Agricultural Pumps Market by Type (Rotodynamic Pumps, Positive Displacement Pumps), Power Source (Electricity-grid Connection, Diesel/Petrol, Solar), HP, End-Use (Irrigation, Livestock Watering), and Region Global Forecast to 2025

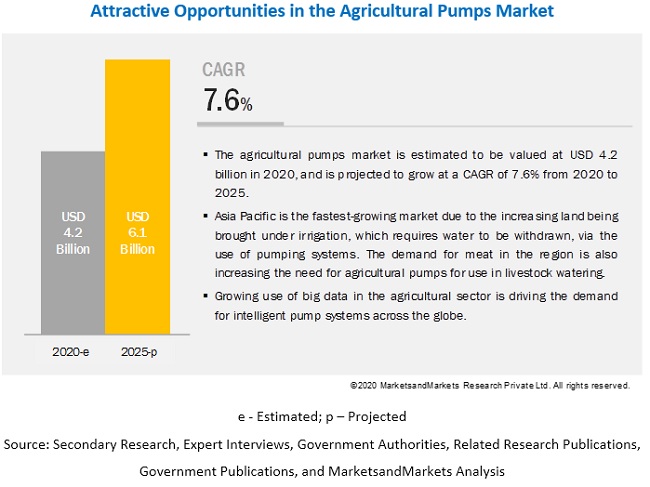

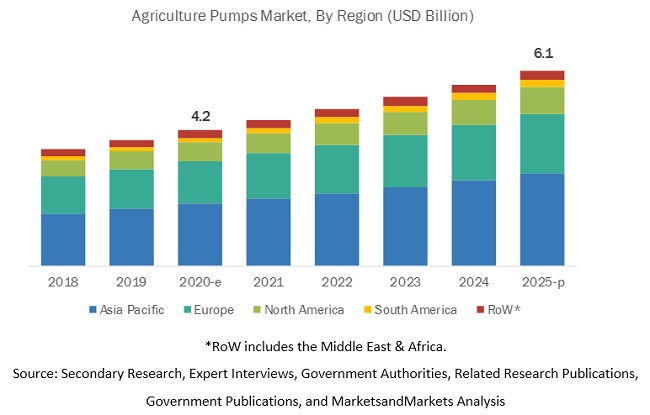

[167 Pages Report] The global agricultural pumps market size is estimated to grow from USD 4.2 billion in 2020 and is projected to reach USD 6.1 billion by 2025, at a CAGR of 7.6% during the forecast. The increasing adoption of modern techniques of irrigation in developing countries, the advent of big data in agricultural farms, and the increase in government support toward the adoption of modern agricultural equipment are some of the factors driving the growth of the market.

The rotodynamic segment of the market is projected to account for the largest share, by type

The rotodynamic segment, by type, is estimated to witness a higher demand. Increasing the adoption of modern techniques for irrigation in developing countries is leading to increased demand for rotodynamic pumps.

The market for agricultural pumps in the range of 4-15 hp is projected to account for the largest share during the forecast period

Based on hp, the market has been classified into 0.5 -3, 4-15, 16-30, 31-40, and > 40. The demand for pumps in the range of 4-15 hp is the highest due to their growing adoption in small and medium-sized landholdings. They are used to withdraw water from sources, such as reservoirs and lakes.

The availability of subsidy for solar pumps driving the growth of the market

Solar pumps are being provided at subsidized rates to the farmers across countries in China, India, and the Middle East. Due to this, the market for solar pumps would be growing at the fastest rate during the forecast period.

The rising demand from the irrigation sector to drive the agriculture pumps market

By end-use, the market is segmented into irrigation and livestock watering. The agricultural sector makes use of pumps, majorly for application in irrigation. With the growing area being brought under irrigation, the market for pumps for use in irrigation is growing. With the meat consumption growth across the regions, the need for agriculture pumps in the livestock watering sector is also growing.

Asia Pacific accounted for the largest share of the global agricultural pumps market

Asia Pacific accounted for the largest share in the global agricultural pump industry due to the increasing land being brought under irrigation. The agricultural ministries of countries such as China and India are providing subsidies for solar and electric pumps, which is also one of the factors that are driving the growth of the market.

Key Market Players

Key participants in the global market include Grundfos (Denmark), Xylem Inc (US), KSB SE & Co. (Germany), Flowserve Corporation (US), Lindsay Corporation (US), Valmont Industries (US), and Jain Irrigation Systems (India). These companies are focused on strategies such as acquisitions and new product launches to cater to the growing demand for intelligent pump systems in the agricultural sector. The market for agricultural pumps for the study has been segmented by type, end-use, hp, and power source.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Million), Volume (Units) |

|

Segments covered |

Type, Power Source, hp, End-use |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, RoW |

|

Companies covered |

Xylem Inc.(US), Grundfos (Denmark), Shakti Pumps Ltd (India), Valmont Industries (US), Jain Irrigation Systems (India), Lindsay Corporation (US), Shimge Pump Industry Group (China), Franklin Electric (US), Zhejiang Doyin Pump industry Co. Ltd (China), Mahindra EPC Ltd (India), Leo Group Pumps (China), CNP Pumps India Pvt Ltd (India), Flowserve (US), KSB SE (Germany), WILO (Germany), Mono Pumps (US), Texmo Pumps (India), National Pump Company (US), Weir Pumps (England), and Pentair Pumps (England), |

This research report categorizes the agricultural pumps market based on type, power source, end-use, hp, and region.

By Type:

- Rotodynamic pumps

- Centrifugal pumps

- Axial flow

- Mixed flow

- Positive displacement pumps

- Rotary pumps

- Reciprocating pumps

By Power Source:

- Electricity grid-connection

- Diesel/Petrol

- Solar

By End-use:

- Irrigation

- Livestock watering

By HP:

- 0.5-3

- 4-15

- 16-30

- 31-40

- >40

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of World (RoW) (Includes Africa and the Middle East)

Recent Developments

- In January 2020, Franklin Electric acquired Valley Farms Supply, Inc. (Lansing, Michigan) for USD 9.0 million. Valley Farms is a professional groundwater distributor operating three locations in the State of Michigan and one in the State of Indiana. Valley Farms has approximately USD 28.0 million of consolidated annual sales.

- In November 2019, WILO USA LLC, a subsidiary of WILO SE, through its newly-established subsidiary, American-Marsh Pumps LLC, acquired the assets of US manufacturer J-Line Pump Co. d/b/a American-Marsh Pumps. The acquisition of American-Marsh Pumps strengthens its footprint in the US and expands the product portfolio for its customers in the Water Management, Industry, and Building Services segments.

- In February 2018, Lindsay Corporation announced the launch of a new version of its FieldNET application, which is designed to fully automate farm functions, including pumps, motors, and emitters.

- In May 2017, KSB launched a new horizontal version of its compact high-pressure Movitec centrifugal pumps. The company offers new horizontal pumps in five different sizes with different numbers of stages. These new pumps deliver the maximum flow rate of 26 m3/hr and the maximum discharge head of 195 meters.

Key Questions Addressed by the Report

- What are the growth opportunities in the agricultural pumps market?

- What are the major and new product launches in the agricultural pumps market?

- What are the significant trends that are disrupting the agricultural pumps market?

- What are some of the major regulatory challenges and restraints that the industry faces?

- Which region is projected to emerge as a global leader by 2025?

Frequently Asked Questions (FAQ):

Who are the key players in the agricultural pumps market?

Some of the major players in the market include Grundfos (Denmark), Xylem Inc (US), KSB SE & Co. (Germany), Flowserve Corporation (US), Lindsay Corporation (US), Valmont Industries (US), and Jain Irrigation Systems (India). These companies are focused on strategies such as acquisitions and new product launches to cater to the growing demand for intelligent pump systems in the agricultural sector.

What are the major drivers for agricultural pumps market?

Some of the major factors driving the growth of the agricultural pumps market include government support towards the adoption of modern agricultural equipment and increased mechanization of agricultural activities across the globe

What type of power source is preferred among the farmers in the agricultural pumps market?

Electricity-grid connected source holds the largest market share in the agricultural pumps market and is majorly preferred and recommended for use in regions, such as North America, Asia Pacific, and Europe, which are major consumers of agricultural pumps. Compared to diesel/petrol, which is costly, electricity-grid connected are comparatively cheaper. Electric pumps have lower running costs and are highly efficient due to which it is preferred by the farmers. Farmers in the Asia Pacific region receive subsidies for the use of electric pumps

Which region is expected to witness a significant demand during the forecast period?

Asia Pacific accounted for the largest market share in the agricultural pumps in the market due to the increasing land being brought under irrigation. The agricultural ministries of countries such as China and India are providing subsidies for solar and electric pumps, which is also one of the factors that are driving the growth of the market

Which type of pump is preferred in the agricultural sector?

Centrifugal pumps experience maximum demand in the market due to its high efficiency over a wide range of operating conditions, ease of installation, and cost. Vertical centrifugal pumps that are submerged do not require priming, which is also advantageous. The maintenance cost associated with centrifugal pumps is lesser than that of their counterparts used in the agricultural sector.

What is the impact of COVID-19 on the agricultural pumps market?

Many agricultural machinery companies are unable to complete the production of these machines and proceed with registration and provide service at the set timelines. Efforts are being made by the European Agricultural Machinery Industry Association to look at the timely availability of the agricultural equipment ordered by farmers. This could have an impact on the overall sales of agricultural pumps in the latter half of 2020. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 UNITS

1.7 STAKEHOLDERS

1.8 INCLUSIONS & EXCLUSIONS

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 32)

4 PREMIUM INSIGHTS (Page No. - 36)

4.1 OPPORTUNITIES IN THE GLOBAL MARKET

4.2 MARKET, BY POWER SOURCE

4.3 ASIA PACIFIC: AGRICULTURAL PUMPS MARKET, BY TYPE & KEY COUNTRIES

4.4 AGRICULTURAL PUMPS, BY HP & REGION

4.5 MARKET, BY END-USE

4.6 MARKET, BY COUNTRY

5 MARKET OVERVIEW (Page No. - 39)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 INCREASE IN DEMAND FOR ARABLE LAND

5.2.2 DISTRIBUTION & AVAILABILITY OF WATER

5.2.3 INCREASING AREA UNDER IRRIGATION

5.3 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Government support for the adoption of modern agricultural equipment

5.3.1.2 Increased mechanization of agricultural activities at a global scale

5.3.2 RESTRAINTS

5.3.2.1 High costs associated with the installation and maintenance of pump systems

5.3.2.2 Operation of large pumps in fragmented land holdings

5.3.3 OPPORTUNITIES

5.3.3.1 Increasing adoption of modern techniques for irrigation in developing countries leading to increased demand for rotodynamic pumps

5.3.4 ADVENT OF BIG DATA IN AGRICULTURAL FARMS

5.3.5 INTEGRATION OF SMARTPHONES WITH HARDWARE DEVICES AND SOFTWARE APPLICATIONS

5.3.6 CHALLENGES

5.3.6.1 Degradation of equipment

5.4 VALUE-CHAIN ANALYSIS

5.4.1 RAW MATERIALS

5.4.2 RESEARCH AND DEVELOPMENT

5.4.3 MANUFACTURING

5.4.4 DISTRIBUTION, MARKETING & SALES, END-USERS

5.5 TECHNOLOGY ANALYSIS

5.6 MARKET ECOSYSTEM

6 AGRICULTURE PUMPS, BY TYPE (Page No. - 51)

6.1 INTRODUCTION

6.2 ROTODYNAMIC PUMPS

6.3 CENTRIFUGAL

6.3.1 THE GROWING DEMAND FROM THE IRRIGATION AND LIVESTOCK WATERING SECTORS IS DRIVING THE MARKET DEMAND

6.4 MIXED FLOW

6.5 AXIAL FLOW

6.6 POSITIVE DISPLACEMENT

6.6.1 CHARACTERISTICS SUCH AS BETTER CONTROL AND HIGHER EFFICIENCY FUELING THE MARKET DEMAND

6.7 RECIPROCATING

6.8 ROTARY

7 AGRICULTURE PUMPS, BY POWER SOURCE (Page No. - 59)

7.1 INTRODUCTION

7.2 ELECTRICITY GRID-CONNECTION

7.2.1 FACTORS SUCH AS LOWER MAINTENANCE, GREATER POTENTIAL, AND REMOTE ACCESS ARE FUELING THE DEMAND FOR ELECTRIC SOURCE

7.3 DIESEL/PETROL

7.3.1 RISING DEMAND FOR WATER-INTENSIVE MANUFACTURING IS BOOSTING THE DEMAND FOR FUEL-BASED PUMPS

7.4 SOLAR

7.4.1 SOLAR ENERGY PUMPS ARE RELIABLE AND COST-EFFECTIVE AND ARE RAISING THE LEVELS OF AGRICULTURAL PRODUCTIVITY

8 AGRICULTURE PUMPS, BY HORSEPOWER (Page No. - 65)

8.1 INTRODUCTION

8.2 0.5 TO 3

8.3 4 TO 15

8.4 16 TO 30

8.5 31 TO 40

8.6 >40 HP

9 AGRICULTURE PUMPS MARKET, BY END-USE (Page No. - 69)

9.1 INTRODUCTION

9.2 IRRIGATION

9.3 LIVESTOCK WATERING

10 AGRICULTURE PUMPS, BY REGION (Page No. - 73)

10.1 INTRODUCTION

10.2 ASIA PACIFIC

10.2.1 CHINA

10.2.1.1 The population of China heavily relies on agriculture, and this has persuaded the Chinese government to adopt advanced technologies & machinery boosting the demand for agriculture pumps in the country

10.2.2 INDIA

10.2.2.1 With the rising demand for food in the region, the demand for agriculture pumps is projected to rise during the forecast period

10.2.3 JAPAN

10.2.3.1 Being highly industrialized, Japans agriculture pump industry is also quite developed

10.2.4 AUSTRALIA

10.2.4.1 Around 4% of the countrys GDP is derived from agriculture, which contributes toward the rising demand for agriculture pumps in the country

10.2.5 SOUTH KOREA

10.2.5.1 The government in the region has been focusing on the development of the agriculture sector by emphasizing on commercialization, specialization, and mechanization

10.2.6 REST OF ASIA PACIFIC

10.3 EUROPE

10.3.1 SPAIN

10.3.1.1 Most of the territory experience a dry climate leading to a shortage of rainfall, fuelling the demand for pumps for irrigation and livestock watering

10.3.2 FRANCE

10.3.2.1 The improved government support, and increased interest in improving agricultural productivity, are boosting the demand for agricultural pumps

10.3.3 GERMANY

10.3.3.1 Irrigational quality enhancement, high irrigation efficiency, variety of equipment, no high maintenance, and low-cost driving the demand

10.3.4 UK

10.3.4.1 Rising adoption of smart pumps and the emergence of renewable energy submersible pumps boosting market growth

10.3.5 ITALY

10.3.5.1 Increasing agricultural activities, coupled with livestock water, supply expected to expand market penetration

10.3.6 RUSSIA

10.3.6.1 Strong government support spurred business development in the farming to fuel the market demand

10.3.7 REST OF EUROPE

10.4 NORTH AMERICA

10.4.1 US

10.4.1.1 Modernization of water supply and waste treatment plants are fueling the demand for agriculture pumps in the region

10.4.2 CANADA

10.4.2.1 Canada is the largest export market for US agricultural equipment, with exports totaling USD 2.6 billion in 2017

10.4.3 MEXICO

10.4.3.1 Growing agribusiness sector of Mexico is driven directly by the greater use of modern-day agricultural equipment such as agricultural pumps

10.5 SOUTH AMERICA

10.5.1 BRAZIL

10.5.1.1 Technological advancements, increasing population levels, strong economic growth, good availability of agriculture products high arable land boosting the markets growth

10.5.2 ARGENTINA

10.5.2.1 The country is working to increase the livestock export by opening international markets, repealing government export regulations, and adopting new methods of production

10.5.3 CHILE

10.5.3.1 Around 10% of the countrys labor force is engaged in agriculture and related services

10.5.4 REST OF SOUTH AMERICA

10.6 ROW

10.6.1 MIDDLE EAST

10.6.1.1 Continued growth in agriculture fueling the demand for agriculture pumps

10.6.2 AFRICA

10.6.2.1 Owing to high dependency on agricultural activities, African countries witnessed high demand for agriculture pumps

11 COMPETITIVE LANDSCAPE (Page No. - 111)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

11.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

11.4 KEY MARKET DEVELOPMENTS

11.4.1 NEW PRODUCT LAUNCHES

11.4.2 ACQUISITIONS

11.4.3 EXPANSIONS &INVESTMENTS

11.4.4 CONTRACTS & AGREEMENTS

12 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 115)

12.1 OVERVIEW

12.2 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

12.2.1 MARKET SHARE/RANKING

12.2.2 STARS

12.2.3 EMERGING LEADERS

12.2.4 PERVASIVE

12.3 COMPANY EVALUATION MATRIX, 2019

12.4 COMPANY PROFILES

(Business overview, Products offered, Recent developments, SWOT analysis & Right to win)*

12.4.1 GRUNDFOS

12.4.2 XYLEM

12.4.3 LINDSAY CORPORATION

12.4.4 VALMONT INDUSTRIES INC.

12.4.5 JAIN IRRIGATION SYSTEMS LTD.

12.4.6 SHIMGE PUMP INDUSTRY PVT. LTD.

12.4.7 FRANKLIN ELECTRIC

12.4.8 ZHEJIANG DOYIN PUMP INDUSTRY CO. LTD

12.4.9 MAHINDRA EPC LTD.

12.4.10 LEO GROUP PUMPS (ZHEJIANG) CO., LTD.

12.4.11 CNP PUMPS INDIA PVT. LTD.

12.4.12 FLOWSERVE

12.4.13 KSB

12.4.14 WILO

12.4.15 MONO

12.4.16 TEXMO

12.4.17 NATIONAL PUMP COMPANY

12.4.18 SHAKTI PUMPS

12.4.19 WEIR

12.4.20 PENTAIR PUMPS

*Details on Business overview, Products offered, Recent developments, SWOT analysis & Right to win might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 159)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

LIST OF TABLES (121 TABLES)

TABLE 1 USD EXCHANGE RATE, 20152019

TABLE 2 LAND WITH RAINFED CROP PRODUCTION POTENTIAL

TABLE 3 COUNTRIES WITH THE LARGEST AGRICULTURAL WATER WITHDRAWALS

TABLE 4 NEW TECHNOLOGIES IN PUMPING SYSTEMS

TABLE 5 GLOBAL MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 6 FACTORS TO BE CONSIDERED WHILE SELECTING AGRICULTURAL PUMPS

TABLE 7 ROTODYNAMIC PUMPS: AGRICULTURAL PUMPS MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 8 CENTRIFUGAL PUMPS: AGRICULTURAL PUMPS MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 9 MIXED FLOW: MARKET SIZE FOR AGRICULTURAL PUMPS, BY REGION, 20182025 (USD MILLION)

TABLE 10 AXIAL FLOW: AGRICULTURAL PUMPS MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 11 POSITIVE DISPLACEMENT PUMPS: AGRICULTURAL PUMPS MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 12 RECIPROCATING PUMPS: AGRICULTURAL PUMPS MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 13 ROTARY PUMPS: AGRICULTURAL PUMPS MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 14 MARKET SIZE, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 15 MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 16 ELECTRICITY GRID-CONNECTION: AGRICULTURAL PUMPS MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 17 ELECTRICITY GRID-CONNECTION: MARKET SIZE, BY REGION, 20182025 (THOUSAND UNITS)

TABLE 18 DIESEL/PETROL: AGRICULTURAL PUMPS MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 19 DIESEL/PETROL: AGRICULTURAL PUMPS MARKET SIZE, BY REGION, 20182025 (THOUSAND UNITS)

TABLE 20 SOLAR: MARKET SIZE FOR AGRICULTURAL PUMPS, BY REGION, 20182025 (USD MILLION)

TABLE 21 SOLAR: MARKET SIZE, BY REGION, 20182025 (THOUSAND UNITS)

TABLE 22 GLOBAL MARKET SIZE, BY HP, 20182025 (USD MILLION)

TABLE 23 0.5-3 HP: AGRICULTURAL PUMPS MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 24 4-16 HP: MARKET SIZE FOR AGRICULTURAL PUMPS, BY REGION, 20182025 (USD MILLION)

TABLE 25 16-30 HP: MARKET SIZE FOR AGRICULTURAL PUMPS, BY REGION, 20182025 (USD MILLION)

TABLE 26 31-40 HP: MARKET SIZE FOR AGRICULTURAL PUMPS, BY REGION, 20182025 (USD MILLION)

TABLE 27 >40 HP: MARKET SIZE FOR AGRICULTURAL PUMPS, BY REGION, 20182025 (USD MILLION)

TABLE 28 IRRIGATION: AGRICULTURAL PUMPS MARKET SIZE, BY END-USE, 20182025 (USD MILLION)

TABLE 29 IRRIGATION: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 30 LIVESTOCK WATERING: AGRICULTURAL PUMPS MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 31 ASIA PACIFIC: MARKET SIZE FOR AGRICULTURAL PUMPS, BY COUNTRY/REGION, 20182025 (USD MILLION)

TABLE 32 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 20182025 (THOUSAND UNITS)

TABLE 33 ASIA PACIFIC: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 34 ASIA PACIFIC: POSITIVE DISPLACEMENT PUMPS MARKET SIZE, BY SUB-TYPE, 20182025 (USD MILLION)

TABLE 35 ASIA PACIFIC: ROTODYNAMIC PUMPS MARKET SIZE, BY SUB-TYPE, 20182025 (USD MILLION)

TABLE 36 ASIA PACIFIC: MARKET SIZE FOR AGRICULTURAL PUMPS, BY HP, 20182025 (USD MILLION)

TABLE 37 ASIA PACIFIC: MARKET SIZE, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 38 ASIA PACIFIC: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 39 ASIA PACIFIC: MARKET SIZE, BY END-USE, 20182025 (USD MILLION)

TABLE 40 CHINA: MARKET SIZE FOR AGRICULTURAL PUMPS, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 41 CHINA: MARKET SIZE FOR AGRICULTURAL PUMPS, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 42 INDIA: MARKET SIZE FOR AGRICULTURAL PUMPS, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 43 INDIA: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 44 JAPAN: AGRICULTURAL PUMPS MARKET SIZE, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 45 JAPAN: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 46 AUSTRALIA: MARKET SIZE FOR AGRICULTURAL PUMPS, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 47 AUSTRALIA: MARKET SIZE, BY POWER SOURCE, 20182025 (MILLION UNITS)

TABLE 48 SOUTH KOREA: MARKET SIZE FOR AGRICULTURAL PUMPS, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 49 SOUTH KOREA: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 50 REST OF ASIA PACIFIC: AGRICULTURAL PUMPS MARKET SIZE, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 51 REST OF ASIA PACIFIC: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 52 EUROPE: AGRICULTURAL PUMPS MARKET SIZE, BY COUNTRY/REGION, 20182025 (USD MILLION)

TABLE 53 EUROPE: MARKET SIZE, BY COUNTRY/REGION, 20182025 (THOUSAND UNITS)

TABLE 54 EUROPE: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 55 EUROPE: ROTODYNAMIC PUMPS MARKET SIZE, BY SUB-TYPE, 20182025 (USD MILLION)

TABLE 56 EUROPE: POSITIVE DISPLACEMENT PUMPS MARKET SIZE, BY SUB-TYPE, 20182025 (USD MILLION)

TABLE 57 EUROPE: MARKET SIZE FOR AGRICULTURAL PUMPS, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 58 EUROPE: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND MILLION)

TABLE 59 EUROPE: MARKET SIZE, BY END-USE, 20182025 (USD MILLION)

TABLE 60 SPAIN: MARKET SIZE FOR AGRICULTURAL PUMPS, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 61 SPAIN: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 62 FRANCE: MARKET SIZE FOR AGRICULTURAL PUMPS, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 63 FRANCE: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 64 GERMANY: MARKET SIZE FOR AGRICULTURAL PUMPS, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 65 GERMANY: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 66 UK: AGRICULTURAL PUMPS MARKET SIZE, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 67 UK: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 68 ITALY: MARKET SIZE FOR AGRICULTURAL PUMPS, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 69 ITALY: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 70 RUSSIA: AGRICULTURAL PUMPS MARKET SIZE, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 71 RUSSIA: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 72 REST OF EUROPE: MARKET SIZE FOR AGRICULTURAL PUMPS, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 73 REST OF EUROPE: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 74 NORTH AMERICA: AGRICULTURAL PUMPS MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20182025 (THOUSAND UNITS)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 77 NORTH AMERICA: ROTODYNAMIC PUMPS MARKET SIZE, BY SUB-TYPE, 20182025 (USD MILLION)

TABLE 78 NORTH AMERICA: POSITIVE DISPLACEMENT PUMPS MARKET SIZE, BY SUB-TYPE, 20182025 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE FOR AGRICULTURAL PUMPS, BY HP, 20182025 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 82 NORTH AMERICA: MARKET SIZE FOR AGRICULTURAL PUMPS, BY END-USE, 20182025 (USD MILLION)

TABLE 83 US: MARKET SIZE FOR AGRICULTURAL PUMPS, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 84 US: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 85 CANADA: AGRICULTURAL PUMPS MARKET SIZE, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 86 CANADA: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 87 MEXICO: MARKET SIZE FOR AGRICULTURAL PUMPS, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 88 MEXICO: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 89 SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL PUMPS, BY COUNTRY/REGION, 20182025 (USD MILLION)

TABLE 90 SOUTH AMERICA: MARKET SIZE, BY COUNTRY/REGION, 20182025 (THOUSAND UNITS)

TABLE 91 SOUTH AMERICA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 92 SOUTH AMERICA: ROTODYNAMIC PUMPS MARKET SIZE , BY SUB- TYPE, 20182025 (USD MILLION)

TABLE 93 SOUTH AMERICA: POSITIVE DISPLACEMENT PUMPS MARKET SIZE, BY SUB-TYPE, 20182025 (USD MILLION)

TABLE 94 SOUTH AMERICA: AGRICULTURAL PUMPS MARKET SIZE, BY END-USE, 20182025 (USD MILLION)

TABLE 95 SOUTH AMERICA: MARKET SIZE, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 96 SOUTH AMERICA: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 97 SOUTH AMERICA: MARKET SIZE, BY HP, 20182025 (USD MILLION)

TABLE 98 BRAZIL: AGRICULTURAL PUMPS MARKET SIZE, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 99 BRAZIL: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 100 ARGENTINA: AGRICULTURAL PUMPS MARKET SIZE, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 101 ARGENTINA: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 102 CHILE: AGRICULTURAL PUMPS MARKET SIZE, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 103 CHILE: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 104 REST OF SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL PUMPS, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 105 REST OF SOUTH AMERICA: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 106 ROW: AGRICULTURAL PUMPS MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 107 ROW: MARKET SIZE, BY REGION, 20182025 (THOUSAND UNITS)

TABLE 108 ROW: AGRICULTURAL PUMPS MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 109 ROW: ROTODYNAMIC PUMPS MARKET SIZE, BY SUB-TYPE, 20182025 (USD MILLION)

TABLE 110 ROW: POSITIVE DISPLACEMENT PUMPS MARKET SIZE, BY SUB-TYPE, 20182025 (USD MILLION)

TABLE 111 REST OF THE WORLD: AGRICULTURAL PUMPS MARKET SIZE, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 112 REST OF THE WORLD: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 113 ROW: MARKET SIZE FOR AGRICULTURAL PUMPS, BY END-USE, 20182025 (USD MILLION)

TABLE 114 MIDDLE EAST: AGRICULTURAL PUMPS MARKET SIZE, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 115 MIDDLE EAST: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 116 AFRICA: MARKET SIZE FOR AGRICULTURAL PUMPS, BY POWER SOURCE, 20182025 (USD MILLION)

TABLE 117 AFRICA: MARKET SIZE, BY POWER SOURCE, 20182025 (THOUSAND UNITS)

TABLE 118 NEW PRODUCT LAUNCHES, 20172018

TABLE 119 ACQUISITIONS, 20172020

TABLE 120 EXPANSIONS & INVESTMENTS, 2017

TABLE 121 CONTRACTS & AGREEMENTS, 2017

LIST OF FIGURES (59 FIGURES)

FIGURE 1 AGRICULTURAL PUMPS: MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

FIGURE 3 RESEARCH DESIGN

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 6 DATA TRIANGULATION METHODOLOGY

FIGURE 7 GLOBAL MARKET, 20182025 (USD MILLION)

FIGURE 8 THE ROTODYNAMICS PUMPS SEGMENT ACCOUNTED FOR A LARGER MARKET SHARE IN THE AGRICULTURAL PUMPS MARKET, 2020 VS. 2025

FIGURE 9 THE MARKET FOR AGRICULTURAL PUMPS IN THE RANGE OF 4-15 HP ACCOUNTS FOR THE LARGEST SHARE DURING THE FORECAST PERIOD

FIGURE 10 AVAILABILITY OF SUBSIDY FOR SOLAR PUMPS DRIVES THE GROWTH OF THE MARKET

FIGURE 11 THE IRRIGATION SEGMENT ACCOUNTED FOR THE LARGEST MARKET DURING THE FORECAST PERIOD

FIGURE 12 MARKET SNAPSHOT: ASIA PACIFIC ACCOUNTED FOR THE LARGEST SHARE, 2019 (USD MILLION)

FIGURE 13 INCREASING LAND BROUGHT UNDER IRRIGATION IS DRIVING THE MARKET FOR AGRICULTURAL PUMPS

FIGURE 14 THE ELECTRICITY GRID-CONNECTION SEGMENT ACCOUNTED FOR THE LARGEST SHARE IN THE AGRICULTURAL PUMPS MARKET IN 2019

FIGURE 15 ASIA PACIFIC: CHINA IS ONE OF THE LARGEST MARKETS FOR AGRICULTURAL PUMPS

FIGURE 16 4-15 HP PUMPS ARE WIDELY USED IN THE AGRICULTURAL SECTOR

FIGURE 17 THE IRRIGATION SEGMENT IS ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE FOR AGRICULTURAL PUMPS IN 2019

FIGURE 18 CHINA ESTIMATED TO ACCOUNT FOR THE LARGEST MARKET IN THE AGRICULTURAL PUMPS MARKET IN 2019

FIGURE 19 SECTOR-WISE WATER WITHDRAWAL, BY REGION, 2017

FIGURE 20 GLOBAL SECTOR-WISE WATER WITHDRAWAL, 2018

FIGURE 21 LAND USE IN DEVELOPING COUNTRIES (MILLION HECTARES)

FIGURE 22 MARKET DYNAMICS: AGRICULTURAL PUMPS

FIGURE 23 LEVEL OF MECHANIZATION OF AGRICULTURE, BY COUNTRY, 2018

FIGURE 24 LIFECYCLE COST BREAKUP OF A TYPICAL PUMP

FIGURE 25 VALUE-CHAIN ANALYSIS

FIGURE 26 KEY COUNTRY MARKETS FOR EXPORTS/IMPORT OF PUMPS

FIGURE 27 THE ROTODYNAMIC PUMPS SEGMENT IS LEADING TO THE INCREASED DEMAND FOR AGRICULTURAL PUMPS

FIGURE 28 THE ELECTRICITY GRID-CONNECTION SEGMENT IS LEADING TO THE INCREASED DEMAND FOR AGRICULTURAL PUMPS

FIGURE 29 MARKET SIZE, BY HP (USD MILLION) 2020 VS. 2025

FIGURE 30 AGRICULTURE PUMPS MARKET, BY END-USE, 2020 VS. 2025 (USD MILLION)

FIGURE 31 KEY COUNTRY MARKETS FOR EXPORTS/IMPORT OF PUMPS, 2018 (TONS)

FIGURE 32 CHINA IS PROJECTED TO GROW AT THE FASTEST RATE DURING THE FORECAST PERIOD

FIGURE 33 ASIA PACIFIC: AGRICULTURE PUMPS MARKET SNAPSHOT, 2019

FIGURE 34 EUROPE: AGRICULTURE PUMPS MARKET SNAPSHOT, 2019

FIGURE 35 MARKET EVALUATION FRAMEWORK - 2017 WITNESSED MARKET EXPANSIONS AND CONSOLIDATION

FIGURE 36 TOP FIVE MARKET PLAYERS HAVE DOMINATED THE MARKET IN THE LAST FIVE YEARS

FIGURE 37 MARKET RANKING, AGRICULTURE PUMPS MARKET, 2019

FIGURE 38 AGRICULTURAL PUMPS MARKET(GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 39 GRUNDFOS: COMPANY SNAPSHOT

FIGURE 40 GRUNDFOS: SWOT ANALYSIS

FIGURE 41 XYLEM: COMPANY SNAPSHOT

FIGURE 42 XYLEM: SWOT ANALYSIS

FIGURE 43 LINDSAY CORPORATION: COMPANY SNAPSHOT

FIGURE 44 LINDSAY CORPORATION: SWOT ANALYSIS

FIGURE 45 VALMONT INDUSTRIES INC.: COMPANY SNAPSHOT

FIGURE 46 VALMONT INDUSTRIES INC.: SWOT ANALYSIS

FIGURE 47 JAIN IRRIGATION SYSTEMS LTD.: COMPANY SNAPSHOT

FIGURE 48 JAIN IRRIGATION SYSTEMS LTD.: SWOT ANALYSIS

FIGURE 49 FRANKLIN ELECTRIC: COMPANY SNAPSHOT

FIGURE 50 FRANKLIN ELECTRIC: SWOT ANALYSIS

FIGURE 51 MAHINDRA EPC LTD.: COMPANY SNAPSHOT

FIGURE 52 FLOWSERVE: COMPANY SNAPSHOT

FIGURE 53 KSB: COMPANY SNAPSHOT

FIGURE 54 WILO: COMPANY SNAPSHOT

FIGURE 55 MONO: COMPANY SNAPSHOT

FIGURE 56 NATIONAL PUMP COMPANY: COMPANY SNAPSHOT

FIGURE 57 SHAKTI PUMPS: COMPANY SNAPSHOT

FIGURE 58 WEIR PUMPS: COMPANY SNAPSHOT

FIGURE 59 PENTAIR: COMPANY SNAPSHOT

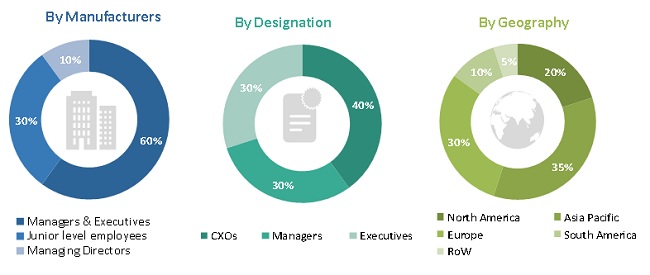

The study involves four major activities to estimate the current market size of the agricultural pumps market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation approaches were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The agricultural pumps market comprises several stakeholders, such as agricultural institutes, crop growers, suppliers, intermediary suppliers, wholesalers, traders, research institutes and organizations, and regulatory bodies.

The demand side comprises a strong demand for high-value crops, which have a high requirement of irrigation, and advancements in farming practices and technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the Breakdown of Primary Respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the agricultural pump market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive secondary research.

- The industrys supply chain and market size were determined through primary and secondary research.

- All percentage shares splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall agricultural pumps market sizeusing the market size estimation processes as explained abovethe market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the market.

Report Objectives

- To define, segment, and estimate the size of the market with respect to its type, power source, end-use, hp, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the complete supply chain and influence of all key stakeholders, such as manufacturers, suppliers, and end users

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their core competencies1

- To analyze the competitive developments, such as new product launches, acquisitions, investments, expansions, partnerships, agreements, joint ventures, and product approvals, in the global market

1 Core competencies of companies include their key developments and strategies adopted by them to sustain their position in the market.

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs. The following customization options are available for the market report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

Geographic Analysis

- Further breakdown of the Rest of Europe market for agricultural pumps market, which includes countries such as Denmark, Netherlands, Switzerland, Poland, and Portugal

- Further breakdown of the Rest of Asia Pacific market for agricultural pumps, which includes countries such as Indonesia, Thailand, and Vietnam

- Further breakdown of the Rest of South America agricultural pumps market, which includes countries such as Columbia and Venezuela

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Agricultural Pumps Market