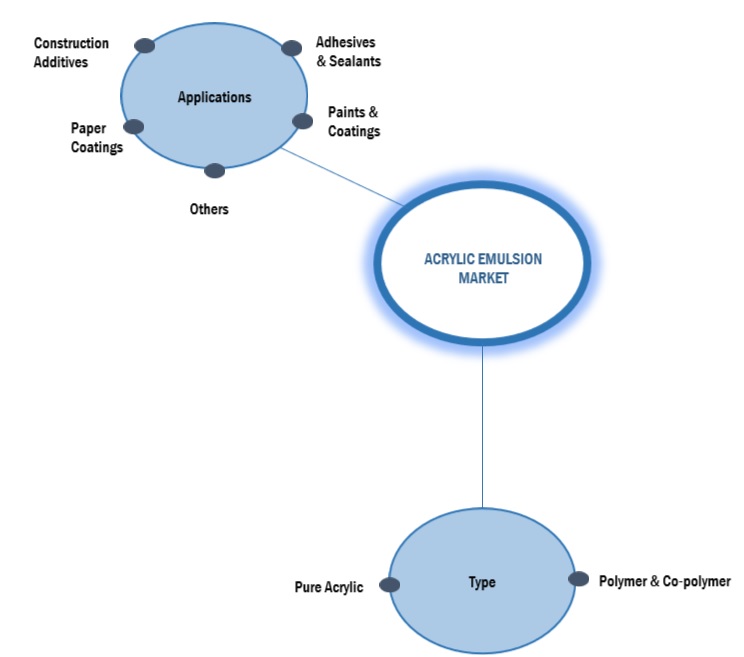

Acrylic Emulsion Market by Type (Pure Acrylic Emulsion, Polymer & Co-polymer Acrylic Emulsion), Application (Paints & Coatings, Adhesives & Sealants, Construction Additives, Paper Coating), and Region - Global Forecast to 2028

Updated on : September 17, 2025

Acrylic Emulsion Market

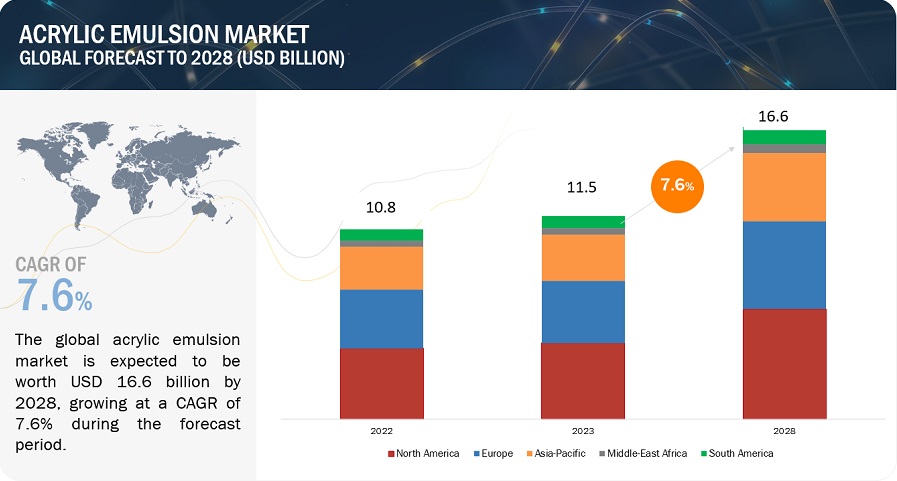

The global acrylic emulsion market size was valued at USD 11.5 billion in 2023 and is projected to reach USD 16.6 billion by 2028, growing at 7.6% cagr from 2023 to 2028. Acrylic emulsion serves as a foundational building block extensively utilized in diverse sectors, including paints, coatings, adhesives, textiles, and construction. This adaptable substance embodies a range of characteristics such as adhesion, durability, and flexibility, crucial for crafting high-caliber products that excel in meeting stringent performance standards while adhering to environmentally conscious principles.

Acrylic Emulsion Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Acrylic Emulsion Market

Acrylic Emulsion Market Dynamics

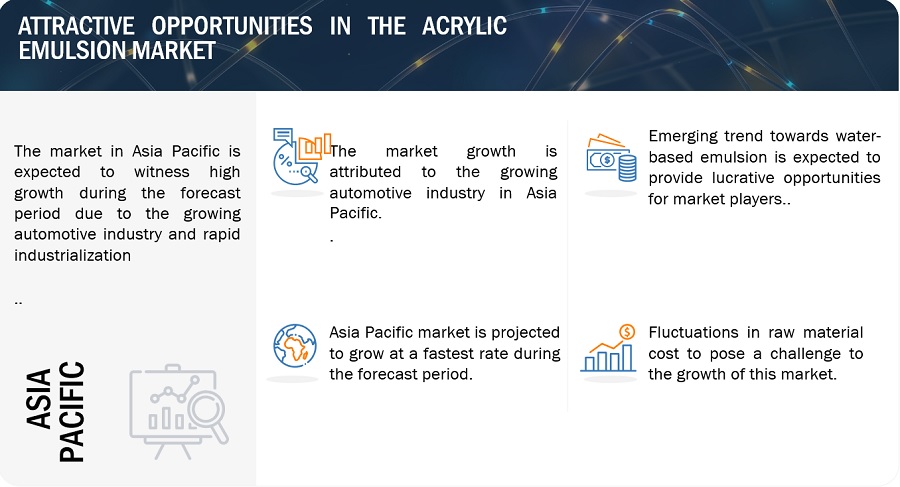

Driver:Growing automotive industry in Asia Pacific

The thriving automotive industry in the Asia Pacific region is a significant driving force behind the growth of the acrylic emulsion market. With countries like China, India, Japan, and South Korea emerging as key players in automotive manufacturing, the demand for high-quality coatings and finishes has surged. Acrylic emulsions play a pivotal role in this scenario, as they offer exceptional properties such as durability, gloss retention, and weather resistance that are crucial for automotive coatings. As consumers in the region seek vehicles with superior aesthetics and longevity, manufacturers rely on acrylic emulsions to provide the desired finish and protection.

Furthermore, the shift towards eco-friendly practices in the automotive sector aligns perfectly with the characteristics of acrylic emulsions. These water-based formulations have lower levels of volatile organic compounds (VOCs) compared to solvent-based alternatives, thus contributing to better air quality and reduced environmental impact. As environmental regulations tighten and consumer preferences for sustainable products grow, the use of acrylic emulsions becomes more appealing for automotive manufacturers aiming to meet these requirements.

In essence, the rapid expansion of the Asia Pacific automotive industry creates a robust demand for top-quality coatings that enhance both the visual appeal and durability of vehicles.

Restraint: Substiution of acrylic emulsions by polyurethane dispersion especially in coating application

The substitution of acrylic emulsions by polyurethane dispersions, particularly in coating applications, presents a notable restraint to the growth of the acrylic emulsion market. Polyurethane dispersions offer specific performance advantages such as enhanced durability, chemical resistance, and superior adhesion, making them an attractive alternative in certain scenarios. As industries seek advanced solutions that meet evolving demands, the appeal of polyurethane dispersions can impact the market share of acrylic emulsions, particularly in segments where specialized properties are prioritized.

Opportunity: Emerging trend towards water-based emulsion

The escalating demand for water-based acrylic emulsions in emerging markets presents a significant growth opportunity for the acrylic emulsion market. As economies in these regions undergo rapid development, there is an increasing emphasis on sustainable and environmentally-friendly solutions. Water-based acrylic emulsions, with their low VOC content and alignment with stringent regulations, perfectly cater to this demand. The trend towards urbanization, coupled with a rising middle class, propels sectors like construction, automotive, and consumer goods - all of which can benefit from the advantages offered by water-based acrylic emulsions.

Challenge: Fluctuations in raw material cost

Raw material costs are a pivotal concern within the acrylic emulsion market due to their inherent volatility. The market dynamics governing the pricing of key components used in acrylic emulsion formulation are subject to intricate influences, including global supply chain disruptions, geopolitical shifts, and fluctuating demand-supply equilibrium. These variables can engender substantial variability in the cost structure of raw materials, exerting a direct impact on the production expenditure incurred in the synthesis of acrylic emulsions.

Acrylic Emulsion Market Ecosystem

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Polymer & co-polymer type was the largest segment for acrylic emulsion market in 2022, in terms of value.

The acrylic emulsion market is characterized by two distinct categories: polymer acrylic emulsions and co-polymer acrylic emulsions. Polymer acrylic emulsions are derived from individual acrylic monomers, resulting in coatings and products with specific performance attributes tailored to particular needs. Conversely, co-polymer acrylic emulsions are synthesized by combining various monomers, allowing for the customization of properties to suit a wide range of applications. This segmentation offers an expansive spectrum of choices, empowering industries like paints, coatings, adhesives, and textiles to select emulsions that precisely align with their unique requirements.

"Adhesives & sealants application was the second largest application for acrylic emulsion market in 2022, in terms of value."

The adhesives and sealants market is a pivotal sector spanning diverse industries. Adhesives create strong material bonds, while sealants provide leakage protection. This market thrives in construction, automotive, packaging, and manufacturing. Acrylic emulsions play a strategic role here. Known for robust adhesion, they create secure bonds and act as sealant foundations, offering flexibility and resilience. Amid the pursuit of sustainable bonding solutions, demand for acrylic emulsion-based adhesives and sealants is surging, intertwining their growth with the adhesives and sealants market's expansion.

"Asia Pacific was the fastest growing market for acrylic emulsion in 2022, in terms of value."

Asia Pacific was the fastest growing market for global acrylic emulsion market, in terms of value, in 2022. China is the largest market in Asia Pacific. It is projected to witness the highest growth during the forecast period considering of high usage of acrylic emulsion in the region for various application.

To know about the assumptions considered for the study, download the pdf brochure

Acrylic Emulsion Market Players

The key players in this market BASF SE (Germany), Dow Inc. (US), Arkema S.A. (France), Synthomer PLC (UK), Celanese Corporation (US), Avery Dennison (US), Covestro AG (Germany), DIC Group (Japan), Henkel (Germany), H.B. Fuller (US), Mallard Creek Polymers (US) Nippon Shokubai Co., Ltd. (Japan) and The Lubrizol Corporation (US).Continuous developments in the market—including new partnership, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of acrylic emulsion have opted for investment & expansion to sustain their market position.

Acrylic Emulsion Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 11.5 billion |

|

Revenue Forecast in 2028 |

USD 16.6 billion |

|

CAGR |

7.6% |

|

Years considered for the study |

2019-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (Kiloton); Value (USD Billion) |

|

Segments |

Type, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

BASF SE (Germany), Dow Inc. (US), Arkema S.A. (France), Synthomer PLC (UK), Celanese Corporation (US), Avery Dennison (US), Covestro AG (Germany), DIC Group (Japan), Henkel (Germany), H.B. Fuller (US), Mallard Creek Polymers (US) Nippon Shokubai Co., Ltd. (Japan) and The Lubrizol Corporation (US) |

This report categorizes the global acrylic emulsion market based on type, application, and region.

Based on type, the acrylic emulsion market has been segmented as follows:

- Polymer & co-polymer

- Pure Acrylic

Based on application, the acrylic emulsion market has been segmented as follows:

- Paints & coatings

- Adhesives & sealants

- Construction additives

- Paper coating

- Others

Based on region, the acrylic emulsion market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In March 2023, BASF SE has started construction a new production complex at its Verbund site in Zhanjiang, China, that includes plants for glacial acrylic acid (GAA), butyl acrylate (BA) and 2-ethylhexyl acrylate (2-EHA).

- In february 2023, Celanese Corporation has announced the completion of an ultra-low capital project. This move supports significant growth in the acetyl chain’s downstream vinyl portfolio.

- In August 2022, Arkema S.A. introduced new acrylic polyol emulsion for industrial paints. It offers significantly lower VOC capabilities and performs well in 2K or 1K stoving systems.

- In August 2021 , Arkema S.A. acquired Ashland’s Performance Adhesives business, a first-class leader in high performance adhesives for industrial applications in the United States with a unique and innovative product portfolio. This move is perfectly aligned with the Group’s ambition to become a pure Specialty Materials player by 2024.

- In April 2021, Synthomer PLC has launched the Asia Innovation Center at Johar Bahru. This facility is fully operational and started to provide leadership in research and development for both Performance Elastomers and Functional Solutions business units which cover a wide range of industries including healthcare and protection, foam, carpet, paper, automotive, coating, construction, adhesive and textile

Frequently Asked Questions (FAQ):

What is the expected growth rate of the acrylic emulsion market?

The forecast period for the acrylic emulsion market in this study is 2023-2028. The acrylic emulsion market is expected to grow at a CAGR of 7.6%in terms of value, during the forecast period.

Who are the major key players in the acrylic emulsion market?

BASF SE (Germany), Dow Inc. (US), Arkema S.A. (France), Synthomer PLC (UK), Celanese Corporation (US), Avery Dennison (US), Covestro AG (Germany), DIC Group (Japan), Henkel (Germany), H.B. Fuller (US), Mallard Creek Polymers (US) Nippon Shokubai Co., Ltd. (Japan) and The Lubrizol Corporation (US) are the leading manufacturers of acrylic emulsion.

What are some of the strategies adopted by the top market players to penetrate emerging regions?

The major players in the market use expansion, acquisitions, and partnership, as important growth tactics.

What are the drivers and opportunities for the acrylic emulsion market?

Growing automotive industry in Asia Pacific is driving the market during the forecast period. Emerging trend towards water-based acrylic emulsion acts as an opportunity during the forecast period.

Which are the key technology trends prevailing in the acrylic emulsion market?

The key technologies prevailing in the acrylic emulsion market include nano-technology integration, and additive incorporation. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing automotive industry in Asia Pacific- Urbanization and industrialization in emerging markets- Government regulations related to VOC content in emulsionsRESTRAINTS- Substitution of acrylic emulsion by polyurethane dispersions, especially in coating applications- Technological limitation of acrylic emulsionsOPPORTUNITIES- Emerging trend toward water-based emulsions- Commercialization of bio-based acrylic acidCHALLENGES- Fluctuations in raw material costs

-

5.3 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSMANUFACTURERSDISTRIBUTORSEND USERS

-

5.4 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.5 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEPUBLICATION TRENDS - LAST 10 YEARSINSIGHTSJURISDICTION ANALYSISTOP 10 COMPANIES/APPLICANTSPATENTS BY LG CHEMICAL LTDPATENTS BY AVERY DENNISON CORP.TOP 10 PATENT OWNERS IN AST 10 YEARS

-

5.6 AVERAGE SELLING PRICE ANALYSISAVERAGE SELLING PRICE BASED ON REGIONAVERAGE SELLING PRICE BASED ON TYPEAVERAGE SELLING PRICE TREND OF KEY PLAYERS

-

5.7 ECOSYSTEM

-

5.8 TECHNOLOGY ANALYSISTAILOR-MADE ACRYLIC EMULSIONNANOSTRUCTURED ACRYLIC EMULSIONADVANCED CROSSLINKING TECHNOLOGIES

-

5.9 TRADE ANALYSISIMPORT-EXPORT SCENARIO OF ACRYLIC EMULSION MARKETIMPORT-EXPORT SCENARIO OF ACRYLIC ACID ESTERS MARKET

-

5.10 MACROECONOMIC INDICATORSTRENDS IN AUTOMOTIVE INDUSTRYTRENDS IN CEMENT INDUSTRY

-

5.11 TARIFF & REGULATIONSREGULATIONS- North AmericaASIA PACIFICEUROPEMIDDLE EAST & AFRICA AND SOUTH AMERICALIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 KEY CONFERENCES & EVENTS IN 2023–2024

-

5.13 KEY FACTORS AFFECTING BUYING DECISIONQUALITYSERVICE

-

5.14 TRENDS/DISRUPTIONS IMPACTING BUSINESSES

-

5.15 CASE STUDY ANALYSISBASF SEDOW INC.

-

5.16 LASD APPLICATIONBUILDING & CONSTRUCTIONINDUSTRIAL EQUIPMENT & MACHINERYMARINEHVAC UNITSAEROSPACEAPPLIANCES

-

5.17 ACRYLIC EMULSION BASED LASD MANUFACTURERSBASFDOWHENKELMALLARD CREEK POLYMERS

-

5.18 LASD COATING MANUFACTURERSPPG- Business overview- Products/Solutions/Services Offered.DAUBERT CHEMICAL COMPANY- Business overview- Products/Solutions/Services Offered.BLACHFORD ACOUSTICS GROUP- Business overview- Products/Solutions/Services Offered.HY-TECH THERMAL SOLUTIONS- Business overview- Products/Solutions/Services Offered.SECOND SKIN AUDIO- Business overview- Products/Solutions/Services Offered.

- 6.1 INTRODUCTION

-

6.2 PURE ACRYLIC EMULSIONEXCELLENT PERFORMANCE CHARACTERISTICS TO INCREASE DEMAND IN VARIOUS APPLICATIONS

-

6.3 POLYMER & COPOLYMER ACRYLIC EMULSIONEXCEPTIONAL VERSATILITY AND PERFORMANCE ATTRIBUTES TO DRIVE DEMANDSTYRENE ACRYLIC EMULSIONVINYL ACRYLIC EMULSIONOTHERS

- 7.1 INTRODUCTION

-

7.2 PAINTS & COATINGSARCHITECTURAL COATINGSAUTOMOTIVE COATINGSINDUSTRIAL COATINGS

-

7.3 ADHESIVES & SEALNATSGENERAL PURPOSE ADHESIVESPRESSURE-SENSITIVE ADHESIVES

-

7.4 CONSTRUCTION ADDITIVESCEMENT MODIFIERSCONCRETE ADMIXTURESBINDERS

- 7.5 PAPER COATINGS

- 7.6 OTHERS

- 8.1 INTRODUCTION

-

8.2 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFICCHINA- Large population and rising infrastructure projects to drive marketJAPAN- Large automotive industry to drive marketINDIA- Government infrastructure projects to drive marketSOUTH KOREA- Esthetic and corrosion protection benefits in coating industry to drive marketMALAYSIA- Growing automotive coating industry to drive marketINDONESIA- Increasing foreign investments to drive marketREST OF ASIA PACIFIC

-

8.3 EUROPERECESSION IMPACT ON EUROPEGERMANY- Large automotive sector to drive marketUK- Upcoming construction project to drive marketFRANCE- Demand for architectural coating to drive growthITALY- Government investments in public infrastructure to drive marketSPAIN- Increased foreign investments and economic growth to drive marketREST OF EUROPE

-

8.4 NORTH AMERICARECESSION IMPACT ON NORTH AMERICAUS- Presence of major manufacturers to drive marketCANADA- Increasing foreign trade to drive marketMEXICO- Advancements in construction sector to increase demand

-

8.5 SOUTH AMERICARECESSION IMPACT ON SOUTH AMERICABRAZIL- Government initiatives for construction sector to drive marketARGENTINA- Urban population growth to increase demand for residential and commercial buildingsREST OF SOUTH AMERICA

-

8.6 MIDDLE EAST & AFRICARECESSION IMPACT ON MIDDLE EAST & AFRICASAUDI ARABIA- Development in real estate sector to drive marketUAE- Construction pipelines to drive demandSOUTH AFRICA- Construction sector to significantly drive marketREST OF MIDDLE EAST & AFRICA

- 9.1 OVERVIEW

- 9.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

- 9.3 MARKET SHARE ANALYSIS

- 9.4 REVENUE ANALYSIS OF TOP PLAYERS

- 9.5 MARKET EVALUATION MATRIX

-

9.6 COMPANY EVALUATION MATRIX, 2022 (TIER 1)STAR PLAYERSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

9.7 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIXRESPONSIVE COMPANIESSTARTING BLOCKSPROGRESSIVE COMPANIESDYNAMIC COMPANIES

- 9.8 COMPANY END-USE INDUSTRY FOOTPRINT

- 9.9 COMPANY REGION FOOTPRINT

-

9.10 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

10.1 MAJOR PLAYERSBASF SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDOW INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewARKEMA S.A.- Business overview- Recent developments- MnM viewCOVESTRO AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCELANESE CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAVERY DENNISON- Business overview- Products/Solutions/Services offered- MnM viewDIC GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHENKEL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewH.B. FULLER- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMALLARD CREEK POLYMERS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNIPPON SHOKUBAI CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSYNTHOMER PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHE LUBRIZOL CORPORATION- Business overview- Products/Solutions/Services offered- MnM view

-

10.2 OTHER KEY PLAYERS3MADVANCED POLYMER EMULSION COMPANYARCHROMAASTRA CHEMTECH PRIVATE LIMITEDGELLNER INDUSTRIAL, LLCINDOFIL INDUSTRIES LIMITEDJSR CORPORATIONKAMSONS CHEMICALS PVT. LTD.ORGANIK KIMYASPECIALITY POLYMERS, INC.STANCHEM RESINSNISSIN CHEMICAL INDUSTRY CO., LTD.

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 VEHICLE PRODUCTION STATISTICS, BY ASIAN COUNTRIES, 2021–2022 (UNIT)

- TABLE 2 ACRYLIC EMULSION MARKET: VOC REGULATIONS

- TABLE 3 ACRYLIC EMULSION MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 AVERAGE SELLING PRICE, BY TYPE (USD/KG)

- TABLE 5 ACRYLIC EMULSION: ECOSYSTEM

- TABLE 6 IMPORT TRADE DATA OF TOP 20 COUNTRIES, 2020–2022 (USD THOUSAND)

- TABLE 7 EXPORT TRADE DATA OF TOP 20 COUNTRIES 2020–2022 (USD THOUSAND)

- TABLE 8 IMPORT TRADE DATA OF ACRYLIC ACID ESTERS FOR TOP COUNTRIES, 2020–2022 (USD THOUSAND)

- TABLE 9 EXPORT TRADE DATA OF ACRYLIC ACID ESTERS FOR TOP COUNTRIES 2020–2022 (USD THOUSAND)

- TABLE 10 VEHICLE PRODUCTION STATISTICS, BY COUNTRY, 2021–2022 (UNIT)

- TABLE 11 CEMENT PRODUCTION STATISTICS, BY COUNTRY, 2021–2022 (THOUSAND METRIC TONS)

- TABLE 12 ACRYLIC EMULSION MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2023–2024

- TABLE 13 PPG: COMPANY OVERVIEW

- TABLE 14 PPG PRODUCTS OFFERED

- TABLE 15 DAUBERT CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 16 DAUBERT CHEMICAL COMPANY: PRODUCTS OFFERED

- TABLE 17 BLACHFORD ACOUSTICS GROUP: COMPANY OVERVIEW

- TABLE 18 BLATCHFORD ACOUSTICS GROUP: PRODUCTS OFFERED

- TABLE 19 HY-TECH THERMAL SOLUTIONS: COMPANY OVERVIEW

- TABLE 20 HY-TECH THERMAL SOLUTIONS: PRODUCTS OFFERED

- TABLE 21 SECOND SKIN AUDIO: COMPANY OVERVIEW

- TABLE 22 SECOND SKIN AUDIO: PRODUCTS OFFERED

- TABLE 23 ACRYLIC EMULSION MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 24 ACRYLIC EMULSION MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 25 ACRYLIC EMULSION MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 26 ACRYLIC EMULSION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 27 ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 28 ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 29 ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 30 ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 31 ACRYLIC EMULSION MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 32 ACRYLIC EMULSION MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 33 ACRYLIC EMULSION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 ACRYLIC EMULSION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: ACRYLIC EMULSION MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 36 ASIA PACIFIC: ACRYLIC EMULSION MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 37 ASIA PACIFIC: ACRYLIC EMULSION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 38 ASIA PACIFIC: ACRYLIC EMULSION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 39 ASIA PACIFIC: ACRYLIC EMULSION MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 40 ASIA PACIFIC: ACRYLIC EMULSION MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 41 ASIA PACIFIC: ACRYLIC EMULSION MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 42 ASIA PACIFIC: ACRYLIC EMULSION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 44 ASIA PACIFIC: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 45 ASIA PACIFIC: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 46 ASIA PACIFIC: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 47 CHINA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 48 CHINA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 49 CHINA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 50 CHINA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 51 JAPAN: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 52 JAPAN: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 53 JAPAN: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 54 JAPAN: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 55 INDIA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 56 INDIA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 57 INDIA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 58 INDIA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 59 SOUTH KOREA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 60 SOUTH KOREA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 61 SOUTH KOREA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 62 SOUTH KOREA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 63 MALAYSIA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 64 MALAYSIA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 65 MALAYSIA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 66 MALAYSIA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 67 INDONESIA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 68 INDONESIA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 69 INDONESIA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 70 INDONESIA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 71 REST OF ASIA PACIFIC: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 72 REST OF ASIA PACIFIC: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 73 REST OF ASIA PACIFIC: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 74 REST OF ASIA PACIFIC: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 75 EUROPE: ACRYLIC EMULSION MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 76 EUROPE: ACRYLIC EMULSION MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 77 EUROPE: ACRYLIC EMULSION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 78 EUROPE: ACRYLIC EMULSION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 79 EUROPE: ACRYLIC EMULSION MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 80 EUROPE: ACRYLIC EMULSION MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 81 EUROPE: ACRYLIC EMULSION MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 82 EUROPE: ACRYLIC EMULSION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 83 EUROPE: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 84 EUROPE: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 85 EUROPE: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 86 EUROPE: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 87 GERMANY: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 88 GERMANY: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 89 GERMANY: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 90 GERMANY: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 91 UK: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 92 UK: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 93 UK: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 94 UK: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 95 FRANCE: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 96 FRANCE: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 97 FRANCE: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 98 FRANCE: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 99 ITALY: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 100 ITALY: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 101 ITALY: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 102 ITALY: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 103 SPAIN: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 104 SPAIN: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 105 SPAIN: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 106 SPAIN: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 107 REST OF EUROPE: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 108 REST OF EUROPE: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 109 REST OF EUROPE: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 110 REST OF EUROPE: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 111 NORTH AMERICA: ACRYLIC EMULSION MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 112 NORTH AMERICA: ACRYLIC EMULSION MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 113 NORTH AMERICA: ACRYLIC EMULSION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 114 NORTH AMERICA: ACRYLIC EMULSION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 115 NORTH AMERICA: ACRYLIC EMULSION MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 116 NORTH AMERICA: ACRYLIC EMULSION MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 117 NORTH AMERICA: ACRYLIC EMULSION MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 118 NORTH AMERICA: ACRYLIC EMULSION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 119 NORTH AMERICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 120 NORTH AMERICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 121 NORTH AMERICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 122 NORTH AMERICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 123 US: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 124 US: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 125 US: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 126 US: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 127 CANADA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 128 CANADA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 129 CANADA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 130 CANADA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 131 MEXICO: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 132 MEXICO: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 133 MEXICO: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 134 MEXICO: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 135 SOUTH AMERICA: ACRYLIC EMULSION MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 136 SOUTH AMERICA: ACRYLIC EMULSION MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 137 SOUTH AMERICA: ACRYLIC EMULSION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 138 SOUTH AMERICA: ACRYLIC EMULSION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 139 SOUTH AMERICA: ACRYLIC EMULSION MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 140 SOUTH AMERICA: ACRYLIC EMULSION MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 141 SOUTH AMERICA: ACRYLIC EMULSION MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 142 SOUTH AMERICA: ACRYLIC EMULSION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 143 SOUTH AMERICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 144 SOUTH AMERICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 145 SOUTH AMERICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 146 SOUTH AMERICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 147 BRAZIL: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 148 BRAZIL: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 149 BRAZIL: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 150 BRAZIL: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 151 ARGENTINA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 152 ARGENTINA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 153 ARGENTINA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 154 ARGENTINA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 155 REST OF SOUTH AMERICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 156 REST OF SOUTH AMERICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 157 REST OF SOUTH AMERICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 158 REST OF SOUTH AMERICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: ACRYLIC EMULSION MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 160 MIDDLE EAST & AFRICA: ACRYLIC EMULSION MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 161 MIDDLE EAST & AFRICA: ACRYLIC EMULSION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: ACRYLIC EMULSION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: ACRYLIC EMULSION MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 164 MIDDLE EAST & AFRICA: ACRYLIC EMULSION MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 165 MIDDLE EAST & AFRICA: ACRYLIC EMULSION MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: ACRYLIC EMULSION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 168 MIDDLE EAST & AFRICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 169 MIDDLE EAST & AFRICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 171 SAUDI ARABIA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 172 SAUDI ARABIA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 173 SAUDI ARABIA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 174 SAUDI ARABIA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 175 UAE: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 176 UAE: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 177 UAE: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 178 UAE: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 179 SOUTH AFRICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 180 SOUTH AFRICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 181 SOUTH AFRICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 182 SOUTH AFRICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 183 REST OF MIDDLE EAST & AFRICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 184 REST OF MIDDLE EAST & AFRICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 185 REST OF MIDDLE EAST & AFRICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 186 REST OF MIDDLE EAST & AFRICA: ACRYLIC EMULSION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 187 COMPANIES ADOPTED ACQUISITIONS AND EXPANSIONS AS KEY GROWTH STRATEGIES BETWEEN 2018 AND 2023

- TABLE 188 ACRYLIC EMULSION MARKET: DEGREE OF COMPETITION

- TABLE 189 ACRYLIC EMULSION MARKET: REVENUE ANALYSIS (USD)

- TABLE 190 MARKET EVALUATION MATRIX

- TABLE 191 PRODUCT LAUNCHES, 2018–2023

- TABLE 192 DEALS, 2018—2022

- TABLE 193 OTHER DEVELOPMENTS, 2018–2023

- TABLE 194 BASF SE: COMPANY OVERVIEW

- TABLE 195 BASF SE PRODUCTS OFFERED

- TABLE 196 BASF SE: DEALS

- TABLE 197 BASF SE: OTHERS

- TABLE 198 DOW INC.: COMPANY OVERVIEW

- TABLE 199 DOW INC.: PRODUCTS OFFERED

- TABLE 200 DOW INC.: PRODUCT LAUNCHES

- TABLE 201 ARKEMA S.A.: COMPANY OVERVIEW

- TABLE 202 ARKEMA S.A.: PRODUCTS OFFERED

- TABLE 203 ARKEMA S.A.: PRODUCT LAUNCHES

- TABLE 204 ARKEMA S.A.: DEALS

- TABLE 205 ARKEMA S.A.: OTHERS

- TABLE 206 COVESTRO AG: COMPANY OVERVIEW

- TABLE 207 COVESTRO AG.: PRODUCTS OFFERED

- TABLE 208 COVESTRO AG: PRODUCT LAUNCHES

- TABLE 209 COVESTRO AG: DEALS

- TABLE 210 CELANESE CORPORATION: COMPANY OVERVIEW

- TABLE 211 CELANESE CORPORATION: PRODUCTS OFFERED

- TABLE 212 CELANESE CORPORATION.: OTHERS

- TABLE 213 AVERY DENNISON: COMPANY OVERVIEW

- TABLE 214 AVERY DENNISON: PRODUCTS OFFERED

- TABLE 215 DIC GROUP: COMPANY OVERVIEW

- TABLE 216 DIC GROUP: PRODUCTS OFFERED

- TABLE 217 DIC GROUP: OTHERS

- TABLE 218 HENKEL: COMPANY OVERVIEW

- TABLE 219 HENKEL: PRODUCTS OFFERED

- TABLE 220 HENKEL: OTHERS

- TABLE 221 H.B. FULLER: COMPANY OVERVIEW

- TABLE 222 H.B. FULLER: PRODUCTS OFFERED

- TABLE 223 H.B. FULLER: DEALS

- TABLE 224 H.B. FULLER: OTHERS

- TABLE 225 MALLARD CREEK POLYMERS: COMPANY OVERVIEW

- TABLE 226 MALLARD CREEK POLYMERS: PRODUCTS OFFERED

- TABLE 227 MALLARD CREEK POLYMERS: PRODUCT LAUNCHES

- TABLE 228 MALLARD CREEK POLYMERS: DEALS

- TABLE 229 MALLARD CREEK POLYMERS: OTHERS

- TABLE 230 NIPPON SHOKUBAI CO., LTD.: COMPANY OVERVIEW

- TABLE 231 NIPPON SHOKUBAI CO., LTD.: PRODUCTS OFFERED

- TABLE 232 NIPPON SHOKUBAI CO., LTD.: DEALS

- TABLE 233 NIPPON SHOKUBAI CO., LTD.: OTHERS

- TABLE 234 SYNTHOMER PLC: COMPANY OVERVIEW

- TABLE 235 SYNTHOMER PLC: PRODUCTS OFFERED

- TABLE 236 SYNTHOMER PLC: OTHERS

- TABLE 237 THE LUBRIZOL CORPORATION: COMPANY OVERVIEW

- TABLE 238 THE LUBRIZOL CORPORATION: PRODUCTS OFFERED

- TABLE 239 3M: COMPANY OVERVIEW

- TABLE 240 ADVANCED POLYMER EMULSION COMPANY: COMPANY OVERVIEW

- TABLE 241 ARCHROMA: COMPANY OVERVIEW

- TABLE 242 ASTRA CHEMTECH PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 243 GELLNER INDUSTRIAL, LLC: COMPANY OVERVIEW

- TABLE 244 INDOFIL INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 245 JSR CORPORATION: COMPANY OVERVIEW

- TABLE 246 KAMSONS CHEMICALS PVT. LTD.: COMPANY OVERVIEW

- TABLE 247 ORGANIK KIMYA.: COMPANY OVERVIEW

- TABLE 248 SPECIALITY POLYMERS, INC..: COMPANY OVERVIEW

- TABLE 249 STANCHEM RESINS COMPANY OVERVIEW

- TABLE 250 NISSIN CHEMICAL INDUSTRY CO., LTD..: COMPANY OVERVIEW

- FIGURE 1 ACRYLIC EMULSION MARKET: RESEARCH DESIGN

- FIGURE 2 ACRYLIC EMULSION MARKET: BOTTOM-UP APPROACH

- FIGURE 3 ACRYLIC EMULSION MARKET: TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: ACRYLIC EMULSION MARKET

- FIGURE 5 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 6 ACRYLIC EMULSION MARKET: DATA TRIANGULATION

- FIGURE 7 POLYMER & COPOLYMER ACRYLIC EMULSION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 PAINTS & COATINGS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 10 HIGH GROWTH POTENTIAL OF ASIA PACIFIC ACRYLIC EMULSION MARKET

- FIGURE 11 PAINTS & COATINGS SEGMENT LED MARKET IN NORTH AMERICA IN 2020

- FIGURE 12 POLYMER & COPOLYMER SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 PAINTS & COATINGS SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 14 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ACRYLIC EMULSION MARKET

- FIGURE 16 VALUE CHAIN ANALYSIS

- FIGURE 17 ACRYLIC EMULSION MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 18 GRANTED PATENTS

- FIGURE 19 AVERAGE SELLING PRICE, BY REGION (USD/KG)

- FIGURE 20 AVERAGE SELLING PRICE TREND, BY MARKET PLAYERS (USD/KG)

- FIGURE 21 ACRYLIC EMULSION ECOSYSTEM

- FIGURE 22 SUPPLIER SELECTION CRITERION

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING BUSINESSES

- FIGURE 24 POLYMER & COPOLYMER TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 25 PAINTS & COATINGS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 26 CHINA TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 27 ASIA PACIFIC: ACRYLIC EMULSION MARKET SNAPSHOT

- FIGURE 28 EUROPE: ACRYLIC EMULSION MARKET SNAPSHOT

- FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 30 RANKING OF TOP FIVE PLAYERS IN ACRYLIC EMULSION MARKET, 2022

- FIGURE 31 ACRYLIC EMULSION MARKET SHARE, BY COMPANY (2022)

- FIGURE 32 ACRYLIC EMULSION MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 33 ACRYLIC EMULSION MARKET: START-UPS AND SMES MATRIX, 2022

- FIGURE 34 BASF SE: COMPANY SNAPSHOT

- FIGURE 35 DOW INC.: COMPANY SNAPSHOT

- FIGURE 36 ARKEMA S.A.: COMPANY SNAPSHOT

- FIGURE 37 COVESTRO AG: COMPANY SNAPSHOT

- FIGURE 38 CELANESE CORPORATION: COMPANY SNAPSHOT

- FIGURE 39 AVERY DENNISON: COMPANY SNAPSHOT

- FIGURE 40 DIC GROUP: COMPANY SNAPSHOT

- FIGURE 41 HENKEL: COMPANY SNAPSHOT

- FIGURE 42 H.B. FULLER: COMPANY SNAPSHOT

- FIGURE 43 NIPPON SHOKUBAI CO. LTD.: COMPANY SNAPSHOT

- FIGURE 44 SYNTHOMER PLC: COMPANY SNAPSHOT

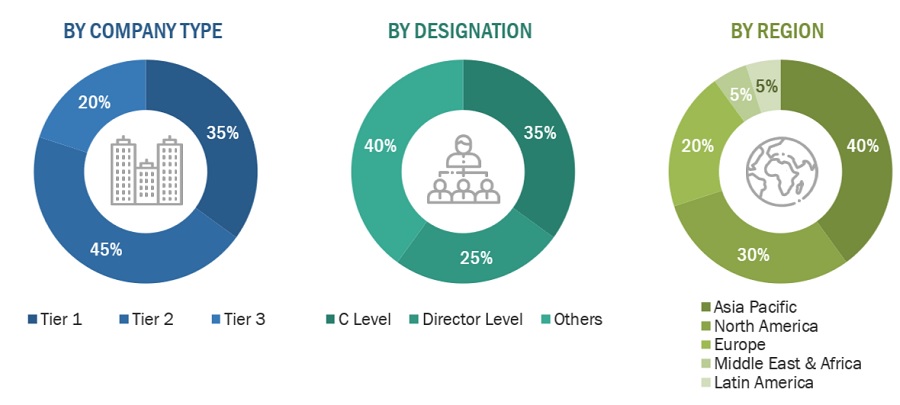

The study involved four major activities in estimating the market size of the acrylic emulsion market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The acrylic emulsion market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the acrylic emulsion market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the acrylic emulsion industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, raw material, application type, end-use industries, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of acrylic emulsion and outlook of their business which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

Dow Inc. |

Individual Industry Expert |

|

BASF SE |

Sales Manager |

|

H.B.Fuller |

Director |

|

Henkel |

Marketing Manager |

|

Mallard Creek Polymers |

R&D Manager |

|

|

|

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the acrylic emulsion market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

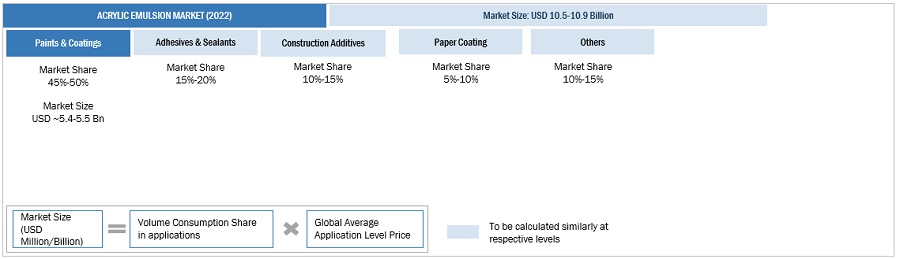

Acrylic Emulsion Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Acrylic Emulsion Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Acrylic emulsion refers to a versatile and water-based formulation composed of acrylic polymers suspended within a stable liquid mixture. This emulsion serves as a fundamental raw material extensively utilized across industries such as paints, coatings, adhesives, textiles, and construction. Acrylic emulsions offer a range of properties including adhesion, durability, and flexibility, making them essential for creating high-quality products that fulfill both performance requirements and environmental considerations.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the size of the acrylic emulsion market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on type, application, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Acrylic Emulsion Market