Advanced Lead Acid Battery Market by Type (Stationary, Motive), Construction Method (Flooded, VRLA), End-User (Utilities, Transportation, Industrial, Commercial & Residential) and Region (North America, APAC, Europe, RoW) - Global Forecast to 2027

Updated on : April 15, 2024

Advanced Lead Acid Battery Market

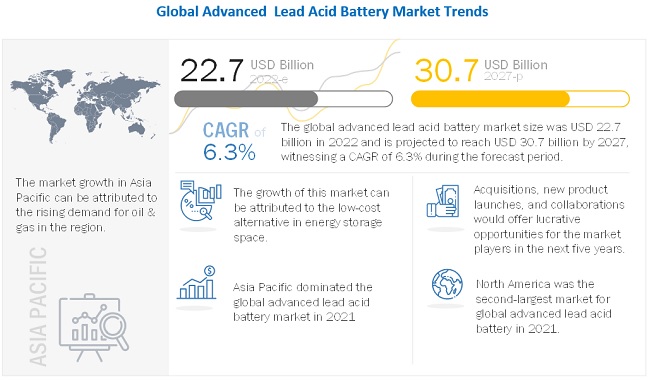

The advanced lead acid battery market was valued at USD 22.7 billion in 2022 and is projected to reach USD 30.7 billion by 2027, growing at a cagr 6.3% from 2022 to 2027. Advanced lead acid batteries being a cost-competitive energy storage solution with easy recyclability when compared with lithium-ion batteries, is driving the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the global advanced lead acid battery market

Advanced lead acid battery is used in various end use industries, such as utility, transportation, industries, and commercial & residential. However, due to the pandemic, industries were affected globally. . Workforce shortage, logistical restrictions, material unavailability, and other restrictions have slowed the industry's growth during 2019–2020. Asia Pacific is a major hub for global advanced lead acid battery manufacturing, and China is among the world’s largest advanced lead acid battery manufacturer. It also is a major supplier of lead acid battery materials and parts. The COVID-19 pandemic has impacted the supply of advanced lead acid battery and raw materials from the country since January 2020. The global advanced lead acid battery production industry is expected to witness a further decline and significant disruptions in the supply chain if the COVID-19 impact remains.

Advanced Lead Acid Battery Market Dynamics

Driver: Easy recyclable compared to lithium-ion battery

The decomposition process of advanced lead acid batteries is less cumbersome compared to other alternative battery storage systems. The old battery acid, which is generally sulfuric acid, can be handled through two methods. First, the acid is neutralized with an industrial chemical compound equivalent to the household baking soda. This neutralization process turns the acid into water. The water is then cleaned, treated, and tested in a wastewater treatment plant to ensure its compliance with the clean water standards. Second, the acid is processed and converted into another chemical component called sodium sulfate. This is an odorless white powder used as a laundry detergent in the laundry business in glass and textile manufacturing industries. Lead acid batteries are closed-loop recycled, which means that each part of the old battery is processed and recycled into a new battery. It is estimated that about 98% of all advanced lead acid batteries undergo recycling and processing.

Restraints: Safety related to battery usage

Advanced acid batteries, if not handled carefully and correctly, have the potential to cause serious injuries. They can deliver an electric charge at a high rate. The toxic and foul gases released when batteries are charging, including hydrogen (very flammable and easily ignited) and oxygen (supporting combustion), can result in a serious explosion. The sulfuric acid used in a lead acid battery is used as electrolytes. It is very corrosive and can cause severe injuries if it comes in contact with the skin of the people operating the battery. A spilled electrolyte has tremendous potential to cause significant damage to property and the environment

Opportunity: Expanding data cente infrastructure

There is massive demand for battery storage in data centers. Any power disruptions and inconsistencies in data centers can be crucial. Thus, lead acid batteries mostly cater to the backup power needs of this particular industry. UPS used in this industry are mostly lead acid battery systems.

In the near future, the installation of data centers is expected to increase. According to the United Nations, the amount of data created in the world is increasing exponentially. In 2020, 64.2 zettabytes of data were created, that is a 314% increase from 2015. With the growing amount of data, the data handling capacity is also expected to increase in the years to come. As data centers use lead acid batteries, their demand is expected to increase.

Challenge: Limited usage capacity of lead acid battery

Lead acid batteries are expected to have a low useable capacity. Typically, 30–50% of the rated capacity of a lead acid battery is used. This indicates that a 600 Ah battery bank in daily practice provides only, at the maximum, 300 Ah of actual capacity. If one even occasionally drains the batteries more than this, their life would drastically reduce.

These batteries have a limited life cycle. Even if one goes easy on these batteries and is particularly careful to never over drain these cells, the very best deep-cycle lead acid batteries are typically great for 500– 1,000 cycles. If one frequently taps into the battery bank, it will mean that the batteries, in this case, may need replacement in less than 2 years of use.

Based on type, stationary segment is the fastest growing market during the forecast period

The stationary segment is the second-largest segment in 2021 in terms of value. These batteries are used for smooth power integration in solar PV systems, provided that the battery bank has an accurate capacity. Majorly professional stationary batteries are used as a standby power supply in energy, telecommunications, hospitals, and industry. Thus, with growth in the telecom sector and rapid industrialization in developing countries, the demand for this segment is expected to boost during the forecast period.

Based on construction method, VRLA segment accounted for the largest and fastest market during the forecast period

The VRLA advanced lead acid battery accounted for the largest segment, by construction method in 2021, in terms of value. A VRLA battery is an improved version of a semiconcentric sulfuric acid electrolyte battery. Owing to its construction, a VRLA battery does not specifically require the addition of water to the cells, regularly and is mostly termed as no or zero maintenance batteries. VRLA batteries having no maintenance requirement will drive the market for this segment.

Based on end-user, utility segment is the fastest growing market during the forecast period

With increased renewable input and the need to optimize electricity generated from renewables, the energy storage concept is getting more critical. Advanced lead acid batteries are reliable, cost-effective solutions, making battery storage affordable for the utility sector. Thus, growth in power consumption in various countries across the globe is driving the demand for advanced lead acid battery during the forecast period.

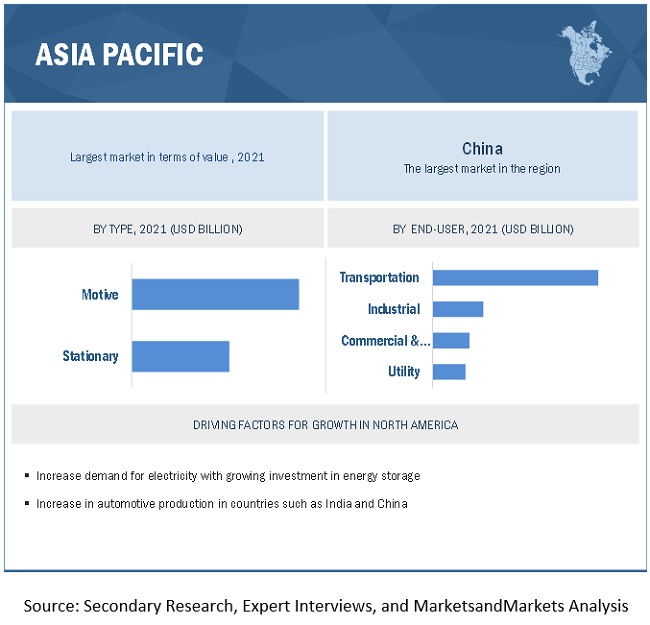

Asia Pacific is the largest advanced lead acid battery market in terms of value

Asia Pacific accounted for the largest share followed by North America, in terms of value, in 2021. Huge population in this region leads to an increased energy demand. The governments of various countries in this region focus on minimizing the adverse effects of the energy sector on the environment. Thus, it is advisable to store energy in battery systems for fulfilling the energy demand instead of generating energy from burning fossil fuels. These factors lead to the growth in the deployment of battery energy storage systems in residential and public utility applications in Asia Pacific and thus drives the market for advanced lead acid batteries.

To know about the assumptions considered for the study, download the pdf brochure

Advanced Lead Acid Battery Market Players

Major companies in the advanced lead acid battery market include Enersys (US), Exide Industries Ltd. (India), GS Yuasa International Ltd. (Japan), Clarios (US), and Leoch International Technology Limited Inc (China), among others. A total of 25 major players have been covered. These players have adopted expansions, agreements, acquisitions, partnerships, new product launches, and new product developments as the major strategies to consolidate their position in the market.

Advanced Lead Acid Battery Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Billion) |

|

Segments Covered |

Type, Construction Method, End-User, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

The major market players include Enersys (US), Exide Industries Ltd. (India), GS Yuasa International Ltd. (Japan), Clarios (US), and Leoch International Technology Limited Inc (China) |

This research report categorizes the advanced lead acid battery market based on Type, Construction Method, End-User, and Region.

Based on Type, the advanced lead acid battery market has been segmented as follows:

- Stationary

- Motive

Based on Construction Method, the advanced lead acid battery market has been segmented as follows:

- Flooded

- VRLA (Valve Regulated Lead Acid battery)

Based on End-User, the advanced lead acid battery market has been segmented as follows:

- Utility

- Transportation

- Industrial

- Commercial & Residential

Based on Region, the advanced lead acid battery market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In January 2021, Kolkata Discom CESC and Exide partnered on a grid-connected 315 kWh battery energy storage systems (BESS) at low tension (LT) distribution system. This development enabled better peak load control. The initiative is the first of its sort on this scale in West Bengal. The newly inaugurated BESS is located at CESC’s East Calcutta Substation near Kankurgachi, Kolkata

- In July 2020, EnerSys collaborated with Blink Charging Co., one of the providers of electric vehicle (EV) charging equipment and services. This collaboration enabled the development of high-power wireless and enhanced DC fast charging (DCFC) systems with integrated battery storage for the transportation market.

- In June 2019, EnerSys invested over USD 100 million in new capital over the next three years to expand its Thin Plate Pure Lead (TPPL) capacity, with an expected 15% increase. These two initiatives improved TPPL capacity by more than USD 500 million per year when combined.

Frequently Asked Questions (FAQ):

What is the current size of the global advanced lead acid battery market?

The advanced lead acid battery market is projected to grow from USD 22.7 billion in 2022 to USD 30.7 billion by 2027, at a CAGR of 6.3% during the forecast period.

Who are the leading players in the global advanced lead acid battery market?

Some of the key players operating in the advanced lead acid battery market are Enersys (US), Exide Industries Ltd. (India), GS Yuasa International Ltd. (Japan), Clarios (US), and Leoch International Technology Limited Inc (China), among others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVE OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.4 INCLUSIONS & EXCLUSIONS

1.4.1 ADVANCED LEAD ACID BATTERY MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.4.2 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 RESEARCH LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 ADVANCED LEAD ACID BATTERY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 MATRIX CONSIDERED FOR DEMAND-SIDE

FIGURE 2 MAIN MATRIX CONSIDERED FOR CONSTRUCTING AND ASSESSING DEMAND FOR ADVANCED LEAD ACID BATTERY

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 METHODOLOGY FOR SUPPLY-SIDE SIZING OF ADVANCED LEAD ACID BATTERY MARKET

FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF ADVANCED LEAD ACID BATTERY MARKET (2/2)

2.3.2.1 Calculations for supply-side analysis

2.3.3 FORECAST

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.5 DATA TRIANGULATION

FIGURE 7 ADVANCED LEAD ACID BATTERY MARKET: DATA TRIANGULATION

2.6 KEY ASSUMPTIONS WHILE CALCULATING DEMAND-SIDE MARKET SIZE

2.7 LIMITATIONS

2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 43)

TABLE 1 ADVANCED LEAD ACID BATTERY MARKET

FIGURE 8 MOTIVE SEGMENT EXPECTED TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

FIGURE 9 VRLA SEGMENT EXPECTED TO DOMINATE OVERALL MARKET DURING FORECAST PERIOD

FIGURE 10 TRANSPORTATION SEGMENT EXPECTED TO BE MAJOR END USER OF ADVANCED LEAD ACID BATTERIES

FIGURE 11 ASIA PACIFIC ACCOUNTS FOR LARGEST SHARE OF ADVANCED LEAD ACID BATTERY MARKET

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN ADVANCED LEAD ACID BATTERY MARKET

FIGURE 12 ADVANCED LEAD ACID BATTERY MARKET PROJECTED TO WITNESS MODERATE GROWTH DURING FORECAST PERIOD

4.2 ADVANCED LEAD ACID BATTERY MARKET, BY REGION

FIGURE 13 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF ADVANCED LEAD ACID BATTERY DURING FORECAST PERIOD

4.3 ADVANCED LEAD ACID BATTERY MARKET, BY TYPE

FIGURE 14 MOTIVE SEGMENT ACCOUNTED FOR LARGER SHARE IN 2021

4.4 ADVANCED LEAD ACID BATTERY MARKET, BY CONSTRUCTION METHOD

FIGURE 15 VRLA (VALVE REGULATED LEAD ACID BATTERY) ACCOUNTED FOR LARGER SHARE IN 2021

4.5 ADVANCED LEAD ACID BATTERY MARKET, BY END-USER

FIGURE 16 TRANSPORTATION WAS LARGEST END-USER IN 2021

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 MARKET DYNAMICS FOR ADVANCED LEAD ACID BATTERY MARKET

5.2.1 DRIVERS

5.2.1.1 Cost-competitive energy storage solution

5.2.1.2 Rapid technological advancements and expansion in telecom sector

5.2.1.3 Easily recyclable compared to lithium-ion battery

FIGURE 18 IMPACT OF DRIVERS ON ADVANCED LEAD ACID BATTERY MARKET

5.2.2 RESTRAINTS

5.2.2.1 Low-cost alternatives in energy storage space

5.2.2.2 Safety related to battery usage

FIGURE 19 IMPACT OF RESTRAINTS ON ADVANCED LEAD ACID BATTERY MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Expanding data center infrastructure

5.2.3.2 Increase in renewable energy generation target

FIGURE 20 IMPACT OF OPPORTUNITIES ON ADVANCED LEAD ACID BATTERY MARKET

5.2.4 CHALLENGES

5.2.4.1 Growth of electric vehicles

TABLE 2 COST COMPARISON OF LEAD ACID BATTERY AND LITHIUM-ION BATTERY

5.2.4.2 Impact of COVID-19 on advanced lead acid battery market

FIGURE 21 IMPACT OF CHALLENGES ON ADVANCED LEAD ACID BATTERY MARKET

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 22 ADVANCED LEAD ACID BATTERY MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 3 ADVANCED LEAD ACID BATTERY MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 ECOSYSTEM/MARKET MAP

FIGURE 23 ADVANCED LEAD ACID BATTERY MARKET: ECOSYSTEM/MARKET MAP

5.5 VALUE CHAIN

FIGURE 24 ADVANCED LEAD ACID BATTERY MARKET: VALUE CHAIN

5.6 PRICING ANALYSIS

FIGURE 25 AVERAGE PRICE OF MOTIVE AND STATIONARY ADVANCED LEAD ACID BATTERIES FROM 2018 TO 2021

5.7 REGULATORY LANDSCAPE

TABLE 4 REGULATIONS AND STANDARDS FOR BATTERIES

5.8 LEAD ACID BATTERY PATENT ANALYSIS

5.8.1 INTRODUCTION

5.8.2 METHODOLOGY

5.8.3 DOCUMENT TYPE

FIGURE 26 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

FIGURE 27 PUBLICATION TRENDS - LAST 10 YEARS

5.8.4 INSIGHT

5.8.5 LEGAL STATUS

FIGURE 28 LEGAL STATUS OF PATENTS

5.8.6 JURISDICTION ANALYSIS

FIGURE 29 TOP JURISDICTION, BY DOCUMENT

5.8.7 TOP COMPANIES/APPLICANTS

FIGURE 30 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

TABLE 5 LIST OF PATENTS BY GS YUASA INTERNATIONAL LTD.

TABLE 6 LIST OF PATENTS BY DARAMIC LLC.

TABLE 7 LIST OF PATENTS BY THE FURUKAWA BATTERY CO., LTD.

TABLE 8 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.9 TECHNOLOGY ANALYSIS

5.10 TRADE DATA

TABLE 9 EXPORT OF BATTERIES, 2020

TABLE 10 IMPORT OF BATTERIES, 2020

5.11 CASE STUDY

5.11.1 ALASKA, US ISLAND/OFF-GRID FREQUENCY RESPONSE

5.12 IMPACT OF COVID-19 ON ADVANCED LEAD ACID BATTERY MARKET

5.12.1 IMPACT OF COVID-19 ON LIVES AND LIVELIHOOD

5.12.2 ECONOMIC OUTLOOK

TABLE 11 PROJECTED ECONOMIC OUTLOOK BY IMF FOR 2021 AND 2022

5.12.3 DISRUPTION IN INDUSTRY

TABLE 12 IMPACT OF COVID-19 ON VALUE CHAIN

5.12.4 SUPPLY CHAIN CONSTRAINTS AND STRATEGIES UNDERTAKEN

5.12.5 IMPACT OF COVID-19 ON TRANSPORTATION SECTOR

6 ADVANCED LEAD ACID BATTERY MARKET, BY TYPE (Page No. - 73)

6.1 INTRODUCTION

FIGURE 31 MOTIVE SEGMENT TO LEAD ADVANCED LEAD ACID BATTERY MARKET DURING FORECAST PERIOD

TABLE 13 ADVANCED LEAD ACID BATTERY MARKET SIZE, BY TYPE, 2017–2020 (USD BILLION)

TABLE 14 ADVANCED LEAD ACID BATTERY MARKET SIZE, BY TYPE, 2021–2027 (USD BILLION)

6.2 STATIONARY

6.2.1 USAGE IN COMMERCIAL & RESIDENTIAL AND UTILITY SECTORS TO DRIVE THE DEMAND

TABLE 15 STATIONARY: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY REGION, 2017–2020 (USD BILLION)

TABLE 16 STATIONARY: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY REGION, 2021–2027 (USD BILLION)

6.3 MOTIVE

6.3.1 INCREASED APPLICATION IN TRANSPORTATION SECTOR TO BOOST MARKET

TABLE 17 MOTIVE: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY REGION, 2017–2020 (USD BILLION)

TABLE 18 MOTIVE: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY REGION, 2021–2027 (USD BILLION)

7 ADVANCED LEAD ACID BATTERY MARKET, BY CONSTRUCTION METHOD (Page No. - 77)

7.1 INTRODUCTION

FIGURE 32 VRLA SEGMENT TO LEAD ADVANCED LEAD ACID BATTERY MARKET DURING FORECAST PERIOD

TABLE 19 ADVANCED LEAD ACID BATTERY MARKET SIZE, BY CONSTRUCTION METHOD, 2017–2020 (USD BILLION)

TABLE 20 ADVANCED LEAD ACID BATTERY MARKET SIZE, BY CONSTRUCTION METHOD, 2021–2027 (USD BILLION)

7.2 FLOODED

7.2.1 DEMAND FOR FLOODED BATTERIES MOSTLY DRIVEN BY USAGE IN STATIONARY UNITS, UPS

TABLE 21 FLOODED: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY REGION, 2017–2020 (USD BILLION)

TABLE 22 FLOODED: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY REGION, 2021–2027 (USD BILLION)

7.3 VRLA BATTERY (VALVE-REGULATED LEAD ACID BATTERY)

7.3.1 ASIA PACIFIC IS LARGEST AND FASTEST-GROWING MARKET FOR VRLA BATTERIES

TABLE 23 VRLA: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY REGION, 2017–2020 (USD BILLION)

TABLE 24 VRLA: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY REGION, 2021–2027 (USD BILLION)

8 ADVANCED LEAD ACID BATTERY MARKET, BY END-USER (Page No. - 81)

8.1 INTRODUCTION

FIGURE 33 TRANSPORTATION SEGMENT TO LEAD ADVANCED LEAD ACID BATTERY MARKET DURING FORECAST PERIOD

TABLE 25 ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 26 ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

8.2 UTILITY

8.2.1 GROWTH IN POWER CONSUMPTION TO INCREASE DEMAND IN UTILITY SEGMENT

TABLE 27 UTILITY: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY REGION, 2017–2020 (USD BILLION)

TABLE 28 UTILITY: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY REGION, 2021–2027 (USD BILLION)

8.3 TRANSPORTATION

8.3.1 ASIA PACIFIC IS LARGEST AS WELL AS FASTEST-GROWING MARKET IN TRANSPORTATION SEGMENT

TABLE 29 TRANSPORTATION: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY REGION, 2017–2020 (USD BILLION)

TABLE 30 TRANSPORTATION: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY REGION, 2021–2027 (USD BILLION)

8.4 INDUSTRIAL

8.4.1 GROWING INDUSTRIALIZATION IN DEVELOPING COUNTRIES CREATING DEMAND FOR ADVANCED LEAD ACID BATTERY

TABLE 31 INDUSTRIAL: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY REGION, 2017–2020 (USD BILLION)

TABLE 32 INDUSTRIAL: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY REGION, 2021–2027 (USD BILLION)

8.5 COMMERCIAL & RESIDENTIAL

8.5.1 GROWING INDUSTRIALIZATION IN DEVELOPING COUNTRIES DRIVING DEMAND FOR ADVANCED LEAD ACID BATTERIES FOR POWER BACKUP

TABLE 33 COMMERCIAL & RESIDENTIAL: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY REGION, 2017–2020 (USD BILLION)

TABLE 34 COMMERCIAL & RESIDENTIAL: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY REGION, 2021–2027 (USD BILLION)

9 ADVANCED LEAD ACID BATTERY MARKET, BY REGION (Page No. - 87)

9.1 INTRODUCTION

FIGURE 34 ASIA PACIFIC TO BE LARGEST ADVANCED LEAD ACID BATTERY MARKET DURING FORECAST PERIOD

TABLE 35 ADVANCED LEAD ACID BATTERY MARKET SIZE, BY REGION, 2017–2020 (USD BILLION)

TABLE 36 ADVANCED LEAD ACID BATTERY MARKET SIZE, BY REGION, 2021–2027 (USD BILLION)

9.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA: ADVANCED LEAD ACID BATTERY MARKET SNAPSHOT

TABLE 37 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD BILLION)

TABLE 38 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD BILLION)

TABLE 39 NORTH AMERICA: MARKET SIZE, BY TYPE, 2017–2020 (USD BILLION)

TABLE 40 NORTH AMERICA: MARKET SIZE, BY TYPE, 2021–2027 (USD BILLION)

TABLE 41 NORTH AMERICA: MARKET SIZE, BY CONSTRUCTION METHOD, 2017–2020 (USD BILLION)

TABLE 42 NORTH AMERICA: MARKET SIZE, BY CONSTRUCTION METHOD, 2021–2027 (USD BILLION)

TABLE 43 NORTH AMERICA: MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.2.1 US

9.2.1.1 Growing production of cars and commercial vehicles in US expected to fuel market

TABLE 45 US: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 46 US: MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.2.2 CANADA

9.2.2.1 Investment in data centers expected to propel demand for advanced lead acid battery

TABLE 47 CANADA: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 48 CANADA: MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.2.3 MEXICO

9.2.3.1 Rising investment in automotive sector propelling demand for advanced lead acid battery

TABLE 49 MEXICO: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 50 MEXICO: MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.3 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: ADVANCED LEAD ACID BATTERY MARKET SNAPSHOT

TABLE 51 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD BILLION)

TABLE 52 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2027 (USD BILLION)

TABLE 53 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2017–2020 (USD BILLION)

TABLE 54 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2027 (USD BILLION)

TABLE 55 ASIA PACIFIC: MARKET SIZE, BY CONSTRUCTION METHOD, 2017–2020 (USD BILLION)

TABLE 56 ASIA PACIFIC: MARKET SIZE, BY CONSTRUCTION METHOD, 2021–2027 (USD BILLION)

TABLE 57 ASIA PACIFIC: MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 58 ASIA PACIFIC: MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.3.1 CHINA

9.3.1.1 Advanced lead acid battery likely to witness high growth due to growing demand for cars and commercial vehicles

TABLE 59 CHINA: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 60 CHINA: MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.3.2 JAPAN

9.3.2.1 Growing renewables such as solar and wind expected to drive market

TABLE 61 JAPAN: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 62 JAPAN: MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.3.3 INDIA

9.3.3.1 Growing renewable sector to create high demand for advanced lead acid battery

TABLE 63 INDIA: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 64 INDIA: MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.3.4 SOUTH KOREA

9.3.4.1 Increasing investment in renewable sector expected to propel demand

TABLE 65 SOUTH KOREA: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 66 SOUTH KOREA: MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.3.5 REST OF ASIA PACIFIC

TABLE 67 REST OF ASIA PACIFIC: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 68 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.4 EUROPE

FIGURE 37 EUROPE: ADVANCED LEAD ACID BATTERY MARKET SNAPSHOT

TABLE 69 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (USD BILLION)

TABLE 70 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2027 (USD BILLION)

TABLE 71 EUROPE: MARKET SIZE, BY TYPE, 2017–2020 (USD BILLION)

TABLE 72 EUROPE: MARKET SIZE, BY TYPE, 2021–2027 (USD BILLION)

TABLE 73 EUROPE: MARKET SIZE, BY CONSTRUCTION METHOD, 2017–2020 (USD BILLION)

TABLE 74 EUROPE: MARKET SIZE, BY CONSTRUCTION METHOD, 2021–2027 (USD BILLION)

TABLE 75 EUROPE: MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 76 EUROPE: MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.4.1 UK

9.4.1.1 Increased production of commercial vehicles to boost demand for advanced lead acid batteries

TABLE 77 UK: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 78 UK: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.4.2 GERMANY

9.4.2.1 Shift toward renewable energy will drive demand for advanced lead acid battery

TABLE 79 GERMANY: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 80 GERMANY: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.4.3 ITALY

9.4.3.1 Extensive growth in renewable sector will drive demand for advanced lead acid battery

TABLE 81 ITALY: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 82 ITALY: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.4.4 RUSSIA

9.4.4.1 Major developments in automobile manufacturing expected to boost market growth

TABLE 83 RUSSIA: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 84 RUSSIA: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.4.5 REST OF EUROPE

TABLE 85 REST OF EUROPE: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 86 REST OF EUROPE: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.5 MIDDLE EAST & AFRICA

TABLE 87 MIDDLE EAST & AFRICA: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY COUNTRY, 2017–2020 (USD BILLION)

TABLE 88 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD BILLION)

TABLE 89 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2017–2020 (USD BILLION)

TABLE 90 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2021–2027 (USD BILLION)

TABLE 91 MIDDLE EAST & AFRICA: MARKET SIZE, BY CONSTRUCTION METHOD, 2017–2020 (USD BILLION)

TABLE 92 MIDDLE EAST & AFRICA: MARKET SIZE, BY CONSTRUCTION METHOD, 2021–2027 (USD BILLION)

TABLE 93 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 94 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.5.1 UAE

9.5.1.1 Government initiatives for renewable energy to support market growth

TABLE 95 UAE: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 96 UAE: MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.5.2 SAUDI ARABIA

9.5.2.1 Growing investment in data centers to accelerate demand for advanced lead acid battery

TABLE 97 SAUDI ARABIA: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 98 SAUDI ARABIA: MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.5.3 SOUTH AFRICA

9.5.3.1 Government initiative to boost automotive sector expected to increase demand for advanced lead acid battery

TABLE 99 SOUTH AFRICA: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 100 SOUTH AFRICA: MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 101 REST OF MIDDLE EAST & AFRICA: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 102 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.6 SOUTH AMERICA

TABLE 103 SOUTH AMERICA: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY COUNTRY, 2017–2020 (USD BILLION)

TABLE 104 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD BILLION)

TABLE 105 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2017–2020 (USD BILLION)

TABLE 106 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2021–2027 (USD BILLION)

TABLE 107 SOUTH AMERICA: MARKET SIZE, BY CONSTRUCTION METHOD, 2017–2020 (USD BILLION)

TABLE 108 SOUTH AMERICA: MARKET SIZE, BY CONSTRUCTION METHOD, 2021–2027 (USD BILLION)

TABLE 109 SOUTH AMERICA: MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 110 SOUTH AMERICA: MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.6.1 BRAZIL

9.6.1.1 Investment in data centers to create huge growth opportunity for advanced lead acid battery market

TABLE 111 BRAZIL: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 112 BRAZIL: MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.6.2 CHILE

9.6.2.1 Growing initiative towards solar energy to create demand for advanced lead acid batteries

TABLE 113 CHILE: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 114 CHILE: MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

9.6.3 REST OF SOUTH AMERICA

TABLE 115 REST OF SOUTH AMERICA: ADVANCED LEAD ACID BATTERY MARKET SIZE, BY END-USER, 2017–2020 (USD BILLION)

TABLE 116 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USER, 2021–2027 (USD BILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 122)

10.1 INTRODUCTION

10.2 STRATEGIES OF KEY PLAYERS

TABLE 117 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS

10.3 REVENUE ANALYSIS

FIGURE 38 REVENUE ANALYSIS FOR KEY COMPANIES OF LAST 5 YEARS

10.4 RANKING OF LEADING MARKET PLAYERS, 2021

FIGURE 39 RANKING OF LEADING PLAYERS IN ADVANCED LEAD ACID BATTERY MARKET, 2021

10.4.1 ENERSYS

10.4.2 EXIDE INDUSTRIES LTD.

10.4.3 GS YUASA INTERNATIONAL LTD.

10.4.4 CLARIOS

10.4.5 LEOCH INTERNATIONAL TECHNOLOGY LIMITED INC.

TABLE 118 ADVANCED LEAD ACID BATTERY MARKET: CONSTRUCTION METHOD FOOTPRINT

TABLE 119 ADVANCED LEAD ACID BATTERY MARKET: END-USER FOOTPRINT

TABLE 120 ADVANCED LEAD ACID BATTERY MARKET: REGION FOOTPRINT

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STAR

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE

10.5.4 PARTICIPANTS

FIGURE 40 ADVANCED LEAD ACID BATTERY MARKET: COMPANY EVALUATION MATRIX, 2021

10.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) MATRIX, 2021

10.6.1 PROGRESSIVE COMPANIES

10.6.2 STARTING BLOCKS

10.6.3 DYNAMIC COMPANIES

10.6.4 RESPONSIVE COMPANIES

FIGURE 41 ADVANCED LEAD ACID BATTERY MARKET: SME MATRIX, 2021

10.7 COMPETITIVE SCENARIO

TABLE 121 ADVANCED LEAD ACID BATTERY MARKET: PRODUCT LAUNCHES, 2019–2022

TABLE 122 ADVANCED LEAD ACID BATTERY MARKET: DEALS, 2019–2022

TABLE 123 ADVANCED LEAD ACID BATTERY MARKET: OTHER DEVELOPMENTS, 2019–2022

11 COMPANY PROFILES (Page No. - 137)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 INTRODUCTION

11.2 KEY COMPANIES

11.2.1 ENERSYS

TABLE 124 ENERSYS: COMPANY OVERVIEW

FIGURE 42 ENERSYS: COMPANY SNAPSHOT

TABLE 125 ENERSYS: PRODUCT OFFERINGS

TABLE 126 ENERSYS: PRODUCT LAUNCHES

TABLE 127 ENERSYS: DEAL

TABLE 128 ENERSYS: OTHERS

11.2.2 CLARIOS

TABLE 129 CLARIOS: COMPANY OVERVIEW

TABLE 130 CLARIOS: PRODUCT OFFERINGS

TABLE 131 CLARIOS: PRODUCT LAUNCHES

TABLE 132 CLARIOS: OTHERS

11.2.3 EXIDE INDUSTRIES LTD.

TABLE 133 EXIDE INDUSTRIES LTD.: COMPANY OVERVIEW

FIGURE 43 EXIDE INDUSTRIES LTD.: COMPANY SNAPSHOT

TABLE 134 EXIDE INDUSTRIES LTD.: PRODUCT OFFERINGS

TABLE 135 EXIDE INDUSTRIES LTD.: DEAL

TABLE 136 EXIDE INDUSTRIES LTD.: OTHERS

11.2.4 GS YUASA INTERNATIONAL LTD.

TABLE 137 GS YUASA INTERNATIONAL LTD.: COMPANY OVERVIEW

FIGURE 44 GS YUASA INTERNATIONAL LTD.: COMPANY SNAPSHOT

TABLE 138 GS YUASA INTERNATIONAL LTD.: PRODUCT OFFERINGS

TABLE 139 GS YUASA INTERNATIONAL LTD.: PRODUCT LAUNCHES

TABLE 140 GS YUASA INTERNATIONAL LTD.: OTHERS

11.2.5 LEOCH INTERNATIONAL TECHNOLOGY LIMITED INC.

TABLE 141 LEOCH INTERNATIONAL TECHNOLOGY LIMITED INC.: COMPANY OVERVIEW

FIGURE 45 LEOCH INTERNATIONAL TECHNOLOGY LIMITED INC.: COMPANY SNAPSHOT

TABLE 142 LEOCH INTERNATIONAL TECHNOLOGY LIMITED INC.: PRODUCT OFFERINGS

11.2.6 CROWN BATTERY

TABLE 143 CROWN BATTERY: COMPANY OVERVIEW

TABLE 144 CROWN BATTERY: PRODUCT OFFERINGS

TABLE 145 CROWN BATTERY: DEAL

11.2.7 NARADA POWER

TABLE 146 NARADA POWER: COMPANY OVERVIEW

TABLE 147 NARADA POWER: PRODUCT OFFERINGS

TABLE 148 NARADA POWER: DEAL

11.2.8 AMARA RAJA BATTERIES LTD.

TABLE 149 AMARA RAJA BATTERIES LTD.: COMPANY OVERVIEW

FIGURE 46 AMARA RAJA BATTERIES LTD.: COMPANY SNAPSHOT

TABLE 150 AMARA RAJA BATTERIES LTD.: PRODUCT OFFERINGS

TABLE 151 AMARA RAJA BATTERIES LTD.: DEAL

11.2.9 EAST PENN MANUFACTURING COMPANY

TABLE 152 EAST PENN MANUFACTURING COMPANY: COMPANY OVERVIEW

TABLE 153 EAST PENN MANUFACTURING COMPANY: PRODUCT OFFERINGS

TABLE 154 EAST PENN MANUFACTURING COMPANY: PRODUCT LAUNCHES

TABLE 155 EAST PENN MANUFACTURING COMPANY: DEAL

TABLE 156 EAST PENN MANUFACTURING COMPANY: OTHERS

11.2.10 FIAMM ENERGY TECHNOLOGY S.P.A.

TABLE 157 FIAMM ENERGY TECHNOLOGY S.P.A.: COMPANY OVERVIEW

TABLE 158 FIAMM ENERGY TECHNOLOGY S.P.A.: PRODUCT OFFERINGS

TABLE 159 FIAMM ENERGY TECHNOLOGY S.P.A.: DEAL

11.2.11 THE FURUKAWA BATTERY CO., LTD.

TABLE 160 THE FURUKAWA BATTERY CO., LTD.: COMPANY OVERVIEW

FIGURE 47 THE FURUKAWA BATTERY CO., LTD.: COMPANY SNAPSHOT

TABLE 161 THE FURUKAWA BATTERY CO., LTD.: PRODUCT OFFERINGS

11.2.12 TIANNENG GROUP

TABLE 162 TIANNENG GROUP: COMPANY OVERVIEW

FIGURE 48 TIANNENG GROUP: COMPANY SNAPSHOT

TABLE 163 TIANNENG GROUP: PRODUCT OFFERINGS

11.2.13 SHUANGDENG GROUP CO., LTD.

TABLE 164 SHUANGDENG GROUP CO., LTD.: COMPANY OVERVIEW

TABLE 165 SHUANGDENG GROUP CO., LTD.: PRODUCT OFFERINGS

11.2.14 TROJAN BATTERY COMPANY, LLC.

TABLE 166 TROJAN BATTERY COMPANY, LLC: COMPANY OVERVIEW

TABLE 167 TROJAN BATTERY COMPANY, LLC.: PRODUCT OFFERINGS

TABLE 168 TROJAN BATTERY COMPANY, LLC.: DEAL

11.2.15 CAMEL GROUP CO., LTD.

TABLE 169 CAMEL GROUP CO., LTD.: COMPANY OVERVIEW

FIGURE 49 CAMEL GROUP CO., LTD.: COMPANY SNAPSHOT

TABLE 170 CAMEL GROUP CO., LTD.: PRODUCT OFFERINGS

11.2.16 CHAOWEI POWER HOLDINGS LIMITED

TABLE 171 CHAOWEI POWER HOLDINGS LIMITED: COMPANY OVERVIEW

FIGURE 50 CHAOWEI POWER HOLDINGS LIMITED: COMPANY SNAPSHOT

TABLE 172 CHAOWEI POWER HOLDINGS LIMITED: PRODUCT OFFERINGS

11.2.17 COSLIGHT TECHNOLOGY INTERNATIONAL GROUP CO., LTD.

TABLE 173 COSLIGHT TECHNOLOGY INTERNATIONAL GROUP CO., LTD.: COMPANY OVERVIEW

FIGURE 51 COSLIGHT TECHNOLOGY INTERNATIONAL GROUP CO., LTD.: COMPANY SNAPSHOT

TABLE 174 COSLIGHT TECHNOLOGY INTERNATIONAL GROUP CO., LTD.: PRODUCT OFFERINGS

11.3 OTHER PLAYERS

11.3.1 RITAR INTERNATIONAL GROUP

TABLE 175 RITAR INTERNATIONAL GROUP: COMPANY OVERVIEW

11.3.2 FIRST NATIONAL BATTERY

TABLE 176 FIRST NATIONAL BATTERY: COMPANY OVERVIEW

11.3.3 MIDAC BATTERIES S.P.A.

TABLE 177 MIDAC BATTERIES S.P.A.: COMPANY OVERVIEW

11.3.4 CSB ENERGY TECHNOLOGY CO., LTD.

TABLE 178 CSB ENERGY TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

11.3.5 GRIDTENTIAL ENERGY, INC.

TABLE 179 GRIDTENTIAL ENERGY, INC.: COMPANY OVERVIEW

11.3.6 BANNER BATTERIES

TABLE 180 BANNER BATTERIES: COMPANY OVERVIEW

11.3.7 EXIDE TECHNOLOGIES

TABLE 181 EXIDE TECHNOLOGIES: COMPANY OVERVIEW

11.3.8 HOPPECKE BATTERIEN GMBH & CO. KG

TABLE 182 HOPPECKE BATTERIEN GMBH & CO. KG: COMPANY OVERVIEW

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 190)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

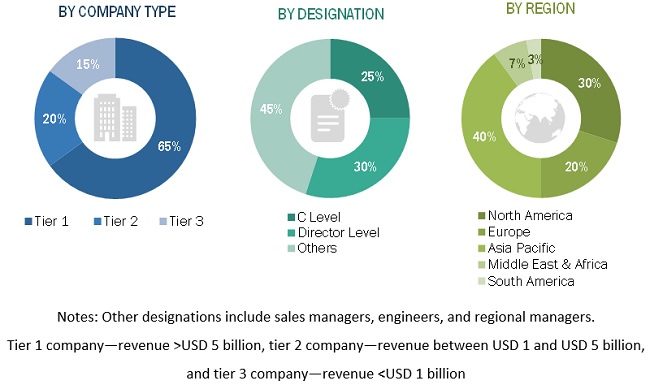

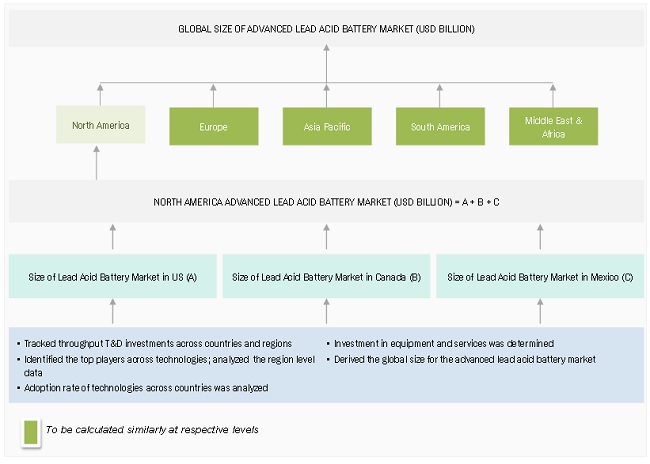

The study involved four major activities in estimating the current size of the advanced lead acid battery market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the advanced lead acid battery value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study include annual reports; press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors, gold- and silver-standard websites, advanced lead acid battery manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

The advanced lead acid battery market comprises several stakeholders, such as raw material suppliers, processors, end-use industries, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of advanced lead acid battery manufacturers, importers/exporters, and manufacturers engaged in the production of various products. The supply side is characterized by key technology providers for advanced lead acid battery, end-users, researchers, and service providers.

In the primary research process, various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side included key opinion leaders, executives, vice presidents, and CEOs of construction companies. The primary sources from the supply side included research institutions involved in R&D activities to introduce new technologies, key opinion leaders, distributors, and advanced lead acid battery manufacturing companies.

Breakdown of the Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the advanced lead acid battery market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- The value chain and market size of the advanced lead acid battery market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global Advanced Lead Acid Battery Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches.

Report Objectives

MARKET INTELLIGENCE

- To analyze and forecast the size of the advanced lead acid battery market in terms of value

- To define, describe, and forecast the market size by type, construction method, end-user, and region

- To forecast the market size with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market segments with respect to individual growth trends, prospects, and their contribution to the market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as product launches, and expansions in the advanced lead acid battery market

COMPETITIVE INTELLIGENCE

- To identify and profile the key players in the advanced lead acid battery market

- To determine the top players offering various products in the advanced lead acid battery market

- To provide a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify the key growth strategies adopted by the leading players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

Product matrix, which gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Advanced Lead Acid Battery Market