Waste Paper Management Market by Service & Equipment (Collection & Transportation, Recycling, Incineration, Disposal), Recovery (Containerboard, Newsprint, Tissue), Source (Commercial, Industrial, Residential), Paper Grade - Global Forecast to 2020

[272 Pages Report]The global market for waste paper management has been growing proportionally with the increasing environmental concerns among people and enforcement of stringent environmental laws & regulations.

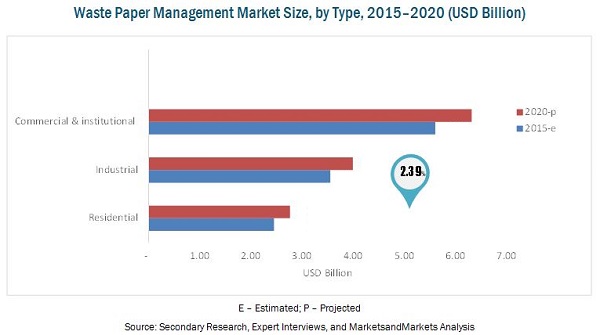

The paper industry has been dominated by North America for more than a century now. North America is the largest producer as well as consumer of paper & paper products with a yearly per capita consumption of 487 pounds of paper. This region also enjoys significant availability of fiber resources, which enables it to hold the highest position in the global export of pulp & waste paper. The U.S. ranks first in pulp & paper manufacture and exports, globally, followed by Canada. The global waste paper management market is projected to be valued at around USD 43.35 Billion by 2020, and to grow at a CAGR of 2.55% from 2015 to 2020. The commercial sector as a source of waste paper is projected to grow at the highest CAGR from 2015 to 2020.

This report provides a complete analysis of key companies and competitive analysis of developments recorded in the industry in the last five years. In this report, market drivers, restraints, opportunities, and challenges have been discussed in detail. Companies such as Veolia Environnement S.A. (France), International Paper Company (U.S.), Waste Management, Inc. (U.S.), UPM-Kymmene OYJ (Finland), and WestRock Company (U.S.), Republic Services Inc. (U.S.), Mondi Group (South Africa), Georgia-Pacific LLC (U.S.), Sappi Ltd. (South Africa), and DS Smith Plc. (U.K.) have been profiled to provide an insight into the competitive scenario of the waste paper management market.

Mergers & acquisitions have been the key strategies adopted by leading companies to accommodate the rapidly changing technologies in application areas and to increase their market share. Companies have also adopted strategic investments & expansions and new product developments to bridge the existing gaps in their product offerings, end-market requirements, and geographical constraints. These strategies have been adopted by leading companies to ensure retention of the existing market share within the highly fragmented waste paper management market.

The waste paper management market is primarily driven by socio-economic factors such as public awareness and population trends. Laws and regulations enforced by governments is another major factor that compels paper & paper product manufacturers to manage and recycle waste papers. The key players of the waste paper management market prefer agreements, expansions & investments, and mergers & acquisitions to gain a larger share in the market. Leading waste management service providers are focusing on emerging countries that are estimated to show potential for industrial development in the near future.

Scope of the Report

- On the basis of service, this market has been segmented as follows:

- Collection & transportation

- Collection & transportation equipment

- Storage

- Storage equipment

- Sorting

- Sorting equipment

- Processing

- Processing equipment

- Disposal & landfill

- On the basis of source, this market has been segmented as follows:

- Commercial & institutional

- Industrial

- Residential

- Others

- On the basis of waste type, this market has been segmented as follows:

- Old corrugated containers

- Mixed paper

- Newsprint

- High-grade de-inked paper

- Pulp substitutes

- On the basis of recovery potential, this market has been segmented as follows:

- Container board

- Other paper & paperboard

- Newsprint

- Tissue

- Pulp substitutes

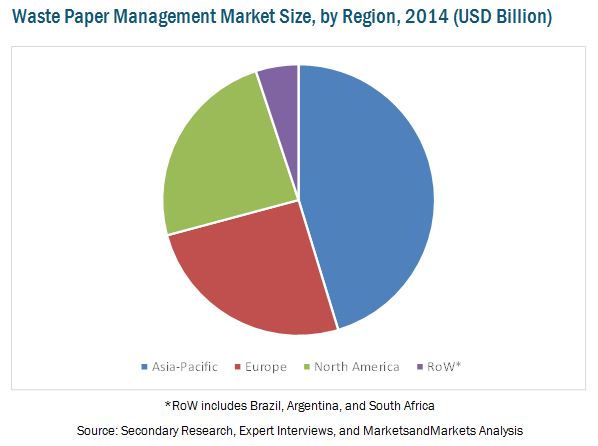

- On the basis of region, this market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW

The demand for waste paper management services is projected to grow at a CAGR of 2.55%, in terms of value, from 2015 to 2020. The waste paper management market has been growing in accordance with changing consumer lifestyles and increasing urbanization. Factors such as growing population and increasing income levels of people have generated new opportunities for the waste management market after the economic downturn between 2008 and 2010. New technologies have been developed globally, which help in bringing down the amount of waste. The awareness about waste management has increased significantly with the progress in consumer education and increased awareness about health & environment.

Concerns about the environment have compelled governments to impose stringent regulations to minimize the impact of waste and its harmful by-products on the environment. Strict laws have been enforced by governments for the management of waste paper to reduce the rate of deforestation globally. Regulatory bodies in the U.S. and European countries impose fines for non-compliance with standards and Acts.

The waste paper management market is dominated by firms such as Veolia Environnement S.A. (France), International Paper Company (U.S.), Waste Management, Inc. (U.S.), UPM-Kymmene OYJ (Finland), and WestRock Company (U.S.). By gaining considerable expertise and experience over the years, they have optimized their processes and practices to become more efficient.

The various waste paper generating sectors include commercial & institutional, industrial, residential, and others. The segmentation based on recovered products of waste paper recycling consists of container board, other paper & paperboard, newsprint, tissue, and pulp substitutes. The final segment, region, comprises the four main regions, namely, North America, Europe, Asia-Pacific, and Rest of the World (RoW).

The commercial & institutional segment as a source of waste paper is projected to be the fastest-growing from 2015 to 2020. The key players in the waste paper management market prefer acquisitions and new product development to gain a larger share in the market. Leading waste management service providers are focusing on emerging countries that are estimated to show potential for industrial development in the near future. These strategies have aided companies to create a larger customer and partner base in key markets.

Table of Contents

1 Introduction (Page No. - 24)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Periodization

1.4 Currency

1.5 Package Size

1.6 Stakeholders

2 Research Methodology (Page No. - 28)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions Made for This Study

2.4.2 Limitations for the Research Study

3 Executive Summary (Page No. - 36)

3.1 Waste Paper Management Market Evolved Significantly to Its Current Position Since Early 1031

3.2 Waste Paper Management Market: Driving Factors

3.3 Old Containerboard is Projected to Cover Major Market By 2020

3.4 Commercial & Institutional Sector to Be the Largest Source of Waste Paper By 2020

3.5 Asia-Pacific is Projected to Dominate the Waste Paper Management Market By 2020

3.6 Waste Paper Management Market in China Witnessed the Highest Growth in 2014

4 Premium Insights (Page No. - 43)

4.1 Emerging Economies to Have Higher Demand for Waste Paper Management

4.2 Containerboard is Projected to Grow at the Highest CAGR Between 2015 & 2020

4.3 Containerboard Captured the Largest Share in Asia-Pacific in 2014

4.4 Waste Paper Management Industry: Life Cycle Analysis, By Region – Asia-Pacific Region Witnessed High Growth in 2014

4.5 Old Corrugated Container Was the Most Recycled Paper Grade Across All the Regions in 2014

5 Market Overview (Page No. - 48)

5.1 Introduction

5.2 Evolution

5.3 Waste Paper Management Market Segmentation

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Laws & Regulations Enforced By Governments

5.4.1.2 Increase in Awareness Programs for Waste Management is Expected to Systemize the Waste Segregation Process

5.4.1.3 Increasing Urbanization and Industrialization has Raised the Demand for Paper & Paper Products

5.4.2 Restraints

5.4.2.1 Less Participation of Source Sectors Towards Management of Waste

5.4.2.2 Absence of Proper Framework for Waste Paper Collection & Segregation in Developing Regions

5.4.2.3 Less Number of Treatment Plants and Lack of Expertise Restrict the Amount of Recycled Waste Paper

5.4.3 Opportunities

5.4.3.1 Reduced Environmental Impact Through Paper Recycling

5.4.3.2 Economic Benefits Attract Paper Manufacturers to Recycle Paper

5.4.4 Challenges

5.4.4.1 Repeated Recycling Results in Poor Quality Paper

5.5 Value Chain Analysis

6 Waste Paper Management Market, By Paper Grade (Page No. - 58)

6.1 Introduction

6.2 Old Corrugated Containers (OCC)

6.2.1 Old Corrugated Containers Market, By Region

6.3 Mixed Paper

6.3.1 Mixed Paper Market Size, By Region

6.4 Old Newspaper (ONP)

6.4.1 Old Newspaper Market Size, By Region

6.5 High-Grade De-Inked Paper

6.5.1 High-Grade De-Inked Paper Market Size, By Region

6.6 Pulp Substitutes

6.6.1 Pulp Substitutes Market Size, By Region

7 Waste Paper Management Market, By Source (Page No. - 74)

7.1 Introduction

7.1.1 Comercial & Institutional Sector to Generate the Maximum Amount of Waste Paper

7.2 Waste Paper Management Source,

7.2.1 Commercial & Institutional

7.2.1.1 Commercial & Institutional Waste Paper Management Market, By Region

7.2.2 Industrial

7.2.2.1 Asia-Pacific to Lead the Market for Industrial Waste Paper Management Between 2015 and 2020

7.2.3 Residential

7.2.3.1 Residential Waste Paper Management Market is Projected to Witness the Highest Growth in Asia-Pacific Market

8 Waste Paper Management Market, By Recycled Product (Page No. - 82)

8.1 Introduction

8.1.1 Growth in Demand for Containerboard to Drive Waste Paper Management Demand

8.2 Waste Paper Management Recycled Products, By Region

8.2.1 Containerboard

8.2.1.1 Containerboard Market is Projected to Witness the Highest Growth in Asia-Pacific Region

8.2.2 Other Paper & Paperboard

8.2.2.1 Asia-Pacific to Lead the Market for Other Paper & Paperboards Between 2015 and 2020

8.2.3 Newsprint

8.2.3.1 Newsprint Market, By Region

8.2.4 Tissue

8.2.4.1 Tissue Market, By Region

8.2.5 Pulp Substitute

8.2.5.1 Pulp Substitute Market, By Region

9 Waste Paper Management Market, By Service (Page No. - 94)

9.1 Introduction

9.2 Collection & Transportation

9.2.1 Collection & Transportation Market, By Region

9.3 Equipment Market for Collection & Transportation

9.3.1 Garbage Truck

9.3.2 Garbage Trucks Market, By Region

9.4 Storage

9.4.1 Storage Market, By Region

9.5 Sorting

9.5.1 Sorting Market Size, By Region

9.5.2 Equipment Market for Sorting Operations

9.5.2.1 Balers

9.5.2.2 Balers Market Size, By Region

9.6 Compactors

9.6.1 Compactors Market Size, By Region

9.7 Shredders

9.7.1 Shredders Market Size, By Region

9.8 Recycling

9.8.1 Recycling Market Size, By Region

9.8.2 Equipment Market for Recycling Operations

9.9 Pulper

9.9.1 Pulper Market Size, By Region

9.1 De-Inking Machine

9.10.1 De-Inking Machine Market Size, By Region

9.11 Incineration

9.11.1 Incineration Market Size, By Region

9.12 Scrubbers

9.12.1 Scrubber Market Size, By Region

9.13 Precipitators

9.13.1 Precipitator Market Size, By Region

9.14 Combustors

9.14.1 Combustor Market Size, By Region

9.15 Disposal

9.15.1 Disposal Market Size, By Region

9.16 Equipment Market for Papermaking Operations

9.17 Drier

9.17.1 Drier Market Size, By Region

9.18 Mixers

9.18.1 Mixer Market Size, By Region

9.19 Forming Machine

9.19.1 Forming Machine Market Size, By Region

9.20 Air Heater

9.20.1 Air Heater Market Size, By Region

9.21 Pressing Machine

9.21.1 Pressing Machine Market Size, By Region

9.22 Sheet Cutter

9.22.1 Sheet Cutter Market Size, By Region

10 Waste Paper Management Market, By Region (Page No. - 126)

10.1 Introduction

10.2 North America

10.2.1 North America: Waste Paper Management Market, By Country

10.2.2 North America: Waste Paper Management Market, By Paper Grade

10.2.3 North America: Waste Paper Management Market Size, By Recycled Product

10.2.4 North America: Waste Paper Management Market Size, By Source

10.2.5 North America: Waste Paper Management Market Size, By Service

10.2.6 U.S.

10.2.6.1 U.S.: Laws & Regulations

10.2.6.2 U.S.: Waste Paper Management Market, By Paper Grade

10.2.6.3 U.S.: Waste Paper Management Market, By Source

10.2.7 Canada

10.2.7.1 Canada: Economic Indicator

10.2.7.2 Canada: Laws & Regulations

10.2.7.3 Canada: Waste Paper Management Market, By Paper Grade

10.2.7.4 Canada: Waste Paper Management Market, By Recycled Product

10.2.7.5 Canada: Waste Paper Management Market, By Source

10.2.8 Mexico

10.2.8.1 Mexico: Economic Indicators

10.2.8.2 Mexico: Laws & Regulations

10.2.8.3 Mexico: Waste Paper Management Market, By Paper Grade

10.2.8.4 Mexico: Waste Paper Management Market, By Recycled Product

10.2.8.5 Mexico: Waste Paper Management Market, By Source

10.3 Europe

10.3.1 Europe: Waste Paper Management Market Size, By Country

10.3.2 Europe: Waste Paper Management Market, By Paper Grade

10.3.3 Europe: Waste Paper Management Market Size, By Recycled Product

10.3.4 Europe: Waste Paper Management Market Size, By Source

10.3.5 Europe: Waste Paper Management Market Size, By Service

10.3.6 Germany

10.3.6.1 Germany: Economic Indicators

10.3.6.2 Germany: Laws & Regulations

10.3.6.3 Germany: Waste Paper Management Market, By Paper Grade

10.3.6.4 Germany: Waste Paper Management Market, By Recycled Product

10.3.6.5 Germany: Waste Paper Management Market, By Source

10.3.7 Finland

10.3.7.1 Finland: Economic Indicators

10.3.7.2 Finland: Waste Paper Management Market, By Paper Grade

10.3.7.3 Finland: Waste Paper Management Market, By Recycled Product

10.3.7.4 Finland: Waste Paper Management Market, By Source

10.3.8 Sweden

10.3.8.1 Sweden: Economic Indicators

10.3.8.2 Sweden: Laws & Regulations

10.3.8.3 Sweden: Waste Paper Management Market, By Paper Grade

10.3.8.4 Sweden: Waste Paper Management Market, By Recycled Product

10.3.8.5 Sweden: Waste Paper Management Market, By Source

10.3.9 U.K.

10.3.9.1 U.K.: Economic Indicators

10.3.9.1.1 U.K.: Laws & Regulations

10.3.9.2 U.K.: Waste Paper Management Market, By Paper Grade

10.3.9.3 U.K.: Waste Paper Management Market, By Recycled Product

10.3.9.4 U.K.: Waste Paper Management Market, By Source

10.3.10 France

10.3.10.1 France: Economic Indicators

10.3.10.2 France: Laws & Regulations

10.3.10.3 France: Waste Paper Management Market, By Paper Grade

10.3.10.4 France: Waste Paper Management Market, By Recycled Product

10.3.10.5 France: Waste Paper Management Market, By Source

10.3.11 Rest of Europe

10.3.11.1 Rest of Europe: Waste Paper Management Market, By Paper Grade

10.3.11.2 Rest of Europe: Waste Paper Management Market, By Recycled Product

10.3.11.3 Rest of Europe: Waste Paper Management Market, By Source

10.4 Asia-Pacific

10.4.1 Asia-Pacific: Waste Paper Management Market, By Country

10.4.2 Asia-Pacific: Waste Paper Management Market, By Paper Grade

10.4.3 Asia-Pacific: Waste Paper Management Market, By Recycled Product

10.4.4 Asia-Pacific: Waste Paper Management Market, By Source

10.4.5 Asia-Pacific: Waste Paper Management Market, By Service

10.4.6 China

10.4.6.1 China: Economic Indicators

10.4.6.2 China: Laws & Regulations

10.4.6.3 China: Waste Paper Management Market, By Paper Grade

10.4.6.4 China: Waste Paper Management Market, By Recycled Product

10.4.6.5 China: Waste Paper Management Market, By Source

10.4.7 Japan

10.4.7.1 Japan: Economic Indicators

10.4.7.2 Japan: Laws & Regulations

10.4.7.3 Japan: Waste Paper Management Market, By Paper Grade

10.4.7.4 Japan: Waste Paper Management Market, By Recycled Product

10.4.7.5 Japan: Waste Paper Management Market, By Source

10.4.8 South Korea

10.4.8.1 South Korea: Economic Indicator

10.4.8.2 South Korea: Waste Paper Management Market Size, By Paper Grade

10.4.8.3 South Korea: Waste Paper Management Market, By Recycled Product

10.4.8.4 South Korea: Waste Paper Management Market, By Source

10.4.9 Indonesia

10.4.9.1 Indonesia: Economic Indicator

10.4.9.2 Indonesia: Waste Paper Management Market, By Paper Grade

10.4.9.3 Indonesia: Waste Paper Management Market, By Recycled Product

10.4.9.4 Indonesia: Waste Paper Management Market, By Source

10.4.10 India

10.4.10.1 India: Economic Indicators

10.4.10.2 India: Waste Paper Management Market, By Paper Grade

10.4.10.3 India: Waste Paper Management Market, By Recycled Product

10.4.10.4 India: Waste Paper Management Market, By Source

10.4.11 Rest of Asia-Pacific

10.4.11.1 Rest of Asia-Pacific: Waste Paper Management Market, By Paper Grade

10.4.11.2 Rest of Asia-Pacific: Waste Paper Management Market, By Recycled Product

10.4.11.3 Rest of Asia-Pacific: Waste Paper Management Market, By Source

10.5 Rest of the World

10.5.1 RoW: Waste Paper Management Market Size, By Country

10.5.2 RoW: Waste Paper Management Market, By Paper Grade

10.5.3 RoW: Waste Paper Management Market Size, By Recycled Products

10.5.4 RoW: Waste Paper Management Market Size, By Source

10.5.5 RoW: Waste Paper Management Market Size, By Service

10.5.6 Brazil

10.5.6.1 Brazil: Economic Indicators

10.5.6.2 Brazil: Laws & Regulations

10.5.6.3 Brazil: Waste Paper Management Market Size, By Paper Grade

10.5.6.4 Brazil: Waste Paper Management Market, By Recycled Products

10.5.6.5 Brazil: Waste Paper Management Market, By Source

10.5.7 Saudi Arabia

10.5.7.1 Saudi Arabia: Economic Indicators

10.5.7.2 Saudi Arabia: By Market Size, By Paper Grade

10.5.7.3 Saudi Arabia: By Market, By Recycled Products

10.5.7.4 Saudi Arabia: By Market, By Source

10.5.8 South Africa

10.5.8.1 South Africa: Economic Indicators

10.5.8.1 South Africa: Laws & Regulations

10.5.8.2 South Africa: By Market Size, By Paper Grade

10.5.8.3 South Africa: By Market, By Recycled Products

10.5.8.4 South Africa: By Market, By Source

10.5.9 Others in RoW

10.5.9.1 Others in RoW: By Market Size, By Paper Grade

10.5.9.2 Others in RoW: By Market, By Recycled Products

10.5.9.3 Others in RoW: By Market, By Source

11 Trade Dynamics (Page No. - 225)

11.1 Trade Overview

11.2 Factors Influencing Waste Paper Trade

11.2.1 Constant Factors

11.2.1.1 Point of Collection

11.2.1.2 Printing

11.2.1.3 Type of Paper

11.2.1.4 Ease of Pulping

11.2.1.5 Ash Content

11.2.2 Variable Factors:

11.2.2.1 Environmental Conditions

11.2.2.2 Freightage

11.2.2.3 Currency Exchange Rate Fluctuations

11.2.2.4 Tariffs & Duties

11.3 Pulp & Waste Paper Import and Export Data, Global

11.4 Pulp & Waste Paper Export Data, Top Exporting Countries

11.5 Pulp & Waste Paper Import Data, By Top Importing Country, 2013

11.6 China is Expected to Continue Leading the Waste Paper Management Market in the Coming Years

12 Competitive Landscape (Page No. - 230)

12.1 Overview

12.1.1 Westrock Company Grew at the Highest Rate Between 2010 & 2014

12.2 Competitive Situation & Trends

12.2.1 Mergers & Acquisitions Have Fuelled the Growth of the Waste Paper Management Market

12.2.2 Mergers & Acquisitions Were the Key Strategies Undertaken By Market Leaders in Waste Paper Management Market

12.3 Mergers & Acquisitions

12.4 Expansions , Investments & Divestments

12.5 Partnerships, Contracts, Agreements & Joint Ventures

12.6 New Product Launches

13 Company Profiles (Page No. - 239)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

13.1 Introduction

13.2 Veolia Environnement S.A.

13.3 International Paper Company

13.4 Waste Management Inc.

13.5 UPM-Kymmene OYJ

13.6 Westrock Company

13.7 Republic Services, Inc.

13.8 Mondi Group

13.9 Georgia-Pacific LLC

13.10 Sappi Ltd

13.11 DS Smith PLC

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 268)

14.1 Discussion Guide

14.2 Introducing RT: Real Time Market Intelligence

14.3 Available Customizations

14.4 Related Reports

List of Tables (246 Tables)

Table 1 Impact of Key Drivers on Waste Paper Management Market

Table 2 World Urbanization Prospects

Table 3 Economic Downturn May Restrain Market Growth

Table 4 Opportunities for Growth of Waste Paper Management Market

Table 5 Efforts to Obtain High-Grade Paper Even After Repeated Recycling is the Major Challenge Faced By the Industry

Table 6 Classification of Waste Paper Grades According to En-643 Standard

Table 7 Waste Paper Management Market Size, By Paper Grade, 2013–2020 (USD Billion)

Table 8 Waste Paper Management Market Size, By Paper Grade, 2013–2020 (MMT)

Table 9 Old Corrugated Containers Market Size, By Region, 2013–2020 (USD Billion)

Table 10 Old Corrugated Containers Market Size, By Region, 2013–2020 (MMT)

Table 11 Mixed Paper Market Size, By Region, 2013–2020 (USD Billion)

Table 12 Mixed Paper Market Size, By Region, 2013–2020 (MMT)

Table 13 Old Newspaper Market Size, By Region, 2013–2020 (USD Billion)

Table 14 Old Newspaper Market Size, By Region, 2013–2020 (MMT)

Table 15 High-Grade De-Inked Paper Market Size, By Region, 2013–2020 (USD Billion)

Table 16 High-Grade De-Inked Paper Market Size, By Region, 2013–2020 (MMT)

Table 17 Pulp Substitutes Market Size, By Region, 2013–2020 (USD Million)

Table 18 Pulp Substitutes Market Size, By Region, 2013–2020 (MMT)

Table 19 Waste Paper Management Market Size, By Source, 2013–2020 (USD Billion)

Table 20 Waste Paper Management Market Size, By Source, 2013–2020 (MMT)

Table 21 Commercial & Institutional Waste Paper Management Market Size, By Region, 2013–2020 (USD Billion)

Table 22 Commercial & Institutional Waste Paper Management Market Size, By Region, 2013–2020 (MMT)

Table 23 Industrial Waste Paper Management Market Size, By Region, 2013–2020 (USD Billion)

Table 24 Industrial Waste Paper Management Market Size, By Region, 2013–2020 (MMT)

Table 25 Residential Waste Paper Management Market Size, By Region, 2013–2020 (USD Billion)

Table 26 Residential Waste Paper Management Market Size, By Region, 2013–2020 (MMT)

Table 27 Waste Paper Management Market Size, By Recycled Product, 2013–2020 (USD Billion)

Table 28 Waste Paper Management Market Size, By Recycled Product, 2013–2020 (MMT)

Table 29 Containerboard Market Size, By Region, 2013–2020 (USD Billion)

Table 30 Containerboard Market Size, By Region, 2013–2020 (MMT)

Table 31 Other Paper & Paperboards Market Size, By Region, 2013–2020 (USD Billion)

Table 32 Other Paper & Paperboards Market Size, By Region, 2013–2020 (MMT)

Table 33 Newsprint Market Size, By Region, 2013–2020 (USD Million)

Table 34 Newsprint Market Size, By Region, 2013–2020 (MMT)

Table 35 Tissue Market Size, By Region, 2013–2020 (USD Million)

Table 36 Tissue Market Size, By Region, 2013–2020 (MMT)

Table 37 Pulp Substitute Market Size, By Region, 2013–2020 (USD Million)

Table 38 Pulp Substitute Market Size, By Region, 2013–2020 (MMT)

Table 39 Waste Paper Management Market Size, By Service, 2013–2020 (USD Billion)

Table 40 Waste Paper Management Market Size, By Service, 2013–2020 (MMT)

Table 41 Collection & Transportation Market Size, By Region, 2013–2020 (USD Billion)

Table 42 Collection & Transportation Market Size, By Region, 2013–2020 (MMT)

Table 43 Garbage Trucks Market Size, By Region, 2013–2020 (USD Billion)

Table 44 Garbage Trucks Market Size, By Region, 2013–2020 (Thousand Units)

Table 45 Storage Market Size, By Region, 2013–2020 (USD Billion)

Table 46 Storage Market Size, By Region, 2013–2020 (MMT)

Table 47 Sorting Market Size, By Region, 2013–2020 (USD Billion)

Table 48 Sorting Market Size, By Region, 2013–2020 (MMT)

Table 49 Balers Market Size, By Region, 2013–2020 (USD Million)

Table 50 Balers Market Size, By Region, 2013–2020 (Thousand Units)

Table 51 Compactors Market Size, By Region, 2013–2020 (USD Million)

Table 52 Compactors Market Size, By Region, 2013–2020 (Thousand Units)

Table 53 Shredders Market Size, By Region, 2013–2020 (USD Million)

Table 54 Shredders Market Size, By Region, 2013–2020 (Thousand Units)

Table 55 Recycling Market Size, By Region, 2013–2020 (USD Billion)

Table 56 Recycling Market Size, By Region, 2013–2020 (MMT)

Table 57 Pulper Market Size, By Region, 2013–2020 (USD Million)

Table 58 Pulper Market Size, By Region, 2013–2020 (Thousand Units)

Table 59 De-Inking Machine Market Size, By Region, 2013–2020 (USD Million)

Table 60 De-Inking Machine Market Size, By Region, 2013–2020 (Thousand Units)

Table 61 Incineration Market Size, By Region, 2013–2020 (USD Million)

Table 62 Incineration Market Size, By Region, 2013–2020 (MMT)

Table 63 Scrubber Market Size, By Region, 2013–2020 (USD Billion)

Table 64 Scrubber Market Size, By Region, 2013–2020 (Thousand Units)

Table 65 Precipitator Market Size, By Region, 2013–2020 (USD Billion)

Table 66 Precipitator Market Size, By Region, 2013–2020 (Units)

Table 67 Combustor Market Size, By Region, 2013–2020 (USD Billion)

Table 68 Combustor Market Size, By Region, 2013–2020 (Units)

Table 69 Disposal Market Size, By Region, 2013–2020 (USD Million)

Table 70 Disposal Market Size, By Region, 2013–2020 (MMT)

Table 71 Drier Market Size, By Region, 2013–2020 (USD Million)

Table 72 Drier Market Size, By Region, 2013–2020 (Thousand Units)

Table 73 Mixer Market Size, By Region, 2013–2020 (USD Million)

Table 74 Mixer Market Size, By Region, 2013–2020 (Thousand Units)

Table 75 Forming Machine Market Size, By Region, 2013–2020 (USD Million)

Table 76 Forming Machine Market Size, By Region, 2013–2020 (Thousand Units)

Table 77 Air Heater Market Size, By Region, 2013–2020 (USD Million)

Table 78 Air Heater Market Size, By Region, 2013–2020 (Thousand Units)

Table 79 Pressing Machine Market Size, By Region, 2013–2020 (USD Million)

Table 80 Pressing Machine Market Size, By Region, 2013–2020 (Thousand Units)

Table 81 Sheet Cutter Market Size, By Region, 2013–2020 (USD Million)

Table 82 Sheet Cutter Market Size, By Region, 2013–2020 (Thousand Units)

Table 83 Waste Paper Management Market Size, By Region, 2013–2020 (USD Billion)

Table 84 Waste Paper Management Market Size, By Region, 2013–2020 (MMT)

Table 85 North America: Market Size, By Country, 2013–2020 (USD Billion)

Table 86 North America: Market Size, By Country, 2013–2020 (MMT)

Table 87 North America: Market Size, By Paper Grade, 2013–2020 (USD Billion)

Table 88 North America: Market Size, By Paper Grade, 2013-2020 (MMT)

Table 89 North America: Market Size, By Recycled Product, 2013–2020 (USD Billion)

Table 90 North America: Market Size, By Recycled Product, 2013–2020 (MMT)

Table 91 North America: Market Size, By Source, 2013–2020 (USD Billion)

Table 92 North America: Market Size, By Source, 2013–2020 (MMT)

Table 93 North America: Market Size, By Service, 2013–2020 (USD Billion)

Table 94 North America: Market Size, By Service, 2013–2020 (MMT)

Table 95 U.S.: Economic Indicators

Table 96 U.S.: Waste Paper Management Market Size, By Paper Grade, 2013–2020 (USD Billion)

Table 97 U.S.: Market Size, By Paper Grade, 2013–2020 (MMT)

Table 98 U.S.: Market Size, By Recycled Product, 2013–2020 (USD Billion)

Table 99 U.S.: Market Size, By Recycled Product, 2013–2020 (MMT)

Table 100 U.S.: Waste Paper Management Market Size, By Source, 2013–2020 (USD Billion)

Table 101 U.S.: Market Size, By Source, 2013–2020 (MMT)

Table 102 Canada: Waste Paper Management Market Size, By Paper Grade, 2013–2020 (USD Million)

Table 103 Canada: Market Size, By Paper Grade, 2013-2020 (MMT)

Table 104 Canada: Market Size, By Recycled Product, 2013–2020 (USD Million)

Table 105 Canada: Market Size, By Recycled Product, 2013–2020 (MMT)

Table 106 Canada: Market Size, By Source, 2013–2020 (USD Million)

Table 107 Canada: Market Size, By Source, 2013–2020 (MMT)

Table 108 Mexico: Waste Paper Management Market Size, By Paper Grade, 2013–2020 (USD Million)

Table 109 Mexico: Market Size, By Paper Grade, 2013-2020 (MMT)

Table 110 Mexico: Market Size, By Recycled Product, 2013–2020 (USD Million)

Table 111 Mexico: Market Size, By Recycled Product, 2013–2020 (MMT)

Table 112 Mexico: Market Size, By Source, 2013–2020 (USD Million)

Table 113 Mexico: Market Size, By Source, 2013–2020 (MMT)

Table 114 Europe: Waste Paper Management Market Size, By Country, 2013–2020 (USD Billion)

Table 115 Europe: Market Size, By Country, 2013–2020 (MMT)

Table 116 Europe: Market Size, By Paper Grade, 2013–2020 (USD Billion)

Table 117 Europe: Market Size, By Paper Grade, 2014-2020 (MMT)

Table 118 Europe: Market Size, By Recycled Product, 2013–2020 (USD Billion)

Table 119 Europe: Market Size, By Recycled Product, 2013–2020 (MMT)

Table 120 Europe: Market Size, By Source, 2013–2020 (USD Billion)

Table 121 Europe: Market Size, By Source, 2013–2020 (MMT)

Table 122 Europe: Market Size, By Service, 2013–2020 (USD Billion)

Table 123 Europe: Market Size, By Service, 2013–2020 (MMT)

Table 124 Germany: Waste Paper Management Market Size, By Paper Grade, 2013–2020 (USD Million)

Table 125 Germany: Market Size, By Paper Grade, 2013–2020 (MMT)

Table 126 Germany: Market Size, By Recycled Product, 2013–2020 (USD Million)

Table 127 Germany: Market Size, By Recycled Product, 2013–2020 (MMT)

Table 128 Germany: Market Size, By Source, 2013–2020 (USD Million)

Table 129 Germany: Market Size, By Source, 2013–2020 (MMT)

Table 130 Finland: Waste Paper Management Market Size, By Paper Grade, 2013–2020 (USD Million)

Table 131 Finland: Market Size, By Paper Grade, 2013-2020 (MMT)

Table 132 Finland: Market Size, By Recycled Product, 2013–2020 (USD Million)

Table 133 Finland: Market Size, By Recycled Product, 2013–2020 (MMT)

Table 134 Finland: Market Size, By Source, 2013–2020 (USD Million)

Table 135 Finland: Market Size, By Source, 2013–2020 (MMT)

Table 136 Sweden: Waste Paper Management Market Size, By Paper Grade, 2013–2020 (USD Million)

Table 137 Sweden: Market Size, By Paper Grade, 2013–2020 (MMT)

Table 138 Sweden: Market Size, By Recycled Product, 2013–2020 (USD Million)

Table 139 Sweden: Market Size, By Recycled Product, 2013–2020 (MMT)

Table 140 Sweden: Market Size, By Source, 2013–2020 (USD Million)

Table 141 Sweden: Market Size, By Source, 2013–2020 (MMT)

Table 142 U.K.: Waste Paper Management Market Size, By Paper Grade, 2013–2020 (USD Million)

Table 143 U.K.: Market Size, By Paper Grade, 2013–2020 (MMT)

Table 144 U.K.: Market Size, By Recycled Product, 2013–2020 (USD Million)

Table 145 U.K.: Market Size, By Recycled Product, 2013–2020 (MMT)

Table 146 U.K.: Market Size, By Source, 2013–2020 (USD Billion)

Table 147 U.K.: Market Size, By Source, 2013–2020 (MMT)

Table 148 France: Waste Paper Management Market Size, By Paper Grade, 2013–2020 (USD Million)

Table 149 France: Market Size, By Paper Grade, 2013–2020 (MMT)

Table 150 France: Market Size, By Recycled Product, 2013–2020 (USD Million)

Table 151 France: Market Size, By Recycled Product, 2013–2020 (MMT)

Table 152 France: Market Size, By Source, 2013–2020 (USD Million)

Table 153 France: Market Size, By Source, 2013–2020 (MMT)

Table 154 Rest of Europe: Waste Paper Management Market Size, By Paper Grade, 2013-2020 (USD Million)

Table 155 Rest of Europe: Market Size, By Paper Grade, 2013-2020 (MMT)

Table 156 Rest of Europe: Market Size, By Recycled Product, 2013-2020 (USD Million)

Table 157 Rest of Europe: Market Size, By Recycled Product, 2013-2020 (MMT)

Table 158 Rest of Europe: Market Size, By Source, 2013-2020 (USD Billion)

Table 159 Rest of Europe: Market Size, By Source, 2013-2020 (MMT)

Table 160 Asia-Pacific: Waste Paper Management Market Size, By Country, 2013–2020 (USD Billion)

Table 161 Asia-Pacific: Market Size, By Country, 2013–2020 (MMT)

Table 162 Asia-Pacific: Market Size, By Paper Grade, 2013–2020 (USD Billion)

Table 163 Asia-Pacific: Market Size, By Paper Grade, 2013–2020 (MMT)

Table 164 Asia-Pacific: Market Size, By Recycled Product, 2013–2020 (USD Billion)

Table 165 Asia-Pacific: Market Size, By Recycled Product, 2013–2020 (MMT)

Table 166 Asia-Pacific: Market Size, By Source, 2013–2020 (USD Billion)

Table 167 Asia-Pacific: Market Size, By Source, 2013–2020 (MMT)

Table 168 Asia-Pacific: Market Size, By Service, 2013–2020 (USD Billion)

Table 169 Asia-Pacific: Market Size, By Service, 2013–2020 (MMT)

Table 170 China: Waste Paper Management Market Size, By Paper Grade, 2013–2020 (USD Billion)

Table 171 China: Market Size, By Paper Grade, 2013–2020 (MMT)

Table 172 China: Market Size, By Recycled Product, 2013–2020 (USD Billion)

Table 173 China: Market Size, By Recycled Product, 2013–2020 (MMT)

Table 174 China: Market Size, By Source, 2013–2020 (USD Billion)

Table 175 China: Market Size, By Source, 2013–2020 (MMT)

Table 176 Japan: Waste Paper Management Market Size, By Paper Grade, 2013–2020 (USD Billion)

Table 177 Japan: Market Size, By Paper Grade, 2013–2020 (MMT)

Table 178 Japan: Market Size, By Recycled Product, 2013–2020 (USD Billion)

Table 179 Japan: Market Size, By Recycled Product, 2013–2020 (MMT)

Table 180 Japan: Market Size, By Source, 2013–2020 (USD Billion)

Table 181 Japan: Market Size, By Source, 2013–2020 (MMT)

Table 182 South Korea: Waste Paper Management Market Size, By Paper Grade, 2013–2020 (USD Million)

Table 183 South Korea: Market Size, By Paper Grade, 2013–2020 (MMT)

Table 184 South Korea: Market Size, By Recycled Product, 2013–2020 (USD Million)

Table 185 South Korea: Market Size, By Recycled Product, 2013–2020 (MMT)

Table 186 South Korea: Market Size, By Source, 2013–2020 (USD Billion)

Table 187 South Korea: Market Size, By Source, 2013–2020 (MMT)

Table 188 Indonesia: Waste Paper Management Market Size, By Paper Grade, 2013–2020 (USD Million)

Table 189 Indonesia: Market Size, By Paper Grade, 2013–2020 (MMT)

Table 190 Indonesia: Market Size, By Recycled Product, 2013–2020 (USD Million)

Table 191 Indonesia: Market Size, By Recycled Product, 2013–2020 (MMT)

Table 192 Indonesia: Market Size, By Source, 2013–2020 (USD Million)

Table 193 Indonesia: Market Size, By Source, 2013–2020 (MMT)

Table 194 India: Waste Paper Management Market Size, By Paper Grade, 2013–2020 (USD Million)

Table 195 India: Market Size, By Paper Grade, 2013–2020 (MMT)

Table 196 India: Market Size, By Recycled Product, 2013–2020 (USD Million)

Table 197 India: Market Size, By Recycled Product, 2013–2020 (MMT)

Table 198 India: Market Size, By Source, 2013–2020 (USD Million)

Table 199 India: Market Size, By Source, 2013–2020 (MMT)

Table 200 Rest of Asia-Pacific: Waste Paper Management Market Size, By Paper Grade, 2013–2020 (USD Billion)

Table 201 Rest of Asia-Pacific: Market Size, By Paper Grade, 2013–2020 (MMT)

Table 202 Rest of Asia-Pacific: Market Size, By Recycled Product, 2013–2020 (USD Million)

Table 203 Rest of Asia-Pacific: Market Size, By Recycled Product, 2013–2020 (MMT)

Table 204 Rest of Asia-Pacific: Market Size, By Source, 2013–2020 (USD Billion)

Table 205 Rest of Asia-Pacific: Market Size, By Source, 2013–2020 (MMT)

Table 206 RoW: Waste Paper Management Market Size, By Country, 2013–2020 (USD Billion)

Table 207 RoW: Market Size, By Country, 2013–2020 (MMT)

Table 208 RoW: Market Size, By Paper Grade, 2013–2020 (USD Billion)

Table 209 RoW: Market Size, By Paper Grade, 2013–2020 (MMT)

Table 210 RoW: Market Size, By Recycled Products, 2013–2020 (USD Million)

Table 211 RoW: Market Size, By Recycled Products, 2013–2020 (MMT)

Table 212 RoW: Market Size, By End User, 2013–2020 (USD Billion)

Table 213 RoW: Market Size, By Source, 2013–2020 (MMT)

Table 214 RoW: Market Size, By Service, 2013–2020 (USD Billion)

Table 215 RoW: Market Size, By Service, 2013–2020 (MMT)

Table 216 Brazil: Waste Paper Management Market Size, By Paper Grade, 2013–2020 (USD Million)

Table 217 Brazil: Market Size, By Paper Grade, 2013–2020 (MMT)

Table 218 Brazil: Market Size, By Recycled Products, 2013–2020 (USD Million)

Table 219 Brazil: Market Size, By Recycled Products, 2013–2020 (MMT)

Table 220 Brazil: Market Size, By Source, 2013–2020 (USD Million)

Table 221 Brazil: Market Size, By Source, 2013–2020 (MMT)

Table 222 Saudi Arabia: Waste Paper Management Market Size, By Paper Grade, 2013–2020 (USD Million)

Table 223 Saudi Arabia: Market Size, By Paper Grade, 2013–2020 (MMT)

Table 224 Saudi Arabia: Market Size, By Recycled Products, 2013–2020 (USD Million)

Table 225 Saudi Arabia: Market Size, By Recycled Products, 2013–2020 (MMT)

Table 226 Saudi Arabia: Market Size, By Source, 2013–2020 (USD Million)

Table 227 Saudi Arabia: Market Size, By Source, 2013–2020 (MMT)

Table 228 South Africa: Market Size, By Paper Grade, 2013–2020 (USD Million)

Table 229 South Africa: Market Size, By Paper Grade, 2013–2020 (MMT)

Table 230 South Africa: Market Size, By Recycled Products, 2013–2020 (USD Million)

Table 231 South Africa: Market Size, By Recycled Products, 2013–2020 (MMT)

Table 232 South Africa: Market Size, By Source, 2013–2020 (USD Million)

Table 233 South Africa: Market Size, By Source, 2013–2020 (MMT)

Table 234 Others in RoW: Waste Paper Management Market Size, By Paper Grade, 2013–2020 (USD Million)

Table 235 Others in RoW: Market Size, By Paper Grade, 2013–2020 (MMT)

Table 236 Others in RoW: Market Size, By Recycled Products, 2013–2020 (USD Million)

Table 237 Others in RoW: Market Size, By Recycled Products, 2013–2020 (MMT)

Table 238 Others in RoW: Market Size, By Source, 2013–2020 (USD Million)

Table 239 Others in RoW: Market Size, By Source, 2013–2020 (MMT)

Table 240 Pulp & Waste Paper Import and Export Data, 2008–2013 (USD Billion)

Table 241 Pulp & Waste Paper Export Data, Top Exporting Countries, 2013 (USD Billion)

Table 242 Pulp & Waste Paper Import Data, By Top Importing Country, 2013 (USD Billion)

Table 243 Mergers & Acquisitions, 2013–2015

Table 244 Expansions, Investments & Divestments, 2012–2015

Table 245 Partnerships, Contracts, Agreements & Joint Ventures, 2013–2015

Table 246 New Product Launches, 2012–2015

List of Figures (61 Figures)

Figure 1 Waste Paper Management Market

Figure 2 Waste Paper Management Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Evolution of Waste Paper Management Market

Figure 7 Waste Paper Management Market Snapshot (2015 vs 2020)

Figure 8 Waste Paper Generation By Commercial & Institutional Sector Will Be the Highest By 2020

Figure 9 Asia-Pacific is Projected to Dominate the Waste Paper Management Market By 2020

Figure 10 China Was the Fastest-Growing Country for the Waste Paper Management Market in 2014

Figure 11 Leading Market Players Adopted Mergers & Acquisitions as the Key Strategy From 2011 to 2015

Figure 12 Emerging Economies Offer Attractive Opportunities in the Waste Paper Management Market

Figure 13 Containerboard Segment Was the Largest Market in 2014

Figure 14 The Largest Share Was Captured By China in the Emerging Asia-Pacific Market in 2014

Figure 15 Waste Paper Management Industry Life Cycle, By Region

Figure 16 Old Corrugated Container: Most Recycled Paper Grade in 2014

Figure 17 Evolution of Waste Paper Management

Figure 18 Waste Paper Management Market Segmentation

Figure 19 Laws & Regulations and Increasing Urbanization & Industrialization Result in Increased Demand for Waste Paper Management Services

Figure 20 Value Chain Analysis

Figure 21 Waste Paper Management Market, By Paper Grade, 2015 vs 2020 (USD Billion)

Figure 22 Asia-Pacific Led the Global Waste Paper Management Market in 2014

Figure 23 Old Corrugated Containers Market Size, 2015 vs 2020 (USD Billion)

Figure 24 Mixed Paper Market Size, 2015 vs 2020 (USD Billion)

Figure 25 Old Newspaper Market Size, 2015 vs 2020 (USD Billion)

Figure 26 High-Grade De-Inked Paper Market Size, 2015 vs 2020 (USD Billion)

Figure 27 Pulp Substitutes Market Size, 2015 vs 2020 (USD Billion)

Figure 28 The Commercial & Institutional Segment is Projected to Grow at the Highest CAGR, in Terms of Value

Figure 29 Commercial & Institutional Waste Paper Management Market Size, By Region, 2015–2020 (USD Billion)

Figure 30 Industrial Waste Paper Management Market Size, By Region, 2015–2020 (USD Billion)

Figure 31 Asia-Pacific Region is Projected to Be the Largest Market for Residential Waste Paper Management, 2015–2020

Figure 32 Containerboard is Projected to Grow at the Highest CAGR, 2015–2020

Figure 33 Asia-Pacific Region is Projected to Be the Largest Market for Containerboard in Waste Paper Management, 2015–2020

Figure 34 Other Paper & Paperboards Market, By Region, 2015–2020

Figure 35 Newsprint Market, By Region, 2015–2020

Figure 36 Tissue Market, By Region, 2015–2020

Figure 37 Pulp Substitute Market Size, By Region, 2015–2020

Figure 38 Recycling to Form the Largest Segment for the Waste Paper Management Services in 2015

Figure 39 Geographic Snapshot (2015–2020): the Markets in Asia-Pacific is Projected to Register the Highest Growth Rates, in Terms of Value

Figure 40 North American Waste Paper Management Market Snapshot: the .U.S is Projected to Be the Leading Country in North America

Figure 41 Asia-Pacific Waste Paper Management Market Snapshot: China is the Most Lucrative Market

Figure 42 Companies Adopted Mergers & Acquisitions as the Key Growth Strategy During the Studied Period (2012–2015)

Figure 43 Growth Scenario of Top Five Waste Paper Management Companies Between 2010 & 2014

Figure 44 Mergers & Acquisitions in Waste Paper Management Market

Figure 45 Mergers & Acquisitions: the Key Strategies, 2011–2015

Figure 46 Annual Developments in Waste Paper Management Market, 2011–2015

Figure 47 Geographic Revenue Mix of Top 5 Market Players

Figure 48 Veolia Environnement S.A.: Company Snapshot

Figure 49 Veolia Environnement S.A.: SWOT Analysis

Figure 50 International Paper Company: Company Snapshot

Figure 51 International Paper Company: SWOT Analysis

Figure 52 Waste Management, Inc. : Company Snapshot

Figure 53 Waste Management, Inc. :SWOT Analysis

Figure 54 UPM-Kymmene OYJ: Company Snapshot

Figure 55 UPM-Kymmene OYJ: SWOT Analysis

Figure 56 Westrock Company: Company Snapshot

Figure 57 Westrock Company: SWOT Analysis

Figure 58 Republic Services, Inc.: Company Snapshot

Figure 59 Mondi Group: Company Snapshot

Figure 60 Sappi Limited: Company Snapshot

Figure 61 DS Smith PLC: Company Snapshot

Growth opportunities and latent adjacency in Waste Paper Management Market