Airborne Surveillance Market by Type (LiDAR, Radar, Imaging System), Product Type (Manned, Unmanned), Application (Military, Defense & Security, Commercial (Surveying & Mapping, Inspection, & Monitoring)), and Geography - Global Forecast to 2023

[162 Pages Report] The overall airborne surveillance market is expected to be worth USD 4.23 Billion in 2016 and is expected to reach USD 5.81 Billion by 2023, at a CAGR of 4.7% during the forecast period.

The airborne surveillance market is expected to be valued at USD 4.42 Billion in 2017 and is expected to reach USD 5.81 Billion by 2023, at a CAGR of 4.7% during the forecast period. The growth of this market can be attributed to the availability of low-cost UAVs, the growing use of UAVs in commercial applications, amendments in laws, and rapid technological advancements.

This report segments the airborne surveillance market based on type, product type, application, and region. The airborne surveillance market, on the basis of type, has been segmented into LiDAR, radar, and imaging systems. Radar systems are expected to dominate the airborne surveillance market. This is mainly because of the growing adoption of radar systems for airborne surveillance in military, defense, and security applications for various platforms such as fixed-wing and rotary-wing, manned and unmanned aircraft, and small tactical UAVs (STUAVs).

The airborne surveillance market has been segmented, on the basis of product type, into manned system and unmanned system. The airborne surveillance market for unmanned system is expected to grow at the highest rate during the forecast period. The growing use of unmanned systems has been observed in both military and commercial applications. Unmanned aerial vehicles have always relied on already developed aviation technologies to meet their relatively modest performance criteria. Today’s UAVs employ the latest sensor and communication technologies to deliver a capability. Different military unmanned systems or vehicles include high-altitude long-endurance (HALE), medium-altitude long-endurance (MALE), tactical, strategic, and others. For military unmanned systems, major demand is derived from radar and imaging systems, while for commercial unmanned systems, major demand is derived from LiDAR and imaging systems. Drones are now being used with laser scanners, as well as other remote sensors, as a more economical method to scan smaller areas. Drones are now updated with LiDAR technology for a variety of applications such as agriculture, mining, surveying, forestry, and monitoring.

The airborne surveillance is broadly classified into two applications such as military, defense, and security; and commercial applications. Currently, military applications account for a major share of the airborne surveillance market, where the majority comprises radar and imaging systems. The airborne surveillance market for commercial applications is expected to grow rapidly because of the wide adoption of drones in various commercial applications such as surveying, mapping, infrastructure inspection and monitoring, agriculture, and others.

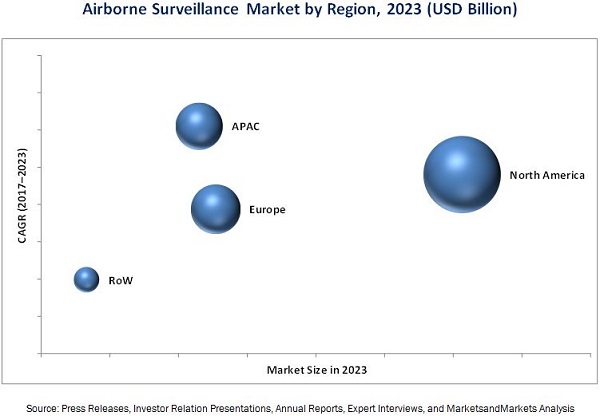

North America is expected to account for the largest share of the airborne surveillance market during the forecast period. The market in North America has been further segmented into the US, Canada, and Mexico, and is dominated by manufacturers such as Boeing, Lockheed Martin (US), Raytheon (US), and BAE Systems (US). Countries in North America, mainly the US, have a huge defense budget as compared to Europe or APAC, thus leading to the increasing demand for airborne surveillance systems in North America. The US is expected to be the major contributor to the airborne surveillance market in North America. The presence of major players in the US is expected to drive the airborne surveillance market growth in this region. Also, the relaxation in regulations in Mexico has led to the increase in research and development for drones and UAVs in the country. Owing to the amendments by the FAA and the US government, it has raised an interest for the companies to invest in drones and UAVs in the US. The production of UAVs is expected to increase in the next few years, as amendments in rules allowed the commercial use of drones in 2016. Since August 2016, the FAA has approved more than 300 waivers for the use of drones in many places/locations.

Major players in this market include Airbus (France), Boeing (US), Saab (Sweden), BAE Systems (UK), Raytheon (US), Lockheed Martin (US), Leonardo (Italy), FLIR Systems (US), Northrop Grumman (US), L-3 Wescam (Canada), Leica Geosystems (Switzerland), Teledyne Technologies (US), Safran (France), Thales (France), and Israel Aerospace Industries (Israel).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

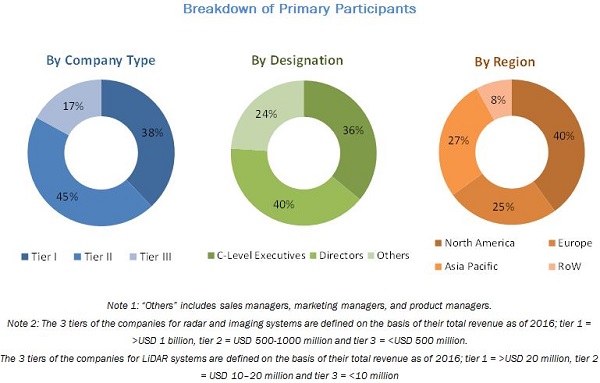

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Data From Primary Sources

2.1.2.4 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Airborne Surveillance Market

4.2 Airborne Surveillance Market, By Application

4.3 Airborne Surveillance Market in North America, By Type and Country

4.4 Airborne Surveillance Market: Geographic Snapshot

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Availability of Low-Cost UAVS in Abundance

5.2.1.2 Growing Demand for UAVS in Commercial Applications

5.2.1.3 Amendments in Laws Leading to Increase in the Use of UAVS and Drones

5.2.1.4 Internet of Things (IoT) Leading to Increase in the Applications of Drones

5.2.1.5 Rapid Technological Advancements

5.2.2 Restraints

5.2.2.1 High Cost of LiDAR

5.2.3 Opportunities

5.2.3.1 Use of Enhanced Batteries to Increase the Flying Time of UAVS

5.2.3.2 Rising Interest and Funding Toward UAVS

5.2.4 Challenges

5.2.4.1 Air Traffic Management

5.2.4.2 Possible Violation of Human Privacy

5.2.4.3 Lack of Skilled Pilots

6 Airborne Surveillance Market, By Type (Page No. - 40)

6.1 Introduction

6.2 LiDAR

6.3 Radar

6.4 Imaging System

7 Airborne Surveillance Market, By Product Type (Page No. - 55)

7.1 Introduction

7.2 Manned Systems

7.2.1 Helicopter

7.2.2 Aircraft

7.3 Unmanned System

7.3.1 UAV/UAS

7.3.1.1 Fixed Wing

7.3.1.2 Rotary Wing

7.3.1.3 Drones

7.3.1.4 Vtols

7.3.2 Balloons/Aerostats

8 Airborne Surveillance Market, By Application (Page No. - 65)

8.1 Introduction

8.2 Military, Defense, and Security

8.2.1 Isr and Targeting

8.2.2 Search and Rescue (SAR)

8.2.3 Law Enforcement

8.2.4 Border Surveillance

8.3 Commercial

8.3.1 Engineering, Surveying, and Mapping

8.3.2 Inspection and Monitoring

8.3.3 Agriculture and Forestry

8.3.4 Exploration

8.3.5 Insurance

8.3.6 Others

8.3.6.1 Education

8.3.6.2 Healthcare

8.3.6.3 Delivery and Logistics

9 Geographic Analysis (Page No. - 81)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Russia

9.3.2 Germany

9.3.3 UK

9.3.4 France

9.3.5 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.2 Japan

9.4.3 India

9.4.4 Rest of APAC

9.5 RoW

9.5.1 South America

9.5.2 Middle East & Africa

10 Competitive Landscape (Page No. - 105)

10.1 Overview

10.2 Market Ranking Analysis

10.2.1 Product Launches

10.2.2 Agreements, Collaborations, Partnerships, and Contracts

10.2.3 Mergers & Acquisitions

10.2.4 Expansions

11 Company Profiles (Page No. - 109)

11.1 Introduction

11.2 Airbus

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.3 BAE Systems

11.4 Boeing

11.5 Lockheed Martin

11.6 Raytheon

11.7 Flir Systems

11.8 Israel Aerospace Industries (IAI)

11.9 L-3 Wescam

11.10 Leica Geosystems AG

11.11 Leonardo

11.12 Northrop Grumman

11.13 Saab

11.14 Safran

11.15 Teledyne Technologies

11.16 Thales

11.17 Start-Up Ecosystem

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 154)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customization

12.6 Related Reports

12.7 Author Details

List of Tables (70 Tables)

Table 1 List of UAVS and Their Prices

Table 2 Airborne Surveillance Market, By Type, 2015–2023 (USD Million)

Table 3 Airborne LiDAR Market, By Type, 2015–2023 (USD Million)

Table 4 Airborne LiDAR Market, By Application, 2015–2023 (USD Million)

Table 5 Airborne LiDAR Market for Commercial Application By Type, 2015–2023 (USD Million)

Table 6 Airborne LiDAR Market, By Region, 2015–2023 (USD Million)

Table 7 Airborne LiDAR Market in North America, By Country, 2015–2023 (USD Million)

Table 8 Airborne LiDAR Market in Europe, By Country, 2015–2023 (USD Million)

Table 9 Airborne LiDAR Market in APAC, By Country, 2015–2023 (USD Million)

Table 10 Airborne LiDAR Market in RoW, By Region, 2015–2023 (USD Million)

Table 11 Airborne Radar Market, By Application, 2015–2023 (USD Billion)

Table 12 Airborne Radar Market, By Region, 2015–2023 (USD Million)

Table 13 Airborne Radar Market in North America, By Country, 2015–2023 (USD Million)

Table 14 Airborne Radar Market in Europe, By Country, 2015–2023 (USD Million)

Table 15 Airborne Radar Market in APAC, By Country, 2015–2023 (USD Million)

Table 16 Airborne Radar Market in RoW, By Region, 2015–2023 (USD Million)

Table 17 Airborne Imaging System Market, By Application, 2015–2023 (USD Million)

Table 18 Airborne Imaging System Market, for Commercial Application, By Type, 2015–2023 (USD Million)

Table 19 Airborne Imaging System Market, By Region, 2015–2023 (USD Million)

Table 20 Airborne Imaging System Market in North America, By Country, 2015–2023 (USD Million)

Table 21 Airborne Imaging System Market in Europe, By Country, 2015–2023 (USD Million)

Table 22 Airborne Imaging System Market in APAC, By Country, 2015–2023 (USD Million)

Table 23 Airborne Imaging System Market in RoW, By Region, 2015–2023 (USD Million)

Table 24 Airborne Surveillance Market, By Product Type, 2015–2023 (USD Million)

Table 25 Airborne Radar Market, By Product Type, 2015–2023 (USD Billion)

Table 26 Airborne Imaging System Market, By Product Type, 2015–2023 (USD Million)

Table 27 Airborne Imaging System Market for Manned System, By Application, 2015–2023 (USD Million)

Table 28 Unmanned Airborne Imaging System Market, By Application, 2015–2023 (USD Million)

Table 29 Capabilities of UAVS Based on Type

Table 30 Airborne Surveillance Market, By Application, 2015–2023 (USD Million)

Table 31 Drones/UAS Used in Military Applications:

Table 32 Airborne LiDAR Market for Military, Defense, and Security Application, By Region, 2015–2023 (USD Million)

Table 33 Airborne Imaging System Market for Military, Defense, and Security Application, By Region, 2015–2023 (USD Million)

Table 34 Airborne LiDAR Market for Commercial Application, By Region, 2015–2023 (USD Million)

Table 35 Airborne Imaging System Market for Commercial Application, By Region, 2015–2023 (USD Million)

Table 36 Airborne LiDAR Market for Engineering, Surveying, and Mapping Application, By Region, 2015–2023 (USD Million)

Table 37 Airborne Imaging System Market for Engineering, Surveying, and Mapping Application, By Region, 2015–2023 (USD Million)

Table 38 Airborne LiDAR Market for Inspection and Monitoring Application, By Region, 2015–2023 (USD Million)

Table 39 Airborne Imaging System Market for Inspection and Monitoring Application, By Region, 2015-2023 (USD Million)

Table 40 Airborne LiDAR Market for Agriculture and Forestry Application, By Region, 2015–2023 (USD Million)

Table 41 Airborne Imaging System Market for Agriculture and Forestry Application, By Region, 2015–2023 (USD Million)

Table 42 Airborne LiDAR Market for Exploration Application, By Region, 2015–2023 (USD Million)

Table 43 Airborne Imaging System Market for Insurance Application, By Region, 2015–2023 (USD Million)

Table 44 Airborne Imaging System Market for Other Commercial Application, By Region, 2015–2023 (USD Million)

Table 45 Airborne Surveillance Market, By Region,2015–2023 (USD Million)

Table 46 Airborne Surveillance Market in North America, By Country, 2015–2023 (USD Million)

Table 47 Airborne LiDAR Market in North America By Application 2015–2023 (USD Million)

Table 48 Airborne LiDAR Market in North America, for Commercial Application By Type, 2015–2023 (USD Million)

Table 49 Airborne Imaging System Market in North America, By Application, 2015–2023 (USD Million)

Table 50 Airborne Imaging System Market in North America, for Commercial Application By Type, 2015–2023 (USD Million)

Table 51 Airborne Surveillance Market in Europe, By Country, 2015–2023 (USD Million)

Table 52 Airborne LiDAR Market in Europe By Application, 2015–2023 (USD Million)

Table 53 Airborne LiDAR Market in Europe for Commercial Application By Type, 2015–2023 (USD Million)

Table 54 Airborne Imaging System Market in Europe By Application, 2015–2023 (USD Million)

Table 55 Airborne Imaging System Market in Europe for Commercial Application By Type, 2015–2023 (USD Million)

Table 56 Airborne Surveillance Market in APAC, By Country, 2015–2023 (USD Million)

Table 57 Airborne LiDAR Market in APAC By Application, 2015–2023 (USD Million)

Table 58 Airborne LiDAR Market in APAC for Commercial Application By Type, 2015–2023 (USD Million)

Table 59 Airborne Imaging System Market in APAC By Application, 2015–2023 (USD Million)

Table 60 Airborne Imaging System Market in APAC for Commercial Application By Type, 2015–2023 (USD Million)

Table 61 Airborne Surveillance Market in RoW By Region, 2015–2023 (USD Million)

Table 62 Airborne LiDAR Market in RoW By Application, 2015–2023 (USD Million)

Table 63 Airborne LiDAR Market for Commercial Application By Type, 2015–2023 (USD Million)

Table 64 Airborne Imaging System Market in RoW By Application, 2015–2023 (USD Million)

Table 65 Airborne Imaging System Market in RoW for Commercial Application, 2015–2023 (USD Million)

Table 66 Ranking of Players, 2016

Table 67 Product Launches, 2014–2017

Table 68 Agreements, Collaborations, Partnerships, and Contracts, 2014–2017

Table 69 Mergers & Acquisitions, 2014–2017

Table 70 Expansions, 2015–2017

List of Figures (71 Figures)

Figure 1 Airborne Surveillance Market Segmentation

Figure 2 Airborne Surveillance Market: Process Flow of Market Size Estimation

Figure 3 Airborne Surveillance Market: Research Design

Figure 4 Bottom-Up Approach to Arrive at Market Size

Figure 5 Top-Down Approach to Arrive at Market Size

Figure 6 Data Triangulation

Figure 7 Assumptions for Research Study

Figure 8 LiDAR Expected to Grow at the Highest Rate in the Airborne Surveillance Market During the Forecast Period

Figure 9 Airborne Surveillance Market for Unmanned Systems Expected to Grow at the Highest CAGR During the Forecast Period

Figure 10 Engineering, Surveying and Mapping Expected to Dominate the Airborne Imaging System Market for Commercial Application During the Forecast Period

Figure 11 North America Dominated the Airborne Surveillance Market in 2016

Figure 12 Increasing Adoption of Unmanned Aerial Vehicles is Expected to Drive Airborne Surveillance Market Between 2017 and 2023

Figure 13 Airborne Surveillance Market for Commercial Application Expected to Grow at the Highest CAGR During the Forecast Period

Figure 14 Radar and US Held A Major Share of the North American Airborne Surveillance Market in 2016

Figure 15 US Accounted for the Largest Share of the Airborne Surveillance Market in 2016

Figure 16 The Availability of Drones at Lower Cost and Improved Laws Have Been A Major Driving Force for Airborne Surveillance Market.

Figure 17 Airborne LiDAR Market Expected to Grow at the Highest CAGR During the Forecast Period

Figure 18 Conceptual Working of LiDAR System

Figure 19 Airborne LiDAR Market for Topography Type Expected to Grow at A Higher CAGR During the Forecast Period

Figure 20 Airborne LiDAR Market for Engineering, Surveying, and Mapping Application Expected to Grow at the Highest CAGR During the Forecast Period

Figure 21 Airborne LiDAR Market in APAC Expected to Grow at the Highest CAGR During the Forecast Period

Figure 22 Airborne Radar Market for Commercial Application Expected to Grow at A Higher CAGR During the Forecast Period

Figure 23 North America Expected to Dominate the Airborne Radar Market During the Forecast Period

Figure 24 Key Elements of Imaging Systems

Figure 25 Airborne Imaging System Market for Imaging, Surveying, and Mapping Application Expected to Grow at the Highest CAGR During the Forecast Period

Figure 26 Airborne Imaging System Market in APAC Expected to Grow at the Highest CAGR During the Forecast Period

Figure 27 Airborne Surveillance Market for Unmanned System Expected to Grow at A Higher CAGR During the Forecast Period

Figure 28 Airborne Radar Market for Manned System Expected to Lead During the Forecast Period

Figure 29 Airborne Imaging System Market for Unmanned System Expected to Grow at A Higher CAGR During the Forecast Period

Figure 30 Manned Airborne Imaging System Market Expected to Grow at A Higher CAGR for the Commercial Application During the Forecast Period

Figure 31 Unmanned Airborne Imaging System Market Expected to Grow at A Higher CAGR for the Commercial Application During the Forecast Period

Figure 32 Data Communication in UAV

Figure 33 Key Components of Drones

Figure 34 Elements of Aerostat

Figure 35 Airborne Surveillance Market for the Commercial Application to Grow at A Higher CAGR During the Forecast Period

Figure 36 North America Expected to Lead the Airborne LiDAR Market for Commercial Application During the Forecast Period

Figure 37 Airborne Imaging System Market for Engineering, Surveying, and Mapping Application is Expected to Grow at the Highest CAGR in APAC During the Forecast Period

Figure 38 Airborne LiDAR Market for Inspection and Monitoring Application to Grow at the Highest CAGR in APAC

Figure 39 North America Expected to Dominate the Airborne Imaging System Market for Inspection and Monitoring Application During the Forecast Period

Figure 40 Market for Airborne Imaging System for Agriculture and Forestry Application in APAC is Expected to Grow at the Highest CAGR

Figure 41 Airborne Surveillance Market in China Expected to Grow at the Highest CAGR Between 2017 and 2023

Figure 42 Airborne Surveillance Market in APAC is Expected to Grow at the Highest CAGR Between 2017 and 2023

Figure 43 Airborne Surveillance Market Snapshopt in North America

Figure 44 Airborne Surveillance Market in the US to Grow at the Highest CAGR Between 2017 and 2023

Figure 45 Engineering, Surveying, and Mapping Application Expected to Dominate the Commercial Airborne LiDAR Market in North America

Figure 46 Airborne Surveillance Market Snapshot in Europe

Figure 47 Russia Expected to Dominate the Airborne Surveillance Market in Europe During 2017–2023

Figure 48 Engineering, Surveying, and Mapping Application in Europe is Expected to Grow at the Highest CAGR for Airborne LiDAR Market During the Forecast Period

Figure 49 Airborne Surveillance Market Snapshot in APAC

Figure 50 China is Expected to Dominate the Airborne Surveillance Market in APAC

Figure 51 Engineering, Surveying, and Mapping Application Expected to Lead the Commercial Airborne LiDAR Market in APAC During the Forecast Period

Figure 52 Airborne Surveillance Market in South America in RoW to Grow at A Higher CAGR During the Forecast Period

Figure 53 Organic and Inorganic Strategies Adopted By Companies Operating in the Airborne Surveillance Market

Figure 54 AirbUS: Company Snapshot

Figure 55 AirbUS: SWOT Analysis

Figure 56 BAE Systems: Company Snapshot

Figure 57 BAE Systems: SWOT Analysis

Figure 58 Boeing: Company Snapshot

Figure 59 Boeing: SWOT Analysis

Figure 60 Lockheed Martin: Company Snapshot

Figure 61 Lockheed Martin: SWOT Analysis

Figure 62 Raytheon: Company Snapshot

Figure 63 Raytheon: SWOT Analysis

Figure 64 Flir Systems: Company Snapshot

Figure 65 Israel Aerospace Industries: Company Snapshot

Figure 66 Leonardo: Company Snapshot

Figure 67 Northrop Grumman: Company Snapshot

Figure 68 Saab: Company Snapshot

Figure 69 Safran: Company Snapshot

Figure 70 Teledyne Technologies: Company Snapshot

Figure 71 Thales: Company Snapshot

The base year considered for the study is 2016, and the forecast period considered is 2017–2023. This report provides a detailed analysis of the airborne surveillance market based on type, product type, application, and region. The report forecasts the market size, in terms of value, for various segments with regard to four main regions—North America, Europe, APAC, and RoW. It strategically profiles key players and comprehensively analyzes their market rankings and core competencies, along with detailing the competitive landscape for the market leaders.

The research methodology used to estimate and forecast the airborne surveillance market begins with capturing data on key vendor revenues through secondary research. Secondary sources used for this research study include government sources, corporate filings (such as annual reports, investor presentations, and financial statements), and trade, industry news, and associations. The bottom-up procedure has been employed to arrive at the overall size of the airborne surveillance market from the revenues of key players for different types of airborne surveillance systems in the market. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have been verified through primary research by conducting extensive interviews with people holding key positions in the industry such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primary respondents has been depicted in the below figure.

To know about the assumptions considered for the study, download the pdf brochure

The airborne surveillance market comprises a network of players involved in the research and product development, raw material suppliers, manufacturers, OEMs, investors, and distributors. Players operating in the airborne surveillance market include Airbus (France), Boeing (US), Saab (Sweden), BAE Systems (UK), Raytheon (US), Lockheed Martin (US), Leonardo (Italy), FLIR Systems (US), Northrop Grumman (US), L-3 Wescam (Canada), Leica Geosystems (Switzerland), Teledyne Technologies (US), Safran (France), Thales (France), and Israel Aerospace Industries (Israel).

Key Target Audience

- Drones and UAV manufacturers

- Airborne surveillance system manufacturers and suppliers

- Research organizations and consulting companies

- Associations, alliances, and organizations related to airborne surveillance

- Analysts and strategic business planners

- End users of airborne surveillance systems across various industries such as military and commercial applications. The military segment applications are ISR and targeting, search and rescue, law enforcement, border surveillance. The commercial applications are engineering, surveying, and mapping, inspection and monitoring, agriculture and forestry, exploration, insurance, education sector, healthcare and delivery and logistics.

“This study answers several questions for the stakeholders, primarily which market segments to focus on in the next 2–5 years for prioritizing efforts and investments.”

Scope of the Report:

This research report categorizes the airborne surveillance market on the basis of type, product type, application, and region.

Airborne surveillance market by type:

- LiDAR

- Radar

- Imaging System

Airborne surveillance market by product type:

- Manned system

- Unmanned system

Airborne surveillance market by application:

-

Military, defense, and security

- ISR and targeting

- Search and rescue

- Law enforcement

- Border surveillance

-

Commercial

- Engineering, surveying, and mapping

- Inspection and monitoring

- Agriculture and forestry

- Exploration

- Insurance

- Others

Airborne surveillance market by region:

- North America

- Europe

- APAC

- RoW

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Airborne Surveillance Market

We produce hyperspectral & multispectral imaging sensors for a range of applications, including remote sensing. I would like to speak to an analyst who is working on reports focusing on this area.