Collaborative Robot Market Growth in the US

Driving Efficiency and Innovation: The Growth of the U.S. Collaborative Robot Market

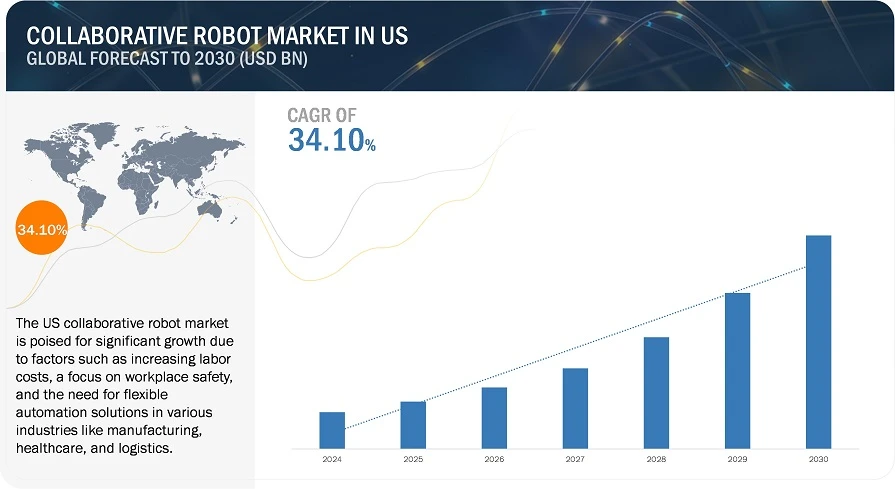

The cobot market in the United States is growing further, driven by significant investments into automation, along with the emerging workforce-related challenges and push for higher efficiency in manufacturing processes. These are areas said to primarily adopt cobots, focusing on increasing the precision and output of production and manufacturing tasks. Automotive would be one of these industries that represent a significant part of U.S. GDP, which is a major driver, with vehicle sales expected to increase by 7% by 2027. This directly correlates with increased cobot adoption in assembly lines and manufacturing processes.

The U.S. market is also seeing an influx of partnerships and product launches. For instance, Doosan Robotics Americas teamed with iAutomation in April 2023 to increase cobot distribution down the East Coast. Universal Robots launched UR20, a cobot designed with heavy payloads in mind, thus focusing on plastics, chemical, and food and beverage industries. Such developments indicate growing penetration of cobots across industries as manufacturers opt for flexible automation solutions that support them in addressing labor shortages and enhancing production efficiency.

Health care is emerging as a promising sector for cobot deployment in the U.S. According to the Bureau of Labor Statistics, healthcare employment was 9.3% of the workforce in 2022, and the industry is growing to alleviate healthcare professional workload. Cobots are being used for patient handling, surgical assistance, and laboratory automation in these streamlined operations and improved care delivery. Government automation programs for the healthcare sector further popularize the adoption of cobots in filling gaps in the workforce and increasing productivity.

The electronics industry has been widely adopting cobots for key applications in circuit board assembly, quality inspection, and device manufacturing. In parallel, as e-commerce grows, so does the adoption of cobots in warehouses and logistics and includes stockroom management, picking orders, and packaging. As such, FANUC, ABB, and Yaskawa have developed superior cobot solutions that have been optimized for applications in logistics and electronics.

Due to a highly robust manufacturing base, deep technological innovation, and great investments, the U.S. cobot market will be likely to dominate this global landscape. Companies that lead transformation in this industry are Universal Robots, ABB, and Doosan Robotics. The favorable policies of the government toward labor shortages have also helped support this advanced automation culture. Thus, the US collaborative robot market will continue to surge with expanding use cases across many industries and will remain an undisputed leader in automation technologies.

Related Report

Collaborative Robot Market Size, Share, Statistics and Industry Growth Analysis Report by Payload (Up to 5 kg, 5-10 kg, 10-25 kg, & More than 25 kg), Application (Handling, Assembling & Disassembling, Dispensing), Industry (Automotive, Electronics, Metals & Machining) & Region - Global Growth Driver and Industry Forecast to 2030

Contact:

Mr. Rohan Salgarkar

MarketsandMarkets™ INC.

1615 South Congress Ave.

Suite 103

Delray Beach, FL 33445

USA : 1-888-600-6441

sales@marketsandmarkets.com

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

SEND ME A FREE SAMPLE