Military Auxiliary Power Unit (APU) Market by Platform (Airborne, Land, and Naval), By Type (Emergency Power Unit, Fuel Cell, Electric, and Combustion Engines), By End Use (OEM and MRO) and Region - Global Forecast to 2025-2035

Market Overview

Source: MarketsandMarkets analysis; secondary research; primary interviews

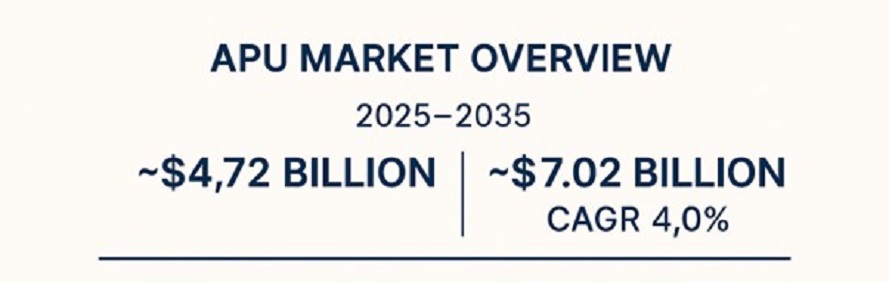

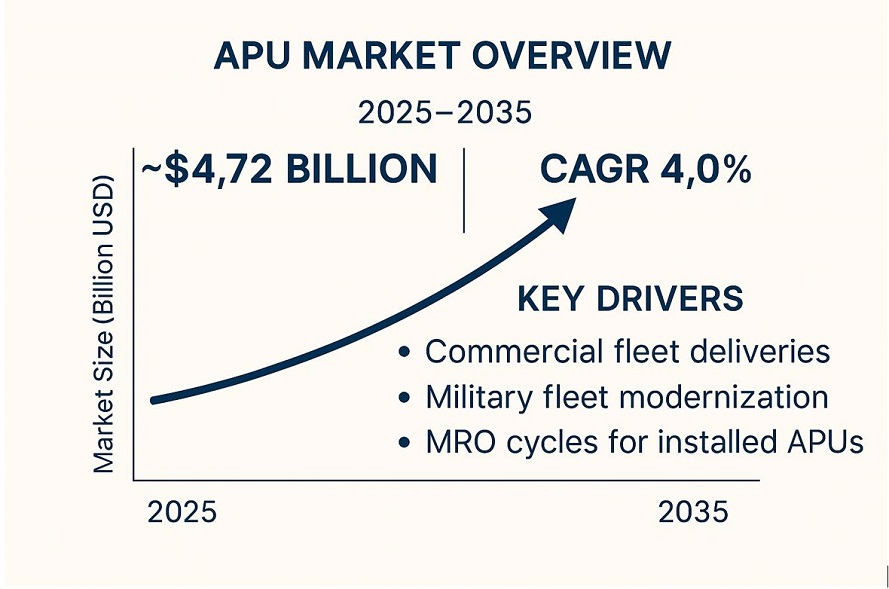

The global aerospace & military APU market is estimated at ~USD 4.72 billion in 2025 and is projected to reach ~USD 7.02 billion by 2035, reflecting a blended CAGR of ~4.0%.

Sustained commercial fleet deliveries, military fleet modernization, and MRO cycles for installed APUs support growth. At the same time, airport “APU-off” rules and fixed ground power availability are changing usage patterns, prompting OEMs to adopt lower-emission, lower-noise architectures and starter-generator upgrades. Fuel-cell and hybrid concepts are emerging for future airframes and ground operations. At the same time, today’s demand skews to reliable turboshaft APUs with improved digital controls, lighter LRU packages, and extended on-wing life. (Policy pressure to limit ramp emissions is noted by multiple sources discussing APU-off practices.)

Segmentation Analysis

Source: MarketsandMarkets analysis; secondary research; primary interviews

By Platform

Commercial fixed-wing (narrow-/wide-body, regional jets)

Largest installed base and aftermarket demand; line-fit tied to OEM production, with strong retrofit/MRO replacement cycles.

Business & general aviation

Value-added upgrades focused on quieter operation, faster starts, and reduced maintenance.

Military fixed- and rotary-wing

Ruggedized APUs with higher bleed/electrical loads for austere starts and mission equipment; demand linked to fleet availability and readiness programs.

By Function

Start power

Main-engine start reliability in hot/high, cold-soak, or expeditionary scenarios is covered

Electrical power

Starter-generator upgrades, as well as higher kVA for avionics and cabin loads, are included under this segment.

Pneumatic/bleed & ECS support

Including packs, de-icing, and environmental control on the ground.

Hybrid/auxiliary roles

Ground cart/APU interface, health monitoring, and prognostics are part of the scope.

By End User

OEM line-fit

Linked to aircraft delivery rates and platform refresh cycles.

Aftermarket/MRO

Replacement APUs, hot section overhauls, LRUs, rentals/leases.

Defense depots & fleet sustainment

Overhauls aligned to flight hours and readiness.

By Region

Source: MarketsandMarkets analysis; secondary research; primary interviews

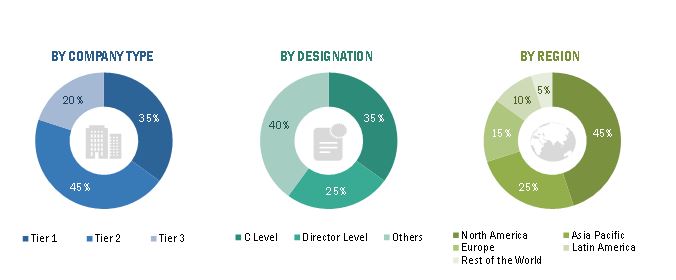

North America leads in installed base and MRO capacity; Europe remains steady with line-fit and aftermarket support; the Asia Pacific accelerates with fleet growth and localized support; the Middle East sustains wide-body fleets; Latin America & Africa grow gradually with modernization programs.

Competitive Landscape

Source: MarketsandMarkets analysis, public filings, and vendor literature

The market is concentrated around a few tier-1 APU OEMs and a broad aftermarket ecosystem:

- APU OEMs / System Integrators: Honeywell Aerospace (broad commercial & military portfolio), Safran Power Units (ex-Microturbo), Pratt & Whitney / Collins (APS/APU programs), PBS Aerospace (PBS Velká Bíteš) for select platforms.

- Key Subsystem & Service Providers: Woodward (fuel controls), AMETEK (starter-generators), Triumph Group (gearboxes), Crane Aerospace (valves), plus global MRO networks supporting overhauls, rentals, and exchanges.

Strategic priorities include lower NOx/particulate emissions, noise reduction, condition-based maintenance, digital engine controls, and extended TBO to reduce the total cost of ownership.

Regulatory & Sustainability

- Airport APU-use restrictions (“APU-off when ground power available”) are increasingly enforced to curb ramp emissions and noise; this elevates the importance of efficient starts, fast spools, and reliable ECS support when needed.

- Certification remains under FAA/EASA engine/APU standards with applicable environmental limits; military usage adds expeditionary and acoustic constraints on bases and carriers.

- OEMs are investing in fuel-efficient combustors, advanced materials, and hybrid/fuel-cell demonstrators to align with airline and defense emissions and readiness goals.

Technology Trends

- Digital FADEC/ECU and health-monitoring for predictive maintenance and faster troubleshooting.

- Higher-power starter-generators supporting more-electric aircraft loads.

- Noise-attenuated, low-emission combustors and improved thermal management.

- Hybrid and fuel-cell APUs in R&D for reduced ramp emissions and future more-electric architectures.

Why This Report

The MarketsandMarkets Aerospace & Military APU Report (2025–2035) offers a comprehensive view of line-fit versus aftermarket demand, platform trends across commercial, business, and military fleets, and a grounded forecast based on a blended, scope-normalized baseline. The model triangulates OEM production, fleet age/utilization, MRO cycles, and airport policy shifts to quantify revenue pools and replacement timing through 2035.

FAQs

Q1. What is the market size of aerospace & military APUs?

A1. ~USD 4.72 billion (2025), projected to reach ~USD 7.02 billion by 2035 at ~4.0% CAGR (MnM blended estimate based on multiple public sources).

Q2. What is driving growth?

A2. OEM deliveries, military fleet sustainment, and aftermarket replacements, alongside technology upgrades (starter-generators, digital controls) and reliability improvements.

Q3. How do APU-off rules affect demand?

A3. They reduce ground-idle runtime but increase the premium on efficient starts, reliability, and low emissions, steering investment to cleaner, smarter APUs.

Q4. Who are the key players?

A4. Honeywell Aerospace, Safran Power Units, Pratt & Whitney/Collins (APS/APU), PBS Aerospace, with subsystem partners like Woodward, AMETEK, Triumph, Crane Aerospace, and global MROs.

Q5. What is the longest public forecast, and how does MnM differ?

A5. Public horizons extend to 2034 in some sources; MnM extends to 2035, per policy, with a blended CAGR to provide a 10-year overview.

Table Of Contents

1 Introduction (Page No. - 16)

1.1 Objectives

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.6 Forecast Assumptions

2 Executive Summary (Page No. - 26)

3 Market Overview (Page No. - 28)

3.1 Market Definition-Auxiliary Power Units

3.2 Market Segmentation

3.3 Market Dynamics

3.3.1 Drivers

3.3.1.1 Fuel Economy

3.3.1.2 Technological Improvements

3.3.1.3 Need For Electric Aircraft

3.3.1.4 Increase in Air Travel

3.3.1.5 Evolution of A Quieter APU

3.3.1.6 Green Environment

3.3.2 Restraints

3.3.2.1 Defense Budget Cuts

3.3.2.2 Battery Technology

3.3.3 Challenges

3.3.3.1 Need For Skilled Workforce

3.3.3.2 Technological Drawbacks

3.3.4 Opportunities

3.3.4.1 Fuel Cells

3.3.4.2 Requirement of Additional Power

3.4 Market Share Analysis

3.4.1 Global Aerospace & Military APU Spending: Revenue Analysis

3.4.2 APU Segments: Revenue Analysis

4 Trends Analysis (Page No. - 49)

4.1 Market Trends

4.2 Technology Trends

4.2.1 Gas Turbine APU

4.2.2 E-APU

4.2.3 Fuel Cell APU

5 Regional Analysis (Page No. - 53)

5.1 North America: the Dominant APU Manufacturer

5.2 Latin America: A Rising APU Market

5.3 Europe: Advanced APU Market

5.4 Asia-Pacific: Upcoming APU Market

5.5 the Middle East & Africa: APU Importers Market

6 Country Analysis (Page No. - 84)

6.1 U.S.: New APU Technology Market

6.2 Brazil: Rising Military APU Market

6.3 U.K.: Steady APU Market

6.4 France: APU Opportunity Market

6.5 Germany: Rising Defense APU Market

6.6 Russia: Expanding APU Market

7 Competitive Landscape (Page No. - 103)

7.1 APU Market Size, By Region, 2014

7.2 APU Company Market Size: By Commercial Aircraft, 2014

7.3 APU Company Market Size: By Rotarycopter, 2014

7.4 APU Company Market Size: Military Land Vehicle, 2014

8 Company Profiles (Page No. - 108)

8.1 Honeywell Inc.

8.1.1 Overview

8.1.2 Products & Services

8.1.3 Developments

8.1.4 Strategy & Insights

8.1.5 MNM View

8.2 Hamilton Sundstrand

8.2.1 Overview

8.2.2 Products & Services

8.2.3 Developments

8.2.4 Strategy & Insights

8.2.5 MNM View

8.3 Jenoptik AG

8.3.1 Overview

8.3.2 Products & Services

8.3.3 Developments

8.3.4 Strategy & Insights

8.3.5 MNM View

8.4 Microturbo

8.4.1 Overview

8.4.2 Products & Services

8.4.3 Developments

8.4.4 Strategy & Insights

8.5 Kinetics Ltd.

8.5.1 Overview

8.5.2 Products & Services

8.5.3 Developments

8.5.4 Strategy & Insights

8.6 The Marvin Group

8.6.1 Overview

8.6.2 Products & Services

8.6.3 Developments

8.6.4 Strategy & Insights

8.7 Dewey Electronics Corporation

8.7.1 Overview

8.7.2 Products & Services

8.7.3 Developments

8.7.4 Strategy & Insights

8.8 Falck Schmidt

8.8.1 Overview

8.8.2 Products & Services

8.8.3 Developments

8.8.4 Strategy & Insights

List of Tables (49 Tables)

Table 1 Forecast Assumptions

Table 2 APU Commercial Aircraft Market Size, By Type, 2014-2019 ($Million)

Table 3 APU Military Aircraft Market Size, By Type, 2014-2019 ($Million)

Table 4 APU Rotarycopter Market Size, By Application, 2014-2019 ($Million)

Table 5 APU Military Land Vehicle Market Size, By Type, 2014-2019 ($Million)

Table 6 North America: Military APU Market Size, By Application, 2014-2019 ($Million)

Table 7 North America: APU Commercial Aircraft Market Size, By Type, 2014-2019 ($Million)

Table 8 North America: Aircraft Deliveries, By Type, 2019

Table 9 North America: Military APU Aircraft Market Size, By Type, 2014-2019 ($Million)

Table 10 North America: APU Rotarycopter Market Size, By Application, 2014-2019 ($Million)

Table 11 North America: Military APU Land Vehicle Market Size, By Type, 2014-2019 ($Million)

Table 12 Latin America: Military APU Market Size, By Application, 2014-2019 ($Million)

Table 13 Latin America: APU Commercial Aircraft Market Size, By Type, 2014-2019 ($Million)

Table 14 Latin America: Military APU Aircraft Market Size, By Type, 2014-2019 ($Million)

Table 15 Latin America: APU Rotarycopter Market Size, By Application, 2014-2019 ($Million)

Table 16 Latin America: APU Military Land Vehicle Market Size, By Type, 2014-2019 ($Million)

Table 17 Europe: Military APU Market Size, By Application, 2014-2019 ($Million)

Table 18 Europe: APU Commercial Aircraft Market Size, By Type, 2014-2019 ($Million)

Table 19 Europe: Aircraft Deliveries, By Type, 2019

Table 20 Europe: APU Military Aircraft Market Size, By Type, 2014-2019 ($Million)

Table 21 Europe: APU Rotarycopter Market Size, By Application, 2014-2019 ($Million)

Table 22 Europe: Military APU Land Vehicle Market Size, By Type, 2014-2019 ($Million)

Table 23 Asia Pacific: Military APU Market Size, By Application, 2014-2019 ($Million)

Table 24 Asia Pacific: APU Commercial Aircraft Market Size, By Type, 2014-2019 ($Million)

Table 25 Asia Pacific: APU Military Aircraft Market Size, By Type, 2014-2019 ($Million)

Table 26 Asia Pacific: APU Rotarycopter Market Size, By Application, 2014-2019 ($Million)

Table 27 Asia Pacific: APU Military Land Vehicle Market Size, By Type, 2014-2019 ($Million)

Table 28 Middle East Africa: Military APU Market Size, By Application, 2014-2019 ($Million)

Table 29 Middle East Africa: APU Military Aircraft Market Size, By Type, 2014-2019 ($Million)

Table 30 Middle East Africa: APU Rotarycopter Market Size, By Application, 2014-2019 ($Million)

Table 31 Middle East Africa: APU Military Land Vehicle Market Size, By Type, 2014-2019 ($Million)

Table 32 U.S.: Overview

Table 33 U.S.: APU Military Aircraft Market Size, By Type, 2014-2019 ($Million)

Table 34 U.S.: APU Military Land Vehicle Market Size, By Type, 2014-2019 ($Million)

Table 35 Brazil: Overview

Table 36 Brazil: APU Military Aircraft Market Size, By Type, 2014-2019 ($Million)

Table 37 Brazil: APU Military Land Vehicle Market Size, By Type, 2014-2019 ($Million)

Table 38 U.K.: Overview

Table 39 U.K.: APU Military Aircraft Market Size, By Type, 2014-2019 ($Million)

Table 40 U.K.: APU Military Land Vehicle Market Size, By Type, 2014-2019 ($Million)

Table 41 France: Overview

Table 42 France: APU Military Aircraft Market Size, By Type, 2014-2019 ($Million)

Table 43 France: APU Military Land Vehicle Market Size, By Type, 2014-2019 ($Million)

Table 44 Germany: Overview

Table 45 Germany: APU Military Aircraft Market Size, By Type, 2014-2019 ($Million)

Table 46 Germany: Military APU Land Vehicle Market Size, By Type, 2014-2019 ($Million)

Table 47 Russia: Overview

Table 48 Russia: APU Military Aircraft Market Size, By Type, 2014-2019 ($Million)

Table 49 Russia: Military APU Land Vehicle Market Size, By Type, 2014-2019 ($Million)

List of Figures (13 Figures)

Figure 1 General Segmentation

Figure 2 Research Methodology

Figure 3 Research Methodology Approach

Figure 4 Total APU Market: Data Triangulation

Figure 5 Aerospace & Military APU Market Segmentation

Figure 6 Market Drivers & Restraints

Figure 7 Defense Expenditure of the Top Five Spenders, 2010-2013

Figure 8 Impact Analysis of Drivers & Restraints

Figure 9 Global Aerospace & Military APU Spending

Figure 10 Commercial & Military Application APU Spending

Figure 11 Honeywell Inc. SWOT Analysis

Figure 12 Hamilton Sundstrand SWOT Analysis

Figure 13 Jenoptik AG SWOT Analysis

Exhaustive secondary research was done to collect information on military auxiliary power unit (APU) market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, Business Week, and different magazines were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and research papers.

Primary Research

Extensive primary research was conducted after acquiring information regarding the military auxiliary power unit (APU) market scenario through secondary research. The market for military auxiliary power unit (APU) is being driven by a range of stakeholders, including APU manufacturers, Component suppliers, system integrators, and MRO service providers. The demand-side of this market is characterized by various end users, such as military forces, military vehicle manufacturers, and defense departments and ministries. The supply side is characterized by technological advancements and the development in military auxiliary power unit (APU). Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the military auxiliary power unit (APU) market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments, the data triangulation procedure has been implemented, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the military auxiliary power unit (APU) Market based on platform, type, end use, and region.

- To forecast the size of different segments of the market with respect to five key regions, namely, North America, Europe, Asia Pacific, Latin America, and Rest of the World, along with their key countries

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To identify technology trends currently prevailing in the military auxiliary power unit (APU) market

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying the key market trends

- To profile the leading market players and comprehensively analyze their market share and core competencies.

- To analyze the degree of competition in the market by identifying the key growth strategies, such as acquisitions, new product launches, contracts, and partnerships, adopted by the leading market players.

- To identify detailed financial positions, key products, and unique selling points of the leading companies in the market

- To provide a detailed competitive landscape of the market, along with a ranking analysis, market share analysis, and revenue analysis of the key players

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Platform, By Type, By End Use |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Rest of the World |

|

Companies covered |

Honeywell International Inc. (US), Safran SA (France), Elbit Systems Ltd. (Israel), The Marvin Group (US), Pratt & Whitney (US), Milspec Manufacturing (Australia), The Dewey Electronics Corporation (US), Astronics Corporation (US), AAR (US) are some of the major players of military auxiliary power unit (APU) market. (25 Companies) |

Military Auxiliary Power Unit (APU) Market Highlights

The study categorizes the military auxiliary power unit (APU) market based on Platform, Type, End Use, and Region.

|

Segment |

Subsegment |

|

By Platform |

|

|

By Type |

|

|

By End Use |

|

|

By Region |

|

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

Company Information

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the military auxiliary power unit (APU) market.

Growth opportunities and latent adjacency in Military Auxiliary Power Unit (APU) Market