Security Information and Event Management Market by Component, Application, Deployment Mode, Organization Size, Vertical (Information, Finance and Insurance, Healthcare and Social Assistance, Utilities), and Region - Global Forecast to 2025

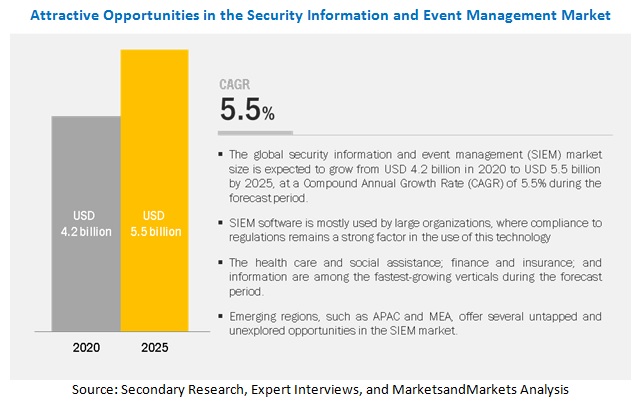

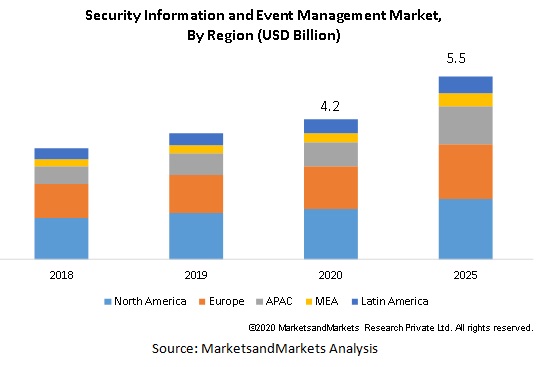

[185 Pages Report] MarketsandMarkets forecasts the global Security Information and Event Management (SIEM) market size is expected to grow from USD 4.2 billion in 2020 to USD 5.5 billion by 2025, at a CAGR of 5.5% during the forecast period. The need for continuous monitoring and incident response, adhering to compliance requirements, gaining and maintaining certifications, and managing and retaining logs are the primary factors to drive the demand for the market during the forecast period.

By application, the security analytics segment to grow at significant CAGR during the forecast period

SIEM solution and services are used for various crucial applications by organizations. Some of the factors that invoke the need for security analytics include automation for error detection and remediation, adherence to stringent compliance mandates, holistic visibility, log collection and management, and reduced false positives. The next-generation SIEM solution and services facilitate security analytics with statistical modeling, pattern modeling, and machine learning. These analytical tools help organizations manipulate data and guide decisions for event detection. They are also used to identify potential breaches and dwelling threats from disparate network areas, and indicators of compromise.

By vertical, the healthcare and social assistance segment to exhibit a higher growth rate during the forecast period

The healthcare and social assistance vertical consists of organizations which provide healthcare and social assistance to individuals. This vertical comprises organizations that generate and commercialize healthcare goods and services and provide social assistance. It includes medical equipment and pharmaceutical manufacturers; health insurance firms; private and public healthcare organizations; and the providers of diagnostic, preventive, remedial, and therapeutic services. It also possesses data related to doctors, patients, staff, and administrators, which is private and highly confidential. SIEM plays a key role in healthcare enterprises, due to the rising cyberattacks.

By region, North America to hold the highest market share during the forecast period

The Security Information and Event Management Market in North America is growing at a rapid pace. Several companies across verticals in North America are looking for enhancing their breach detection and monitoring capabilities by deploying SIEM solution. Companies are focusing on security and compliance reporting requirements are rapidly adopting SIEM technology. Larger companies who follow a conservative approach in adopting technology are also deploying SIEM solution. North America is the most highly regulated region in the world with numerous regulations across various industry verticals. To name a few North American regulations, Federal Energy Regulatory Commission (FERC), Health Insurance Portability & Accountability Act (HIPAA), Payment Card Industry Data Security Standards (PCI DSS), Sarbanes-Oxley Act (SOX) among others govern the North American market. North American companies are quite advanced when it comes to deploying SIEM solutions and best practices to their everyday business processes.

Market Players:

The major vendors covered in the Security Information and Event Management Market include SolarWinds (US), IBM (US), Micro Focus (UK), Rapid7 (US), RSA (US), McAfee (US), Splunk (US), ManageEngine (US), LogRhythm (US), Sumo Logic (US), Exabeam (US), Securonix (US), Alert Logic (US), Graylog (US), BlackStratus (US), AlienVault (US), Forinet (US), LogPoint (Denmark), Gurucul (US), and Cygilant (US). These players have adopted various growth strategies, including new product launches and product enhancements, partnerships, strategic expansions, and acquisitions, to expand their presence in the log management market.

Scope of report

|

Report Metrics |

Details |

|

Market size available for years |

20182025 |

|

Base year considered |

2019 |

|

Forecast period |

20202025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Component (Solution and Services), Application, Organization Size, Deployment Mode, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

SolarWinds (US), IBM (US), Micro Focus (UK), Rapid7 (US), RSA (US), McAfee (US), Splunk (US), ManageEngine (US), LogRhythm (US), Exabeam (US), Securonix (US),Alert Logic (US), Sumo Logic (US), BlackStratus (US), AlienVault (US), Fortinet (US), LogPoint (Europe), Gurucul (US),Graylog (US), and Cygilant (US). |

This research report categorizes the market to forecast revenues and analyze trends in each of the following submarkets:

On the basis of components, the Security Information and Event Management Market has been segmented as follows:

- Solution

- Services

On the basis of applications, the SIEM market has been segmented as follows:

- Log Management and Reporting

- Threat Intelligence

- Security Analytics

- Others (include application monitoring, behavior profiling, and database management)

On the basis of organization size, the SIEM market has been segmented as follows:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

On the basis of deployment modes, the SIEM market has been segmented as follows:

- On-premises

- Cloud

On the basis of verticals, the SIEM market has been segmented as follows:

- Information

- Finance and Insurance

- Healthcare and Social Assistance

- Retail Trade

- Manufacturing

- Utilities

- Others (includes transportation and warehousing; arts, entertainment and recreation; and educational services)

On the basis of regions, the Security Information and Event Management Market has been segmented as follows:

- North America

- United States (US)

- Canada

- Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

- APAC

- Australia and New Zealand

- Japan

- India

- Rest of APAC

- MEA

- Middle East

- Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In July 2018, ManageEngine extended the log management capabilities of the SIEM solution to the cloud. Enterprises can now store and manage log data from the network on Zoho's secure cloud platform.

- In March 2019, RSA extended its SIEM capabilities to reduce digital risks with expanded analytics. The company unveiled a new version of its SIEM solution, RSA NetWitness platform, which features Machine Learning (ML) models based on deep endpoint observations to rapidly detect anomalies in user behavior to uncover evolving threats.

- In March 2019, ManageEngine introduced User and Entity Behavior Analytics (UEBA) in the SIEM solution, Log360. Log360, the companys SIEM solution, offers real-time log collection, analysis, monitoring, correlation, and archiving of data.

- In September 2019, McAfee partnered with Oracle to enhance its SIEM capabilities over the cloud. Enterprises can complete the entire implementation within three days on the Oracle Cloud Infrastructure and offer flexible architecture to meet the ever-changing customer demands regardless of the current topology. This would enable security teams to operate more efficiently and in a cost-effective manner.

- In December 2019, Rapid7 announced its cloud SIEM offering, InsightIDRs availability in the AWS marketplace. InsightIDR also offers centralized log management for searches, dashboards, and compliances.

Key questions addressed by the report

- What are the opportunities in the Security Information and Event Management Market?

- What is the competitive landscape of the market?

- What are the restraining factors that will impact the market?

- How have SIEM solution evolved from conventional techniques to modern techniques?

- What are the dynamics of the SIEM market?

Frequently Asked Questions (FAQ):

What is Security Information and Event Management (SIEM)?

Security Information and Event Management (SIEM) aggregates, stores, and analyzes different types of events generated throughout the technology infrastructure of organizations. The technology infrastructure includes host systems, applications, domain controllers, and network and security devices, such as firewalls and antivirus filters.

What are the applications of SIEM?

Below mentioned are the application areas of SIEM:

- Log Management and Reporting

- Threat Intelligence

- Security Analytics

- Others includes application monitoring, behavior profiling, and database management

- Log management to grow at a higher CAGR in the SIEM market because of its capabilities such as the generation, collection, transmission, storage, analysis, disposing, and monitoring of logs. Log management is mainly used by organizations for ensuring adherence to various norms related to security, troubleshooting, and compliance.

What are the benefits of SIEM solutions?

- Increased efficiency

- Prevention of potential security threats

- Reduction in the impact of security breaches

- Reduction in costs

- Better reporting, and log analysis and retention

- Enhanced IT compliance

Who are the prominent players in the SIEM market?

IBM, Micro Focus, Rapid7, RSA, McAfee, Alert Logic, ManageEngine, Splunk, and LogRhythm are some of the prominent players in the SIEM market.

What are the various verticals in which SIEM solutions are being deployed?

The SIEM solution is deployed in various verticals, including information, finance and insurance, healthcare and social assistance, utilities, manufacturing, retail trade, and others which include transportation and warehousing; arts, entertainment, and recreation; and educational services. The growing advancements in IT technologies, and increasing use of IoT solutions and connected devices have increased the adoption of the SIEM solution and the penetration of IT solutions across major verticals and service sectors.

What are the top trends in SIEM market?

Trends that are impacting the SIEM market includes:

- Exponential rise and sophistication of cyber attacks

- Stringent security compliances and government regulations

- Increase in adoption of cloud-based services among SMEs

Opportunities for the SIEM market:

- Integration of SIEM solution with managed detection and response tools

- Necessity of balanced security approach

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Vendor selection and evaluation

2.1.1.2 Geographic analysis

2.1.1.3 Industry trend analysis

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 REVENUE ESTIMATES

2.3.2 BOTTOM-UP APPROACH

2.3.3 TOP-DOWN APPROACH

2.4 MARKET FORECAST

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 36)

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

4.2 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET, BY COMPONENT, 2020

4.3 MARKET, BY APPLICATION, 2020

4.4 MARKET SHARE OF TOP 3 VERTICALS AND REGIONS, 2020

4.5 MARKET, BY DEPLOYMENT MODE, 2020

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 44)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Exponential rise and sophistication of cyber attacks

5.2.1.2 Stringent security compliances and government regulations

5.2.1.3 Increase in adoption of cloud-based services among SMEs

5.2.2 RESTRAINTS

5.2.2.1 Higher cost involved in deploying SIEM solution

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing instances of false positives

5.2.3.2 Integration of SIEM solution with managed detection and response tools

5.2.3.3 Necessity of balanced security approach

5.2.4 CHALLENGES

5.2.4.1 Management of enormous data

5.3 REGULATORY IMPLICATIONS

5.3.1 INTRODUCTION

5.3.2 GENERAL DATA PROTECTION REGULATION

5.3.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.3.4 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.3.5 GOVERNANCE, RISK, AND COMPLIANCE STANDARDS

5.3.6 GRAMM-LEACH-BLILEY ACT

5.3.7 SARBANES-OXLEY ACT

5.3.8 THE INTERNATIONAL ORGANIZATION FOR STANDARDIZATION 27001

5.4 USE CASES

6 IMPACT OF COVID-19 ON SECURITY INFORMATION AND EVENT MANAGEMENT MARKET (Page No. - 50)

7 MARKET, BY COMPONENT (Page No. - 51)

7.1 INTRODUCTION

7.2 SOLUTION

7.2.1 SOLUTION: MARKET DRIVERS

7.3 SERVICES

7.3.1 SERVICES: MARKET DRIVERS

8 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET, BY APPLICATION (Page No. - 57)

8.1 INTRODUCTION

8.2 LOG MANAGEMENT AND REPORTING

8.2.1 LOG MANAGEMENT AND REPORTING: MARKET DRIVERS

8.3 THREAT INTELLIGENCE

8.3.1 THREAT INTELLIGENCE: MARKET DRIVERS

8.4 SECURITY ANALYTICS

8.4.1 SECURITY ANALYTICS: MARKET DRIVERS

8.5 OTHER APPLICATIONS

9 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET, BY DEPLOYMENT MODE (Page No. - 64)

9.1 INTRODUCTION

9.2 CLOUD

9.2.1 CLOUD: MARKET DRIVERS

9.3 ON-PREMISES

9.3.1 ON-PREMISES: MARKET DRIVERS

10 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET, BY ORGANIZATION SIZE (Page No. - 68)

10.1 INTRODUCTION

10.2 SMALL AND MEDIUM-SIZED ENTERPRISES

10.2.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

10.3 LARGE ENTERPRISES

10.3.1 LARGE ENTERPRISES: MARKET DRIVERS

11 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET, BY VERTICAL (Page No. - 72)

11.1 INTRODUCTION

11.2 INFORMATION

11.2.1 INFORMATION: MARKET DRIVERS

11.3 FINANCE AND INSURANCE

11.3.1 FINANCE AND INSURANCE: MARKET DRIVERS

11.4 HEALTHCARE AND SOCIAL ASSISTANCE

11.4.1 HEALTHCARE AND SOCIAL ASSISTANCE: MARKET DRIVERS

11.5 RETAIL TRADE

11.5.1 RETAIL TRADE: MARKET DRIVERS

11.6 MANUFACTURING

11.6.1 MANUFACTURING: MARKET DRIVERS

11.7 UTILITIES

11.7.1 UTILITIES: MARKET DRIVERS

11.8 OTHERS

12 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET, BY REGION (Page No. - 82)

12.1 INTRODUCTION

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: MARKET DRIVERS

12.2.2 UNITED STATES

12.2.3 CANADA

12.3 EUROPE

12.3.1 EUROPE: MARKET DRIVERS

12.3.2 UNITED KINGDOM

12.3.3 GERMANY

12.3.4 FRANCE

12.3.5 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: MARKET DRIVERS

12.4.2 AUSTRALIA AND NEW ZEALAND

12.4.3 INDIA

12.4.4 JAPAN

12.4.5 REST OF ASIA PACIFIC

12.5 MIDDLE EAST AND AFRICA

12.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

12.5.2 MIDDLE EAST

12.5.3 AFRICA

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: MARKET DRIVERS

12.6.2 BRAZIL

12.6.3 MEXICO

12.6.4 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE (Page No. - 144)

13.1 MICROQUADRANT OVERVIEW

13.2 COMPETITIVE LEADERSHIP MAPPING

13.2.1 VISIONARY LEADERS

13.2.2 INNOVATORS

13.2.3 DYNAMIC DIFFERENTIATORS

13.2.4 EMERGING COMPANIES

14 COMPANY PROFILES (Page No. - 146)

14.1 INTRODUCTION

(Business overview, Products offered, Solutions offered, Recent developments & SWOT analysis)*

14.2 SOLARWINDS

14.3 IBM

14.4 MICRO FOCUS

14.5 RAPID7

14.6 RSA

14.7 MCAFEE

14.8 SPLUNK

14.9 MANAGEENGINE

14.10 LOGRHYTHM

14.11 EXABEAM

14.12 SECURONIX

14.13 ALERT LOGIC

14.14 SUMO LOGIC

14.15 BLACKSTRATUS

14.16 ALIEN VAULT

14.17 FORTINET

14.18 LOGPOINT

14.19 GURUCUL

14.20 GRAYLOG

14.21 CYGILANT

14.22 RIGHT-TO-WIN

*Details on Business overview, Products offered, Solutions offered, Recent developments & SWOT analysis might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 179)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

LIST OF TABLES (137 Tables)

TABLE 1 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET ECOSYSTEM: VENDOR SELECTION AND EVALUATION CRITERIA (INDICATIVE SAMPLE)

TABLE 2 REVENUE AND SHARE ESTIMATES FOR SELECTED VENDORS IN THE MARKET (INDICATIVE SAMPLE)

TABLE 3 TYPES OF EVENT LOGS AND THEIR DESCRIPTION

TABLE 4 MARKET SIZE AND GROWTH RATE, 20182025 (USD MILLION, Y-O-Y %)

TABLE 5 USE CASE 1: HEALTHCARE

TABLE 6 USE CASE 2: TECHNOLOGY

TABLE 7 USE CASE 3: BANKING

TABLE 8 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 9 EVENT TYPES AND THEIR DESCRIPTION

TABLE 10 SOLUTION: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 11 SECURITY INFORMATION AND EVENT MANAGEMENT - RELATED SERVICES AND THEIR DESCRIPTION

TABLE 12 SERVICES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 13 MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 14 LOG MANAGEMENT AND REPORTING: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 15 THREAT INTELLIGENCE: SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 16 SECURITY ANALYTICS: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 17 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 18 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 19 CLOUD: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 20 ON-PREMISES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 21 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 22 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 23 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 24 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 25 INFORMATION: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 26 FINANCE AND INSURANCE: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 27 HEALTHCARE AND SOCIAL ASSISTANCE: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 28 RETAIL TRADE: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 29 MANUFACTURING: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 30 UTILITIES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 31 OTHERS: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 32 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 38 NORTH AMERICA: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 39 UNITED STATES: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 40 UNITED STATES: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 41 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 42 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 43 UNITED STATES: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 44 CANADA: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 45 CANADA: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 46 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 47 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 48 CANADA: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 49 EUROPE: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 50 EUROPE: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 51 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 52 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 53 EUROPE: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 54 EUROPE: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 55 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 56 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 57 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 58 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 59 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 60 GERMANY: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 61 GERMANY: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 62 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 63 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 64 GERMANY: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 65 FRANCE: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 66 FRANCE: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 67 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 68 FRANCE: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 69 FRANCE: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 70 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 71 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 72 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 73 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 74 REST OF EUROPE: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 75 ASIA PACIFIC: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 76 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 77 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 78 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 79 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 80 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 81 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 82 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 83 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 84 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 85 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 86 INDIA: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 87 INDIA: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 88 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 89 INDIA: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 90 INDIA: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 91 JAPAN: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 92 JAPAN: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 93 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 94 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 95 JAPAN: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 96 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 97 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 98 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 99 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 100 REST OF ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 101 MIDDLE EAST AND AFRICA: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 102 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 103 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 104 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 105 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 106 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 107 MIDDLE EAST: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 108 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 109 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 110 MIDDLE EAST: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 111 MIDDLE EAST: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 112 AFRICA: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 113 AFRICA: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 114 AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 115 AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 116 AFRICA: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 117 LATIN AMERICA: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 118 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 119 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 120 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 121 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 122 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 123 BRAZIL: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 124 BRAZIL: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 125 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 126 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 127 BRAZIL: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 128 MEXICO: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 129 MEXICO: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 130 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 131 MEXICO: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 132 MEXICO: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 133 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 134 REST OF LATIN AMERICA: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 135 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 136 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 137 REST OF LATIN AMERICA: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

LIST OF FIGURES (35 Figures)

FIGURE 1 GLOBAL SECURITY INFORMATION AND EVENT MANAGEMENT MARKET: RESEARCH DESIGN

FIGURE 2 SAMPLE SECONDARY DATA: COUNTRIES BEST PREPARED FOR CYBER ATTACKS

FIGURE 3 SAMPLE SECONDARY DATA: GLOBAL INFORMATION AND COMMUNICATIONS TECHNOLOGY INDICATORS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF SECURITY INFORMATION AND EVENT MANAGEMENT VENDORS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2 BOTTOM-UP (DEMAND-SIDE ANALYSIS)

FIGURE 6 FACTOR ANALYSIS FOR MARKET TREND AND FORECAST

FIGURE 7 SOLUTION SEGMENT TO WITNESS A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

FIGURE 8 NORTH AMERICA TO ACCOUNT FOR THE HIGHEST MARKET SHARE IN 2020

FIGURE 9 FASTEST-GROWING SEGMENTS OF THE SECURITY INFORMATION AND EVENT MANAGEMENT MARKET

FIGURE 10 INCREASING NUMBER OF COMPLIANCES TO FUEL THE GROWTH OF THE MARKET

FIGURE 11 SOLUTION SEGMENT TO HOLD A HIGHER MARKET SHARE DURING THE FORECAST PERIOD

FIGURE 12 LOG MANAGEMENT AND REPORTING SEGMENT TO HOLD THE HIGHEST MARKET SHARE DURING THE FORECAST PERIOD

FIGURE 13 INFORMATION VERTICAL AND NORTH AMERICA TO HOLD THE HIGHEST MARKET SHARES IN 2020

FIGURE 14 CLOUD SEGMENT TO HOLD A HIGHER MARKET SHARE IN 2020

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SECURITY INFORMATION AND EVENT MANAGEMENT MARKET

FIGURE 16 SOLUTION SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 17 LOG MANAGEMENT AND REPORTING SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 18 CLOUD SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

FIGURE 19 LARGE ENTERPRISES SEGMENT TO HOLD A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 20 INFORMATION VERTICAL TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 21 NORTH AMERICA TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 22 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 23 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 24 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 25 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET (GLOBAL), COMPETITIVE LEADERSHIP MAPPING, 2020

FIGURE 26 SOLARWINDS: COMPANY SNAPSHOT

FIGURE 27 SOLARWINDS: SWOT ANALYSIS

FIGURE 28 IBM: COMPANY SNAPSHOT

FIGURE 29 IBM: SWOT ANALYSIS

FIGURE 30 MICRO FOCUS: COMPANY SNAPSHOT

FIGURE 31 MICRO FOCUS: SWOT ANALYSIS

FIGURE 32 RAPID7: COMPANY SNAPSHOT

FIGURE 33 RAPID7: SWOT ANALYSIS

FIGURE 34 RSA: SWOT ANALYSIS

FIGURE 35 SPLUNK: COMPANY SNAPSHOT

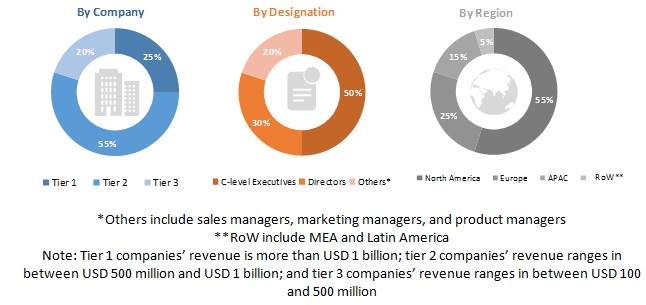

The study involved four major activities in estimating the current market size for the Security Information And Event Management (SIEM) market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the Security Information and Event Management market.

Secondary research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva, have been referred to, for identifying and collecting information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, certified publications and articles by recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Primary research

The Security Information and Event Management market comprises several stakeholders, such as SIEM vendors, regulatory bodies, system integrators, resellers and distributors, research organizations, government agencies, enterprise users, venture capitalists, private equity firms, and start-up companies. The demand-side of the market consists of enterprises across different industries, including information, finance and insurance, retail trade, healthcare and social assistance, manufacturing and others. The supply-side includes SIEM providers offering SIEM solution and services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market size estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Security Information and Event Management market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Report objectives

- To define, describe, and forecast the Security Information and Event Management market by component (solution and services), application, organization size, deployment mode, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the market

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their core competencies in each sub segments

- To analyze the competitive developments, such as agreements, partnerships, acquisitions, and product/solution launches, in the Security Information and Event Management market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American market into the US, and Canada

- Further breakup of the European market into the UK, Germany, France and Rest of Europe

- Further breakup of the APAC market into Australia and New Zealand, Japan, India and Rest of APAC

- Further breakup of the MEA market into Middle East and Africa

- Further breakup of the Latin American market into Brazil, Mexico and Rest of Latin America

Company information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Security Information and Event Management Market