Industrial Waste Management Market by Services (Collection, Recycling, Incineration, Landfill) & Geography (Asia-Pacific, Europe, Middle East & Africa, Americas) - Global Trends and Forecasts to 2019

[153 Pages Report] Waste is an inevitable by-product of our use of natural resources. Industrial waste is defined as waste that is generated by an industrial or manufacturing activity. The types of industrial waste generated includes dirt and gravel, masonry and concrete, scrap metals, oil, trash, solvents, chemicals, weed grass and trees, wood and scrap lumber, coal ash, boiler slags, and similar waste.

In most of the industrialized economies, the traditional approach to waste has been to dispose of it as cheaply as possible, paying little concern on what happens once the waste leaves the producer’s facility. However, this scenario is changing as increased environmental awareness is reflected in stringent waste management regulations and a dedicated approach on the part of industry to better environmental performance and meet customer’s expectations.

The global industrial waste management market is segmented on the basis of their services which include collection, recycling, incineration, and landfill. The market is further segmented on the basis of regions such as Asia-Pacific, Europe, Middle East & Africa, and Americas. Each segment has been analyzed with respect to its market trends, growth trends, and future prospects. The data has been analyzed from 2011 to 2019, and all quantitative data regarding segmentation is mentioned in terms of value ($Million).

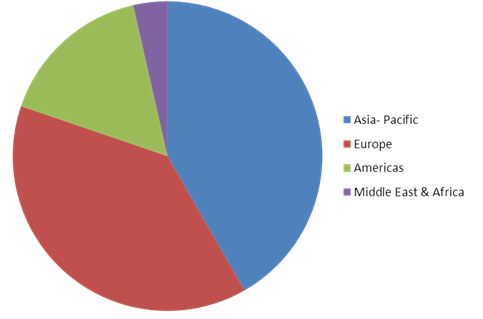

Asia-Pacific expected to witness highest growth rate

The global industrial waste management market is expected to cross $1 trillion by 2019, growing at a CAGR of 8.9% from 2014 to 2019. In terms of market size, Asia-Pacific stood first followed by Europe and Americas in 2013. Rapid industrialization in the emerging countries of Asia-Pacific has led to increased waste generation, creating a huge demand for waste management services in the region. Between 2014 and 2019, the region is expected to witness the highest growth at a CAGR of 11.4%, to reach $685.0 billion by 2019, from $398.6 billion in 2013.

Industrial Waste Management: Market Share (Value), by Geography, 2013

Source: MarketsandMarkets Analysis

The industrial waste management market is also analyzed with respect to Porter's Five Force model. Different market forces such as suppliers’ power, buyers’ power, degree of competition, threat from substitutes, and threat from new entrants, are analyzed with respect to the industrial waste management industry. The report also provides a competitive landscape of major market players that includes developments, mergers & acquisition, expansion & investments, agreements & contracts, new technologies, developments, and others. A number of these developments are spotted by key industry players that suggest the growth strategy of these companies as well as of the overall industry.

The report also provides a comprehensive review of major market drivers, restraints, opportunities, winning imperatives, and key burning issues in the industrial waste management market. Key players in the industry are profiled in detail with their recent developments. Some of these include companies such as Daiseki Co. Ltd. (Japan), SembCorp (Singapore), EnviroServ Waste (South Africa), Remondis (Germany), Clean Harbors (U.S.), Republic Services (U.S.), Suez Environnment (France), Veolia Environmental (Paris), Waste Management Inc.(U.S.), and Stericycle Inc.(U.S.).

The global industrial waste management market is expected to be a trillion dollar industry by 2019, with a projected CAGR of 8.9%, signifying a high demand for waste management services in both developed and developing countries.

Industrial waste management market is at various stages of development and opportunities are diverse across regions. In the emerging economies such as China and India, the market is tied to the rapid industrialization and urbanization activities. Government and regulatory bodies in these regions are implementing stringent regulations to effectively process and manage waste that demand effective waste management services. However, the matured markets of Europe and Americas, are striving towards a complete recycling region with an aim to recover as waste material and re-use, thereby reducing the consumption of fresh natural resources.

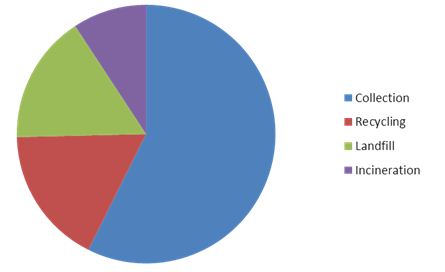

Collection services dominates the market

Collection services dominated the industrial waste management market and accounted for almost 60% share of the total market in 2013. This service is expected to witness strong growth because of the increased environmental awareness and a dedicated approach on the part of industry to better environmental performance. The biggest markets for collection services are Asia-Pacific, followed by Europe, Americas, and Middle East & Africa.

Industrial Waste Management: Market Share (Value), by Service, 2013

Source: MarketsandMarkets Analysis

Key companies in the industrial waste management service market are Daiseki Co. Ltd. (Japan), SembCorp (Singapore), EnviroServ Waste (South Africa), Remondis (Germany), Clean Harbors (U.S.), Republic Services (U.S.), Suez Environn ement (France), Veolia Environnement (France), Waste Management Inc. (U.S.), Stericycle Inc. (U.S.).

Mergers and Acquisitions: Key strategy

The leading companies of market focus on the growth of their mergers & acquisitions with the key objective of serving various industry sectors with a wide geographic presence. The leading companies have been able to acquire regional/local waste management service providers in order to expand their range of operations. They are constantly focusing on the emerging regions to establish themselves as leading industrial waste management service providers.

Table Of Contents

1 Introduction (Page No. - 16)

1.1 Key Objectives

1.2 Analyst Insights

1.3 Report Description

1.4 Market Definitions

1.5 Market Segmentation & Aspects Covered

1.6 Stakeholders

1.7 Research Methodology

1.7.1 Approach

1.7.2 Market Size Estimation

1.7.3 Market Crackdown & Data Triangulation

1.7.4 Key Data Points Taken From Secondary Sources

1.7.5 Key Secondary Sources Used

1.7.6 Key Data Points Taken From Primary Sources

1.7.7 Assumptions Made for This Report

2 Executive Summary (Page No. - 28)

3 Premium Insights (Page No. - 31)

3.1 Introduction

3.1.1 Asia-Pacific Dominates the Market

3.1.2 Regional Market Lifecycle Analysis

3.1.3 Current Market & Growth Analysis

3.1.4 Market Attractiveness By Waste Management Services

3.1.5 China Creates A High Potential Market for Waste Services Due to Large Volumes of Waste Generation

3.1.6 Global Industrial Waste Generated, By Industry

3.2 Related Markets

3.2.1 Medical Waste Management Market

4 Market Overview (Page No. - 40)

4.1 Introduction

4.1.1 Source Reduction

4.1.2 Recycling/Reuse

4.1.3 Treatment & Disposal

4.2 Classification of Industrial Waste

4.2.1 Agricultural & forestry Waste

4.2.2 Chemical Waste

4.2.3 Construction & Demolition Waste

4.2.4 Energy Waste

4.2.5 Mining Waste

4.2.6 Metallurgy Waste

4.2.7 Manufacturing Waste

4.3 Market Segmentation

4.3.1 By Service

4.3.1.1 Collection

4.3.1.2 Recyling

4.3.1.3 Incineration

4.3.1.4 Landfill

4.3.2 By Geography

4.3.3 Value Chain Analysis

4.3.3.1 Waste Generation

4.3.3.2 Waste Collection & Transport

4.3.3.3 Recycling

4.3.3.4 Landfill

4.3.3.5 Incineration

4.4 Market Dynamics

4.4.1 Drivers

4.4.1.1 Rapid Industrialization & Urbanization

4.4.1.2 Focus on Energy and Resource Recovery

4.4.2 Restraints

4.4.2.1 Low Importance Towards Waste Management

4.4.2.2 Low Sustainability in Waste Management

4.4.3 Opportunities

4.4.3.1 Increase in the Purchase of Recyclable Products

4.4.3.2 Increasing Environment & Safety Regulations

4.5 Burning Issues

4.5.1.1 Illegal Dumping

4.5.1.2 Lack of Capital Expenditure for Waste Management

4.6 Winning Imperatives

4.6.1.1 Focus on Industrial Waste Minimization

4.7 Porter’s Five forces Analysis

4.7.1 Suppliers’ Power

4.7.2 Buyers’ Power

4.7.3 Threats of New Entrants

4.7.4 Threats of Substitutes

4.7.5 Degree of Competition

5 Industrial Waste Management, By Service (Page No. - 61)

5.1 Introduction

5.2 Industrial Waste Management Market, By Service

5.2.1 Collection

5.2.2 Recycling

5.2.3 Incineration

5.2.4 Landfill

6 Indsutrial Waste Management, By Geography (Page No. - 71)

6.1 Introduction

6.2 Industrial Waste Management Market, By Geography

6.2.1 Asia-Pacific Industrial Waste Management Market, By Service

6.2.1.1 Industrial Waste Management Market, Japan

6.2.1.2 Industrial Waste Management Market, China

6.2.1.3 Industrial Waste Management Market, India

6.2.1.4 Industrial Waste Management Market, Australia

6.2.1.5 Industrial Waste Management Market, South Korea

6.2.1.6 Industrial Waste Management Market, the Rest of Asia-Pacific

6.2.2 Europe

6.2.2.1 Industrial Waste Management Market, Germany

6.2.2.2 Industrial Waste Management Market, Bulgaria

6.2.2.3 Industrial Waste Management Market, United Kingdom

6.2.2.4 Industrial Waste Management Market, France

6.2.2.5 Industrial Waste Management Market, Russia

6.2.2.6 Industrial Waste Management Market, the Rest of Europe

6.2.3 the Middle East & Africa

6.2.3.1 Industrial Waste Management Market, South Africa

6.2.3.2 Industrial Waste Management Market, Saudi Arabia

6.2.3.3 Industrial Waste Management Market, United Arab Emirates

6.2.3.4 Industrial Waste Management Market, Tunisia

6.2.3.5 Industrial Waste Management Market, Egypt

6.2.3.6 Industrial Waste Management Market, the Rest of the Middle East & Africa

6.2.4 Americas

6.2.4.1 Industrial Waste Management Market, the United States

6.2.4.2 Industrial Waste Management Market, Brazil

6.2.4.3 Industrial Waste Management Market, Colombia

6.2.4.4 Industrial Waste Management Market, Chile

6.2.4.5 Industrial Waste Management Market, Canada

6.2.4.6 Industrial Waste Management Market, the Rest of America

7 Competitive Landscape (Page No. - 128)

7.1 Introduction

7.2 Key Players of the Market

7.3 Growth Strategies in the Market

7.4 Market Share Analysis

7.5 SWOT Analysis

7.5.1 Clean Harbors (U.S.)

7.5.2 Republic Services Inc. (U.S.)

7.5.3 Sembcorp Environmental Management Pte. Ltd. (Singapore)

7.5.4 Veolia Environnement (France)

7.5.5 Waste Managementinc. (U.S.)

7.6 Mergers & Acquisitions

7.7 Contracts & Agreements

7.8 Other Developments

8 Company Profiles (Company At A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)* (Page No. - 145)

8.1 Clean Harbors

8.2 Daiseki Co. Ltd.

8.3 Enviroserv Waste Management (Pty) Ltd.

8.4 Remondis AG & Co. Kg

8.5 Republic Services Inc.

8.6 Sembcorp Environmental Management Pte. Ltd.

8.7 Stericycle Inc.

8.8 Suez Environnement Sa

8.9 Veolia Environnement

8.10 Waste Management Inc.

*Details on Company At A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

List of Tables (63 Tales)

Table 1 Global Industrial Waste Management Market Size (Value), By Service, 2011-2019 ($Billion)

Table 2 Medical Waste Management: Market Revenue, By Sector, 2011-2018 ($Million)

Table 3 Industrial Waste Management Market Size (Value), By Service, 2011-2019 ($Billion)

Table 4 Collection: Market Size (Value), By Geography, 2011-2019 ($Billion)

Table 5 Recycling: Market Size (Value), By Geography, 2011-2019 ($Billion)

Table 6 Incineration: Market Size (Value), By Geography, 2011-2019 ($Billion)

Table 7 Landfill: Market Size (Value), By Geography, 2011-2019 ($Billion)

Table 8 Industrial Waste Management Market Size (Value), By Geography, 2011-2019 ($Billion)

Table 9 Asia-Pacific: Market Size (Value), By Service, 2011-2019 ($Billion)

Table 10 Asia-Pacific: Market Size (Value), By Country, 2011-2019 ($Billion)

Table 11 Japan: Industrial Waste Generated (Volume), 2013 (Million Tons)

Table 12 Japan:Market Size (Value), 2011-2019 ($Million)

Table 13 China: Industrial Waste Generated (Volume), 2013 (Million Tons)

Table 14 China:Market Size (Value), 2011-2019 ($Million)

Table 15 India: Industrial Waste Generated (Volume), 2013 (Million Tons)

Table 16 India: Industrial Waste Management Market Size (Value), 2011-2019 ($Million)

Table 17 Australia: Industrial Waste Generated (Volume), 2013 (Million Tons)

Table 18 Australia: Industrial Waste Management Market Size (Value), 2011-2019 ($Million)

Table 19 South Korea: Industrial Waste Generated (Volume), 2013 (Million Tons)

Table 20 South Korea: Market Size (Value), 2011-2019 ($Million)

Table 21 The Rest of Asia-Pacific:Market Size (Value), 2011-2019 ($Million)

Table 22 Europe: Market Size (Value), By Service, 2011-2019 ($Billion)

Table 23 Europe: Market Size (Value), By Country, 2011-2019 ($Billion)

Table 24 Germany: Industrial Waste Generated (Volume), 2013 (Million Tons)

Table 25 Germany: Market Size (Value), 2011-2019($Million)

Table 26 Bulgaria: Industrial Waste Generated (Volume), 2013 (Million Tons)

Table 27 Bulgaria: Industrial Waste Management Market Size (Value), 2011-2019($Million)

Table 28 U.K.: Industrial Waste Generated (Volume), 2013(Million Tons)

Table 29 U.K.: Market Size (Value) 2011-2019($Million)

Table 30 France: Industrial Waste Generated (Volume), 2013 (Million Tons)

Table 31 France: Industrial Waste Management Market Size (Value), 2011-2019($Million)

Table 32 Russia: Industrial Waste Generated (Volume), 2013 (Million Tons)

Table 33 Russia: Market Size (Value), 2011-2019($Million)

Table 34 Rest of Europe: Market Size (Value) 2011-2019($Million)

Table 35 The Middle East & Africa: Industrial Waste Management Market Size (Value), By Service, 2011-2019 ($Billion)

Table 36 The Middle East & Africa: Market Size (Value), By Country, 2011-2019 ($Billion)

Table 37 South Africa: Industrial Waste Generated (Volume), 2013 (Million Tons)

Table 38 South Africa: Market Size (Value), 2011-2019($Million)

Table 39 Saudia Arabia: Industrial Waste Generated (Volume), 2013(Million Tons)

Table 40 Saudi Arabia: Market Size (Value), 2011-2019($Million)

Table 41 UAE: Industrial Waste Generated (Volume), 2013 (Million Tons)

Table 42 UAE: Industrial Waste Managament Market Size (Value), 2011-2019 ($Million)

Table 43 Tunisia: Industrial Waste Generated (Volume), 2013 (Million Tons)

Table 44 Tunisia: Industrial Waste Management Market Size (Value), 2011-2019($Million)

Table 45 Egypt: Industrial Waste Generated (Volume), 2013 (Million Tons)

Table 46 Egypt: Market Size (Value), 2011-2019($Million)

Table 47 Rest of The Middle East & Africa: Market Size (Value), 2011-2019 ($Million)

Table 48 Americas: Market Size (Value), By Service, 2011-2019 ($Billion)

Table 49 Americas: Industrial Waste Management Market Size (Value), By Country, 2011-2019 ($Billion)

Table 50 U.S.: Industrial Waste Generated (Volume), 2013 (Million Tons)

Table 51 U.S.:Market Size (Value), 2011-2019($Million)

Table 52 Brazil: Industrial Waste Generated (Volume), 2013 (Million Tons)

Table 53 Brazil: Industrial Waste Management Market Size (Value), 2011-2019($Million)

Table 54 Colombia: Industrial Waste Generated (Volume), 2013 (Million Tons)

Table 55 Colombia: Market Size (Value), 2011-2019($Million)

Table 56 Chile: Industrial Waste Generated (Volume), 2013 (Million Tons)

Table 57 Chile: Industrial Waste Management Market Size (Value), 2011-2019($Million)

Table 58 Canada: Industrial Waste Generated (Volume), 2013 (Million Tons)

Table 59 Canada: Market Size (Value), 2011-2019($Million)

Table 60 Rest of the Americas: Industrial Waste Management Market Size (Value), 2011-2019($Million)

Table 61 Annual Mergers & Acquisitions

Table 62 Annual Contracts & Agreements

Table 63 Other Annual Developments

List of Figures (26 Figures)

Figure 1 Research Methodology

Figure 2 Data Triangulation Methodology

Figure 3 Global Market Share (Value), By Service, 2013

Figure 4 Global Market Size: Regional Scenario, 2013

Figure 5 Regional Market Lifecycle

Figure 6 Market Size (Value), By Region, 2014 & Growth Analysis, 2014-2019

Figure 7 Market Size (Value), By Service, 2014 & Growth Analysis, 2014-2019

Figure 8 Industrial Waste Generated VS Collected (Volume), 2013

Figure 9 Global Industrial Waste Generated (Volume), By Industry, 2013

Figure 10 Industrial Waste Management Hierarchy

Figure 11 Market Share (Value), By Service, 2013

Figure 12 Market Share (Value), By Geography, 2013

Figure 13 Value Chain Analysis of the Global Market

Figure 14 Porter’s Five forces Analysis

Figure 15Market Share (Value), By Service, 2013

Figure 16 Market Share (Value), By Geography, 2013

Figure 17 Industrial Waste Management Activities, By Key Players, 2013-2019

Figure 18 Market Share (Value), Major Companies, 2013

Figure 19 Clean Harbors: SWOT Analysis

Figure 20 Republic Servicesinc.: SWOT Analysis

Figure 21 Sembcorp Environmental Management: SWOT Analysis

Figure 22 Veolia Environnement: SWOT Analysis

Figure 23 Waste Management Inc.: SWOT Analysis

Figure 24 Annual Mergers & Acquisitions Analysis, 2007-2014

Figure 25 Annual Contracts & Agreements Analysis, 2008-2014

Figure 26 Other Annual Developments Analysis, 2008-2014

Growth opportunities and latent adjacency in Industrial Waste Management Market