Wireless Gigabit Market SoC, Module, IEEE 802.11AD, IEEE 802.11AY, 57-71 GHz, Router, Access Point, Docking Station, Backhaul Station, Adapter, AR/VR, Multimedia Streaming, Video Wall, Biometric, Smart City, Gesture Control - Global Forecast to 2029

Wireless Gigabit Market Summary

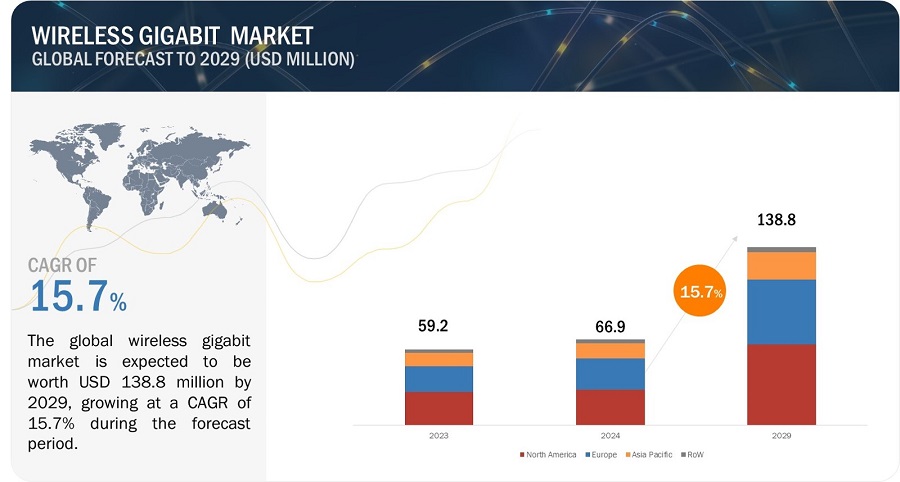

The global Wireless Gigabit Market was valued at USD 66.9 million in 2024 and is projected to grow from USD 76.4 million in 2025 to USD 138.8 million by 2029, at a CAGR of 15.7% during the forecast period. This growth is driven by the increasing demand for high-speed wireless connectivity, which traditional Wi-Fi networks often cannot meet. WiGig technology, operating in the 60 GHz frequency band, offers multi-gigabit speeds and low interference, making it ideal for high-bandwidth applications such as HD video streaming, online gaming, and smart devices like smartphones and AR/VR devices. The deployment of 5G networks and the expansion of smart cities further enhance the market's potential by improving network performance and capacity.

Key Takeaways:

• The global Wireless Gigabit Market was valued at USD 66.9 million in 2024 and is projected to grow from USD 76.4 million in 2025 to USD 138.8 million by 2029, at a CAGR of 15.7% during the forecast period.

• By Technology: Key technologies such as millimeter-wave technology, beamforming, and advanced antenna arrays are driving the market. The integration of complementary technologies like IoT, AI, and edge computing is enhancing the capabilities of WiGig, offering more robust and adaptive networks.

• By Application: The surging adoption of high-definition content and AR/VR devices is a major growth driver, with WiGig technology supporting seamless, low-latency connections essential for these applications.

• By End User: The increasing demand for smart devices and high-speed internet services is accelerating the adoption of WiGig technology in consumer electronics, enterprise solutions, and smart city infrastructures.

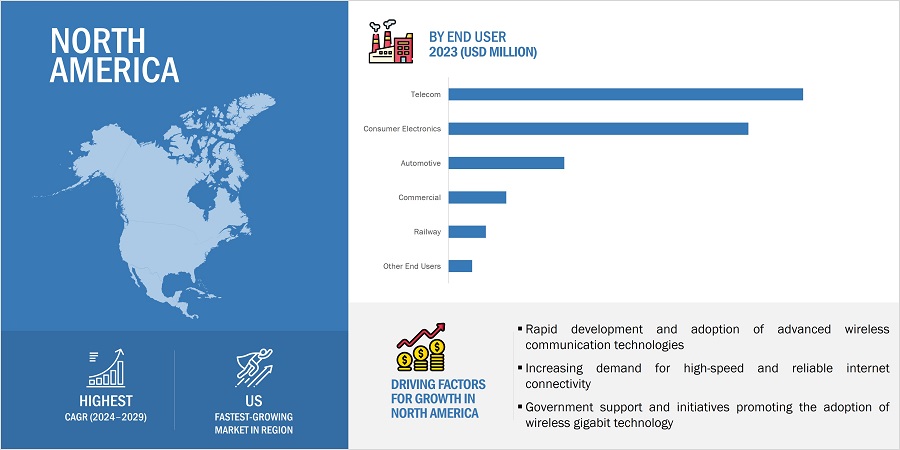

• By Region: NORTH AMERICA is expected to grow fastest at 17.6% CAGR, driven by significant investments in digital infrastructure and the rapid adoption of new wireless technologies.

• Market Dynamics: While the market benefits from drivers like rising demand for high-speed connectivity and smart city projects, challenges such as high deployment costs and data privacy concerns remain.

• Competitive Landscape: Key partnerships and collaborations, such as those between Dell, Qualcomm, and other tech giants, are propelling the integration of WiGig technology into diverse products and solutions, enhancing market competitiveness.

In conclusion, the Wireless Gigabit Market is poised for substantial growth, driven by technological advancements and increasing demand for high-speed wireless connectivity. The ongoing deployment of 5G networks and smart city projects present significant growth opportunities. However, addressing challenges related to high deployment costs and data privacy will be crucial for sustained market expansion. As WiGig technology continues to evolve, it will play a pivotal role in shaping the future of wireless communications, providing seamless connectivity for a wide range of applications..

Wireless Gigabit Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

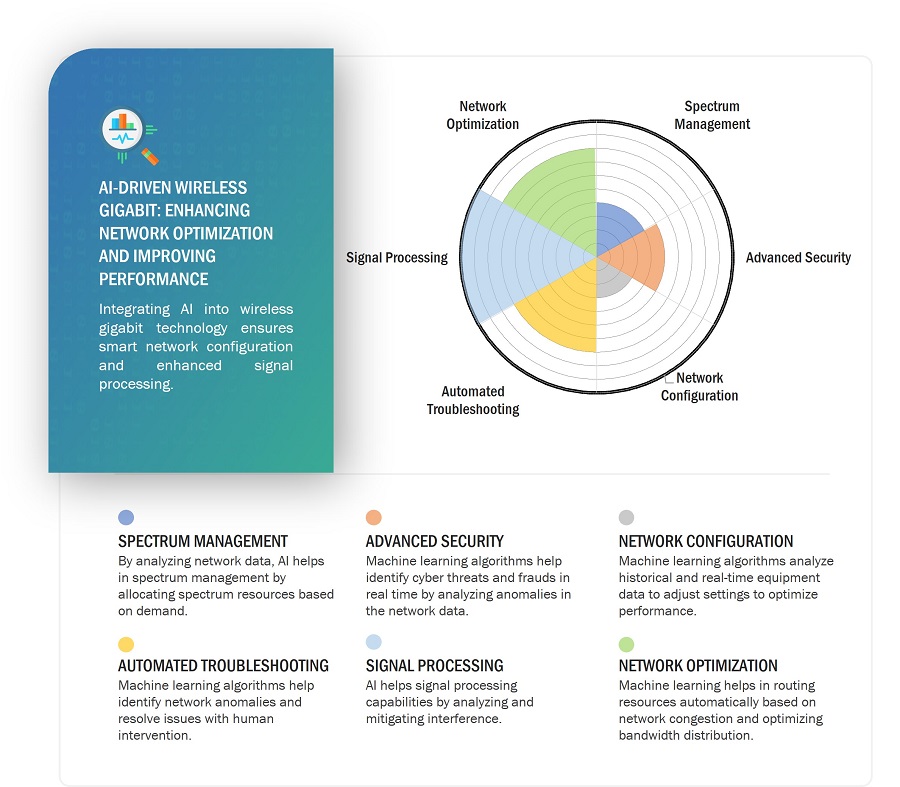

AI Impact on Wireless Gigabit Market

AI is playing a pivotal role in optimizing network performance and improving user experiences. AI-driven algorithms now enable efficient administration and bandwidth distribution, reducing latency and helping maintain high-speed connections even in high-congestion areas. This is crucial for AR/VR, HD video streaming, and IoT applications that depend on seamless, low-latency connections. This leads to better user experience, making Wi-Fi 802.11ad networks even more reliable due to AI-powered predictive maintenance and automated troubleshooting that reduces downtimes when transitioning from one module to another within a WiGig network.

Wireless Gigabit Market Trends & Dynamics

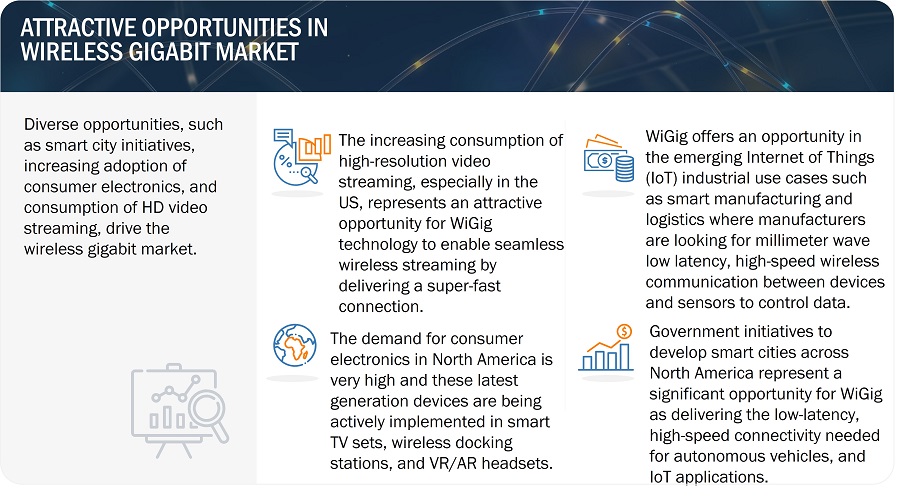

Driver: Growing consumption of HD video streaming

The advent of OTT streaming services offering 4K and 8K content has led consumers to expect seamless playback without buffering interruptions, which can be caused by limited Wi-Fi bandwidth and network congestion. WiGig technology operates in the 60 GHz frequency band and offers multi-gigabit speeds and near-zero latency to meet high-speed data rate requirements critical for HD video streaming. The increasing consumption of HD video streaming fuels the wireless gigabit market growth.

Restraint: Data privacy and security concerns associated with WiGig technology

Integration of WiGig technology in the communication channel leads to various risks associated with collecting, storing, and transmitting traffic data. WiGig operates in the 60 GHz unlicensed frequency band, creating a high-risk environment of privacy breaches due to the rising threats. These cyberattacks may lead to unauthorized access to connectivity channels, disrupting communications. Additionally, cyber threats create a risk of unauthorized access to user data generated by smartphones, IoT devices, and other connected devices, leading to concerns regarding unauthorized surveillance and cyberattacks.

Opportunity: Significant focus on smart city initiatives due to rapid urbanization

Rapid urbanization has led to the expansion of smart cities globally. Countries worldwide invest heavily in smart infrastructure by integrating advanced wireless technologies such as wireless gigabit (WiGig). For instance, a smart city ecosystem consists of various connected and IoT devices, and WiGig technology provides wireless channels for data transmission and ensures efficient transmission and processing of data generated by these devices.

Challenge: Rapid and ongoing changes in technology landscape

As the technology landscape evolves rapidly, wireless gigabit presents a significant challenge in the wireless connectivity market. As new technologies appear and current technology evolves, companies in the ecosystem must continuously invest in the research and development of changing market demand and advancements. Additionally, intense competition in the market and pressure to offer innovative solutions further restrict companies from maintaining market leadership. Companies' negligence in identifying the technological shift may result in declining market share and revenue.

Wireless Gigabit Market Ecosystem

The wireless gigabit market is dominated by established and financially sound manufacturers with extensive experience in the industry. These companies have diversified product portfolios, cutting-edge technologies, and strong global sales and marketing networks. Leading players in the market include Peraso Technologies Inc. (US), Tensorcom, Inc. (US), Sivers Semiconductors AB (Sweden), STMicroelectronics (Switzerland), and Qualcomm (US).

Module segment to hold largest share of wireless gigabit market, by offering, throughout forecast period.

The wireless gigabit market is gaining momentum in module offerings, driven by the rising need for high-speed and low-latency wireless connections across various devices and applications, including smartphones, laptops, and tablets. Modules enable fast switching of consumer electronics, enterprise solutions, and industrial systems to WiGig technology and represent a flexible solution with the right cost strategy for manufacturers implementing high-speed wireless functionality. As the WiGig technology is widely adopted in AR/VR, IoT, and smart home devices along with backhaul applications, the demand for WiGig modules grows exponentially.

63-65 GHz frequency band to exhibit highest CAGR in wireless gigabit market, by channel, from 2024 to 2029.

WiGig for the 63–65 GHz channel is gaining momentum, as it can deliver ultra-high-speed transmission and has the maximum resistance to interference between short ranges. It is an excellent opportunity in dense urban environments with high-capacity requirements. This spectrum is crucial for 4K/8K video streaming, AR/VR experiences in real-time, and wireless backhaul necessary in high-bandwidth activities on future 5G networks. The utilization of a combination of this frequency band and WiGig technology significantly improves connectivity, making it a tuned solution for deployment in consumer and enterprise applications.

Telecom segment to hold majority of market share during forecast period.

The telecom segment is projected to account for the largest share of the wireless gigabit market, by end user, during the forecast period. Mobile and internet penetration has increased network traffic, driving operators to invest in advanced technologies to mitigate network congestion. Telecom companies are increasingly adopting WiGig technology to expand network capacity and reduce congestion by routing network traffic to other frequency bands. Thus, they can improve service quality and user experience.

Wireless Gigabit Market by Region

To know about the assumptions considered for the study, download the pdf brochure

North America to capture largest market share between 2024 and 2029.

North America is expected to hold the largest market share during the forecast period. North America, specifically the US, is an innovation hub due to the significant presence of large tech companies such as Qualcomm Incorporated (US), Cisco Systems, Inc. (US), Microsoft (US) in the region, attracting huge investments in WiGig technology innovations. Additionally, the region experiences high internet penetration, leading to increased adoption of smart devices, which require high-speed wireless connectivity. The rise in the adoption of smart devices drives the demand for WiGig technology for its ability to offer high-speed wireless connectivity.

Top Companires Wireless Gigabit- Key Market Players:

The Wireless gigabit market is dominated by players such as Peraso Technologies Inc. (US), Tensorcom, Inc. (US), Sivers Semiconductors AB (Sweden), STMicroelectronics (Switzerland), Qualcomm (US) and others.

Scope of the Wireless Gigabit Market Report

|

Report Metric |

Details |

| Estimated Market Size | USD 66.9 million in 2024 |

| Projected Market Size | USD 138.8 million by 2029 |

| Wireless Gigabit Market Growth Rate | at a CAGR of 15.7% |

|

Market size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million) |

|

Segments Covered |

By Offering, By Protocol, By Channel, By Product, and By End User |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

The major market players include Peraso Technologies Inc. (US); Tensorcom, Inc. (US); Sivers Semiconductors AB (Sweden); STMicroelectronics (Switzerland); Qualcomm (US); Fujikura Ltd. (Japan); Blu Wireless (US); Pharrowtech (US); Analog Devices (US); indie Semiconductor (US); Renesas Electronics Corporation (Japan); Murata Manufacturing Co., Ltd. (Japan). (Total 25 players are profiled.) |

Wireless Gigabit Market Highlights

The study categorizes the Wireless gigabit market based on the following segments:

|

Segment |

Subsegment |

|

By Offering |

|

|

By Protocol |

|

|

By Channel |

|

|

By Product |

|

|

By End User |

|

|

By Region |

|

Recent Developments

- In September 2023, Peraso Technologies Inc. announced the release of the PRM2144X, its latest mmWave module in the Perspectus series, which features long-range, outdoor applications.

- In February 2022, Pharrowtech launched the PTR1060, the world’s first IEEE 802.11ay-compliant CMOS RF chip for indoor and outdoor wireless use cases, supporting 57 to 71 GHz bandwidth.

Frequently Asked Questions:

What are the major driving factors and opportunities for the wireless gigabit market?

Some of the major driving factors for the growth of this market include the growing demand for HD video streaming, increased adoption of AR/VR devices, proliferation of smart devices, and a rise in investment in high-speed internet. Moreover, the rising deployment of 5G networks, the increasing prevalence of smart city initiatives, and increasing investments in vehicle-to-everything (V2X) communication are critical opportunities for the wireless gigabit market.

Which region is expected to hold the largest market share?

The North American WiGig market is emerging, providing a cutting-edge digital network in the region supported by early adoption of new technology and heavy investment in deploying 5G networks. WiGig is emerging as an essential technology for delivering ultra-fast wireless connections, a must-have due to the popularity of HD video streaming and other bandwidth-heavy applications such as remote work solutions or AR/VR. North America also holds a significant market position, focusing on smart cities, IT, IoT development, etc. These factors contribute to the growth of the wireless gigabit market in North America.

Who are the leading players in the global wireless gigabit market?

Companies such as Peraso Technologies Inc. (US), Tensorcom, Inc. (US), Sivers Semiconductors AB (Sweden), STMicroelectronics (Switzerland), and Qualcomm (US) are the leading players in the market.

What are some of the technological advancements in the market?

Increased innovation in the chipsets and modules has significantly improved the power consumption and range limitations. WiGig integration with 5G networks is transforming wireless backhaul, meeting modern networks' high-speed and low-latency needs. In addition, more effective beamforming technology and spectrum management allow for stronger signals with less interference, even in crowded areas. These technological advancements are fuelling the development of advanced WiGig-powered products, such as high-resolution wireless displays and AR/VR headsets to home automation devices, expanding this market's adoption and growth.

What are some macroeconomic factors impacting the wireless gigabit market?

Macroeconomic factors such as interest rates, inflation, GDP growth, unemployment, and debt will significantly impact the wireless gigabit market in the coming years. These factors highly depend on government initiatives, enterprise investments, borrowing costs, and research and development spending. High inflation leads to an increase in interest rates, restricting businesses from minimizing spending on advanced wireless communication technology research and development. Reduced wireless communication technology investments may delay the development of advanced wireless solutions, impacting the wireless gigabit market growth.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand for high-definition content- Surging adoption of AR/VR devices- Increasing demand for smart devices- Growing investments in high-speed internetRESTRAINTS- High deployment costs- Data privacy and security concerns- Interoperability issues due to lack of standard protocolsOPPORTUNITIES- Rising deployment of 5G networks- Increasing investments in smart city projects- Emergence of smart and connected vehiclesCHALLENGES- Obsolescence of older technologies due to constant technological advancements- Complexities associated with integration of WiGig technology with existing and legacy systems

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.4 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERINGINDICATIVE PRICING TREND OF WIRELESS GIGABIT OFFERINGS, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

-

5.8 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Millimeter-wave technology- Beamforming- Advanced antenna arrays- High-efficiency power amplifiersCOMPLEMENTARY TECHNOLOGIES- Edge computing- Internet of Things- Artificial intelligence and machine learning- Augmented reality and virtual realityADJACENT TECHNOLOGIES- Cloud computing- 5G networks- Wi-Fi 6E

-

5.9 PATENT ANALYSIS

-

5.10 TRADE ANALYSISIMPORT SCENARIO (HS CODE 8517)EXPORT SCENARIO (HS CODE 8517)

- 5.11 KEY CONFERENCES AND EVENTS, 2024–2025

-

5.12 CASE STUDY ANALYSISDELL PARTNERED WITH QUALCOMM TO INTEGRATE WIGIG TECHNOLOGY INTO ITS LAPTOPS AND DOCKING STATIONSHARMAN PARTNERED WITH PERASO TECHNOLOGIES TO INTEGRATE WIGIG TECHNOLOGY INTO IN-CAR INFOTAINMENT SYSTEMSCISCO PARTNERED WITH PERASO TECHNOLOGIES TO INTEGRATE WIGIG TECHNOLOGY INTO THEIR WIRELESS INFRASTRUCTURE SOLUTIONSHP COLLABORATED WITH WILOCITY TO INCORPORATE WIGIG TECHNOLOGY INTO ITS ELITEBOOK SERIES OF LAPTOPSNETGEAR COLLABORATED WITH QUALCOMM TO DEVELOP NIGHTHAWK X10 AD7200 SMART WI-FI ROUTER

-

5.13 TARIFF AND REGULATORY LANDSCAPETARIFF ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS

-

5.14 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITION RIVALRY

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON WIRELESS GIGABIT MARKET

- 6.1 INTRODUCTION

-

6.2 MULTIMEDIA STREAMINGVIDEO WALL

- 6.3 ONLINE GAMING

- 6.4 WIRELESS DOCKING

- 6.5 BIOMETRIC AUTHENTICATION

- 6.6 GESTURE CONTROL & PROXIMITY SENSING

- 6.7 AR/VR DEVICES

- 6.8 SMART CITIES

- 7.1 INTRODUCTION

-

7.2 57–59 GHZHIGH-SPEED DATA DEMANDS IN VR/AR AND WIRELESS CONNECTIVITY TO FUEL MARKET GROWTH

-

7.3 59–61 GHZINCREASING DEMAND FOR HIGH-CAPACITY WIRELESS BACKHAUL AND SECURE NETWORKS TO FOSTER MARKET GROWTH

-

7.4 61–63 GHZHIGH FLEXIBILITY AND EFFICIENCY DUE TO MINIMIZED CABLING TO BOOST DEMAND

-

7.5 63–65 GHZSURGING DEMAND FOR ADVANCED DRIVER-ASSISTANCE SYSTEMS TO ACCELERATE MARKET GROWTH

- 7.6 OTHER CHANNELS

- 8.1 INTRODUCTION

-

8.2 IEEE 802.11 ADHIGH-SPEED DATA TRANSFER FOR ULTRA-HD STREAMING AND VR TO DRIVE MARKET

-

8.3 IEEE 802.11 AYEXTENDED RANGE AND ENHANCED CONNECTIVITY TO PROPEL MARKET GROWTH

- 9.1 INTRODUCTION

-

9.2 DISPLAY DEVICESGROWING DEMAND FOR HIGH-SPEED VIDEO STREAMING AND REMOTE WORK TO DRIVE ADOPTION

-

9.3 NETWORK INFRASTRUCTURE DEVICESNETWORK ROUTERS & ACCESS POINTS- Rising demand for high-speed internet and data services to drive marketNETWORK ADAPTERS- Escalating adoption of IoT and smart home technologies to accelerate market growthBACKHAUL STATIONS- Surging demand for high-speed and low-latency connectivity to fuel market growthDOCKING STATIONS- Elevating need for laptops and mobile devices to boost demand

- 10.1 INTRODUCTION

-

10.2 SOCRISING DEMAND FOR EFFICIENT AND HIGH-PERFORMANCE WIRELESS COMMUNICATION TO FUEL MARKET GROWTH

-

10.3 MODULEPRESSING NEED FOR RAPID, HIGH-BANDWIDTH WIRELESS CONNECTIONS TO FOSTER MARKET GROWTH

- 11.1 INTRODUCTION

-

11.2 TELECOMGROWING DATA TRAFFIC AND DEMAND FOR HIGH-SPEED CONNECTIVITY TO PROPEL MARKET

-

11.3 CONSUMER ELECTRONICSRAPID ADOPTION OF SMART DEVICES TO ACCELERATE MARKET GROWTH

-

11.4 AUTOMOTIVERISING DEMAND FOR V2X COMMUNICATION TO AUGMENT MARKET GROWTH

-

11.5 COMMERCIALSHIFT TOWARD DIGITAL BANKING AND ADVANCED FINANCIAL SERVICES TO BOOST DEMANDBFSIMEDICAL

-

11.6 RAILWAYADOPTION OF SMART TECHNOLOGIES TO ENHANCE EFFICIENCY, SAFETY, AND PASSENGER EXPERIENCE TO FUEL MARKET GROWTHHIGH-SPEED RAIL

- 11.7 OTHER END USERS

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICAMACROECONOMIC OUTLOOK FOR NORTH AMERICAUS- Surging demand for high-speed, low-latency wireless connectivity to fuel market growthCANADA- Government-led remote and rural connectivity projects to foster market growthMEXICO- Rapid expansion of data centers to boost demand

-

12.3 EUROPEMACROECONOMIC OUTLOOK FOR EUROPEUK- Significant funding to support enhancement of digital infrastructure to spike demandGERMANY- Increasing adoption of cloud computing to drive market growthFRANCE- Government and private sector investments to boost demandITALY- High-speed broadband networks and 5G deployment to foster market growthREST OF EUROPE

-

12.4 ASIA PACIFICMACROECONOMIC OUTLOOK FOR ASIA PACIFICCHINA- Industrial and consumer IoT expansion to drive marketJAPAN- Robust digital infrastructure and government support to fuel market growthSOUTH KOREA- Need for robust network security solutions to offer lucrative growth opportunitiesREST OF ASIA PACIFIC

-

12.5 ROWMACROECONOMIC OUTLOOK FOR ROWMIDDLE EAST- Increasing number of smart city projects to drive market- Rest of Middle EastSOUTH AMERICA- Growing adoption of advanced wireless connectivity solutions to support market growthAFRICA- Government efforts to expand internet access and encourage usage to spur demand

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2024

- 13.3 REVENUE ANALYSIS, 2019–2023

- 13.4 MARKET SHARE ANALYSIS, 2023

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

-

13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2023- Company footprint- Offering footprint- Protocol footprint- Channel footprint- Product footprint- End user footprint- Region footprint

-

13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023- Detailed list of key startups/SMEs- Competitive benchmarking of key startups/SMEs

-

13.9 COMPETITIVE SCENARIOPRODUCT/SERVICE LAUNCHESDEALS

-

14.1 KEY PLAYERSPERASO TECHNOLOGIES INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSIVERS SEMICONDUCTORS AB- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTENSORCOM, INC.- Business overview- Products/Solutions/Services offered- MnM viewSTMICROELECTRONICS- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewQUALCOMM TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offered- MnM viewFUJIKURA LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsBLU WIRELESS- Business overview- Products/Solutions/Services offeredPHARROWTECH- Business overview- Products/Solutions/Services offered- Recent developmentsINDIE SEMICONDUCTOR- Business overview- Products/Solutions/Services offeredANALOG DEVICES, INC.- Business overview- Products/Solutions/Services offeredCAMBIUM NETWORKS, LTD.- Business overview- Products/Solutions/Services offeredRENESAS ELECTRONICS CORPORATION- Business overview- Products/Solutions/Services offeredMURATA MANUFACTURING CO., LTD.- Business overview- Products/Solutions/Services offered

-

14.2 OTHER KEY PLAYERSMISTRAL SOLUTIONS PVT. LTD.MOVANDI CORPORATIONPASTERNACKJIANGSU CREATCOMM TECHNOLOGIES CO., LTD.MIKROTIKCOMMON NETWORKS, INC.EDGECORE NETWORKSAIRVINE SCIENTIFIC, INC.WIRELESS EXCELLENCE LIMITEDLASER 2000AXXCSS WIRELESS SOLUTIONS, INC.TACHYON NETWORKS

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 WIRELESS GIGABIT MARKET: RISK ANALYSIS

- TABLE 2 INDICATIVE PRICING TREND OF WIRELESS GIGABIT OFFERINGS, BY KEY PLAYER, 2023 (USD)

- TABLE 3 INDICATIVE PRICING TREND OF SOC & MODULE, BY REGION, 2023 (USD)

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 LIST OF PATENTS IN WIRELESS GIGABIT MARKET, 2020–2023

- TABLE 6 IMPORT DATA FOR HS CODE 8517-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023

- TABLE 7 EXPORT DATA FOR HS CODE 8517-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023

- TABLE 8 WIRELESS GIGABIT MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 9 MFN TARIFFS FOR HS CODE 8517-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 10 MFN TARIFFS FOR HS CODE 8517-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 11 MFN TARIFFS FOR HS CODE 8517-COMPLIANT PRODUCTS EXPORTED BY GERMANY

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 STANDARDS AND REGULATIONS RELATED TO WIRELESS GIGABIT MARKET

- TABLE 17 IMPACT OF PORTER'S FIVE FORCES ON WIRELESS GIGABIT MARKET

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS (%)

- TABLE 19 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 20 WIRELESS GIGABIT MARKET, BY CHANNEL, 2020–2023 (USD MILLION)

- TABLE 21 WIRELESS GIGABIT MARKET, BY CHANNEL, 2024–2029 (USD MILLION)

- TABLE 22 57–59 GHZ: WIRELESS GIGABIT MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 23 57–59 GHZ: WIRELESS GIGABIT MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 24 59–61 GHZ: WIRELESS GIGABIT MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 25 59–61 GHZ: WIRELESS GIGABIT MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 26 61–63 GHZ: WIRELESS GIGABIT MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 27 61–63 GHZ: WIRELESS GIGABIT MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 28 63–65 GHZ: WIRELESS GIGABIT MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 29 63–65 GHZ: WIRELESS GIGABIT MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 30 OTHER CHANNELS: WIRELESS GIGABIT MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 31 OTHER CHANNELS: WIRELESS GIGABIT MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 32 WIRELESS GIGABIT MARKET, BY PROTOCOL, 2020–2023 (USD MILLION)

- TABLE 33 WIRELESS GIGABIT MARKET, BY PROTOCOL, 2024–2029 (USD MILLION)

- TABLE 34 IEEE 802.11 AD: WIRELESS GIGABIT MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 35 IEEE 802.11 AD: WIRELESS GIGABIT MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 36 IEEE 802.11AY: WIRELESS GIGABIT MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 37 IEEE 802.11AY: WIRELESS GIGABIT MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 38 WIRELESS GIGABIT MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 39 WIRELESS GIGABIT MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 40 DISPLAY DEVICES: WIRELESS GIGABIT MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 41 DISPLAY DEVICES: WIRELESS GIGABIT MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 42 NETWORK INFRASTRUCTURE DEVICES: WIRELESS GIGABIT MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 43 NETWORK INFRASTRUCTURE DEVICES: WIRELESS GIGABIT MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 44 NETWORK INFRASTRUCTURE DEVICES: WIRELESS GIGABIT MARKET, BY DEVICE TYPE, 2020–2023 (USD MILLION)

- TABLE 45 NETWORK INFRASTRUCTURE DEVICES: WIRELESS GIGABIT MARKET, BY DEVICE TYPE, 2024–2029 (USD MILLION)

- TABLE 46 WIRELESS GIGABIT MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 47 WIRELESS GIGABIT MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 48 WIRELESS GIGABIT MARKET, BY OFFERING, 2020–2023 (THOUSAND UNITS)

- TABLE 49 WIRELESS GIGABIT MARKET, BY OFFERING, 2024–2029 (THOUSAND UNITS)

- TABLE 50 SOC: WIRELESS GIGABIT MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 51 SOC: WIRELESS GIGABIT MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 52 SOC: WIRELESS GIGABIT MARKET, BY PROTOCOL, 2020–2023 (USD MILLION)

- TABLE 53 SOC: WIRELESS GIGABIT MARKET, BY PROTOCOL, 2024–2029 (USD MILLION)

- TABLE 54 SOC: WIRELESS GIGABIT MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 55 SOC: WIRELESS GIGABIT MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 56 MODULE: WIRELESS GIGABIT MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 57 MODULE: WIRELESS GIGABIT MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 58 MODULE: WIRELESS GIGABIT MARKET, BY PROTOCOL, 2020–2023 (USD MILLION)

- TABLE 59 MODULE: WIRELESS GIGABIT MARKET, BY PROTOCOL, 2024–2029 (USD MILLION)

- TABLE 60 MODULE: WIRELESS GIGABIT MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 61 MODULE: WIRELESS GIGABIT MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 62 WIRELESS GIGABIT MARKET, BY END USER, 2020–2023 (USD MILLION)

- TABLE 63 WIRELESS GIGABIT MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 64 TELECOM: WIRELESS GIGABIT MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 65 TELECOM: WIRELESS GIGABIT MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 66 CONSUMER ELECTRONICS: WIRELESS GIGABIT MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 67 CONSUMER ELECTRONICS: WIRELESS GIGABIT MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 68 AUTOMOTIVE: WIRELESS GIGABIT MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 69 AUTOMOTIVE: WIRELESS GIGABIT MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 70 COMMERCIAL: WIRELESS GIGABIT MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 71 COMMERCIAL: WIRELESS GIGABIT MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 72 RAILWAY: WIRELESS GIGABIT MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 73 RAILWAY: WIRELESS GIGABIT MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 74 OTHER END USERS: WIRELESS GIGABIT MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 75 OTHER END USERS: WIRELESS GIGABIT MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 76 WIRELESS GIGABIT MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 77 WIRELESS GIGABIT MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 78 NORTH AMERICA: WIRELESS GIGABIT MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 79 NORTH AMERICA: WIRELESS GIGABIT MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 80 NORTH AMERICA: WIRELESS GIGABIT MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 81 NORTH AMERICA: WIRELESS GIGABIT MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 82 NORTH AMERICA: WIRELESS GIGABIT MARKET, BY CHANNEL, 2020–2023 (USD MILLION)

- TABLE 83 NORTH AMERICA: WIRELESS GIGABIT MARKET, BY CHANNEL, 2024–2029 (USD MILLION)

- TABLE 84 NORTH AMERICA: WIRELESS GIGABIT MARKET, BY END USER, 2020–2023 (USD MILLION)

- TABLE 85 NORTH AMERICA: WIRELESS GIGABIT MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 86 EUROPE: WIRELESS GIGABIT MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 87 EUROPE: WIRELESS GIGABIT MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 88 EUROPE: WIRELESS GIGABIT MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 89 EUROPE: WIRELESS GIGABIT MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 90 EUROPE: WIRELESS GIGABIT MARKET, BY CHANNEL, 2020–2023 (USD MILLION)

- TABLE 91 EUROPE: WIRELESS GIGABIT MARKET, BY CHANNEL, 2024–2029 (USD MILLION)

- TABLE 92 EUROPE: WIRELESS GIGABIT MARKET, BY END USER, 2020–2023 (USD MILLION)

- TABLE 93 EUROPE: WIRELESS GIGABIT MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 94 ASIA PACIFIC: WIRELESS GIGABIT MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 95 ASIA PACIFIC: WIRELESS GIGABIT MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 96 ASIA PACIFIC: WIRELESS GIGABIT MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 97 ASIA PACIFIC: WIRELESS GIGABIT MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 98 ASIA PACIFIC: WIRELESS GIGABIT MARKET, BY CHANNEL, 2020–2023 (USD MILLION)

- TABLE 99 ASIA PACIFIC: WIRELESS GIGABIT MARKET, BY CHANNEL, 2024–2029 (USD MILLION)

- TABLE 100 ASIA PACIFIC: WIRELESS GIGABIT MARKET, BY END USER, 2020–2023 (USD MILLION)

- TABLE 101 ASIA PACIFIC: WIRELESS GIGABIT MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 102 ROW: WIRELESS GIGABIT MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 103 ROW: WIRELESS GIGABIT MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 104 ROW: WIRELESS GIGABIT MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 105 ROW: WIRELESS GIGABIT MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 106 ROW: WIRELESS GIGABIT MARKET, BY CHANNEL, 2020–2023 (USD MILLION)

- TABLE 107 ROW: WIRELESS GIGABIT MARKET, BY CHANNEL, 2024–2029 (USD MILLION)

- TABLE 108 ROW: WIRELESS GIGABIT MARKET, BY END USER, 2020–2023 (USD MILLION)

- TABLE 109 ROW: WIRELESS GIGABIT MARKET, BY END USER, 2024–2029 (USD MILLION)

- TABLE 110 MIDDLE EAST: WIRELESS GIGABIT MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 111 MIDDLE EAST: WIRELESS GIGABIT MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 112 WIRELESS GIGABIT MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021–2024

- TABLE 113 WIRELESS GIGABIT: DEGREE OF COMPETITION

- TABLE 114 WIRELESS GIGABIT MARKET: OFFERING FOOTPRINT

- TABLE 115 WIRELESS GIGABIT MARKET: PROTOCOL FOOTPRINT

- TABLE 116 WIRELESS GIGABIT MARKET: CHANNEL FOOTPRINT

- TABLE 117 WIRELESS GIGABIT MARKET: PRODUCT FOOTPRINT

- TABLE 118 WIRELESS GIGABIT MARKET: END USER FOOTPRINT

- TABLE 119 WIRELESS GIGABIT MARKET: REGION FOOTPRINT

- TABLE 120 WIRELESS GIGABIT MARKET: DETAILED LIST OF KEY STARTUPS

- TABLE 121 WIRELESS GIGABIT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 122 WIRELESS GIGABIT MARKET: PRODUCT/SERVICE LAUNCHES, JANUARY 2021– AUGUST 2024

- TABLE 123 WIRELESS GIGABIT MARKET: DEALS, JANUARY 2021–AUGUST 2024

- TABLE 124 PERASO TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 125 PERASO TECHNOLOGIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERINGS

- TABLE 126 PERASO TECHNOLOGIES INC.: PRODUCT/SERVICE LAUNCHES

- TABLE 127 SIVERS SEMICONDUCTORS AB: COMPANY OVERVIEW

- TABLE 128 SIVERS SEMICONDUCTORS AB: PRODUCTS/SOLUTIONS/SERVICES OFFERINGS

- TABLE 129 SIVERS SEMICONDUCTORS AB: PRODUCT/SERVICE LAUNCHES

- TABLE 130 TENSORCOM, INC.: COMPANY OVERVIEW

- TABLE 131 TENSORCOM, INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 132 STMICROELECTRONICS: COMPANY OVERVIEW

- TABLE 133 STMICROELECTRONICS: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 134 STMICROELECTRONICS: PRODUCT/SERVICE LAUNCHES

- TABLE 135 STMICROELECTRONICS: DEALS

- TABLE 136 QUALCOMM TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 137 QUALCOMM TECHNOLOGIES, INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 138 FUJIKURA LTD.: COMPANY OVERVIEW

- TABLE 139 FUJIKURA LTD.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 140 FUJIKURA LTD.: PRODUCT/SERVICE LAUNCHES

- TABLE 141 BLU WIRELESS: COMPANY OVERVIEW

- TABLE 142 BLU WIRELESS: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 143 PHARROWTECH: COMPANY OVERVIEW

- TABLE 144 PHARROWTECH: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 145 PHARROWTECH: PRODUCT/SERVICE LAUNCHES

- TABLE 146 PHARROWTECH: DEALS

- TABLE 147 INDIE SEMICONDUCTOR: COMPANY OVERVIEW

- TABLE 148 INDIE SEMICONDUCTOR: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 149 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- TABLE 150 ANALOG DEVICES, INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 151 CAMBIUM NETWORKS, LTD.: COMPANY OVERVIEW

- TABLE 152 CAMBIUM NETWORKS, LTD.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 153 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 154 RENESAS ELECTRONICS CORPORATION: PRODUCT/SOLUTION/ SERVICE OFFERINGS

- TABLE 155 MURATA MANUFACTURING CO., LTD.: COMPANY OVERVIEW

- TABLE 156 MURATA MANUFACTURING CO., LTD.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- FIGURE 1 WIRELESS GIGABIT MARKET SEGMENTATION

- FIGURE 2 WIRELESS GIGABIT MARKET: RESEARCH DESIGN

- FIGURE 3 WIRELESS GIGABIT MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 4 WIRELESS GIGABIT MARKET: REVENUE FROM SALES OF WIRELESS GIGABIT PRODUCTS AND SOLUTIONS

- FIGURE 5 WIRELESS GIGABIT MARKET: BOTTOM-UP APPROACH

- FIGURE 6 WIRELESS GIGABIT MARKET: TOP-DOWN APPROACH

- FIGURE 7 WIRELESS GIGABIT MARKET: DATA TRIANGULATION

- FIGURE 8 WIRELESS GIGABIT MARKET: RESEARCH ASSUMPTIONS

- FIGURE 9 MODULE SEGMENT TO HOLD LARGER MARKET SHARE IN 2029

- FIGURE 10 57–59 GHZ SEGMENT TO DOMINATE MARKET, BY CHANNEL, DURING FORECAST PERIOD

- FIGURE 11 NETWORK INFRASTRUCTURE DEVICES SEGMENT TO SECURE LARGER MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 12 TELECOM SEGMENT TO CAPTURE LARGEST SHARE OF WIRELESS GIGABIT MARKET, BY END USER, THROUGHOUT FORECAST PERIOD

- FIGURE 13 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF WIRELESS GIGABIT MARKET IN 2023

- FIGURE 14 INCREASING ADOPTION OF SMART DEVICES AND EXPANSION OF SMART CITIES TO CONTRIBUTE TO MARKET GROWTH

- FIGURE 15 CHINA AND TELECOM SEGMENT TO HOLD LARGEST SHARES OF WIRELESS GIGABIT MARKET IN ASIA PACIFIC IN 2024

- FIGURE 16 US TO HOLD LARGEST SHARE OF NORTH AMERICAN WIRELESS GIGABIT MARKET IN 2029

- FIGURE 17 US TO EXHIBIT HIGHEST CAGR IN GLOBAL WIRELESS GIGABIT MARKET DURING FORECAST PERIOD

- FIGURE 18 WIRELESS GIGABIT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 WIRELESS GIGABIT MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 20 WIRELESS GIGABIT MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 21 WIRELESS GIGABIT MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 22 WIRELESS GIGABIT MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 23 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 24 AVERAGE SELLING PRICE TREND OF WIRELESS GIGABIT OFFERINGS PROVIDED BY KEY PLAYERS

- FIGURE 25 AVERAGE SELLING PRICE TREND OF WIRELESS GIGABIT OFFERINGS, 2020–2024

- FIGURE 26 AVERAGE SELLING PRICE OF WIRELESS GIGABIT SOC OFFERING, BY REGION, 2020–2024

- FIGURE 27 AVERAGE SELLING PRICE TREND OF WIRELESS GIGABIT MODULE OFFERING, BY REGION, 2020–2024

- FIGURE 28 WIRELESS GIGABIT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 29 ECOSYSTEM ANALYSIS

- FIGURE 30 WIRELESS GIGABIT-RELATED DEALS AND FUNDING FROM 2018 TO 2023

- FIGURE 31 PATENTS APPLIED AND GRANTED, 2013–2023

- FIGURE 32 IMPORT SCENARIO FOR HS CODE 8517-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023

- FIGURE 33 EXPORT SCENARIO FOR HS CODE 8517-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023

- FIGURE 34 WIRELESS GIGABIT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 36 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 37 IMPACT OF AI/GEN AI ON WIRELESS GIGABIT MARKET

- FIGURE 38 57–59 GHZ SEGMENT TO CAPTURE LARGEST SHARE OF WIRELESS GIGABIT MARKET, BY CHANNEL, THROUGHOUT FORECAST PERIOD

- FIGURE 39 IEEE 802.11 AD SEGMENT TO ACCOUNT FOR LARGER SHARE OF WIRELESS GIGABIT MARKET, BY PROTOCOL, THROUGHOUT FORECAST PERIOD

- FIGURE 40 NETWORK INFRASTRUCTURE DEVICES TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 41 MODULE SEGMENT TO SECURE LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 42 TELECOM SEGMENT TO SECURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 43 WIRELESS GIGABIT MARKET IN NORTH AMERICA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 NORTH AMERICA: WIRELESS GIGABIT MARKET

- FIGURE 45 EUROPE: WIRELESS GIGABIT MARKET

- FIGURE 46 ASIA PACIFIC: WIRELESS GIGABIT MARKET

- FIGURE 47 WIRELESS GIGABIT MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2019–2023

- FIGURE 48 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 49 WIRELESS GIGABIT MARKET: COMPANY EV/EBITDA, 2023

- FIGURE 50 WIRELESS GIGABIT MARKET: COMPANY VALUATION, 2023

- FIGURE 51 WIRELESS GIGABIT MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 52 WIRELESS GIGABIT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 53 WIRELESS GIGABIT MARKET: COMPANY FOOTPRINT

- FIGURE 54 WIRELESS GIGABIT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 55 PERASO TECHNOLOGIES INC.: COMPANY SNAPSHOT

- FIGURE 56 SIVERS SEMICONDUCTORS AB: COMPANY SNAPSHOT

- FIGURE 57 STMICROELECTRONICS: COMPANY SNAPSHOT

- FIGURE 58 QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 59 FUJIKURA LTD.: COMPANY SNAPSHOT

- FIGURE 60 INDIE SEMICONDUCTOR: COMPANY SNAPSHOT

- FIGURE 61 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 62 CAMBIUM NETWORKS, LTD.: COMPANY SNAPSHOT

- FIGURE 63 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 MURATA MANUFACTURING CO., LTD.: COMPANY SNAPSHOT

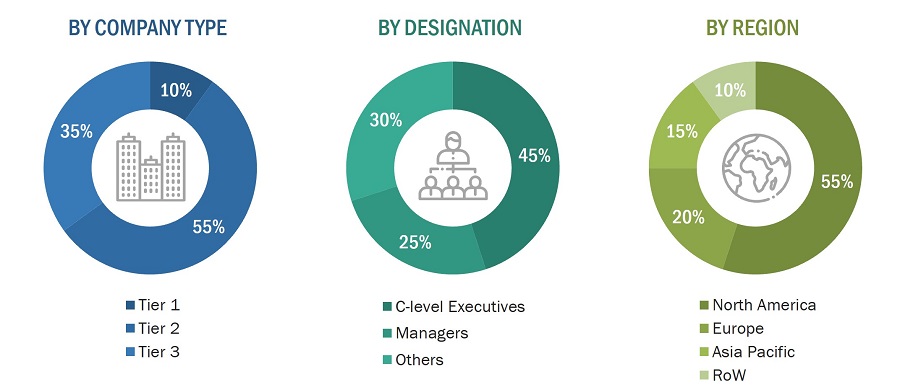

The study involved four major activities in estimating the current size of the Wireless gigabit market. Exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements), trade, business, professional associations, white papers, certified publications, articles by recognized authors, directories, and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of major secondary sources

|

SOURCE |

WEB LINK |

|

Federal Communications Commission (FCC) |

|

|

Canadian Radio-television and Telecommunications Commission (CRTC) |

|

|

European Telecommunications Standards Institute (ETSI) |

|

|

Office of Communications (Ofcom) |

|

|

Ministry of Industry and Information Technology (MIIT) |

|

|

Ministry of Internal Affairs and Communications (MIC) |

|

|

Ministry of Electronics and Information Technology (MeitY) |

|

|

Ericsson |

https://www.ericsson.com/en/reports-and-papers/mobility-report/reports/june-2024 |

|

Nokia |

https://www.nokia.com/about-us/company/worldwide-presence/india/mbit-index-2024/ |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the Wireless gigabit market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions: North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephone interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the Wireless gigabit market size and its various dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

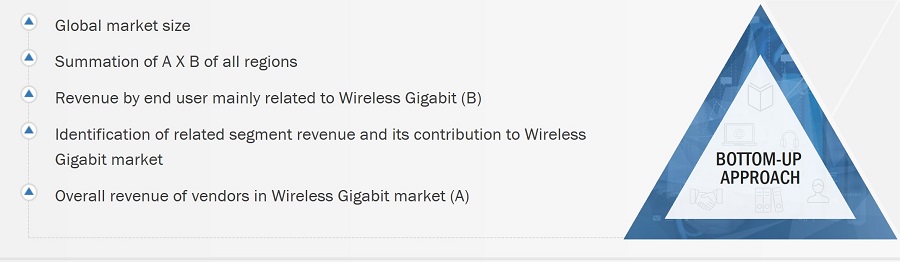

Bottom-Up Approach

The bottom-up approach was used to determine the overall size of the wireless gigabit market based on the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

- Identifying various end-use industries using or expected to implement Wireless Gigabit

- Identifying various end users using or expected to implement Wireless Gigabit

- Analyzing each end user, along with the significant related companies and Wireless gigabit providers

- Estimating the Wireless gigabit market for end user

- Understanding the demand generated by companies operating across different end-user

- Tracking the ongoing and upcoming implementation of projects based on Wireless gigabit technology by end users and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand the type of Wireless gigabit products designed and developed vertically, helping analyze the breakdown of the scope of work carried out by each significant company in the Wireless gigabit market

- Arriving at the market estimates by analyzing Wireless gigabit companies as per their countries and subsequently combining this information to arrive at the market estimates by region

- Verifying and cross-checking the forecasts at every level through discussions with the key opinion leaders, including CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

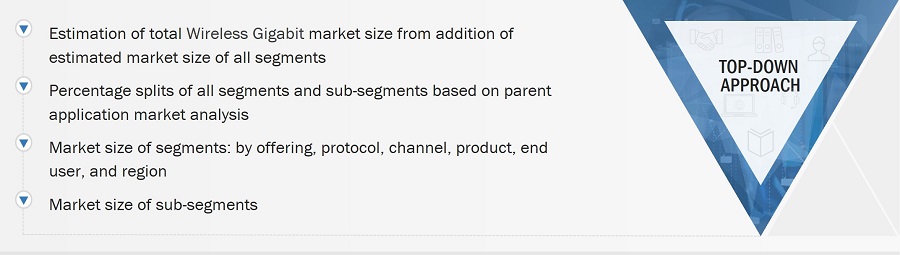

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

The most appropriate immediate parent market size has been used to implement the top-down approach to calculate the market size of specific segments. The top-down approach was implemented for the data extracted from the secondary research to validate the market size obtained.

Each company's market share was estimated to verify the revenue shares used earlier in the top-down approach. This study determined and confirmed the overall parent and individual market sizes using the data triangulation method and validating data through primaries. The data triangulation method is explained in the next section.

- Focusing on top-line investments and expenditures being made in the ecosystems of various end-user

- Building and developing the information related to the market revenue generated by critical Wireless gigabit solution providers

- Conducting multiple on-field discussions with the key opinion leaders involved in the development of Wireless gigabit products in various end-user

- Estimating geographic splits using secondary sources based on numerous factors, such as the number of players in a specific country and region, the offering of Wireless gigabit, and the level of solutions offered by end-user

Data Triangulation

After arriving at the overall market size from the above estimation process, the market has been split into several segments and subsegments. The data triangulation procedure has been employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Wireless Gigabit (WiGig) is a high-speed wireless communication technology operating in the 60 GHz frequency band. It is designed to provide very fast data rates over short distances, making it ideal for high-bandwidth and low-latency applications such as AR/VR devices, HD video streaming, online gaming, and more. WiGig technology follows the IEEE 802.11ad and IEEE 802.11ay standard protocols, enabling multi-gigabit speeds up to 7 Gbps.

Key Stakeholders

- Technology Developers and Standardization Bodies

- Semiconductor Manufacturers

- Device Manufacturers

- Network Equipment Manufacturers

- Telecommunications Providers

- Software and Application Developers

- Enterprise Users and End Consumers

- Regulatory Bodies and Governments

- Research and Academic Institutions

- Investors and Venture Capitalists

Report Objectives

- To define, describe, and forecast the Wireless gigabit (WiGig) market by offering, protocol, channel, product, use case, end user, and region

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets concerning individual growth trends, prospects, and contributions to the total market

- To provide a detailed overview of the Wireless gigabit (WiGig) market’s value chain, the ecosystem, technology trends, use cases, regulatory environment, and Porter’s five forces analysis.

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To analyze competitive developments, such as partnerships, product developments, and research & development (R&D), in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the Wireless gigabit market

Product Analysis

- The product matrix provides a detailed comparison of each company's product portfolio in the wireless gigabit market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Wireless Gigabit Market