Water Blocking Tapes Market by Conductive Type (Conductive, Semi-conductive, Non-conductive), Application (Optical Fiber cable, Submarine cable, Power cable Communication cable) and Region (North America, Europe, APAC, RoW) - Global Forecast to 2027

Updated on : September 02, 2025

Water Blocking Tapes Market

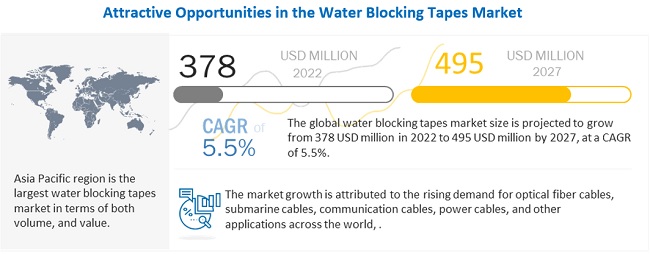

The global water blocking tapes market was valued at USD 378 million in 2022 and is projected to reach USD 495 million by 2027, growing at 5.5% cagr from 2022 to 2027. The demand from the construction industry is expected to drive the growth of the market during the forecast period between 2022 to 2027. However, factory shutdowns, interrupted supply chains, and reduced demand from end-use industries has negatively affected the water blocking tapes market.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on global water blocking tapes market

The COVID-19 outbreak had drastically altered the demand for water blocking tapes globally due to a decline in demand from the various applications of the cables industry. The pandemic impacted abruptly and interrupted the operations and global supply chain across various industries, which, in turn, resulted in a decline in demand and growth of the water blocking tapes market. Various countries had imposed lockdowns to prevent the further spread of the virus in 2020. Europe and North America were the most severely affected regions due to COVID-19. Companies are still trying to cope with this sudden impact brought by the pandemic and have to efficiently work on their supply chain and improve their distribution network to capture the demand for water blocking tapes in the future and tackle the sudden fluctuations in the market. With the recovering markets and end-use industries, the market is gaining pace along with the increasing construction projects and expenditure on the cables industry across the world.

Growth in cross-continental power and data cables usage propels the water blocking tapes market

According to Submarine Telecoms Forum’s report, the yearly investment made in the year 2021, for laying new submarine cables was about 1.2 USD Billions, with a total investment of 14.23 USD billion between 2013 and 2022. The submarine cables are majorly used for two needs, power transmission and communication transmission. The cable communication is used for having a reduced latency of information shared in comparison with the popular wireless telecommunication solutions. More number of information providers setup their data centres across the continents to provide fast and secure connections for the end users. These companies are relying heavily on the submarine and land telecommunication cables for the purpose of interconnecting their multiple data centres setup across various continents. This market it expected to increase with the implementation of newer cable technologies to improve the bandwidth they serve further reducing the latency period required for transferring the information.

The power cable applications are further increasing in submarine application with the increased installation of offshore wind farms, underwater pipelines for crude transportation and other energy solutions. The increase in offshore wind farm installations in the European region to meet their goal of climate neutrality by 2050. The European Commission had proposed a strategy to increase Europe’s offshore wind energy capacity from 12GW to 60GW by 2030 and further to 300GW by end of 2050, with an expected investment of 800 billion Euros. This impacts the submarine power cable application positively, along with indirect positive impact on the water blocking tapes used in these power cables for protecting the electrical conductors inside from the sea water intrusion.

Adverse impact of Covid-19 to restrict the market growth

The pandemic has adversely affected all industries, and the construction industry stands as one of the most badly affected industries. Also, COVID-19 disrupted the entire supply chain of the water blocking tapes industry in 2020. More than 100 countries had locked their boundaries against internal and external trade and transportation. Furthermore, the pandemic had brought the production of non-essential goods to almost a halt in most of the major economies. Most of the ongoing construction projects and others that were in the pipeline were stopped due to the pandemic. As a result, the demand for water blocking tape products used in various cable applications fell. The companies had to lower production and curtail their workforce to reduce costs and sustain their business as there was very low demand. These factors restrained the growth of water blocking tapes.

Increasing demand for latency free telecommunication devices

With the incremental updates to the wireless technologies, the transferring of data to longer distances has become a major hold back for completely getting into wireless transmission of telecommunication data. Wired communication cables like optical fiber cables becomes the obvious way to opt in for transferring of large amount of data over a long distance. With the increase in dependency over internet and communication devices, and services, the installation of newer devices is increasing at higher rate in the developing countries like India, Vietnam, Brazil, South Africa, and others. This increase in installation of network devices like routers which depend on the optical fiber cables for data transfer, consumption of the water blocking tape market is expected to increase in these application segment.

Maintaining uninterrupted supply chain and operating at full capacity is a major challenge

The global cables industry has witnessed adverse and immediate consequences of the COVID-19 pandemic. challenge for manufacturers who make water blocking tapes used in cables is to maintain the production at their original capacities and make up for the revenue loss and damage caused by the pandemic. Also, the COVID-19 pandemic had created ripples across the global water blocking tapes industry due to the closure of national and international borders, which led to the disrupted supply chain. The challenge in the future scenario for the water blocking tapes industry is to ensure the smooth flow of global supply chains, which are responsible for transporting materials and components rapidly across borders and fabrication facilities. These industries must make up for the delays or nonarrival of raw materials.

Submarine cable application segment dominated the water blocking tapes market, in terms of value and volume

The submarine cable application segment is projected to lead the water blocking tapes market during the forecast period, in terms of value and volume. Submarine cable application is expected to grow significantly in the water blocking tapes market. The water blocking tapes are used for protecting the electrical conductors in the cables from water thus evading from short circuit failure which poses a huge threat for underwater/submarine cables.

To know about the assumptions considered for the study, download the pdf brochure

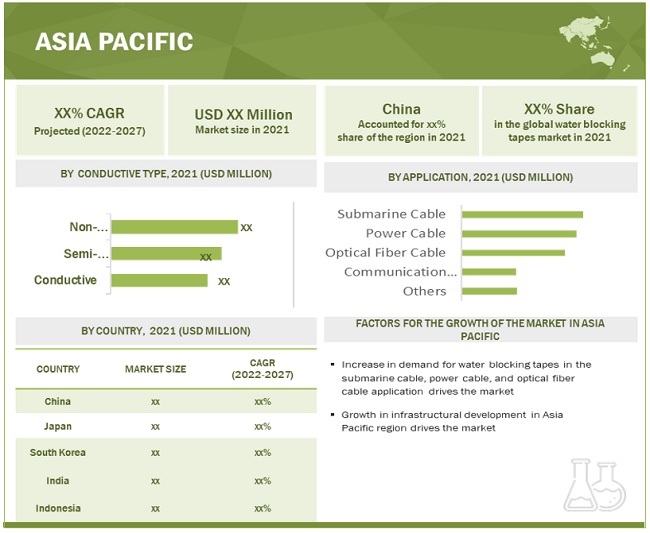

Asia Pacific held the largest market share in the water blocking tapes market

Asia Pacific is the significantly growing market for water blocking tapes. The Asia Pacific market for water blocking tapes is driven by growing energy infrastructure investments and growing cross-regional power and data cables across the region.

Asia Pacific is increasingly becoming an important trade and commerce center. Currently, this region is one of the significant markets for water blocking tapes. With economic contraction and saturation in the European and North American markets, the demand is expected to shift towards Asia Pacific region. The manufacturers of water blocking tapes are targeting this region due to availability of raw materials, and cheap labor resources.

The Chinese market for water blocking tapes has grown rapidly and is projected to witness a high growth in the future due to the continuous shift of the global water blocking tapes production facilities in the country. In addition, India, Japan, and South Korea are also expected to show significant growth of the water blocking tapes market in forecasted years.

Water Blocking Tapes Market Players

Some of the key players in the global water blocking tapes market are 3M (US), Nitto Denko Corporation (Japan), Tesa SE (Germany), Scapa Group Ltd (UK), Intertape Polymer Group (Canada), Beery Global Inc. (US), Nichiban Co., Ltd. (Japan), and Sika AG (Switzerland).

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the water blocking tapes industry. The study includes an in-depth competitive analysis of these key players in the water blocking tapes market, with their company profiles, recent developments, and key market strategies.

Water Blocking Tapes Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 378 Million |

|

Revenue Forecast in 2027 |

USD 495 Million |

|

CAGR |

5.5% |

|

Years considered for the study |

2018–2021 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD million), Volume (Million Square Meter) |

|

Segments |

Conductive type, Application and Region |

|

Regions |

Europe, North America, APAC, MEA, and South America |

|

Companies |

Sneham International (India), Indore Composites (Inida), Scapa Industrial (UK), Unitape UK Ltd., (UK) |

This research report categorizes the water blocking tapes market based on resin type, manufacturing process, application, and region.

Water Blocking Tapes Market by Conductive Type:

- Conductive

- Semi-Conductive

- Non-Conductive

Water Blocking Tapes Market by Application:

- Optical Fiber Cable

- Submarine Cable

- Power Cable

- Communication cable

- Others

Water Blocking Tapes Market by Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In January 2022, Tesa SE invested around USD 61.5 million for the foundation of its new plant located in Vietnamese port, Haiphong. The company is planning to expand its manufacturing capacity for Asia region as it is one of the fastest growing markets. In this new plant, around 40 million square meters adhesive tapes will get manufactured every year.

- In April 2021, SWM International completed the acquisition of Scapa Group Ltd. This acquisition significantly expanded the company’s research, innovation, and manufacturing capabilities.

- In December 2019, Nitto Denko Corporation expanded their business in Japan by opening new head office along with the current one in Tokyo. This new office was aimed at increasing the strength and corporate system in order to increase the company’s brand value.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the water blocking tapes market?

Growth in global cables industry is driving the market.

Which is the largest country-level market for water blocking tapes?

China is the largest water blocking tapes market due to high demand from well-established end-use industries.

What are the factors contributing to the final price of water blocking tapes?

Raw material plays a vital role in the costs. The cost of these materials contributes largely to the final pricing of water blocking tapes.

What are the challenges in the water blocking tapes market?

Maintaining an uninterrupted supply chain and operating at full capacity is a challenge

How is the water blocking tapes market aligned?

The market is growing at the fastest pace. It is a potential market and many manufacturers are undertaking business strategies to expand their business.

Who are the major manufacturers?

3M (US), Nitto Denko Corporation (Japan), Tesa SE (Germany), Scapa Group Ltd (UK), Intertape Polymer Group (Canada), Beery Global Inc. (US), Nichiban Co., Ltd. (Japan), and Sika AG (Switzerland).

What is the biggest restraint in the water blocking tapes market?

Volatility in raw material cost is one of the biggest restraining factors for the market growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 WATER BLOCKING TAPES MARKET SEGMENTATION

1.3.1 REGIONS COVERED

FIGURE 2 WATER BLOCKING TAPES MARKET, BY REGION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 3 WATER BLOCKING TAPES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

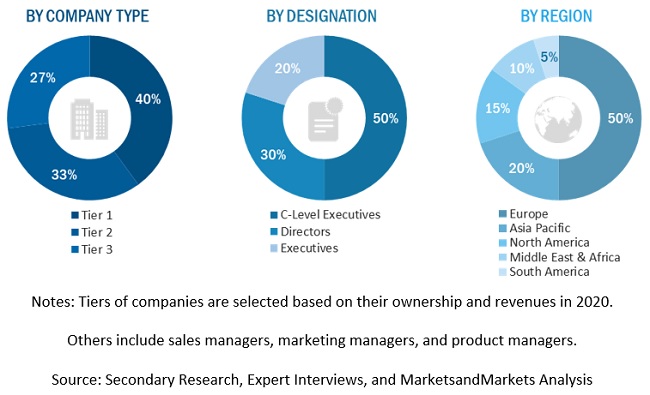

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews - top water blocking tape manufacturers

2.1.2.2 Breakdown of primary interviews

2.1.2.3 Key industry insights

2.2 BASE NUMBER CALCULATION

2.2.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

2.2.2 APPROACH 2: DEMAND-SIDE APPROACH

2.3 FORECAST NUMBER CALCULATION

2.3.1 SUPPLY SIDE

2.3.2 DEMAND SIDE

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 6 WATER BLOCKING TAPES MARKET: DATA TRIANGULATION

2.6 FACTOR ANALYSIS

2.7 ASSUMPTIONS

2.8 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 7 NON-CONDUCTIVE TYPE LED WATER BLOCKING TAPES MARKET

FIGURE 8 SUBMARINE CABLE APPLICATION LED OVERALL WATER BLOCKING TAPES MARKET

FIGURE 9 ASIA PACIFIC LED WATER BLOCKING TAPES MARKET

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 ATTRACTIVE OPPORTUNITIES IN GLOBAL WATER BLOCKING TAPES MARKET

FIGURE 10 SIGNIFICANT GROWTH EXPECTED IN WATER BLOCKING TAPES MARKET BETWEEN 2022 AND 2027

4.2 WATER BLOCKING TAPES MARKET, BY CONDUCTIVE TYPE

FIGURE 11 NON-CONDUCTIVE TYPE LED WATER BLOCKING TAPES MARKET

4.3 WATER BLOCKING TAPES MARKET, BY APPLICATION

FIGURE 12 SUBMARINE CABLE APPLICATION LED WATER BLOCKING TAPES MARKET

4.4 WATER BLOCKING TAPES MARKET GROWTH: KEY COUNTRIES

FIGURE 13 UK TO BE FASTEST-GROWING WATER BLOCKING TAPES MARKET

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN WATER BLOCKING TAPES MARKET

5.2.1 DRIVERS

5.2.1.1 Growth in cross-continental power and data cables

5.2.1.2 Growth in energy infrastructure investments

5.2.2 RESTRAINTS

5.2.2.1 Impact of COVID-19 on power cable industry

5.2.2.2 Decline in water blocking tapes market growth due to COVID-19

5.2.2.3 Volatility in price of raw materials

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for latency-free telecommunication devices

5.2.3.2 Replacement of older telecommunication cables with newer technologies 45

5.2.3.3 Increasing demand for safe power transmission cables

5.2.4 CHALLENGES

5.2.4.1 Maintaining uninterrupted supply chain and operating at full capacity

5.2.4.2 Implementation of stringent regulatory policies

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 15 WATER BLOCKING TAPES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF BUYERS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 1 WATER BLOCKING TAPES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 IMPACT OF COVID-19 ON WATER BLOCKING TAPES MARKET

5.5 SUPPLY CHAIN ANALYSIS

TABLE 2 WATER BLOCKING TAPES MARKET: SUPPLY CHAIN

5.6 PRICING ANALYSIS

5.7 AVERAGE SELLING PRICE

TABLE 3 WATER BLOCKING TAPES AVERAGE SELLING PRICE, BY REGION

5.8 TECHNOLOGY ANALYSIS

5.8.1 SOLVENT-BASED

5.8.2 HOT-MELT

5.9 VALUE CHAIN ANALYSIS OF WATER BLOCKING TAPES MARKET

FIGURE 16 VALUE CHAIN ANALYSIS

5.10 WATER BLOCKING TAPES MARKET: OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

TABLE 4 WATER BLOCKING TAPES MARKET: CAGR (BY VALUE) IN REALISTIC, PESSIMISTIC, AND OPTIMISTIC SCENARIOS

5.10.1 OPTIMISTIC SCENARIO

5.10.2 PESSIMISTIC SCENARIO

5.10.3 REALISTIC SCENARIO

5.11 PATENT ANALYSIS

5.11.1 INTRODUCTION

5.11.2 METHODOLOGY

5.11.3 DOCUMENT TYPE

TABLE 5 WATER BLOCKING TAPES: GLOBAL PATENTS

FIGURE 17 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

FIGURE 18 GLOBAL PATENT PUBLICATION TREND ANALYSIS: 2011-2021

5.11.4 INSIGHTS

5.11.5 LEGAL STATUS OF PATENTS

FIGURE 19 WATER BLOCKING TAPES MARKET: LEGAL STATUS OF PATENTS

5.11.6 JURISDICTION ANALYSIS

FIGURE 20 GLOBAL JURISDICTION ANALYSIS, 2011-2021

5.11.7 TOP APPLICANTS’ ANALYSIS

FIGURE 21 NITTO DENKO POSSESSES HIGHEST NUMBER OF PATENTS

5.11.8 LIST OF PATENTS

5.11.9 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.12 CASE STUDY ANALYSIS

6 WATER BLOCKING TAPES MARKET, BY CONDUCTIVE TYPE (Page No. - 59)

6.1 INTRODUCTION

FIGURE 22 NON-CONDUCTIVE SEGMENT TO LEAD WATER BLOCKING TAPES MARKET DURING FORECAST PERIOD

TABLE 6 WATER BLOCKING TAPES MARKET SIZE, BY CONDUCTIVE TYPE, 2020–2027 (USD MILLION)

TABLE 7 WATER BLOCKING TAPES MARKET SIZE, BY CONDUCTIVE TYPE, 2020–2027 (MILLION SQUARE METER)

6.2 CONDUCTIVE WATER BLOCKING TAPES

6.2.1 CONDUCTIVE WATER BLOCKING TAPES WIDELY USED IN POWER CABLES

FIGURE 23 ASIA PACIFIC TO LEAD CONDUCTIVE WATER BLOCKING TAPES MARKET

6.2.2 CONDUCTIVE WATER BLOCKING TAPES MARKET SIZE, BY REGION

TABLE 8 CONDUCTIVE WATER BLOCKING TAPES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 9 CONDUCTIVE WATER BLOCKING TAPES MARKET SIZE, BY REGION, 2020–2027 (MILLION SQUARE METER)

6.3 SEMI-CONDUCTIVE WATER BLOCKING TAPES

6.3.1 CONTRIBUTED SECOND-LARGEST MARKET SHARE IN TERMS OF VALUE

FIGURE 24 ASIA PACIFIC TO LEAD SEMI-CONDUCTIVE WATER BLOCKING TAPES MARKET

6.3.2 SEMI-CONDUCTIVE WATER BLOCKING TAPES MARKET SIZE, BY REGION

TABLE 10 SEMI-CONDUCTIVE WATER BLOCKING TAPES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 11 SEMI-CONDUCTIVE WATER BLOCKING TAPES MARKET SIZE, BY REGION, 2020–2027 (MILLION SQUARE METER)

6.4 NON-CONDUCTIVE WATER BLOCKING TAPES

6.4.1 SEGMENT TO GROW SIGNIFICANTLY DUE TO HIGHLY EFFICIENT BEDDING, SEPARATION, AND WATER BLOCKING PROPERTIES OF TAPES

FIGURE 25 ASIA PACIFIC TO HAVE HIGHEST CAGR IN NON-CONDUCTIVE WATER BLOCKING TAPES MARKET

6.4.2 NON-CONDUCTIVE WATER BLOCKING TAPES MARKET, BY REGION

TABLE 12 NON-CONDUCTIVE WATER BLOCKING TAPES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 13 NON-CONDUCTIVE WATER BLOCKING TAPES MARKET SIZE, BY REGION, 2020–2027 (MILLION SQUARE METER)

7 WATER BLOCKING TAPES MARKET, BY APPLICATION (Page No. - 67)

7.1 INTRODUCTION

FIGURE 26 SUBMARINE CABLE APPLICATION SEGMENT TO LEAD WATER BLOCKING TAPES DURING FORECAST PERIOD

TABLE 14 WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 15 WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

7.2 OPTICAL FIBER CABLE

7.2.1 SEGMENT TO GROW SIGNIFICANTLY DUE TO HIGHLY-EFFICIENT ABSORPTION CAPACITY AND FIRE RESISTANCE OF OPTICAL FIBERS

FIGURE 27 ASIA PACIFIC TO LEAD OPTICAL FIBER CABLE APPLICATION IN WATER BLOCKING TAPES MARKET

7.2.2 WATER BLOCKING TAPES MARKET SIZE IN OPTICAL FIBER CABLE APPLICATION, BY REGION

TABLE 16 WATER BLOCKING TAPES MARKET SIZE IN OPTICAL FIBER CABLE APPLICATION, BY REGION, 2020–2027 (USD MILLION)

TABLE 17 WATER BLOCKING TAPES MARKET SIZE IN OPTICAL FIBER CABLE APPLICATION, BY REGION, 2020–2027 (MILLION SQUARE METER)

7.3 SUBMARINE CABLE

7.3.1 USE OF SWOLLEN NON-WOVEN TAPES TO MINIMIZE DAMAGE AND REDUCE REPAIR TIME

FIGURE 28 NORTH AMERICA TO LEAD SUBMARINE CABLE APPLICATION IN WATER BLOCKING TAPES MARKET

7.3.2 WATER BLOCKING TAPES MARKET SIZE IN SUBMARINE CABLE APPLICATION, BY REGION

TABLE 18 WATER BLOCKING TAPES MARKET SIZE IN SUBMARINE CABLE APPLICATION, BY REGION, 2020–2027 (USD MILLION)

TABLE 19 WATER BLOCKING TAPES MARKET SIZE IN SUBMARINE CABLE APPLICATION, BY REGION, 2020–2027 (MILLION SQUARE METER)

7.4 COMMUNICATION CABLE

7.4.1 SEMI-CONDUCTIVE WATER-SWELLABLE TAPES ARE MOSTLY USED FOR WATER BLOCKING IN THREE CORE COMMUNICATION CABLES

7.4.2 WATER BLOCKING TAPES MARKET SIZE IN COMMUNICATION CABLE APPLICATION, BY REGION

TABLE 20 WATER BLOCKING TAPES MARKET SIZE IN COMMUNICATION CABLE APPLICATION, BY REGION, 2020–2027 (USD MILLION)

TABLE 21 WATER BLOCKING TAPES MARKET SIZE IN COMMUNICATION CABLE APPLICATION, BY REGION, 2020–2027 (MILLION SQUARE METER)

7.5 POWER CABLE

7.5.1 NON-CONDUCTIVE WATER-SWELLABLE TAPES AND POWER PREVENT LONGITUDINAL WATER INGRESS INTO POWER CABLES

7.5.2 WATER BLOCKING TAPES MARKET SIZE IN POWER CABLE APPLICATION, BY REGION

TABLE 22 WATER BLOCKING TAPES MARKET SIZE IN POWER CABLE APPLICATION, BY REGION, 2020–2027 (USD MILLION)

TABLE 23 WATER BLOCKING TAPES MARKET SIZE IN POWER CABLE APPLICATION, BY REGION, 2020–2027 (MILLION SQUARE METER)

7.6 OTHERS

7.6.1 WATER BLOCKING TAPES MARKET SIZE IN OTHER APPLICATIONS, BY REGION

TABLE 24 WATER BLOCKING TAPES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 25 WATER BLOCKING TAPES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2027 (MILLION SQUARE METER)

8 REGIONAL ANALYSIS (Page No. - 77)

8.1 INTRODUCTION

FIGURE 29 UK TO BE FASTEST-GROWING WATER BLOCKING TAPES MARKET, 2022–2027

TABLE 26 WATER BLOCKING TAPES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 27 WATER BLOCKING TAPES MARKET, BY REGION, 2020–2027 (MILLION SQUARE METER)

8.2 NORTH AMERICA

FIGURE 30 NORTH AMERICA: WATER BLOCKING TAPES MARKET SNAPSHOT

8.2.1 WATER BLOCKING TAPES MARKET IN NORTH AMERICA, BY CONDUCTIVE TYPE

TABLE 28 NORTH AMERICA: WATER BLOCKING TAPES MARKET SIZE, BY CONDUCTIVE TYPE, 2020–2027 (USD MILLION)

TABLE 29 NORTH AMERICA: WATER BLOCKING TAPES MARKET SIZE, BY CONDUCTIVE TYPE, 2020–2027 (MILLION SQUARE METER)

8.2.2 WATER BLOCKING TAPES MARKET IN NORTH AMERICA, BY APPLICATION

TABLE 30 NORTH AMERICA: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 31 NORTH AMERICA: WATER BLOCKING TAPE MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.2.3 WATER BLOCKING TAPES MARKET IN NORTH AMERICA, BY COUNTRY

TABLE 32 NORTH AMERICA: WATER BLOCKING TAPES MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 33 NORTH AMERICA: WATER BLOCKING TAPES MARKET SIZE, BY COUNTRY, 2020–2027 (MILLION SQUARE METER)

8.2.4 US

8.2.4.1 Increasing investments in energy infrastructure development to fuel water blocking tapes demand

TABLE 34 US: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 35 US: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.2.5 CANADA

8.2.5.1 Growth in investments boosts consumption of water blocking tapes in various cable applications

TABLE 36 CANADA: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 37 CANADA: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.2.6 MEXICO

8.2.6.1 Growth in energy infrastructure boosts water blocking tapes market

TABLE 38 MEXICO: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 39 MEXICO: WATER BLOCKING TAPE MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.3 ASIA PACIFIC

FIGURE 31 ASIA PACIFIC: WATER BLOCKING TAPES MARKET SNAPSHOT

8.3.1 WATER BLOCKING TAPES MARKET SIZE IN ASIA PACIFIC, BY CONDUCTIVE TYPE

TABLE 40 ASIA PACIFIC: WATER BLOCKING TAPES MARKET SIZE, BY CONDUCTIVE TYPE, 2020–2027 (USD MILLION)

TABLE 41 ASIA PACIFIC: WATER BLOCKING TAPES MARKET SIZE, BY CONDUCTIVE TYPE, 2020–2027 (MILLION SQUARE METER)

8.3.2 WATER BLOCKING TAPES MARKET SIZE IN ASIA PACIFIC, BY APPLICATION

TABLE 42 ASIA PACIFIC: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 43 ASIA PACIFIC: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.3.3 WATER BLOCKING TAPES MARKET SIZE IN ASIA PACIFIC, BY COUNTRY

TABLE 44 ASIA PACIFIC: WATER BLOCKING TAPES MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 45 ASIA PACIFIC: WATER BLOCKING TAPES MARKET SIZE, BY COUNTRY, 2020–2027 (MILLION SQUARE METER)

8.3.4 CHINA

8.3.4.1 High demand for water blocking tapes from power cable and submarine cable applications

TABLE 46 CHINA: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 47 CHINA: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.3.5 INDIA

8.3.5.1 Second-fastest growing market for water blocking tapes

TABLE 48 INDIA: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 49 INDIA: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.3.6 JAPAN

8.3.6.1 Second-largest water blocking tapes market in region

TABLE 50 JAPAN: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 51 JAPAN: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.3.7 SOUTH KOREA

8.3.7.1 Stringent environmental regulations to reduce use of high VOC content tapes

TABLE 52 SOUTH KOREA: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 53 SOUTH KOREA: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.3.8 INDONESIA

8.3.8.1 Availability of cost-effective labor and raw materials to propel market growth

TABLE 54 INDONESIA: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 55 INDONESIA: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.3.9 REST OF ASIA PACIFIC

TABLE 56 REST OF ASIA PACIFIC: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 57 REST OF ASIA PACIFIC: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.4 EUROPE

FIGURE 32 EUROPE: WATER BLOCKING TAPES MARKET SNAPSHOT

8.4.1 WATER BLOCKING TAPES MARKET IN EUROPE, BY CONDUCTIVE TYPE

TABLE 58 EUROPE: WATER BLOCKING TAPES MARKET SIZE, BY CONDUCTIVE TYPE, 2020–2027 (USD MILLION)

TABLE 59 EUROPE: WATER BLOCKING TAPES MARKET SIZE, BY CONDUCTIVE TYPE, 2020–2027 (MILLION SQUARE METER)

8.4.2 WATER BLOCKING TAPES MARKET IN EUROPE, BY APPLICATION

TABLE 60 EUROPE: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 61 EUROPE: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.4.3 WATER BLOCKING TAPES MARKET IN EUROPE, BY COUNTRY

TABLE 62 EUROPE: WATER BLOCKING TAPES MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 63 EUROPE: WATER BLOCKING TAPES MARKET SIZE, BY COUNTRY, 2020–2027 (MILLION SQUARE METER)

8.4.4 GERMANY

8.4.4.1 Increasing maintenance and replacement of submarine cables boost consumption of water blocking tapes

TABLE 64 GERMANY: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 65 GERMANY: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.4.5 FRANCE

8.4.5.1 Increasing installation of offshore wind farms boosts consumption of water blocking tapes

TABLE 66 FRANCE: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 67 FRANCE: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.4.6 ITALY

8.4.6.1 Growth in the economy is major driver for water blocking tapes market

TABLE 68 ITALY: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 69 ITALY: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.4.7 UK

8.4.7.1 Growth in submarine cable laying market increases consumption of water blocking tapes

TABLE 70 UK: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 71 UK: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.4.8 SPAIN

8.4.8.1 Growth in industrial sector boosts the water blocking tapes market

TABLE 72 SPAIN: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 73 SPAIN: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.4.9 TURKEY

8.4.9.1 Companies focusing on creating brands of water blocking tapes

TABLE 74 TURKEY: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 75 TURKEY: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.4.10 REST OF EUROPE

TABLE 76 REST OF EUROPE: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 77 REST OF EUROPE: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.5 MIDDLE EAST & AFRICA

8.5.1 WATER BLOCKING TAPES MARKET IN MIDDLE EAST & AFRICA, BY CONDUCTIVE TYPE

TABLE 78 MIDDLE EAST & AFRICA: WATER BLOCKING TAPES MARKET SIZE, BY CONDUCTIVE TYPE, 2020–2027 (USD MILLION)

TABLE 79 MIDDLE EAST & AFRICA: WATER BLOCKING TAPE MARKET SIZE, BY CONDUCTIVE TYPE, 2020–2027 (MILLION SQUARE METER)

8.5.2 WATER BLOCKING TAPES MARKET IN MIDDLE EAST & AFRICA, BY APPLICATION

TABLE 80 MIDDLE EAST & AFRICA: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 81 MIDDLE EAST & AFRICA: WATER BLOCKING TAPE MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.5.3 WATER BLOCKING TAPES MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY

TABLE 82 MIDDLE EAST & AFRICA: WATER BLOCKING TAPES MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 83 MIDDLE EAST & AFRICA: WATER BLOCKING TAPES MARKET SIZE, BY COUNTRY, 2020–2027 (MILLION SQUARE METER)

8.5.4 SOUTH AFRICA

8.5.4.1 Increasing investments in energy infrastructure development to fuel water blocking tapes demand

TABLE 84 SOUTH AFRICA: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 85 SOUTH AFRICA: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.5.5 SAUDI ARABIA

8.5.5.1 Growth in investments and need for fast networking devices

TABLE 86 SAUDI ARABIA: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 87 SAUDI ARABIA: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.5.6 REST OF MIDDLE EAST & AFRICA

TABLE 88 REST OF MIDDLE EAST & AFRICA: WATER BLOCKING TAPE MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 89 REST OF MIDDLE EAST & AFRICA: WATER BLOCKING TAPE MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.6 SOUTH AMERICA

8.6.1 WATER BLOCKING TAPES MARKET IN SOUTH AMERICA, BY CONDUCTIVE TYPE

TABLE 90 SOUTH AMERICA; WATER BLOCKING TAPES MARKET SIZE, BY CONDUCTIVE TYPE, 2020–2027 (USD MILLION)

TABLE 91 SOUTH AMERICA: WATER BLOCKING TAPE MARKET SIZE, BY CONDUCTIVE TYPE, 2020–2027 (MILLION SQUARE METER)

8.6.2 WATER BLOCKING TAPES MARKET IN SOUTH AMERICA, BY APPLICATION

TABLE 92 SOUTH AMERICA; WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 93 SOUTH AMERICA: WATER BLOCKING TAPE MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.6.3 WATER BLOCKING TAPES MARKET IN SOUTH AMERICA, BY COUNTRY

TABLE 94 SOUTH AMERICA; WATER BLOCKING TAPES MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 95 SOUTH AMERICA; WATER BLOCKING TAPES MARKET SIZE, BY COUNTRY, 2020–2027 (MILLION SQUARE METER)

8.6.4 BRAZIL

8.6.4.1 Increasing investments in energy infrastructure development to fuel water blocking tapes demand

TABLE 96 BRAZIL: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 97 BRAZIL: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.6.5 ARGENTINA

8.6.5.1 Growth in investments boosts consumption of water blocking tapes in various cable applications

TABLE 98 ARGENTINA: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 99 ARGENTINA: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

8.6.6 REST OF SOUTH AMERICA

TABLE 100 REST OF SOUTH AMERICA: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 101 REST OF SOUTH AMERICA: WATER BLOCKING TAPES MARKET SIZE, BY APPLICATION, 2020–2027 (MILLION SQUARE METER)

9 COMPETITIVE LANDSCAPE (Page No. - 120)

9.1 INTRODUCTION

9.2 MARKET SHARE ANALYSIS

FIGURE 33 MARKET SHARE OF TOP COMPANIES IN WATER BLOCKING TAPES MARKET

TABLE 102 DEGREE OF COMPETITION: WATER BLOCKING TAPES MARKET

9.3 MARKET RANKING

FIGURE 34 RANKING OF TOP FIVE PLAYERS IN WATER BLOCKING TAPES MARKET

9.4 COMPANY EVALUATION MATRIX

TABLE 103 COMPANY PRODUCT FOOTPRINT

TABLE 104 COMPANY END-USE INDUSTRY FOOTPRINT

TABLE 105 COMPANY REGION FOOTPRINT

9.4.1 STAR

9.4.2 PERVASIVE

9.4.3 PARTICIPANTS

9.4.4 EMERGING LEADERS

FIGURE 35 WATER BLOCKING TAPES MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2021

9.4.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 36 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN WATER BLOCKING TAPES MARKET

9.4.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 37 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN WATER BLOCKING TAPES MARKET

9.5 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

9.5.1 PROGRESSIVE COMPANIES

9.5.2 RESPONSIVE COMPANIES

9.5.3 DYNAMIC COMPANIES

9.5.4 STARTING BLOCKS

FIGURE 38 WATER BLOCKING TAPES MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) MAPPING, 2020

9.6 MARKET EVALUATION FRAMEWORK

TABLE 106 WATER BLOCKING TAPES MARKET: DEALS, 2016–2022

TABLE 107 WATER BLOCKING TAPES MARKET: OTHERS, 2016–2022

10 COMPANY PROFILES (Page No. - 129)

10.1 KEY COMPANIES

(Business Overview, Products Offered, Deals, and MnM View)*

10.1.1 SCAPA GROUP PLC

TABLE 108 SCAPA GROUP PLC: BUSINESS OVERVIEW

FIGURE 39 SCAPA GROUP PLC: COMPANY SNAPSHOT

10.1.2 CHASE CORPORATION

TABLE 109 CHASE CORPORATION: BUSINESS OVERVIEW

FIGURE 40 CHASE CORPORATION: COMPANY SNAPSHOT

10.1.3 HANYU CABLE MATERIALS

TABLE 110 HANYU CABLE MATERIALS: BUSINESS OVERVIEW

10.1.4 GURFIL

TABLE 111 GURFIL: BUSINESS OVERVIEW

10.1.5 STAR MATERIALS

TABLE 112 STAR MATERIALS: BUSINESS OVERVIEW

10.1.6 WEIHAI HONGDA CABLE MATERIAL

TABLE 113 WEIHAI HONGDA CABLE MATERIAL: BUSINESS OVERVIEW

10.1.7 INDORE COMPOSITE

TABLE 114 INDORE COMPOSITE: BUSINESS OVERVIEW

10.1.8 UNITAPE UK LTD

TABLE 115 UNITAPE UK LTD: BUSINESS OVERVIEW

10.1.9 LIFELINE TECHNOLOGIES

TABLE 116 LIFELINE TECHNOLOGIES: BUSINESS OVERVIEW

10.1.10 CHHAPERIA INTERNATIONAL COMPANY

TABLE 117 CHHAPERIA INTERNATIONAL COMPANY: BUSINESS OVERVIEW

10.2 OTHER PLAYERS

10.2.1 EKSTEL

10.2.2 HONGZHOU PHOTOELECTRIC MATERIAL TECHNOLOGY LTD

10.2.3 INTERNATIONAL MATERIALS GROUP

10.2.4 SHENYANG TIANRONG CABLE MATERIALS CO LTD

10.2.5 SNEHAM INTERNATIONAL

10.2.6 SHINYUAN TECHNOLOGIES

10.2.7 NANTONG SIBER COMMUNICATION

10.2.8 SWABS TAPES INDIA PRIVATE LIMITED

10.2.9 CABLE TAPES UK

10.2.10 CHENGDU CENTRAN INDUSTRIAL

10.2.11 FORI GROUP

10.2.12 NAVANK CONSULTANTS

10.2.13 VITAHCO

10.2.14 SUZHOU KAYING INDUSTRIAL MATERIALS CO LTD

10.2.15 GECA TAPES

* Business Overview, Products Offered, Deals, and MnM View might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 153)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

The study involves two major activities in estimating the current size of the water blocking tapes market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases, and investor presentations of companies; certified publications; articles from recognized authors; gold & silver standard websites; and various databases were referred to for identifying and collecting information for this study.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the total pool of players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and related key executives from various leading companies and organizations operating in the water blocking tapes market. Primary sources from the demand side included procurement managers and experts from end-use industries.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total water blocking tapes market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall water blocking tapes market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the cable application segments.

Report Objectives

- To analyze and forecast the global water blocking tapes market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on conductive type, and application.

- To analyze and forecast the market size based on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and South America.

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of Asia Pacific water blocking tapes market

- Further breakdown of Rest of European water blocking tapes market

- Further breakdown of Rest of Middle East & Africa water blocking tapes market

- Further breakdown of Rest of South American water blocking tapes market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Water Blocking Tapes Market