Volumetric Display Market by Component (Projector, Motor & Position Sensor), Technology (DLP and LCOS), Display Type (Swept and Static), Application (Medical, Aerospace & Defense and Oil & Gas), Geography - Global Trend & Forecast to 2015 - 2020

Volumetric display is a graphic display device that forms a visual representation of an object in three physical dimensions, as opposed to a planar image on traditional screens that simulate depth through a number of different visual effects. Unique properties of volumetric displays include 360-degree viewing, agreement of converge and accommodation cues, and their inherent 3D format enabling new user interface techniques. A volumetric display device was first developed in 1912; it was under development till the 1980s and commercialized in the 1990s. Consistent R&D activities have resulted in technological advancements and innovation. This technology is now being commercialized in many sectors such as medical, aerospace & defense, automotive and industrial.

Volumetric displays are categorized into swept volumetric display, static volumetric display and multi-planar display. This segmentation has been done on the basis of their functionalities and applications in the market. There are four major components, which are used in volumetric displays- projectors, motor & position sensors, mirrors, and others which include rendering software and rendering electronics. These components are essentially used to develop volumetric displays.

In this market, there are many component manufacturers and system integrators. Major companies present in this market include 3DIcon Corporation (U.S.), LightSpace Technologies Inc. (U.S.), Voxon (U.S.), Holografika Kft. (Hungary), Zebra Imaging (U.S.), and many more.

Key Takeaways:

- The overall volumetric display market is expected to reach $348.2 million by 2020 at a CAGR of 33.28% between 2015 and 2020

- Analysis of the global market with a special focus on high growth applications in various verticals

- The market has been segmented based on component, technology, display type, application, and geography with detailed classification splits by revenue.

- Detailed Porters analysis and overview of the market

- Major market trends, drivers, opportunities, restraints, and challenges for the volumetric display market

- Illustrative segmentation, analysis, and forecast of the major geographic markets to provide an overall view of the market

- Projection of volumetric display from technical as well as market oriented perspectives

- Detailed competitive landscape with identification of the key players

A volumetric display device enables generation and scattering of visible radiation from a set of localized and specified regions within a three-dimensional space. In certain cases a volumetric system allows a controlled anisotropic propagation of radiation from each of these regions. It can be used to increase the visibility of a three-dimensional image.

Volumetric display is a 3D autostereoscopic display, which is used in sectors such as medical, aerospace & defense, automotive, and industrial. During the past few years, there has been extensive research for volumetric displays pertaining to entertainment and gaming applications which has led to much technological advancement. The medical sector is a major application area, where it is used in human body scanning, surgery, and training. The application of volumetric displays in the aerospace and defense sector is on a battlefield, for training commanders, and controlling air traffic among others.

This report comprises market trends, drivers, and challenges for the volumetric display market along with the market size projections from 2015 to 2020 on the basis of component, technology, display type, application, and geography. Company profiles consist of the company overview, financial overview, products & services, recent developments, and SWOT analysis for top five companies. Based on the geography, this report covers markets in North America, Europe, APAC, and RoW (Rest of the World).

Some of the major companies present in the market are 3DIcon Corporation (U.S.), LightSpace Technologies Inc. (U.S.), Voxon (U.S.), Holografika Kft. (Hungary), Zebra Imaging (U.S.), Holoxica (U.K.), Burton Inc. (Japan), LEIA Inc. (U.S.), Seekway Technologies (China), Alioscopy (France). and others.

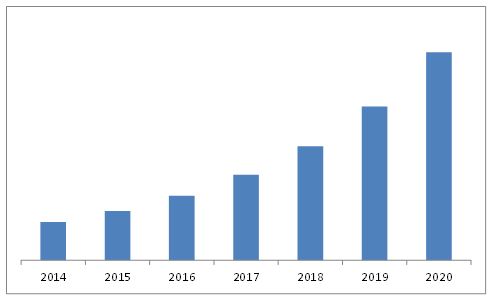

Volumetric Display Market Size, 2014-2020

The market size for volumetric displays is expected to reach to $348.17 Million by 2020, at a CAGR of 33.28% between 2015 and 2020. The maximum application of volumetric displays is in medical and aerospace & defense sectors. The application in the medical sector dominated the volumetric display market accounting for the largest share in 2014 followed by aerospace & defense. North America led the overall market in 2014.

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities for the Volumetric Display Market

4.2 MarketMajor Segments

4.3 Market in the Asia-Pacific Region

4.4 North America is Expected to Emerge as the Fastest Growing Market Between 2015 and 2020

4.5 Market: Application, 2014 to 2020

4.6 Market: Developed vs Developing Nations

4.7 Market: Medical and Aerospace & Defense Sectors (2020)

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Component

5.2.2 By Technology

5.2.3 By Display Type

5.2.4 By Industry

5.2.5 By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Need for Advanced Medical Imaging Devices for Better Treatment Will Drive the Market

5.3.1.2 Technological Advancements in 3d Displays

5.3.2 Restraints

5.3.2.1 Requirement of Advanced Software and Electronic Components

5.3.2.2 The Cost Factor Affecting the Growth of Market

5.3.3 Opportunities

5.3.3.1 Commercialization of the Market

5.3.3.2 Potential Application of Volumetric Displays in Telemedicine and Surgery

5.3.3.3 Advancements in the Volumetric Display Technology for Applications in Consumer Service Sectors

5.3.4 Challenge

5.3.4.1 Lack of Technological Awareness

6 Industry Analysis (Page No. - 45)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.3.1 Key Influencers

6.4 Industry Trends

6.5 Porters Five Forces Model

6.5.1 Threat of New Entrants

6.5.2 Threat 0f Substitutes

6.5.3 Bargaining Power of Buyers

6.5.4 Bargaining Power of Suppliers

6.5.5 Competitive Rivalry

6.6 Strategic Benchmarking

6.6.1 Technology Integration & Product Enhancement

7 Volumetric Display Market, By Component (Page No. - 57)

7.1 Introduction

7.2 Projector

7.3 Motor & Position Sensor

7.4 Mirror

7.5 Others

7.5.1 Rendering Software

7.5.2 Rendering Electronics

8 Volumetric Display Market, By Technology (Page No. - 61)

8.1 Introduction

8.2 Digital Light Processing (DLP) Technology

8.3 Liquid Crystal on Silicon (LCOS) Technology

9 Volumetric Display Market, By Display Type (Page No. - 65)

9.1 Introduction

9.2 Swept Volume Display

9.2.1 Oscillating

9.2.2 Rotating

9.3 Static Volume Display

9.4 Multi-Planar Volumetric Display

10 Volumetric Display Market, By Application (Page No. - 72)

10.1 Introduction

10.2 Medical

10.3 Aerospace & Defense

10.4 Automotive

10.5 Oil & Gas

10.6 Other Applications

10.6.1 Education

10.6.2 Entertainment

11 Geographic Analysis (Page No. - 91)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Rest of North America

11.3 Europe

11.3.1 Germany

11.3.2 U.K.

11.3.3 France

11.3.4 Rest of Europe

11.4 APAC

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 South Korea

11.4.5 Rest of Asia-Pacific

11.5 Rest of the World (RoW)

11.5.1 Middle East & Africa

11.5.2 Latin America

12 Competitive Landscape (Page No. - 112)

12.1 Overview

12.2 Major Companies Market, 2014

12.3 Competitive Situation and Trends

12.4 Battle for the Market Share: New Product Launches, Participating in Promotional Activities & Events, and Partnerships Were the Key Strategies Adopted By Many Players

12.4.1 New Product Launches and Developments

12.4.2 Agreements, Partnerships, Collaborations, and Joint Ventures

12.4.3 Other Developments

13 Company Profiles (Page No. - 118)

(Overview, Products and Services, Financials, Strategy & Development)*

13.1 3dicon Corp.

13.2 Holografika KFT

13.3 Lightspace Technologies.

13.4 Holoxica Limited

13.5 Zebra Imaging

13.6 Voxon

13.7 Burton Inc.

13.8 Jiangmen Seekway Technology Ltd.

13.9 Leia Inc

13.10 Alioscopy

14 Appendix (Page No. - 135)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Introducing RT: Real Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

List of Tables (71 Tables)

Table 1 Medical Imaging and Healthcare Applications are Expected to Propel the Growth of the Market

Table 2 High Cost May Obstruct the Growth of the Market

Table 3 The On-Going R&D and Advancements in the Volumetric Display Technology are Expected to Increase Its Applications in the Future

Table 4 Lack of Awareness

Table 5 Some of the Prominent Companies in the Market

Table 6 Market Size , By Component, 2014 2020 ($Million)

Table 7 Global Market Size, By Technology, 2014-2020 ($Million)

Table 8 Digital Light Processing (DLP) Technology Market Size, By Display Type, 2014-2020 ($Million)

Table 9 Market Size for Liquid Crystal on Silicon (LCOS) Technology, By Display Type, 2014-2020 ($Million)

Table 10 Market Size , By Display Type, 2014 2020 ($Million)

Table 11 Swept Volumetric Display Market Size, By Technology, 2014 2020 ($Million)

Table 12 Swept Volumetric Display Market Size , By Application 2014 2020 ($Million)

Table 13 Static Volumetric Display Market Size, By Technology, 2014 2020 ($Million)

Table 14 Static Volumetric Display Market Size, By Application, 2014 2020 ($Million)

Table 15 Multi-Planar Volumetric Display Market Size, By Technology, 2014 2020 ($Million)

Table 16 Multi-Planar Volumetric Display Market Size, By Application, 2014 2020 ($Million)

Table 17 Market Size, By Industry, 2014 2020 ($Million)

Table 18 Market in the Medical Sector, By Display Type, 2014 2020 ($Million)

Table 19 Market in the Medical Sector, By Geography, 2014 2020 ($Million)

Table 20 North America: Market in the Medical Sector, By Country, 2014 2020 ($Million)

Table 21 Europe: Market in the Medical Sector, By Country, 2014 2020 ($Million)

Table 22 APAC: Market in the Medical Sector, By Country, 2014 2020 ($Thousand)

Table 23 RoW: Market in the Medical Sector, By Country, 2014 2020 ($Thousand)

Table 24 Global Market in the Aerospace & Defense Sector, By Display Type, 2014 2020 ($Million)

Table 25 Global Market in the Aerospace & Defense Sector, By Geography, 2014 2020 ($Million)

Table 26 North America: Volumetric Display Market in the Aerospace & Defense Sector, By Country, 2014 2020 ($Million)

Table 27 Europe: Volumetric Display Market in the Aerospace & Defense Sector, By Country, 2014 2020 ($Million)

Table 28 APAC: Market in the Aerospace & Defense Sector, By Country, 2014 2020 ($Thousand)

Table 29 RoW: Volumetric Display Market in the Aerospace & Defense Sector, By Country, 2014 2020 ($Thousand)

Table 30 Global Market in the Automotive Sector, By Display Type, 2014 2020 ($Million)

Table 31 Global Market in the Automotive Sector, By Geography, 2014 2020 ($Million)

Table 32 North America Volumetric Display Market in the Automotive Sector, By Country, 2014 2020 ($Million)

Table 33 Europe :Market in the Automotive Sector, By Country, 2014 2020 ($Million)

Table 34 APAC Volumetric Display Market in the Automotive Sector, By Country, 2014 2020 ($Thousand)

Table 35 RoW Volumetric Display Market in the Automotive Sector, By Country, 2014 2020 ($Thousand)

Table 36 Global Market in the Oil & Gasoil & Gas Sector, By Display Type, 2014 2020 ($Million)

Table 37 Global Market in the Oil & Gas Sector, By Geography, 2014 2020 ($Million)

Table 38 North America: Volumetric Display Market in the Oil & Gas Sector, By Country, 2014 2020 ($Million)

Table 39 Europe: Market in the Oil & Gas Sector, By Country, 2014 2020 ($Million)

Table 40 APAC: Volumetric Display Market in the Oil & Gas Sector, By Country, 2014 2020 ($Thousand)

Table 41 RoW: Market in the Oil & Gas Sector, By Country, 2014 2020 ($Thousand)

Table 42 Global Market in the Other Sectors, By Display Type, 2014 2020 ($Million)

Table 43 Global Market in the Other Sectors, By Geography, 2014 2020 ($Million)

Table 44 North America: Volumetric Display Market in the Other Sectors, By Country, 2014 2020 ($Million)

Table 45 Europe: Market in the Other Sectors, By Country, 2014 2020 ($Million)

Table 46 APAC: Volumetric Display Market in the Other Sectors, By Country, 2014 2020 ($Thousand)

Table 47 RoW: Volumetric Display Market in the Other Sectors, By Country, 2014 2020 ($Thousand)

Table 48 North America: Volumetric Display Market Size, By Application, 20142020 ($Million)

Table 49 North America: Market Size, By Country, 2014 2020 ($Million)

Table 50 U.S.: Market Size, By Application, 2014 2020 ($Million)

Table 51 Rest of North America: Market Size, By Application, 2014 2020 ($Million)

Table 52 Europe: Market Size, By Application, 2014 2020 ($Million)

Table 53 Europe: Market Size, By Country, 2014 2020 ($Million)

Table 54 Germany: Market Size, By Application, 2014 2020 ($Million)

Table 55 U.K.: Market Size, By Application, 2014 2020 ($Million)

Table 56 France: Market Size, By Application, 2014 2020 ($Million)

Table 57 Rest of Europe: Market Size, By Application, 2014 2020 ($Million)

Table 58 APAC: Volumetric Display Market Size, By Application, 2014 2020 ($Million)

Table 59 APAC: Market Size, By Country, 2014 2020 ($Million)

Table 60 China: Market Size, By Application, 2014 2020 ($Million)

Table 61 Japan: Market Size, By Application, 2014 2020 ($Million)

Table 62 India :Market Size, By Application, 2014 2020 ($Thousand)

Table 63 South Korea: Market Size, By Application, 2014 2020 ($Million)

Table 64 Rest of Asia Pacific: Market Size, By Application, 2014 2020 ($Thousand)

Table 65 RoW: Market Size, By Application, 2014 2020 ($Thousand)

Table 66 RoW: Market Size, By Country, 2014 2020 ($Thousand)

Table 67 Middle East & Africa: Market Size, By Application, 2014 2020 ($Thousand)

Table 68 Latin America: Market Size, By Application, 2014 2020 ($Thousand)

Table 69 New Product Launches and Developments, 2014

Table 70 Agreements, Partnerships, Collaborations, and Joint Ventures, 2013 - 2014

Table 71 Other Developments, 2014

List of Figures (57 Figures)

Figure 1 Markets Covered

Figure 2 Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Assumptions of the Research Study

Figure 6 Limitations of the Study

Figure 7 Market, 2014 to 2020

Figure 8 Volumetric Display Component Market Share, 2014

Figure 9 Market, By Technology, 2014 vs 2020

Figure 10 Market, By Application, 2014 vs 2020

Figure 11 The Application in Medical Sector is Expected to Witness the Highest Growth By 2020

Figure 12 Market Share, By Geography in 2014

Figure 13 The Application in the Medical Sector Accounted for A Large Share of the Volumetric Display Market in 2014

Figure 14 The Swept Volume Display Segment is Expected to Grow at the Highest Rate Due to the Increasing Demand in the Medical Sector

Figure 15 Application in the Medical Sector Accounted for the Largest Share in APAC, in 2014

Figure 16 In North America, the U.S. is Expected to Grow at the Highest Rate

Figure 17 The Medical Sector is Expected to Be the Largest for Volumetric Display Applications, From 2014 to 2020

Figure 18 The U.S. is Expected to Be the Largest Market By 2020

Figure 19 The Application of Volumetric Displays in the Medical Sector has A Promising Future in North America

Figure 20 Volumetric Display Market Segmentation: By Component

Figure 21 Market Segmentation: By Technology

Figure 22 Market Segmentation: By Display Type

Figure 23 Market Segmentation: By Industry

Figure 24 Market Segmentation: By Geography

Figure 25 Increased R&D and Application in the Healthcare Industry Likely to Increase the Demand for Volumetric Displays

Figure 26 Value Chain Analysis (2014): Major Value Addition is Done During Manufacturing and Assembling Phases

Figure 27 Supply Chain of Major Players in the Market

Figure 28 Key Trends in the Market

Figure 29 Porters Five Forces Analysis

Figure 30 The Porters Five Forces Analysis for the Market

Figure 31 Threat of New Entrants

Figure 32 Threat of Substitutes

Figure 33 Bargaining Power of Buyers

Figure 34 Bargaining Power of Suppliers

Figure 35 Competitive Rivalry

Figure 36 Strategic Benchmarking: Organic & Inorganic Growth Strategies for Technology Integration and Product Enhancement

Figure 37 Volumetric Display Market, By Component

Figure 38 Projectors Accounted for the Largest Share of the Volumetric Display Components Market in 2014

Figure 39 Market Segmentation, By Technology

Figure 40 Digital Light Processing Technology Accounted for the Largest Market Size in 2014

Figure 41 Market, By Display Type

Figure 42 Swept Volume Displays Accounted for the Largest Share of the Volumetric Display Market in 2014

Figure 43 Volumetric Display Market Segmentation, By Industry

Figure 44 Market Was Dominated By Applications in the Medical Sector, in 2014

Figure 45 Geographic Growth Snapshot (20152020)- U.S., Germany, and China are Emerging as New Hot Spots

Figure 46 Country-Wise Growth of Volumetric Display Applications in Various Sectors Between 2015 and 2020

Figure 47 The North American Market Snapshot: Demand Expected to Be Driven By the Requirement of Advanced Medical Equipment

Figure 48 Europe: Market Snapshot Germany is Expected to Grow at A High Rate Between 2015 and 2020

Figure 49 Asia-Pacific: Market Snapshot China is the Most Lucrative Market

Figure 50 Companies Adopted Partnerships and Agreements as Key Growth Strategies During the Last Three Years (20122014)

Figure 51 Battle for the Market Share: New Product Launches and Partnerships Were the Key Strategies Adopted By Most Players, 20122014

Figure 52 3dicon Corp.: Company Snapshot

Figure 53 3dicon Corp : SWOT Analysis

Figure 54 Holografika KFT: SWOT Analysis

Figure 55 Lightspace Technologies: SWOT Analysis

Figure 56 Zebra Imaging: SWOT Analysis

Figure 57 Voxon: SWOT Analysis

Growth opportunities and latent adjacency in Volumetric Display Market