govern the market?

The need for customized SATCOM on the move solutions, increase in adoption of SATCOM transceivers, Increased need to enhance passenger experience, Increased use of ultra compact SATCOM terminals for UAVs are few drivers and opportunities that govern the market.

What are the key sustainability strategies adopted by the leading players operating in the airborne SATCOM market?

Some of the techniques used by the top manufacturers of airborne SATCOM systems include long-term contracts with airlines, aircraft manufacturers, and integrators for specific aircraft fleets.

What are the new emerging technologies and use cases disrupting the airborne SATCOM market?

The major emerging technologies and use cases disrupting the airborne SATCOM market are laser communication terminals, New SATCOM Antenna Designs, Digitized satellite communications payload and increased high speed internet systems offering increased business efficiency.

Who are the key players and innovators in the ecosystem of the airborne SATCOM systems?

Few key players and innovators in the ecosystem of the airborne SATCOM systems are L3 Harris Corporation (US), General Dynamics Mission Systems (US), Viasat Inc. (US), Teledyne Defense Electronics (US), and Orbit Communication Systems Ltd (Israel). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.2.1 MARKETS COVERED

1.2.2 YEARS CONSIDERED

1.3 INCLUSIONS AND EXCLUSIONS

TABLE 1 AIRBORNE SATCOM MARKET: INCLUSIONS AND EXCLUSIONS

1.4 CURRENCY AND PRICING

TABLE 2 USD EXCHANGE RATES

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

FIGURE 1 AIRBORNE SATCOM MARKET TO GROW AT HIGHER RATE COMPARED TO PREVIOUS ESTIMATES

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH PROCESS FLOW

FIGURE 3 AIRBORNE SATCOM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

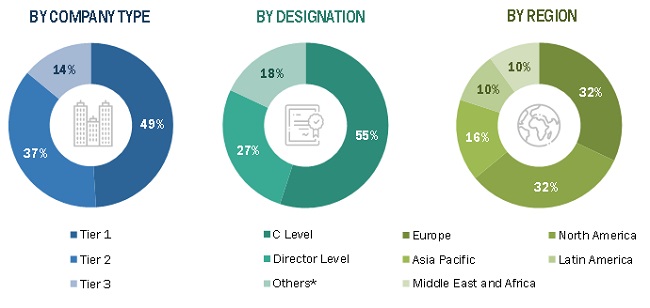

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 SEGMENTS AND SUBSEGMENTS

TABLE 3 SEGMENTS AND SUBSEGMENTS

2.3 RESEARCH APPROACH AND METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

TABLE 4 AIRBORNE SATCOM MARKET FOR NEW INSTALLATION

2.3.2 AIRBORNE SATCOM MARKET FOR UPGRADE

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.3 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.5 GROWTH RATE ASSUMPTIONS

2.6 RESEARCH ASSUMPTIONS

FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY ON AIRBORNE SATCOM MARKET

2.6.1 MARKET SIZING AND MARKET FORECASTING

3 EXECUTIVE SUMMARY (Page No. - 57)

FIGURE 9 KU-BAND SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2022

FIGURE 10 COMMERCIAL SEGMENT ESTIMATED TO ACCOUNT FOR LARGER SHARE OF MARKET IN 2022

FIGURE 11 NEW INSTALLATION SEGMENT ESTIMATED TO ACCOUNT FOR LARGER SHARE OF MARKET IN 2022

FIGURE 12 AIRBORNE SATCOM MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 60)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN AIRBORNE SATCOM MARKET

FIGURE 13 NEED FOR CUSTOMIZED SATCOM ON-THE-MOVE SOLUTIONS DRIVING AIRBORNE SATCOM MARKET

4.2 AIRBORNE SATCOM MARKET, BY COMPONENT

FIGURE 14 TRANSCEIVERS SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

4.3 AIRBORNE SATCOM MARKET, BY FREQUENCY

FIGURE 15 EHF/SHF BAND SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

4.4 AIRBORNE SATCOM MARKET, BY COUNTRY

FIGURE 16 AIRBORNE SATCOM MARKET IN AUSTRALIA PROJECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 62)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 AIRBORNE SATCOM MARKET DYNAMICS: DRIVERS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Need for customized SATCOM on-the-move solutions

5.2.1.2 Increasing number of aircraft fleet deliveries

FIGURE 18 COMMERCIAL FLEET AND DELIVERIES (2019 TO 2040)

5.2.1.3 Increase in adoption of SATCOM transceivers

5.2.1.4 Growing demand for high-throughput satellites

5.2.2 RESTRAINTS

5.2.2.1 High cost of development and maintenance of infrastructure to support SATCOM antennae

5.2.3 OPPORTUNITIES

5.2.3.1 Increased use of ultra-compact SATCOM terminals for UAVs

5.2.3.2 Increased need to enhance passenger experience

5.2.4 CHALLENGES

5.2.4.1 Cybersecurity issues

5.3 RANGE AND SCENARIOS

5.4 CASE STUDY ANALYSIS

5.4.1 IN-FLIGHT CONNECTIVITY PROVIDED TO UNICOM AIR NET VIA SATELLITE

5.4.2 HIGH-SPEED INTERNET SYSTEMS OFFER IMPROVED BUSINESS EFFICIENCY

5.4.3 FLEXIBILITY OF ORBIT GX46 AIRBORNE SATCOM TERMINAL WIDENED ITS GOVERNMENT APPLICATIONS

5.5 AIRBORNE SATCOM MARKET ECOSYSTEM

5.5.1 PROMINENT COMPANIES

5.5.2 PRIVATE AND SMALL ENTERPRISES

5.5.3 END USERS

FIGURE 19 AIRBORNE SATCOM MARKET ECOSYSTEM

TABLE 5 AIRBORNE SATCOM MARKET ECOSYSTEM

5.6 DISRUPTION IMPACTING CUSTOMER’S BUSINESS

FIGURE 20 REVENUE SHIFT IN AIRBORNE SATCOM MARKET

5.7 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS

5.7.1 RAW MATERIALS

5.7.2 R&D

5.7.3 COMPONENT MANUFACTURING

5.7.4 ASSEMBLY & TESTING

5.7.5 END USERS

5.8 TRADE DATA ANALYSIS

TABLE 6 TRADE DATA ANALYSIS

5.9 PORTER’S FIVE FORCES ANALYSIS

FIGURE 22 PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.10 KEY STAKEHOLDERS & BUYING CRITERIA

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 23 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 COMPONENTS

TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 COMPONENTS (%)

5.10.2 BUYING CRITERIA

FIGURE 24 KEY BUYING CRITERIA FOR TOP 3 COMPONENTS

TABLE 8 KEY BUYING CRITERIA FOR TOP 3 COMPONENTS

5.11 AVERAGE SELLING PRICE

TABLE 9 AVERAGE SELLING PRICE: AIRBORNE SATCOM, BY COMPONENT (USD MILLION)

5.12 PRICING ANALYSIS

5.12.1 AVERAGE SELLING PRICES OF AIRBORNE SATCOM, BY COMPONENT

FIGURE 25 AVERAGE SELLING PRICES OF TACTICAL DATA LINK COMPONENTS

5.13 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 10 AIRBORNE SATCOM MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.14 TARIFF AND REGULATORY LANDSCAPE

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.2 NORTH AMERICA

5.14.3 EUROPE

6 INDUSTRY TRENDS (Page No. - 88)

6.1 INTRODUCTION

6.2 EMERGING TRENDS

FIGURE 26 EMERGING TRENDS

6.2.1 LASER COMMUNICATION TERMINALS

6.2.2 NEW SATCOM ANTENNA DESIGNS

6.2.3 DEVELOPMENT OF ACTIVE ELECTRONICALLY SCANNED ARRAY (AESA)

6.2.4 USE OF LARGE REFLECTORS FOR HIGH-SPEED TRANSMISSION

6.2.5 ONBOARD RADIOFREQUENCY AND BASEBAND EQUIPMENT

6.2.6 DIGITIZED SATELLITE COMMUNICATIONS PAYLOAD

6.3 TECHNOLOGY TRENDS

6.3.1 USE OF KA- AND KU- BANDS FOR SATCOM

6.3.2 MULTIBAND TACTICAL COMMUNICATION AMPLIFIERS

6.3.3 SOFTWARE-DEFINED RADIO

6.3.4 USE OF WIDE V-BAND FOR SATELLITE-AIRCRAFT COMMUNICATION

6.4 SUPPLY CHAIN ANALYSIS

6.4.1 MAJOR COMPANIES

6.4.2 SMALL AND MEDIUM ENTERPRISES

6.4.3 MRO SUPPLIERS

6.4.4 END USERS/CUSTOMERS IN SATCOM ON-THE-MOVE MARKET

FIGURE 27 SUPPLY CHAIN ANALYSIS

6.5 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 13 INNOVATIONS & PATENT REGISTRATIONS, 2019-2021

6.6 IMPACT OF MEGATRENDS

6.6.1 HYBRID BEAMFORMING METHODS

6.6.2 DEVELOPMENT OF SMART ANTENNAE

6.6.3 MULTI-BAND, MULTI-MISSION (MBMM) ANTENNA

7 AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE (Page No. - 97)

7.1 INTRODUCTION

FIGURE 28 NEW INSTALLATION SEGMENT PROJECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 14 AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 15 AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

7.2 NEW INSTALLATION

7.2.1 DEPLOYMENT OF ADVANCED AIRBORNE SATCOM SYSTEMS ACROSS COMMERCIAL AND MILITARY APPLICATIONS TO DRIVE SEGMENT

7.3 UPGRADE

7.3.1 FREQUENT UPGRADE OF OLD AIRCRAFT FLEET TO DRIVE SEGMENT

8 AIRBORNE SATCOM MARKET, BY COMPONENT (Page No. - 100)

8.1 INTRODUCTION

FIGURE 29 TRANSCEIVER SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 16 AIRBORNE SATCOM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 17 AIRBORNE SATCOM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

8.2 SATCOM TERMINALS

TABLE 18 SATCOM TERMINALS: AIRBORNE SATCOM MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 19 SATCOM TERMINALS: AIRBORNE SATCOM MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.2.1 ANTENNAE

8.2.1.1 Fuselage-mount antennae

8.2.1.1.1 Increased use in commercial and special mission aircraft to drive segment

8.2.1.2 Tail-mount Antennae

8.2.1.2.1 Increased use in business jets to drive segment

TABLE 20 SATCOM TERMINALS: AIRBORNE SATCOM MARKET, BY ANTENNA TYPE, 2018–2021 (USD MILLION)

TABLE 21 SATCOM TERMINALS: AIRBORNE SATCOM MARKET, BY ANTENNA TYPE, 2022–2027 (USD MILLION)

8.2.2 RADIOFREQUENCY (RF) UNITS

8.2.2.1 Demand for higher bandwidth to support faster data rates to drive segment

8.2.3 NETWORKING DATA UNITS (NDU)

8.2.3.1 Increased need to gauge current position of aircraft to drive segment

8.2.4 ANTENNAE SUBSYSTEMS

8.2.4.1 Antennae control units

8.2.4.1.1 Need for precision satellite tracking devices and flyaway antennae to drive segment

8.2.4.2 Stabilized antennae pedestals

8.2.4.2.1 Increasing need for real-time information in any environment to drive segment

8.3 TRANSCEIVERS

TABLE 22 TRANSCEIVERS: AIRBORNE SATCOM MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 23 TRANSCEIVERS: AIRBORNE SATCOM MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.3.1 RECEIVERS

8.3.1.1 Block downconverters

8.3.1.1.1 Increased need for uninterrupted satellite communication to drive segment

8.3.1.2 Low-noise amplifiers

8.3.1.2.1 Need for radio communication systems to drive segment

8.3.2 TRANSMITTERS

8.3.2.1 Block upconverters

8.3.2.1.1 Increased need for aircraft movement and connectivity information to drive segment

8.3.2.2 High-power amplifiers

8.3.2.2.1 Need for high amplitude signals to drive segment

8.4 AIRBORNE RADIO

8.4.1 NEED FOR INCREASING RANGE AND PHYSICAL SECURITY OF COMMUNICATION SYSTEMS TO DRIVE SEGMENT

8.5 MODEMS & ROUTERS

8.5.1 NEED FOR HIGH-SPEED DATA COMMUNICATION IN AIRCRAFT TO DRIVE SEGMENT

8.6 SATCOM RADOMES

8.6.1 NEED FOR SAFETY AND SECURITY OF AIRBORNE SATCOM SYSTEMS IN HARSH ENVIRONMENTS TO DRIVE SEGMENT

8.7 OTHER COMPONENTS

9 AIRBORNE SATCOM MARKET, BY APPLICATION (Page No. - 110)

9.1 INTRODUCTION

FIGURE 30 COMMERCIAL SEGMENT PROJECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 24 AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 25 AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 GOVERNMENT & DEFENSE

TABLE 26 GOVERNMENT & DEFENSE AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 27 GOVERNMENT & DEFENSE AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2.1 ISR MISSIONS

9.2.1.1 Increased need to provide advanced SA is driving this segment

9.2.2 EMERGENCY RESPONSE & PUBLIC SAFETY

9.2.2.1 Growing aircraft rescue missions to drive segment

9.2.3 BORDER PROTECTION & SURVEILLANCE

9.2.3.1 Increasing use of UAVs for real-time battlefield information to drive segment

9.2.4 COMMAND, CONTROL & COMMUNICATIONS ON-THE-MOVE

9.2.4.1 Increased spending on system deployment to drive segment

9.3 COMMERCIAL

TABLE 28 COMMERCIAL AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 29 COMMERCIAL AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.3.1 IN-FLIGHT CONNECTIVITY

9.3.1.1 Increased demand for enhanced passenger experience to drive segment

9.3.2 REAL-TIME DATA GATHERING

9.3.2.1 Increased use of aerial platforms to broadcast and communicate to drive segment

9.3.3 TELEMEDICINE

9.3.3.1 Need for improved medical services to drive segment

10 AIRBORNE SATCOM MARKET, BY FREQUENCY (Page No. - 117)

10.1 INTRODUCTION

FIGURE 31 EHF/SHF BAND SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 30 AIRBORNE SATCOM MARKET, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 31 AIRBORNE SATCOM MARKET, BY FREQUENCY, 2022–2027 (USD MILLION)

10.2 VHF/UHF-BAND

10.2.1 MAJOR USE IN CUBESATS FOR COMMUNICATION APPLICATIONS TO DRIVE SEGMENT

10.3 L-BAND

10.3.1 EXTENSIVE USE IN DATA COMMUNICATIONS AND TRAFFIC INFORMATION TO DRIVE SEGMENT

10.4 S-BAND

10.4.1 LOW DRAG, LIGHTWEIGHT, AND COMPATIBILITY WITH AIRCRAFT PLATFORMS TO DRIVE SEGMENT

10.5 C-BAND

10.5.1 USE IN UNMANNED AIRCRAFT TO DRIVE SEGMENT

10.6 X-BAND

10.6.1 USE IN LONG-ENDURANCE SURVEILLANCE AND RECONNAISSANCE TO DRIVE SEGMENT

10.7 KU-BAND

10.7.1 USE IN SMALL PLATFORMS TO PROVIDE IMAGING APPLICATIONS IN REMOTE LOCATIONS TO DRIVE SEGMENT

10.8 KA-BAND

10.8.1 USE IN MILITARY AND COMMERCIAL AIRCRAFT FOR HIGH BANDWIDTH COMMUNICATION TO DRIVE SEGMENT

10.9 EHF/SHF BAND

10.9.1 USE IN MOST RADAR TRANSMITTERS TO DRIVE SEGMENT

10.10 MULTI-BAND

10.10.1 NEED FOR SEAMLESS, ASSURED CONNECTIVITY BETWEEN NETWORK AND GRID TO DRIVE SEGMENT

10.11 Q-BAND

10.11.1 NEED TO REDUCE SIGNAL FADING AT HIGH-FREQUENCY TO DRIVE SEGMENT

11 AIRBORNE SATCOM MARKET, BY PLATFORM (Page No. - 124)

11.1 INTRODUCTION

FIGURE 32 UAV SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 32 AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 33 AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

11.2 FIXED WING

TABLE 34 FIXED WING AIRBORNE SATCOM MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 35 FIXED WING AIRBORNE SATCOM MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.2.1 COMMERCIAL AVIATION

TABLE 36 COMMERCIAL AVIATION AIRBORNE SATCOM MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 37 COMMERCIAL AVIATION AIRBORNE SATCOM MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

11.2.1.1 Narrow-body aircraft

11.2.1.1.1 Increasing domestic air travel to drive segment

11.2.1.2 Wide-body aircraft

11.2.1.2.1 Growing military and commercial usage to drive segment

11.2.1.3 Regional transport aircraft (RTA)

11.2.1.3.1 Increasing demand for short-distance transport to drive segment

11.2.2 BUSINESS AVIATION & GENERAL AVIATION

TABLE 38 BUSINESS AVIATION & GENERAL AVIATION AIRBORNE SATCOM MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 39 BUSINESS AVIATION & GENERAL AVIATION AIRBORNE SATCOM MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.2.2.1 Business jets

11.2.2.1.1 Increasing customization requirements to drive segment

11.2.2.2 Light aircraft

11.2.2.2.1 Growing business travel across the world to drive segment

11.2.3 MILITARY AVIATION

TABLE 40 MILITARY AVIATION AIRBORNE SATCOM MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 41 MILITARY AVIATION AIRBORNE SATCOM MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.2.3.1 Fighter aircraft

11.2.3.1.1 Increasing modernization programs by militaries to drive segment

11.2.3.2 Special mission aircraft

11.2.3.2.1 Increasing defense spending in North America and Asia Pacific to drive segment

11.2.3.3 Transport aircraft

11.2.3.3.1 Consistent global military operations to drive segment

11.3 ROTARY WING

TABLE 42 ROTARY WING AIRBORNE SATCOM MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 43 ROTARY WING AIRBORNE SATCOM MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

11.3.1 COMMERCIAL HELICOPTER

11.3.1.1 Increasing operational capabilities and decreasing cost of production to drive segment

11.3.2 MILITARY HELICOPTER

11.3.2.1 Increasing need to cater to military applications to drive segment

11.4 UNMANNED AERIAL VEHICLES

TABLE 44 UNMANNED AERIAL VEHICLES AIRBORNE SATCOM MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 45 UNMANNED AERIAL VEHICLES AIRBORNE SATCOM MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.4.1 FIXED WING UAV

11.4.1.1 Wide range of military applications to drive segment

11.4.2 FIXED-WING HYBRID VTOL UAV

11.4.2.1 Long flight and large payload capacities to drive segment

11.4.3 ROTARY WING UAV

11.4.3.1 Technical advancements and innovations to drive segment

12 AIRBORNE SATCOM MARKET, BY REGION (Page No. - 136)

12.1 INTRODUCTION

FIGURE 33 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF AIRBORNE SATCOM MARKET IN 2022

TABLE 46 AIRBORNE SATCOM MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 AIRBORNE SATCOM MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 PESTLE ANALYSIS

FIGURE 34 NORTH AMERICA: AIRBORNE SATCOM MARKET SNAPSHOT

TABLE 48 NORTH AMERICA: AIRBORNE SATCOM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 49 NORTH AMERICA: AIRBORNE SATCOM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 50 NORTH AMERICA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 51 NORTH AMERICA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 52 NORTH AMERICA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 53 NORTH AMERICA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 54 NORTH AMERICA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 55 NORTH AMERICA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.2.2 US

12.2.2.1 Presence of leading aircraft manufacturers to drive market

TABLE 56 US: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 57 US: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 58 US: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 59 US: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 60 US: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 61 US: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.2.3 CANADA

12.2.3.1 Growing aircraft deliveries and old fleet upgrade to drive market

TABLE 62 CANADA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 63 CANADA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 64 CANADA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 65 CANADA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 66 CANADA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 67 CANADA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.3 EUROPE

12.3.1 PESTLE ANALYSIS

FIGURE 35 EUROPE: AIRBORNE SATCOM MARKET SNAPSHOT

TABLE 68 EUROPE: AIRBORNE SATCOM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 69 EUROPE: AIRBORNE SATCOM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 70 EUROPE: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 71 EUROPE: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 72 EUROPE: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 73 EUROPE: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 74 EUROPE: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 75 EUROPE: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.3.2 UK

12.3.2.1 Advancements in unmanned technologies to drive market

TABLE 76 UK: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 77 UK: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 78 UK: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 79 UK: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 80 UK: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 81 UK: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.3.3 FRANCE

12.3.3.1 Availability of affordable and advanced technologies to drive market

TABLE 82 FRANCE: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 83 FRANCE: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 84 FRANCE: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 85 FRANCE: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 86 FRANCE: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 87 FRANCE: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.3.4 GERMANY

12.3.4.1 Demand for defense and commercial aircraft to drive market

TABLE 88 GERMANY: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 89 GERMANY: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 90 GERMANY: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 91 GERMANY: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 92 GERMANY: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 93 GERMANY: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.3.5 RUSSIA

12.3.5.1 Increased spending on aviation to enhance aircraft capabilities to drive market

TABLE 94 RUSSIA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 95 RUSSIA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 96 RUSSIA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 97 RUSSIA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 98 RUSSIA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 99 RUSSIA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.3.6 ITALY

12.3.6.1 Replacement of old fleets by domestic airlines to drive market

TABLE 100 ITALY: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 101 ITALY: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 102 ITALY: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 103 ITALY: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 104 ITALY: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 105 ITALY: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 PESTLE ANALYSIS

FIGURE 36 ASIA PACIFIC: AIRBORNE SATCOM MARKET SNAPSHOT

TABLE 106 ASIA PACIFIC: AIRBORNE SATCOM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 107 ASIA PACIFIC: AIRBORNE SATCOM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 108 ASIA PACIFIC: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 109 ASIA PACIFIC: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 110 ASIA PACIFIC: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 111 ASIA PACIFIC: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 112 ASIA PACIFIC: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 113 ASIA PACIFIC: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.4.2 CHINA

12.4.2.1 Growing demand for new aircraft to drive market

TABLE 114 CHINA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 115 CHINA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 116 CHINA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 117 CHINA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 118 CHINA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 119 CHINA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.4.3 INDIA

12.4.3.1 Defense spending on different types of military aircraft to drive market

TABLE 120 INDIA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 121 INDIA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 122 INDIA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 123 INDIA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 124 INDIA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 125 INDIA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.4.4 JAPAN

12.4.4.1 Increased focus on commercial IFC services to drive market

TABLE 126 JAPAN: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 127 JAPAN: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 128 JAPAN: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 129 JAPAN: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 130 JAPAN: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 131 JAPAN: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.4.5 AUSTRALIA

12.4.5.1 Advancements in IFC to drive market

TABLE 132 AUSTRALIA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 133 AUSTRALIA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 134 AUSTRALIA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 135 AUSTRALIA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 136 AUSTRALIA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 137 AUSTRALIA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.4.6 SOUTH KOREA

12.4.6.1 Significant growth opportunities for domestic production to drive market

TABLE 138 SOUTH KOREA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 139 SOUTH KOREA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 140 SOUTH KOREA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 141 SOUTH KOREA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 142 SOUTH KOREA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 143 SOUTH KOREA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.5 LATIN AMERICA

12.5.1 PESTLE ANALYSIS

FIGURE 37 LATIN AMERICA: AIRBORNE SATCOM MARKET SNAPSHOT

TABLE 144 LATIN AMERICA: AIRBORNE SATCOM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 145 LATIN AMERICA: AIRBORNE SATCOM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 146 LATIN AMERICA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 147 LATIN AMERICA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 148 LATIN AMERICA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 149 LATIN AMERICA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 150 LATIN AMERICA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 151 LATIN AMERICA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.5.2 BRAZIL

12.5.2.1 Increase in domestic production of aircraft to drive market

TABLE 152 BRAZIL: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 153 BRAZIL: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 154 BRAZIL: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 155 BRAZIL: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 156 BRAZIL: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 157 BRAZIL: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.5.3 MEXICO

12.5.3.1 Increased investments by global aircraft manufacturing companies to drive market

TABLE 158 MEXICO: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 159 MEXICO: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 160 MEXICO: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 161 MEXICO: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 162 MEXICO: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 163 MEXICO: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.6 MIDDLE EAST AND AFRICA

12.6.1 PESTLE ANALYSIS

FIGURE 38 MIDDLE EAST: AIRBORNE SATCOM MARKET SNAPSHOT

TABLE 164 MIDDLE EAST & AFRICA: AIRBORNE SATCOM MARKET, 2018–2021 (USD MILLION)

TABLE 165 MIDDLE EAST & AFRICA: AIRBORNE SATCOM MARKET, 2022–2027 (USD MILLION)

TABLE 166 MIDDLE EAST & AFRICA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 167 MIDDLE EAST & AFRICA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 168 MIDDLE EAST & AFRICA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 169 MIDDLE EAST & AFRICA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 171 MIDDLE EAST & AFRICA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.6.2 TURKEY

12.6.2.1 Focus on in-house production of UAVs to drive market

TABLE 172 TURKEY: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 173 TURKEY: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 174 TURKEY: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 175 TURKEY: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 176 TURKEY: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 177 TURKEY: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.6.3 SAUDI ARABIA

12.6.3.1 Increasing investments in UAVs to drive market

TABLE 178 SAUDI ARABIA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 179 SAUDI ARABIA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 180 SAUDI ARABIA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 181 SAUDI ARABIA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 182 SAUDI ARABIA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 183 SAUDI ARABIA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.6.4 ISRAEL

12.6.4.1 Presence of leading OEMs to drive market

TABLE 184 ISRAEL: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 185 ISRAEL: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 186 ISRAEL: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 187 ISRAEL: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 188 ISRAEL: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 189 ISRAEL: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

12.6.5 SOUTH AFRICA

12.6.5.1 Demand for advanced connectivity in new and old fleets of major airlines to drive market

TABLE 190 SOUTH AFRICA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 191 SOUTH AFRICA: AIRBORNE SATCOM MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 192 SOUTH AFRICA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 193 SOUTH AFRICA: AIRBORNE SATCOM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 194 SOUTH AFRICA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 195 SOUTH AFRICA: AIRBORNE SATCOM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 189)

13.1 INTRODUCTION

13.2 MARKET SHARE ANALYSIS, 2021

TABLE 196 DEGREE OF COMPETITION

FIGURE 39 MARKET SHARE OF TOP PLAYERS IN AIRBORNE SATCOM MARKET, 2021 (%)

13.3 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2021

13.4 COMPANY EVALUATION QUADRANT

13.4.1 STARS

13.4.2 EMERGING LEADERS

13.4.3 PERVASIVE COMPANIES

13.4.4 PARTICIPANTS

FIGURE 40 COMPETITIVE LEADERSHIP MAPPING, 2021

13.5 START-UP EVALUATION QUADRANT

13.5.1 PROGRESSIVE COMPANIES

13.5.2 RESPONSIVE COMPANIES

13.5.3 STARTING BLOCKS

13.5.4 DYNAMIC COMPANIES

FIGURE 41 COMPETITIVE LEADERSHIP MAPPING OF STARTUPS, 2021

TABLE 197 AIRBORNE SATCOM MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 198 AIRBORNE SATCOM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

TABLE 199 COMPANY PRODUCT FOOTPRINT

TABLE 200 COMPANY FOOTPRINT BY APPLICATION

TABLE 201 COMPANY FOOTPRINT BY PLATFORM

TABLE 202 COMPANY FOOTPRINT BY REGION

13.6 COMPETITIVE SCENARIO

13.6.1 DEALS

TABLE 203 DEALS, 2019–2022

13.6.2 NEW PRODUCT DEVELOPMENTS

TABLE 204 NEW PRODUCT DEVELOPMENTS, 2019–2022

13.6.3 OTHERS

TABLE 205 OTHERS, 2019–2022

14 COMPANY PROFILES (Page No. - 218)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

14.1 INTRODUCTION

14.2 KEY PLAYERS

14.2.1 L3HARRIS TECHNOLOGIES

TABLE 206 L3HARRIS TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 42 L3HARRIS TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 207 L3HARRIS TECHNOLOGIES: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

TABLE 208 L3HARRIS TECHNOLOGIES: DEALS

TABLE 209 L3HARRIS CORPORATION: NEW PRODUCT DEVELOPMENTS

TABLE 210 L3HARRIS CORPORATION: OTHERS

14.2.2 THALES GROUP

TABLE 211 THALES GROUP: BUSINESS OVERVIEW

FIGURE 43 THALES GROUP: COMPANY SNAPSHOT

TABLE 212 THALES GROUP: PRODUCTS/SOLUTIONS OFFERED

TABLE 213 THALES GROUP: DEALS

14.2.3 COLLINS AEROSPACE

TABLE 214 COLLINS AEROSPACE: BUSINESS OVERVIEW

FIGURE 44 COLLINS AEROSPACE SYSTEM: COMPANY SNAPSHOT

TABLE 215 COLLINS AEROSPACE: PRODUCTS/SOLUTIONS OFFERED

TABLE 216 COLLINS AEROSPACE: DEALS

TABLE 217 COLLINS AEROSPACE: OTHERS

14.2.4 ISRAEL AEROSPACE INDUSTRIES

TABLE 218 ISRAEL AEROSPACE INDUSTRIES: BUSINESS OVERVIEW

FIGURE 45 ISRAEL AEROSPACE INDUSTRIES: COMPANY SNAPSHOT

TABLE 219 ISRAEL AEROSPACE INDUSTRIES: PRODUCTS/SOLUTIONS OFFERED

TABLE 220 ISRAEL AEROSPACE INDUSTRIES: DEALS

TABLE 221 ISRAEL AEROSPACE INDUSTRIES: OTHERS

14.2.5 HONEYWELL INTERNATIONAL INC.

TABLE 222 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 46 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 223 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS OFFERED

TABLE 224 HONEYWELL INTERNATIONAL: DEALS

TABLE 225 HONEYWELL INTERNATIONAL: NEW PRODUCT DEVELOPMENTS

TABLE 226 HONEYWELL INTERNATIONAL: OTHERS

14.2.6 RAYTHEON INTELLIGENCE AND SPACE

TABLE 227 RAYTHEON INTELLIGENCE AND SPACE: BUSINESS OVERVIEW

FIGURE 47 RAYTHEON INTELLIGENCE AND SPACE: COMPANY SNAPSHOT

TABLE 228 RAYTHEON INTELLIGENCE AND SPACE: PRODUCTS/SOLUTIONS OFFERED

TABLE 229 RAYTHEON INTELLIGENCE AND SPACE: DEALS

TABLE 230 RAYTHEON INTELLIGENCE AND SPACE: OTHERS

14.2.7 ASELSAN A.S.

TABLE 231 ASELSAN A.S: BUSINESS OVERVIEW

FIGURE 48 ASELSAN A.S.: COMPANY SNAPSHOT

TABLE 232 ASELSAN A.S.: PRODUCTS/SOLUTIONS OFFERED

TABLE 233 ASELSAN A.S: DEALS

14.2.8 BAE SYSTEMS

TABLE 234 BAE SYSTEMS: BUSINESS OVERVIEW

FIGURE 49 BAE SYSTEMS: COMPANY SNAPSHOT

TABLE 235 BAE SYSTEMS: PRODUCTS/SOLUTIONS OFFERED

TABLE 236 BAE SYSTEMS: DEALS

14.2.9 GENERAL DYNAMICS MISSION SYSTEMS, INC.

TABLE 237 GENERAL DYNAMICS CORPORATION: BUSINESS OVERVIEW

FIGURE 50 GENERAL DYNAMICS MISSION SYSTEMS, INC.: COMPANY SNAPSHOT

TABLE 238 GENERAL DYNAMICS MISSION SYSTEMS, INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

TABLE 239 GENERAL DYNAMICS MISSION SYSTEMS, INC.: DEALS

TABLE 240 GENERAL DYNAMICS MISSION SYSTEMS, INC.: NEW PRODUCT DEVELOPMENTS

14.2.10 GILAT SATELLITE NETWORKS

TABLE 241 GILAT SATELLITE NETWORKS: BUSINESS OVERVIEW

FIGURE 51 GILAT SATELLITE NETWORKS: COMPANY SNAPSHOT

TABLE 242 GILAT SATELLITE NETWORKS: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

TABLE 243 GILAT SATELLITE NETWORKS: DEALS

TABLE 244 GILAT SATELLITE NETWORKS: NEW PRODUCT DEVELOPMENTS

TABLE 245 GILAT SATELLITE NETWORKS: OTHERS

14.2.11 HUGHES NETWORK SYSTEMS

TABLE 246 HUGHES NETWORK SYSTEMS: BUSINESS OVERVIEW

FIGURE 52 HUGHES NETWORK SYSTEMS: COMPANY SNAPSHOT

TABLE 247 HUGHES NETWORK SYSTEMS: PRODUCTS/SOLUTIONS OFFERED

TABLE 248 HUGHES NETWORK SYSTEMS: DEALS

TABLE 249 HUGHES NETWORK SYSTEMS: NEW PRODUCT DEVELOPMENTS

14.2.12 VIASAT, INC

TABLE 250 VIASAT, INC: BUSINESS OVERVIEW

FIGURE 53 VIASAT, INC: COMPANY SNAPSHOT

TABLE 251 VIASAT, INC: PRODUCTS/SOLUTIONS OFFERED

TABLE 252 VIASAT INC.: DEALS

TABLE 253 VIASAT INC.: NEW PRODUCT DEVELOPMENTS

TABLE 254 VIASAT INC.: OTHERS

14.2.13 ORBIT COMMUNICATION SYSTEMS LTD

TABLE 255 ORBIT COMMUNICATION SYSTEM LTD: BUSINESS OVERVIEW

FIGURE 54 ORBIT COMMUNICATION SYSTEMS: COMPANY SNAPSHOT

TABLE 256 ORBIT COMMUNICATION SYSTEMS LTD: PRODUCTS/SOLUTIONS OFFERED

TABLE 257 ORBIT COMMUNICATION SYSTEMS: DEALS

TABLE 258 ORBIT COMMUNICATION SYSTEMS: NEW PRODUCT DEVELOPMENTS

TABLE 259 ORBIT COMMUNICATION SYSTEMS: OTHERS

14.2.14 SMITHS GROUP PLC

TABLE 260 SMITHS GROUP PLC: BUSINESS OVERVIEW

FIGURE 55 SMITHS GROUP PLC: COMPANY SNAPSHOT

TABLE 261 SMITHS GROUP PLC: PRODUCTS/SOLUTIONS OFFERED

TABLE 262 SMITHS GROUP PLC: DEALS

TABLE 263 SMITHS GROUP PLC: OTHERS

14.2.15 ST ENGINEERING

TABLE 264 ST ENGINEERING: BUSINESS OVERVIEW

FIGURE 56 ST ENGINEERING: COMPANY SNAPSHOT

TABLE 265 ST ENGINEERING: PRODUCTS/SOLUTIONS OFFERED

TABLE 266 ST ENGINEERING: DEALS

14.2.16 IRIDIUM COMMUNICATIONS INC.

TABLE 267 IRIDIUM COMMUNICATIONS INC.: BUSINESS OVERVIEW

FIGURE 57 IRIDIUM COMMUNICATIONS INC: COMPANY SNAPSHOT

TABLE 268 IRIDIUM COMMUNICATIONS INC: PRODUCTS/ SOLUTIONS OFFERED

TABLE 269 IRIDIUM COMMUNICATIONS INC: NEW PRODUCT DEVELOPMENTS

14.2.17 TELEDYNE DEFENSE ELECTRONICS

TABLE 270 TELEDYNE DEFENSE ELECTRONICS: BUSINESS OVERVIEW

FIGURE 58 TELEDYNE DEFENSE ELECTRONICS: COMPANY SNAPSHOT

TABLE 271 TELEDYNE DEFENSE ELECTRONICS: PRODUCTS/SOLUTIONS OFFERED

TABLE 272 TELEDYNE DEFENSE ELECTRONICS: DEALS

TABLE 273 TELEDYNE DEFENSE ELECTRONICS: NEW PRODUCT DEVELOPMENTS

14.3 OTHER PLAYERS

14.3.1 COBHAM AEROSPACE COMMUNICATIONS

TABLE 274 COBHAM AEROSPACE COMMUNICATIONS: COMPANY OVERVIEW

14.3.2 BALL CORPORATION

TABLE 275 BALL CORPORATION: COMPANY OVERVIEW

14.3.3 ASTRONICS CORPORATION

TABLE 276 ASTRONICS CORPORATION: COMPANY OVERVIEW

14.3.4 ECLIPSE GLOBAL CONNECTIVITY

TABLE 277 ECLIPSE GLOBAL CONNECTIVITY: COMPANY OVERVIEW

14.3.5 THINKOM SOLUTIONS

TABLE 278 THINKOM SOLUTIONS: COMPANY OVERVIEW

14.3.6 GET SAT

TABLE 279 GET SAT: COMPANY OVERVIEW

14.3.7 NORSAT INTERNATIONAL INC

TABLE 280 NORSAT INTERNATIONAL INC: COMPANY OVERVIEW

14.3.8 SATCOM DIRECT

TABLE 281 SATCOM DIRECT: COMPANY OVERVIEW

14.3.9 COMTECH TELECOMMUNICATIONS CORP.

TABLE 282 COMTECH TELECOMMUNICATIONS CORP.: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 294)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATION

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

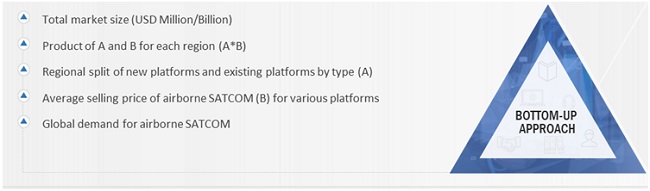

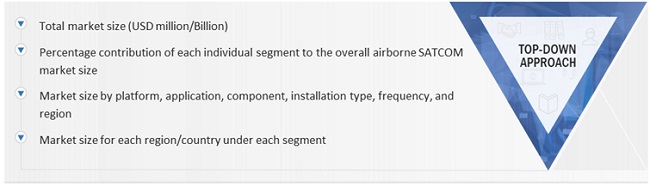

The global study involved four major activities for estimating the size of The airborne SATCOM market Exhaustive secondary research has been conducted to collect information on the market, peer market and parent market. The next step involved has been validating these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall market size. Furthermore, market breakdown and data triangulation techniques have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Statista, Boeing and Airbus Outlook, World Bank, Global Firepower, Factiva, Bloomberg, BusinessWeek, SEC filings, annual reports, press releases & investor presentations of companies, certified publications, and articles by recognized authors were referred to for identifying and collecting information on the airborne SATCOM market.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as chief experience officers (CXOs), vice presidents (VPs), and directors, from business development, marketing, and product development/innovation teams, and related key executives from airborne SATCOM vendors, independent aviation consultants and importers, distributors, and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products & services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, platform, and region. Stakeholders from the demand side, such as CXOs, production managers, engineers, and installation teams of end users of airborne SATCOM, were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current usage and outlook of their business, which could affect the overall airborne SATCOM market.

The breakup of Primary Research :

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the airborne SATCOM market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global airborne SATCOM market Size: Bottom-Up Approach

The bottom-up approach was employed to arrive at the overall size of the airborne SATCOM market. The market size was calculated by adding the two main segments mentioned below, and the various communication of aircraft systems that aircraft platforms adopt were tracked to arrive at the market numbers, which are delineated below:

Airborne SATCOM Market = Airborne SATCOM market for New Installation + Airborne SATCOM market for Upgradation

To know about the assumptions considered for the study, Request for Free Sample Report

Global airborne SATCOM market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented wherever applicable to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the airborne SATCOM market based on component, platform, frequency, application, installation, and region

- To analyze the degree of competition in the market by mapping the recent developments, products, and services of key market players

- To understand the structure of the airborne SATCOM market by identifying its various segments and subsegments

- To identify and analyze key drivers, restraints, opportunities, and challenges that influence the growth of the market

- To forecast the size of market segments across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, along with major countries in each region

- To identify transportation industry trends, market trends, and technology trends currently prevailing in the market

- To analyze micromarkets1 with respect to individual technological trends and their contribution to the total market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies2

- To provide a detailed competitive landscape of the market, along with an analysis of business and strategies such as mergers & acquisitions, partnerships, agreements, and new product developments in airborne SATCOM

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

Available Customizations

With the market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Airborne SATCOM Market