Advanced Energy Storage Systems Market by Technology (Electro Chemical Technology, Mechanical Technology, Thermal Storage Technology), by Application (Transportation and Grid Storage), and Region - Global Forecast to 2022

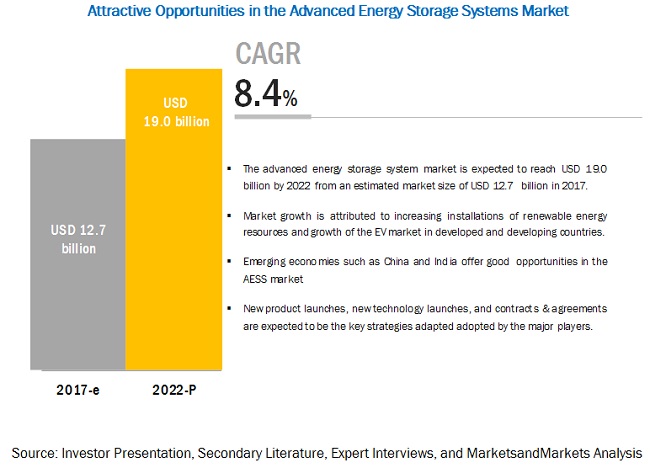

[205 Pages Report] MarketsandMarkets forecasts the advanced energy storage systems market to grow from USD 12.7 billion in 2017 to USD 19.0 billion by 2022, at a Compound Annual Growth Rate (CAGR) of 8.4% during the forecast period. The growth of the advanced energy storage systems market is attributed to increasing renewable energy investments, and growth in the electric vehicles market globally and regulatory changes demanding energy efficiency. The objective of the report is to define, describe, and forecast the global advanced energy storage market by application, technology, and region

By application, transportation segment is expected to dominate the CHP market during the forecast period

The report segments the advanced energy storage systems market, by application, into transportation and grid storage. The transportation segment is expected to hold the largest market share by 2022. The growth in this segment is primarily driven by increasing deployment of lithium-ion batteries in the electric vehicles market. Moreover, grid expansion and investment in modern infrastructure in developing countries also present opportunities for growth.

By technology, the electro chemical segment is expected to have the highest market share during the forecast period

The electro chemical segment is expected to grow at the highest rate during the forecast period. The lithium-ion sub segment, within the electro chemical segment led the advanced energy storage systems market in 2016 and is projected to dominate the market during the forecast period. Moreover, technological advancements and growing deployment of lithium-ion batteries is expected to result in economies of scale, which would lower the cost for this technology, further driving the growth in the market.

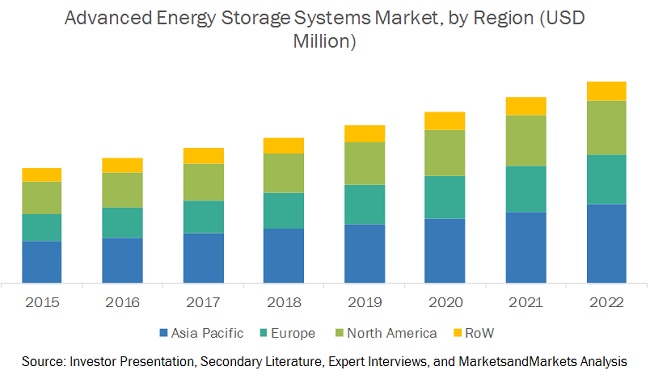

Asia Pacific to account for the largest market size during the forecast period.

The market in Asia Pacific is estimated to be the fastest growing market for advanced energy storage systems from 2017 to 2022. Increasing use of renewable energy resources for power generation, especially in China, South Korea, India and increase in number of electric vehicles are driving the demand for advanced energy storage systems in this region. The growing need for energy reliability and efficiency are also expected to spur the growth of the market and represents a promising opportunity for major advanced energy storage systems providers.

Market Dynamics

Driver: Increasing renewable energy investments

The developed as well as developing countries are revising energy policies to include a considerable portion of generation, to be sourced from renewable energy resources that includes wind and solar. Financial incentives by government bodies and associated returns are increasing investments in renewable energy, which are expected to boost the AESS market.

By the end of 2015, almost 173 countries established renewable energy targets at the provincial, state, or national level. In addition, about 146 countries had renewable energy support policies by the end of 2015. Several countries held auctions to deploy renewables in a structured but in a cost efficient manner. As per International Renewable Energy Agency (IRENA), at least 67 countries held such auctions in 2016 as compared to just six in 2005.

Renewables have now become the first choice for expanding, upgrading, and modernizing power systems around the world. According to Bloomberg New energy finance wind and solar energy accounted for 90% of the 2015 investments in renewable power, as the cost of wind turbines has fallen by nearly a third, since 2009 and that of solar photovoltaic modules fell by 80%. It is reported that, currently the cost of onshore wind, biomass, hydro power, and geothermal are competitive with coal, oil, and gas powered power plants

Restraint: High capital investments

Energy storage technologies such as lithium-ion batteries, flow batteries, and sodium sulfur (NaS) batteries require high capital for production as compared to the other technologies due to their benefits of high energy density and improved performance. Lithium, being an expensive metal, increases the cost of battery production; therefore, with its emerging and evolving applications in EV & grid storage for the initial two or three years, the cost of technology is expected to be high; with the increasing adoption, the cost will decrease. The total cost of technology also increases with rated power. High capital investments associated with AESS installations restrain the usage of these technologies by customers such as captive power customers and residential customers among others. Hence, the impact of this factor is expected to be there for next 3-4 years.

Opportunity: Grid expansion and investment in the modern infrastructure

The developing countries, such as India and China require modernization of the aging infrastructure and grid expansion. Currently, there is a need to bring power to an estimated 30% of the rapidly growing global population without access to electricity.

Further, according to the United Nations Sustainable Energy for All initiative (SE4All), around USD 45 billion investment is required by 2030, to provide universal access to the modern electric power. Advanced energy storage is expected to play a prominent role in these investments by strengthening the grid against diverse threats, such as natural disasters and facilitating improved deployment of both new and existing resources.

Challenge: Dynamic valuations

The value of energy storage can be ascertained by the difference between light load hour and heavy load hour energy prices in the wholesale energy market. Decreased natural gas prices and the introduction of low variable cost resources, such as solar and wind, depressed the market prices generally. It may be noted that market prices will not reflect the value of resource additions until major shortages were to occur, such as in case of unforeseen events of market disrupt ability. There is a need to devise a policy or regulation to analyze energy storage valuation to propel growth in the energy storage market.

Further, the current market structure does not allow for a buyer of energy storage equipment to easily capture the value streams, as there are number of services and benefits that the energy storage systems provide cannot be easily monetized. Some of these benefits are reduced incidence of service interruption, increased system reliability, and increased efficiency.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20152022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Application (Transportation, Grid Storage), Technology (Electrochemical [lithium-ion battery, lead acid battery, sodium sulfur battery, flow battery, nickel metal hydride & nickel cadmium battery]; Thermal Storage [thermo chemical energy storage, sensible heat thermal energy storage, latent heat thermal energy storage]; Mechanical energy storage [pumped hydro energy storage, flywheel energy storage, compressed air & liquid air energy storage], and other storage technologies. |

|

Geographies covered |

Asia Pacific, Europe, North America, Rest of the World |

|

Companies covered |

ABB Ltd. (Switzerland), LG Chem, Ltd. (South Korea), General Electric Company (US), Samsung SDI Co ltd. (South Korea), GS Yuasa Corporation (Japan), Siemens Ltd. (Germany), Panasonic Corporation (Japan), CALMAC (US), Tesla Inc. (US), Toshiba Corporation (Japan) |

The research report categorizes the advanced energy storage systems market to forecast the revenues and analyze the trends in each of the following sub-segments:

Advanced Energy Storage Systems Market, By Application

- Transportation

- Grid Storage

Advanced Energy Storage Systems Market, By End-User

- Residential

- Non-Residential

Advanced Energy Storage Systems Market, By Technology

- Electro Chemical

- Lithium-ion battery

- Lead Acid battery

- Sodium Sulfur (NaS) battery

- Flow battery

- Nickel Metal Hydride (NiMH) & Nickel Metal Cadmium (NiCd)

- Mechanical

- Pumped Hydro

- Flywheel

- Compressed Air Energy Storage (CAES) & Liquid Air Energy Storage (LAES)

- Thermal Storage

- Thermo Chemical

- Sensible

- Latent

Advanced Energy Storage Systems Market, By Region

- Asia Pacific

- North America

- Europe

- Rest of the World

Key Market Players

The major players in the advanced energy storage systems market include ABB Ltd. (Switzerland), LG Chem, Ltd. (South Korea), Samsung SDI Co., Ltd (South Korea), General Electric Company (US), and Tesla, Inc. (US).

Siemens is a leading manufacturing and engineering company. It operates its business through nine segments, namely, power & gas, healthcare, energy management, digital factory, process industries and drives, mobility, building technologies, wind power and renewables, and financial services. Siemens provide DERMS under its energy management business segment. Siemens provide an integrated and comprehensive portfolio of software and hardware needed to manage the modern two-way grid. Some of the features are planning and impact analysis, which evaluates network capacity to support DER and integrate T&D planning effort with operational decisions. It provides customer centric application which helps to create the ability to define, aggregate, forecast, settle, and control customer owned DER installations within a territory. In February 2017, Siemens AG (Germany) upgraded its EnergyIP software with a new integrated distributed energy application which combines distributed energy management, virtual power plant capabilities, and demand response on one platform. This is expected to increase the market for VPP solutions provided by the company in the energy industry.

Recent Developments

- In February 2017, ABB launched an innovative microgrid, combining battery and flywheel-based storage technologies, designed to test the scalability and improve the power stability for around 300,000 people in Anchorage, Alaska, USA.

- In December 2016, Leading battery storage producer Samsung SDI Co., Ltd. (South Korea) is teaming up with leading storage inverter maker Dynapower to develop an all-in-one storage solution for commercial and industrial customers. It is a move that will remove intermediaries, lower the installed costs, and encourage a broader use of behind-the-meter batteries.

- In March 2016, GS Yuasa Corporation (Japan) announced that the company has introduced a new advanced Nano-Carbon Lead Acid battery. The new SLR-1000 is a two volt advanced lead battery that provides an unprecedented 5000 cycles at 70% depth of discharge.

- In March 2015, Samsung SDI Co., Ltd. (South Korea) and ABB Ltd (Switzerland) formed a strategic commercial alliance to develop and market microgrid systems that comprise energy storage solutions. The alliance will help Samsung to expand its leading position in the microgrid market.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the market?

- Which segment provides the most opportunity for growth?

- Who are the leading manufacturers operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Advanced Energy Storage Systems Market, 20172022

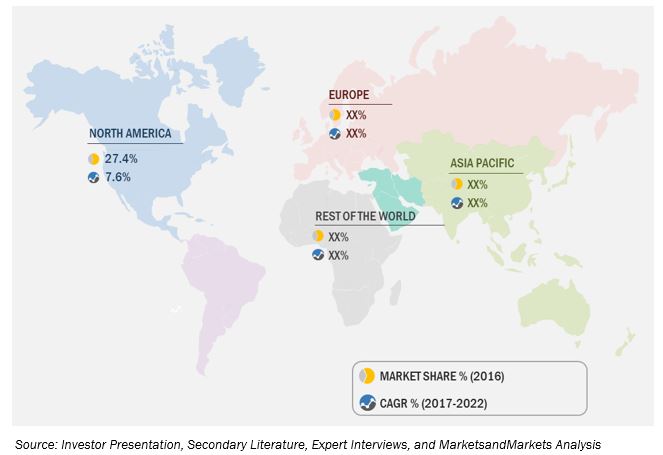

4.2 Market, By Region, 2017-2022

4.3 Market, By Application, 2017 & 2022

4.4 Transportation Market, By Region, 2017 & 2022

4.5 Market, By Technology, 2017 & 2022

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Technology Overview

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Renewable Energy Investments

5.3.1.2 Energy Arbitrage

5.3.1.3 Regulations Demanding Energy Efficiency

5.3.1.4 Declining Technology Cost Due to Technology Advancement and Expanded Deployment

5.3.1.5 Electrification of the Transport Sector

5.3.2 Restraints

5.3.2.1 High Capital Investments

5.3.2.2 Hazardous Environmental Impact

5.3.3 Opportunities

5.3.3.1 Grid Expansion and Investment in the Modern Infrastructure

5.3.3.2 Growing Opportunity for Commercial and Residential Applications

5.3.4 Challenges

5.3.4.1 Dynamic Valuations

5.3.4.2 Regulatory Treatment

5.3.4.3 Lack of Common Codes and Standards

6 Advanced Energy Storage Systems Market, By Application (Page No. - 40)

6.1 Introduction

6.2 Transportation

6.2.1 Growth of Battery Electric Vehicle is Expected to Drive the Market

6.3 Grid Storage

6.3.1 Increase in Renewable Installations is Expected to Drive the Grid Storage Market

7 Advanced Energy Storage Systems Market, By Technology (Page No. - 45)

7.1 Introduction

7.2 Electro Chemical

7.2.1 Lithium-Ion Battery

7.2.1.1 Technological Advancements in Terms of High Charge and Discharge Efficiency is Driving the Market

7.2.2 Lead Acid Battery

7.2.2.1 Low Cost of This Battery is Expected to Drive the Market

7.2.3 Sodium Sulfur (NAS) Battery

7.2.3.1 Large-Scale Grid Energy Storage Applications is Expected to Drive the Market

7.2.4 Flow Battery

7.2.4.1 Increase in Demand for Storing Renewable Energy is Expected to Drive the Market

7.2.5 Nickel Metal Hydride (NIMH) & Nickel Cadmium Battery (NICD)

7.2.5.1 Growth of Electric Vehicles is Expected to Drive the Market

7.3 Thermal Storage

7.3.1 Thermo Chemical Energy Storage

7.3.1.1 Government Funding for Initiating the Commercialization of Thermo Chemical Energy Storage is Expected to Drive the Market

7.3.2 Sensible Heat Thermal Energy Storage

7.3.2.1 Increase in Installation of District Heating and Colling is Expected to Drive the Market

7.3.3 Latent Heat Thermal Energy Storage

7.3.3.1 Capacity to Store Large Amounts of Heat With Only Small Temperature Changes is Driving the Market

7.4 Mechanical Energy Storage

7.4.1 Pumped Hydro Energy Storage

7.4.1.1 High Efficiency of Pumped Hydro Storage System is Expected to Drive the Market

7.4.2 Flywheel Energy Storage

7.4.2.1 Large Scale Stationary Energy Storage is Driving the Market

7.4.3 Compressed Air & Liquid Air Energy Storage

7.4.3.1 Energy Storage at A Relatively Low Cost is Expected to Drive the Market

7.5 Other Storage Technologies

8 Advanced Energy Storage Systems Market, By End-User (Page No. - 69)

8.1 Introduction

8.2 Residential

8.2.1 Recovering Excess Heat to Produce Hot Water and Space Heating is Expected to Drive the Market

8.3 Non-Residential

8.3.1 Reduction in Energy Cost is Expected to Drive the Market

9 Advanced Energy Storage Systems Market, By Region (Page No. - 71)

9.1 Introduction

9.2 Asia Pacific

9.2.1 China

9.2.1.1 Increasing Investments in Battery Storage Technologies is Expected to Drive the Market

9.2.2 India

9.2.2.1 Rise in Focus on Renewable Energy Generation and Growing Interest in Micro-Grids is Expected to Drive the Market

9.2.3 South Korea

9.2.3.1 Increasing Investments in Grid-Scale and Distributed Energy Storage for Load Leveling and Frequency Regulation is Expected to Drive the Market

9.2.4 Japan

9.2.4.1 Rapid Expansion in the Solar and Wind Power is Expected to Drive the Energy Storage Market

9.2.5 The Rest of Asia Pacific

9.3 North America

9.3.1 US

9.3.1.1 Government Support Policies for Energy Storage is Expected to Drive the Market

9.3.2 Canada

9.3.2.1 Increasing Focus on Renewable Energy Generation is Expected to Drive the Market

9.4 Europe

9.4.1 The UK

9.4.1.1 Rising Investments in R&D for Development of Advanced Battery Technology is Expected to Drive the Market

9.4.2 Germany

9.4.2.1 Implementation of Energy Storage Projects is Expected to Drive the Market

9.4.3 France

9.4.3.1 Investments in Battery Manufacturing is Driving the Market for Advanced Energy Storage Systems

9.4.4 The Rest of Europe

9.5 Rest of the World

9.5.1 South Africa

9.5.1.1 Focus on Storing Renewable Energy is Expected to Drive the Market

9.5.2 Chile

9.5.2.1 Increase in Deployment of Solar Pv is Expected to Drive the Market

9.5.3 Rest of RoW

10 Competitive Landscape (Page No. - 98)

10.1 Overview

10.2 Key Players of the Market

10.2.1 Growth Strategies in the Advanced Energy Storage System Market

10.3 Market Ranking, Advanced Energy Storage Systems, 2016

10.4 Competitive Situations & Trends

10.5 Competitive Leadership Mapping

10.5.1 Visionary Leaders

10.5.2 Dynamic Differentiators

10.5.3 Innovators

10.5.4 Emerging Companies

10.6 Strength of Product Portfolio (25 Companies)

10.7 Business Strategy Excellenece (25 Companies)

11 Company Profiles (Page No. - 106)

11.1 LG Chem, LTD.

11.1.1 Overview

11.1.2 Products Offered

11.1.3 Strength of Product Portfolio

11.1.4 Business Strategy Excellence

11.1.5 Recent Developments

11.2 ABB LTD.

11.2.1 Overview

11.2.2 Products Offered

11.2.3 Strength of Product Portfolio

11.2.4 Business Strategy Excellence

11.2.5 Recent Developments

11.3 GS Yuasa Corporation

11.3.1 Overview

11.3.2 Products Offered

11.3.3 Strength of Product Portfolio

11.3.4 Business Strategy Excellence

11.3.5 Recent Developments

11.4 Samsung SDI Co., LTD.

11.4.1 Overview

11.4.2 Products Offered

11.4.3 Strength of Product Portfolio

11.4.4 Business Strategy Excellence

11.4.5 Recent Developments

11.5 General Electric Company

11.5.1 Overview

11.5.2 Products Offered

11.5.3 Strength of Product Portfolio

11.5.4 Business Strategy Excellence

11.5.5 Recent Developments

11.6 Saft Groupe S.A.

11.6.1 Overview

11.6.2 Products Offered

11.6.3 Strength of Product Portfolio

11.6.4 Business Strategy Excellence

11.6.5 Recent Developments

11.7 Tesla, Inc.

11.7.1 Overview

11.7.2 Products Offered

11.7.3 Strength of Product Portfolio

11.7.4 Business Strategy Excellence

11.7.5 Recent Developments

11.8 Evapco, Inc.

11.8.1 Overview

11.8.2 Products Offered

11.8.3 Strength of Product Portfolio

11.8.4 Business Strategy Excellence

11.9 Calmac

11.9.1 Overview

11.9.2 Products Offered

11.9.3 Strength of Product Portfolio

11.9.4 Business Strategy Excellence

11.9.5 Recent Developments

11.10 Baltimore Aircoil Company, Inc.

11.10.1 Overview

11.10.2 Products Offered

11.10.3 Strength of Product Portfolio

11.10.4 Business Strategy Excellence

11.10.5 Recent Developments

11.11 BYD Company Limited

11.11.1 Overview

11.11.2 Products Offered

11.11.3 Strength of Product Portfolio

11.11.4 Business Strategy Excellence

11.11.5 Recent Developments

11.12 Hitachi, LTD.

11.12.1 Overview

11.12.2 Products Offered

11.12.3 Strength of Product Portfolio

11.12.4 Business Strategy Excellence

11.12.5 Recent Developments

11.13 Siemens AG

11.13.1 Overview

11.13.2 Products Offered

11.13.3 Strength of Product Portfolio

11.13.4 Business Strategy Excellence

11.13.5 Recent Developments

11.14 Panasonic Corporation

11.14.1 Business Overview

11.14.2 Products Offered

11.14.3 Strength of Product Portfolio

11.14.4 Business Strategy Excellence

12 Appendix (Page No. - 153)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (72 Tables)

Table 1 Advanced Energy Storage Systems Market Snapshot

Table 2 Comparison of Major Energy Storage Technologies By Technical Characteristics

Table 3 Advanced Energy Storage Systems Market Size, By Application, 20152022 (USD Million)

Table 4 Transportation: Market Size, By Region, 20152022 (USD Million)

Table 5 Grid Storage: Market Size, By Region, 20152022 (USD Million)

Table 6 Advanced Energy Storage Systems Market Size, By Technology, 20152022 (USD Million)

Table 7 Electro Chemical: Market Size, By Region, 20152022 (USD Million)

Table 8 Electro Chemical: Market Size, By Technology, 20152022 (USD Million)

Table 9 Lithium-Ion Battery: Market Size, By Region, 20152022 (USD Million)

Table 10 Lithium-Ion Battery: Market Size, By Application, 20152022 (USD Million)

Table 11 Lead Acid Battery: Market Size, By Region, 20152022 (USD Million)

Table 12 Sodium Sulfur (NAS) Battery: Market Size, By Region, 20152022 (USD Million)

Table 13 Flow Battery: Market Size, By Region, 20152022 (USD Million)

Table 14 Nickel Metal Hydride & Nickel Cadmium Battery: Market Size, By Region, 20152022 (USD Million)

Table 15 Thermal: Market Size, By Region, 20152022 (USD Million)

Table 16 Thermal: Market Size, By Technology, 20152022 (USD Thousands)

Table 17 Thermo Chemical: Market Size, By Region, 20152022 (USD Thousands)

Table 18 Sensible Heat Thermal: Market Size, By Region, 20152022 (USD Thousands)

Table 19 Latent Heat Thermal: Market Size, By Region, 20152022 (USD Thousands)

Table 20 Mechanical: Market Size, By Region, 20152022 (USD Million)

Table 21 Mechanical: Market Size, By Technology, 20152022 (USD Million)

Table 22 Pumped Hydro: Market Size, By Region, 20152022 (USD Million)

Table 23 Flywheel: Market Size, By Region, 20152022 (USD Million)

Table 24 Caes & Laes: Market Size, By Region, 20152022 (USD Million)

Table 25 Others: Market Size, By Region, 20152022 (USD Million)

Table 26 Advanced Energy Storage Systems Market Size, By End-User, 20152022 (USD Million)

Table 27 Residential: Market Size, By Region, 20152022 (USD Million)

Table 28 Non- Residential: Market Size, By Region, 20152022 (USD Million)

Table 29 Advanced Energy Storage Systems Market Size, By Region, 2015 2022 (USD Million)

Table 30 Asia Pacific: Market Size, By Country, 20152022 (USD Million)

Table 31 Asia Pacific: Market, By Application, 20152022 (USD Million)

Table 32 Asia Pacific: Transportation Market, By Technology, 20152022 (USD Million)

Table 33 Asia Pacific: Market, By Technology, 20152022 (USD Million)

Table 34 Asia Pacific: Market, By Electro Chemical Technology, 20152022 (USD Million)

Table 35 Asia Pacific: Market, By Thermal Storage Technology, 20152022 (USD Thousand)

Table 36 Asia Pacific: Market, By Mechanical Technology, 20152022 (USD Million)

Table 37 China: Advanced Energy Storage Systems Market, By Application, 20152022 (USD Million)

Table 38 India: Market, By Application, 20152022 (USD Million)

Table 39 South Korea: Advanced Energy Storage Systems Market, By Application, 20152022 (USD Million)

Table 40 Japan: Market, By Application, 20152022 (USD Million)

Table 41 The Rest of Asia Pacific: Market, By Application, 20152022 (USD Million)

Table 42 North America: Market, By Country, 20152022 (USD Million)

Table 43 North America: Market, By Application, 20152022 (USD Million)

Table 44 North America: Transportation Market, By Technology, 20152022 (USD Million)

Table 45 North America: Market, By Technology, 20152022 (USD Million)

Table 46 North America: Market, By Electro Chemical Technology, 20152022 (USD Million)

Table 47 North America: Market, By Thermal Storage Technology, 20152022 (USD Thousand)

Table 48 North America: Market, By Mechanical Technology, 20152022 (USD Million)

Table 49 US: Advanced Energy Storage Systems Market, By Application, 20152022 (USD Million)

Table 50 Canada: Market, By Application, 20152022 (USD Million)

Table 51 Europe: Market, By Country, 20152022 (USD Million)

Table 52 Europe: Market, By Application, 20152022 (USD Million)

Table 53 Europe: Transportation Market, By Technology, 20152022 (USD Million)

Table 54 Europe: Market, By Technology, 20152022 (USD Million)

Table 55 Europe: Market, By Electro Chemical Technology, 20152022 (USD Million)

Table 56 Europe: Market, By Thermal Storage Technology, 20152022 (USD Million)

Table 57 Europe: Market, By Mechanical Technology, 20152022 (USD Million)

Table 58 The UK: Market, By Application, 20152022 (USD Million)

Table 59 Germany: Market, By Application, 20152022 (USD Million)

Table 60 France: Market, By Application, 20152022 (USD Million)

Table 61 The Rest of Europe: Market, By Application, 20152022 (USD Million)

Table 62 Rest of the World: Market Size, By Country, 20152022 (USD Million)

Table 63 Rest of the World: Advanced Energy Storage System Market, By Application, 20152022 (USD Million)

Table 64 Rest of the World: Transportation Application Market, By Technology, 20152022 (USD Million)

Table 65 Rest of the World: Advanced Energy Storage Systems Market, By Technology, 20152022 (USD Million)

Table 66 Rest of World: Market, By Electro Chemical Technology, 20152022 (USD Million)

Table 67 Rest of the World: Market, By Thermal Storage Technology, 20152022 (USD Million)

Table 68 Rest of the World: Market, By Mechanical Technology, 20152022 (USD Million)

Table 69 South Africa: Market, By Application, 20152022 (USD Million)

Table 70 Chile: Advanced Energy Storage Systems Market, By Application, 20152022 (USD Million)

Table 71 Rest of the World: Market, By Application, 20152022 (USD Million)

Table 72 Market Ranking, 2016

List of Figures (55 Figures)

Figure 1 Markets Covered: Advanced Energy Storage Systems Market Segmentation

Figure 2 Advanced Energy Storage Systems Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Asia Pacific Dominated the Market in 2016

Figure 8 Advanced Energy Storage Systems Market: Application Snapshot

Figure 9 Advanced Energy Storage Systems Market: Technologies Snapshot

Figure 10 Attractive Opportunities in the Market

Figure 11 Asia Pacific is Expected to Dominate the Market in 2017

Figure 12 The Transportation Segment is Expected to Hold the Largest Share During the Forecast Period

Figure 13 Asia Pacific to Dominate the Market for Transportation Application of Advanced Energy Storage Systems During the Forecast Period

Figure 14 Electro Chemical to Dominate the Market for Technology in the Advanced Energy Storage Systems During the Forecast Period

Figure 15 Market Dynamics: Advanced Energy Storage Systems Market

Figure 16 Investment in Renewable Energy Sources, 20042016 (USD Billion)

Figure 17 Transportation Application is Projected to Grow Rapidly During 20172022

Figure 18 Asia Pacific is Expected to Drive the Growth of Advanced Energy Storage Systems in the Transportation Application During 20172022

Figure 19 Asia Pacific is Expected to Drive the Growth of Advanced Energy Storage Systems in the Grid Storage Application During 20172022

Figure 20 Electro Chemical Market is Projected to Grow Rapidly During 20172022

Figure 21 Asia Pacific is Expecetd to Grow Rapidly in the Electro Chemical Market During 20172022

Figure 22 Lithium-Ion Battery is Expecetd to Grow Rapidly in the Electro Chemical Market During 20172022

Figure 23 Asia Pacific is Expected to Grow Rapidly in the Lithium-Ion Battery Market During 20172022

Figure 24 North America is Expected to have the Highest Share in the Lead Acid Battery Energy Storage Market During 20172022

Figure 25 Europe is Expected to Be the Highest Growing Region for the NAS Battery Market During 20172022

Figure 26 Asia Pacific is Expected to Be the Highest Growing Region for the Flow Battery Advanced Energy Stoarge Systems Market During 20172022

Figure 27 Asia Pacific is Expected to Be the Highest Growing Region for the NIMH & NICD Battery Advanced Energy Stoarge Systems Market During 20172022

Figure 28 Europe is Expecetd to Grow Rapidly in the Thermal Market During 20172022

Figure 29 Sensible Thermal Storage Technology is Expecetd to Grow Rapidly During 20172022

Figure 30 Rest of the World is Estimated to have the Maximum Share in the Sensible Heat Thermal Market During 20172022

Figure 31 Rest of the World is Estimated to have the Maximum Share in the Latent Heat Thermal Market During 20172022

Figure 32 Europe is Expecetd to Grow Rapidly in the Mechanical Energy Advanced Storage Systems Market During 20172022

Figure 33 Pumped Hydro Storage is Expecetd to Grow Rapidly in the Mechanical Market During 20172022

Figure 34 Europe is Expected to Be the Highest Growing Region for the Pumped Hydro Market During 20172022

Figure 35 North America is Estimated to have the Maximum Share in the Flywheel Market During 20172022

Figure 36 North America is Expecetd to have the Largest Share in the Caes & Laes Market During 20172022

Figure 37 North America has the Largest Share in the Other Market

Figure 38 Non-Residential Application is Projected to Grow Rapidly During 20172022

Figure 39 Regional Snapshot:South Korea, China and India are the Fastest Growing Countries, By Value, During the Forecast Period

Figure 40 Advanced Energy Storage Systems Market Share (Value), By Region, 2017

Figure 41 Asia Pacific, Market Snapshot

Figure 42 North America, Market Snapshot

Figure 43 Companies Adopted New Product Launches and Contracts and Agreements as Key Strategies to Capture the Market, 2013 July 2017

Figure 44 Market Evaluation Framework: New Product Launches, Mergers & Acquisitions, and Contracts & Agreements have Fueled the Growth of Companies, 2013 July 2017

Figure 45 Advanced Energy Storage System Market (Global): Competitive Leadership Mapping, 2017

Figure 46 LG Chem, LTD.: Company Snapshot

Figure 47 ABB LTD.: Company Snapshot

Figure 48 GS Yuasa Corporation: Company Snapshot

Figure 49 Samsung SDI Co., LTD.: Company Snapshot

Figure 50 General Electric Company: Company Snapshot

Figure 51 Tesla, Inc.: Company Snapshot

Figure 52 BYD Company Limited: Company Snapshot

Figure 53 Hitachi, LTD.: Company Snapshot

Figure 54 Siemens AG: Company Snapshot

Figure 55 Panasonic Corporation: Company Snapshot

Growth opportunities and latent adjacency in Advanced Energy Storage Systems Market