Adaptive Learning Market by Component (Platform and Services), Application, Deployment (Cloud and On-premises), End User (Academic (K-12 and Higher Education) and Enterprise (SME and Large Enterprise)), and Region - Global Forecast to 2025

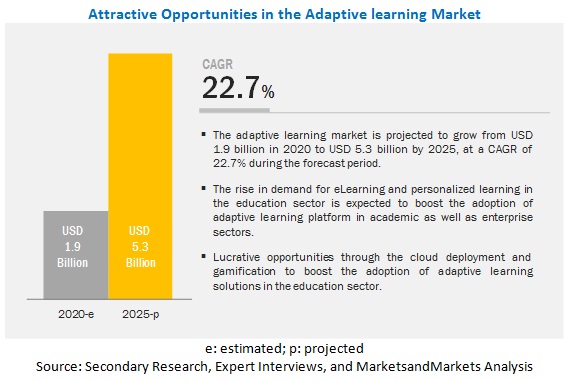

The global Adaptive Learning Market size is projected to reach USD 5.3 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 22.7% during the forecast period. The major factors driving the growth of the adaptive learning industry include the rising demand for eLearning solutions, personalized learning, and government initiatives for adaptive learning solutions.

The services segment to grow at the higher CAGR during the forecast period

Based on components, the services segment of the adaptive learning market is projected to grow at a higher CAGR during the forecast period. Adaptive learning service providers render a variety of services, which are categorized into consulting, implementation, and support and maintenance services. These services provide end users with services for adaptive learning solution development and smooth installation, deployment, and maintenance of ongoing solutions. Certain service providers assist end users in customized solution development for their organization. These service providers handle the implementation of solutions that are tailored to fit the business processes, such as customized solutions

The academic segment to hold a higher market share during the forecast period

Based on end user, the academic segment is projected to hold a higher share in the adaptive learning market during the forecast period. Academic institutions, such as schools, colleges, universities, and private tutorials, are included in this segment. Academic end users in the market facilitate the process of learning and teaching through the share of data, voice, and video over adaptive learning platforms. This streamlines the education process by allowing mobility, interaction, and real-time teaching. The use of mobile phones and smart devices has become extremely popular among the younger generation. This is expected to boost the market for academic users.

The higher education segment to grow at a higher CAGR during the forecast period

Based on academic users, the higher education segment is expected to grow at a higher growth rate during the forecast period. Educational organizations and institutions that provide education beyond K-12 are considered as higher education institutions. These include colleges and universities that are private and government funded. Though these institutions vary from region-to-region, based on the local law, the basic system of post-secondary education remains constant for higher education institutions. The use of digitalized systems has been prevalent and adopted in such organizations for quite a few years, paving the way for the adoption of adaptive learning solutions.

North America to record the highest market share during the forecast period

North America is expected to hold the highest market share and play a huge role in the development of technology, which helps in the adoption of adaptive learning solutions across the major verticals. North America is one of the major adopters of adaptive learning platforms. The region plays a huge role in the development of technology, and emerging technologies and methodologies that reshape corporate training.

Adaptive learning platforms make use of https://www.marketsandmarkets.com/Market-Reports/artificial-intelligence-market-74851580.htmlArtificial Intelligence (AI) to actively tailor content to each individual’s needs and its powerful feedback loops are used in blended learning environments for offering greater personalization. North America is expected to grow and adopt new technologies at the fastest pace as compared to the rest of the world and dominate the overall learning ecosystem. The major growth drivers for this region are collaborations between the government and network arenas as well as institutional partnerships between digital education vendors and research specialists. The need to enhance the skill sets of employees and technicalities among students in the region enforce universities and educational organizations to deploy adaptive learning platforms and services.

North America consists of developed countries with well-established economies and infrastructures that help educational stakeholders to invest in advanced technologies. The US and Canada are expected to have the highest adoption rates of the adaptive learning platform and services. Hence, North America dominates the global adaptive learning market with a notable market share.

Key Market Players

Key market players profiled in this report include McGraw-Hill (US), Pearson (UK), Curriculum Associates (UK), Wiley (US), Istation (US), Area9 Lyceum(US), ScootPad (US), CogBooks (UK), VitalSource (US), DreamBox (US), Impelsys (US), Mathspace (Australia), Fulcrum Labs (US), Knowre (US), Follett (US), Imagine Learning (US), Cerego (US), Realizeit (US), K12 (US), and Houghton Mifflin Harcourt (US). These players have adopted various growth strategies, such as partnerships and new service launches to expand their presence further in the adaptive learning market and broaden their customer base.

McGraw-Hill provides SmartBook, LearnSmart, Learning Science Platform, Assessment and Learning in Knowledge Spaces (ALEKS), and Redbird Advanced Learning solutions in the market. The company offers SmartBook through the McGraw-Hill Connect learning platform, which caters to higher education institutes in more than 90 disciplines. The SmartBook tracks students’ progress and provides reports that allow instructors to identify where and when students are facing difficulties. The solution also makes the instructor more aware of students facing the most difficulties, which can lead to the issue being resolved. The instructor has control over the course and he/she can also add pre-testing assignments. LearnSmart is online adaptive courseware that helps learners in their homework and lab sessions. It observes the learner’s confidence, time to complete learning exercises, performance on questions, mastery of prior learning objectives, and the past performance of learners. The Learning Science Platform helps create a data layer over the content, which helps learners to extract the right content at the right time. This increases the efficiency, engagement, and retention rate of the students. In this solution, instructors can also retrieve real-time analytics and know the exact progress of the learners. ALEKS is a web-based learning system that covers a wide range of courses in math for K-12 and higher education. The company’s QuickTables program provides math fact fluency for addition, subtraction, multiplication, and division. It also offers specialized preparation programs for chemistry and physics. In September 2016, McGrwa-Hill acquired Redbird Advanced Learning, which is used to provide digital personalized learning. This is an online blended and adaptive learning solution that offers a library of common core math and English Language Arts (ELA) curriculum for its learners.

Scope of Report

|

Report Metrics |

Details |

|

Market size value in 2020 |

USD 1.9 Billion |

|

Market size value in 2025 |

USD 5.3 Billion |

|

Growth rate |

CAGR of 22.7% |

|

Market size available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Component (Platform and Services), Application, Deployment (Cloud and On-premises), End User (Academic [K-12 and Higher Education] and Enterprise [SME and Large Enterprise]), and Region` |

|

Regions covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

McGraw-Hill (US), Pearson (UK), Curriculum Associates (UK), Wiley (US), Istation (US), Area9 Lyceum(US), ScootPad (US), CogBooks (UK), VitalSource (US), DreamBox (US), Impelsys (US), Mathspace (Australia), Fulcrum Labs (US), Knowre (US), Follett (US), Imagine Learning (US), Cerego (US), Realizeit (US), K12 (US), and Houghton Mifflin Harcourt (US) |

This research report categorizes the adaptive learning market to forecast revenue and analyze trends in each of the following submarkets:

Based on components:

- Platform

-

Services

-

Professional Services

- Consulting

- Implementation

- Support and Maintenance

- Managed Services

-

Professional Services

Based on application:

- EdTech Companies

- Educational Institutes

Based on deployment

- Cloud

- On-premises

Based on end user:

-

Academic

- K-12

- Higher Education

-

Enterprise

- SME

- Large Enterprise

Based on regions:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- Australia and New Zealand (ANZ)

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia (KSA)

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In February 2020, McGraw-Hill signed an agreement with Proctorio, a provider of the learning integrity platform. McGraw-Hill will use remote proctoring and browser locking capabilities of Proctorio for assessments in its McGraw-Hill Connect Digital Learning Platform. These services will be initially for college courses and will start from Fall 2020.

- In January 2020, Pearson acquired Smart Sparrow, an adaptive learning platform provider. Pearson acquired Smart Sparrow for approximately USD 25 million to enhance its capabilities in the adaptive learning market. This acquisition will also accelerate the growth of Pearson's Global Learning Programme (GLP).

- In August 2019, Curriculum Associates upgraded its solutions i-Ready and Ready. Curriculum Associates added learning games to i-Ready and Ready. These games are related to classroom mathematics to help students practice mathematical concepts. These upgrades are for grade K-5 students to motivate and encourage them understand mathematics.

- In May 2019, Wiley acquired Knewton, an adaptive learning platform provider. The company acquired Knewton to enhance its capabilities in the adaptive learning market and provide its available eContent to users in the market. Knewton majorly focused on customers from K-12 and higher education institutes.

- In August 2018, Istation collaborated with Boulder Learning. The collaboration was on oral reading and listening program to measure the accuracy, fluency, and expressions of students while reading. With this collaboration, Istation incorporated Boulder Learning’s speech-recognition and assessment product called Fluent Oral Reading Assessment (FLORA) in its Oral Reading Fluency (ORF) assessment program.

Key questions addressed by the report

- What are the growth opportunities in the adaptive learning market?

- What is the competitive landscape scenario in the market?

- What are the regulations that are expected to have an impact on the market?

- How have adaptive learning solution and services evolved from traditional technologies?

- What are the dynamics of the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2016–2019

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 6 ADAPTIVE LEARNING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 1 (SUPPLY SIDE): REVENUE OF PLATFORM AND SERVICES OF THE MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 1 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PLATFORM AND SERVICES OF THE ADAPTIVE LEARNING MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 TOP-DOWN (DEMAND SIDE): SHARE OF THE MARKET

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 ASSUMPTIONS FOR THE STUDY

2.5.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 34)

FIGURE 11 ADAPTIVE LEARNING MARKET SIZE, 2018–2025

FIGURE 12 PLATFORM SEGMENT TO HOLD A LARGER MARKET SIZE IN 2020

FIGURE 13 CLOUD SEGMENT TO ACCOUNT FOR A HIGHER MARKET SHARE IN 2020

FIGURE 14 ACADEMIC SEGMENT TO HOLD A LARGER MARKET SIZE IN 2020

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 ATTRACTIVE OPPORTUNITIES IN THE ADAPTIVE LEARNING MARKET

FIGURE 15 RISING DEMAND FOR ELEARNING AND PERSONALIZED LEARNING TO DRIVE THE MARKET GROWTH

4.2 MARKET IN ASIA PACIFIC, BY COMPONENT AND COUNTRY

FIGURE 16 PLATFORM SEGMENT AND CHINA TO ACCOUNT FOR HIGH MARKET SHARES IN ASIA PACIFIC IN 2020

4.3 MARKET: MAJOR COUNTRIES

FIGURE 17 MEXICO TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 40)

5.1 INTRODUCTION

5.2 ADAPTIVE LEARNING MARKET SCENARIO IN THE COVID–19 ERA

5.3 CURRENT MARKET TRENDS AND TECHNOLOGY ANALYSIS

5.3.1 CURRENT MARKET TRENDS

TABLE 3 RECENT ACQUISITIONS, 2018-2020

FIGURE 18 KEY STRATEGIES ADOPTED BY LEADING PLAYERS IN THE MARKET DURING 2019–2020

5.3.1.1 Competitive scenario

FIGURE 19 MARKET EVALUATION FRAMEWORK, 2018-2020

5.3.2 TECHNOLOGY TRENDS

TABLE 4 BREAKUP OF ADAPTIVE LEARNING TOOLS

5.4 BUSINESS MODEL

5.4.1 PARTNERSHIPS

TABLE 5 PARTNERSHIPS, 2019-2020

5.4.2 NEW PRODUCT LAUNCHES

TABLE 6 NEW PRODUCT/SERVICE LAUNCHES AND ENHANCEMENTS, 2019-2020

5.4.3 ACQUISITIONS

TABLE 7 ACQUISITIONS, 2018-2020

5.5 MARKET DYNAMICS

FIGURE 20 ADAPTIVE LEARNING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Rising demand for eLearning solutions

5.5.1.2 Rising demand for personalized learning

5.5.1.3 Government initiatives for adaptive learning solutions

5.5.2 RESTRAINTS

5.5.2.1 Low end user motivation and engagement to adopt adaptive learning solutions

5.5.3 OPPORTUNITIES

5.5.3.1 Boosting the use of blended learning technology

5.5.3.2 Increasing demand for gamification in adaptive learning to provide opportunities for adaptive learning vendors

5.5.3.3 Growing use of cloud computing among organizations and educational institutes to motivate learners to adopt web-based adaptive solutions

5.5.4 CHALLENGES

5.5.4.1 High cost of producing eLearning content

5.5.4.2 Lack of skilled trainers and instructors

5.6 REGULATORY IMPLICATIONS

5.6.1 RIGHT TO EDUCATION

5.6.2 NATIONAL SCIENCE EDUCATION STANDARDS

5.6.3 INTERNATIONAL STANDARD CLASSIFICATION OF EDUCATION

5.6.4 EUROPEAN NETWORK FOR QUALITY ASSURANCE IN HIGHER EDUCATION

5.6.5 AUSTRALIAN EDUCATION ACT

5.6.6 EDUCATION SERVICES FOR OVERSEAS STUDENTS ACT

5.6.7 FUNDAMENTAL LAW OF EDUCATION

5.6.8 COMPULSORY EDUCATION LAW OF THE PEOPLE'S REPUBLIC OF CHINA

5.6.9 SOUTH AFRICAN SCHOOLS ACT, NO. 84 OF 1996

5.6.10 THE EDUCATION ACT 2011

5.6.11 EVERY STUDENT SUCCEEDS ACT

5.6.12 FUND FOR MAINTENANCE AND DEVELOPMENT OF THE FUNDAMENTAL EDUCATION AND VALORIZATION OF TEACHING

5.7 USE CASES

5.7.1 USE CASE 1: DREAMBOX

5.7.2 USE CASE 2: SMART SPARROW (NOW PEARSON)

5.7.3 USE CASE 3: KNEWTON (NOW WILEY)

5.7.4 USE CASE 4: REALIZEIT

5.7.5 USE CASE 5: COGBOOKS

6 ADAPTIVE LEARNING MARKET, BY APPLICATION (Page No. - 55)

6.1 INTRODUCTION

6.2 EDTECH COMPANIES

6.3 EDUCATIONAL INSTITUTES

7 ADAPTIVE LEARNING MARKET, BY COMPONENT (Page No. - 56)

7.1 INTRODUCTION

7.1.1 COMPONENT: MARKET DRIVERS

FIGURE 21 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 8 MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

7.2 PLATFORM

TABLE 9 PLATFORM: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.3 SERVICES

FIGURE 22 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGE DURING THE FORECAST PERIOD

TABLE 10 SERVICES: MARKET SIZE, BY TYPE 2018–2025 (USD MILLION)

TABLE 11 SERVICES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.3.1 PROFESSIONAL SERVICES

FIGURE 23 SUPPORT AND MAINTENANCE SERVICES SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 12 PROFESSIONAL SERVICES: ADAPTIVE LEARNING MARKET SIZE, BY TYPE 2018–2025 (USD MILLION)

TABLE 13 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.3.1.1 Consulting

TABLE 14 CONSULTING MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.3.1.2 Implementation

TABLE 15 IMPLEMENTATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.3.1.3 Support and maintenance

TABLE 16 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.3.2 MANAGED SERVICES

TABLE 17 MANAGED SERVICES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8 ADAPTIVE LEARNING MARKET, BY DEPLOYMENT (Page No. - 65)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT: MARKET DRIVERS

FIGURE 24 CLOUD SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 18 MARKET SIZE, BY DEPLOYMENT, 2018–2025 (USD MILLION)

8.2 CLOUD

TABLE 19 CLOUD: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.3 ON-PREMISES

TABLE 20 ON-PREMISES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9 ADAPTIVE LEARNING MARKET, BY END USER (Page No. - 69)

9.1 INTRODUCTION

9.1.1 END USER: MARKET DRIVERS

FIGURE 25 ENTERPRISE SEGMENT TO WITNESS A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

TABLE 21 MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

9.2 ACADEMIC

TABLE 22 ACADEMIC: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

FIGURE 26 HIGHER EDUCATION SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 23 ACADEMIC: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.2.1 K-12

TABLE 24 K-12 MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.2.2 HIGHER EDUCATION

TABLE 25 HIGHER EDUCATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.3 ENTERPRISE

TABLE 26 ENTERPRISE: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

FIGURE 27 SMALL AND MEDIUM-SIZED ENTERPRISE SEGMENT TO WITNESS A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

TABLE 27 ENTERPRISE: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.3.1 SMALL AND MEDIUM-SIZED ENTERPRISE

TABLE 28 SMALL AND MEDIUM-SIZED ENTERPRISE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.3.2 LARGE ENTERPRISE

TABLE 29 LARGE ENTERPRISE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10 ADAPTIVE LEARNING MARKET, BY REGION (Page No. - 77)

10.1 INTRODUCTION

10.1.1 REGION: MARKET DRIVERS

FIGURE 28 NORTH AMERICA TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 30 MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

TABLE 31 NORTH AMERICA: ADAPTIVE LEARNING MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT, 2018–2025 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET SIZE, BY ACADEMIC, 2018–2025 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET SIZE, BY ENTERPRISE, 2018–2025 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.2.1 UNITED STATES

TABLE 39 UNITED STATES: ADAPTIVE LEARNING MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 40 UNITED STATES: MARKET SIZE, BY DEPLOYMENT, 2018–2025 (USD MILLION)

TABLE 41 UNITED STATES: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

10.2.2 CANADA

TABLE 42 CANADA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 43 CANADA: MARKET SIZE, BY DEPLOYMENT, 2018–2025 (USD MILLION)

TABLE 44 CANADA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

10.3 EUROPE

TABLE 45 EUROPE: ADAPTIVE LEARNING MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 46 EUROPE: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 47 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 48 EUROPE: MARKET SIZE, BY DEPLOYMENT, 2018–2025 (USD MILLION)

TABLE 49 EUROPE: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

TABLE 50 EUROPE: MARKET SIZE, BY ACADEMIC, 2018–2025 (USD MILLION)

TABLE 51 EUROPE: MARKET SIZE, BY ENTERPRISE, 2018–2025 (USD MILLION)

TABLE 52 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.3.1 UNITED KINGDOM

TABLE 53 UNITED KINGDOM: ADAPTIVE LEARNING MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 54 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT, 2018–2025 (USD MILLION)

TABLE 55 UNITED KINGDOM: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

10.3.2 GERMANY

TABLE 56 GERMANY: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 57 GERMANY: MARKET SIZE, BY DEPLOYMENT, 2018–2025 (USD MILLION)

TABLE 58 GERMANY: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

10.3.3 FRANCE

TABLE 59 FRANCE: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 60 FRANCE: MARKET SIZE, BY DEPLOYMENT, 2018–2025 (USD MILLION)

TABLE 61 FRANCE: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

10.3.4 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 62 ASIA PACIFIC: ADAPTIVE LEARNING MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 63 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 64 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 65 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT, 2018–2025 (USD MILLION)

TABLE 66 ASIA PACIFIC: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

TABLE 67 ASIA PACIFIC: MARKET SIZE, BY ACADEMIC, 2018–2025 (USD MILLION)

TABLE 68 ASIA PACIFIC: MARKET SIZE, BY ENTERPRISE, 2018–2025 (USD MILLION)

TABLE 69 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.4.1 CHINA

TABLE 70 CHINA: ADAPTIVE LEARNING MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 71 CHINA: MARKET SIZE, BY DEPLOYMENT, 2018–2025 (USD MILLION)

TABLE 72 CHINA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

10.4.2 JAPAN

TABLE 73 JAPAN: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 74 JAPAN: MARKET SIZE, BY DEPLOYMENT, 2018–2025 (USD MILLION)

TABLE 75 JAPAN: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

10.4.3 AUSTRALIA AND NEW ZEALAND

TABLE 76 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 77 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEPLOYMENT, 2018–2025 (USD MILLION)

TABLE 78 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

10.5 MIDDLE EAST AND AFRICA

TABLE 79 MIDDLE EAST AND AFRICA: ADAPTIVE LEARNING MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT, 2018–2025 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ACADEMIC, 2018–2025 (USD MILLION)

TABLE 85 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ENTERPRISE, 2018–2025 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.5.1 KINGDOM OF SAUDI ARABIA

TABLE 87 KINGDOM OF SAUDI ARABIA: ADAPTIVE LEARNING MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 88 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT, 2018–2025 (USD MILLION)

TABLE 89 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

10.5.2 SOUTH AFRICA

TABLE 90 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 91 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT, 2018–2025 (USD MILLION)

TABLE 92 SOUTH AFRICA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

10.5.3 REST OF MIDDLE EAST AND AFRICA

10.6 LATIN AMERICA

TABLE 93 LATIN AMERICA: ADAPTIVE LEARNING MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 94 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 95 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 96 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT, 2018–2025 (USD MILLION)

TABLE 97 LATIN AMERICA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

TABLE 98 LATIN AMERICA: MARKET SIZE, BY ACADEMIC, 2018–2025 (USD MILLION)

TABLE 99 LATIN AMERICA: MARKET SIZE, BY ENTERPRISE, 2018–2025 (USD MILLION)

TABLE 100 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.6.1 BRAZIL

TABLE 101 BRAZIL: ADAPTIVE LEARNING MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 102 BRAZIL: MARKET SIZE, BY DEPLOYMENT, 2018–2025 (USD MILLION)

TABLE 103 BRAZIL: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

10.6.2 MEXICO

TABLE 104 MEXICO: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 105 MEXICO: MARKET SIZE, BY DEPLOYMENT, 2018–2025 (USD MILLION)

TABLE 106 MEXICO: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

10.6.3 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 114)

11.1 COMPETITIVE LEADERSHIP MAPPING

11.1.1 VISIONARY LEADERS

11.1.2 INNOVATORS

11.1.3 DYNAMIC DIFFERENTIATORS

11.1.4 EMERGING COMPANIES

FIGURE 31 ADAPTIVE LEARNING MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

11.2 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 32 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

11.3 BUSINESS STRATEGY EXCELLENCE

FIGURE 33 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

12 COMPANY PROFILES (Page No. - 118)

12.1 INTRODUCTION

(Business Overview, Solution, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.2 MCGRAW-HILL

FIGURE 34 MCGRAW-HILL: COMPANY SNAPSHOT

FIGURE 35 MCGRAW-HILL: SWOT ANALYSIS

12.3 PEARSON

FIGURE 36 PEARSON: COMPANY SNAPSHOT

FIGURE 37 PEARSON: SWOT ANALYSIS

12.4 CURRICULUM ASSOCIATES

FIGURE 38 CURRICULUM ASSOCIATES: SWOT ANALYSIS

12.5 WILEY

FIGURE 39 WILEY: COMPANY SNAPSHOT

FIGURE 40 WILEY: SWOT ANALYSIS

12.6 ISTATION

FIGURE 41 ISTATION: SWOT ANALYSIS

12.7 AREA9 LYCEUM

12.8 SCOOTPAD

12.9 COGBOOKS

12.10 VITALSOURCE

12.11 DREAMBOX

12.12 IMPELSYS

12.13 MATHSPACE

12.14 FULCRUM LABS

12.15 KNOWRE

12.16 FOLLETT

12.17 IMAGINE LEARNING

12.18 CEREGO

12.19 REALIZEIT

12.20 K12

12.21 HOUGHTON MIFFLIN HARCOURT

*Details on Business Overview, Solution, Key Insights, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12.22 RIGHT-TO-WIN

13 APPENDIX (Page No. - 152)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATION

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size for the adaptive learning market. An exhaustive secondary research was done to collect information on the adaptive learning industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred, to identify and collect information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; regulatory bodies; trade directories; and databases.

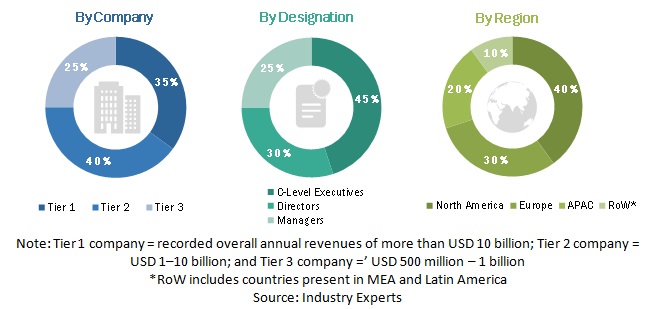

Primary Research

The adaptive learning market comprises several stakeholders, such as adaptive learning vendors, adaptive learning service providers, venture capitalists, government organizations, regulatory authorities, policymakers, and financial organizations, consulting firms, research organizations, academic institutions, resellers and distributors and training providers. The demand side of the market consists of all the firms operating in several industry verticals. The supply side includes adaptive learning providers, offering adaptive learning services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global adaptive learning market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors offering solutions and services in the market was prepared while using the top-down approach. The market share for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its components (solution, and services). The aggregate of all companies’ revenues was extrapolated to reach the overall market size.

Further, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and managers.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global adaptive learning market by component, application, deployment, end user, and region during the forecast period, and analyze the various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA)

- To provide detailed information about the major factors (drivers, opportunities, and challenges) influencing the growth of the market

- To analyze each submarket with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile key market players; provide a comparative analysis based on business overview, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research & Development (R&D) activities, in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Adaptive Learning Market