Airborne Optronics Market by End Use, System, Technology (Hyperspectral, Multispectral), Application (Commercial, Military, Space), Aircraft Type (Fixed Wing, Rotary Wing, Urban Air Mobility, Unmanned Aerial Vehicles) and Region 2025

Update: 20/05/2025

Airborne Optronics Market Size & Growth

[373 Pages Report] The Global Airborne Optronics Market Size was valued at USD 1.4 Billion in 2020 and is estimated to reach USD 2.5 Billion by 2025, growing at a CAGR of 12.7% during the forecast period. The Airborne Optronics Industry is driven by various factors, such as growing fleet of commercial and combat aircraft and increased deployment of electro-optics in unmanned vehicles.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Airborne Optronics Market

The airborne optronics market includes major players Northrop Grumman Corporation (US), Thales SA (France), Safran (France), FLIR Systems, Inc. (US), and Elbit Systems Ltd. (Israel). These players have spread their business across various countries includes North America, Europe, Asia Pacific, Middle East, Africa, and Latin America. COVID-19 has impacted their businesses as well. Industry experts believe that COVID-19 could affect airborne optronics production and services by 7–10% globally in 2020.

The COVID-19 pandemic has impacted the end-use industries adversely, resulting in a sudden dip in 2020 aircraft orders and deliveries. This is expected to negatively impact the aircraft market in the short term, with slow recovery expected in Q1 of 2021.

Airborne Optronics Market Trends

Driver: Modernization and Technological Advancements

Major regions across the globe are witnessing a technological transformation and undergoing modernization. The increasing types of attacks make the use of imagery in decision-making processes crucial, which, in turn, drives the use of electro-optics technologies to better counter the increasing security threats and make the process of decision-making faster. Thus, there is a need by the armed forces to enhance their electro-optics systems enough to cope up with the security threats. Electro-optics systems are also used for non-destructive testing in the aerospace sector, and the border protection agencies use these systems to monitor an intrusion attempt. With terrorist activities are on the rise across various regions, there is a need for advanced surveillance systems and the need to prevent intrusion attempts by terrorist organizations.

Technological advancements are driving the development of highly capable electro-optics systems that can be used in several applications. Advancements in the field of imaging sensors have enabled electro-optics systems to have an increased range of surveillance and detection of targets. Thus, electro-optics systems are being preferred in a wide range of applications such as gunshot detection and surveillance due to their enhanced capabilities.

Advancements made in the field of Nanotechnology have enabled the development of smaller and more efficient electro-optics systems. These systems can be deployed on smaller platforms such as micro UAVs and other small-unmanned systems.

Opportunity: Emergence of Urban Air Mobility Platforms

The emergence of new, advanced, and autonomous alternative modes of transportation and urban air mobility platforms is expected to boost the airborne optronics market. The urban air mobility market is expected to grow from USD 2,576 million to USD 4,900 million from 2020 to 2025. The urban air mobility platforms constitute air taxis, air ambulances, and personal aerial vehicles. Each of these urban air mobility platforms serves different purposes, and hence, will be designed and manufactured accordingly. The key purpose of urban air mobility is to facilitate intracity transportation to reduce stress on the existing urban mobility solutions. Players such as Pipistrel, Bell, Hyundai Motors, Volocopter, and EHang are also planning to develop autonomous aircraft for intracity transportation. Passenger drones, post their social acceptance, would be used for intercity air transportation by 2030. These autonomous aircraft primarily focuses on the safety and security of passengers while commuting from one place to another. As a result, airborne optronics systems would be one of the crucial factors to look into for these urban air mobility platforms. The development of these newer-generation aerial platforms is fueling the need for new and advanced sensor systems that have better functionality in harsh environments. This factor is currently driving the market growth. Hence, it is expected that the emergence of urban air mobility platforms will certainly increase the demand for airborne optronics systems in the near future.

Challenge: Inefficiency in Extreme Weather Conditions

Electro-optics (EO) sensors used in airborne optronics systems are weather sensitive. In a battlefield situation/environment, there are natural conditions to visibility, such as fog and haze (smoke may be used to deliberately shield moving targets from sight during a battle).

Battlefield-induced contaminants (BIC), such as the smoke from burning targets and dust raised by bomb impacts, can also obscure the target scene, as these conditions change rapidly and are challenging to forecast accurately even with the most current weather and intelligence information. Any atmospheric interference reduces the effectiveness of optronics systems. As a result, electro-optic sensors’ sensitivity to the wavelength poses a challenge to the performance of EO/IR systems in extreme weather conditions.

Airborne Optronics Market Segments

Increasing Utilization of UAVs in the Military Sector to Provide Battlefield Intelligence Will Drive the Demand for Surveillance System Segment

The surveillance system segment is expected to be the largest market by value. The growth of the surveillance system segment of the airborne optronics market can be attributed to the increasing usage of small UAVs in the military sector along with long-range and high-altitude UAVs to provide battlefield intelligence. Small UAVs help monitor enemy forces or specific areas and send video feedback to ground stations with the help of GPS. UAVs are used for ISR operations to record information of potential targets that are otherwise challenging to detect.

The Multispectral Segment is Projected to Witness a Higher CAGR During the Forecast Period

Based on techology, the multispectral segment is projected to be the highest CAGR rate for the airborne optronics market during the forecast period. The growth of the multispectral segment of the airborne optronics market can be attributed to the low-cost multispectral imaging system which is considered to be the best fit for unmanned autonomous aircraft.

The Commercial Segment is Projected to Witness a Higher CAGR During the Forecast Period

Based on the application, the commercial segment is projected to be the highest CAGR rate for the airborne optronics market during the forecast period. This growth can be attributed to various commercial applications of airborne optronics. The use of drones is not limited to aerial imaging and surveying applications. UAVs are also integrated with artificial intelligence (AI) to carry out a range of commercial operations, including preventive maintenance, rapid emergency response, facility surveys, security, and land surveys. The demand for drone services in different verticals is also increasing, with the rise in the use of UAVs.

The Unmanned Aerial Vehicles Segment is Projected to Witness the Highest CAGR During the Forecast Period

Based on the aircraft type, the unmanned aerial vehicles segment is projected to grow at the highest CAGR rate for the airborne optronics market during the forecast period. UAVs are commonly termed drones and are mostly known for their wide usage in various military missions such as border surveillance. They are also used for mapping, surveying, and determining weather conditions of a specific area. Certain remotely piloted UAVs are designed to operate as loitering munition for defense forces. These UAVs are equipped with high-resolution cameras and electro-optics and infrared systems that help them carry out surveillance activities and identify the location of a target. Once located, the UAV is guided towards the target to destroy it.

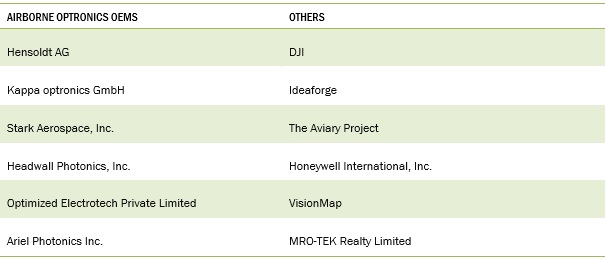

The OEM Segment is Projected to Witness the Highest CAGR During the Forecast Period

Based on the end use, the OEM segment is projected to grow at the highest CAGR rate for the airborne optronics market during the forecast period. OEMs are responsible for the installation of optronics in an aircraft during the assembly stage and are then made available for delivery to aircraft manufacturers and space agencies. Over the years, there has been a significant rise in the demand for different aircraft types across regions. According to Airbus, it delivered 863 commercial aircraft to 99 customers in 2019.

Airborne Optronics Market Regions

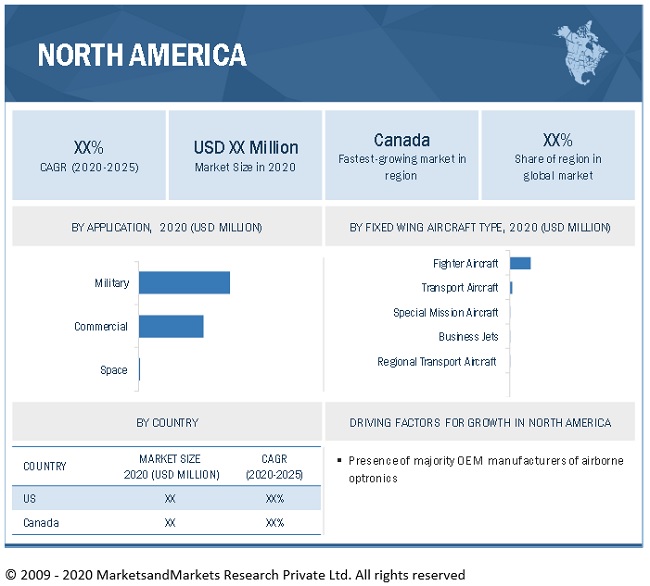

The North America Market is Projected to Contribute the Largest Share From 2020 to 2025

North America is projected to be the largest regional share for the airborne optronics market during the forecast period. The key factor responsible for North America, leading the airborne optronics market owing to the rapid growth of the technologically advanced optronics in the region. In North America, the rise in aircraft orders and supplies is encouraging manufacturers of airborne optronics to increase their sales year on year. The increasing demand for commercial aircraft and the presence of some of the leading players operating in the market, such as Northrop Grumman Corporation (US), FLIR System (US), Lockheed Martin (US), L3Harris Technologies (US), and Collins Aerospace (US), are expected to drive the airborne optronics market in North America. These players are focusing on R&D to increase their product lines and using technologically advanced systems, subsystems, and other components for manufacturing airborne optronics.

To know about the assumptions considered for the study, download the pdf brochure

Airborne Optronics Companies: Top Key Market Players

The Airborne Optronics Companies is dominated by globally established players such as:

- Northrop Grumman Corporation (US)

- Thales SA (France)

- Safran (France)

- FLIR Systems, Inc. (US)

- Elbit Systems Ltd. (Israel)

Airborne Optronics Market Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 1.4 billion |

|

Projected Market Size |

USD 2.5 billion |

|

Growth Rate (CAGR) |

CAGR of 12.7% |

|

Forecast Period |

2017–2025 |

|

On Demand Data Available |

2030 |

|

Segments Covered |

|

|

Region Covered |

|

|

Market Leaders |

|

|

Top Companies in North America |

|

|

Key Market Driver |

Modernization and Technological Advancements |

|

Key Market Opportunity |

Emergence of Urban Air Mobility Platforms |

|

Largest Growing Region |

North America |

|

Largest Market Share Segment |

Surveillance System Segment |

|

Highest CAGR Segment |

Multispectral Segment |

|

Largest Application Market Share |

Commercial Segment |

The study categorizes the airborne optronics market based on System, Technology, Application, Aircraft Type, End Use, and Region.

Airborne Optronics Market By System

- Reconnaissance system

- Targeting system

- Search and track system

- Surveillance system

- Warning/detection system

- Countermeasure system

- Navigation and guidance system

- Special mission system

By Technology

- Multispectral

- Hyperspectral

By Application

- Commercial

- Military

- Space

By Aircraft Type

- Fixed Wing

- Rotary Wing

- Urban Air Mobility

- Unmanned Aerial Vehicles

By End Use

- OEM

- Aftermarket

Airborne Optronics Market By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East

- Africa

Recent Developments in Airborne Optronics Industry

- In March 2021, Elbit Systems Ltd. announced to have received a five-year contract worth USD 300 million from a country in Asia to provide HermesTM 900 Unmanned Aircraft Systems. Under the contract, the company will provide its Hermes 900 UAS and associated sub-systems, as well as maintenance and support services.

- In February 2021, Northrop Grumman Corporation’s RQ-4D Phoenix Global Hawk enabled NATO Alliance Ground Surveillance (AGS) Force to achieve a declaration of initial operating capability (IOC) from Supreme Allied Commander Europe, giving NATO commanders the ability to perform uninterrupted in-theater operations 24/7/365.

- In Jnauary 2021, Teledyne Technologies Incorporated and FLIR Systems, Inc. jointly announced that they have entered into a definitive agreement under which Teledyne will acquire FLIR in a cash and stock transaction valued at USD 8.0 billion.

- In January 2021, HENSOLDT and Fraunhofer IOSB in Ettlingen, Germany, have entered into a cooperation agreement with the aim of developing future-proof, robust, and powerful lasers for laser-based countermeasures for self-protection systems and reconnaissance purposes.

Frequently Asked Questions (FAQ):

What Are Your Views on the Growth Prospect of the Airborne Optronics Market?

The airborne optronics market is expected to grow substantially owing to modernization and technological advancements.

What Are the Key Sustainability Strategies Adopted by Leading Players Operating in the Airborne Optronics Market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the airborne optronics market. The major players include Northrop Grumman Corporation (US), Thales SA (France), Safran (France), FLIR Systems, Inc. (US), and Elbit Systems Ltd. (Israel), these players have adopted various strategies, such as acquisitions, contracts, new product launches, and partnerships & agreements, to expand their presence in the market further.

What Are the New Emerging Technologies and Use Cases Disrupting the Airborne Optronics Market?

Some of the major emerging technologies and use cases disrupting the market include multi-sensor data fusion for navigation, camera for unmanned vehicles, and weaponized drones with electro-optics.

Who Are the Key Players and Innovators in the Ecosystem of the Airborne Optronics Market?

The key players in the airborne optronics market include Northrop Grumman Corporation (US), Thales SA (France), Safran (France), FLIR Systems, Inc. (US), and Elbit Systems Ltd. (Israel).

Which Region is Expected to Hold the Highest Market Share in the Airborne Optronics Market?

Airborne optronics market in North America is projected to hold the highest market share during the forecast period. In North America, the rise in aircraft orders and supplies is encouraging manufacturers of airborne optronics to increase their sales year on year. The increasing demand for commercial aircraft and the presence of some of the leading players operating in the market, such as Northrop Grumman Corporation (US), FLIR System (US), Lockheed Martin (US), L3Harris Technologies (US), and Collins Aerospace (US), are expected to drive the airborne optronics market in North America. These players are focusing on R&D to increase their product lines and using technologically advanced systems, subsystems, and other components for manufacturing airborne optronics.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 56)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 INCLUSIONS AND EXCLUSIONS

TABLE 1 INCLUSIONS AND EXCLUSIONS IN AIRBORNE OPTRONICS MARKET

1.5 CURRENCY & PRICING

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 60)

2.1 RESEARCH DATA

FIGURE 2 REPORT PROCESS FLOW

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET DEFINITION & SCOPE

2.2.2 SEGMENTS AND SUBSEGMENTS

2.3 RESEARCH APPROACH & METHODOLOGY

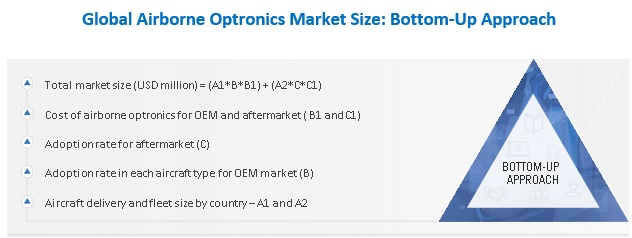

2.3.1 BOTTOM-UP APPROACH

2.3.2 MARKET FOR OEM

FIGURE 4 MARKET SIZE CALCULATION FOR OEM

2.3.3 AIRBORNE OPTRONICS AFTERMARKET

FIGURE 5 MARKET SIZE CALCULATION FOR AFTERMARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.4 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 TRIANGULATION & VALIDATION

FIGURE 8 DATA TRIANGULATION

2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.5 ASSUMPTIONS FOR THE RESEARCH STUDY

2.6 RISKS

3 EXECUTIVE SUMMARY (Page No. - 69)

FIGURE 9 SURVEILLANCE SYSTEM SEGMENT ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE OF MARKET IN 2020

FIGURE 10 MARKET, BY AIRCRAFT TYPE, 2020

FIGURE 11 OEM SEGMENT ESTIMATED TO ACCOUNT FOR A LARGER SHARE OF AIRBORNE OPTRONICS MARKET IN 2020

FIGURE 12 MARKET IN ASIA PACIFIC EXPECTED TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 72)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES

FIGURE 13 MODERNIZATION AND TECHNOLOGICAL ADVANCEMENT IN AEROSPACE INDUSTRY IS EXPECTED TO DRIVE THE MARKET FROM 2O20 TO 2025

4.2 MARKET, BY APPLICATION

FIGURE 14 MILITARY SEGMENT PROJECTED TO LEAD THE MARKET FROM 2020 TO 2025

4.3 MARKET, BY COUNTRY

FIGURE 15 MARKET IN JAPAN IS PROJECTED TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2025

5 MARKET OVERVIEW (Page No. - 74)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing fleet of commercial and combat aircraft

FIGURE 17 GLOBAL COMMERCIAL AND MILITARY AIRCRAFT DELIVERIES, 2017-2025

5.2.1.2 Modernization and technological advancements

5.2.1.3 Increased deployment of electro-optics for unmanned vehicles

5.2.2 OPPORTUNITIES

5.2.2.1 Emergence of urban air mobility platforms

5.2.2.2 Growing defense budgets of major economies

5.2.2.3 Global expansion of military air fleet

5.2.2.4 Use of UAVs in military operations

5.2.3 CHALLENGES

5.2.3.1 Inefficiency in extreme weather conditions

5.2.3.2 Impact of COVID-19

TABLE 2 COVID-19 IMPACT ON PASSENGER TRAFFIC AND REVENUE

5.3 OPERATIONAL DATA

TABLE 3 NEW COMMERCIAL AIRPLANE DELIVERIES, BY REGION, 2019-2038

TABLE 4 AIRBUS MILITARY AIRCRAFT ORDERS AND DELIVERIES, BY AIRCRAFT TYPE, 2021

5.4 RANGES AND SCENARIOS

5.5 IMPACT OF COVID-19

5.6 DISRUPTION IMPACTING CUSTOMER’S BUSINESS

5.6.1 REVENUE SHIFT AND & NEW REVENUE POCKETS

5.7 SUPPLY CHAIN ANALYSIS

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 COMPETITION IN THE INDUSTRY

5.9 TECHNOLOGY ANALYSIS

FIGURE 18 TECHNOLOGY ANALYSIS FOR AIRBORNE OPTRONICS

5.9.1 KESTREL

5.9.2 NIGHT VISION/LOW LIGHT IMAGING

5.9.3 LIDAR

5.9.4 MEASUREMENT AND SIGNATURE INTELLIGENCE (MASINT)

5.9.5 COTS CAMERA

5.10 MARKET ECOSYSTEM

5.10.1 PROMINENT COMPANIES

5.10.2 PRIVATE AND SMALL ENTERPRISES

5.10.3 END USERS

FIGURE 19 MARKET ECOSYSTEM

TABLE 6 MARKET ECOSYSTEM

5.11 CASE STUDY ANALYSIS: AIRBORNE OPTRONICS MARKET

5.11.1 TARGETING SYSTEMS

TABLE 7 COUNTRIES USING LOITERING MUNITION

5.11.2 SURVEILLANCE SYSTEMS

5.11.3 GUIDANCE & NAVIGATION SYSTEMS

5.12 TARIFF AND REGULATORY LANDSCAPE

5.12.1 LASERS

5.12.2 REMOTE SENSING EQUIPMENT

5.12.3 LIDAR TECHNOLOGY

TABLE 8 PARAMETERS OF LIDAR DATA ACQUISITION POINT SPACING

5.13 AVERAGE SELLING PRICE

TABLE 9 AVERAGE SELLING PRICE: OEM AIRBORNE OPTRONICS, BY FIXED WING AND ROTARY AIRCRAFT TYPE (USD)

TABLE 10 AVERAGE SELLING PRICE: AFTERMARKET AIRBORNE OPTRONICS, BY FIXED WING AND ROTARY WING AIRCRAFT TYPE (USD)

5.14 VOLUME DATA

TABLE 11 OEM: AIRBORNE OPTRONICS MARKET SIZE, BY FIXED WING AND ROTARY WING AIRCRAFT TYPE (UNITS)

TABLE 12 AFTERMARKET: AIRBORNE OPTRONICS MARKET SIZE, BY FIXED WING AND ROTARY WING AIRCRAFT TYPE (UNITS)

5.15 TRADE DATA ANALYSIS

TABLE 13 TRADE DATA TABLE FOR AIRBORNE OPTRONICS MARKET

6 INDUSTRY TRENDS (Page No. - 99)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

6.3 EMERGING TECHNOLOGIES

FIGURE 20 EMERGING TRENDS IN AIRBORNE OPTRONICS

6.3.1 CAMERAS FOR UNMANNED VEHICLES

6.3.2 HYPERSPECTRAL IMAGING

6.3.3 MULTISPECTRAL IMAGING

6.3.4 MULTI-SENSOR DATA FUSION FOR NAVIGATION

6.3.5 AUTONOMY LEVEL FOR UNMANNED SYSTEMS

6.3.6 WEAPONIZED DRONES WITH ELECTRO-OPTICS

TABLE 14 TYPES OF WEAPONIZED DRONES

6.4 IMPACT OF MEGATREND

6.5 INNOVATION & PATENT ANALYSIS

7 AIRBORNE OPTRONICS MARKET, BY SYSTEM (Page No. - 106)

7.1 INTRODUCTION

FIGURE 21 NAVIGATION AND GUIDANCE SYSTEM SEGMENT ESTIMATED TO LEAD THE MARKET DURING THE FORECAST PERIOD

TABLE 15 AIRBORNE OPTRONICS MARKET, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 16 AIRBORNE OPTRONICS MARKET, BY SYSTEM, 2020–2025 (USD MILLION)

7.2 RECONNAISSANCE SYSTEM

7.2.1 TECHNOLOGICAL ADVANCEMENTS IN OPTRONICS ENABLE UAVS TO CARRY-OUT RECONNAISSANCE MISSIONS

7.3 TARGETING SYSTEM

7.3.1 NEW CONTRACTS ARE BEING SECURED BY AIRBORNE TARGETING MANUFACTURERS TO PROVIDE NEW ADVANCED TARGETING SYSTEMS FOR COMBAT AIRCRAFT

7.4 SEARCH AND TRACK SYSTEM

7.4.1 SEARCH AND TRACK SYSTEM PROVIDES FIGHTER AIRCRAFT STEALTH VISION

7.5 SURVEILLANCE SYSTEM

7.5.1 UAVS ARE INCREASINGLY UTILIZED IN THE MILITARY SECTOR TO PROVIDE BATTLEFIELD INTELLIGENCE

7.6 WARNING/DETECTION SYSTEM

7.6.1 INCEASING INVESTMENTS BY ARMED FORCES FACILITATE WARNING/DETECTION

7.7 COUNTERMEASURE SYSTEM

7.7.1 REQUIREMENT FOR ADDING SELF-PROTECTION CAPABILITY TO FIGHTER AIRCRAFT DRIVES THIS SEGMENT

7.8 NAVIGATION AND GUIDANCE SYSTEM

7.8.1 NEW GUIDANCE AND NAVIGATION STANDARDS DRIVE THE DEMAND OF THESE SYSTEMS

7.9 SPECIAL MISSION SYSTEM

7.9.1 DEMAND FOR MONITORING AERIAL REFUELING DRIVES THIS SEGMENT

8 AIRBORNE OPTRONICS MARKET, BY TECHNOLOGY (Page No. - 113)

8.1 INTRODUCTION

FIGURE 22 MULTISPECTRAL TECHNOLOGY SEGMENT EXPECTED TO LEAD THE MARKET DURING THE FORECAST PERIOD

TABLE 17 AIRBORNE OPTRONICS MARKET, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 18 AIRBORNE OPTRONICS MARKET, BY TECHNOLOGY, 2020–2025 (USD MILLION)

8.2 MULTISPECTRAL

8.2.1 LOW-COST MULTISPECTRAL IMAGING SYSTEM IS CONSIDERED TO BE THE BEST FIT FOR UNMANNED AUTONOMOUS AIRCRAFT

8.3 HYPERSPECTRAL

8.3.1 HYPERSPECTRAL IMAGING IMPROVES SITUATIONAL AWARENESS WITH THE HELP OF ISR SYSTEMS

9 AIRBORNE OPTRONICS MARKET, BY APPLICATION (Page No. - 117)

9.1 INTRODUCTION

FIGURE 23 COMMERCIAL SEGMENT EXPECTED TO LEAD THE MARKET DURING FORECAST PERIOD

TABLE 19 AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 20 AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

9.2 COMMERCIAL

9.2.1 TECHNOLOGICAL ADVANCEMENTS IN DRONES TECHNOLOGY HAVE ENHANCED THEIR CAPABILITIES FOR COMMERCIAL APPLICATIONS

9.3 MILITARY

9.3.1 WIDE USE OF AIRBORNE OPTRONICS IN MILITARY APPLICATIONS DRIVE THE MARKET

9.4 SPACE

9.4.1 INCREASING USE OF ADVANCED HIGH-TECH CAMERAS FOR SPACE APPLICATIONS WILL DRIVE THIS SEGMENT

10 AIRBORNE OPTRONICS MARKET, BY AIRCRAFT TYPE (Page No. - 121)

10.1 INTRODUCTION

10.1.1 IMPACT OF COVID-19 ON AIRCRAFT TYPE SEGMENT

10.1.1.1 Most impacted segment

10.1.1.2 Least impacted segment

FIGURE 24 UNMANNED AERIAL VEHICLES SEGMENT EXPECTED TO LEAD THE MARKET DURING THE FORECAST PERIOD

TABLE 21 AIRBORNE OPTRONICS MARKET, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 22 AIRBORNE OPTRONICS MARKET, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

10.2 FIXED WING

TABLE 23 FIXED WING: AIRBORNE OPTRONICS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 24 FIXED WING: AIRBORNE OPTRONICS MARKET, BY TYPE, 2020–2025 (USD MILLION)

10.2.1 BUSINESS JETS

10.2.1.1 Increase in corporate activities across the globe fuel the demand for business jets

10.2.2 REGIONAL TRANSPORT AIRCRAFT

10.2.2.1 Increasing use of regional transport aircraft in the US and India to drive demand for this aircraft

10.2.3 FIGHTER AIRCRAFT

10.2.3.1 Growing concerns over border tensions to fuel this segment

10.2.4 TRANSPORT AIRCRAFT

10.2.4.1 Increasing use of transport aircraft in military operations drive this segment

10.2.5 SPECIAL MISSION AIRCRAFT

10.2.5.1 Growing defense spending and territorial disputes drive demand for special mission aircraft

10.3 ROTARY WING

TABLE 25 ROTARY WING: AIRBORNE OPTRONICS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 26 ROTARY WING: AIRBORNE OPTRONICS MARKET, BY TYPE, 2020–2025 (USD MILLION)

10.3.1 COMMERCIAL HELICOPTERS

10.3.1.1 Increasing usage of commercial helicopters for multiple purposes drive their demand

10.3.2 MILITARY HELICOPTERS

10.3.2.1 Technologically advanced military helicopters with next-generation sensors provide precision flight control

10.4 URBAN AIR MOBILITY

TABLE 27 URBAN AIR MOBILITY: AIRBORNE OPTRONICS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 28 URBAN AIR MOBILITY: AIRBORNE OPTRONICS MARKET, BY TYPE, 2020–2025 (USD MILLION)

10.4.1 AIR TAXI

10.4.1.1 Demand for air taxis as an alternate mode of mass transportation drive the market

TABLE 29 MAJOR DEVELOPMENT IN THE FIELD OF DRONE TAXI

10.4.2 AIR SHUTTLE AND AIR METRO

10.4.2.1 Air shuttles or metros considered to be the convenient mode of public transport

10.4.3 PERSONAL AERIAL VEHICLES

10.4.3.1 Use of personal aerial vehicles by HNIS and business tycoons drive this segment

10.4.4 CARGO AERIAL VEHICLES

10.4.4.1 Multiple applications of cargo aerial vehicles across sectors boost the demand for these vehicles

10.4.5 LAST-MILE DELIVERY VEHICLES

10.4.5.1 Demand for same-day delivery to boost the market for last-mile delivery vehicles

10.5 UNMANNED AERIAL VEHICLES

TABLE 30 UNMANNED AERIAL VEHICLES: AIRBORNE OPTRONICS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 31 UNMANNED AERIAL VEHICLES: AIRBORNE OPTRONICS MARKET, BY TYPE, 2020–2025 (USD MILLION)

10.5.1 FIXED WING UAVS

10.5.1.1 Predator and Reaper are the most used fixed wing UAVs in military applications

10.5.2 FIXED WING VTOL UAVS

10.5.2.1 Fixed wing VTOL UAVs can carry heavy payloads resulting in their growth and, thereby, optronics market

10.5.3 ROTARY WING UAVS

10.5.3.1 Rotary-wing UAVs are used for search & rescue operations, precision farming, and law enforcement

11 AIRBORNE OPTRONICS MARKET, BY END USE (Page No. - 134)

11.1 INTRODUCTION

11.1.1 IMPACT OF COVID-19 ON END USE SEGMENTS

11.1.1.1 Most impacted segment

11.1.1.2 Least impacted segment

FIGURE 25 OEM SEGMENT PROJECTED TO LEAD THE AIRBORNE OPTRONICS MARKET DURING THE FORECAST PERIOD

TABLE 32 AIRBORNE OPTRONICS MARKET, BY END USE, 2017–2019 (USD MILLION)

TABLE 33 AIRBORNE OPTRONICS MARKET, BY END USE, 2020–2025 (USD MILLION)

11.2 ORIGINAL EQUIPMENT MANUFACTURER (OEM)

11.2.1 INCREASING USE OF UAVS IN CIVIL AND COMMERCIAL APPLICATIONS DRIVE THIS SEGMENT

TABLE 34 FIXED WING: AIRBORNE OPTRONICS OEM MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 35 FIXED WING: AIRBORNE OPTRONICS OEM MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 36 ROTARY WING: AIRBORNE OPTRONICS OEM MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 37 ROTARY WING: AIRBORNE OPTRONICS OEM MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 38 URBAN AIR MOBILITY: AIRBORNE OPTRONICS OEM MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 39 URBAN AIR MOBILITY: AIRBORNE OPTRONICS OEM MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 40 UNMANNED AERIAL VEHICLE: AIRBORNE OPTRONICS OEM MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 41 UNMANNED AERIAL VEHICLE: AIRBORNE OEM OPTRONICS OEM MARKET, BY TYPE, 2020–2025 (USD MILLION)

11.3 AFTERMARKET

11.3.1 INCREASING USE OF OPTRONIC DEVICES IN MILITARY AIRCRAFT DRIVE THIS SEGMENT

TABLE 42 FIXED WING: AIRBORNE OPTRONICS AFTERMARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 43 FIXED WING: AIRBORNE OPTRONICS AFTERMARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 44 ROTARY WING: AIRBORNE OPTRONICS AFTERMARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 45 ROTARY WING: AIRBORNE OPTRONICS AFTERMARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 46 UNMANNED AERIAL VEHICLES: AIRBORNE OPTRONICS AFTERMARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 47 UNMANNED AERIAL VEHICLES: AIRBORNE OEM OPTRONICS AFTERMARKET, BY TYPE, 2020–2025 (USD MILLION)

12 REGIONAL ANALYSIS (Page No. - 142)

12.1 INTRODUCTION

FIGURE 26 AIRBORNE OPTRONICS MARKET: REGIONAL SNAPSHOT

12.2 IMPACT OF COVID-19 ON AIRBORNE OPTRONICS MARKET

FIGURE 27 IMPACT OF COVID-19 ON AIRBORNE OPTRONICS MARKET

TABLE 48 AIRBORNE OPTRONICS MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 49 AIRBORNE OPTRONICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 50 AIRBORNE OPTRONICS OEM MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 51 AIRBORNE OPTRONICS OEM MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 52 AIRBORNE OPTRONICS AFTERMARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 53 AIRBORNE OPTRONICS AFTERMARKET, BY REGION, 2020–2025 (USD MILLION)

12.3 NORTH AMERICA

FIGURE 28 NORTH AMERICA AIRBORNE OPTRONICS MARKET SNAPSHOT

12.3.1 PESTLE ANALYSIS: NORTH AMERICA

TABLE 54 NORTH AMERICA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 55 NORTH AMERICA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 56 NORTH AMERICA: AIRBORNE OPTRONICS MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 57 NORTH AMERICA: AIRBORNE OPTRONICS MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

12.3.2 OEM MARKET

TABLE 58 NORTH AMERICA: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 59 NORTH AMERICA: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 60 NORTH AMERICA: AIRBORNE OPTRONICS OEM MARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 61 NORTH AMERICA: AIRBORNE OPTRONICS OEM MARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 62 NORTH AMERICA: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 63 NORTH AMERICA: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 64 NORTH AMERICA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 65 NORTH AMERICA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.3.3 AFTERMARKET

TABLE 66 NORTH AMERICA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 67 NORTH AMERICA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 68 NORTH AMERICA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 69 NORTH AMERICA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 70 NORTH AMERICA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 71 NORTH AMERICA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.3.4 US

12.3.4.1 Presence of leading OEMs manufacturers drive the market

TABLE 72 US: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 73 US: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.3.4.2 OEM market

TABLE 74 US: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 75 US: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 76 US: AIRBORNE OPTRONICS OEM MARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 77 US: AIRBORNE OPTRONICS OEM MARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 78 US: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 79 US: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 80 US: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 81 US: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.3.4.3 Aftermarket

TABLE 82 US: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 83 US: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 84 US: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 85 US: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 86 US: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 87 US: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.3.5 CANADA

12.3.5.1 Aircraft modernization programs expected to drive the market

TABLE 88 CANADA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 89 CANADA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.3.5.2 OEM market

TABLE 90 CANADA: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 91 CANADA: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 92 CANADA: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 93 CANADA: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 94 CANADA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 95 CANADA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.3.5.3 Aftermarket

TABLE 96 CANADA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 97 CANADA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 98 CANADA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 99 CANADA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 100 CANADA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 101 CANADA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.4 EUROPE

FIGURE 29 EUROPE AIRBORNE OPTRONICS MARKET SNAPSHOT

12.4.1 PESTLE ANALYSIS: EUROPE

TABLE 102 EUROPE: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 103 EUROPE: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 104 EUROPE: AIRBORNE OPTRONICS MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 105 EUROPE: AIRBORNE OPTRONICS OEM MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

12.4.2 OEM MARKET

TABLE 106 EUROPE: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 107 EUROPE: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 108 EUROPE: AIRBORNE OPTRONICS OEM MARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 109 EUROPE: AIRBORNE OPTRONICS OEM MARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 110 EUROPE: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 111 EUROPE: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 112 EUROPE: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 113 EUROPE: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.4.3 AFTERMARKET

TABLE 114 EUROPE: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 115 EUROPE: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 116 EUROPE: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 117 EUROPE: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 118 EUROPE: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 119 EUROPE: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.4.4 UK

12.4.4.1 Technological advancements and changed regulatory policies for unmanned aerial vehicles expected to drive the market in the UK

TABLE 120 UK: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 121 UK: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.4.4.2 OEM market

TABLE 122 UK: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 123 UK: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 124 UK: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 125 UK: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 126 UK: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 127 UK: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.4.4.3 Aftermarket

TABLE 128 UK: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 129 UK: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 130 UK: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 131 UK: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 132 UK: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 133 UK: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.4.5 FRANCE

12.4.5.1 Heavy investments in the aerospace sector expected to drive the market

TABLE 134 FRANCE: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 135 FRANCE: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.4.5.2 OEM market

TABLE 136 FRANCE: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 137 FRANCE: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 138 FRANCE: AIRBORNE OPTRONICS OEM MARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 139 FRANCE: AIRBORNE OPTRONICS OEM MARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 140 FRANCE: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 141 FRANCE: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 142 FRANCE: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 143 FRANCE: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.4.5.3 Aftermarket

TABLE 144 FRANCE: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 145 FRANCE: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 146 FRANCE: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 147 FRANCE: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 148 FRANCE: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 149 FRANCE: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.4.6 GERMANY

12.4.6.1 Growing investments in air travel and connectivity to drive the market

TABLE 150 GERMANY: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 151 GERMANY: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.4.6.2 OEM market

TABLE 152 GERMANY: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 153 GERMANY: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 154 GERMANY: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 155 GERMANY: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.4.6.3 Aftermarket

TABLE 156 GERMANY: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 157 GERMANY: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 158 GERMANY: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 159 GERMANY: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 160 GERMANY: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 161 GERMANY: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.4.7 ITALY

12.4.7.1 Rising demand for UASs for border surveillance and intelligence gathering is expected to drive market in Italy

TABLE 162 ITALY: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 163 ITALY: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.4.7.2 OEM market

TABLE 164 ITALY: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 165 ITALY: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 166 ITALY: AIRBORNE OPTRONICS OEM MARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 167 ITALY: AIRBORNE OPTRONICS OEM MARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 168 ITALY: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 169 ITALY: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.4.7.3 Aftermarket

TABLE 170 ITALY: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 171 ITALY: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 172 ITALY: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 173 ITALY: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 174 ITALY: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 175 ITALY: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.4.8 RUSSIA

12.4.8.1 Increased spending on procurement of technologically advanced combat drones by Russian armed forces drive the market

TABLE 176 RUSSIA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 177 RUSSIA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.4.8.2 OEM market

TABLE 178 RUSSIA: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 179 RUSSIA: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 180 RUSSIA: AIRBORNE OPTRONICS OEM MARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 181 RUSSIA: AIRBORNE OPTRONICS OEM MARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 182 RUSSIA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 183 RUSSIA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.4.8.3 Aftermarket

TABLE 184 RUSSIA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 185 RUSSIA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 186 RUSSIA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 187 RUSSIA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 188 RUSSIA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 189 RUSSIA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.4.9 REST OF EUROPE

12.4.9.1 Emergence of urban air mobility expected to drive the market

TABLE 190 REST OF EUROPE: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 191 REST OF EUROPE: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.4.9.2 OEM market

TABLE 192 REST OF EUROPE: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 193 REST OF EUROPE: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 194 REST OF EUROPE: AIRBORNE OPTRONICS OEM MARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 195 REST OF EUROPE: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 196 REST OF EUROPE: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 197 REST OF EUROPE: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 198 REST OF EUROPE: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.4.9.3 Aftermarket

TABLE 199 REST OF EUROPE: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 200 REST OF EUROPE: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 201 REST OF EUROPE: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 202 REST OF EUROPE: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 203 REST OF EUROPE: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 204 REST OF EUROPE: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.5 ASIA PACIFIC

FIGURE 30 ASIA PACIFIC AIRBORNE OPTRONICS MARKET SNAPSHOT

12.5.1 PESTLE ANALYSIS: ASIA PACIFIC

TABLE 205 ASIA PACIFIC: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 206 ASIA PACIFIC: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 207 ASIA PACIFIC: AIRBORNE OPTRONICS MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 208 ASIA PACIFIC: AIRBORNE OPTRONICS OEM MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

12.5.2 OEM MARKET

TABLE 209 ASIA PACIFIC: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 210 ASIA PACIFIC: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 211 ASIA PACIFIC: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 212 ASIA PACIFIC: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 213 ASIA PACIFIC: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 214 ASIA PACIFIC: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.5.3 AFTERMARKET

TABLE 215 ASIA PACIFIC: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 216 ASIA PACIFIC: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 217 ASIA PACIFIC: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 218 ASIA PACIFIC: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 219 ASIA PACIFIC: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 220 ASIA PACIFIC: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.5.4 CHINA

12.5.4.1 Growing demand for military uavs expected to drive the market

TABLE 221 CHINA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 222 CHINA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.5.4.2 OEM market

TABLE 223 CHINA: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 224 CHINA: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 225 CHINA: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 226 CHINA: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 227 CHINA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 228 CHINA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.5.4.3 Aftermarket

TABLE 229 CHINA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 230 CHINA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 231 CHINA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 232 CHINA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 233 CHINA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 234 CHINA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.5.5 JAPAN

12.5.5.1 Urban air mobility to attain key sustainable development which will drive the market

TABLE 235 JAPAN: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 236 JAPAN: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.5.5.2 OEM market

TABLE 237 JAPAN: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 238 JAPAN: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 239 JAPAN: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 240 JAPAN: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.5.5.3 Aftermarket

TABLE 241 JAPAN: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 242 JAPAN: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 243 JAPAN: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 244 JAPAN: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 245 JAPAN: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 246 JAPAN: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.5.6 INDIA

12.5.6.1 Five-year modernization plan for its armed forces is driving the market in India

FIGURE 31 INDIA DEFENSE BUDGET, 2010–2019

TABLE 247 INDIA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 248 INDIA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.5.6.2 OEM market

TABLE 249 INDIA: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 250 INDIA: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 251 INDIA: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 252 INDIA: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 253 INDIA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 254 INDIA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.5.6.3 Aftermarket

TABLE 255 INDIA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 256 INDIA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 257 INDIA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 258 INDIA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 259 INDIA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 260 INDIA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLE, BY TYPE, 2020–2025 (USD MILLION)

12.5.7 AUSTRALIA

12.5.7.1 Growing use of uavs for commercial applications such as the delivery of food products and medical supplies drive the market

TABLE 261 AUSTRALIA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 262 AUSTRALIA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.5.7.2 OEM market

TABLE 263 AUSTRALIA: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 264 AUSTRALIA: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 265 AUSTRALIA: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 266 AUSTRALIA : AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 267 AUSTRALIA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 268 AUSTRALIA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.5.7.3 Aftermarket

TABLE 269 AUSTRALIA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 270 AUSTRALIA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 271 AUSTRALIA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 272 AUSTRALIA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 273 AUSTRALIA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 274 AUSTRALIA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.5.8 SOUTH KOREA

12.5.8.1 Expected launch of urban air mobility services by 2025 to drive the market

TABLE 275 SOUTH KOREA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 276 SOUTH KOREA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.5.8.2 OEM market

TABLE 277 SOUTH KOREA: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 278 SOUTH KOREA: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 279 SOUTH KOREA: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 280 SOUTH KOREA: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 281 SOUTH KOREA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 282 SOUTH KOREA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.5.8.3 Aftermarket

TABLE 283 SOUTH KOREA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 284 SOUTH KOREA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 285 SOUTH KOREA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 286 SOUTH KOREA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 287 SOUTH KOREA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 288 SOUTH KOREA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.5.9 REST OF ASIA PACIFIC

12.5.9.1 Focusing on urban air mobility to drive the market

TABLE 289 REST OF ASIA PACIFIC: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 290 REST OF ASIA PACIFIC: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.5.9.2 OEM market

TABLE 291 REST OF ASIA PACIFIC: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 292 REST OF ASIA PACIFIC: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 293 REST OF ASIA PACIFIC: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 294 REST OF ASIA PACIFIC: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.5.9.3 Aftermarket

TABLE 295 REST OF ASIA PACIFIC: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 296 REST OF ASIA PACIFIC: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 297 REST OF ASIA PACIFIC: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 298 REST OF ASIA PACIFIC: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 299 REST OF ASIA PACIFIC: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 300 REST OF ASIA PACIFIC: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.6 MIDDLE EAST

12.6.1 PESTLE ANALYSIS: MIDDLE EAST

TABLE 301 MIDDLE EAST: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 302 MIDDLE EAST: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 303 MIDDLE EAST: AIRBORNE OPTRONICS MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 304 MIDDLE EAST: AIRBORNE OPTRONICS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

12.6.2 OEM MARKET

TABLE 305 MIDDLE EAST: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 306 MIDDLE EAST: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 307 MIDDLE EAST: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 308 MIDDLE EAST: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 309 MIDDLE EAST: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 310 MIDDLE EAST: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.6.3 AFTERMARKET

TABLE 311 MIDDLE EAST: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 312 MIDDLE EAST: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 313 MIDDLE EAST: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 314 MIDDLE EAST: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 315 MIDDLE EAST: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 316 MIDDLE EAST: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.6.4 ISRAEL

12.6.4.1 Increased spending in R&D of uavs drives the market in Israel

TABLE 317 ISRAEL: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 318 ISRAEL: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.6.4.2 OEM market

TABLE 319 ISRAEL: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 320 ISRAEL: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 321 ISRAEL: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 322 ISRAEL: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 323 ISRAEL: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 324 ISRAEL: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.6.4.3 Aftermarket

TABLE 325 ISRAEL: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 326 ISRAEL: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 327 ISRAEL: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 328 ISRAEL: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 329 ISRAEL: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 330 ISRAEL: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.6.5 UAE

12.6.5.1 Increasing procurement of unmanned vehicles for military and law enforcement applications drives the market in the UAE

TABLE 331 UAE: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 332 UAE: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.6.5.2 OEM market

TABLE 333 UAE: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 334 UAE: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 335 UAE: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 336 UAE: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.6.5.3 Aftermarket

TABLE 337 UAE: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 338 UAE: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 339 UAE: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING, BY TYPE, 2017–2019 (USD MILLION)

TABLE 340 UAE: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 341 UAE: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 342 UAE: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.6.6 SAUDI ARABIA

12.6.6.1 Multi-billion contracts with the US drive the airborne optronics market in Saudi Arabia

FIGURE 32 SAUDI ARABIA DEFENSE BUDGET, 2010–2019

TABLE 343 SAUDI ARABIA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 344 SAUDI ARABIA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.6.6.2 OEM market

TABLE 345 SAUDI ARABIA: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 346 SAUDI ARABIA: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 347 SAUDI ARABIA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 348 SAUDI ARABIA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.6.6.3 Aftermarket

TABLE 349 SAUDI ARABIA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 350 SAUDI ARABIA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 351 SAUDI ARABIA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 352 SAUDI ARABIA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING, BY TYPE, 2020–2025 (USD MILLION)

TABLE 353 SAUDI ARABIA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 354 SAUDI ARABIA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.6.7 TURKEY

12.6.7.1 Substantial rise in military spending and development of uavs expected to boost the market

TABLE 355 TURKEY: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 356 TURKEY: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.6.7.2 OEM market

TABLE 357 TURKEY: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 358 TURKEY: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 359 TURKEY: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 360 TURKEY: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 361 TURKEY: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 362 TURKEY: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.6.7.3 Aftermarket

TABLE 363 TURKEY: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 364 TURKEY: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 365 TURKEY: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 366 TURKEY: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 367 TURKEY: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 368 TURKEY: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.6.8 REST OF MIDDLE EAST

12.6.8.1 Increase in the use of armed drones expected to boost the market

TABLE 369 REST OF MIDDLE EAST: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 370 REST OF MIDDLE EAST: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.6.8.2 OEM market

TABLE 371 REST OF MIDDLE EAST: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 372 REST OF MIDDLE EAST: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.6.8.3 Aftermarket

TABLE 373 REST OF MIDDLE EAST: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 374 REST OF MIDDLE EAST: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 375 REST OF MIDDLE EAST: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 376 REST OF MIDDLE EAST: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 377 REST OF MIDDLE EAST: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 378 REST OF MIDDLE EAST: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.7 LATIN AMERICA

12.7.1 PESTLE ANALYSIS

TABLE 379 LATIN AMERICA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 380 LATIN AMERICA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 381 AIRBORNE OPTRONICS MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 382 AIRBORNE OPTRONICS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

12.7.2 OEM MARKET

TABLE 383 LATIN AMERICA: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 384 LATIN AMERICA: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 385 LATIN AMERICA: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 386 LATIN AMERICA: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 387 LATIN AMERICA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 388 LATIN AMERICA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.7.3 AFTERMARKET

TABLE 389 LATIN AMERICA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 390 LATIN AMERICA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 391 LATIN AMERICA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 392 LATIN AMERICA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 393 LATIN AMERICA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 394 LATIN AMERICA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.7.4 BRAZIL

12.7.4.1 Rising use of uavs by the police force to monitor drug trafficking and smuggling drives the market

TABLE 395 BRAZIL: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 396 BRAZIL: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.7.4.2 OEM market

TABLE 397 BRAZIL: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 398 BRAZIL: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 399 BRAZIL: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 400 BRAZIL: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 401 BRAZIL: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 402 BRAZIL: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.7.4.3 Aftermarket

TABLE 403 BRAZIL: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 404 BRAZIL: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 405 BRAZIL: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 406 BRAZIL: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 407 BRAZIL: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 408 BRAZIL: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.7.5 MEXICO

12.7.5.1 Rising use of uavs by the Mexican government to fight organized crimes and carry out surveillance activities drives market

TABLE 409 MEXICO: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 410 MEXICO: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.7.5.2 OEM market

TABLE 411 MEXICO: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 412 MEXICO: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 413 MEXICO: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 414 MEXICO: AIRBORNE OPTRONICS OEM MARKET IN URBAN AIR MOBILITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 415 MEXICO: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 416 MEXICO: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.7.5.3 Aftermarket

TABLE 417 MEXICO: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 418 MEXICO: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 419 MEXICO: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 420 MEXICO: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 421 MEXICO: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 422 MEXICO: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.7.6 REST OF LATIN AMERICA

12.7.6.1 Rising demand for drones for pipeline inspections drives the market

TABLE 423 REST OF LATIN AMERICA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 424 REST OF LATIN AMERICA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.7.6.2 OEM market

TABLE 425 REST OF LATIN AMERICA: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 426 REST OF LATIN AMERICA: AIRBORNE OPTRONICS OEM MARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 427 REST OF LATIN AMERICA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 428 REST OF LATIN AMERICA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.7.6.3 Aftermarket

TABLE 429 REST OF LATIN AMERICA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 430 REST OF LATIN AMERICA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 431 REST OF LATIN AMERICA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 432 REST OF LATIN AMERICA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 433 REST OF LATIN AMERICA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 434 REST OF LATIN AMERICA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.8 AFRICA

12.8.1 PESTLE ANALYSIS

TABLE 435 AFRICA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 436 AFRICA: AIRBORNE OPTRONICS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.8.2 OEM MARKET

TABLE 437 AFRICA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 438 AFRICA: AIRBORNE OPTRONICS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

12.8.3 AFTERMARKET

TABLE 439 AFRICA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 440 AFRICA: AIRBORNE OPTRONICS AFTERMARKET IN FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 441 AFRICA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 442 AFRICA: AIRBORNE OPTRONICS AFTERMARKET IN ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 443 AFRICA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 444 AFRICA: AIRBORNE OPTRONICS AFTERMARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2020–2025 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 282)

13.1 INTRODUCTION

13.2 MARKET SHARE ANALYSIS, 2019

TABLE 445 DEGREE OF COMPETITION

FIGURE 33 MARKET SHARE OF TOP PLAYERS IN AIRBORNE OPTRONICS MARKET, 2019

13.3 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2019

13.4 COMPETITIVE SCENARIO

FIGURE 34 COMPANIES ADOPTED NEW PRODUCT LAUNCHES AS THE KEY GROWTH STRATEGY FROM 2017 TO 2021

13.4.1 COMPETITIVE LEADERSHIP MAPPING

13.4.1.1 Star

13.4.1.2 Emerging leader

13.4.1.3 Pervasive

13.4.1.4 Participant

FIGURE 35 AIRBORNE OPTRONICS MARKET COMPETITIVE LEADERSHIP MAPPING, 2019

TABLE 446 COMPANY PRODUCT FOOTPRINT