3D Printing Elastomers Market by Form (Powder, Filament, Liquid), Material (TPE, SBR & SBS), Technology (FDM/FFF, SLA, SLS, DLP),End-use Industry (Automotive, Consumer Goods, Aerospace & Defense, Medical & Dental), Region - Global Forecast to 2026

Updated on : September 03, 2025

3D Printing Elastomers Market

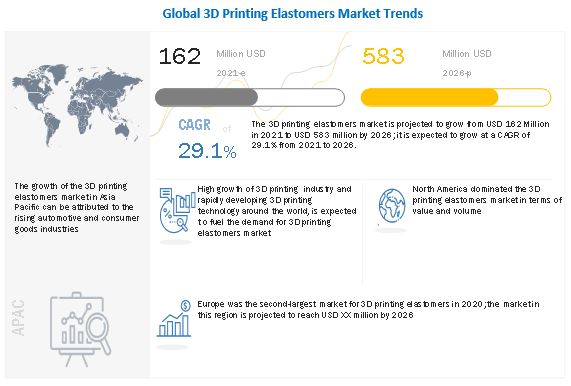

The 3D printing elastomers market was valued at USD 162 million in 2021 and is projected to reach USD 583 million by 2026, growing at 29.1% cagr from 2021 to 2026. The growing adoption of home 3D printers in the North American and European regions is one of the major factors augmenting the demand for 3D printing elastomers.

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 Impact on the Global 3D Printing Elastomers Market

The pandemic is estimated to have impact on various factors of the value chain of 3D printing elastomers market, which is expected to reflect during the forecast period, especially in the year 2020. The various impact of COVID-19 are as follows:

IMPACT ON PRINTER MANUFACTURERS AND MATERIAL SUPPLIERS:

Printer manufacturers have already been contributing to the fight against the pandemic by providing their devices and resources free of charge across the world. Currently, the only and primary focus for printer manufacturers is to ensure that their products are able to print the required healthcare essentials round the clock. Many countries are yet to reach the peak in terms of the number of infected COVID-19 individuals and hence, it is absolutely necessary that healthcare essentials such as face masks, face shields, and nasal swabs are available in bulk, which is not the case currently. For example, in order to address the shortage of nasal swabs, which were required for the testing for COVID-19, Northwell Health teamed up with the University of South Florida, Tampa General Hospital, and Formlabs to 3D-print nasal swabs. In other areas, Stratasys has been working with respective government officials, partners, customers, and the medical community in connecting the right individuals with the right resources. The company has also shared its specifications for a face shield frame for individuals to print the same and contribute to the overall supply of these products.

3D Printing Elastomers Market Dynamics

Driver: Increasing demand from the automotive, consumer, and medical industries

3D printing technology is transforming the manufacturing process in the automotive industry. The technology has helped the industry in making more complex and lighter structures at optimized costs. Many Formula 1, supercars, and concept cars are using 3D-printed parts. For example, BMW is collaborating with major 3D printing companies, including EOS GmbH Electro Optical Systems (Germany) and Carbon (US), to manufacture 3D-printed parts for commercial vehicles.

Additionally, elastomeric 3D printing materials are being used in manufacturing consumer products such as cell phone cases, ear buds, midsoles, saddles, and helmet liners. Due to their flexibility and high tensile strength, elastomeric additives also find applications, such as hearing aids, surgical tool handles, and prototypes, in the medical industry.

Restraint: High material costs

3D printing is an easier way to manufacture objects but is expensive due to high material costs, which is a major restraint in the market. These high costs are due to higher standards of purity and composition required for 3D printing. Elastomer materials for 3D printing cost an average of about USD 250.0 to USD 500.0 per liter, which is expensive to use in general applications, as the final product cost is high compared to that of products available in the market.

With the growing demand in several applications, it is a big challenge for material manufacturers to develop and supply low-cost materials.

Opportunity: Adoption of 3D printing technology in home printing

3D printing technology has been in the market for the last 30 years, but the sudden increase in the hype is due to the availability of home 3D printers. These home printers are available in the market at low costs, which is boosting the demand for home 3D printers leading to the high growth of the 3D printing elastomers market. Currently, these printers are available in homes, offices, computer stores, and shopping hubs, where one can create inexpensive products in a considerably short span of time. Thus, the rising trend of 3D printing technology in home printing acts as an opportunity for the 3D printing elastomers market.

Challenge: Production of low-cost 3D printing materials

The high cost of 3D printing elastomeric materials has been a significant point of concern associated with its market growth. A large number of applications of 3D printing elastomers have been discovered but are facing restrictions due to their high costs. Developing low-cost technologies for manufacturing 3D printing elastomers is a major challenge for all researchers and key manufacturers. 3D printing materials are introduced only in high-end and luxury cars due to their high cost.

Powder segment is estimated to be the leading segment of 3D printing elastomers market from 2021 to 2026, in terms of value and volume.

Based on form, the powder segment led the market in 2020. High demand for the powder form is due to the growing adoption of 3D printing in the aerospace & defense and automotive industries. Further, the filament form is estimated to be the second-largest segment of the 3D printing elastomers market. High consumption of plastic materials across various end-use industries, such as healthcare and automotive, are responsible for the surging demand for the filament form.

SLS technology led the 3D printing elastomers market during 2019-2026

Selective laser sintering (SLS) is one of the major technologies in the 3D printing materials market that works on powder bed fusion technology. The objects created using SLS are generally made with thermoplastic powders. Nylon is one of the widely used types of plastics that are used to print 3D objects using this technology. SLS is used to create objects using thermoplastic powders and is very useful in producing parts with complex geometries and good mechanical properties, and the materials are also easily available.

TPE to lead the 3D printing elastomers market during 2019-2026

TPE is projected to be the largest material segment in the 3D printing elastomers market during the forecast period. It is majorly due to the cost-effectiveness and design flexibility offered by TPE. The major end-use markets for TPE include consumer goods, medical devices, automotive, and electronics, among others. TPE is further sub-segmented into thermoplastic polyurethane (TPU) and thermoplastic vulcanizate (TPV).

North America dominated the 3D printing elastomers market, in terms of value and volume in 2020.

North America held the largest share in the 3D printing elastomers market, in terms of value, in 2020 . This is mainly due to the high presence of leading 3D printing elastomers manufacturers, such as Carbon Inc. and 3D Printing Systems Inc., in the region. These companies are producing a wide range of elastomeric 3D printing materials and doing business expansions through partnerships and investments.

3D Printing Elastomers Market Players

Carbon Inc (US)., Formlabs (US), BASF SE (Germany), 3D Systems Inc. (US), Stratasys Ltd.(Israel), Proto Labs Inc. (US), Henkel (Germany), Materialise NV (Belgium), EOS (Germany), Dow Chemical Company(US) Evonik Industries AG (Germany), Arkema SA (France), Sinterit (Germany), The Lubrizol Corporation (US), ExOne (US), Zortrax (Poland), HP Development Company, L.P. (US), LANXESS (Germany), Voxeljet AG (Germany), Impossible Objects (US), and EnvisionTEC (Germany) are some of the leading players in the 3D printing elastomers market. These players have adopted product launches, collaborations, partnerships, expansions, acquisitions, agreements, joint ventures, and investments as the main strategies for enhancing their business revenues and market shares.

3D Printing Elastomers Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2019–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021–2025 |

|

Forecast Units |

Value (USD Million ) and Volume (Tons) |

|

Segments Covered |

Form, Material, End-use Industry, Technology, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

Carbon Inc (US)., Formlabs (US), BASF SE (Germany), 3D Systems Inc. (US), Stratasys Ltd.(Israel), Proto Labs Inc. (US), Henkel (Germany), Materialise NV (Belgium), EOS (Germany), Dow Chemical Company(US) Evonik Industries AG (Germany), Arkema SA (France), Sinterit (Germany), The Lubrizol Corporation (US), ExOne (US), Zortrax (Poland), HP Development Company, L.P. (US), LANXESS (Germany), Voxeljet AG (Germany), Impossible Objects (US), EnvisionTEC (Germany), and 5 SME’s (Other small companies and start-ups ) |

This research report categorizes the 3D printing elastomers market based on form, material, end-use industry, technology, and region.

Based on Form, the 3D printing elastomers market has been segmented as follows:

- Powder

- Filament

- Liquid

Based on Material the 3D printing elastomers market has been segmented as follows:

-

TPE (Thermoplastic elastomer)

- TPU (Thermoplastic polyurethane)

- TPV (Thermoplastic vulcanizate)

- SBR (Styrene-butadiene rubber) & SBS (Styrene-butadiene-styrene)

- Others (EPDM, silicone, and thermoplastic copolyester)

Based on End-use Industry the 3D printing elastomers market has been segmented as follows:

- Automotive

- Consumer goods

- Medical & dental

- Aerospace & defense

- Others (Industrial and electrical)

Based on Region 3D printing elastomers market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Based on Technology the 3D printing elastomers market has been segmented as follows:

- FDM/FFF

- SLA

- SLS

- DLP

- Others (Direct metal laser sintering (DMLS), electron beam melting (EBM), multi-jet fusion (MJF), and continuous liquid interface production (CLIP))

Recent Developments

- In November 2020, BASF SE entered in a partnership with Photocentric Ltd. to launch a new Daylight Product Line (Ultracur3D EPD) for 3D printing applications such as prototyping, engineering, and serial production of automotive parts. These resins offer high stiffness and flexibility to the printed parts.

- In January 2020, The company developed Figure 4 Jewelry Solution specially designed and optimized technology for the 3D printed jewelry market. The development of this technology is estimated to strengthen the 3D Systems Figure 4 platform across the growing 3D printing jewelry market.

Frequently Asked Questions (FAQ):

What is the current size of the global 3D printing elastomers market?

The 3D printing elastomers market is projected to grow from USD 162 million in 2021 to USD 583 million by 2026, at a CAGR of 29.1% from 2021 to 2026.

Who are the leading players in the global 3D printing elastomers market?

The leading companies in the 3D printing elastomers market include Carbon Inc (US)., Formlabs (US), BASF SE (Germany), 3D Systems Inc. (US), Stratasys Ltd.(Israel), Proto Labs Inc. (US), Henkel (Germany), Materialise NV (Belgium) and EOS (Germany). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 OBJECTIVES OF THE STUDY

1.2 COMPETITIVE INTELLIGENCE

1.3 MARKET DEFINITION

1.4 MARKET SCOPE

FIGURE 1 3D PRINTING ELASTOMERS MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED FOR THE STUDY

1.4.2 CURRENCY

1.4.3 UNIT CONSIDERED

1.5 STAKEHOLDERS

1.6 LIMITATIONS

1.7 INCLUSIONS & EXCLUSIONS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 3D PRINTING ELASTOMERS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MATRIX CONSIDERED FOR DEMAND SIDE

FIGURE 3 MAIN MATRIX CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR 3D PRINTING ELASTOMERS

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 6 METHODOLOGY FOR “DEMAND-SIDE” SIZING OF THE 3D PRINTING ELASTOMERS MARKET

FIGURE 7 METHODOLOGY FOR “SUPPLY-SIDE” SIZING OF THE 3D PRINTING ELASTOMERS MARKET (1/2)

FIGURE 8 METHODOLOGY FOR “SUPPLY-SIDE” SIZING OF THE 3D PRINTING ELASTOMERS MARKET (2/2)

2.3.2.1 Calculations for supply-side analysis

FIGURE 9 3D PRINTING ELASTOMERS MARKET: SUPPLY-SIDE ANALYSIS

2.3.3 FORECAST

FIGURE 10 3D PRINTING ELASTOMERS MARKET SIZE CALCULATION THROUGH PARENT MARKET (TOP-DOWN APPROACH)

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.5 MARKET CAGR PROJECTION FROM PARENT MARKET

2.6 MARKET CAGR PROJECTIONS FROM 3D PRINTING MATERIALS MARKET

2.7 MARKET CAGR PROJECTIONS FROM 3D PRINTING MATERIALS MARKET ACROSS REGIONS

2.8 DATA TRIANGULATION

FIGURE 11 3D PRINTING ELASTOMERS MARKET: DATA TRIANGULATION

2.8.1 KEY ASSUMPTIONS WHILE CALCULATING DEMAND SIDE MARKET SIZE

2.8.2 LIMITATIONS

2.8.3 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 47)

TABLE 1 3D PRINTING ELASTOMERS MARKET SNAPSHOT (2021 VS. 2026): MARKET TO GROW AT A HIGH RATE BETWEEN 2021 AND 2026

FIGURE 12 AUTOMOTIVE INDUSTRY TO DOMINATE THE 3D PRINTING ELASTOMERS MARKET

FIGURE 13 TPE TO BE THE LARGEST SEGMENT

FIGURE 14 ASIA PACIFIC TO BE THE FASTEST-GROWING 3D PRINTING ELASTOMERS MARKET DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN 3D PRINTING ELASTOMERS MARKET

FIGURE 15 INCREASING USE OF 3D PRINTING ELASTOMERS IN AUTOMOTIVE INDUSTRY TO DRIVE THE MARKET

4.2 3D PRINTING ELASTOMERS MARKET, BY REGION

FIGURE 16 NORTH AMERICA TO BE THE LARGEST 3D PRINTING ELASTOMERS MARKET FROM 2021 TO 2026

4.3 NORTH AMERICA: 3D PRINTING ELASTOMERS MARKET, BY COUNTRY AND END-USE INDUSTRY, 2021

FIGURE 17 AUTOMOTIVE SEGMENT AND US TO ACCOUNT FOR LARGEST SHARES

4.4 3D PRINTING ELASTOMERS MARKET, BY MATERIAL

FIGURE 18 TPE TO BE THE LARGEST SEGMENT OF THE 3D PRINTING ELASTOMERS MARKET

4.5 3D PRINTING ELASTOMERS MARKET, BY END-USE INDUSTRY

FIGURE 19 AUTOMOTIVE TO BE THE LARGEST END-USE INDUSTRY OF 3D PRINTING ELASTOMERS

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN 3D PRINTING ELASTOMERS MARKET

5.1.1 DRIVERS

5.1.1.1 Increasing demand from the automotive, consumer, and medical industries

5.1.1.2 Mass customization

5.1.1.3 Government initiatives to support the adoption of 3D printing

5.1.2 RESTRAINTS

5.1.2.1 High material costs

5.1.3 OPPORTUNITIES

5.1.3.1 Adoption of 3D printing technology in home printing

5.1.3.2 Growing demand from the educational sector

5.1.4 CHALLENGES

5.1.4.1 Production of low-cost 3D printing materials

5.1.4.2 Reducing lead time

5.2 PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 HIGH-GROWTH MARKET LEADS TO INTENSE COMPETITION

5.2.1 THREAT OF NEW ENTRANTS

5.2.2 THREAT OF SUBSTITUTES

5.2.3 BARGAINING POWER OF SUPPLIERS

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 INTENSITY OF COMPETITIVE RIVALRY

5.3 3D PRINTING ECOSYSTEM AND VALUE CHAIN

FIGURE 22 3D PRINTING MARKET ECOSYSTEM

FIGURE 23 VALUE CHAIN FOR 3D PRINTING MATERIALS

FIGURE 24 STAKEHOLDERS IN 3D PRINTING ELASTOMERS MARKET

6 MACROECONOMIC OVERVIEW AND KEY INDUSTRY TRENDS (Page No. - 62)

6.1 INTRODUCTION

6.2 TRENDS AND FORECAST OF GDP

TABLE 2 ANNUAL PERCENTAGE CHANGE OF GDP, BY REGION, APRIL 2020

6.3 TRENDS IN AEROSPACE INDUSTRY

TABLE 3 NUMBER OF AIRPLANE DELIVERIES BY MANUFACTURERS, 2019

6.3.1 TRENDS IN AUTOMOTIVE INDUSTRY

TABLE 4 MOTOR VEHICLE PRODUCTION, BY COUNTRY, 2019–2020

7 COVID-19 IMPACT ON 3D PRINTING ECOSYSTEM (Page No. - 64)

7.1 INTRODUCTION

FIGURE 25 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

7.2 INVESTMENTS IN 3D ECOSYSTEM

7.3 EFFECT ON PRINTER MANUFACTURERS AND MATERIAL SUPPLIERS

7.3.1 KEY TAKEAWAYS FOR PRINTER MANUFACTURERS AND MATERIAL SUPPLIERS

7.4 EFFECT ON END-USE INDUSTRY

7.4.1 AUTOMOTIVE INDUSTRY

7.4.2 AEROSPACE INDUSTRY

7.4.3 OTHER INDUSTRIES

7.5 IMPACT ON 3D PRINTING MARKET GROWTH

FIGURE 26 KEY OPPORTUNITIES WITHIN AND OUTSIDE 3D PRINTING ECOSYSTEM

8 EMERGING 3D PRINTING TECHNOLOGIES (Page No. - 69)

TABLE 5 EMERGING 3D PRINTING TECHNOLOGIES

9 3D PRINTING ELASTOMERS MARKET: PATENT ANALYSIS (Page No. - 71)

9.1 INTRODUCTION

FIGURE 27 PUBLICATION TRENDS - LAST 5 YEARS

9.2 INSIGHTS

FIGURE 28 GEOGRAPHICAL REPRESENTATION: TOP REGIONS

FIGURE 29 TOP ASSIGNEES

9.3 AVERAGE SELLING PRICE TREND OF 3D PRINTING ELASTOMERS

TABLE 6 CARBON INC.: MATERIAL PRICING OF ONE-PART RESINS (US)

FIGURE 30 AVERAGE PRICES (GLOBAL) OF 3D PRINTING ELASTOMERS, BY MATERIAL (USD/KG)

TABLE 7 AVERAGE PRICES (GLOBAL) OF 3D PRINTING ELASTOMERS (USD/KG)

TABLE 8 AVERAGE PRICES OF TPU, BY REGION (USD/KG)

9.4 AVERAGE SELLING PRICE OF 3D PRINTERS

9.4.1 COST COMPARISON: DESKTOP VS. INDUSTRIAL FDM PRINTERS

9.4.1.1 Cost of desktop FDM printers

9.4.1.2 Cost of industrial FDM printers

9.4.2 COST COMPARISON: DESKTOP VS. INDUSTRIAL SLS PRINTERS

9.4.2.1 Cost of desktop SLS printers

9.4.2.2 Cost of industrial SLS printers

9.4.3 COST COMPARISON: SLA VS. LCD PRINTERS

9.4.3.1 Cost of SLA printers

9.4.3.2 Cost of LCD printers

9.5 TRADE DATA STATISTICS

9.5.1 TRADE DATA OF MATERIALS USED IN 3D PRINTING

9.6 REVENUE SHIFT AND NEW REVENUE POCKETS FOR 3D PRINTING ELASTOMER MANUFACTURERS

FIGURE 31 REVENUE SHIFT FOR 3D PRINTING ELASTOMERS MARKET

9.7 CASE STUDY ANALYSIS

9.7.1 AUTOMOTIVE

9.7.1.1 CARBON3D INC. partnered with FORD and BMW for manufacturing 3D printed automotive parts

10 REGULATORY LANDSCAPE (Page No. - 83)

10.1 REGULATIONS ON TPU 3D PRINTING MATERIAL FOR MEDICAL APPLICATIONS

11 3D PRINTING ELASTOMERS MARKET, BY TECHNOLOGY (Page No. - 84)

11.1 INTRODUCTION

FIGURE 32 SLS SEGMENT TO LEAD THE 3D PRINTING ELASTOMERS MARKET DURING THE FORECAST PERIOD

TABLE 9 3D PRINTING ELASTOMERS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 10 3D PRINTING ELASTOMERS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

11.2 FDM/FFF

11.2.1 GROWING DEMAND FROM THE AUTOMOTIVE SECTOR TO BOOST THE MARKET IN THIS SEGMENT

11.3 SLA

11.3.1 USE OF SLA TECHNOLOGY IN VARIOUS NEW APPLICATIONS TO PROPEL THE MARKET

11.4 SLS

11.4.1 EASE OF MATERIAL AVAILABILITY AND ITS USE IN PRODUCING PARTS WITH COMPLEX GEOMETRIES TO BOOST THE MARKET

11.5 DLP

11.5.1 DLP TECHNOLOGY CREATES LESS WASTAGE OF RESINS T

11.6 OTHERS

12 3D PRINTING ELASTOMERS MARKET, BY FORM (Page No. - 88)

12.1 INTRODUCTION

FIGURE 33 POWDER SEGMENT TO LEAD THE 3D PRINTING ELASTOMERS MARKET DURING THE FORECAST PERIOD

TABLE 11 3D PRINTING ELASTOMERS MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

TABLE 12 3D PRINTING ELASTOMERS MARKET SIZE, BY FORM, 2019–2026 (TON)

12.2 POWDER

12.2.1 HIGH PRINT QUALITY AND EXCELLENT DIMENSIONAL ACCURACY DRIVING THE POWDER FORM SEGMENT

TABLE 13 POWDER 3D PRINTING ELASTOMERS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 14 POWDER 3D PRINTING ELASTOMERS MARKET SIZE, BY REGION, 2019–2026 (TON)

12.3 FILAMENT

12.3.1 GROWING USE OF 3D PRINTING IN CONSUMER GOODS BOOSTING THE DEMAND FOR FILAMENT FORM

TABLE 15 FILAMENT 3D PRINTING ELASTOMERS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 16 FILAMENT 3D PRINTING ELASTOMERS MARKET SIZE, BY REGION, 2019–2026 (TON)

12.4 LIQUID

12.4.1 GROWING USAGE OF LIQUID 3D PRINTINGELASTOMERS IN HEALTHCARE AND JEWELRY MAKING SECTORS TO DRIVE THE MARKET IN THIS SEGMENT

TABLE 17 LIQUID 3D PRINTING ELASTOMERS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 18 LIQUID 3D PRINTING ELASTOMERS MARKET SIZE, BY REGION, 2019–2026 (TON)

13 3D PRINTING ELASTOMERS MARKET, BY MATERIAL (Page No. - 94)

13.1 INTRODUCTION

FIGURE 34 TPE TO LEAD THE 3D PRINTING ELASTOMERS MARKET DURING THE FORECAST PERIOD

TABLE 19 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 20 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

13.2 TPU (THERMOPLASTIC POLYURETHANE)

13.2.1 UNIQUE PROPERTIES AND EASE OF 3D PRINTING PROPELLING THE TPU SEGMENT

TABLE 21 TPU: 3D PRINTING ELASTOMERS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 22 TPU: 3D PRINTING ELASTOMERS MARKET SIZE, MARKET SIZE, BY REGION, 2019–2026 (TON)

13.3 TPV (THERMOPLASTIC VULCANIZATE)

13.3.1 RISING DEMAND FROM AUTOMOTIVE INDUSTRY DRIVING THE MARKET FOR TPV ELASTOMERS

TABLE 23 TPV: 3D PRINTING ELASTOMERS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 24 TPV: 3D PRINTING ELASTOMERS MARKET SIZE, BY REGION, 2019–2026 (TON)

13.4 SBR (STYRENE-BUTADIENE RUBBER)

13.4.1 LOW PRICES OF SBR TO DRIVE THE MARKET

TABLE 25 SBR: 3D PRINTING ELASTOMERS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 26 SBR: 3D PRINTING ELASTOMERS MARKET SIZE, BY REGION, 2019–2026 (TON)

13.5 OTHERS

TABLE 27 OTHER MATERIALS: 3D PRINTING ELASTOMERS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 28 OTHER MATERIALS: 3D PRINTING ELASTOMERS MARKET SIZE, BY REGION, 2019–2026 (TON)

14 3D PRINTING ELASTOMERS MARKET, BY END-USE INDUSTRY (Page No. - 101)

14.1 INTRODUCTION

FIGURE 35 AUTOMOTIVE INDUSTRY TO LEAD THE 3D PRINTING ELASTOMERS MARKET DURING THE FORECAST PERIOD

TABLE 29 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 30 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

14.2 AUTOMOTIVE

14.2.1 NEED FOR VEHICLE WEIGHT REDUCTION TO INCREASE THE DEMAND FOR 3D PRINTING ELASTOMERS IN THIS SECTOR

14.2.1.1 Impact of COVID-19

TABLE 31 3D PRINTING ELASTOMERS MARKET SIZE IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 32 3D PRINTING ELASTOMERS MARKET SIZE IN AUTOMOTIVE END-USE INDUSTRY, MARKET SIZE, BY REGION, 2019–2026 (TON)

14.3 CONSUMER GOODS

14.3.1 GROWING USE OF 3D PRINTING IN VARIOUS CONSUMER GOODS IS DRIVING THE MARKET

14.3.1.1 Impact of COVID-19

TABLE 33 3D PRINTING ELASTOMERS MARKET SIZE IN CONSUMER GOODS END-USE INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 34 3D PRINTING ELASTOMERS MARKET SIZE IN CONSUMER GOODS END-USE INDUSTRY, BY REGION, 2019–2026 (TON)

14.4 MEDICAL & DENTAL

14.4.1 GROWING USAGE OF 3D PRINTING IN HEALTHCARE SECTOR TO DRIVE THE MARKET

14.4.1.1 Impact of COVID-19

TABLE 35 3D PRINTING ELASTOMERS MARKET SIZE IN MEDICAL & DENTAL END-USE INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 36 3D PRINTING ELASTOMERS MARKET SIZE IN MEDICAL & DENTAL END-USE INDUSTRY, BY REGION, 2019–2026 (TON)

14.5 AEROSPACE & DEFENSE

14.5.1 LIGHTWEIGHT AND HIGH STRENGTH PROPERTIES OF ELASTOMER DRIVING THE MARKET IN THIS SEGMENT

14.5.1.1 Impact of COVID-19

TABLE 37 3D PRINTING ELASTOMERS MARKET SIZE IN AEROSPACE & DEFENSE END-USE INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 38 3D PRINTING ELASTOMERS MARKET SIZE IN AEROSPACE & DEFENSE END-USE INDUSTRY, BY REGION, 2019–2026 (TON)

14.6 OTHERS

14.6.1 IMPACT OF COVID-19

TABLE 39 3D PRINTING ELASTOMERS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 40 3D PRINTING ELASTOMERS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2026 (TON)

15 3D PRINTING ELASTOMERS MARKET, BY REGION (Page No. - 109)

15.1 INTRODUCTION

FIGURE 36 NORTH AMERICA TO BE LARGEST MARKET FOR 3D PRINTING ELASTOMERS DURING FORECAST PERIOD

TABLE 41 3D PRINTING ELASTOMERS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 42 3D PRINTING ELASTOMERS MARKET SIZE, BY REGION, 2019–2026 (TON)

15.2 ASIA PACIFIC

FIGURE 37 ASIA PACIFIC: 3D PRINTING ELASTOMERS MARKET SNAPSHOT

TABLE 43 ASIA PACIFIC: 3D PRINTING ELASTOMERS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 44 ASIA PACIFIC: 3D PRINTING ELASTOMER MARKET SIZE, BY COUNTRY, 2019–2026 (TON)

TABLE 45 ASIA PACIFIC: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 46 ASIA PACIFIC: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 47 ASIA PACIFIC: 3D PRINTING ELASTOMERS MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

TABLE 48 ASIA PACIFIC: 3D PRINTING ELASTOMER MARKET SIZE, BY FORM, 2019–2026 (TON)

TABLE 49 ASIA PACIFIC: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 50 ASIA PACIFIC: 3D PRINTING ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

15.2.1 CHINA

15.2.1.1 Growing population to augment demand

TABLE 51 CHINA: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 52 CHINA: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 53 CHINA: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 54 CHINA: 3D PRINTING ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

15.2.2 JAPAN

15.2.2.1 Rise in aging population leading to higher investment in medical sector

TABLE 55 JAPAN: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 56 JAPAN: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 57 JAPAN: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 58 JAPAN: 3D PRINTING ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

15.2.3 SOUTH KOREA

15.2.3.1 Need for consumer goods will boost the demand for 3D printing elastomers

TABLE 59 SOUTH KOREA: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 60 SOUTH KOREA: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 61 SOUTH KOREA: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 62 SOUTH KOREA: 3D PRINTING ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

15.2.4 INDIA

15.2.4.1 Growing investments in aerospace and medical sectors to boost demand

TABLE 63 INDIA: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 64 INDIA: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 65 INDIA: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 66 INDIA: 3D PRINTING ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

15.2.5 AUSTRALIA

15.2.5.1 Growing investments in the medical sector to boost demand

TABLE 67 AUSTRALIA: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 68 AUSTRALIA: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 69 AUSTRALIA: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 70 AUSTRALIA: 3D PRINTING ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

15.2.6 REST OF ASIA PACIFIC

TABLE 71 REST OF ASIA PACIFIC: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 72 REST OF ASIA PACIFIC: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 73 REST OF ASIA PACIFIC: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 74 REST OF ASIA PACIFIC: 3D PRINTING ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

15.3 NORTH AMERICA

FIGURE 38 NORTH AMERICA: 3D PRINTING ELASTOMERS MARKET SNAPSHOT

TABLE 75 NORTH AMERICA: 3D PRINTING ELASTOMERS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 76 NORTH AMERICA: 3D PRINTING ELASTOMER MARKET SIZE, BY COUNTRY, 2019–2026 (TON)

TABLE 77 NORTH AMERICA: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 78 NORTH AMERICA: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 79 NORTH AMERICA: 3D PRINTING ELASTOMERS MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

TABLE 80 NORTH AMERICA: 3D PRINTING ELASTOMER MARKET SIZE, BY FORM, 2019–2026 (TON)

TABLE 81 NORTH AMERICA: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 82 NORTH AMERICA: 3D PRINTING ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

15.3.1 US

15.3.1.1 Growing aerospace and defense sector to boost market

TABLE 83 US: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 84 US: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 85 US: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 86 US: 3D PRINTING ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

15.3.2 CANADA

15.3.2.1 Increasing demand for 3D printing elastomers in growing aerospace industry

TABLE 87 CANADA: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 88 CANADA: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 89 CANADA: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 90 CANADA: 3D PRINTING ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

15.3.3 MEXICO

15.3.3.1 Increasing demand from automotive and aerospace to boost the demand for 3D printing elastomers

TABLE 91 MEXICO: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 92 MEXICO: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 93 MEXICO: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 94 MEXICO: 3D PRINTING ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

15.4 EUROPE

FIGURE 39 EUROPE: 3D PRINTING ELASTOMERS MARKET SNAPSHOT

TABLE 95 EUROPE: 3D PRINTING ELASTOMERS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 96 EUROPE: 3D PRINTING ELASTOMER MARKET SIZE, BY COUNTRY, 2019–2026 (TON)

TABLE 97 EUROPE: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 98 EUROPE: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 99 EUROPE: 3D PRINTING ELASTOMERS MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

TABLE 100 EUROPE: 3D PRINTING ELASTOMER MARKET SIZE, BY FORM, 2019–2026 (TON)

TABLE 101 EUROPE: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 102 EUROPE: 3D PRINTING ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

15.4.1 GERMANY

15.4.1.1 Government focus on automotive sector to fuel market growth

TABLE 103 GERMANY: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 104 GERMANY: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 105 GERMANY: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 106 GERMANY: 3D PRINTING ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

15.4.2 UK

15.4.2.1 Government initiatives toward 3D printing to enhance demand

TABLE 107 UK: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 108 UK: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 109 UK: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 110 UK: 3D PRINTING ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

15.4.3 FRANCE

15.4.3.1 Aerospace being one of the major sectors to enhance demand

TABLE 111 FRANCE: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 112 FRANCE: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 113 FRANCE: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 114 FRANCE: 3D PRINTING ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

15.4.4 SPAIN

15.4.4.1 Huge investment in R&D in aerospace and defense to increase demand

TABLE 115 SPAIN: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 116 SPAIN: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 117 SPAIN: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 118 SPAIN: 3D PRINTING ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

15.4.5 ITALY

15.4.5.1 Aerospace and medical sectors to drive market

TABLE 119 ITALY: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 120 ITALY: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 121 ITALY: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 122 ITALY: 3D PRINTING ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

15.4.6 NETHERLANDS

15.4.6.1 Government expenditure in medical sector

TABLE 123 NETHERLANDS: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 124 NETHERLANDS: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 125 NETHERLANDS: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 126 NETHERLANDS: 3D PRINTING ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

15.4.7 REST OF EUROPE

TABLE 127 REST OF EUROPE: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 128 REST OF EUROPE: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 129 REST OF EUROPE: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 130 REST OF EUROPE: 3D PRINTING ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

15.5 MIDDLE EAST & AFRICA

TABLE 131 MIDDLE EAST & AFRICA: 3D PRINTING ELASTOMERS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 132 MIDDLE EAST & AFRICA: 3D PRINTING ELASTOMER MARKET SIZE, BY COUNTRY, 2019–2026 (TON)

TABLE 133 MIDDLE EAST & AFRICA: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 134 MIDDLE EAST & AFRICA: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 135 MIDDLE EAST & AFRICA: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 136 MIDDLE EAST & AFRICA: 3D PRINTING ELASTOMER MARKET SIZE, END-USE INDUSTRY, 2019–2026 (TON)

TABLE 137 MIDDLE EAST & AFRICA: 3D PRINTING ELASTOMERS MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

TABLE 138 MIDDLE EAST & AFRICA: 3D PRINTING ELASTOMER MARKET SIZE, BY FORM, 2019–2026 (TON)

15.5.1 UAE

15.5.1.1 Government support driving 3D printing industry

TABLE 139 UAE: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 140 UAE: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 141 UAE: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 142 UAE: 3D PRINTING ELASTOMER MARKET SIZE, END-USE INDUSTRY, 2019–2026 (TON)

15.5.2 SAUDI ARABIA

15.5.2.1 High demand from consumer goods and automotive industries

TABLE 143 SAUDI ARABIA: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 144 SAUDI ARABIA: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 145 SAUDI ARABIA: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 146 SAUDI ARABIA: 3D PRINTING ELASTOMER MARKET SIZE, END-USE INDUSTRY, 2019–2026 (TON)

15.5.3 SOUTH AFRICA

15.5.3.1 Growth in the automotive industry to boost demand for 3D printing elastomers

TABLE 147 SOUTH AFRICA: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 148 SOUTH AFRICA: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 149 SOUTH AFRICA: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 150 SOUTH AFRICA: 3D PRINTING ELASTOMER MARKET SIZE, END-USE INDUSTRY, 2019–2026 (TON)

15.5.4 REST OF MIDDLE EAST & AFRICA

15.5.4.1 Growing investments in industrial sector

TABLE 151 REST OF MIDDLE EAST & AFRICA: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 152 REST OF MIDDLE EAST & AFRICA: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 153 REST OF MIDDLE EAST & AFRICA: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 154 REST OF MIDDLE EAST & AFRICA: 3D PRINTING ELASTOMER MARKET SIZE, END-USE INDUSTRY, 2019–2026 (TON)

15.6 SOUTH AMERICA

TABLE 155 SOUTH AMERICA: 3D PRINTING ELASTOMERS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 156 SOUTH AMERICA: 3D PRINTING ELASTOMER MARKET SIZE, BY COUNTRY, 2019–2026 (TON)

TABLE 157 SOUTH AMERICA: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 158 SOUTH AMERICA: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 159 SOUTH AMERICA: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 160 SOUTH AMERICA: 3D PRINTING ELASTOMER MARKET SIZE, END-USE INDUSTRY, 2019–2026 (TON)

TABLE 161 SOUTH AMERICA: 3D PRINTING ELASTOMERS MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

TABLE 162 SOUTH AMERICA: 3D PRINTING ELASTOMER MARKET SIZE, BY FORM, 2019–2026 (TON)

15.6.1 BRAZIL

15.6.1.1 Economic growth supporting industrialization and promoting use of 3D printing

TABLE 163 BRAZIL: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 164 BRAZIL: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 165 BRAZIL: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 166 BRAZIL: 3D PRINTING ELASTOMER MARKET SIZE, END-USE INDUSTRY, 2019–2026 (TON)

15.6.2 ARGENTINA

15.6.2.1 High demand from automotive industry propelling market growth

TABLE 167 ARGENTINA: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 168 ARGENTINA: 3D PRINTING ELASTOMER MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 169 ARGENTINA: 3D PRINTING ELASTOMERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 170 ARGENTINA: 3D PRINTING ELASTOMER MARKET SIZE, END-USE INDUSTRY, 2019–2026 (TON)

15.6.3 REST OF SOUTH AMERICA

TABLE 171 REST OF SOUTH AMERICA: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 172 REST OF SOUTH AMERICA: 3D PRINTING ELASTOMERS MARKET SIZE, BY MATERIAL, 2019–2026 (TON)

TABLE 173 REST OF SOUTH AMERICA: 3D PRINTING ELASTOMERS MARKET SIZE,BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 174 REST OF SOUTH AMERICA: 3D PRINTING ELASTOMERS MARKET SIZE, END-USE INDUSTRY, 2019–2026 (TON)

16 COMPETITIVE LANDSCAPE (Page No. - 168)

16.1 INTRODUCTION

16.2 MARKET EVALUATION FRAMEWORK

FIGURE 40 3D PRINTING ELASTOMERS MARKET EVALUATION FRAMEWORK FOR TOP 5 PLAYERS, 2018-2021

16.3 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2020

FIGURE 41 RANKING ANALYSIS OF TOP FIVE PLAYERS IN 3D PRINTING ELASTOMERS MARKET, 2020

FIGURE 42 3D PRINTING MATERIALS: MAPPING PRESENCE OF KEY PLAYERS BY END-USE INDUSTRY

16.4 MARKET SHARE ANALYSIS

16.4.1 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS VS. OTHERS IN 3D PRINTING ELASTOMERS MARKET

16.4.2 BASF SE

16.4.3 3D SYSTEMS INC.

16.4.4 CARBON INC.

16.4.5 HENKEL

16.4.6 FORMLABS

16.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 175 3D PRINTING ELASTOMERS MARKET: PRODUCT TYPE FOOTPRINT

16.6 COMPANY 3D PRINTING TECHNOLOGY FOOTPRINT ANALYSIS

TABLE 176 3D PRINTING ELASTOMERS MARKET: TECHNOLOGY FOOTPRINT

TABLE 177 3D PRINTING ELASTOMERS MARKET: END-USE INDUSTRY FOOTPRINT

TABLE 178 3D PRINTING ELASTOMERS MARKET: COMPANY REGION FOOTPRINT

16.7 EVALUATION MATRIX (TIER 1)

16.7.1 TERMINOLOGY/NOMENCLATURE

16.7.1.1 Star

16.7.1.2 Emerging Leader

16.7.2 PERVASIVE

16.7.3 PARTICIPANT

FIGURE 43 COMPANY EVALUATION MATRIX FOR 3D PRINTING ELASTOMERS MARKET (TIER 1)

16.7.4 STRENGTH OF PRODUCT PORTFOLIO

16.7.5 BUSINESS STRATEGY EXCELLENCE

16.8 START-UP/SMSE EVALUATION MATRIX

16.8.1 TERMINOLOGY/NOMENCLATURE

16.8.1.1 Progressive companies

16.8.1.2 Responsive companies

16.8.1.3 Starting blocks

FIGURE 44 STARTUP/SMES EVALUATION MATRIX FOR 3D PRINTING ELASTOMERS MARKET

16.9 COMPETITIVE SITUATIONS AND TRENDS

16.9.1 PRODUCT LAUNCHES

TABLE 179 3D PRINTING ELASTOMERS MARKET: PRODUCT LAUNCHES, JANUARY 2018- MARCH 2021

16.9.2 DEALS

TABLE 180 3D PRINTING ELASTOMERS MARKET: DEALS, JANUARY 2018- MARCH 2021

16.9.3 OTHER DEVELOPMENTS

TABLE 181 3D PRINTING ELASTOMERS MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS, JANUARY 2018- MARCH 2021

17 COMPANY PROFILE (Page No. - 190)

17.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, Winning imperatives)*

17.1.1 BASF SE

FIGURE 45 BASF SE: COMPANY SNAPSHOT

TABLE 182 BASF SE: BUSINESS OVERVIEW

17.1.2 3D SYSTEMS INC.

FIGURE 46 3D SYSTEMS INC.: COMPANY SNAPSHOT

17.1.3 CARBON INC.

TABLE 183 CARBON INC.: BUSINESS OVERVIEW

17.1.4 HENKEL

FIGURE 47 HENKEL: COMPANY SNAPSHOT

TABLE 184 HENKEL: BUSINESS OVERVIEW

17.1.5 FORMLABS

TABLE 185 FORMLABS: BUSINESS OVERVIEW

17.1.6 STRATASYS, LTD

FIGURE 48 STRATASYS, LTD: COMPANY SNAPSHOT

TABLE 186 STRATASYS, LTD: BUSINESS OVERVIEW

17.1.7 EVONIK INDUSTRIES AG

FIGURE 49 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

TABLE 187 EVONIK INDUSTRIES AG: BUSINESS OVERVIEW

17.1.8 ARKEMA S.A.

FIGURE 50 ARKEMA S.A.: COMPANY SNAPSHOT

TABLE 188 ARKEMA S.A.: BUSINESS OVERVIEW

17.1.9 MATERIALISE NV

FIGURE 51 MATERIALISE NV: COMPANY SNAPSHOT

TABLE 189 MATERIALISE NV: BUSINESS OVERVIEW

17.1.10 PROTO LABS INC.

FIGURE 52 PROTO LABS INC.: COMPANY SNAPSHOT

TABLE 190 PROTO LABS INC.: BUSINESS OVERVIEW

17.1.11 EOS GMBH ELECTRO OPTICAL SYSTEMS

FIGURE 53 EOS GMBH ELECTRO OPTICAL SYSTEMS: COMPANY SNAPSHOT

TABLE 191 EOS GMBH ELECTRO OPTICAL SYSTEMS: BUSINESS OVERVIEW

*Details on Business overview, Products offered, Recent Developments, Winning imperatives might not be captured in case of unlisted companies.

17.2 OTHER PLAYERS

17.2.1 EXONE

TABLE 192 EXONE: BUSINESS OVERVIEW

TABLE 193 EXONE: PRODUCTS OFFERED

17.2.2 ZORTRAX

TABLE 194 ZORTRAX: BUSINESS OVERVIEW

TABLE 195 ZORTAX: PRODUCTS OFFERED

17.2.3 HP DEVELOPMENT COMPANY, L.P.

TABLE 196 HP DEVELOPMENT COMPANY, L.P.: BUSINESS OVERVIEW

TABLE 197 HP DEVELOPMENT COMPANY, L.P.: PRODUCTS OFFERED

17.2.4 DOW CHEMICAL COMPANY

TABLE 198 DOW CHEMICAL COMPANY: BUSINESS OVERVIEW

TABLE 199 DOW CHEMICAL COMPANY: PRODUCTS OFFERED

17.2.5 LANXESS

TABLE 200 LANXESS: BUSINESS OVERVIEW

TABLE 201 LANXESS: PRODUCTS OFFERED

17.2.6 VOXELJET AG

TABLE 202 VOXELJET AG: BUSINESS OVERVIEW

TABLE 203 VOXELJET AG: PRODUCTS OFFERED

17.2.7 IMPOSSIBLE OBJECTS

TABLE 204 IMPOSSIBLE OBJECTS: BUSINESS OVERVIEW

TABLE 205 IMPOSSIBLE OBJECTS: PRODUCTS OFFERED

17.2.8 ENVISIONTEC

TABLE 206 ENVISIONTEC: BUSINESS OVERVIEW

TABLE 207 ENVISIONTEC: PRODUCTS OFFERED

17.2.9 SINTERIT

TABLE 208 SINTERIT: BUSINESS OVERVIEW

TABLE 209 SINTERIT: PRODUCTS OFFERED

17.2.10 THE LUBRIZOL CORPORTAION

TABLE 210 THE LUBRIZOL CORPORATION: BUSINESS OVERVIEW

TABLE 211 THE LUBRIZOL CORPORATION: PRODUCTS OFFERED

18 APPENDIX (Page No. - 250)

18.1 DISCUSSION GUIDE

18.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

18.3 RELATED REPORTS

18.4 AUTHOR DETAILS

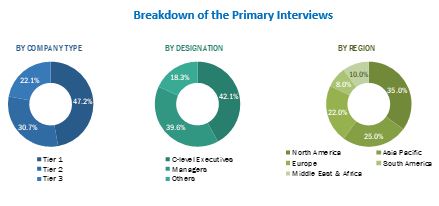

The study involved four major activities in estimating the current size of the 3D printing elastomers market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the 3D printing elastomers value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this study include Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet, were referred for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

The 3D printing elastomers market comprises several stakeholders, such as raw material suppliers, manufacturers, distributors, service providers, end-product manufacturers, and regulatory organizations in the supply chain.

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the 3D printing elastomers market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the 3D printing elastomers market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries.

To know about the assumptions considered for the study, download the pdf brochure

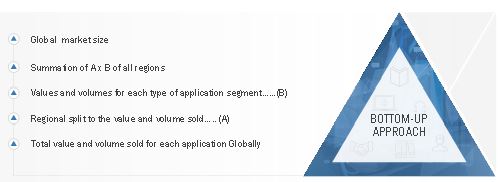

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the 3D printing elastomers market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the 3D printing elastomers market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global 3D printing elastomers market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- To determine and project the size of the 3D printing elastomers market with respect to form, material, end-use industry, technology, and region., over five years, from 2021 to 2026

- To identify attractive opportunities in the market by determining the largest and the fastest-growing segments across key regions

- To project the size of the market segments, in terms of value and volume, with respect to five regions: Asia Pacific, North America, Europe, the Middle East & Africa, and South America

- To provide detailed information regarding the crucial factors influencing the growth of the market (drivers, opportunities, restraints, and challenges)

- To analyze competitive developments, such as product launches, collaborations, partnerships, expansions, acquisitions, agreements, joint ventures, and investments in the 3D printing elastomers market

- To analyze the demand-side factors based on the impact of macroeconomic and microeconomic factors on different segments of the market across different regions

Competitive Intelligence

- To identify and profile key players in the 3D printing elastomers market

- To determine the market share of key players operating in the market

- To provide a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify key growth strategies adopted by the leading players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Further country-level breakdown of the Rest of Europe into Denmark and Poland in the 3D printing elastomers market

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 3D Printing Elastomers Market