Zinc Oxide Market by Process (French Process, Wet Process, American Process), Grade (Standard, Treated, USP, FCC), Application (Rubber, Ceramics, Chemicals, Agriculture, Cosmetics & Personal Care, Pharmaceuticals), Region - Global Forecast to 2024

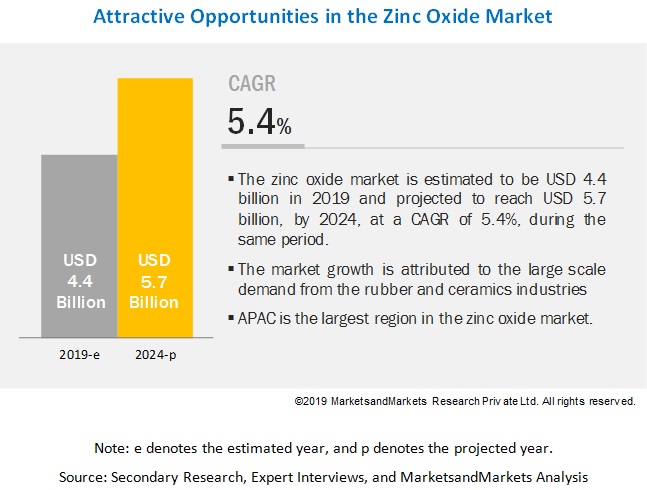

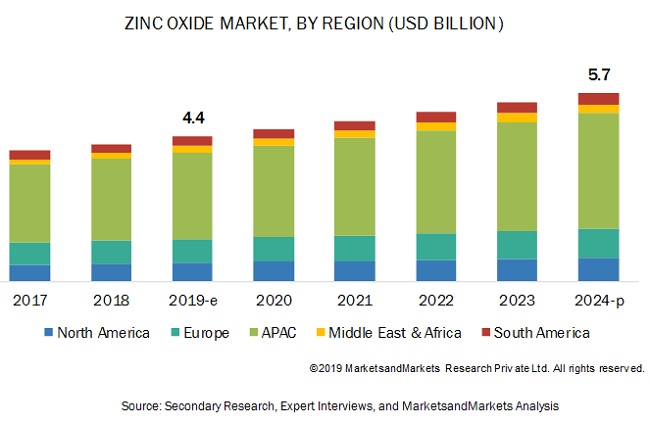

[117 Pages Report] The global zinc oxide (ZnO) market size is projected to grow from USD 4.4 billion in 2019 to USD 5.7 billion by 2024, at a compound annual growth rate (CAGR) of 5.4%, during the forecast period. ZnO is a white inorganic compound that is used widely in pharmaceuticals, rubber, ceramics cosmetics, chemicals, and glass industries. The growth of these end-use industries is expected to fuel the global zinc oxide market demand over the forecast period.

Wet chemical process is expected to be the fastest-growing process for ZnO between 2019 and 2024.

The wet chemical process is projected to grow at the fastest rate during the forecast period. ZnO Grade produced by this process are very fine in size has good dispersion and slow settling rate. Due to the more effective activation offered by the product, it is called Active ZnO, which has superior quality than the ones produced by the French process.

Rubber was the largest application of the zinc oxide market in 2018.

ZnO is used for the vulcanization of rubber to increase the durability of rubber. The tire industry further uses this vulcanized rubber for the manufacturing of tires. In 2018, the rubber industry consumed more than half of the ZnO produced around the world due to the growing production of tires. Rising demand for rubber in the tire, as well as non-tire applications, is expected to drive the demand for zinc oxide consequently.

APAC is projected to be the largest zinc oxide market during the forecast period.

APAC is estimated to lead the ZnO market during the forecast period. The region has emerged as the largest producer of ZnO. China is the dominant manufacturer and consumer of ZnO globally. The country is also the largest exporter of ZnO. A similar trend is projected to continue during the forecast period. Moreover, the presence of a large manufacturing base in the region housing several sectors, including glass, pharmaceutical, and rubber production, is expected to play a vital role in driving zinc oxide market growth in the region during the forecast period.

Key Market Players

The key players in the zinc oxide market are US Zinc (US), Zochem (US), EverZinc (Belgium), ZM Silesia (Poland), Akrochem (South Africa), Rubamin (India), Pan-Continental Chemical (Taiwan), J.G. Chemicals (India), Upper India (India), and Suraj Udyog (India). These players have strong R&D and focus on producing high-performance products to meet the demands of end-users.

US Zinc is one of the leading producers of ZnO in the world. It manufactures almost 40 different grades of ZnO, which caters to various applications such as rubber, ceramics, chemicals, and animal feed. In recent years, the developed economies such as Europe has brought in regulation which limits the use of ZnO in application like animal feed. These regulations will create an opportunity for the company in developing economies like the Middle East & Africa, which can be tapped easily due to the global reach of the company.

Scope of the report

|

Report Metric |

Details |

|

Years Considered |

20172024 |

|

Base year |

2018 |

|

Forecast period |

20192024 |

|

Units Considered |

Value (USD Million) and Volume (Ton) |

|

Segments |

Application, Grade, Process and Region |

|

Regions |

North America, South America APAC, Europe, and the Middle East and Africa |

|

Companies |

US Zinc (US), Zochem (US), EverZinc (Belgium), ZM Silesia (Poland), Akrochem (South Africa), Rubamin (India), Pan-Continental Chemical (Taiwan), J.G. Chemicals (India), Upper India (India), and Suraj Udyog (India) are the 10 key players covered. |

This research report categorizes the global ZnO market based on application, grade, process, and region.

Based on the Application:

- Rubber

- Ceramics

- Chemicals

- Agriculture

- Cosmetics and Personal Care

- Pharmaceuticals

- Others

Based on Process:

- Indirect (French) Process

- Direct (American) Process

- Wet Chemical Process

- Others

Based on Grade:

- Standard

- Treated

- USP

- FCC

- Others

Based on the region:

- North America

- South America

- Europe

- APAC

- Middle East & Africa

Key questions addressed by the report

- What was the zinc oxide market size in 2018?

- What are the global zinc oxide market trends in demand for ZnO?

- Will the market witness an increase or decline in demand in the near future?

- What were the revenue pockets for ZnO in 2018?

- Who are the key players in the global ZnO market?

Frequently Asked Questions (FAQ):

What is the importance of zinc oxide in the chemicals industry?

What are the major end-use industries for zinc oxide?

What are the factors driving the growth of the zinc oxide market?

What are the restraints faced by the manufacturers in the market?

What are the upcoming opportunities for zinc oxide manufacturers?

What is the major process used for the production of zinc oxide?

What are the different grades of zinc oxide available in the market?

Who are the major players in the zinc oxide market?

How consolidated is the zinc oxide industry?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Zinc Oxide Market Segmentation

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Supply-Side Analysis

2.2.2 Demand-Side Analysis

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Attractive Opportunities in the Zinc Oxide Market

4.2 Zinc Oxide Market in APAC

4.3 Zinc Oxide Market, By Country

5 Market Overview (Page No. - 28)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Large Scale and Growing Demand From the Rubber Industry

5.2.1.2 Lack of Suitable Alternative in the Critical Application Areas of Zinc Oxide

5.2.2 Restraints

5.2.2.1 The Slowdown in the Global Automotive Production

5.2.2.2 Fluctuation in the Price of Zinc

5.2.3 Opportunities

5.2.3.1 Growing Demand for Zinc Oxide Nanoparticles

5.2.4 Challenges

5.2.4.1 Ban on the Usage of Zinc Oxide in Various Applications

5.3 Porters Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Threat of New Entrants

5.3.3 Threat of Substitutes

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 YC, YCC Drivers

5.5 Zinc Oxide Patent Analysis

5.5.1 Inferences

5.5.2 Top Assignees

6 Zinc Oxide Market, By Process (Page No. - 36)

6.1 Introduction

6.2 Direct Process (American Process)

6.2.1 Limitations on Product Purity are Hampering the Growth of This Process in the Zinc Oxide Market

6.3 Indirect Process (French Process)

6.3.1 The French Process to Dominate the Global Zinc Oxide Market During the Forecast Period

6.4 Wet-Chemical Process

6.4.1 Zinc Oxide Manufactured By This Process is Expected to Witness A Higher Growth During the Forecast Period Due to Its Enhanced Properties

7 Zinc Oxide Market, By Grade (Page No. - 40)

7.1 Introduction

7.2 Standard Grade

7.2.1 Standard Grade Accounted for the Largest Share of the Global Zinc Oxide Market

7.3 Treated Grade

7.3.1 Treated Grade Zinc Oxide is Projected to Grow at A Relatively Slower Rate During the Forecast Period

7.4 United States Pharmacopeia (USP) Grade

7.4.1 Stringent Regulations on the Heavy Metal Content to Drive This Product Grade in the Global Market

7.5 Food and Chemical Codex (FCC) Grade

7.5.1 Regulations to Hamper the Growth of the FCC Grade in the Coming Years

7.6 Others

7.6.1 The Middle East and Africa is Expected to Be the Fastest-Growing Market for Other Grades of Zinc Oxide, in Terms of Value

8 Zinc Oxide Market, By Application (Page No. - 46)

8.1 Introduction

8.2 Rubber

8.2.1 Rubber is Expected to Be the Largest Application of Zinc Oxide

8.3 Ceramics

8.3.1 APAC is Expected to Be the Largest Market for the Ceramics Application

8.4 Chemicals

8.4.1 Growing Demand From End-Use Industries of Zinc Oxide-Based Chemicals is Expected to Drive the Market for This Application

8.5 Agriculture

8.5.1 South America is Expected to Be the Fastest-Growing Region for the Agriculture Application

8.6 Pharmaceuticals

8.6.1 Growing Awareness About the Advantages of the Use of Zinc Oxide is Expected to Drive the Market

8.7 Cosmetics and Personal Care

8.7.1 The Middle East and Africa is Expected to Be the Fastest-Growing Market for This Application During the Forecast Period

8.8 Others

8.8.1 Electrical & Electronics Application is Expected to Be the Major Driver in This Segment

9 Zinc Oxide Market, By Region (Page No. - 56)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 The US is the Largest Market for Zinc Oxide in North America

9.2.2 Canada

9.2.2.1 Automotive to Be the Dominant End-Use Industry of Zinc Oxide in Canada

9.2.3 Mexico

9.2.3.1 Growing Tire Industry to Lead the Zinc Oxide Market in Mexico

9.3 Europe

9.3.1 France

9.3.1.1 Rubber Application to Drive the Demand for Zinc Oxide in France

9.3.2 UK

9.3.2.1 The Demand for Zinc Oxide is Projected to Be Slow During the Forecast Period

9.3.3 Russia

9.3.3.1 Growing Tire Manufacturing to Drive the Demand for Zinc Oxide in the Country

9.3.4 Germany

9.3.4.1 Stagnant Demand From the Application Areas is Affecting the Growth of the Zinc Oxide Market in the Country

9.3.5 Italy

9.3.5.1 Growth of Zinc Oxide Market Will Be Driven By the Tire Industry

9.3.6 Spain

9.3.6.1 Slow Growth in the Manufacturing of Tire and Ceramic Products Will Affect the Market for Zinc Oxide

9.3.7 Rest of Europe

9.4 APAC

9.4.1 China

9.4.1.1 China is the Largest Market for Zinc Oxide in APAC

9.4.2 India

9.4.2.1 Increase in Demand for Tires is Expected to Drive the Market for Zinc Oxide

9.4.3 Japan

9.4.3.1 Japan is the Second-Largest Market for Zinc Oxide in the Region

9.4.4 Rest of APAC

9.4.4.1 Increasing Demand From Countries in the Region Will Drive the Market

9.5 Middle East & Africa

9.5.1 South Africa

9.5.1.1 Increasing Investment to Drive the Demand for Zinc Oxide During the Forecast Period

9.5.2 Iran

9.5.2.1 Investment in Tire Manufacturing to Drive the Demand for Zinc Oxide in Iran During the Forecast Period

9.5.3 UAE

9.5.3.1 Setting Up of Greenfield Plant for Tire Production Will Drive the Market for Zinc Oxide During the Forecast Period

9.5.4 Rest of Middle East & Africa

9.5.4.1 Investment in Rubber and Ceramic Industries By the Government is Expected to Drive the Market During the Forecast Period

9.6 South America

9.6.1 Brazil

9.6.1.1 The Growing Capacity of Tire Production Will Drive the Market

9.6.2 Argentina

9.6.2.1 Economic Difficulties are Expected to Hinder the Growth of the Market

9.6.3 Rest of South America

9.6.3.1 Zinc Oxide Market in This Region is Projected to Grow at A Relatively Slow Rate During the Forecast Period

10 Company Profiles (Page No. - 94)

(Business Overview, Products Offered, Recent Developments, and Winning Imperative)*

10.1 US Zinc

10.2 Zochem

10.3 Everzinc

10.4 ZM Silesia SA

10.5 Lanxess

10.6 Akrochem Corporation

10.7 Rubamin

10.8 Pan-Continental Chemical

10.9 J.G. Chemicals

10.10 Upper India

10.11 Suraj Udyog

* Business Overview, Products Offered, Recent Developments, and Winning Imperative Might Not Be Captured in Case of Unlisted Companies.

10.12 Other Key Players

10.12.1 Global Chemical Company Ltd.

10.12.2 American Zinc Recycling

10.12.3 Arabian Zinc

10.12.4 Uttam Industries

10.12.5 L. BrόggeMann GmbH

10.12.6 Silox

10.12.7 Seyang

10.12.8 Nahar Zinc Oxide

10.12.9 Weifang Longda Zinc Industry

10.12.10 Norzinco

11 Appendix (Page No. - 112)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Related Reports

11.4 Author Details

List of Tables (104 Tables)

Table 1 Zinc Oxide Market Size, By Process, 20172024 (Ton)

Table 2 Zinc Oxide Market Size, By Process, 20172024 (USD Million)

Table 3 Zinc Oxide Market Size, By Grade, 20172024 (Ton)

Table 4 Zinc Oxide Market Size, By Grade, 20172024 (USD Million)

Table 5 Standard Grade Zinc Oxide Market Size, By Region, 20172024 (Ton)

Table 6 Standard Grade Zinc Oxide Market Size, By Region, 20172024 (USD Million)

Table 7 Treated Grade Zinc Oxide Market Size, By Region, 20172024 (Ton)

Table 8 Treated Grade Zinc Oxide Market Size, By Region, 20172024 (USD Million)

Table 9 USP Grade Zinc Oxide Market Size, By Region, 20172024 (Ton)

Table 10 USP Grade Zinc Oxide Market Size, By Region, 20172024 (USD Million)

Table 11 FCC Grade Zinc Oxide Market Size, By Region, 20172024 (Ton)

Table 12 FCC Grade Zinc Oxide Market Size, By Region, 20172024 (USD Million)

Table 13 Other Zinc Oxide Grades Market Size, By Region, 20172024 (Ton)

Table 14 Other Zinc Oxide Grades Market Size, By Region, 20172024 (USD Million)

Table 15 Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 16 Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 17 Zinc Oxide Market Size in Rubber Application, By Region, 20172024 (Ton)

Table 18 Zinc Oxide Market Size in Rubber Application, By Region, 20172024 (USD Million)

Table 19 Zinc Oxide Market Size in Ceramics Application, By Region, 20172024 (Ton)

Table 20 Zinc Oxide Market Size in Ceramics Application, By Region, 20172024 (USD Million)

Table 21 Zinc Oxide Market Size in Chemicals Application, By Region, 20172024 (Ton)

Table 22 Zinc Oxide Market Size in Chemicals Application, By Region, 20172024 (USD Million)

Table 23 Zinc Oxide Market Size in Agriculture Application, By Region, 20172024 (Ton)

Table 24 Zinc Oxide Market Size in Agriculture Application, By Region, 20172024 (USD Million)

Table 25 Zinc Oxide Market Size in Pharmaceuticals Application, By Region, 20172024 (Ton)

Table 26 Zinc Oxide Market Size in Pharmaceuticals Application, By Region, 20172024 (USD Million)

Table 27 Zinc Oxide Market Size in Cosmetics and Personal Care Application, By Region, 20172024 (Ton)

Table 28 Zinc Oxide Market Size in Cosmetics and Personal Care Application, By Region, 20172024 (USD Million)

Table 29 Zinc Oxide Market Size in Other Applications, By Region, 20172024 (Ton)

Table 30 Zinc Oxide Market Size in Other Applications, By Region, 20172024 (USD Million)

Table 31 Zinc Oxide Market Size, By Region, 20172024 (Ton)

Table 32 Zinc Oxide Market Size, By Region, 20172024 (USD Million)

Table 33 North America: Zinc Oxide Market Size, By Country, 20172024 (Ton)

Table 34 North America: Zinc Oxide Market Size, By Country, 20172024 (USD Million)

Table 35 North America: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 36 North America: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 37 North America: Zinc Oxide Market Size, By Grade, 20172024 (Ton)

Table 38 North America: Zinc Oxide Market Size, By Grade, 20172024 (USD Million)

Table 39 US: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 40 US: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 41 Canada: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 42 Canada: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 43 Mexico: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 44 Mexico: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 45 Europe: Zinc Oxide Market Size, By Country, 20172024 (Ton)

Table 46 Europe: Zinc Oxide Market Size, By Country, 20172024 (USD Million)

Table 47 Europe: Zinc Oxide Market Size, By Grade, 20172024 (Ton)

Table 48 Europe: Zinc Oxide Market Size, By Grade, 20172024 (USD Million)

Table 49 Europe: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 50 Europe: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 51 France: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 52 France: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 53 UK: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 54 UK: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 55 Russia: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 56 Russia: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 57 Germany: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 58 Germany: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 59 Italy: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 60 Italy: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 61 Spain: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 62 Spain: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 63 Rest of Europe: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 64 Rest of Europe: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 65 APAC: Zinc Oxide Market Size, By Country, 20172024 (Ton)

Table 66 APAC: Zinc Oxide Market Size, By Country, 20172024 (USD Million)

Table 67 APAC: Zinc Oxide Market Size, By Grade, 20172024 (Ton)

Table 68 APAC: Zinc Oxide Market Size, By Grade, 20172024 (USD Million)

Table 69 APAC: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 70 APAC: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 71 China: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 72 China: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 73 India: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 74 India: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 75 Japan: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 76 Japan: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 77 Rest of APAC: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 78 Rest of APAC: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 79 Middle East & Africa: Zinc Oxide Market Size, By Country, 20172024 (Ton)

Table 80 Middle East & Africa: Zinc Oxide Market Size, By Country, 20172024 (USD Million)

Table 81 Middle East & Africa: Zinc Oxide Market Size, By Grade, 20172024 (Ton)

Table 82 Middle East & Africa: Zinc Oxide Market Size, By Grade, 20172024 (USD Million)

Table 83 Middle East & Africa: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 84 Middle East & Africa: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 85 South Africa: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 86 South Africa: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 87 Iran: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 88 Iran: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 89 UAE: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 90 UAE: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 91 Rest of Middle East & Africa: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 92 Rest of Middle East & Africa: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 93 South America: Zinc Oxide Market Size, By Country, 20172024 (Ton)

Table 94 South America: Zinc Oxide Market Size, By Country, 20172024 (USD Million)

Table 95 South America: Zinc Oxide Market Size, By Grade, 20172024 (Ton)

Table 96 South America: Zinc Oxide Market Size, By Grade, 20172024 (USD Million)

Table 97 South America: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 98 South America: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 99 Brazil: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 100 Brazil: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 101 Argentina: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 102 Argentina: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

Table 103 Rest of South America: Zinc Oxide Market Size, By Application, 20172024 (Ton)

Table 104 Rest of South America: Zinc Oxide Market Size, By Application, 20172024 (USD Million)

List of Figures (28 Figures)

Figure 1 Zinc Oxide Market: Research Design

Figure 2 Market Size Estimation: Supply-Side Analysis

Figure 3 Market Size Estimation: Regional Perspective

Figure 4 Market Size Estimation: Demand-Side Analysis

Figure 5 Market Size Estimation: Methodology for Calculating the Value Market

Figure 6 Zinc Oxide Market: Data Triangulation

Figure 7 Indirect Process (French Process) Accounted for the Largest Share in the Zinc Oxide Market in 2018

Figure 8 Rubber Application to Dominate the Zinc Oxide Market During the Forecast Period

Figure 9 Middle East & Africa to Be the Fastest-Growing Market for Zinc Oxide

Figure 10 Increasing Demand From APAC to Drive the Zinc Oxide Market

Figure 11 Rubber Application and China Accounted for the Largest Shares in the Zinc Oxide Market in APAC in 2018

Figure 12 India to Grow at the Highest Rate During the Forecast Period

Figure 13 Overview of Factors Governing the Zinc Oxide Market

Figure 14 Porters Five Forces Analysis

Figure 15 YC, YCC Shift

Figure 16 Publication Trends in the Last 5 Years (20152019)

Figure 17 Patent Analysis, Share By Country

Figure 18 Patent Applications, By Top Applicants

Figure 19 Zinc Oxide Manufacturing Processes

Figure 20 Indirect Process (French Process) to Dominate the Zinc Oxide Market During the Forecast Period

Figure 21 Standard Grade to Lead the Zinc Oxide Market During the Forecast Period

Figure 22 Rubber Accounted for the Largest Application for Zinc Oxide

Figure 23 APAC to Lead the Global Zinc Oxide Market

Figure 24 North America: Zinc Oxide Market Snapshot

Figure 25 Europe: Zinc Oxide Market Snapshot

Figure 26 APAC: Zinc Oxide Market Snapshot

Figure 27 ZM Silesia: Company Snapshot

Figure 28 Lanxess: Company Snapshot

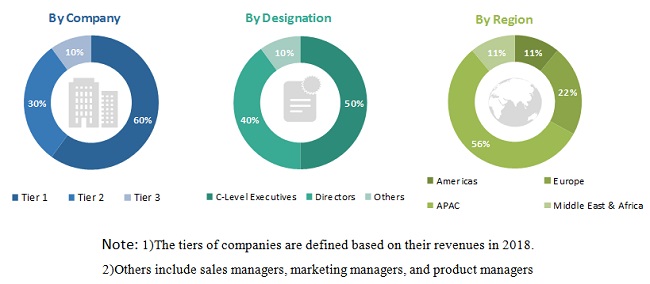

The study involves four major activities in estimating the current market size of ZnO. Exhaustive secondary research was done to collect information related to the ZnO market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The ZnO market comprises several stakeholders, such as raw material suppliers, technology developers, derivatives manufacturers, and regulatory organizations in the supply chain. The development of application usage characterizes the demand side of this market. The supply side is characterized by advancements in technology and diverse application segments. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global ZnO market and to estimate the sizes of various other dependent submarkets. The research methodology used to estimate the market size included the following steps:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value and volume, were determined through primary and secondary research.

- All percentage split and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of the key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After arriving at the overall market size from the process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable. To complete the overall market estimation process and arrive at the exact statistics for all segments and sub-segments. Data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches

Report Objectives

- To define, describe, and forecast the market size of ZnO, in terms of value and volume

- To provide information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the ZnO market size based on application, grade, and process.

- To forecast the market size of different segments with respect to four regions, namely, APAC, Europe, North America, South America, and the Middle East and Africa.

- To forecast the ZnO market size of different segments with respect to key countries of each region

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their growth strategies

The market is analyzed further for the key countries in each of these regions.

Available Customizations:

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data. The following customization options are available for the report:

Regional Analysis:

- Further breakdown of a region with respect to a particular country

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Product Analysis

- Product Matrix that gives a detailed comparison of product portfolio of each company

Growth opportunities and latent adjacency in Zinc Oxide Market