Wood Bio-Products Market by Type (Finished Wood Product, Manufactured Wood Material, Wood Processing), Distribution Channel (Online, Offline), Application (Residential, Commercial), And Region (Asia Pacific, North America) - Global Forecast to 2028

Wood Bio-Products Market

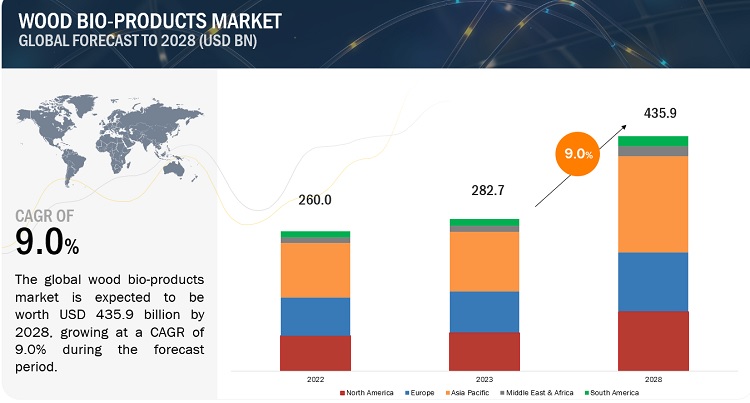

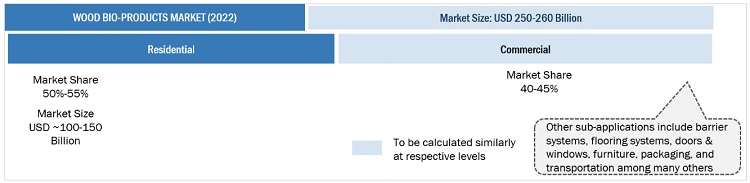

The global wood bio-products market was valued at USD 260.0 billion in 2022 and is projected to reach USD 435.9 billion by 2028, growing at a cagr 9.0% from 2023 to 2028. The demand for wood bio-products is being driven by the increasing awareness of the environmental benefits of using manufactured wood products is a significant driver for the market. Consumers are becoming more aware of the impact of their choices on the environment and are increasingly choosing eco-friendly products. The manufacturing process of engineered wood products uses smaller-diameter logs and wood waste, reducing the amount of waste that goes to landfills. This eco-friendly aspect of manufactured wood products is particularly appealing to environmentally conscious consumers, architects, and builders, thus driving demand for these products.

Global Wood Bio-Products Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Wood Bio-Products Market Dynamics

Driver: Growing preference for engineered wood products over traditional solid wood due to their dimensional stability and cost-effectiveness

Engineered wood products are becoming increasingly popular in the construction industry due to their numerous advantages over traditional solid wood products. One of the main advantages is their superior dimensional stability, which means that they are less prone to warping, twisting, or splitting when exposed to moisture and temperature changes. This makes them a more reliable and long-lasting option for flooring, structural support, and other applications.

In addition, engineered wood products are often more cost-effective than traditional solid wood products, as they are made from lower-grade wood and can be manufactured in large quantities using advanced production techniques. This makes them a more affordable option for both residential and commercial construction projects.

Restraint: Competition from other materials, such as plastics, metals, and concrete

Competition from other materials is one of the primary restraints experienced by the Wood Bioproducts Industry. There are various materials that can serve as alternatives to wood bio-products, such as plastics, metals, and concrete. These materials can be produced at a lower cost and may offer similar or superior properties to wood bio-products, which can limit the growth of the market. For example, plastics have been widely used in the packaging industry due to their low cost, durability, and ease of manufacturing. Similarly, metals are widely used in the construction industry due to their strength and durability. Concrete is another widely used material that is highly durable and cost-effective.

In addition to these traditional materials, emerging sustainable materials such as bamboo and hemp are also competing with wood bio-products. These materials offer similar or superior properties to wood bio-products and can be produced at a lower cost, which can limit the growth of the market.

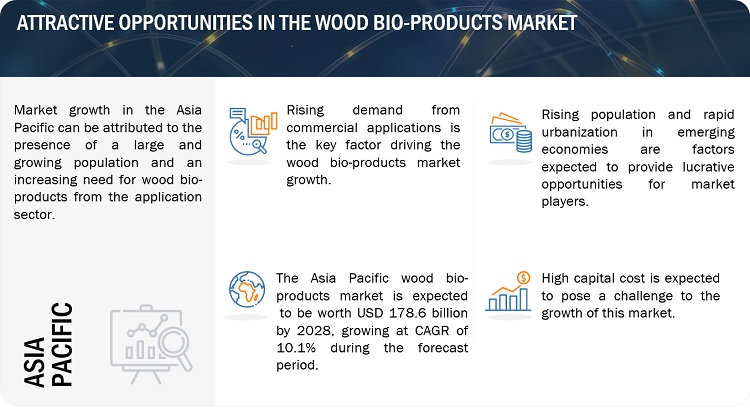

Opportunity: Expansion into emerging markets

The demand for wood bio-products is not limited to developed countries. Emerging markets, such as China and India, are also experiencing growth in demand for sustainable products. This creates opportunities for companies to expand their operations and reach new customers.

The Asia Pacific region is expected to be a key driver of demand for wood bio-products in the coming years due to rapid urbanization and infrastructure development in countries such as China and India. There is also increasing interest in sustainable and eco-friendly materials in this region, which could drive demand for wood bio-products.

Latin America is home to some of the world's largest and most diverse forests, which could offer significant opportunities for the wood bio-products market. In addition, there is a growing demand for sustainable and renewable materials in countries such as Brazil and Mexico, which could drive the demand for wood bio-products.

Challenges: High capital cost

One of the major challenges for the wood bio-products market is the high capital cost required for setting up manufacturing facilities. The production of wood bio-products requires specialized equipment and processes, which can be expensive to install and maintain. For example, the production of engineered wood products, such as cross-laminated timber, requires specialized equipment and facilities that can be costly to set up.

Wood Bio-Products Market: Ecosystem

By type, finished wood product is estimated to be the largest segment during the forecast period in the wood bio-products market

The construction and housing sectors are significant drivers of the demand for finished wood products. As economies grow and urbanization continues, there is a greater need for residential and commercial buildings, leading to increased demand for wood products such as flooring, doors, windows, and furniture. In addition, the proliferation of e-commerce platforms has facilitated the global trade of finished wood products. Consumers have access to a wide range of wood products from different regions, expanding the market and increasing overall demand. E-commerce platforms have also made it easier for small and medium-sized wood product manufacturers to reach a broader customer base.

By distribution channel, offline is estimated to be the largest segment during the forecast period

Wood bio-products are often considered high-value items, and customers prefer to inspect the quality, texture, and finish before making a purchase. Offline distribution channels, such as physical retail stores, provide customers with the opportunity to see, touch, and feel wood products, which enhances their buying experience and instills confidence in the product's quality. The wood bio-products market has long-standing relationships with offline distribution channels, including wholesalers, retailers, and distributors. These relationships have been built over time, and there is a level of trust and reliability between manufacturers and the offline channel partners. Manufacturers often rely on these established networks to reach a wider customer base and maintain consistent sales volumes.

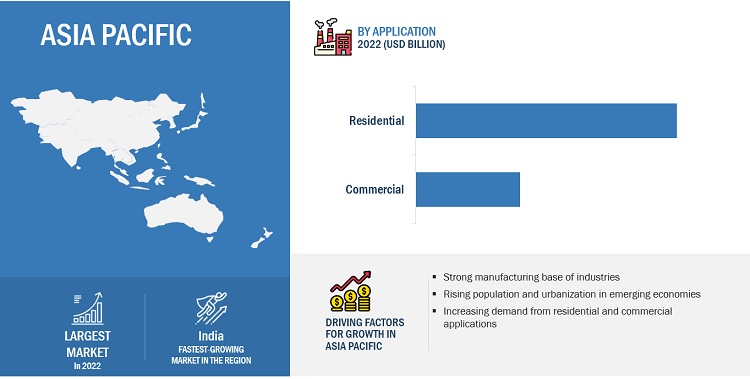

Asia Pacific is projected to be the largest and fastest growing amongst other regions in the wood bio-products market, in terms of value

The Asia Pacific region has been experiencing significant economic growth, with countries like China, India, and Southeast Asian nations driving this expansion. Economic growth translates into increased construction activities, infrastructure development, and urbanization, leading to a surge in demand for wood bio-products in various applications, including building materials, furniture, and interior decor.

In addition, the Asia Pacific region has witnessed significant developments in its wood processing industry. There has been a rise in the establishment of sawmills, plywood mills, and other wood processing facilities. This expansion supports local manufacturing capabilities, enhances supply chain efficiency, and fosters the growth of the wood bio-products market in the region.

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in the wood bio-products market include UPM-Kymmene Corporation (Finland), Stora Enso (Finland), Lixil Group (Japan), West Fraser (Canada), Weyerhaeuser (US), UFP Industries Inc. (US), Canfor (Canada), Sappi (South Africa), Metsä Group (Finland), and JELD-WEN (US) among others. The wood bio-products market report analyzes the key growth strategies, such as new product launches, expansions, agreements, and acquisitions adopted by the leading market players between 2018 and 2022.

Wood Bio-Products Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2019-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Billion) |

|

Segments |

Type, Distribution Channel, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

UPM-Kymmene Corporation (Finland), Stora Enso (Finland), Lixil Group (Japan), West Fraser (Canada), Weyerhaeuser (US), UFP Industries Inc. (US), Canfor (Canada), Sappi (South Africa), Metsä Group (Finland), and JELD-WEN (US) among others are the key players in the market. |

This report categorizes the global wood bio-products market based on type, distribution channel, application, and region.

On the basis of type, the wood bio-products market has been segmented as follows:

- Finished Wood Product

- Manufactured Wood Material

- Wood Processing

On the basis of distribution channel, the wood bio-products market has been segmented as follows:

- Online

- Offline

On the basis of application, the wood bio-products market has been segmented as follows:

-

Residential

- Barrier Systems

- Flooring Systems

- Lumber

- Roof Sheath

- Doors & Windows

- Other Residential Applications

-

Commercial

- Furniture

- Packaging

- Stationary

- Utensils & Hand tools

- Transportation

- Artwork

- Musical Instruments

- Toys

- Other Commercial Applications

On the basis of region, the wood bio-products market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In October 2022, UFP Industries launched wood composite decking under deckorators brand. Deckorators produces deck railing, composite decking, balusters, and post caps. It helped UFP Industries Inc. to provide affordable, low maintenance and distinctive wood composite decking.

- In December 2022, Lixil Group acquired Basco on 14 December 2022. Basco is a leading manufacturer of showers and has a strong presence in the Southeast, Midwest, and East Coast regions. Through this acquisition, Lixil Group has expanded its reach in bathroom products.

- In December 2022, Weyerhaeuser partnered with American Forests. This partnership helped American Forests' Tree Equity program to expand into smaller communities & provide environmental education to the urban youth. This program helped Weyerhaeuser to address the differences in tree canopy coverage in three communities where Weyerhaeuser resides and worked.

Frequently Asked Questions (FAQ):

What is the current size of the global wood bio-products market?

Global wood bio-products market size is estimated to reach USD 435.9 billion by 2028 from USD 260.0 billion in 2022, at a CAGR of 9.0% during the forecast period.

Who are the winners in the global wood bio-products market?

Companies such as UPM-Kymmene Corporation (Finland), Stora Enso (Finland), Lixil Group (Japan), West Fraser (Canada), Weyerhaeuser (US), UFP Industries Inc. (US), Canfor (Canada), Sappi (South Africa), Metsä Group (Finland), and JELD-WEN (US) among others. They have the potential to broaden their product portfolio and compete with other key market players.

What are some of the drivers in the market?

Growing demand for furniture and flooring products in both residential and commercial sectors, rise in construction industry, particularly in emerging economies, and growing preference for engineered wood products over traditional solid wood due to their dimensional stability and cost-effectiveness drives the market.

Which segment on the basis of application is expected to garner the highest traction within the wood bio-products market?

Based on application, residential segment held the largest share of the wood bio-products market in 2022.

What are some of the strategies adopted by the top market players to penetrate emerging regions?

The major players in the market use new product launches, expansions, agreements, and acquisitions as important growth tactics. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

- 5.2 IMPACT OF RECESSION

-

5.3 MARKET DYNAMICSDRIVERS- Growing demand for furniture and flooring products in both residential and commercial sectors- Rise in construction industry, particularly in emerging economies- Growing preference for engineered wood products over traditional solid wood due to their dimensional stability and cost-effectiveness- Increasing awareness about environmental benefits of using manufactured wood productsRESTRAINTS- Fluctuating raw material prices- Environmental concerns- Competition from other materials, such as plastics, metals, and concreteOPPORTUNITIES- Advancements in technology- Expansion into emerging marketsCHALLENGES- Availability of raw materials- High capital cost

-

5.4 VALUE CHAINFOREST RESERVESRAW MATERIAL SUPPLIERS/MANUFACTURERSDISTRIBUTORSEND USERS

-

5.5 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESDEGREE OF COMPETITION

-

5.6 MACROECONOMIC INDICATORSGLOBAL GDP TRENDS

-

5.7 TARIFFS & REGULATIONSREGULATIONS- US- European Union- Australia- CITES (Global regulatory framework)- The Forest Stewardship Council (Global non-profit organization)- The Program for the Endorsement of Forest Certification (Global system for forest management)

-

5.8 TRADE ANALYSISIMPORT-EXPORT TRADE ANALYSIS

-

5.9 KEY CONFERENCES & EVENTS IN 2023–2024

- 5.10 TECHNOLOGY ANALYSIS

-

5.11 CASE STUDIESUSAGE OF WOOD TO CONSTRUCT MID-RISE BUILDINGSBUILDING CONCEPTS DEVELOPED BY STORA ENSO

-

5.12 PRICING ANALYSISAVERAGE SELLING PRICE, BY REGIONAVERAGE SELLING PRICE, BY TYPEAVERAGE SELLING PRICE, BY COMPANY

-

5.13 ECOSYSTEM MAPPING

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

-

5.15 KEY FACTORS AFFECTING BUYING DECISIONPRICESUSTAINABILITYBRAND REPUTATIONAVAILABILITY AND DELIVERYCUSTOMER SERVICE

-

5.16 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEPUBLICATION TRENDS – LAST 10 YEARSINSIGHTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS

- 6.1 INTRODUCTION

-

6.2 FINISHED WOOD PRODUCTGROWING DEMAND FOR SUSTAINABLY SOURCED AND ENVIRONMENTALLY FRIENDLY PRODUCTS

-

6.3 MANUFACTURED WOOD MATERIALSEVERAL ADVANTAGES OVER NATURAL SOLID WOOD TO DRIVE DEMAND

-

6.4 WOOD PROCESSINGEXPANSION OF CONSTRUCTION INDUSTRY

- 7.1 INTRODUCTION

- 7.2 ONLINE

- 7.3 OFFLINE

- 8.1 INTRODUCTION

-

8.2 RESIDENTIALBARRIER SYSTEMSFLOORING SYSTEMSROOF SHEATHDOORS & WINDOWSOTHER RESIDENTIAL APPLICATIONS

-

8.3 COMMERCIALFURNITUREPACKAGINGSTATIONERYUTENSILS & HAND TOOLSTRANSPORTATIONARTWORKMUSICAL INSTRUMENTSTOYSOTHER COMMERCIAL APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICCHINA- Growing construction industry fueling demand for wood bio-productsJAPAN- Manufactured wood material to drive Japanese marketINDIA- Construction industry to drive demand for wood bio-productsSOUTH KOREA- South Korea is a leading exporter of wood bio-products in Asia PacificREST OF ASIA PACIFIC

-

9.3 NORTH AMERICAUS- US to be dominant manufacturer and consumer of wood bio-productsCANADA- Rapidly growing construction industry to drive demandMEXICO- Residential construction to drive demand for wood bio-products

-

9.4 EUROPEGERMANY- Furniture industry major driving force for growthUK- Furniture and construction industries to fuel demand for wood bio-productsFRANCE- Furniture industry to boost growth of wood bio-products marketSPAIN- Wood processing industry to be dominant end user of wood bio-productsITALY- Manufacturing industry driving force for wood bio-products marketREST OF EUROPE

-

9.5 MIDDLE EAST & AFRICASAUDI ARABIA- Construction industry to drive growth of wood bio-productsSOUTH AFRICA- Furniture industry driving demand for wood bio-productsUAE- UAE investing heavily in infrastructure projectsREST OF MIDDLE EAST & AFRICA- Construction industry driving demand for wood bio-products

-

9.6 SOUTH AMERICABRAZIL- Domestic demand, particularly from construction and furniture industries, to drive marketARGENTINA- Strong tradition of forest management and sustainable forestry practicesREST OF SOUTH AMERICA

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 MARKET EVALUATION FRAMEWORK

- 10.4 REVENUE ANALYSIS

- 10.5 RANKING OF KEY PLAYERS

- 10.6 MARKET SHARE ANALYSIS

-

10.7 COMPANY EVALUATION MATRIX (TIER 1)STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

- 10.8 STRENGTH OF PRODUCT PORTFOLIO FOR TIER 1 COMPANIES, 2022

- 10.9 BUSINESS STRATEGY EXCELLENCE FOR TIER 1 COMPANIES, 2022

-

10.10 COMPANY EVALUATION MATRIX (START-UPS AND SMES)PROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 10.11 STRENGTH OF PRODUCT PORTFOLIO (START-UPS AND SMES)

- 10.12 BUSINESS STRATEGY EXCELLENCE (START-UPS AND SMES)

-

10.13 COMPETITIVE BENCHMARKINGCOMPANY SOURCE FOOTPRINTCOMPANY APPLICATION FOOTPRINTCOMPANY REGION FOOTPRINTCOMPANY FOOTPRINT

-

10.14 COMPETITIVE SITUATIONS AND TRENDSPRODUCT LAUNCHES/DEVELOPMENTSDEALSOTHERS

-

11.1 KEY PLAYERSUPM-KYMMENE CORPORATION- Business overview- Products offered- Recent developments- MnM viewSTORA ENSO- Business overview- Products offered- Recent developments- MnM viewLIXIL GROUP- Business overview- Products offered- Recent developments- MnM viewWEST FRASER- Business overview- Products offered- Recent developments- MnM viewWEYERHAEUSER COMPANY- Business overview- Products offered- Recent developments- MnM viewUFP INDUSTRIES INC.- Business overview- Products offered- Recent developments- MnM viewCANFOR- Business overview- Products offered- Recent developments- MnM viewSAPPI- Business overview- Products offered- Recent developments- MnM viewMETSÄ GROUP- Business overview- Products offered- Recent developments- MnM viewJELD-WEN INC.- Business overview- Products offered- Recent developments- MnM view

-

11.2 OTHER PLAYERSBILLERUD AMERICAS CORPORATIONDOMTAR CORPORATIONGUANGDONG WEIHUA CORPORATIONSUZANOSVENSKA CELLULOSA AKTIEBOLAGETRAYONIER ADVANCED MATERIALS INC.ENVIVA INC.GEORGIA-PACIFICSÖDRA SKOGSUDDENVIRU KEEMIA GRUPPMERCER INTERNATIONAL INC.KLABIN S.A.EKMAN & CO ABHOLZINDUSTRIE SCHWEIGHOFER TIMBER GROUPKRUGER INC.

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS & EXCLUSIONS

- TABLE 2 WOOD BIO-PRODUCTS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 TRENDS OF PER CAPITA GDP (USD), BY COUNTRY, 2020–2022

- TABLE 4 GDP GROWTH ESTIMATE AND PROJECTION OF KEY COUNTRIES, 2023–2027

- TABLE 5 COUNTRY-WISE IMPORT TRADE (USD THOUSAND) FOR HS 4407

- TABLE 6 COUNTRY-WISE EXPORT TRADE (USD THOUSAND) FOR HS 4407

- TABLE 7 WOOD BIO-PRODUCTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 8 AVERAGE SELLING PRICE, BY TYPE (USD/TON)

- TABLE 9 AVERAGE SELLING PRICE, BY COMPANY (USD/TON)

- TABLE 10 LIST OF PATENTS BY WEYERHAEUSER CO

- TABLE 11 TOP 10 PATENT OWNERS IN LAST 10 YEARS

- TABLE 12 WOOD BIO-PRODUCTS MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 13 WOOD BIO-PRODUCTS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 14 WOOD BIO-PRODUCTS MARKET, BY TYPE, 2019–2022 (TON)

- TABLE 15 WOOD BIO-PRODUCTS MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 16 WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (USD BILLION)

- TABLE 17 WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD BILLION)

- TABLE 18 WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (TON)

- TABLE 19 WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (TON)

- TABLE 20 WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 21 WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 22 WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 23 WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 24 WOOD BIO-PRODUCTS MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 25 WOOD BIO-PRODUCTS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 26 WOOD BIO-PRODUCTS MARKET, BY REGION, 2019–2022 (TON)

- TABLE 27 WOOD BIO-PRODUCTS MARKET, BY REGION, 2023–2028 (TON)

- TABLE 28 ASIA PACIFIC: WOOD BIO-PRODUCTS MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 29 ASIA PACIFIC: WOOD BIO-PRODUCTS, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 30 ASIA PACIFIC: WOOD BIO-PRODUCTS MARKET, BY COUNTRY, 2019–2022 (TON)

- TABLE 31 ASIA PACIFIC: WOOD BIO-PRODUCTS, BY COUNTRY, 2023–2028 (TON)

- TABLE 32 ASIA PACIFIC: WOOD BIO-PRODUCTS MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 33 ASIA PACIFIC: WOOD BIO-PRODUCTS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 34 ASIA PACIFIC: WOOD BIO-PRODUCTS MARKET, BY TYPE, 2019–2022 (TON)

- TABLE 35 ASIA PACIFIC: WOOD BIO-PRODUCTS MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 36 ASIA PACIFIC: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 37 ASIA PACIFIC: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 38 ASIA PACIFIC: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 39 ASIA PACIFIC: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 40 ASIA PACIFIC: WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (USD BILLION)

- TABLE 41 ASIA PACIFIC: WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD BILLION)

- TABLE 42 ASIA PACIFIC: WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (TON)

- TABLE 43 ASIA PACIFIC: WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (TON)

- TABLE 44 CHINA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 45 CHINA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 46 CHINA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 47 CHINA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 48 JAPAN: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 49 JAPAN: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 50 JAPAN: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 51 JAPAN: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 52 INDIA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 53 INDIA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 54 INDIA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 55 INDIA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 56 SOUTH KOREA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 57 SOUTH KOREA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 58 SOUTH KOREA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 59 SOUTH KOREA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 60 REST OF ASIA PACIFIC: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 61 REST OF ASIA PACIFIC: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 62 REST OF ASIA PACIFIC: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 63 REST OF ASIA PACIFIC: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 64 NORTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 65 NORTH AMERICA: WOOD BIO-PRODUCTS, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 66 NORTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY COUNTRY, 2019–2022 (TON)

- TABLE 67 NORTH AMERICA: WOOD BIO-PRODUCTS, BY COUNTRY, 2023–2028 (TON)

- TABLE 68 NORTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 69 NORTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 70 NORTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY TYPE, 2019–2022 (TON)

- TABLE 71 NORTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 72 NORTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 73 NORTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 74 NORTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 75 NORTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 76 NORTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (USD BILLION)

- TABLE 77 NORTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD BILLION)

- TABLE 78 NORTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (TON)

- TABLE 79 NORTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (TON)

- TABLE 80 US: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 81 US: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 82 US: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 83 US: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 84 CANADA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 85 CANADA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 86 CANADA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 87 CANADA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 88 MEXICO: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 89 MEXICO: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 90 MEXICO: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 91 MEXICO: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 92 EUROPE: WOOD BIO-PRODUCTS MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 93 EUROPE: WOOD BIO-PRODUCTS, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 94 EUROPE: WOOD BIO-PRODUCTS MARKET, BY COUNTRY, 2019–2022 (TON)

- TABLE 95 EUROPE: WOOD BIO-PRODUCTS, BY COUNTRY, 2023–2028 (TON)

- TABLE 96 EUROPE: WOOD BIO-PRODUCTS MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 97 EUROPE: WOOD BIO-PRODUCTS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 98 EUROPE: WOOD BIO-PRODUCTS MARKET, BY TYPE, 2019–2022 (TON)

- TABLE 99 EUROPE: WOOD BIO-PRODUCTS MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 100 EUROPE: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 101 EUROPE: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 102 EUROPE: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 103 EUROPE: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 104 EUROPE: WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (USD BILLION)

- TABLE 105 EUROPE: WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD BILLION)

- TABLE 106 EUROPE: WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (TON)

- TABLE 107 EUROPE: WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (TON)

- TABLE 108 GERMANY: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 109 GERMANY: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 110 GERMANY: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 111 GERMANY: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 112 UK: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 113 UK: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 114 UK: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 115 UK: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 116 FRANCE: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 117 FRANCE: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 118 FRANCE: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 119 FRANCE: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 120 SPAIN: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 121 SPAIN: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 122 SPAIN: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 123 SPAIN: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 124 ITALY: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 125 ITALY: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 126 ITALY: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 127 ITALY: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 128 REST OF EUROPE: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 129 REST OF EUROPE: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 130 REST OF EUROPE: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 131 REST OF EUROPE: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 132 MIDDLE EAST & AFRICA: WOOD BIO-PRODUCTS MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 133 MIDDLE EAST & AFRICA: WOOD BIO-PRODUCTS, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 134 MIDDLE EAST & AFRICA: WOOD BIO-PRODUCTS MARKET, BY COUNTRY, 2019–2022 (TON)

- TABLE 135 MIDDLE EAST & AFRICA: WOOD BIO-PRODUCTS, BY COUNTRY, 2023–2028 (TON)

- TABLE 136 MIDDLE EAST & AFRICA: WOOD BIO-PRODUCTS MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 137 MIDDLE EAST & AFRICA: WOOD BIO-PRODUCTS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 138 MIDDLE EAST & AFRICA: WOOD BIO-PRODUCTS MARKET, BY TYPE, 2019–2022 (TON)

- TABLE 139 MIDDLE EAST & AFRICA: WOOD BIO-PRODUCTS MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 140 MIDDLE EAST & AFRICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 141 MIDDLE EAST & AFRICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 142 MIDDLE EAST & AFRICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 143 MIDDLE EAST & AFRICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 144 MIDDLE EAST & AFRICA: WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (USD BILLION)

- TABLE 145 MIDDLE EAST & AFRICA: WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD BILLION)

- TABLE 146 MIDDLE EAST & AFRICA: WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (TON)

- TABLE 147 MIDDLE EAST & AFRICA: WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (TON)

- TABLE 148 SAUDI ARABIA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 149 SAUDI ARABIA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 150 SAUDI ARABIA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 151 SAUDI ARABIA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 152 SOUTH AFRICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 153 SOUTH AFRICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 154 SOUTH AFRICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 155 SOUTH AFRICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 156 UAE: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 157 UAE: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 158 UAE: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 159 UAE: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 160 REST OF MIDDLE EAST & AFRICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 161 REST OF MIDDLE EAST & AFRICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 162 REST OF MIDDLE EAST & AFRICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 163 REST OF MIDDLE EAST & AFRICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 164 SOUTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 165 SOUTH AMERICA: WOOD BIO-PRODUCTS, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 166 SOUTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY COUNTRY, 2019–2022 (TON)

- TABLE 167 SOUTH AMERICA: WOOD BIO-PRODUCTS, BY COUNTRY, 2023–2028 (TON)

- TABLE 168 SOUTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 169 SOUTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 170 SOUTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY TYPE, 2019–2022 (TON)

- TABLE 171 SOUTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 172 SOUTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 173 SOUTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 174 SOUTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 175 SOUTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 176 SOUTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (USD BILLION)

- TABLE 177 SOUTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD BILLION)

- TABLE 178 SOUTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (TON)

- TABLE 179 SOUTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (TON)

- TABLE 180 BRAZIL: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 181 BRAZIL: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 182 BRAZIL: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 183 BRAZIL: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 184 ARGENTINA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 185 ARGENTINA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 186 ARGENTINA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 187 ARGENTINA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 188 REST OF SOUTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 189 REST OF SOUTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 190 REST OF SOUTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 191 REST OF SOUTH AMERICA: WOOD BIO-PRODUCTS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 192 COMPANIES ADOPTED ACQUISITION AS KEY GROWTH STRATEGY BETWEEN 2018 AND 2022

- TABLE 193 MARKET EVALUATION FRAMEWORK

- TABLE 194 REVENUE ANALYSIS OF KEY COMPANIES (2020–2022)

- TABLE 195 WOOD BIO-PRODUCTS MARKET: DEGREE OF COMPETITION

- TABLE 196 DETAILED LIST OF COMPANIES

- TABLE 197 OVERALL SOURCE FOOTPRINT

- TABLE 198 OVERALL APPLICATION FOOTPRINT

- TABLE 199 OVERALL REGION FOOTPRINT

- TABLE 200 OVERALL COMPANY FOOTPRINT

- TABLE 201 PRODUCT LAUNCHES/DEVELOPMENTS, 2018–2022

- TABLE 202 DEALS, 2018–2022

- TABLE 203 OTHERS, 2018–2022

- TABLE 204 UPM-KYMMENE CORPORATION: COMPANY OVERVIEW

- TABLE 205 UPM-KYMMENE CORPORATION: PRODUCT OFFERINGS

- TABLE 206 UPM-KYMMENE CORPORATION: DEALS

- TABLE 207 UPM-KYMMENE CORPORATION: PRODUCT LAUNCH

- TABLE 208 UPM-KYMMENE CORPORATION: OTHER DEVELOPMENTS

- TABLE 209 STORA ENSO: COMPANY OVERVIEW

- TABLE 210 STORA ENSO: PRODUCT OFFERINGS

- TABLE 211 STORA ENSO: DEALS

- TABLE 212 STORA ENSO: PRODUCT LAUNCH

- TABLE 213 STORA ENSO: OTHER DEVELOPMENTS

- TABLE 214 LIXIL GROUP: COMPANY OVERVIEW

- TABLE 215 LIXIL GROUP: PRODUCT OFFERINGS

- TABLE 216 LIXIL GROUP: RECENT DEVELOPMENTS

- TABLE 217 WEST FRASER: COMPANY OVERVIEW

- TABLE 218 WEST FRASER: PRODUCT OFFERINGS

- TABLE 219 WEST FRASER: DEALS

- TABLE 220 WEST FRASER: OTHER DEVELOPMENTS

- TABLE 221 WEYERHAEUSER COMPANY: COMPANY OVERVIEW

- TABLE 222 WEYERHAEUSER COMPANY: PRODUCT OFFERINGS

- TABLE 223 WEYERHAEUSER COMPANY: DEALS

- TABLE 224 WEYERHAEUSER: OTHER DEVELOPMENTS

- TABLE 225 UFP INDUSTRIES INC.: COMPANY OVERVIEW

- TABLE 226 UFP INDUSTRIES INC.: PRODUCT OFFERINGS

- TABLE 227 UFP INDUSTRIES INC.: DEALS

- TABLE 228 UFP INDUSTRIES INC.: PRODUCT LAUNCH

- TABLE 229 UFP INDUSTRIES INC.: OTHER DEVELOPMENTS

- TABLE 230 CANFOR: COMPANY OVERVIEW

- TABLE 231 CANFOR: PRODUCT OFFERINGS

- TABLE 232 CANFOR: DEALS

- TABLE 233 CANFOR: OTHER DEVELOPMENTS

- TABLE 234 SAPPI: COMPANY OVERVIEW

- TABLE 235 SAPPI: PRODUCT OFFERINGS

- TABLE 236 SAPPI: DEALS

- TABLE 237 SAPPI: NEW PRODUCT LAUNCH

- TABLE 238 SAPPI: OTHER DEVELOPMENTS

- TABLE 239 METSÄ GROUP: COMPANY OVERVIEW

- TABLE 240 METSÄ GROUP: PRODUCT OFFERINGS

- TABLE 241 METSÄ GROUP: DEALS

- TABLE 242 METSÄ GROUP: NEW PRODUCT LAUNCH

- TABLE 243 METSÄ GROUP: OTHER DEVELOPMENTS

- TABLE 244 JELD-WEN: COMPANY OVERVIEW

- TABLE 245 JELD-WEN: PRODUCT OFFERINGS

- TABLE 246 JELD-WEN: DEALS

- TABLE 247 JELD-WEN: NEW PRODUCT LAUNCH

- TABLE 248 JELD-WEN: OTHER DEVELOPMENTS

- TABLE 249 BILLERUD AMERICAS CORPORATION: COMPANY OVERVIEW

- TABLE 250 DOMTAR CORPORATION: COMPANY OVERVIEW

- TABLE 251 GUANGDONG WEIHUA CORPORATION: COMPANY OVERVIEW

- TABLE 252 SUZANO: COMPANY OVERVIEW

- TABLE 253 SVENSKA CELLULOSA AKTIEBOLAGET: COMPANY OVERVIEW

- TABLE 254 RAYONIER ADVANCED MATERIALS INC.: COMPANY OVERVIEW

- TABLE 255 ENVIVA INC.: COMPANY OVERVIEW

- TABLE 256 GEORGIA-PACIFIC: COMPANY OVERVIEW

- TABLE 257 SÖDRA SKOGSUDDEN: COMPANY OVERVIEW

- TABLE 258 VIRU KEEMIA GRUPP: COMPANY OVERVIEW

- TABLE 259 MERCER INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 260 KLABIN S.A.: COMPANY OVERVIEW

- TABLE 261 EKMAN & CO AB: COMPANY OVERVIEW

- TABLE 262 HOLZINDUSTRIE SCHWEIGHOFER TIMBER GROUP: COMPANY OVERVIEW

- TABLE 263 KRUGER INC.: COMPANY OVERVIEW

- FIGURE 1 WOOD BIO-PRODUCTS MARKET SEGMENTATION

- FIGURE 2 WOOD BIO-PRODUCTS MARKET: RESEARCH DESIGN

- FIGURE 3 WOOD BIO-PRODUCTS MARKET: BOTTOM-UP APPROACH

- FIGURE 4 WOOD BIO-PRODUCTS MARKET: TOP-DOWN APPROACH

- FIGURE 5 WOOD BIO-PRODUCTS MARKET: DATA TRIANGULATION

- FIGURE 6 FINISHED WOOD PRODUCT TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 7 ONLINE TO ACCOUNT FOR LARGER SHARE OF WOOD BIO-PRODUCTS DURING FORECAST PERIOD

- FIGURE 8 RESIDENTIAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO OFFER ATTRACTIVE OPPORTUNITIES IN WOOD BIO-PRODUCTS MARKET DURING FORECAST PERIOD

- FIGURE 11 MANUFACTURED WOOD MATERIAL TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 OFFLINE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 RESIDENTIAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 COUNTRIES IN ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN WOOD BIO-PRODUCTS MARKET

- FIGURE 17 WOOD BIO-PRODUCTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 AVERAGE SELLING PRICE, BY REGION (USD/TON)

- FIGURE 19 WOOD BIO-PRODUCTS MARKET ECOSYSTEM

- FIGURE 20 CONSTRUCTION INDUSTRY TO DRIVE GROWTH

- FIGURE 21 SUPPLIER SELECTION CRITERION

- FIGURE 22 PATENTS REGISTERED (2012 TO 2022)

- FIGURE 23 NUMBER OF PATENTS IN LAST 10 YEARS

- FIGURE 24 TOP JURISDICTIONS

- FIGURE 25 TOP APPLICANTS’ ANALYSIS

- FIGURE 26 FINISHED WOOD PRODUCT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 27 OFFLINE SEGMENT TO REGISTER LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 28 RESIDENTIAL APPLICATION TO BE LARGER SEGMENT DURING FORECAST PERIOD

- FIGURE 29 INDIA TO BE FASTEST-GROWING WOOD BIO-PRODUCTS MARKET BETWEEN 2023 AND 2028

- FIGURE 30 ASIA PACIFIC: WOOD BIO-PRODUCTS MARKET SNAPSHOT

- FIGURE 31 NORTH AMERICA: WOOD BIO-PRODUCTS MARKET SNAPSHOT

- FIGURE 32 RESIDENTIAL APPLICATION TO HAVE LARGER SHARE OF EUROPEAN WOOD BIO-PRODUCTS MARKET

- FIGURE 33 RANKING OF TOP 5 PLAYERS IN WOOD BIO-PRODUCTS MARKET

- FIGURE 34 WOOD BIO-PRODUCTS MARKET SHARE, BY COMPANY, 2022

- FIGURE 35 COMPANY EVALUATION MATRIX FOR TIER 1 COMPANIES, 2022

- FIGURE 36 COMPANY EVALUATION MATRIX FOR START-UPS AND SMES, 2022

- FIGURE 37 UPM-KYMMENE CORPORATION: COMPANY SNAPSHOT

- FIGURE 38 STORA ENSO: COMPANY SNAPSHOT

- FIGURE 39 LIXIL GROUP: COMPANY SNAPSHOT

- FIGURE 40 WEST FRASER: COMPANY SNAPSHOT

- FIGURE 41 WEYERHAEUSER COMPANY: COMPANY SNAPSHOT

- FIGURE 42 UFP INDUSTRIES INC.: COMPANY SNAPSHOT

- FIGURE 43 CANFOR: COMPANY SNAPSHOT

- FIGURE 44 SAPPI: COMPANY SNAPSHOT

- FIGURE 45 METSÄ GROUP: COMPANY SNAPSHOT

- FIGURE 46 JELD-WEN: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the wood bio-products market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, trade directories, certified publications, articles from recognized authors, standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

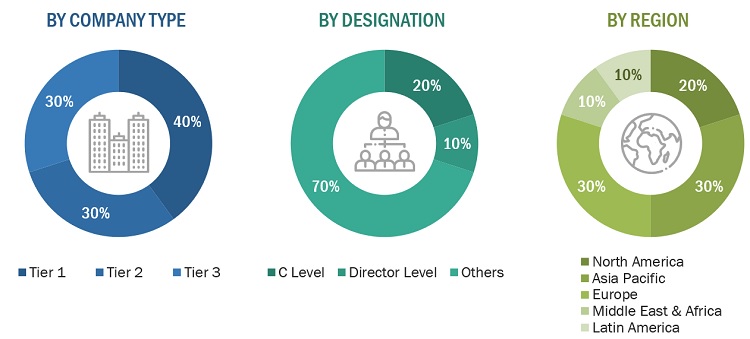

The Wood Bioproducts Industry comprises several stakeholders in the value chain, which include manufacturers, distributors, and end users/consumers. Various primary sources from the supply and demand sides of the wood bio-products market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in application sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the wood bio-products industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, distribution channel, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of wood bio-products and future outlook of their business which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

UPM-Kymmene |

Sales Director |

|

Stora Enso |

Sales Manager |

|

West Fraser |

Director |

|

Lixil Group |

Marketing Manager |

|

Weyerhaeuser |

R&D Manager |

|

|

|

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the wood bio-products market.

- The key players in the industry have been identified through extensive secondary research.

- The purification process of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Wood Bio-Products Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Wood Bio-Products Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Wood bio-products are made up of trunks and limbs of trees. These are derived from renewable biological resources such as agriculture, forestry, & biological waste. They are used in a wide variety of applications, including residential and commercial. To make pulp, paper, board, and other bio-products, thinner trees and treetops are used as pulpwood.

Key Stakeholders

- Forest Reserves

- Wood Bio-products Manufacturer

- Wood Bio-products Distributors

- R&D Department

Report Objectives

- To define, describe, and forecast the size of the wood bio-products market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on type, distribution channel, application, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as partnerships, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Wood Bio-Products Market