Wave Energy Converter Market by Technology (Oscillating Water Column, Oscillating Body Converter (Point Absorber, Attenuator, Oscillating Wave Surge, Submerged Pressure Differential), Overtopping Device), Location, Application, Region - Forecast to 2030

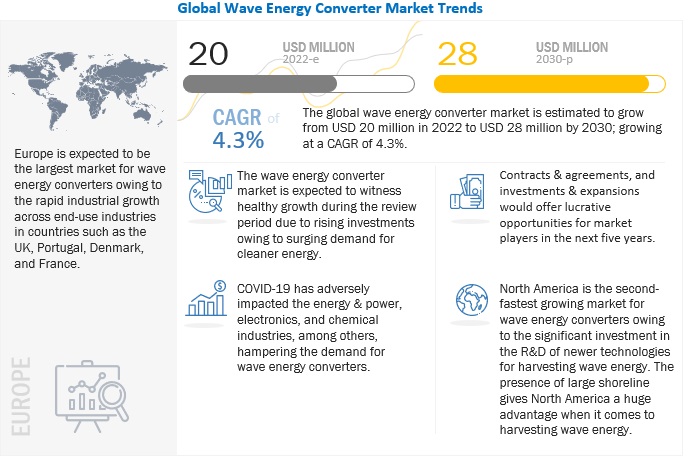

[206 Pages Report] The global wave energy converter market in terms of revenue was estimated to be worth $20 million in 2022 and is projected to reach $28 million by 2030, growing at a CAGR of 4.3% from 2022 to 2030. The factors driving the market include the ample availability of wave energy resources and the growing power demand from coastal communities.

To know about the assumptions considered for the study, Request for Free Sample Report

Wave Energy Market Trends

To know about the assumptions considered for the study, download the pdf brochure

Wave Energy Converter Market Dynamics

Driver: Rising electricity demand from coastal communities

The worldwide per capita power consumption has been increasing at a high rate since 2005. According to the World Bank, the average per capita power consumption of the world per year is more than 3,135 kWh. A few of the major countries that have the highest per capita energy consumption per year include the US, Canada, Japan, the UK, South Korea, and Germany. Extensive usage of various electric equipment such as heaters, air conditioners, refrigerators, and others is increasing the power consumption in these countries. This is further supported by the increased spending capability of consumers. According to Environmental Impact Assessment (EIA), in 2021, the power demand from the US was around 97 quads, up by 4.7% compared to the 2020 consumption. Moreover, in the coming years, a few of these countries have also witnessed a steep growth in their coastal population, increasing the power demand from these areas. In Australia and the US, almost 40% of the total population lives in the coastal regions; similarly, in Japan, around 80% of the population resides in coastal regions. Furthermore, the growing population not only increases the power demand but also restricts the availability of land space. This leads to a situation where the space to set up land-based power generation plants is neither easily available nor economically viable. These factors have led to an upsurge in demand for power plants in coastal regions. The generation of clean energy utilizing wave energy converters could be an advantage for these areas and their inhabitants, further driving the market growth.

Restraints: Insufficient infrastructure and environmental challenges

Wave energy converters can be installed in offshore, near shore, and shoreline locations. Proper connections or port facilities and grid infrastructure are the keys to further development and enabling maintenance undertakings. Though site selection is a significantly important task for installing wave energy converters to maximize power generation, the generated power is equally important to transmit to its place of consumption. This transmission of power requires additional infrastructure such as onshore substations, underground cables, and transmission lines connecting to the grid. Setting up this infrastructure requires additional labor and capital. Moreover, during installation, the mooring of the wave energy converter is an essential factor that contributes to the difficulties as the mooring ropes must be anchored to the sea floor bed with drilled-in anchors. Hence, setting up a wave energy power plant of any scale requires these additional infrastructures, acting as a potential restraint to the wave energy converter market.

Opportunities: Increasing R&D investments and technological development

Wave energy is a relatively underexplored renewable power generation technology. Most of the companies that are offering this technology are still working on their pilot projects. Numerous researchers are studying various parameters corresponding to the viability of WEC and how their cost can be brought down without compromising efficiency. Wave power harnessing is still an emerging technology it is still not fully developed. Due to its complex nature, no single design of this device has emerged as optimal. Major issues faced by the wave power industry are developing technologies that are capable of withstanding extreme ocean weather and harsh environmental conditions, energy storage, and consistency of supply in sufficiently large amounts. Several countries are heavily investing in the development and adoption of renewable energy technologies. As per the International Energy Agency, the global power sector investment in renewable energy generation was more than USD 750 billion in 2018. China, India, the UK, Germany, and the US are among the top investors in the R&D of renewable energy. In 2017, the total renewable investments that happened in the US were close to USD 48.5 billion. As wave energy is a renewable form of energy generation, several key countries such as the US and Australia are significantly investing in R&D. For instance, in 2017, the US Office of Energy Efficiency & Renewable Energy stated that the government has announced about USD 12 million for supporting the development of innovative technologies such as advanced marine and hydrokinetic energy technologies, which can harness energy from the oceans. Furthermore, the International Energy Agency predicts that renewable energy sources are expected to witness the fastest growth rate in the electricity sector, catering to about 30% of the power demand in 2023, up from 24% in 2017. Oceans cover a relatively larger surface area than the habitable land mass. This makes them exposed to a majority of solar radiation and wind motion experienced by our planet. Wave energy converters being placed in the oceans receive the maximum amount of uninterrupted solar radiation throughout the year. This makes them an ideal place to install solar modules for further enhancing power generation.

Challenges: High capital investment

Wave energy converters operate within marine bodies for their entire lifespan. Ocean water contains several impurities and a high level of salinity that can corrode the toughest of metals. These harsh weather conditions are significantly hard to be sustained by wave energy converters. Hence, for making their operation efficient, reliable, and long-lasting, manufacturing companies have to use thick sheets of high-grade metals and coat them with multiple layers of corrosion-resistant heavy-duty paints. Wave energy converters should be able to withstand operational loads under extreme loading conditions and during events such as hurricanes and storms. The process of high-grade manufacturing and coating not only makes the wave energy converters heavy but also increases the price of the equipment. The price of a wave energy converter can go as high as 10 times the price of other renewable technologies offering nearly similar output. In addition, costs incurred in related processes such as installation and mooring add a significant amount to the CAPEX of the whole project, acting as a potential challenge to this market.

By technology, the oscillating water column segment is expected to grow at the fastest rate during the forecast period.

The oscillating body converters technology is expected to continue to hold the largest share of the wave energy market, by technology, owing to the high efficiency and ease of installation of the wave energy converters using this technology in near-shore locations.

By location, the offshore segment is expected to grow at the fastest rate during the forecast period.

By location offshore segment is expected to grow at the fastest rate from 2022 to 2030, offshore wave energy converters can harness the most amount of wave energy as wave energy resources are strongest in offshore locations, this drives the growth in offshore.

By application, power generation segment is expected to grow the fastest, during the forecast period.

By application, the wave energy converter market has been segmented into power generation, desalination and environmental protection. The high growth rate of the power generation segment can be attributed to the increasing demand for power from coastal communities.

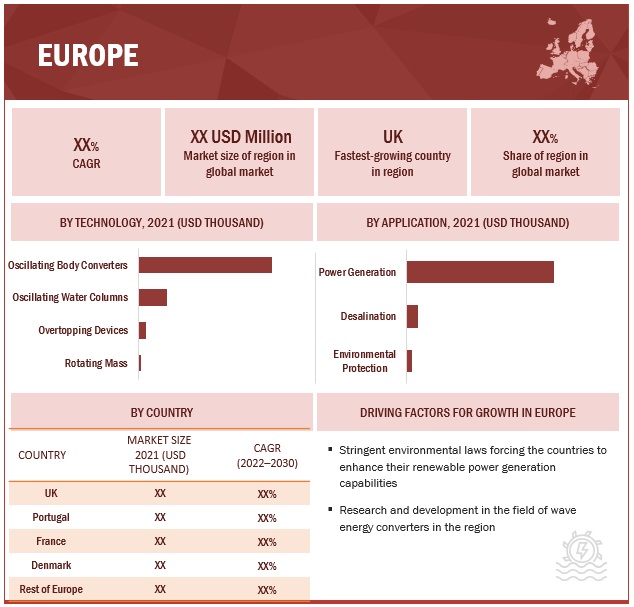

Europe is expected to be the largest market during the forecast period.

Europe is expected to be the largest and the fastest growing region in the global wave energy market, during the forecast period. The growth of the European wave energy converter market is characterized by rapid industrialization of various end-use industries in countries such as UK, Portugal, Denmark and France.

Key Market Players

The major players in the global wave energy converter market are Ocean Power Technologies (US), Eco Wave Power (Israel), CorPower Ocean (Sweden), Wello Oy (Finland) and CalWave (US).

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2020–2030 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2030 |

|

Forecast units |

Value (USD Million); Volume (Kw) |

|

Segments covered |

Technology, application, location and region |

|

Geographies covered |

North America, Europe, Asia Pacific, and rest of the world |

|

Companies covered |

Ocean Power Technologies (US),Eco Wave Power (Israel), Carnegie Clean Energy (Australia), SINN Power GmbH (Germany), AMOG Holdings Pty. Ltd (Australia), NEMOS GmbH (Germany), OceanEnergy (Ireland),Wave Swell (Australia), INGINE Inc. (Korea), AWS Ocean energy (UK), CorPower Ocean (Sweden), Limerick wave ltd (Ireland), Arrecife Energy Systems (Spain), AOE - Accumulated Ocean Energy Inc (Canada), Hann-Ocean Energy Pte. Ltd. (Singapore) Aquanet Power (UK), Able Technologies, L.L.C. (US), AW-Energy Oy (Finland), Applied Technologies Company (Russia), LEANCON Wave Energy (Denmark), SENER group (Spain), Resolute Marine (US), Bombora Wave (Wales), Marine Power Systems (UK), Exowave (Denmark), Oneka Technologies (Canada), Mocean Energy (Scotland) Weptos A/S (Denmark), Oscilla Power (Washington), Wello Oy (Finland), WITT Energy (England), Wave Dragon ApS (Denmark), Chechkmate SeaEnerg Ltd, CalWave (US) |

This research report categorizes the wave energy market by technology, application, location and region.

On the basis of by technology, the wave energy converter market has been segmented as follows:

- Oscillating Body Converters

- Oscillating Water Columns

- Overtopping Devices

- Rotating Mass Converters

On the basis of by application, the wave energy market has been segmented as follows:

- Power generation

- Desalination

- Environmental protection

On the basis of by location, the wave energy converter market has been segmented as follows:

- Nearshore

- Shoreline

- Offshore

On the basis of region, the wave energy market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Rest of the world

Recent Developments

- In May 2022, Eco Wave Power signed an agreement with Port Adriano for the development of a 2 MW wave energy power facility. Port Adriano will assign Eco Wave Power a potentially acceptable location for a term of 20 years, while Eco Wave Power will be responsible for obtaining all licenses, constructing and commissioning the power plant/s, and selling the electricity generated by the power plant.

- In January 2022, Ocean Power Technologies had announced its collaboration with Eco Wave Power to work on a number of projects, including knowledge sharing, joint grant submissions, and collaborative assistance in entry to new markets Moreover, cooperative solutions can be created for Eco Wave Power's applicable projects by combining the offshore and onshore technologies of each company, as well as OPT's offshore engineering and recently acquired robotics skills.

- In December 2021, Carnegie Clean Energy has been awarded a contract by EuropeWave PCP with a funding amount of USD 20 million. Subject to contract signing, Carnegie has been granted USD 294 thousand for phase 1 to provide a CETO tank testing campaign and a CETO concept design for sites in Scotland and the Basque Country. Phase 1 commenced on January 3, 2022, and will last for seven months.

- In October 2021, Carnegie and Hewlett Packard Enterprise Company (HPE) had signed a Collaboration Agreement under which the parties will collaborate on a project to develop a reinforcement learning-based controller for CETO wave energy technology.

- In August 2021, AMOG Holdings Pty. Ltd collaborated with Hellenic Cables for the offshore renewable energy sector which is expanding in the optimal technique to convert and transfer energy from the ocean to the grid subsea cables are one of the most intricate and expensive components of any offshore wind generating installation.

Frequently Asked Questions (FAQ):

What is the current size of the wave energy converter market?

The current market size of the global wave energy converter market is estimated at USD 20 million in 2022.

What are the major drivers for wave energy converter market?

The rising investments pertaining to the adoption of renewable energy generation and the increase in global electricity demand.

Which is the fastest-growing region during the forecasted period in the wave energy converter market?

The European wave energy converter market is estimated to be the largest and the fastest growing region, during the forecast period.

Which is the fastest-growing segment, by location during the forecasted period in wave energy converter market?

The offshore segment is estimated to be the largest and the fastest growing segment by location. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 WAVE ENERGY CONVERTER MARKET, BY TECHNOLOGY

1.3.2 MARKET, BY APPLICATION

1.3.3 MARKET, BY LOCATION

1.4 MARKET SCOPE

1.4.1 MARKET SEGMENTATION

1.4.2 REGIONAL SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 WAVE ENERGY CONVERTER MARKET: RESEARCH DESIGN

2.2 DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

FIGURE 3 KEY INDUSTRY INSIGHTS

2.2.2.2 Breakdown of primaries

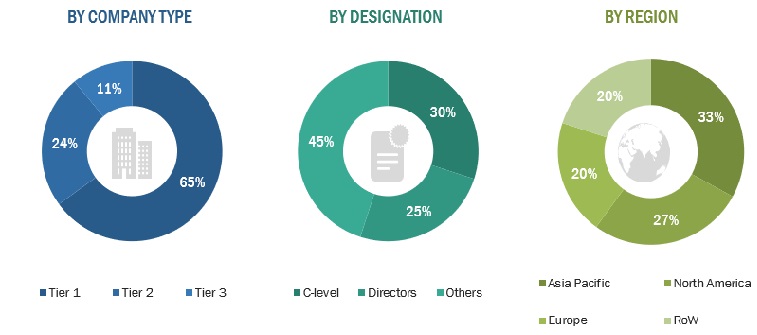

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION

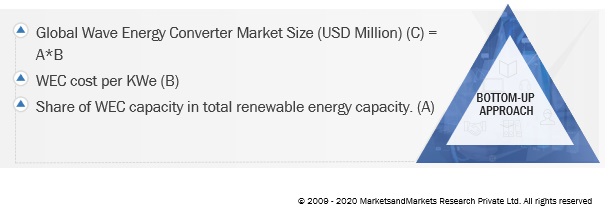

2.3.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3.3 DEMAND-SIDE ANALYSIS

FIGURE 7 DEMAND-SIDE CALCULATION

FIGURE 8 METRICS CONSIDERED FOR ANALYZING AND ASSESSING DEMAND FOR WAVE ENERGY CONVERTERS

2.3.3.1 Assumptions for demand-side analysis

2.3.4 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 42)

TABLE 1 WAVE ENERGY CONVERTER MARKET SNAPSHOT

FIGURE 9 OSCILLATING BODY CONVERTERS TO DOMINATE MARKET, BY TECHNOLOGY, DURING FORECAST PERIOD

FIGURE 10 OFFSHORE SEGMENT TO DOMINATE MARKET, BY LOCATION, DURING FORECAST PERIOD

FIGURE 11 POWER GENERATION TO HOLD LARGEST SIZE OF MARKET, BY APPLICATION, DURING FORECAST PERIOD

FIGURE 12 EUROPE DOMINATED MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES FOR WAVE ENERGY CONVERTER MARKET PLAYERS

FIGURE 13 INCREASING NEED FOR RENEWABLE POWER GENERATION TO DRIVE MARKET, 2022–2030

4.2 WAVE ENERGY CONVERTER MARKET, BY REGION

FIGURE 14 EUROPE TO WITNESS HIGHEST GROWTH RATE IN MARKET DURING FORECAST PERIOD

4.3 MARKET, BY TECHNOLOGY

FIGURE 15 OSCILLATING BODY CONVERTERS SEGMENT DOMINATED MARKET, BY TECHNOLOGY, IN 2021

4.4 MARKET, BY LOCATION

FIGURE 16 OFFSHORE SEGMENT DOMINATED MARKET, BY LOCATION, IN 2021

4.5 MARKET, BY APPLICATION

FIGURE 17 POWER GENERATION SEGMENT DOMINATED MARKET, BY APPLICATION, IN 2021

4.6 MARKET IN EUROPE, BY APPLICATION & COUNTRY

FIGURE 18 POWER GENERATION & UK DOMINATED EUROPEAN MARKET, BY APPLICATION & COUNTRY, IN 2021

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 WAVE ENERGY CONVERTER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising electricity demand from coastal communities

5.2.1.2 Abundant untapped wave energy sources

FIGURE 20 WAVE ENERGY POTENTIAL IN EUROPEAN COUNTRIES

FIGURE 21 WAVE ENERGY RESOURCES (KW/M)

5.2.2 RESTRAINTS

5.2.2.1 Insufficient infrastructure and environmental challenges

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing R&D investments and technological development

5.2.4 CHALLENGES

5.2.4.1 High capital investment

FIGURE 22 COST BREAKDOWN OF WAVE ENERGY CONVERTERS

5.2.4.2 Uncertainty about environmental regulations and licensing procedures

5.2.4.3 Hesitation among wave energy converter developers to collaborate for technology/ information sharing

5.2.4.4 Lack of connectivity to central grid

5.3 IMPACT OF COVID-19

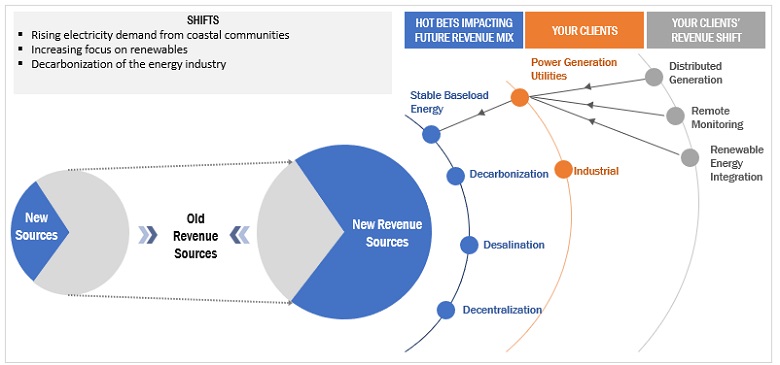

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 23 REVENUE SHIFT FOR WAVE ENERGY CONVERTER PROVIDERS

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 24 MARKET: SUPPLY CHAIN ANALYSIS

5.5.1 COMPONENT MANUFACTURERS

5.5.2 WAVE ENERGY CONVERTER MANUFACTURERS

5.5.3 WAVE ENERGY CONVERTER SUPPORT SERVICE PROVIDERS/ INTEGRATORS

5.5.4 END-USERS

5.6 ECOSYSTEM/MARKET MAP

TABLE 2 WAVE ENERGY CONVERTER MARKET: ECOSYSTEM

5.7 TECHNOLOGY ANALYSIS

5.7.1 MOONWEC TECHNOLOGY

5.7.2 WAVE–TO–GRID

5.7.3 POWER TAKE-OFF (PTO) SYSTEMS

FIGURE 25 ACTIVE COMPANIES WITH DIFFERENT TYPES OF PTO SYSTEMS

5.8 TRADE ANALYSIS

5.8.1 EXPORT SCENARIO

TABLE 3 EXPORT SCENARIO FOR HS CODE 840110, BY COUNTRY, 2019–2021 (USD)

FIGURE 26 EXPORT DATA FOR TOP 5 COUNTRIES, 2019–2021 (USD THOUSAND)

5.8.2 IMPORT SCENARIO

TABLE 4 IMPORT SCENARIO FOR HS CODE: 280410, BY COUNTRY, 2019–2021 (USD)

FIGURE 27 IMPORT DATA FOR TOP 5 COUNTRIES, 2019–2021 (USD THOUSAND)

5.9 PATENT ANALYSIS

TABLE 5 WAVE ENERGY CONVERTERS: INNOVATIONS AND PATENT REGISTRATIONS, JUNE 2020–AUGUST 2022

5.10 PRICING ANALYSIS

5.10.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY APPLICATION

5.10.2 AVERAGE SELLING PRICE TREND

TABLE 6 CAPEX OF WAVE ENERGY CONVERTER PROJECTS, BY DEPLOYMENT STAGE

FIGURE 28 CAPEX BREAKDOWN OF COSTS FOR DIFFERENT COST CENTERS

TABLE 7 OPEX OF WAVE ENERGY CONVERTER PROJECTS, BY DEPLOYMENT STAGE

5.11 TARIFFS, CODES, AND REGULATIONS

TABLE 8 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12 PORTER'S FIVE FORCES ANALYSIS

FIGURE 29 PORTER'S FIVE FORCES ANALYSIS FOR MARKET

TABLE 9 WAVE ENERGY CONVERTER MARKET: PORTER'S FIVE FORCES ANALYSIS

5.13 CASE STUDY ANALYSIS

5.13.1 INWAVE WELL SUITED FOR LOCAL COMMUNITIES TO ACCESS RENEWABLE AND CLEAN ENERGY (2021)

5.13.1.1 Problem statement

5.13.1.2 Solution

5.13.2 MOORPOWER SCALED DEMONSTRATION PROJECT WILL PROVIDE CLEAN ENERGY (2021)

5.13.2.1 Problem statement

5.13.2.2 Solution

5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 30 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY APPLICATION

TABLE 10 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.14.2 BUYING CRITERIA

FIGURE 31 KEY BUYING CRITERIA OF TOP APPLICATIONS

TABLE 11 KEY BUYING CRITERIA, BY APPLICATION

5.15 KEY CONFERENCES AND EVENTS, 2022 & 2023

TABLE 12 WAVE ENERGY CONVERTERS: DETAILED LIST OF CONFERENCES AND EVENTS

6 WAVE ENERGY CONVERTER MARKET, BY TECHNOLOGY (Page No. - 71)

6.1 INTRODUCTION

FIGURE 32 MARKET, BY TECHNOLOGY, 2021

TABLE 13 MARKET, BY TECHNOLOGY, 2016–2019 (USD THOUSAND)

TABLE 14 WAVE ENERGY CONVERTER MARKET, BY TECHNOLOGY, 2020–2030 (USD THOUSAND)

6.2 OSCILLATING WATER COLUMNS

6.2.1 GRID-SCALE GENERATION CAPABILITY

TABLE 15 OSCILLATING WATER COLUMNS: WAVE ENERGY MARKET, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 16 OSCILLATING WATER COLUMNS: WAVE ENERGY MARKET, BY REGION, 2020–2030 (USD THOUSAND)

6.3 OSCILLATING BODY CONVERTERS

6.3.1 EASE OF INSTALLATION AND HIGH EFFICIENCY

TABLE 17 OSCILLATING BODY CONVERTERS: WAVE ENERGY MARKET, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 18 OSCILLATING BODY CONVERTERS: WAVE ENERGY MARKET, BY REGION, 2020–2030 (USD THOUSAND)

FIGURE 33 WAVE ENERGY CONVERTER MARKET, BY OSCILLATING BODY CONVERTER TECHNOLOGY, 2021

TABLE 19 OSCILLATING BODY CONVERTERS: WAVE ENERGY MARKET, BY SUBTYPE, 2016–2019 (USD THOUSAND)

TABLE 20 OSCILLATING BODY CONVERTERS: WAVE ENERGY MARKET, BY SUBTYPE, 2020–2030 (USD THOUSAND)

6.3.2 POINT ABSORBERS

TABLE 21 POINT ABSORBERS: WAVE ENERGY MARKET, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 22 POINT ABSORBERS: WAVE ENERGY MARKET, BY REGION, 2020–2030 (USD THOUSAND)

6.3.3 ATTENUATORS

TABLE 23 ATTENUATORS: WAVE ENERGY MARKET, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 24 ATTENUATORS: WAVE ENERGY MARKET, BY REGION, 2020–2030 (USD THOUSAND)

6.3.4 OSCILLATING WAVE SURGE CONVERTERS

TABLE 25 OSCILLATING WAVE SURGE CONVERTERS: WAVE ENERGY MARKET, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 26 OSCILLATING WAVE SURGE CONVERTERS: WAVE ENERGY MARKET, BY REGION, 2020–2030 (USD THOUSAND)

6.3.5 SUBMERGED PRESSURE DIFFERENTIAL DEVICES

TABLE 27 SUBMERGED PRESSURE DIFFERENTIAL DEVICES: WAVE ENERGY MARKET, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 28 SUBMERGED PRESSURE DIFFERENTIAL DEVICES: WAVE ENERGY MARKET, BY REGION, 2020–2030 (USD THOUSAND)

6.3.6 BULGE WAVE DEVICES

TABLE 29 BULGE WAVE DEVICES: WAVE ENERGY MARKET, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 30 BULGE WAVE DEVICES: WAVE ENERGY MARKET, BY REGION, 2020–2030 (USD THOUSAND)

6.4 OVERTOPPING DEVICES

6.4.1 SIMPLE CONSTRUCTION AND EASE OF OPERATION

TABLE 31 OVERTOPPING DEVICES: WAVE ENERGY MARKET, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 32 OVERTOPPING DEVICES: WAVE ENERGY MARKET, BY REGION, 2020–2030 (USD THOUSAND)

6.5 ROTATING MASS CONVERTERS

6.5.1 ECCENTRIC MASS ROTATING TECHNOLOGY AND EASE OF OPERATION

TABLE 33 ROTATING MASS CONVERTERS: WAVE ENERGY MARKET, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 34 ROTATING MASS CONVERTERS: WAVE ENERGY MARKET, BY REGION, 2020–2030 (USD THOUSAND)

7 WAVE ENERGY CONVERTER MARKET, BY LOCATION (Page No. - 84)

7.1 INTRODUCTION

FIGURE 34 MARKET, BY LOCATION, 2021

TABLE 35 MARKET, BY LOCATION, 2016–2019 (USD THOUSAND)

TABLE 36 WAVE ENERGY CONVERTER MARKET, BY LOCATION, 2020–2030 (USD THOUSAND)

7.2 SHORELINE

7.2.1 ECONOMIC INSTALLATION AND INCREASING POWER DEMAND FROM COASTAL POPULATION

TABLE 37 SHORELINE: WAVE ENERGY MARKET, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 38 SHORELINE: WAVE ENERGY MARKET, BY REGION, 2020–2030 (USD THOUSAND)

7.3 NEARSHORE

7.3.1 WEC INSTALLATIONS FOR KEY APPLICATIONS

TABLE 39 NEARSHORE: WAVE ENERGY MARKET, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 40 NEARSHORE: WAVE ENERGY MARKET, BY REGION, 2020–2030 (USD THOUSAND)

7.4 OFFSHORE

7.4.1 ABILITY TO POWER OTHER OFFSHORE STRUCTURES

TABLE 41 OFFSHORE: WAVE ENERGY MARKET, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 42 OFFSHORE: WAVE ENERGY MARKET, BY REGION, 2020–2030 (USD THOUSAND)

8 WAVE ENERGY CONVERTER MARKET, BY APPLICATION (Page No. - 89)

8.1 INTRODUCTION

FIGURE 35 MARKET, BY APPLICATION, 2021

TABLE 43 MARKET, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 44 WAVE ENERGY CONVERTER MARKET: BY APPLICATION, 2020–2030 (USD THOUSAND)

8.2 POWER GENERATION

8.2.1 NEED TO REDUCE CARBON EMISSIONS GENERATED BY POWER GENERATION ACTIVITIES

TABLE 45 POWER GENERATION: WAVE ENERGY MARKET, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 46 POWER GENERATION: WAVE ENERGY MARKET, BY REGION, 2020–2030 (USD THOUSAND)

8.3 DESALINATION

8.3.1 EASE OF DESALINATION OF SEAWATER BY WAVE ENERGY

TABLE 47 DESALINATION: WAVE ENERGY MARKET, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 48 DESALINATION: WAVE ENERGY MARKET, BY REGION, 2020–2030 (USD THOUSAND)

8.4 ENVIRONMENTAL PROTECTION

8.4.1 NEED TO REDUCE COASTAL EROSION

TABLE 49 ENVIRONMENTAL PROTECTION: WAVE ENERGY MARKET, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 50 ENVIRONMENTAL PROTECTION: WAVE ENERGY MARKET, BY REGION, 2020–2030 (USD THOUSAND)

9 WAVE ENERGY CONVERTER MARKET, BY REGION (Page No. - 94)

9.1 INTRODUCTION

FIGURE 36 REGIONAL SNAPSHOT: MARKET IN EUROPE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 37 EUROPE ACCOUNTED FOR LARGEST SHARE OF WAVE ENERGY MARKET IN 2021

TABLE 51 GLOBAL WAVE ENERGY CONVERTER MARKET, BY REGION, 2016–2019 (KW)

TABLE 52 GLOBAL WAVE ENERGY MARKET, BY REGION, 2020–2030 (KW)

TABLE 53 GLOBAL WAVE ENERGY MARKET, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 54 GLOBAL WAVE ENERGY MARKET, BY REGION, 2020–2030 (USD THOUSAND)

9.2 NORTH AMERICA

FIGURE 38 NORTH AMERICA: SNAPSHOT OF MARKET, 2021

FIGURE 39 NORTH AMERICA: WAVE ENERGY CONVERTER PROJECT LIST

TABLE 55 NORTH AMERICA: WAVE ENERGY CONVERTER MARKET, BY TECHNOLOGY, 2016–2019 (USD THOUSAND)

TABLE 56 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2020–2030 (USD THOUSAND)

TABLE 57 NORTH AMERICA: MARKET, BY LOCATION, 2016–2019 (USD THOUSAND)

TABLE 58 NORTH AMERICA: MARKET, BY LOCATION, 2020–2030 (USD THOUSAND)

TABLE 59 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 60 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

TABLE 61 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2019 (KW)

TABLE 62 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2030 (KW)

TABLE 63 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2019 (USD THOUSAND)

TABLE 64 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2030 (USD THOUSAND)

9.2.1 US

9.2.1.1 Growing power demand from coastal areas

TABLE 65 US: MARKET, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 66 US: MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

9.2.2 CANADA

9.2.2.1 Increasing R&D activities on wave energy

TABLE 67 CANADA: MARKET, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 68 CANADA: MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

9.3 EUROPE

FIGURE 40 EUROPE: SNAPSHOT OF MARKET, 2021

FIGURE 41 EUROPE: WAVE ENERGY CONVERTER PROJECT LIST

TABLE 69 EUROPE: WAVE ENERGY CONVERTER MARKET, BY TECHNOLOGY, 2016–2019 (USD THOUSAND)

TABLE 70 EUROPE: MARKET, BY TECHNOLOGY, 2020–2030 (USD THOUSAND)

TABLE 71 EUROPE: MARKET, BY LOCATION, 2016–2019 (USD THOUSAND)

TABLE 72 EUROPE MARKET, BY LOCATION, 2020–2030 (USD THOUSAND)

TABLE 73 EUROPE: MARKET, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 74 EUROPE: MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

TABLE 75 EUROPE: MARKET, BY COUNTRY, 2016–2019 (KW)

TABLE 76 EUROPE: MARKET, BY COUNTRY, 2020–2030 (KW)

TABLE 77 EUROPE: MARKET, BY COUNTRY, 2016–2019 (USD THOUSAND)

TABLE 78 EUROPE: MARKET, BY COUNTRY, 2020–2030 (USD THOUSAND)

9.3.1 UK

9.3.1.1 Strong focus on R&D and renewable energy

TABLE 79 UK: WAVE ENERGY MARKET, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 80 UK: MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

9.3.2 PORTUGAL

9.3.2.1 Development of new wave energy projects

TABLE 81 PORTUGAL: MARKET, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 82 PORTUGAL: MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

9.3.3 FRANCE

9.3.3.1 Ambitious renewable energy targets

TABLE 83 FRANCE: MARKET, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 84 FRANCE: MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

9.3.4 DENMARK

9.3.4.1 Augmented testing of emerging technologies in renewable energy sector

TABLE 85 DENMARK: MARKET, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 86 DENMARK: MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

9.3.5 REST OF EUROPE

TABLE 87 REST OF EUROPE: MARKET, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 88 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

9.4 ASIA PACIFIC

FIGURE 42 ASIA PACIFIC: WAVE ENERGY CONVERTER PROJECT LIST

TABLE 89 ASIA PACIFIC: WAVE ENERGY CONVERTER MARKET, BY TECHNOLOGY, 2016–2019 (USD THOUSAND)

TABLE 90 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2020–2030 (USD THOUSAND)

TABLE 91 ASIA PACIFIC: MARKET, BY LOCATION, 2016–2019 (USD THOUSAND)

TABLE 92 ASIA PACIFIC: MARKET, BY LOCATION, 2020–2030 (USD THOUSAND)

TABLE 93 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 94 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

TABLE 95 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2019 (KW)

TABLE 96 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2030 (KW)

TABLE 97 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2019 (USD THOUSAND)

TABLE 98 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2030 (USD THOUSAND)

9.4.1 CHINA

9.4.1.1 Ambitious renewables target

TABLE 99 CHINA: MARKET, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 100 CHINA: MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

9.4.2 AUSTRALIA

9.4.2.1 Growing R&D investments in desalination

TABLE 101 AUSTRALIA: MARKET, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 102 AUSTRALIA: MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

9.4.3 SOUTH KOREA

9.4.3.1 Increasing R&D on renewable energy generation

TABLE 103 SOUTH KOREA: WAVE ENERGY MARKET, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 104 SOUTH KOREA: MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

9.4.4 REST OF ASIA PACIFIC

TABLE 105 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 106 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

9.5 ROW

FIGURE 43 ROW: WAVE ENERGY CONVERTER PROJECT LIST

TABLE 107 ROW: WAVE ENERGY CONVERTER MARKET, BY TECHNOLOGY, 2016–2019 (USD THOUSAND)

TABLE 108 ROW: MARKET, BY TECHNOLOGY, 2020–2030 (USD THOUSAND)

TABLE 109 ROW: MARKET, BY LOCATION, 2016–2019 (USD THOUSAND)

TABLE 110 ROW: MARKET, BY LOCATION, 2020–2030 (USD THOUSAND)

TABLE 111 ROW: MARKET, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 112 ROW: MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

TABLE 113 ROW: MARKET, BY COUNTRY, 2016–2019 (KW)

TABLE 114 ROW: MARKET, BY COUNTRY, 2020–2030 (KW)

TABLE 115 ROW: MARKET, BY COUNTRY, 2016–2019 (USD THOUSAND)

TABLE 116 ROW: MARKET, BY COUNTRY, 2020–2030 (USD THOUSAND)

10 COMPETITIVE LANDSCAPE (Page No. - 128)

10.1 OVERVIEW

FIGURE 44 KEY DEVELOPMENTS IN WAVE ENERGY MARKET, 2018 TO 2022

10.2 MARKET SHARE, 2021

FIGURE 45 INDUSTRY CONCENTRATION OF KEY PLAYERS, 2021

10.3 MARKET EVALUATION FRAMEWORK

TABLE 117 MARKET EVALUATION FRAMEWORK, 2018–2021

10.4 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 46 SEGMENTAL REVENUE ANALYSIS, 2018–2021

10.5 RECENT DEVELOPMENTS

10.5.1 DEALS

TABLE 118 WAVE ENERGY MARKET: DEALS, 2018–2022

10.5.2 OTHERS

TABLE 119 WAVE ENERGY MARKET: OTHERS, 2018–2022

10.6 COMPETITIVE LEADERSHIP MAPPING, 2021

10.6.1 STARS

10.6.2 EMERGING LEADERS

10.6.3 PERVASIVE PLAYERS

10.6.4 PARTICIPANTS

FIGURE 47 WAVE ENERGY MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

TABLE 120 COMPANY TECHNOLOGY FOOTPRINT

TABLE 121 COMPANY LOCATION FOOTPRINT

TABLE 122 COMPANY APPLICATION FOOTPRINT

TABLE 123 COMPANY REGIONAL FOOTPRINT

10.7 START-UP/SME EVALUATION QUADRANT, 2021

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 DYNAMIC COMPANIES

10.7.4 STARTING BLOCKS

FIGURE 48 WAVE ENERGY MARKET: START-UP/SME EVALUATION QUADRANT, 2021

10.8 COMPETITIVE BENCHMARKING

TABLE 124 WAVE ENERGY MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 125 COMPANY TECHNOLOGY FOOTPRINT (SME)

TABLE 126 COMPANY LOCATION FOOTPRINT (SME)

TABLE 127 COMPANY APPLICATION FOOTPRINT (SME)

TABLE 128 COMPANY REGIONAL FOOTPRINT (SME)

11 COMPANY PROFILES (Page No. - 146)

11.1 KEY PLAYERS

(Business overview, Products/Services offered, Recent developments, MnM View, Right to win, Strategic choices made, and Weaknesses and competitive threats)*

11.1.1 OCEAN POWER TECHNOLOGIES

TABLE 129 OCEAN POWER TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 49 OCEAN POWER TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 130 OCEAN POWER TECHNOLOGIES: PRODUCT DEVELOPMENT

TABLE 131 OCEAN POWER TECHNOLOGIES: DEALS

11.1.2 ECO WAVE POWER

TABLE 132 ECO WAVE POWER: BUSINESS OVERVIEW

FIGURE 50 ECO WAVE POWER: COMPANY SNAPSHOT

TABLE 133 ECO WAVE POWER: DEALS

TABLE 134 ECO WAVE POWER: OTHERS

11.1.3 CORPOWER OCEAN

TABLE 135 CORPOWER OCEAN: BUSINESS OVERVIEW

TABLE 136 CORPOWER OCEAN: PRODUCT DEVELOPMENT

TABLE 137 CORPOWER OCEAN: DEALS

TABLE 138 CORPOWER OCEAN: OTHERS

11.1.4 WELLO OY

TABLE 139 WELLO OY: BUSINESS OVERVIEW

TABLE 140 WELLO OY: DEALS

11.1.5 CALWAVE POWER TECHNOLOGIES

TABLE 141 CALWAVE: BUSINESS OVERVIEW

TABLE 142 CALWAVE POWER TECHNOLOGIES: DEALS

11.1.6 AW-ENERGY OY

TABLE 143 AW-ENERGY OY: BUSINESS OVERVIEW

TABLE 144 AW-ENERGY OY: DEALS

TABLE 145 AW-ENERGY: OTHERS

11.1.7 CARNEGIE CLEAN ENERGY

TABLE 146 CARNEGIE CLEAN ENERGY: BUSINESS OVERVIEW

FIGURE 51 CARNEGIE CLEAN ENERGY: COMPANY SNAPSHOT

TABLE 147 CARNEGIE CLEAN ENERGY: PRODUCT DEVELOPMENT

TABLE 148 CARNEGIE CLEAN ENERGY: DEALS

11.1.8 SINN POWER

TABLE 149 SINN POWER: BUSINESS OVERVIEW

TABLE 150 SINN POWER: OTHERS

11.1.9 AMOG CONSULTING

TABLE 151 AMOG CONSULTING: BUSINESS OVERVIEW

TABLE 152 AMOG CONSULTING: DEALS

11.1.10 NEMOS GMBH

TABLE 153 NEMOS GMBH: BUSINESS OVERVIEW

11.1.11 OCEANENERGY

TABLE 154 OCEANENERGY: BUSINESS OVERVIEW

TABLE 155 OCEANENERGY: DEALS

11.1.12 WAVE SWELL

TABLE 156 WAVE SWELL: BUSINESS OVERVIEW

11.1.13 INGINE INC.

TABLE 157 INGINE INC.: BUSINESS OVERVIEW

TABLE 158 INGINE INC.: DEALS

11.1.14 AWS OCEAN ENERGY

TABLE 159 AWS OCEAN ENERGY: BUSINESS OVERVIEW

11.1.15 LIMERICK WAVE

TABLE 160 LIMERICK WAVE: BUSINESS OVERVIEW

11.1.16 ARRECIFE ENERGY SYSTEMS

TABLE 161 ARRECIFE ENERGY SYSTEMS: BUSINESS OVERVIEW

11.1.17 HANN-OCEAN ENERGY

TABLE 162 HANN-OCEAN ENERGY: BUSINESS OVERVIEW

11.1.18 ACCUMULATED OCEAN ENERGY

TABLE 163 ACCUMULATED OCEAN ENERGY: BUSINESS OVERVIEW

11.1.19 AQUANET POWER

TABLE 164 AQUANET POWER: BUSINESS OVERVIEW

11.1.20 RESOLUTE ENERGY

TABLE 165 RESOLUTE ENERGY: BUSINESS OVERVIEW

TABLE 166 RESOLUTE ENERGY: DEALS

11.1.21 BOMBORA WAVE POWER

TABLE 167 BOMBORA WAVE POWER: BUSINESS OVERVIEW

TABLE 168 BOMBORA WAVE POWER: DEALS

11.1.22 MARINE POWER SYSTEMS

TABLE 169 MARINE POWER SYSTEMS: BUSINESS OVERVIEW

TABLE 170 MARINE POWER SYSTEMS: DEALS

11.1.23 APPLIED TECHNOLOGIES COMPANY

TABLE 171 APPLIED TECHNOLOGIES COMPANY: BUSINESS OVERVIEW

11.1.24 WEPTOS A/S

TABLE 172 WEPTOS A/S: BUSINESS OVERVIEW

11.1.25 OSCILLA POWER

TABLE 173 OSCILLA POWER: BUSINESS OVERVIEW

TABLE 174 OSCILLA POWER: DEALS

11.2 OTHER PLAYERS

11.2.1 ABLE TECHNOLOGIES, L.L.C.

11.2.2 LEANCON WAVE ENERGY

11.2.3 SENER GROUP

11.2.4 EXOWAVE

11.2.5 WITT ENERGY

11.2.6 WAVE DRAGON APS

11.2.7 CHECKMATE SEAENERGY LTD

11.2.8 ONEKA TECHNOLOGIES

11.2.9 MOCEAN ENERGY

*Details on Business overview, Products/Services offered, Recent developments, MnM View, Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 196)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 CUSTOMIZATION OPTIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the wave energy converter market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as industry publications, several newspaper articles, Statista Industry Journal, and ocean energy systems to identify and collect information useful for a technical, market-oriented, and commercial study of the wave energy converter market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

Primary sources included several industry experts from core and related industries, preferred suppliers, manufacturers, service providers, technology developers, and organizations related to all the segments of the nuclear industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SME), C-level executives of the key market players, and industry consultants, among other experts, to obtain and verify qualitative and quantitative information, as well as to assess the prospects of the market. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global wave energy converter market and its dependent submarkets. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Wave Energy Converter Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the wave energy market.

Objectives of the Study

- To forecast and describe the wave energy converter market size, by technology, application, location, and region, in terms of value

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the market

- To estimate the size of the market in terms of value

- To strategically analyze micro markets with respect to individual growth trends, prospects, future expansions, and contributions to the overall market

- To provide post-pandemic estimation for the wave energy market and analyze the impact of the pandemic on the overall market and value chain

- To forecast the growth of the wave energy market with respect to four major regions, namely, North America, Europe, Asia Pacific and Rest of the world

- To analyze market opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their respective market shares and core competencies

- To analyze competitive developments such as investments & expansions, mergers & acquisitions, product launches, contracts & agreements, and joint ventures & collaborations in the wave energy market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to your specific needs. The following customization options are available for the report:

Company Information

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Wave Energy Converter Market