Top Companies in Application Lifecycle Management - Microsoft (US), Atlassian (Australia), IBM (US), OpenText (Canada) and Broadcom (US)

The global Application Lifecycle Management market size is projected to grow from USD 4.35 billion in 2024 to USD 6.58 billion by 2029 at a compound annual growth rate (CAGR) of 8.6%. The expansion of software ecosystems with microservices, APIs, and cloud-native applications require ALM tools to effectively control activities related to the development, integration, and maintenance of applications. These tools facilitate smooth teamwork, version management and automated testing functions for dependency tracking between linked services. The continuous testing and deployment of independent components through microservices must happen without affecting the system as a whole. APIs create additional challenges because they necessitate security measures, performance monitoring, and lifecycle maintenance. ALM solutions optimize application development workflows, which leads to more efficient work while minimizing risks and delivering scalable, secure applications that are easy to maintain.

To know about the assumptions considered for the study download the pdf brochure

Top Application Lifecycle Management Companies include

- Microsoft (US)

- Atlassian (Australia)

- IBM (US)

- OpenText (Canada)

- Broadcom (US)

Various globally established players, such as Microsoft (US), Atlassian (Australia), IBM (US), OpenText (Canada), Broadcom (US), Siemens (Germany), PTC (US), SAP (Germany), HCLTech (India), Dassault Systèmes (France), BMC Software (US), Rocket Software (US), Digital.ai (US), Perforce (US), Ansys (US), Microgenesis (India), ReQtest (Sweden), Nimblework (US), Kovair Software (US), Jama Software (US), Inflectra (US), Enalean (France), Original Software (UK), Practitest (Israel), Orcanos (Israel), Novalys (France), Visure Solutions (US), Techexcel (US), TestRail (Germany) are dominating the Application Lifecycle Management market. These competitors have used various growth methods to increase their market share in the Application Lifecycle Management market, including partnerships, agreements, collaborations, new product releases, product enhancements, and acquisitions.

Microsoft

Microsoft Corporation is a multinational technology company based in Redmond, Washington. Microsoft operates through three key segments: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. In the ALM domain, it provides Power Platform and Azure DevOps, for secure data management, CI/CD automation, and collaborative development. Azure DevOps Server supports on-premises development with IDE integration and custom tool support. Microsoft collaborated with PTC to develop a generative AI copilot using Codebeamer ALM and with Siemens to deliver AI-enhanced solutions for resilient product lifecycle management on Azure.

Atlassian

Atlassian Corporation is an Australian software company focused on developing collaboration tools tailored for software development and project management. In ALM domain, Atlassian develops software which enables teams to coordinate their work activities through efficient planning and tracking features. The company offers four main products through its portfolio: Jira for tracking issues and projects, Confluence for team collaboration and knowledge sharing, Trello for visual task management and Bitbucket for source code management. The company's tools enable streamlined workflows, enhanced communication and improved efficiency in multiple project types. The company caters to numerous clients from a varied range of industries including IT & software development, education, BFSI, manufacturing and government sectors.

IBM

IBM (US) is a major player in the Application Lifecycle Management (ALM) market, offering a comprehensive suite of tools and solutions that support the end-to-end software development process. Through its IBM Engineering Lifecycle Management (ELM) platform—formerly known as Rational—IBM provides integrated capabilities for requirements management, modeling, testing, change and configuration management, and project planning. The company's ALM solutions are widely adopted in industries such as automotive, aerospace, healthcare, and finance, helping enterprises improve collaboration, traceability, and compliance in complex development environments. IBM’s focus on AI, cloud, and DevOps integration further enhances its value proposition in the ALM space.

OpenText

OpenText, a Canadian enterprise information management company, is a significant player in the Application Lifecycle Management (ALM) market through its flagship platform, OpenText ALM/Quality Center. Acquired via its 2023 purchase of Micro Focus, the platform offers a comprehensive suite of tools for managing the entire software development lifecycle—including requirements management, test planning, defect tracking, and performance testing. It supports both on-premises and cloud deployments, catering to enterprises seeking robust quality assurance, traceability, and compliance. OpenText ALM is widely adopted in regulated industries such as finance, healthcare, and manufacturing, and is known for its integration with DevOps pipelines and support for hybrid delivery environments. With a market share of over 2% in the ALM category, OpenText continues to be a trusted solution for organizations aiming to streamline software delivery and governance.

Broadcom

Broadcom (US) is a prominent player in the Application Lifecycle Management (ALM) market through its Rally® platform, a cloud-based solution that enables organizations to plan, prioritize, manage, and continuously improve software delivery across teams and projects. Rally provides visibility into progress, roadblocks, and dependencies, facilitating alignment with strategic goals and enhancing business outcomes. Additionally, Broadcom offers integrations with tools like Micro Focus ALM, supporting comprehensive test management and continuous delivery processes. These capabilities position Broadcom as a key provider of ALM solutions that support agile and DevOps methodologies, catering to enterprises aiming to streamline their software development lifecycle.

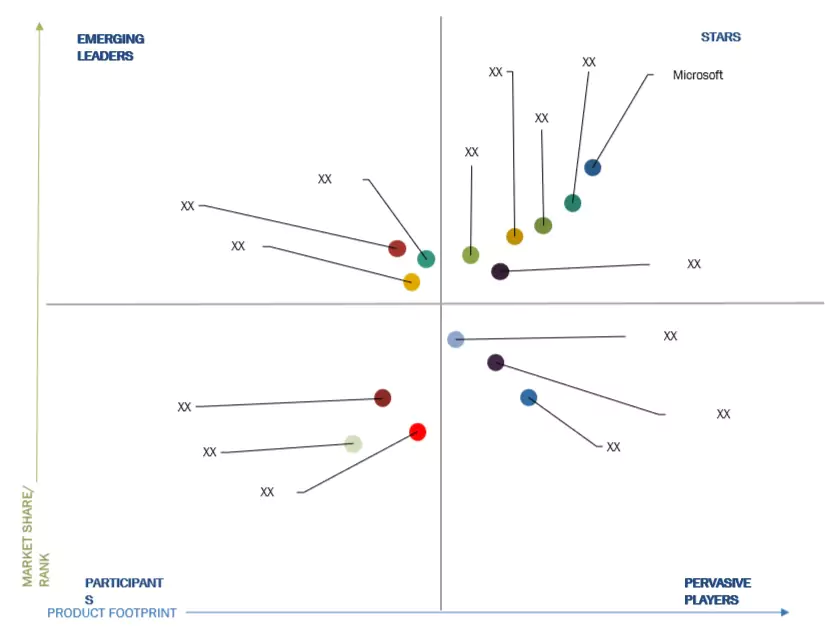

Evaluation Quadrant Matrix for Key Players

The company evaluation matrix assesses major Application Lifecycle Management providers based on product portfolio strength and business strategy excellence. Vendors are evaluated on criteria such as product range, innovation, branding, sales support, geographic presence, revenue, and R&D investment, providing a competitive leadership analysis.

Market Ranking Analysis for Key Players

The market ranking analysis was based on various factors, including the companies' breadth and depth of offerings, service delivery, and deployment across application areas. Key aspects such as delivery support, market reach, channels, and long-term viability were also considered. In addition, the companies' strategic roadmaps and inorganic growth, such as mergers and acquisitions, were factored into the evaluation. The analysis leveraged secondary research, supplemented by in-depth primary interviews with industry leaders, to ensure a comprehensive market understanding.

Related Reports:

Application Lifecycle Management Market by Offering (Software, Services), Platform (Web-based ALM, Mobile-based ALM), Deployment (On-premises, Cloud), Vertical (IT & Software development, Telecom, BFSI) - Global Forecast to 2029

Contact:

Mr. Rohan Salgarkar

MarketsandMarkets Inc.

1615 South Congress Ave.

Suite 103,

Delray Beach, FL 33445

USA : 1-888-600-6441

sales@marketsandmarkets.com

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

SEND ME A FREE SAMPLE