Aircraft Seat Actuation System Market Size, Share, Trends & Growth Analysis by Type (Electromechanical, Pneumatic, Hydraulic), End User (OEM, Aftermarket), Aircraft Type, Seat Class, Component, and Region (2020-2025)

Updated on : Oct 22, 2024

The Aircraft Seat Actuation System market is witnessing increasing demand due to the growing focus on enhancing passenger comfort and luxury in both commercial and business aircraft. Technological advancements, such as the integration of lightweight materials, electric actuators, and smart seat control systems, are driving innovations in this space. These advancements allow for smoother, more precise seat adjustments, contributing to a better passenger experience. Additionally, the rise in air travel and demand for premium seating options, coupled with the push for fuel-efficient aircraft, are further boosting the adoption of advanced seat actuation systems across the aviation industry.

Aircraft Seat Actuation System Market Size & Share:

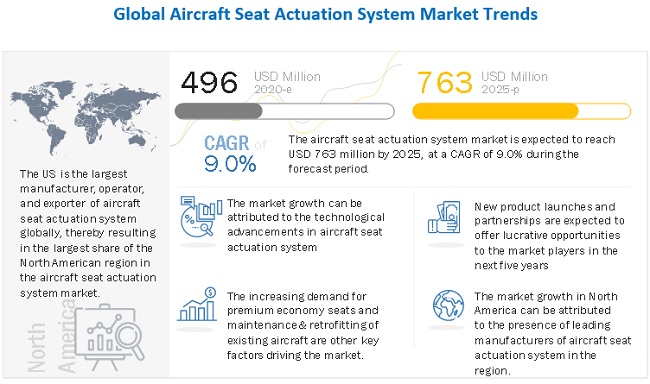

The Global Aircraft Seat Actuation System Market size is projected to grow from USD 496 million in 2020 to USD 763 million by 2025, at a CAGR of 9.0% from 2020 to 2025. The Aircraft Seat Actuation System Industry is driven by various factors, such as increase in demand for premium economy seats and maintenance & retrofitting of existing aircraft.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Aircraft Seat Actuation System Market

The aircraft seat actuation system market includes major players Astronics Corporation (US), ITT Inc. (US), Crane Co. (US), Collins Aerospace (US), and Bühler Motor GmbH (Germany). These players have spread their business across various countries includes North America, Europe, Asia Pacific, Middle East, Africa, and Latin America. COVID-19 has impacted their businesses as well. Industry experts believe that COVID-19 could affect aircraft seat actuation system production and services by 7–10% globally in 2020.

The COVID-19 pandemic has impacted the end-use industries adversely, resulting in a sudden dip in 2020 aircraft orders and deliveries. This is expected to negatively impact the aircraft market in the short term, with slow recovery expected in Q1 of 2021.

Aircraft Seat Actuation System Market Dynamics

Driver:Technological advancements in aircraft seat actuation systems

Technological advancements in the field of aircraft seat actuation systems have led to the development of lightweight, electric control motion, and self-adjusting aircraft seat actuators. Earlier, seat actuation systems provided limited functionalities such as restricted angle of recline, jerky movements, and a few customization options. Presently, manufacturers of aircraft seat actuation systems, such as Crane (US), are offering sophisticated actuation systems with integrated seat adjustment features. For example, in May 2019, Collins Aerospace announced the launch of its next-generation Evolution seat, which combines commercial first-class seating with executive aircraft seating. The seat has a compact pedestal base that allows designers the ability to achieve the appearance of a floating seat and it operates on a proprietary triple roller system for a smooth transition between seat positions with minimal effort. It also has an extended leg rest to accommodate a range of occupant sizes.

In August 2018, Kyntronics developed a patent-pending SMART hydraulic actuator (SHA) with a compact footprint, combining the power-to-weight ratio advantage of hydraulic technology with the versatility, ease of installation, and control of electric servo technology. The implementation of actuation systems reduces the weight of aircraft seats, and subsequently, the after-sales cost of aircraft seats, thereby driving the growth of the aircraft seat actuation system market. Various airlines, including Turkish Airlines, are involved in retrofitting of aircraft seats installed with technologically-advanced seat actuation systems to improve flying experience of passengers.

Restraint:Shortage of profitable airlines due to COVID-19 crisis

The aviation industry in emerging economies has huge growth potential. However, this potential has not been leveraged significantly. Developed countries such as the US dominate the aircraft seat actuation market in which five major airlines—Midwest Airlines, Frontier Airlines, Northwest Airlines, AirTran Airlines, and American Airlines—have merged their business since 2008 to increase overall profit. The US has also been the net beneficiary of low oil prices, expansionary fiscal & monetary policies, and deleveraging of the private sectors, which along with its steady labor market, have been strengthening its position globally. Additionally, the country has a high proportion of consumer spending, which leads to higher demand for air travel. Although, the region experienced significant loss during the COVID-19 situation but is expected to recover promptly in 2021.

The lack of proper infrastructure and other additional taxes imposed by aviation departments of countries, such as India and countries in Africa, have led to the increase in airfare prices. According to the International Air Transport Association (IATA), airlines in the Asia Pacific are expected to generate a net loss of USD 31.7 billion in 2020 and USD 7.5 billion in 2021, which is significantly less than that USD 4.9 billion in 2019. Similarly, airlines operating in Africa and Latin America are expected to earn a loss of USD 2.0 billion and USD 5.0 billion, respectively, in 2020.

Opportunity: Growing urban air mobility platform

The rapid pace of technology improvement has turned the concept of urban air mobility (UAM) into an attractive business proposition. With the increasing road congestion, especially in megacities, people are constantly searching for better and safer ways to commute to work and travel to other destinations. One of the key factors encouraging UAM is the emergence of electric vertical takeoff and landing aircraft (eVTOL). Another prominent factor is the shift in aviation propulsion technologies, specifically distributed electric propulsion (DEP).

Other than established players like Boeing and Airbus, new entrants, such as Uber, Joby Aviation, and Kitty Hawk, with suitable technological expertise, seem to gain traction. Dubai, Singapore, the US, and China are the pioneers of UAM, creating demand in this market. Dubai already launched test flights in 2017 and is attempting to commence commercial operations of its Autonomous Aerial Taxi Service between 2020 and 2025. In addition, the Uber Elevate project was expected to launch in Los Angeles, Dallas, and Melbourne by 2023 before the COVID-19 pandemic. This project will offer two business models - Uber Air and Uber Copter. The emergence of the UAM platform is expected to create new opportunities not only for economy class seat manufacturers but also for business class seat manufacturers. Hence, in both cases the growing UAM platform should prove beneficial for the aircraft seat actuation system market.

Challenge: Regulations to install 16G seats in all aircraft

According to the European Aviation Safety Agency (EASA) and Federal Aviation Administration (FAA) regulations, commercial aircraft with 9G seats will no longer be permitted to operate in the next few years,. The FAA has framed regulations on the requirement for aircraft to have stronger seats, which must be designed to increase the survivability of passengers and flight attendants during accidents. As per the new mandates, which affect all aircraft built after October 2009, the seats must be able to withstand 16 times the force of gravity, compared with the 9G standard in effect since 1952. Floors and tracks where the seats are installed must also be able to withstand the same level of gravity pressure. When the FAA proposed the stronger seat rule in 2002, its intention was for airlines to retrofit existing fleets with stronger seats. Airlines having aircraft with 9G seats are replacing them with 16G seats as and when these aircraft are scheduled for retrofitting, as they have been given about 14 years to comply with the new regulations. These mandates pose a challenge for airlines in terms of cost and time as many of them do not have the budget to replace seats of all older aircraft with new ones.

Growing air passenger traffic and replacement of aging aircraft is driving the growth of fixed wing aircraft

The electromechanical segment is expected to be the largest market by value. The growth of the electromechanical segment of the aircraft seat actuation system market can be attributed to the application of electromechanical actuation system for both linear and rotary mechanism.

Aircraft Seat Actuation System Market Segmentation

The OEM segment is projected to witness a higher CAGR during the forecast period

Based on end user, the OEM segment is projected to be the highest CAGR rate for the aircraft seat actuation system market during the forecast period. The growth of the OEM segment of the market can be attributed to the increased demand for customized aircraft that are fitted with various components as retrofitting existing aircraft is a cumbersome process for airlines.

The rotary wing segment is projected to witness a higher CAGR during the forecast period

Based on the aircraft type, the rotary wing segment is projected to be the highest CAGR rate for the aircraft seat actuation system market during the forecast period. The rotary wing segment includes only helicopters. Over the past few years, countries such as the US, France, Russia, and Italy have made considerable investments in the commercial sector. Russian helicopters have been focusing to promote its chopper Ansat for the civilian market in India. In addition, the increase in government budgets for VIP/VVIP transport has enabled the procurement of new aircraft, including helicopters, which is expected to drive the rotary wing segment.

The first class and economy class segments are projected to witness the highest CAGR during the forecast period

Based on the seat class, the first class and economy class segments are projected to grow at the highest CAGR rate for the aircraft seat actuation system market during the forecast period. First class seats are one of the most expensive classes among all the classes of seats that airlines provide. The first class includes large reclining seats with more legroom and width than other classes to suites with a fully reclining seat, workstation, and an entertainment system surrounded by privacy dividers. Hence, increasing demand of IFEC systems drives this segment. High demand for economy class seats is witnessed with the growth of LCC aircraft. LCCs provide air travel at a minimum cost, as they do not have meal services included in the ticket price

The passenger control unit segment is projected to witness the highest CAGR during the forecast period

Based on component, the passenger control unit segment are projected to grow at the highest CAGR rate for the aircraft seat actuation system market during the forecast period. The growth of the passenger control unit segment of the aircraft seat actuation system market can be attributed to the retrofitting of existing aircraft.

Aircraft Seat Actuation System Market Analysis

The aircraft seat actuation system market growth is attributed to the rising demand for advanced seating solutions in both commercial and private aviation sectors, aimed at enhancing passenger comfort and optimizing cabin space. Key factors contributing to this market expansion include the increased production of aircraft, growing airline fleets, and a heightened focus on passenger experience. Additionally, the market is segmented by type, end user, aircraft type, seat class, and component, with North America anticipated to hold the largest market share due to the presence of major aircraft manufacturers and suppliers in the region?.

Aircraft Seat Actuation System Market Trends

Aircraft Seat Actuation System Market Ecosystem

Aircraft Seat Actuation System Market Regional Analysis

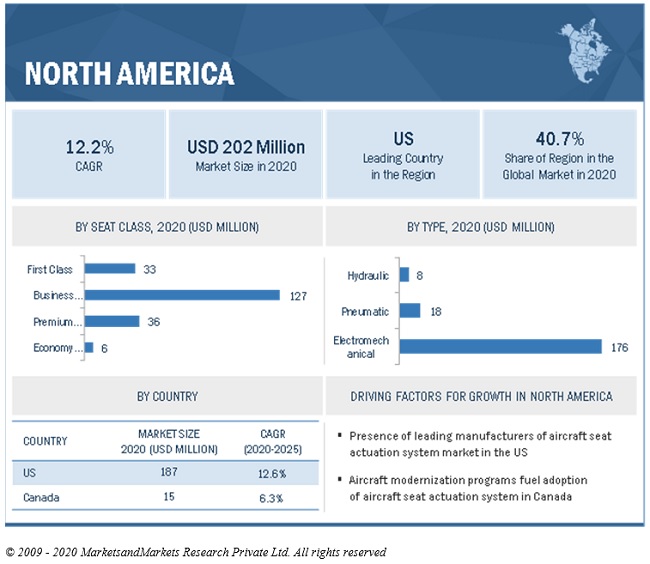

The North America market is projected to contribute the largest share from 2020 to 2025

North America is projected to be the largest regional share for the aircraft seat actuation system market during the forecast period. The key factor responsible for North America, leading the aircraft seat actuation system market owing to the rapid growth of the technologically advanced seating system in the region. The increasing use of technology in aircraft presents several opportunities for aircraft seating technology manufacturers.

Leading aircraft manufacturers, such as The Boeing Company and Bombardier, and major aircraft system and component manufacturers, such as Collins Aerospace, Astronics Corporation, ITT Inc., and Crane Co. are headquartered in North America. Some of the largest commercial airlines (based on fleet size), such as American Airlines Group, Delta Air Lines, Inc., and United Airlines, are also headquartered in the region.

To know about the assumptions considered for the study, download the pdf brochure

Top Aircraft Seat Actuation System Companies - Key Market Players

The aircraft seat actuation system market is dominated by a few globally established players such as Astronics Corporation (US), ITT Inc. (US), Crane Co. (US), Collins Aerospace (US), and Bühler Motor GmbH (Germany).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Scope of the Aircraft Seat Actuation System Market Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 496 Million in 2020 |

|

Projected Market Size |

USD 763 million by 2025 |

|

CAGR |

9.0 % |

|

Market size available for years |

2016–2025 |

|

Base year considered |

2020 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Type, By End User, By Aircraft Type, By Seat Class, By Component |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East, Africa, and Latin America |

|

Companies covered |

Astronics Corporation (US), ITT Inc. (US), Crane Co. (US), Collins Aerospace (US), and Bühler Motor GmbH (Germany) |

The study categorizes the aircraft seat actuation system market based on Type, End User, Aircraft Type, Seat Class, Component and Region.

By Type

- Electromechanical

- Pneumatic

- Hydraulic

By End User

- OEM

- Aftermarket

By Aircraft Type

- Fixed Wing

- Rotary Wing

By Seat Class

- Business Class

- First Class

- Premium Economy Class

- Economy Class

By Component

- Actuator

- Motor

- In-seat Power Supply

- Passenger Control Unit

- Electronic Control Unit

- Others

By Region

- North America

- Asia Pacific

- Europe

- Middle East

- Africa

- Latin America

Recent Developments

- In April 2020, B&D Industrial and Kyntronics announced a strategic partnership regarding new technology used for actuation and motion control solutions.

- In October 2019, Jet Aviation awarded Collins Aerospace, seating contracts for three undisclosed V/VIP customers. Collins Aerospace will provide each customer single and double executive seating, as well as VIP divan products. The single seats will feature the company’s new, patented, track-mounted mini-base technology, which provides approximately 50% space savings when compared to a traditional seat base.

- In September 2019, Astronics launched a new retrofit in-seat passenger power solution for aircraft. The EmPower Xpress on-seat USB outlet housing solution delivers instant USB charging options for aircraft in a simple overnight maintenance turn.

- In April 2019, Crane entered into a partnership with Adient Aerospace to develop seat actuation systems and electrical integration on its Ascent business class seat.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the aircraft seat actuation system market?

The aircraft seat actuation system market is expected to grow substantially owing to the increasing demand for maintenance and retrofitting of existing aircraft.

What are the key sustainability strategies adopted by leading players operating in the aircraft seat actuation system market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the aircraft seat actuation system market. The major players include Astronics Corporation (US), ITT Inc. (US), Crane Co. (US), Collins Aerospace (US), and Bühler Motor GmbH (Germany), these players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the aircraft seat actuation system market?

Some of the major emerging technologies and use cases disrupting the market include connected aircraft, e-enabled architecture, and advanced IFEC module.

Who are the key players and innovators in the ecosystem of the aircraft seat actuation system market?

The key players in the aircraft seat actuation system market include Astronics Corporation (US), ITT Inc. (US), Crane Co. (US), Collins Aerospace (US), and Bühler Motor GmbH (Germany).

Which region is expected to hold the highest market share in the aircraft seat actuation system market?

Aircraft seat actuation system market in North America is projected to hold the highest market share during the forecast period. This is due to the presence of leading aircraft manufacturers, such as The Boeing Company and Bombardier, and major aircraft system and component manufacturers, such as Collins Aerospace, Astronics Corporation, ITT Inc., and Crane Co. in North America. Some of the largest commercial airlines (based on fleet size), such as American Airlines Group, Delta Air Lines, Inc., and United Airlines, are also headquartered in the region. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 AIRCRAFT SEAT ACTUATION SYSTEM MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 INCLUSIONS AND EXCLUSIONS

TABLE 1 INCLUSIONS AND EXCLUSIONS IN AIRCRAFT SEAT ACTUATION SYSTEMS MARKET

1.5 CURRENCY & PRICING

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

FIGURE 2 AIRCRAFT SEAT ACTUATION SYSTEM MARKET TO GROW AT A HIGHER RATE COMPARED TO PREVIOUS ESTIMATES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 3 REPORT PROCESS FLOW

FIGURE 4 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET DEFINITION & SCOPE

2.2.2 SEGMENTS AND SUBSEGMENTS

2.3 RESEARCH APPROACH & METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

2.3.2 AIRCRAFT SEAT ACTUATION SYSTEMS MARKET FOR OEM

2.3.3 AFTERMARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.4 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 TRIANGULATION & VALIDATION

FIGURE 7 DATA TRIANGULATION

2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.5 ASSUMPTIONS FOR THE RESEARCH STUDY

2.6 RISKS

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 8 ELECTROMECHANICAL SEGMENT ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE OF AIRCRAFT SEAT ACTUATION SYSTEM MARKET IN 2020

FIGURE 9 AIRCRAFT SEAT ACTUATION SYSTEMS MARKET, BY SEAT CLASS, 2020

FIGURE 10 OEM SEGMENT ESTIMATED TO ACCOUNT FOR A LARGER SHARE OF MARKET IN 2020

FIGURE 11 MARKET IN NORTH AMERICA TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE AIRCRAFT SEAT ACTUATION SYSTEM MARKET

FIGURE 12 MAINTENANCE AND RETROFITTING OF EXISTING AIRCRAFT IS EXPECTED TO DRIVE THE MARKET FROM 2O20 TO 2025

4.2 AIRCRAFT SEAT ACTUATION SYSTEMS MARKET, BY AIRCRAFT TYPE

FIGURE 13 FIXED WING SEGMENT PROJECTED TO LEAD THE MARKET FROM 2020 TO 2025

4.3 MARKET, BY COUNTRY

FIGURE 14 MARKET IN THE US IS PROJECTED TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2025

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 MARKET DYNAMICS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Technological advancements in aircraft seat actuation systems

5.2.1.2 Growing demand for seats installed with IFEC systems

5.2.1.3 Increasing number of premium economy seats

5.2.1.4 Maintenance & retrofitting of existing aircraft

5.2.2 RESTRAINTS

5.2.2.1 Fewer profitable airlines due to the COVID-19 crisis

5.2.2.2 Regulatory frameworks and certifications

5.2.3 OPPORTUNITIES

5.2.3.1 Rise of low-cost airlines

5.2.3.2 Growing urban air mobility platform

5.2.4 CHALLENGES

5.2.4.1 Mandate to install 16G seats in all aircraft

5.2.4.2 Design and integration of passenger control unit

5.2.4.3 Leakage issues in hydraulic and pneumatic actuators

5.2.4.4 Delay in aircraft deliveries

5.2.4.5 Power density and efficiency of electronic components

5.2.4.6 Economic challenges faced by the aviation industry due to COVID-19

TABLE 2 COVID-19 IMPACT ON PASSENGER NUMBERS AND PASSENGER REVENUE

5.3 AVERAGE SELLING PRICE

FIGURE 16 AVERAGE SELLING PRICE: OEM AIRCRAFT SEAT ACTUATION SYSTEM

FIGURE 17 AVERAGE SELLING PRICE: AFTERMARKET AIRCRAFT SEAT ACTUATION SYSTEM

5.4 VOLUME DATA

TABLE 3 OEM: AIRCRAFT SEAT ACTUATION SYSTEM MARKET SIZE, BY TYPE (UNITS)

TABLE 4 AFTERMARKET: MARKET SIZE, BY TYPE (UNITS)

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 18 SUPPLY CHAIN ANALYSIS

5.6 MARKET ECOSYSTEM MAP

5.6.1 PROMINENT COMPANIES

5.6.2 PRIVATE AND SMALL ENTERPRISES

5.6.3 END USERS

FIGURE 19 ECOSYSTEM MAP: AIRCRAFT SEAT ACTUATION SYSTEM MARKET

5.7 DISRUPTION IMPACTING CUSTOMER’S BUSINESS

5.7.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR MANUFACTURERS

FIGURE 20 REVENUE IMPACT FOR MARKET

5.8 TRADE DATA STATISTICS

TABLE 5 TRADE DATA TABLE FOR AIRCRAFT SEAT ACTUATION SYSTEM

5.9 PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 INTENSITY OF COMPETITIVE RIVALRY IS MODERATE IN THE AIRCRAFT SEAT ACTUATION SYSTEM MARKET

5.10 TARIFF AND REGULATORY LANDSCAPE

5.11 RANGE/SCENARIOS

FIGURE 22 IMPACT OF COVID-19 ON AIRCRAFT SEAT ACTUATION SYSTEM MARKET: GLOBAL SCENARIOS

6 INDUSTRY TRENDS (Page No. - 66)

6.1 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: AIRCRAFT SEAT ACTUATION SYSTEM MARKET

6.2 TYPES OF AIRCRAFT SEATS

6.3 TECHNOLOGY TRENDS

6.3.1 SMART ACTUATORS

6.3.2 ADVANCED MATERIAL

6.3.3 LIGHTWEIGHT AIRCRAFT SEAT

6.3.4 IN-FLIGHT ENTERTAINMENT TECHNOLOGY

6.3.5 STANDING SEATS

6.4 PATENT ANALYSIS

TABLE 6 INNOVATION & PATENT REGISTRATIONS, 2013-2020

7 AIRCRAFT SEAT ACTUATION SYSTEM MARKET, BY TYPE (Page No. - 72)

7.1 INTRODUCTION

FIGURE 24 AIRCRAFT SEAT ACTUATION SYSTEM MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 7 MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 8 MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

7.2 ELECTROMECHANICAL

7.2.1 REQUIREMENT FOR BOTH LINEAR AND ROTARY MECHANISMS DRIVES THE MARKET

TABLE 9 ELECTROMECHANICAL AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY MECHANISM 2016-2019 (USD MILLION)

TABLE 10 ELECTROMECHANICAL MARKET SIZE, BY MECHANISM, 2020-2025 (USD MILLION)

7.3 HYDRAULIC

7.3.1 INCREASING NUMBER OF PREMIUM ECONOMY SEATS DRIVES THE MARKET

7.4 PNEUMATIC

7.4.1 INCREASING DEMAND FOR AIRCRAFT RETROFITTING DRIVES THE MARKET

8 AIRCRAFT SEAT ACTUATION SYSTEM MARKET, BY COMPONENT (Page No. - 76)

8.1 INTRODUCTION

FIGURE 25 ACTUATORS SEGMENT IS PROJECTED TO LEAD THE AIRCRAFT SEAT ACTUATION SYSTEMS MARKET DURING FORECAST PERIOD

TABLE 11 AIRCRAFT SEAT ACTUATION SYSTEM MARKET SIZE, BY COMPONENT, 2016-2019 (USD MILLION)

TABLE 12 MARKET SIZE, BY COMPONENT, 2020-2025 (USD MILLION)

8.1.1 ACTUATORS

TABLE 13 ACTUATORS: AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY TECHNOLOGY, 2016-2019 (USD MILLION)

TABLE 14 ACTUATOR: MARKET SIZE, BY TECHNOLOGY, 2020-2025 (USD MILLION)

8.1.1.1 Traditional/piezoelectric actuators

8.1.1.2 Flexible actuators

8.1.2 MOTORS

TABLE 15 MOTORS: AIRCRAFT SEAT ACTUATION SYSTEM MARKET SIZE, BY TECHNOLOGY, 2016-2019 (USD MILLION)

TABLE 16 MOTORS: MARKET SIZE, BY TECHNOLOGY, 2020-2025 (USD MILLION)

8.1.2.1 Brushless DC motors

8.1.2.2 Brushed DC motors

8.1.3 IN-SEAT POWER SUPPLY

8.1.4 PASSENGER CONTROL UNIT

8.1.5 ELECTRONIC CONTROL UNIT

8.1.6 OTHERS

9 AIRCRAFT SEAT ACTUATION SYSTEM MARKET, BY END USER (Page No. - 82)

9.1 INTRODUCTION

FIGURE 26 OEM SEGMENT IS PROJECTED TO LEAD THE AIRCRAFT SEAT ACTUATION SYSTEM MARKET DURING FORECAST PERIOD

TABLE 17 MARKET SIZE, BY END USER, 2016-2019 (USD MILLION)

TABLE 18 MARKET SIZE, BY END USER, 2020-2025 (USD MILLION)

9.2 ORIGINAL EQUIPMENT MANUFACTURER (OEM)

9.2.1 INCREASE IN AIRCRAFT ORDERS IS DRIVING THE OEM SEGMENT

TABLE 19 OEM: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 20 OEM: AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

9.3 AFTERMARKET

9.3.1 INCREASING DEMAND FOR SEAT MAINTENANCE, REPAIR & OVERHAUL BY AIRLINES DRIVE THIS SEGMENT

TABLE 21 AFTERMARKET: AIRCRAFT SEAT ACTUATION SYSTEM MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 22 AFTERMARKET: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

10 AIRCRAFT SEAT ACTUATION SYSTEM MARKET, BY AIRCRAFT TYPE (Page No. - 87)

10.1 INTRODUCTION

FIGURE 27 FIXED WING SEGMENT IS PROJECTED TO LEAD THE AIRCRAFT SEAT ACTUATION SYSTEMS MARKET DURING FORECAST PERIOD

TABLE 23 MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 24 MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

10.2 FIXED WING

TABLE 25 FIXED WING: MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 26 FIXED WING: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

10.2.1 NARROW BODY AIRCRAFT (NBA)

10.2.1.1 Demand for narrow body aircraft for short-haul travel propels the market growth

10.2.2 WIDE BODY AIRCRAFT (WBA)

10.2.2.1 Increasing global air passenger traffic expected to drive the market

10.2.3 REGIONAL TRANSPORT AIRCRAFT (RTA)

10.2.3.1 Increasing domestic air passenger traffic drives this segment

10.2.4 BUSINESS JETS

10.2.4.1 Growing number of private aviation companies across the globe drives this segment

10.3 ROTARY WING

10.3.1 HELICOPTERS

10.3.1.1 Increasing demand for helicopters for corporate and civil applications is expected to drive the market

11 AIRCRAFT SEAT ACTUATION SYSTEM MARKET, BY SEAT CLASS (Page No. - 92)

11.1 INTRODUCTION

FIGURE 28 AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY SEAT CLASS, 2020 & 2025 (USD MILLION)

TABLE 27 MARKET SIZE, BY SEAT CLASS, 2016–2019 (USD MILLION)

TABLE 28 AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY SEAT CLASS, 2020–2025 (USD MILLION)

11.2 BUSINESS CLASS

11.2.1 PROCUREMENT OF NEW AIRCRAFT BY EMERGING ECONOMIES BOOSTS THE MARKET GROWTH

TABLE 29 BUSINESS CLASS: AIRCRAFT SEAT ACTUATION SYSTEM MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 30 BUSINESS CLASS: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

11.3 FIRST CLASS

11.3.1 INCREASING DEMAND FOR IFEC SYSTEMS DRIVES THE MARKET GROWTH

TABLE 31 FIRST CLASS: AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 32 FIRST CLASS: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

11.4 PREMIUM ECONOMY CLASS

11.4.1 BENEFITS OVER ECONOMY CLASS SEATS DRIVE THE GROWTH OF THIS SEGMENT

TABLE 33 PREMIUM ECONOMY CLASS: AIRCRAFT SEAT ACTUATION SYSTEM MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 34 PREMIUM ECONOMY CLASS: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

11.5 ECONOMY CLASS

11.5.1 INCREASE IN INVESTMENT BY LCCS DRIVES THE MARKET GROWTH

TABLE 35 ECONOMY CLASS: AIRCRAFT SEAT ACTUATION SYSTEM MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 36 ECONOMY CLASS: SYSTEM MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

12 REGIONAL ANALYSIS (Page No. - 99)

12.1 INTRODUCTION

FIGURE 29 AIRCRAFT SEAT ACTUATION SYSTEM MARKET IN NORTH AMERICA EXPECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

12.2 COVID-19 IMPACT ON AIRCRAFT SEAT ACTUATION SYSTEMS MARKET, BY REGION

FIGURE 30 COVID-19 IMPACT ON AVIATION REVENUE IN 2020, BY REGION

FIGURE 31 IMPACT OF COVID-19 ON AIRCRAFT SEAT ACTUATION SYSTEM MARKET

TABLE 37 AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 38 MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

12.3 NORTH AMERICA

12.3.1 COVID-19 RESTRICTIONS IN NORTH AMERICA

12.3.2 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 32 NORTH AMERICA AIRCRAFT SEAT ACTUATION SYSTEM MARKET SNAPSHOT

TABLE 39 NORTH AMERICA: MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

12.3.3 US

12.3.3.1 Presence of leading manufacturers of aircraft seat actuation systems drives the market in the US

TABLE 47 US: AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 48 US: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 49 US: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 50 US: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 51 US: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 52 US: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

12.3.4 CANADA

12.3.4.1 Aircraft modernization programs boost the market in Canada

TABLE 53 CANADA: AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 54 CANADA: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 55 CANADA: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 56 CANADA: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 57 CANADA: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 58 CANADA: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

12.4 EUROPE

12.4.1 COVID-19 RESTRICTIONS IN EUROPE

12.4.2 PESTLE ANALYSIS: EUROPE

FIGURE 33 EUROPE AIRCRAFT SEAT ACTUATION SYSTEMSMARKET SNAPSHOT

TABLE 59 EUROPE: MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 60 EUROPE: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 61 EUROPE: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 62 EUROPE: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 63 EUROPE: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 64 EUROPE: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 65 EUROPE: MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

&nbsnbsp; TABLE 66 EUROPE: AIRCRAFT SEAT ACTUATION SYSTEM MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

12.4.3 FRANCE

12.4.3.1 Presence of aircraft OEMs drives the market in France

TABLE 67 FRANCE: MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 68 FRANCE: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 69 FRANCE: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 70 FRANCE: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 71 FRANCE: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 72 FRANCE: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

12.4.4 GERMANY

12.4.4.1 Growing investment in air travel connectivity boosts demand for aircraft seat actuation systems in Germany

TABLE 73 GERMANY: AIRCRAFT SEAT ACTUATION SYSTEM MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 74 GERMANY: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 75 GERMANY: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 76 GERMANY: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 77 GERMANY: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 78 GERMANY: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

12.4.5 UK

12.4.5.1 Presence of aircraft OEMs fuels demand for aircraft seat actuation systems in the UK

TABLE 79 UK: AIRCRAFT SEAT ACTUATION SYSTEM MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 80 UK: SYSTEM MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 81 UK: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 82 UK: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 83 UK: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 84 UK: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

12.4.6 ITALY

12.4.6.1 High demand for civil and corporate helicopters expected to drive the market in Italy

TABLE 85 ITALY: AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 86 ITALY: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 87 ITALY: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 88 ITALY: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 89 ITALY: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 90 ITALY: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

12.4.7 REST OF EUROPE

12.4.7.1 Increasing aircraft fleet size due to increasing air passenger traffic will fuel the market in this region

TABLE 91 REST OF EUROPE AIR PASSENGER TRANSPORT GROWTH, 2018-2019 (%)

TABLE 92 REST OF EUROPE: AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 93 REST OF EUROPE: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 94 REST OF EUROPE: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 95 REST OF EUROPE: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 96 REST OF EUROPE: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 97 REST OF EUROPE: AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

12.5 ASIA PACIFIC

12.5.1 ASIA PACIFIC COVID-19 RESTRICTIONS

12.5.2 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 34 ASIA PACIFIC AIRCRAFT SEAT ACTUATION SYSTEM MARKET SNAPSHOT

TABLE 98 ASIA PACIFIC: MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

12.5.3 CHINA

12.5.3.1 Growing demand for aerospace products increases the demand for aircraft seat actuation systems in China

TABLE 106 CHINA: AIRCRAFT SEAT ACTUATION SYSTEM MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 107 CHINA: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 108 CHINA: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 109 CHINA: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 110 CHINA: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 111 CHINA: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

12.5.4 INDIA

12.5.4.1 Improving domestic capabilities of the aerospace industry offer growth opportunities to market in India

TABLE 112 INDIA: AIRCRAFT SEAT ACTUATION SYSTEM MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 113 INDIA: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 114 INDIA: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 115 INDIA: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 116 INDIA: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 117 INDIA: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

12.5.5 JAPAN

12.5.5.1 Increasing in-house development of aircraft fuel the growth of the market in Japan

TABLE 118 JAPAN: AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 119 JAPAN: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 120 JAPAN: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 121 JAPAN: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 122 JAPAN: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 123 JAPAN: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

12.5.6 SINGAPORE

12.5.6.1 Use of advanced technology in air transport results in demand for aircraft seat actuation system in Singapore

TABLE 124 SINGAPORE: AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 125 SINGAPORE: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 126 SINGAPORE: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 127 SINGAPORE: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 128 SINGAPORE: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 129 SINGAPORE: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

12.5.7 REST OF ASIA PACIFIC

12.5.7.1 Aging aircraft fleets and an increase in the defense budget are expected to drive demand for aircraft seat actuation system in this region

TABLE 130 REST OF ASIA PACIFIC: AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 131 REST OF ASIA PACIFIC: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 132 REST OF ASIA PACIFIC: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 133 REST OF ASIA PACIFIC: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 134 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 135 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA COVID-19 RESTRICTIONS

12.6.2 PESTLE ANALYSIS: LATIN AMERICA

TABLE 136 LATIN AMERICA: AIRCRAFT SEAT ACTUATION SYSTEM MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 137 LATIN AMERICA: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 138 LATIN AMERICA: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 139 LATIN AMERICA: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 140 LATIN AMERICA: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 141 LATIN AMERICA: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 142 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 143 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

12.6.3 BRAZIL

12.6.3.1 Presence of OEMs and airlines offer growth opportunities to the market in Brazil

TABLE 144 BRAZIL: AIRCRAFT SEAT ACTUATION SYSTEM MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 145 BRAZIL: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 146 BRAZIL: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 147 BRAZIL: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 148 BRAZIL: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 149 BRAZIL: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

12.6.4 MEXICO

12.6.4.1 Increased use of special mission aircraft by the government for surveillance drives the market in Mexico

TABLE 150 MEXICO: MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 151 MEXICO: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 152 MEXICO: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 153 MEXICO: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 154 MEXICO: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 155 MEXICO: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

12.6.5 REST OF LATIN AMERICA

12.6.5.1 Increased fleet size of airlines propels the market in this region

TABLE 156 REST OF LATIN AMERICA: AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 157 REST OF LATIN AMERICA: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 158 REST OF LATIN AMERICA: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 159 REST OF LATIN AMERICA: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 160 REST OF LATIN AMERICA: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 161 REST OF LATIN AMERICA: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

12.7 MIDDLE EAST

12.7.1 MIDDLE EAST COVID-19 RESTRICTIONS

12.7.2 PESTLE ANALYSIS: MIDDLE EAST

TABLE 162 MIDDLE EAST: AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 163 MIDDLE EAST: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 164 MIDDLE EAST: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 165 MIDDLE EAST: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 166 MIDDLE EAST: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 167 MIDDLE EAST: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 168 MIDDLE EAST: MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 169 MIDDLE EAST: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

12.7.3 UAE

12.7.3.1 Increasing upgradation of commercial airlines is expected to drive the market

TABLE 170 UAE: AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 171 UAE: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 172 UAE: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 173 UAE: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 174 UAE: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 175 UAE: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

12.7.4 SAUDI ARABIA

12.7.4.1 Significant growth in airline business drives demand for aircraft seat actuation system in Saudi Arabia

TABLE 176 SAUDI ARABIA: AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 177 SAUDI ARABIA: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 178 SAUDI ARABIA: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 179 SAUDI ARABIA: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 180 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 181 SAUDI ARABIA: MARKET SIZE,BY TYPE, 2020-2025 (USD MILLION)

12.7.5 REST OF MIDDLE EAST

12.7.5.1 Presence of certified commercial aircraft repair stations offer opportunities for the market to grow

TABLE 182 REST OF MIDDLE EAST: AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 183 REST OF MIDDLE EAST: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 184 REST OF MIDDLE EAST: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 185 REST OF MIDDLE EAST: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 186 REST OF MIDDLE EAST: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 187 REST OF MIDDLE EAST: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

12.8 AFRICA

TABLE 188 AFRICA: AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 189 AFRICA: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 190 AFRICA: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 191 AFRICA: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 192 AFRICA: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 193 AFRICA: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 194 AFRICA: MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 195 AFRICA: MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

12.8.1 SOUTH AFRICA

12.8.1.1 Demand for replacing aircraft components fuels market in South Africa

TABLE 196 SOUTH AFRICA: AIRCRAFT SEAT ACTUATION SYSTEMS MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 197 SOUTH AFRICA: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 198 SOUTH AFRICA: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 199 SOUTH AFRICA: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 200 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 201 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

12.8.2 REST OF AFRICA

12.8.2.1 Availability of low-cost raw materials fuels market growth in the Rest of Africa

TABLE 202 REST OF AFRICA: MARKET SIZE, BY AIRCRAFT TYPE, 2016-2019 (USD MILLION)

TABLE 203 REST OF AFRICA: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 204 REST OF AFRICA: MARKET SIZE, BY SEAT CLASS, 2016-2019 (USD MILLION)

TABLE 205 REST OF AFRICA: MARKET SIZE, BY SEAT CLASS, 2020-2025 (USD MILLION)

TABLE 206 REST OF AFRICA: MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 207 REST OF AFRICA: MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 177)

13.1 INTRODUCTION

13.2 MARKET SHARE ANALYSIS, 2019

FIGURE 35 MARKET SHARE OF TOP PLAYERS IN AIRCRAFT SEAT ACTUATION SYSTEM MARKET, 2019 (%)

13.3 REVENUE ANALYSIS OF TOP 4 MARKET PLAYERS, 2019

13.4 COMPETITIVE SCENARIO

FIGURE 36 COMPANIES ADOPTED NEW PRODUCT LAUNCHES AS THE KEY GROWTH STRATEGY FROM 2016 TO 2020

13.5 COMPETITIVE LEADERSHIP MAPPING

13.5.1 STAR

13.5.2 EMERGING LEADER

13.5.3 PERVASIVE

13.5.4 PARTICIPANT

FIGURE 37 AIRCRAFT SEAT ACTUATION SYSTEM MARKET COMPETITIVE LEADERSHIP MAPPING, 2019

TABLE 208 COMPANY PRODUCT FOOTPRINT

TABLE 209 COMPANY SEAT CLASS FOOTPRINT

TABLE 210 COMPANY COMPONENT FOOTPRINT

TABLE 211 COMPANY REGION FOOTPRINT

13.6 STARTUPS COMPETITIVE LEADERSHIP MAPPING

13.6.1 PROGRESSIVE COMPANIES

13.6.2 RESPONSIVE COMPANIES

13.6.3 DYNAMIC COMPANIES

13.6.4 STARTING BLOCKS

FIGURE 38 AIRCRAFT SEAT ACTUATION SYSTEM MARKET STARTUPS COMPETITIVE LEADERSHIP MAPPING, 2019

13.7 COMPETITIVE SCENARIO

13.7.1 NEW PRODUCT LAUNCHES

TABLE 212 NEW PRODUCT LAUNCHES, 2017–2020

13.7.2 ACQUISITIONS

TABLE 213 ACQUISITIONS, 2017–2020

13.7.3 CONTRACTS

TABLE 214 CONTRACTS, 2016–2020

13.7.4 PARTNERSHIPS & AGREEMENTS

TABLE 215 PARTNERSHIPS & AGREEMENTS, 2018–2020

14 COMPANY PROFILES (Page No. - 191)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

14.1 KEY PLAYERS

14.1.1 ASTRONICS CORPORATION

FIGURE 39 ASTRONICS CORPORATION: COMPANY SNAPSHOT

14.1.2 ITT INC.

FIGURE 40 ITT INC.: COMPANY SNAPSHOT

14.1.3 CRANE CO.

FIGURE 41 CRANE CO.: COMPANY SNAPSHOT

14.1.4 COLLINS AEROSPACE

FIGURE 42 COLLINS AEROSPACE: COMPANY SNAPSHOT

14.1.5 BÜHLER MOTOR GMBH

14.1.6 MEGGITT PLC

FIGURE 43 MEGGITT PLC.: COMPANY SNAPSHOT

14.1.7 SAFRAN ELECTRONICS & DEFENSE

14.1.8 BAE SYSTEMS PLC

FIGURE 44 BAE SYSTEMS PLC: COMPANY SNAPSHOT

14.1.9 MOOG INC.

FIGURE 45 MOOG INC.: COMPANY SNAPSHOT

14.1.10 KID-SYSTEME GMBH

14.1.11 LEEAIR, INC.

14.1.12 MAXON MOTOR AG

14.2 OTHER PLAYERS

14.2.1 KYNTRONICS

14.2.2 ELEKTRO-METALL EXPORT GMBH

14.2.3 GGI SOLUTIONS

14.2.4 PORTESCAP

14.2.5 PRECIPART

14.2.6 QUEST GLOBAL SERVICES PTE. LTD.

14.2.7 IMAGIK INTERNATIONAL CORPORATION

14.2.8 MID-CONTINENT INSTRUMENT CO., INC.

14.2.9 MESAG-SYSTEM AG

14.2.10 KYNTEC CORPORATION

14.2.11 ROLLON SPA

14.2.12 TESTWORKS GROUP LTD.

14.2.13 NOOK INDUSTRIES, INC.

14.2.14 INFLIGHT PERIPHERALS LTD.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

15 ADJACENT MARKET (Page No. - 226)

15.1 INTRODUCTION

15.2 AIRCRAFT ACTUATORS MARKET

15.2.1 MARKET DEFINITION

15.2.2 AIRCRAFT ACTUATORS MARKET, BY WING TYPE

FIGURE 46 FIXED WING SEGMENT EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

TABLE 216 AIRCRAFT ACTUATORS MARKET SIZE, BY WING TYPE, 2016–2019 (USD MILLION)

TABLE 217 AIRCRAFT ACTUATORS MARKET SIZE, BY WING TYPE, 2020–2030 (USD MILLION)

15.3 FIXED WING

15.3.1 EXPECTED GROWTH IN PASSENGER TRAFFIC DRIVING DEMAND FOR FIXED WING AIRCRAFT

TABLE 218 FIXED WING AIRCRAFT ACTUATORS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 219 FIXED WING AIRCRAFT ACTUATORS MARKET SIZE, BY APPLICATION, 2020–2030 (USD MILLION)

15.4 ROTARY WING

15.4.1 GROWING APPLICATION OF ROTARY WING AIRCRAFT IN MILITARY AS WELL AS COMMERCIAL AVIATION DRIVES THE MARKET

TABLE 220 ROTARY WING AIRCRAFT ACTUATORS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 221 ROTARY WING AIRCRAFT ACTUATORS MARKET SIZE, BY APPLICATION, 2020–2030 (USD MILLION)

15.4.2 AIRCRAFT ACTUATORS MARKET, BY APPLICATION

FIGURE 47 COMMERCIAL AVIATION SEGMENT TO LEAD AIRCRAFT ACTUATORS MARKET DURING FORECAST PERIOD

TABLE 222 AIRCRAFT ACTUATORS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 223 AIRCRAFT ACTUATORS MARKET SIZE, BY APPLICATION, 2020–2030 (USD MILLION)

16 APPENDIX (Page No. - 231)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATION

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

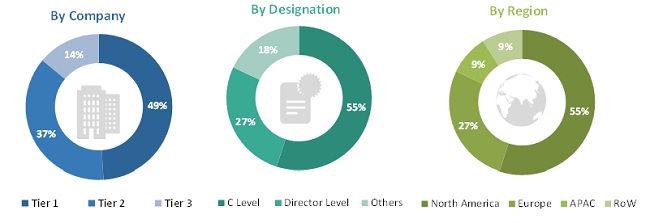

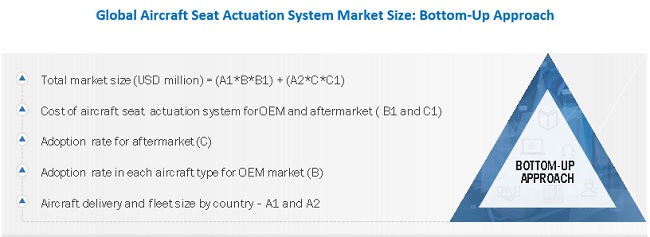

The study involved four major activities in estimating the current size of the aircraft seat actuation system market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as the International Air Transport Association (IATA); the Federal Aviation Administration (FAA); the General Aviation Manufacturers Association (GAMA); corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from aircraft seat actuation system vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using aircraft seat actuation systems were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of aircraft seat actuation system and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the aircraft seat actuation system market. These methods were also used extensively to estimate the size of various segments and subsegment of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the Aircraft Aircraft Seat Actuation System Market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the aircraft seat actuation system market.

Report Objectives

- To define, describe, segment, and forecast the aircraft seat actuation system market on the basis of type, aircraft type, seat class, end user, component, and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the aircraft seat actuation system market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets1, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the aircraft seat actuation system market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Aircraft Seat Actuation System Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aircraft Seat Actuation System Market