Molded Pulp Packaging Market by Molded Type (Thickwall, Transfer Molded, Thermoformed Fiber and Processed Pulp), Product Type (Trays, Clamshells, Cups, Plates, Bowls), End-Use, Source (Wood Pulp and Non Wood Pulp), and Region - Global Forecast to 2027

Updated on : August 21, 2025

Molded Pulp Packaging Market

The global molded pulp packaging market was valued at USD 4.6 billion in 2022 and is projected to reach USD 5.7 billion by 2027, growing at 4.3% cagr from 2022 to 2027. The market is growing due to the end-use industries such as food & beverages, food service, healthcare, electronics and others. Hence, the rapid growth of these industries is expected to contribute to the development of the market.

Attractive Opportunities in Molded Pulp Packaging Market

Note:e-estimated,p-projected.

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Molded Pulp Packaging Market Dynamics

Driver: Sustainability of molded fiber pulp

Molded fiber pulp is made completely from scrap or recycled material. The molded fiber pulp is recycled and remade with normal papers. This drives the market for molded fiber pulp in the packaging industry. Continuous research and innovation in production are expected to fuel the demand for molded fiber pulp packaging which is used as protective packaging during storage and transportation and also to overcome concerns about sustainability.

Restraint: Stringent rules and regulations

Growing concerns related to the environmental impact of packaging waste have led governments in adopting stringent policies. Various concerns related to greenhouse gas emissions from manufacturing plants are also creating several hindrances in the manufacture of high-quality raw materials. Standard tests are also performed to validate the packaging system’s ability to adhere to the regulations mandated by the International Safe Transit Association (ISTA) standards which focus upon specific concerns of transportation packaging such as shock, vibration, and compression.

Opportunity: Emerging economies such as Brazil, India, and China provide significant opportunities for the logistics of molded fiber pulp packaging that offer protection to products. These countries also have extensive availability of raw materials for the molded fiber pulp packaging market. Strong economic development in China and India has provided a stimulus for manufacturing sectors including food & beverages, electronics & appliances, and healthcare. This market is driven by the growing usage of packaging across a range of electronics, particularly in smartphones, laptops, and other gadgets.

Challenge: Fluctuation in prices of raw material

The molded pulp packaging market is facing challenges in the form of fluctuations in the prices of raw materials. The packaging industry is trying to cope with these challenges by undertaking innovative research & development activities. The increasing prices of raw materials such as wood and non-wood pulp and paper adversely affect operations in the molded pulp packaging industry. In addition to the key raw materials, the prices of other raw materials such as water and fuel are also increasing due to weather conditions, market fluctuations, exchange rates, currency control, and government control.

Molded Pulp Packaging Market Ecosystem

Thick wall segment is projected to grow at a highest CAGR from 2022 to 2027, in terms of volume

Thick wall molded pulp packaging has a thickness of 3/16 to 3/18 inches. It is manufactured with a single mold and is primarily used for support packaging for non-fragile and heavier items such as vehicle parts, furniture, and motors. Manufacturers are also using it to make plants, floral, and nursery pots and containers. This type of molded pulp packaging has a moderately smooth finished surface, while the other side is coarse. Thick wall molded pulp packages are mainly used for packaging non-fragile and heavy items.

Wood pulp segment is projected to dominate from 2022 to 2027, in terms of volume

Wood pulp can be soft wood or hardwood pulp. Molded pulp items are generally produced by mixing water with wood pulp made either from virgin fibers or recovered paper and paperboard; for instance, old newspapers, with a consistency commonly of 4% to 1% by weight. The pulp recipe depends mainly upon the surface quality and stiffness properties required to manufacture the product and its application. Soft wood pulp offers excellent strength to the product, whereas hard wood pulp enhances the sustainability of the packaging.

Trays segment to lead market from 2022 to 2027, in terms of volume

Trays are widely used in the food packaging industry to pack meat, fish, frozen food, fruits & vegetables, bakery items, and confectionery products as well as for food service packaging. They also have applications in the medical and pharmaceutical industries for packaging medicines, surgical instruments, and medical devices.

Healthcare segment projected to grow at highest cagr from 2022 to 2027, in terms of volume

Molded fiber pulp packaging is an effective packaging for the temperature sensitive and fragile products in healthcare industry. Healthcare products, such as pharmaceutical, nutraceutical, and life science products, are required to be protected from external conditions such as light and moisture as well as contamination and physical damage, as these can alter the quality of products. Trays are the widely used molded pulp packaging products in the healthcare sector.

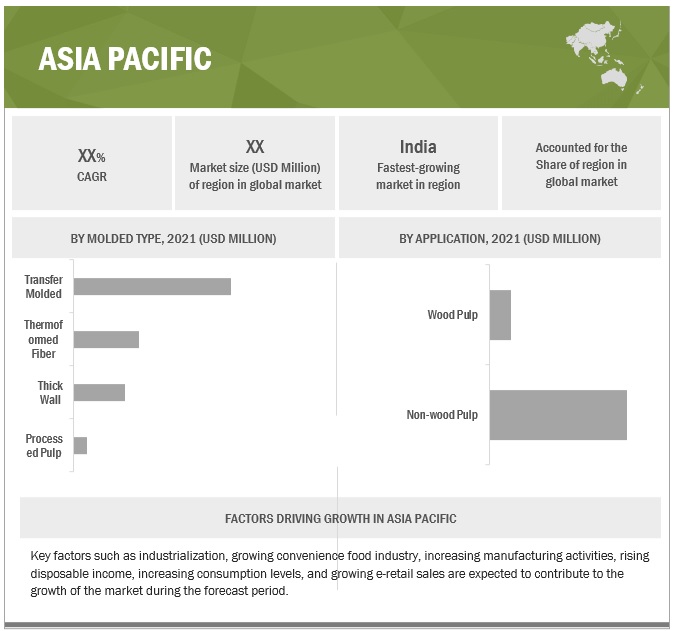

Molded pulp packaging market in india projected to grow at highest CAGR

The packaging industry in India is driven by new product launches by local packaging players, growth of the food packaging industry in the country, and the growth of the middle-class population. However, consumers in this country are still costconscious and are always on the lookout for cost-effective alternatives, which could prove to be a barrier to the growth of the molded fiber pulp packaging market.

To know about the assumptions considered for the study, download the pdf brochure

Molded Pulp Packaging Market Players

Huhtamaki Oyj (Finland), Sonoco Products Co. (US), Fabri-Kal (US), Genpak LLC (US), UFP Technologies (US), Sabert Corporation (US), Brodrene Hartmann A/S (Denmark), and Pro-Pac Packaging (Australia) among others are some of the major players operating in the global market.

Read More: Molded Pulp Packaging Companies

Molded Pulp Packaging Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 4.6 billion |

|

Revenue Forecast in 2027 |

USD 5.7 billion |

|

CAGR |

4.3% |

|

Years Considered |

2020–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Unit considered |

Value (USD Million/USD Billion), and Volume (Thousand Ton) |

|

Segments |

Molded Type, Product Type, Source, End Use, and Region |

|

Regions |

North America, Europe, South America, APAC, Middle East, and Africa. |

|

Companies |

The major players Huhtamaki Oyj (Finland), Bordrene Hartmann A/S (Denmark), Genpack LLC(US), UFP Technologies (US), Sonoco Products Co. (US), Sabert Corporation(US), Fabri-Kal(US), Pro-Pac Packaging(Australia), James Cropper 3D products Ltd., PrimWare-by Prim Link Solutions (US) and others are covered in the molded fiber pulp packaging market. |

This research report categorizes the global molded fiber pulp packaging market on the basis of Molded Type, Source, Product Type, End Use, and Region

Molded pulp packaging market by Molded Type

- Thick Wall

- Transfer Molded

- Thermoformed Fiber

- Processed Pulp

Molded pulp packaging market industry by Source

- Wood pulp

- Non wood pulp

Molded pulp packaging market by Product

- Food

- Trays

- Clamshells

- Cups

- Plates

- Bowls

- Others

Molded pulp packaging market by End Use

- Food Service Disposables

- Food Packaging

- Healthcare

- Electronics

- Others

Molded pulp packaging market industry by Region

- North America

- Europe

- Asia Pacific (APAC)

- South America

- Middle East

- Africa

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In 2022 Huhtamaki Oyj invested in the sustainable packaging fund run by Emerald Technology Ventures AG, which focuses on cutting-edge sustainable packaging technologies.

- In 2022, Sonoco Products Company stated that it acquired the remaining one-third stake from private investors in the joint venture, Sonoco do Brasil Participacoes, Ltda, which produces flexible packaging in Brazil.

- In 2021, UFP Technologies Inc. acquired Das Medical Inc. This acquisition is expected to be able to accelerate the development of UFP technologies in the future with the help of UFP’s sales engine, development engineers, and the expanding technological portfolio of Das medical Inc.

Frequently Asked Questions (FAQ):

Does this report covers the new applications of molded fiber pulp packaging?

Yes the report covers the new applications of molded fiber pulp packaging.

Does this report cover the volume tables in addition to value tables?

Yes the report covers the market both in terms of volume as well as value

What is the current competitive landscape in the molded fiber pulp packaging market in terms of new applications, production, and sales?

The market has various large, medium, and small-scale players operating across the globe. Many players are constantly innovating and developing new products and expanding to developing countries where the demand is constantly growing; thereby boosting sales.

Which all countries are considered in the report?

China, Japan, and India are major countries considered in the report. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Sustainability of molded fiber pulp- Shift in consumer preference toward recyclable and eco-friendly materials- Rising disposable incomes- High demand for reusable and sustainable packagingRESTRAINTS- Stringent rules and regulationsRESTRAINTS- Emerging economies provide significant opportunities- Investments in R&D activitiesCHALLENGES- Fluctuations in prices of raw materials

- 6.1 VALUE CHAIN ANALYSIS

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 PROMINENT COMPANIES

- 6.4 SMALL & MEDIUM-SIZED ENTERPRISES

-

6.5 YC & YCC SHIFTREVENUE SHIFT AND NEW REVENUE POCKETS FOR MOLDED FIBER PULP PACKAGING MANUFACTURERS

-

6.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.7 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEINSIGHTSTOP COMPANIES/APPLICANTS

- 6.8 PRICING ANALYSIS

-

6.9 TECHNOLOGY ANALYSISCOMPUTER-AIDED ENGINEERING (CAE)TUNG-OIL SAND MOLD

- 6.10 REGULATORY LANDSCAPE

- 6.11 TRADE ANALYSIS

-

6.12 ECOSYSTEM

-

6.13 CASE STUDY ANALYSISPROJECT TO IDENTIFY AND SHOWCASE GOOD DESIGN FOR RECYCLABILITY (POTS, TUBS, TRAYS) AND NON-DRINK BOTTLES

- 6.14 KEY CONFERENCES & EVENTS IN 2023

- 7.1 INTRODUCTION

-

7.2 THICK WALLMAINLY USED FOR PACKAGING NON-FRAGILE AND HEAVY ITEMS

-

7.3 TRANSFER MOLDEDPACKAGING FOR EGG CARTONS, TRAYS, SERVING TRAYS, FRUITS, AND FOOD PRODUCTS

-

7.4 THERMOFORMED FIBERMANUFACTURE OF CLAMSHELLS, CUPS, PLATES, BOWLS, AND CUTLERY

-

7.5 PROCESSED PULPCUSTOMIZED MOLDED FIBER PULP PACKAGING

- 8.1 INTRODUCTION

-

8.2 TRAYSAPPLICATIONS IN FOOD PACKAGING, MEDICAL, AND PHARMACEUTICAL INDUSTRIES

-

8.3 CUPSUSE OF WOOD OR NON-WOOD PULP FOR WIDE-MOUTH DISPOSABLE PACKAGING

-

8.4 CLAMSHELLSRECYCLED CARDBOARD, PAPER, AND SUGARCANE BAGASSE TO PROVIDE PROTECTION AGAINST LIGHT, DIRT, AND WEAR & TEAR

-

8.5 PLATESDEMAND FOR ECO-FRIENDLY DISPOSABLES TO DRIVE MARKET

-

8.6 BOWLSEASY TO HANDLE, STABLE, AND STURDY PACKAGING

- 8.7 OTHERS

- 9.1 INTRODUCTION

-

9.2 WOOD PULPNON-TOXIC, SUSTAINABLE, AND RECYCLED MATERIAL

-

9.3 NON-WOOD PULPACCESSIBLE ALTERNATIVE RAW MATERIAL THAT CAN BE CONVERTED INTO PULP AND PAPER OF SAME QUALITY AS WOOD

- 10.1 INTRODUCTION

-

10.2 FOOD PACKAGINGPROTECTION AGAINST MOISTURE AND SHOCK & COMPRESSION DAMAGE DURING SHIPMENT

-

10.3 FOOD SERVICE DISPOSABLESOIL- & WATER-RESISTANT OPTION FOR TAKEAWAYS

-

10.4 HEALTHCAREEFFECTIVE PACKAGING FOR TEMPERATURE-SENSITIVE AND FRAGILE PRODUCTS

-

10.5 ELECTRONICSEXCELLENT SHOCK ABSORBING, COMPRESSION RESISTANCE, AND THERMAL & ATMOSPHERIC RESISTANCE PROPERTIES

- 10.6 OTHERS

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICCHINA- Increasing awareness of importance of eco-friendly, sustainable, and renewable packaging and wide acceptance in industries to drive marketINDIA- Awareness about health and environmental effects of plastic-based packaging to drive marketJAPAN- Consumer awareness of sustainable packaging and strict & unique environmental regulations to drive marketAUSTRALIA- Demand for convenient and sustainable packaging to drive marketREST OF ASIA PACIFIC

-

11.3 NORTH AMERICAUS- Environmental responsibility to drive marketCANADA- Government goal to reduce overall quantity of packaging waste to drive marketMEXICO- Change in consumer lifestyles to drive market

-

11.4 EUROPEUK- Improved and efficient processes and new packaging materials to drive marketGERMANY- Consumer awareness and strict government regulations regarding recycling wastes to drive marketFRANCE- Significant growth due to stringent regulations favoring use of eco-friendly, sustainable, and renewable resources to drive marketITALY- Significant investments from foreign and domestic packaging players to drive marketSPAIN- Cost-effective, low space requirement, and increased shelf life of products to drive marketREST OF EUROPE

-

11.5 SOUTH AMERICABRAZIL- Need for high-quality and effective packaging to prevent food wastage and increase shelf life of products to drive marketARGENTINA- Growing consumption of meat products and government efforts to increase exports to drive marketREST OF SOUTH AMERICA

-

11.6 MIDDLE EAST & AFRICATURKEY- Growing per capita income and changing lifestyles to drive marketSAUDI ARABIA- Demand for convenient and sustainable packaging products to drive marketSOUTH AFRICA- Innovations in sustainability to drive marketREST OF MIDDLE EAST & AFRICA

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 RANKING OF KEY MARKET PLAYERS

- 12.4 REVENUE ANALYSIS OF TOP FIVE COMPANIES

-

12.5 MARKET SHARE OF KEY PLAYERS, 2021HUHTAMAKI OYJ (FINLAND)BRODRENE HARTMANN A/SUFP TECHNOLOGIESSONOCO PRODUCTS CO.PRO-PAC PACKAGING

-

12.6 COMPETITIVE LEADERSHIP MAPPINGSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

12.7 COMPETITIVE LEADERSHIP MAPPING FOR STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 12.8 COMPETITIVE BENCHMARKING

-

12.9 COMPETITIVE SCENARIOSPRODUCT LAUNCHESDEALS

-

13.1 MAJOR PLAYERSBRØDRENE HARTMANN A/S- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHUHTAMAKI OYJ- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewUFP TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSONOCO PRODUCTS CO.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPRO-PAC PACKAGING LIMITED- Business overview- Products/Solutions/Services offered- MnM viewJAMES CROPPER PLC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGENPAK, LLC- Business overview- Products/Solutions/Services offered- MnM viewSABERT CORPORATION- Business overview- Products/Solutions/Services offeredFABRI-KAL- Business overview- Products/Solutions/Services offered- Recent developmentsPRIMEWARE- Business overview- Products/Solutions/Services offered

-

13.2 OTHER PLAYERSHENRY MOLDED PRODUCTSENVIROPAK CORPORATIONPACIFIC PULP MOLDINGPROTOPAK ENGINEERING CORPORATIONCELLULOSE DE LA LOIREUN1F1ED2 GLOBAL PACKAGING GROUPKEIDING, INC.KEYES PACKAGING GROUP (TEKNIPLEX CONSUMER PRODUCTS)PULP-TECTEK PAK INC.

-

13.3 STARTUPSTELLUS PRODUCTS LLCZELLWIN FARMSZUME INCRYPAXFIBERCEL SYSTEMSJIANGYIN GREENPACKING TRADE CO., LTD.

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHORS DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 VALUE CHAIN OF SMALL & MEDIUM-SIZED ENTERPRISES

- TABLE 3 PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 MOLDED, PRESSED ARTICLES IMPORT DATA, 2021 (USD BILLION)

- TABLE 5 MOLDED, PRESSED ARTICLES EXPORT DATA, 2021 (USD BILLION)

- TABLE 6 DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 7 MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2016–2019 (USD MILLION)

- TABLE 8 MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 9 MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2016–2019 (THOUSAND TONS)

- TABLE 10 MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 11 MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2016–2019 (USD MILLION)

- TABLE 12 MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 13 MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2016–2019 (THOUSAND TONS)

- TABLE 14 MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2020–2027 (THOUSAND TONS)

- TABLE 15 MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2016–2019 (USD MILLION)

- TABLE 16 MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2020–2027 (USD MILLION)

- TABLE 17 MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2016–2019 (THOUSAND TONS)

- TABLE 18 MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2020–2027 (THOUSAND TONS)

- TABLE 19 MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2016–2019 (USD MILLION)

- TABLE 20 MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 21 MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2016–2019 (THOUSAND TONS)

- TABLE 22 MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 23 MOLDED FIBER PULP PACKAGING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 24 MOLDED FIBER PULP PACKAGING MARKET, BY REGION, 2020–2027 (THOUSAND TONS)

- TABLE 25 ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 26 ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY COUNTRY, 2020–2027 (THOUSAND TONS)

- TABLE 27 ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2016–2019 (USD MILLION)

- TABLE 28 ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 29 ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2016–2019 (THOUSAND TONS)

- TABLE 30 ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 31 ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2016–2019 (USD MILLION)

- TABLE 32 ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2020–2027 (USD MILLION)

- TABLE 33 ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2016–2019 (THOUSAND TONS)

- TABLE 34 ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2020–2027 (THOUSAND TONS)

- TABLE 35 ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2016–2019 (USD MILLION)

- TABLE 36 ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 37 ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2016–2019 (THOUSAND TONS)

- TABLE 38 ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2020–2027 (THOUSAND TONS)

- TABLE 39 ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2016–2019 (USD MILLION)

- TABLE 40 ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 41 ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2016–2019 (THOUSAND TONS)

- TABLE 42 ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 43 CHINA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 44 CHINA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 45 CHINA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 46 CHINA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 47 INDIA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 48 INDIA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 49 INDIA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 50 INDIA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 51 JAPAN: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 52 JAPAN: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 53 JAPAN: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 54 JAPAN: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 55 AUSTRALIA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 56 AUSTRALIA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 57 AUSTRALIA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 58 AUSTRALIA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 59 REST OF ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 60 REST OF ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 61 REST OF ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 62 REST OF ASIA PACIFIC: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 63 NORTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 64 NORTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY COUNTRY, 2020–2027 (THOUSAND TONS)

- TABLE 65 NORTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2016–2019 (USD MILLION)

- TABLE 66 NORTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 67 NORTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2016–2019 (THOUSAND TONS)

- TABLE 68 NORTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 69 NORTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2016–2019 (USD MILLION)

- TABLE 70 NORTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2020–2027 (USD MILLION)

- TABLE 71 NORTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2016–2019 (THOUSAND TONS)

- TABLE 72 NORTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2020–2027 (THOUSAND TONS)

- TABLE 73 NORTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2016–2019 (USD MILLION)

- TABLE 74 NORTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 75 NORTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2016–2019 (THOUSAND TONS)

- TABLE 76 NORTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2020–2027 (THOUSAND TONS)

- TABLE 77 NORTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2016–2019 (USD MILLION)

- TABLE 78 NORTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 79 NORTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2016–2019 (THOUSAND TONS)

- TABLE 80 NORTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 81 US: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 82 US: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 83 US: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 84 US: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 85 CANADA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 86 CANADA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 87 CANADA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 88 CANADA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 89 MEXICO: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 90 MEXICO: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 91 MEXICO: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 92 MEXICO: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 93 EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 94 EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY COUNTRY, 2020–2027 (THOUSAND TONS)

- TABLE 95 EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2016–2019 (USD MILLION)

- TABLE 96 EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 97 EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2016–2019 (THOUSAND TONS)

- TABLE 98 EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 99 EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2016–2019 (USD MILLION)

- TABLE 100 EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2020–2027 (USD MILLION)

- TABLE 101 EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2016–2019 (THOUSAND TONS)

- TABLE 102 EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2020–2027 (THOUSAND TONS)

- TABLE 103 EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2016–2019 (USD MILLION)

- TABLE 104 EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 105 EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2016–2019 (THOUSAND TONS)

- TABLE 106 EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2020–2027 (THOUSAND TONS)

- TABLE 107 EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2016–2019 (USD MILLION)

- TABLE 108 EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 109 EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2016–2019 (THOUSAND TONS)

- TABLE 110 EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 111 UK: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 112 UK: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 113 UK: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 114 UK: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 115 GERMANY: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 116 GERMANY: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 117 GERMANY: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 118 GERMANY: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 119 FRANCE: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 120 FRANCE: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 121 FRANCE: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 122 FRANCE: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 123 ITALY: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 124 ITALY: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 125 ITALY: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 126 ITALY: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 127 SPAIN: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 128 SPAIN: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 129 SPAIN: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 130 SPAIN: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 131 REST OF EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 132 REST OF EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 133 REST OF EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 134 REST OF EUROPE: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 135 SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 136 SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY COUNTRY, 2020–2027 (THOUSAND TONS)

- TABLE 137 SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2016–2019 (USD MILLION)

- TABLE 138 SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 139 SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2016–2019 (THOUSAND TONS)

- TABLE 140 SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 141 SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2016–2019 (USD MILLION)

- TABLE 142 SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2020–2027 (USD MILLION)

- TABLE 143 SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2016–2019 (THOUSAND TONS)

- TABLE 144 SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2020–2027 (THOUSAND TONS)

- TABLE 145 SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2016–2019 (USD MILLION)

- TABLE 146 SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 147 SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2016–2019 (THOUSAND TONS)

- TABLE 148 SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2020–2027 (THOUSAND TONS)

- TABLE 149 SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2016–2019 (USD MILLION)

- TABLE 150 SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 151 SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2016–2019 (THOUSAND TONS)

- TABLE 152 SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 153 BRAZIL: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 154 BRAZIL: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 155 BRAZIL: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 156 BRAZIL: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 157 ARGENTINA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 158 ARGENTINA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 159 ARGENTINA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 160 ARGENTINA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 161 REST OF SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 162 REST OF SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 163 REST OF SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 164 REST OF SOUTH AMERICA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 165 MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY COUNTRY, 2020–2027 (THOUSAND TONS)

- TABLE 167 MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2016–2019 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2016–2019 (THOUSAND TONS)

- TABLE 170 MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 171 MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2016–2019 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2020–2027 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2016–2019 (THOUSAND TONS)

- TABLE 174 MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2020–2027 (THOUSAND TONS)

- TABLE 175 MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2016–2019 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2016–2019 (THOUSAND TONS)

- TABLE 178 MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY PRODUCT, 2020–2027 (THOUSAND TONS)

- TABLE 179 MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2016–2019 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2016–2019 (THOUSAND TONS)

- TABLE 182 MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 183 TURKEY: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 184 TURKEY: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 185 TURKEY: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 186 TURKEY: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 187 SAUDI ARABIA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 188 SAUDI ARABIA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 189 SAUDI ARABIA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 190 SAUDI ARABIA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 191 SOUTH AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 192 SOUTH AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020-2027 (THOUSAND TONS)

- TABLE 193 SOUTH AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 194 SOUTH AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 195 REST OF MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (USD MILLION)

- TABLE 196 REST OF MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY MOLDED TYPE, 2020–2027 (THOUSAND TONS)

- TABLE 197 REST OF MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (USD MILLION)

- TABLE 198 REST OF MIDDLE EAST & AFRICA: MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2020–2027 (THOUSAND TONS)

- TABLE 199 OVERVIEW OF STRATEGIES ADOPTED BY MOLDED FIBER PULP PACKAGING MANUFACTURERS

- TABLE 200 MARKET SHARE OF KEY PLAYERS

- TABLE 201 DETAILED LIST OF KEY PLAYERS

- TABLE 202 PRODUCT LAUNCHES (2017–2022)

- TABLE 203 DEALS (2017–2022)

- TABLE 204 BRØDRENE HARTMANN A/S: COMPANY OVERVIEW

- TABLE 205 HUHTAMAKI OYJ: COMPANY OVERVIEW

- TABLE 206 UFP TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 207 SONOCO PRODUCTS CO.: COMPANY OVERVIEW

- TABLE 208 PRO-PAC PACKAGING LTD: COMPANY OVERVIEW

- TABLE 209 JAMES CROPPER PLC.: COMPANY OVERVIEW

- TABLE 210 GENPAK LLC: COMPANY OVERVIEW

- TABLE 211 SABERT CORPORATION: COMPANY OVERVIEW

- TABLE 212 FABRI-KAL: COMPANY OVERVIEW

- TABLE 213 PRIMEWARE: COMPANY OVERVIEW

- FIGURE 1 MOLDED FIBER PULP PACKAGING MARKET SEGMENTATION

- FIGURE 2 MOLDED FIBER PULP PACKAGING MARKET, BY REGION

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 KEY MARKET INSIGHTS

- FIGURE 5 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 6 APPROACH (BOTTOM-UP)

- FIGURE 7 APPROACH (TOP-DOWN)

- FIGURE 8 APPROACH (SUPPLY SIDE)

- FIGURE 9 APPROACH TO ESTIMATE VOLUME

- FIGURE 10 DATA TRIANGULATION

- FIGURE 11 THICK WALL MOLDED TYPE SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 WOOD PULP SEGMENT TO DOMINATE IN TERMS OF VALUE

- FIGURE 13 TRAYS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 HIGHEST DEMAND PROJECTED FROM FOOD PACKAGING SEGMENT

- FIGURE 15 REGIONAL MARKET SHARES AND PROJECTED GROWTH RATES

- FIGURE 16 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES FOR MOLDED FIBER PULP PACKAGING MARKET

- FIGURE 17 THICK WALL SEGMENT PROJECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027, IN TERMS OF VOLUME

- FIGURE 18 WOOD PULP SEGMENT PROJECTED TO DOMINATE FROM 2022 TO 2027, IN TERMS OF VOLUME

- FIGURE 19 TRAYS SEGMENT TO LEAD MARKET FROM 2022 TO 2027, IN TERMS OF VOLUME

- FIGURE 20 HEALTHCARE SEGMENT PROJECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027, IN TERMS OF VOLUME

- FIGURE 21 CHINA AND TRANSFER MOLDED SEGMENT LED MARKET IN 2021

- FIGURE 22 MOLDED FIBER PULP PACKAGING MARKET IN INDIA PROJECTED TO GROW AT HIGHEST CAGR

- FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MOLDED FIBER PULP PACKAGING MARKET

- FIGURE 24 VALUE CHAIN OF MOLDED FIBER PULP PACKAGING MARKET

- FIGURE 25 SUPPLY CHAIN OF MOLDED FIBER PULP PACKAGING INDUSTRY

- FIGURE 26 REVENUE SHIFT FOR MOLDED FIBER PULP PACKAGING MANUFACTURERS

- FIGURE 27 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 GRANTED PATENTS ARE 32% OF TOTAL COUNT IN LAST FIVE YEARS

- FIGURE 29 PUBLICATION TRENDS - LAST FIVE YEARS

- FIGURE 30 JURISDICTION ANALYSIS

- FIGURE 31 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 32 COST OF MOLDED PULP PACKAGING PRODUCTS PER KG

- FIGURE 33 ECOSYSTEM OF MOLDED FIBER PULP PACKAGING MARKET

- FIGURE 34 TRANSFER MOLDED SEGMENT TO LEAD MOLDED FIBER PULP PACKAGING MARKET DURING FORECAST PERIOD

- FIGURE 35 TRAYS PRODUCT SEGMENT TO LEAD MOLDED FIBER PULP PACKAGING MARKET DURING FORECAST PERIOD

- FIGURE 36 MOLDED FIBER PULP PACKAGING MARKET, BY SOURCE, 2022–2027

- FIGURE 37 MOLDED FIBER PULP PACKAGING MARKET, BY END USE, 2022 VS. 2027 (USD MILLION)

- FIGURE 38 RISING MANUFACTURING ACTIVITIES AND E-COMMERCE INDUSTRY DRIVING MOLDED FIBER PULP PACKAGING MARKET

- FIGURE 39 ASIA PACIFIC PROJECTED TO BE LARGEST AND FASTEST-GROWING MOLDED FIBER PULP PACKAGING MARKET GLOBALLY FROM 2022 TO 2027

- FIGURE 40 RANKING OF TOP FIVE PLAYERS IN MOLDED FIBER PULP PACKAGING MARKET, 2021

- FIGURE 41 REVENUE ANALYSIS FOR KEY COMPANIES IN MOLDED FIBER PULP PACKAGING MARKET

- FIGURE 42 MARKET SHARE ANALYSIS

- FIGURE 43 COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 44 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2021

- FIGURE 45 BRØDRENE HARTMANN A/S: COMPANY SNAPSHOT (2021)

- FIGURE 46 HUHTAMAKI OYJ: COMPANY SNAPSHOT (2021)

- FIGURE 47 UFP TECHNOLOGIES: COMPANY SNAPSHOT (2021)

- FIGURE 48 SONOCO PRODUCTS CO: COMPANY SNAPSHOT

- FIGURE 49 PRO-PAK PACKAGING LIMITED: COMPANY SNAPSHOT

- FIGURE 50 JAMES CROPPER PLC.: COMPANY SNAPSHOT (2021)

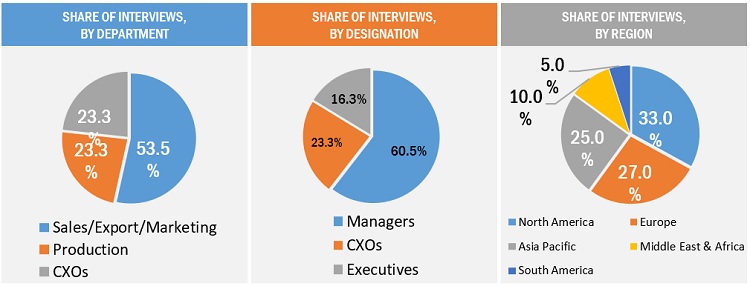

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the molded pulp packing market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Primary Research

The molded pulp packaging market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the molded pulp packaging industry. Primary sources from the supply side include associations and institutions involved in the molded fiber packaging industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global molded fiber pulp packaging market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage share split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach and Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the global molded fiber pulp packaging market in terms of value

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on molded type, product type, source, end-use, and region.

- To forecast the market size, in terms of value, with respect to six main regions: North America, Europe, South America, APAC, Middle East, and Africa.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape

- To strategically profile key players in the market

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions

- To strategically profile the leading players and comprehensively analyze their key developments in the market

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the APAC Molded fiber pulp packaging market

- Further breakdown of the Rest of Europe’s Molded fiber pulp packaging market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Molded Pulp Packaging Market