Voice Assistant Application Market by Component, Deployment Mode, Organization Size, Channel Integration (Websites, Mobile Applications), Application Area (Smart Banking, Connected Healthcare), and Region - Global Forecast to 2026

Voice Assistant Application Market Size, Global Industry Forecast

The worldwide voice assistant application market is projected to grow significantly, with a valuation of $2.8 billion in 2021 and an expected reach of $11.2 billion by 2026, leading to a CAGR of 32.4% during the forecast period. Major factors driving the growth of the voice assistant application market include advancements in voice-based AI technologies, rising adoption of voice-enabled devices, increasing focus on customer engagement, and emergence of low-code platforms for voice-assistant applications.

To know about the assumptions considered for the study, Request for Free Sample Report

Voice Assistant Application Market Growth Dynamics

Driver: Rising adoption of voice-enabled devices

The adoption of voice assistants by people in their daily life is increasing due to the rapid growth of voice assistant technologies, and the trend is set to continue. A report published by Juniper Research in 2017 reports that more than half of US households (55%) are estimated to have a voice-enabled smart speaker by 2022. According to the Adobe Digital Insights 2018 survey, out of the people who own smart speakers, such as Google Home and Amazon Echo, 71% interact with the voice assistant at least once daily, and 44% of the people interact with the voice assistant several times a day. According to the Conversational Commerce Survey carried out by Capgemini in 2017, which involved more than 5,000 consumers across Germany, France, the UK, and the US, 24% of the surveyed people reported that they prefer interacting with a brand through a voice assistant rather than through a website. Consumers find voice-enabled platforms and devices convenient for various activities, such as listening to music, booking appointments, online shopping, banking, and paying bills

Restraint: Inability to recognize customer intent and respond effectively

Voice assistants fed with specific data can assist customers only if posed with questions they are programmed to answer. Hence, if a customer poses a question about which the voice assistant has no information, it will fail to understand the customer’s intent and demonstrate an inability to solve the posed query. In countries such as Indonesia and India where there are multiple regional languages, people prefer their regional languages over English for day-to-day communications. In India, advancements in speech recognition have enabled a better understanding of vernacular Indian languages. However, due to the presence of various dialects, accents, and speech with a combination of more than one language, such as English and Hindi, voice assistants are not able to give appropriate responses. The inability to recognize customer intent would act as a restraining factor for market growth. A lot of customization needs to be done to build a voice assistant that can meet the end-user criteria. AI technologies provide better outputs and display better results when fed with maximum data. Hence, various companies are working toward enhancing the existing voice assistant application technologies by integrating advanced capabilities to help deliver personalized experiences by offering support to multiple use cases.

Opportunity: Increase in online purchasing

The purchase behavior of people in developed and developing countries is changing. There is a shift toward online purchasing. From the comfort of their homes, customers look for products, enquire about prices and product features, and even get personalized recommendations based on their shopping history. Voice assistants can make this experience even more frictionless and interactive. According to Capgemini’s Conversational Commerce Survey conducted in 2017, 41% of the consumers prefer a voice assistant over a website or app while shopping online because it helps them automate their routine shopping tasks. Some of the customer touchpoints where voice assistants can be effectively implemented include searching for products and services, creating a shopping list, adding items to a shopping cart, making a purchase, checking the delivery status of orders, providing feedback about products and services, using the customer support service, and making recommendations for the product or service to other potential customers. An increase in online shopping, coupled with the accelerated adoption and usage of voice assistants by customers, serves as an opportunity for voice assistant application solutions and service providers.

Challenge: Lack of awareness about the effect of implementing voice assistant technologies in various application area

The adoption of voice assistant application solutions is increasing across verticals that cater to various engagement types, including content consumption, customer services, and other productive engagements. However, consumers have limited knowledge about virtual assistants and digital personal assistants and their benefits. For instance, according to Statista, as of May 2021, India and Brazil are among the largest consumers of smartphones. Yet, the awareness of the benefits of voice-based technologies in these countries is less as compared to developed regions, such as Europe and North America. The challenges pertaining to the effective utilization and limited awareness about the benefits offered by AI-powered voice assistant applications may limit the adoption of voice assistant solutions among developing regions, such as Latin America and Africa. Large organizations are at the forefront of adopting voice assistant application solutions; however, SMEs have limited adoption of the same due to the cost associated with their maintenance and the lack of skilled resources. However, the adoption of voice assistant solutions is expected to grow in the coming years among SMEs with awareness about voice assistant application solutions and services.

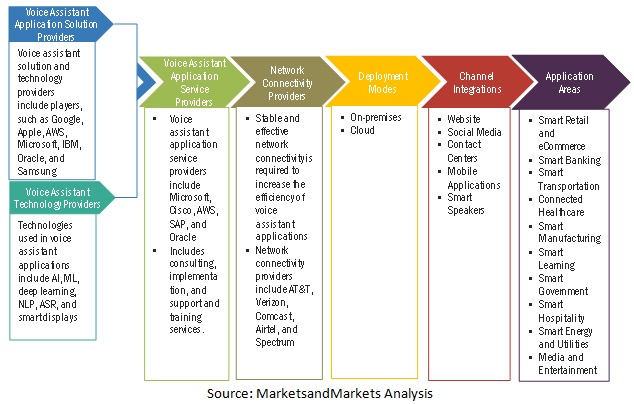

Value Chain Analysis

To know about the assumptions considered for the study, download the pdf brochure

Solutions segment to lead the voice assistant application market in 2021

Voice assistant application solution providers offer two types of voice assistant application solutions, namely, standalone and integrated. Voice assistant application solutions are capable enough to understand the context and the sentiments behind the conversation so voice assistant application solutions can seamlessly integrate with back-end data and third-party databases to enable deeper personalization. The growing need for customer engagement through the various channels would drive the adoption of voice assistant application solutions in the market.

Cloud segment to lead the voice assistant application market in 2021

Based on the deployment mode, the cloud segment is projected to lead the market from 2021 to 2026. Benefits such as cost-effectiveness and scalability would drive the adoption of cloud-based voice assistant application solutions.

SMEs segment to grow at a higher CAGR during the forecast period

Based on end user, the SMEs segment is projected to grow at a higher rate during the forecast period. SMEs play a vital role in increasing the overall growth potential and generating high-quality jobs. SMEs are the key contributors to the majority of businesses across all regions, such as North America, Europe, Asia-pacific, as well as the RoW. Due to the lesser number of resources, it is crucial for SMEs to manage their processes along with communications and operations to meet the business needs efficiently. Voice assistant applications offer flexible pricing, thereby helping organizations cater to different markets, including public and private sectors.

Smart retail and eCommerce application area to lead the voice assistant application market in 2021

Based on vertical, the smart retail and eCommerce application area is projected to lead the market in 2021. The adoption of voice assistant application in physical stores and online shopping platforms is expected to contribute to the growth of the smart retail and eCommerce segment in the market.

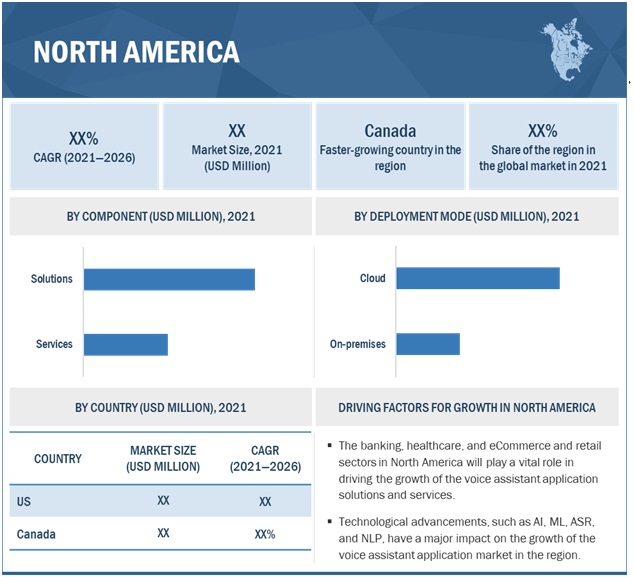

North America to lead the voice assistant application market during the forecast period

North America is estimated to hold the largest share (34.5%) of the market in 2021, with large-scale implementations of voice assistant application solutions by enterprises over the last few years. This region has been extremely responsive toward adopting the latest technological advancements, including mobile devices, cloud computing, and IoT, within enterprises. The US is the major contributor across North America, as continuous innovation and the introduction of new technologies are the key factors driving the growth of the US market. Industries such as BFSI, media and entertainment, healthcare, and retail highly implement the voice assistant application. Virtual assistant solution providers across North America are expected to integrate and deploy voice assistant application solutions and services to enterprises. For example, market leaders such as Amazon, Google, Microsoft, IBM, and Apple have the largest market shares in the voice assistant application market.

Top Companies in Voice Assistant Application Market

The voice assistant application market comprises key solution and service providers, such as [24]7.ai (US), Aivo (Argentina), AWS (US), Apple(US), Avaamo(US), Avaya (US), Baidu (China), Cisco (US), Clinc (US), Creative Virtual (UK), Google (US), Inbenta (US), IBM (US), Haptik (India), Kata.ai (Indonesia), Microsoft (US), Mindsay (US), Oracle (US), Rasa (US), Samsung (South Korea), SAP (Germany), Slang Labs (India), SoundHound (US), Verbio (Spain), Verint Systems (US), and Zaion (France).

Scope of the Report

|

Report Metrics |

Details |

|

Market Size value in 2021 |

USD 2.8 billion |

|

Revenue Forecast for 2026 |

USD 11.2 billion |

|

CAGR Growth Rate |

32.4% |

|

Largest Market |

North America |

|

Market size available for years |

2017-2026 |

|

Forecast period |

2021-2026 |

|

Segments covered |

By component, channel integration, deployment mode, organization size, application area, and region |

|

Market Drivers |

|

|

Market Opportunities |

|

|

Regions covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

[24]7.ai (US), Aivo (Argentina), AWS (US), Apple(US), Avaamo(US), Avaya (US), Baidu (China), Cisco (US), Clinc (US), Creative Virtual (UK), Google (US), Inbenta (US), IBM (US), Haptik (India), Kata.ai (Indonesia), Microsoft (US), Mindsay (US), Oracle (US), Rasa (US), Samsung (South Korea), SAP (Germany), Slang Labs (India), SoundHound (US), Verbio (Spain), Verint Systems (US), and Zaion (France) |

This research report categorizes the voice assistant application market to forecast revenues and analyze trends in each of the following subsegments:

Based on component, the voice assistant application market has the following segments:

-

Solutions

- Standalone

- Integrated

-

Services

- Consulting

- Implementation

- Support and maintenance

Based on deployment mode, the market has the following segments:

- On-premises

- Cloud

Based on organization size, the voice assistant application market has the following segments:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Based on channel integration, the market has the following segments:

- Websites

- Mobile Applications

- Contact Centers

- Smart Speakers

- Social Media

Based on application area, the voice assistant application market has the following segments:

- Smart Retail and eCommerce

- Smart Banking

- Connected Healthcare

- Smart Transportation

- Smart Manufacturing

- Smart Learning

- Others (smart government, telecom, smart hospitality, media and entertainment, smart energy and utilities, and supply chain management)

Based on region, the market has the following segments:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- Israel

- UAE

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In August 2021, Avaya acquired CTIntegrations, a specialized contact center software development and system integration company in Texas, US. This acquisition will provide Avaya with additional digital capabilities for its extensive contact center customer base and enhance the Avaya OneCloud AI-powered experience platform.

- In August 2021, Avaya announced a strategic collaboration with Microsoft to create a powerful set of joint cloud communications solutions to define the future of customer and employee experience. This collaboration will enable the integration of Avaya OneCloud CPaaS and the capabilities of Microsoft Azure Communication Services for global reach, scale, and functionality.

- In July 2021, AWS rolled out a new voice option for Alexa-powered devices and speakers. Devices can now offer a new masculine-sounding voice option that has its name, ‘Ziggy.’

- In April 2021, Samsung launched the Bixby 3.0 voice assistant in India with various India-specific features and the introduction of English (India) language capability. Samsung Galaxy S21, Galaxy A52, and Galaxy A72 are the first smartphones to get the update.

- In August 2020, Avaya rebranded its entire communications portfolio under the Avaya OneCloud name. The Avaya OneCloud portfolio now encapsulates the firm‘s contact center, unified communications and collaboration, and CPaaS offerings.

Frequently Asked Questions (FAQ):

How is voice assistant application market expected to grow in next five years?

According to MarketsandMarkets, the global voice assistant application market size is projected to grow from USD 2.8 billion in 2021 to USD 11.2 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 32.4% during the forecast period.

What region holds the highest market share in the voice assistant application market?

North America has the highest market share in the voice assistant application market due to early adoption of technology and presence of various solutions and services providers.

What are the major factors driving the growth of voice assistant application market?

The major drivers for the voice assistant application market are advancements in voice-based AI technologies, rising adoption of voice-enabled devices, increasing focus on customer engagement, and emergence of low-code platforms for voice-assistant applications.

Who are the major vendors in the voice assistant application market?

The major vendors in the voice assistant application market include AWS, Google, Apple, Microsoft, and IBM. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT: SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 6 VOICE ASSISTANT APPLICATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS AND SERVICES IN THE MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 1- BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF SOLUTIONS IN THE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2 (DEMAND SIDE): SHARE OF THE VOICE ASSISTANT APPLICATION MARKET

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 STUDY ASSUMPTIONS

2.5.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 11 VOICE ASSISTANT APPLICATION MARKET SIZE, 2019–2026

FIGURE 12 LARGEST SEGMENTS IN THE MARKET, 2021

FIGURE 13 MARKET ANALYSIS

FIGURE 14 ASIA PACIFIC TO BE THE BEST MARKET FOR INVESTMENTS DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN THE GLOBAL VOICE ASSISTANT APPLICATION MARKET

FIGURE 15 ADVANCEMENTS IN VOICE-BASED AI TECHNOLOGIES TO DRIVE THE GROWTH OF THE MARKET

4.2 NORTH AMERICAN MARKET, 2021

FIGURE 16 SOLUTIONS SEGMENT AND UNITED STATES TO HOLD LARGE MARKET SHARES DURING THE FORECAST PERIOD

4.3 ASIA PACIFIC MARKET, 2021

FIGURE 17 SOLUTIONS SEGMENT AND CHINA TO HOLD LARGE MARKET SHARES DURING THE FORECAST PERIOD

4.4 MARKET, BY COUNTRY

FIGURE 18 INDIA AND JAPAN TO PROVIDE WHOLESOME OPPORTUNITIES FOR GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW AND MARKET TRENDS (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: VOICE ASSISTANT APPLICATION MARKET

5.2.1 DRIVERS

5.2.1.1 Advancements in voice-based AI technologies

5.2.1.2 Rising adoption of voice-enabled devices

FIGURE 20 CONSUMER USE OF CONVERSATIONAL INTERFACES FOR DIFFERENT ACTIVITIES IN PERCENTAGE, 2019

5.2.1.3 Increasing focus on customer engagement

5.2.1.4 Emergence of low-code platforms for voice-assistant applications

5.2.2 RESTRAINTS

5.2.2.1 Inability to recognize customer intent and respond effectively

5.2.2.2 Dearth of complete accuracy in user’s voice authentication

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for AI-based voice assistant applications across various verticals

FIGURE 21 DEPLOYMENT OF VOICE ASSISTANTS IN VARIOUS SECTORS, 2019

5.2.3.2 Increase in online purchasing

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness about the effect of implementing voice assistant technologies in various application areas

5.3 INDUSTRY TRENDS

5.3.1 CASE STUDY ANALYSIS

TABLE 4 USE CASE 1: HUMANA DEPLOYS IBM WATSON APPLICATIONS TO IMPROVE THE CALL EXPERIENCE FOR HEALTHCARE PROVIDERS

TABLE 5 USE CASE 2: REDAWNING COLLABORATES WITH AWS TO REPLACE ITS CONTACT CENTER SOLUTION WITH AWS SERVICES

TABLE 6 USE CASE 3: MA FRENCH BANK IMPLEMENTS ZAION’S CALLBOTS TO INCREASE CUSTOMER SATISFACTION

TABLE 7 USE CASE 4: PANDORA USES SOUND HOUNDS VOICE-ENABLED USER INTERFACE IN ITS MUSIC APP

TABLE 8 USE CASE 5: UDAAN COLLABORATES WITH SLANGLABS TO CARRY OUT A PILOT PROJECT OF IMPLEMENTING B2B VOICE ORDERING APP FOR ITS MERCHANTS

5.3.2 DISRUPTIVE TECHNOLOGIES

5.3.2.1 Artificial intelligence and machine learning

5.3.2.2 Deep learning

5.3.2.3 Natural language processing

5.3.2.4 Automated speech recognition

5.3.2.5 Smart displays

5.3.3 VALUE CHAIN ANALYSIS

FIGURE 22 VOICE ASSISTANT APPLICATION MARKET: VALUE CHAIN ANALYSIS

5.3.4 ECOSYSTEM

TABLE 9 MARKET ECOSYSTEM

5.3.5 PORTER’S FIVE FORCES MODEL

TABLE 10 IMPACT OF EACH FORCE ON THE MARKET

5.3.5.1 Threat of new entrants

5.3.5.2 Threat of substitutes

5.3.5.3 Bargaining power of buyers

5.3.5.4 Bargaining power of suppliers

5.3.5.5 Competitive rivalry

5.3.6 PATENT ANALYSIS

FIGURE 23 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 11 TOP TWENTY PATENT OWNERS

FIGURE 24 NUMBER OF PATENTS GRANTED IN A YEAR DURING 2012–2021

5.3.7 REGULATORY IMPLICATIONS

5.3.7.1 General Data Protection Regulation

5.3.7.2 Health Insurance Portability and Accountability Act

5.3.7.3 California Consumer Privacy Act

5.3.7.4 Children's Online Privacy Protection Act

5.3.8 AVERAGE SELLING PRICE TREND

TABLE 12 PRICING ANALYSIS

5.4 COVID-19 PANDEMIC-DRIVEN MARKET DYNAMICS AND FACTOR ANALYSIS

5.4.1 OVERVIEW

5.4.2 DRIVERS AND OPPORTUNITIES

5.4.3 RESTRAINTS AND CHALLENGES

5.4.4 CUMULATIVE GROWTH ANALYSIS

TABLE 13 MARKET: CUMULATIVE GROWTH ANALYSIS

6 VOICE ASSISTANT APPLICATION MARKET, BY COMPONENT (Page No. - 78)

6.1 INTRODUCTION

FIGURE 25 SERVICES SEGMENT TO GROW A HIGHER CAGR DURING THE FORECAST PERIOD

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

TABLE 14 MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 15 MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

6.2 SOLUTIONS

FIGURE 26 INTEGRATED SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 16 MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 17 MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 18 SOLUTIONS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 19 SOLUTIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.1 STANDALONE

6.2.1.1 Demand for enhanced customer experience to drive the adoption of standalone voice assistant solution

TABLE 20 STANDALONE: VOICE ASSISTANT APPLICATION MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 STANDALONE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.2 INTEGRATED

6.2.2.1 Low deployment cost to drive the adoption of integrated voice assistant solution

TABLE 22 INTEGRATED: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 INTEGRATED: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 SERVICES

FIGURE 27 IMPLEMENTATION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 24 MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 25 MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 26 SERVICES: VOICE ASSISTANT APPLICATION MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 27 SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.1 CONSULTING

6.3.1.1 Growing demand for implementing voice assistant solutions to boost the consulting services

TABLE 28 CONSULTING: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 CONSULTING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.2 SUPPORT AND MAINTENANCE

6.3.2.1 To overcome the system-related issues effectively, voice assistant application vendors to offer support and

maintenance services in the market

TABLE 30 SUPPORT AND MAINTENANCE: VOICE ASSISTANT APPLICATION MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 31 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.3 IMPLEMENTATION

6.3.3.1 Technicalities involved in implementing voice assistant solutions to boost the implementation services

TABLE 32 IMPLEMENTATION: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 IMPLEMENTATION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 VOICE ASSISTANT APPLICATION MARKET, BY DEPLOYMENT MODE (Page No. - 90)

7.1 INTRODUCTION

FIGURE 28 CLOUD SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 34 MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 35 MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

7.1.1 DEPLOYMENT MODE: MARKET DRIVERS

7.1.2 DEPLOYMENT MODE: COVID-19 IMPACT

7.2 ON-PREMISES

7.2.1 BFSI AND HEALTHCARE INCREASINGLY OPTING FOR ON-PREMISES SOLUTIONS TO ADHERE TO GOVERNMENT REGULATIONS

TABLE 36 ON-PREMISES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 ON-PREMISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 CLOUD

7.3.1 REDUCED OPERATIONAL MAINTENANCE COST TO BOOST THE CLOUD DEPLOYMENT MODE

TABLE 38 CLOUD: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 VOICE ASSISTANT APPLICATION MARKET, BY ORGANIZATION SIZE (Page No. - 95)

8.1 INTRODUCTION

FIGURE 29 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

TABLE 40 MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 41 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

8.2.1 FLEXIBLE PRICING TO DRIVE THE ADOPTION OF VOICE ASSISTANT SOLUTIONS IN SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 42 SMALL AND MEDIUM-SIZED ENTERPRISES: VOICE ASSISTANT APPLICATION MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 LARGE ENTERPRISES

8.3.1 NEED FOR STREAMLINING BUSINESS PROCESSES TO DRIVE THE ADOPTION OF VOICE ASSISTANT SOLUTIONS IN LARGE ENTERPRISES

TABLE 44 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 VOICE ASSISTANT APPLICATION MARKET, BY CHANNEL INTEGRATION (Page No. - 100)

9.1 INTRODUCTION

FIGURE 30 MOBILE APPLICATIONS SEGMENT TO EXPERIENCE THE HIGHEST CAGR DURING THE FORECAST PERIOD

9.1.1 CHANNEL INTEGRATION: MARKET DRIVERS

9.1.2 CHANNEL INTEGRATION: COVID-19 IMPACT

TABLE 46 MARKET SIZE, BY CHANNEL INTEGRATION, 2017–2020 (USD MILLION)

TABLE 47 MARKET SIZE, BY CHANNEL INTEGRATION, 2021–2026 (USD MILLION)

9.2 WEBSITES

9.2.1 INCREASING ADOPTION OF WEB APPLICATIONS BY WORKFORCE TO DRIVE THE GROWTH OF THE MARKET

TABLE 48 WEBSITES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 WEBSITES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 MOBILE APPLICATIONS

9.3.1 MOBILE VOICE ASSISTANT APPLICATIONS TO IMPROVE USER EXPERIENCE AS WELL AS REDUCE TIME TO FIND THE RIGHT CONTENT

TABLE 50 MOBILE APPLICATIONS: VOICE ASSISTANT APPLICATION MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 51 MOBILE APPLICATIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 SOCIAL MEDIA

9.4.1 INCREASE IN THE USAGE OF SOCIAL MEDIA FOR CUSTOMER ENGAGEMENT TO DRIVE THE GROWTH OF THE MARKET

TABLE 52 SOCIAL MEDIA: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 SOCIAL MEDIA: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.5 CONTACT CENTERS

9.5.1 VOICE ASSISTANTS HELP IN HANDLING LARGE CALL VOLUMES AND PROVIDING FASTER CUSTOMER SERVICE

TABLE 54 CONTACT CENTERS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 CONTACT CENTERS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.6 SMART SPEAKERS

9.6.1 INCREASING ADOPTION OF SMART SPEAKERS TO LEAD TO THE GROWTH OF THE VOICE ASSISTANT APPLICATION MARKET

TABLE 56 SMART SPEAKERS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 57 SMART SPEAKERS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 VOICE ASSISTANT APPLICATION MARKET, BY APPLICATION AREA (Page No. - 108)

10.1 INTRODUCTION

FIGURE 31 CONNECTED HEALTHCARE SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 58 MARKET SIZE, BY APPLICATION AREA, 2017–2020 (USD MILLION)

TABLE 59 MARKET SIZE, BY APPLICATION AREA, 2021–2026 (USD MILLION)

10.2 SMART RETAIL AND ECOMMERCE

10.2.1 SMART RETAIL AND ECOMMERCE: MARKET DRIVERS

10.2.2 SMART RETAIL AND ECOMMERCE: COVID-19 IMPACT

TABLE 60 SMART RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 61 SMART RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.3 SMART BANKING

10.3.1 SMART BANKING: VOICE ASSISTANT APPLICATION MARKET DRIVERS

10.3.2 SMART BANKING: COVID-19 IMPACT

TABLE 62 SMART BANKING: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 63 SMART BANKING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.4 CONNECTED HEALTHCARE

10.4.1 CONNECTED HEALTHCARE: MARKET DRIVERS

10.4.2 CONNECTED HEALTHCARE: COVID-19 IMPACT

TABLE 64 CONNECTED HEALTHCARE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 65 CONNECTED HEALTHCARE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.5 SMART TRANSPORTATION

10.5.1 SMART TRANSPORTATION: MARKET DRIVERS

10.5.2 SMART TRANSPORTATION: COVID-19 IMPACT

TABLE 66 SMART TRANSPORTATION: VOICE ASSISTANT APPLICATION MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 67 SMART TRANSPORTATION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.6 SMART MANUFACTURING

10.6.1 SMART MANUFACTURING: MARKET DRIVERS

10.6.2 SMART MANUFACTURING: COVID-19 IMPACT

TABLE 68 SMART MANUFACTURING: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 69 SMART MANUFACTURING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.7 SMART LEARNING

10.7.1 SMART LEARNING: MARKET DRIVERS

10.7.2 SMART LEARNING: COVID-19 IMPACT

TABLE 70 SMART LEARNING: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 71 SMART LEARNING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.8 OTHERS

10.8.1 OTHERS: VOICE ASSISTANT APPLICATION MARKET DRIVERS

10.8.2 OTHERS: COVID-19 IMPACT

TABLE 72 OTHER APPLICATION AREAS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 73 OTHER APPLICATION AREAS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11 VOICE ASSISTANT APPLICATION MARKET, BY REGION (Page No. - 122)

11.1 INTRODUCTION

FIGURE 32 ASIA PACIFIC TO EXHIBIT THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

TABLE 74 MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 75 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: VOICE ASSISTANT APPLICATION MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 IMPACT

11.2.3 NORTH AMERICA: MARKET REGULATORY IMPLICATIONS

FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

TABLE 76 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY CHANNEL INTEGRATION, 2017–2020 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY CHANNEL INTEGRATION, 2021–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: VOICE ASSISTANT APPLICATION MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY APPLICATION AREA, 2017–2020 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY APPLICATION AREA, 2021–2026 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.2.4 UNITED STATES

TABLE 92 UNITED STATES: VOICE ASSISTANT APPLICATION MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 93 UNITED STATES: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 94 UNITED STATES: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 95 UNITED STATES: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 96 UNITED STATES: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 97 UNITED STATES: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 98 UNITED STATES: MARKET SIZE, BY CHANNEL INTEGRATION, 2017–2020 (USD MILLION)

TABLE 99 UNITED STATES: MARKET SIZE, BY CHANNEL INTEGRATION, 2021–2026 (USD MILLION)

TABLE 100 UNITED STATES: VOICE ASSISTANT APPLICATION MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 101 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 102 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 103 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 104 UNITED STATES: MARKET SIZE, BY APPLICATION AREA, 2017–2020 (USD MILLION)

TABLE 105 UNITED STATES: MARKET SIZE, BY APPLICATION AREA, 2021–2026 (USD MILLION)

11.2.5 CANADA

TABLE 106 CANADA: VOICE ASSISTANT APPLICATION MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 107 CANADA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 108 CANADA: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 109 CANADA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 110 CANADA: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 111 CANADA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 112 CANADA: MARKET SIZE, BY CHANNEL INTEGRATION, 2017–2020 (USD MILLION)

TABLE 113 CANADA: MARKET SIZE, BY CHANNEL INTEGRATION, 2021–2026 (USD MILLION)

TABLE 114 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 115 CANADA: VOICE ASSISTANT APPLICATION MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 116 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 117 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 118 CANADA: MARKET SIZE, BY APPLICATION AREA, 2017–2020 (USD MILLION)

TABLE 119 CANADA: MARKET SIZE, BY APPLICATION AREA, 2021–2026 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: VOICEMARKET DRIVERS

11.3.2 EUROPE: COVID-19 IMPACT

11.3.3 EUROPE: VOICE ASSISTANT APPLICATION MARKET REGULATORY IMPLICATIONS

TABLE 120 EUROPE: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 125 EUROPE: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 126 EUROPE: MARKET SIZE, BY CHANNEL INTEGRATION, 2017–2020 (USD MILLION)

TABLE 127 EUROPE: MARKET SIZE, BY CHANNEL INTEGRATION, 2021–2026 (USD MILLION)

TABLE 128 EUROPE: VOICE ASSISTANT APPLICATION MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 129 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 130 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 131 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 132 EUROPE: MARKET SIZE, BY APPLICATION AREA, 2017–2020 (USD MILLION)

TABLE 133 EUROPE: MARKET SIZE, BY APPLICATION AREA, 2021–2026 (USD MILLION)

TABLE 134 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 135 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.3.4 UNITED KINGDOM

TABLE 136 UNITED KINGDOM: VOICE ASSISTANT APPLICATION MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 137 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 138 UNITED KINGDOM: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 139 UNITED KINGDOM: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 140 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 141 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 142 UNITED KINGDOM: MARKET SIZE, BY CHANNEL INTEGRATION, 2017–2020 (USD MILLION)

TABLE 143 UNITED KINGDOM: MARKET SIZE, BY CHANNEL INTEGRATION, 2021–2026 (USD MILLION)

TABLE 144 UNITED KINGDOM: VOICE ASSISTANT APPLICATION MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 145 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 146 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 147 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 148 UNITED KINGDOM: MARKET SIZE, BY APPLICATION AREA, 2017–2020 (USD MILLION)

TABLE 149 UNITED KINGDOM: MARKET SIZE, BY APPLICATION AREA, 2021–2026 (USD MILLION)

11.3.5 GERMANY

11.3.6 FRANCE

11.3.7 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: VOICE ASSISTANT APPLICATION MARKET DRIVERS

11.4.2 ASIA PACIFIC: COVID-19 IMPACT

11.4.3 ASIA PACIFIC: MARKET REGULATORY IMPLICATIONS

FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 150 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET SIZE, BY CHANNEL INTEGRATION, 2017–2020 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET SIZE, BY CHANNEL INTEGRATION, 2021–2026 (USD MILLION)

TABLE 158 ASIA PACIFIC: VOICE ASSISTANT APPLICATION MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 162 ASIA PACIFIC: MARKET SIZE, BY APPLICATION AREA, 2017–2020 (USD MILLION)

TABLE 163 ASIA PACIFIC: MARKET SIZE, BY APPLICATION AREA, 2021–2026 (USD MILLION)

TABLE 164 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 165 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.4.4 CHINA

TABLE 166 CHINA: VOICE ASSISTANT APPLICATION MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 167 CHINA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 168 CHINA: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 169 CHINA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 170 CHINA: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 171 CHINA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 172 CHINA: MARKET SIZE, BY CHANNEL INTEGRATION, 2017–2020 (USD MILLION)

TABLE 173 CHINA: MARKET SIZE, BY CHANNEL INTEGRATION, 2021–2026 (USD MILLION)

TABLE 174 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 175 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 176 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 177 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 178 CHINA: MARKET SIZE, BY APPLICATION AREA, 2017–2020 (USD MILLION)

TABLE 179 CHINA: MARKET SIZE, BY APPLICATION AREA, 2021–2026 (USD MILLION)

11.4.5 JAPAN

11.4.6 INDIA

11.4.7 REST OF ASIA PACIFIC

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: VOICE ASSISTANT APPLICATION MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

11.5.3 MIDDLE EAST AND AFRICA: MARKET REGULATORY IMPLICATIONS

TABLE 180 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 181 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 182 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 183 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 184 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 185 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 186 MIDDLE EAST AND AFRICA: MARKET SIZE, BY CHANNEL INTEGRATION, 2017–2020 (USD

MILLION)

TABLE 187 MIDDLE EAST AND AFRICA: VOICE ASSISTANT APPLICATION MARKET SIZE, BY CHANNEL INTEGRATION, 2021–2026 (USD

MILLION)

TABLE 188 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 189 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 190 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD

MILLION)

TABLE 191 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD

MILLION)

TABLE 192 MIDDLE EAST AND AFRICA: VOICE ASSISTANT APPLICATION MARKET SIZE, BY APPLICATION AREA, 2017–2020 (USD

MILLION)

TABLE 193 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION AREA, 2021–2026 (USD

MILLION)

TABLE 194 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 195 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.5.4 ISRAEL

11.5.5 UNITED ARAB EMIRATES

11.5.6 REST OF MIDDLE EAST AND AFRICA

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: VOICE ASSISTANT APPLICATION MARKET DRIVERS

11.6.2 LATIN AMERICA: COVID-19 IMPACT

11.6.3 LATIN AMERICA: MARKET REGULATORY IMPLICATIONS

TABLE 196 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET SIZE, BY CHANNEL INTEGRATION, 2017–2020 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET SIZE, BY CHANNEL INTEGRATION, 2021–2026 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 205 LATIN AMERICA: VOICE ASSISTANT APPLICATION MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 206 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 207 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET SIZE, BY APPLICATION AREA, 2017–2020 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET SIZE, BY APPLICATION AREA, 2021–2026 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 211 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.6.4 BRAZIL

11.6.5 MEXICO

11.6.6 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 182)

12.1 OVERVIEW

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 35 MARKET EVALUATION FRAMEWORK, 2019–2021

12.3 KEY MARKET DEVELOPMENTS

12.3.1 PRODUCT LAUNCHES

TABLE 212 VOICE ASSISTANT APPLICATION MARKET: PRODUCT LAUNCHES, NOVEMBER 2020– JULY 2021

12.3.2 DEALS

TABLE 213 MARKET: DEALS, FEBRUARY 2020–AUGUST 2021

12.3.3 OTHERS

TABLE 214 MARKET: OTHERS, AUGUST 2020

12.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 215 VOICE ASSISTANT APPLICATION MARKET: DEGREE OF COMPETITION

12.5 HISTORICAL REVENUE ANALYSIS

FIGURE 36 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS, 2018–2020

12.6 COMPANY EVALUATION QUADRANT OVERVIEW

12.7 COMPANY EVALUATION QUADRANT METHODOLOGY AND DEFINITIONS

TABLE 216 PRODUCT FOOTPRINT WEIGHTAGE

12.7.1 STAR

12.7.2 EMERGING LEADERS

12.7.3 PERVASIVE

12.7.4 PARTICIPANT

FIGURE 37 VOICE ASSISTANT APPLICATION MARKET (GLOBAL), COMPANY EVALUATION QUADRANT, 2020

12.8 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 217 COMPANY PRODUCT FOOTPRINT

TABLE 218 COMPANY CHANNEL INTEGRATION FOOTPRINT

TABLE 219 COMPANY APPLICATION AREA FOOTPRINT

TABLE 220 COMPANY REGION FOOTPRINT

12.9 COMPANY MARKET RANKING ANALYSIS

FIGURE 38 RANKING OF KEY PLAYERS IN THE VOICE ASSISTANT APPLICATION MARKET, 2021

12.10 STARTUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

FIGURE 39 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

12.10.1 PROGRESSIVE COMPANIES

12.10.2 RESPONSIVE COMPANIES

12.10.3 DYNAMIC COMPANIES

12.10.4 STARTING BLOCKS

FIGURE 40 VOICE ASSISTANT APPLICATION MARKET (GLOBAL): STARTUP/SME EVALUATION MATRIX, 2020

13 COMPANY PROFILES (Page No. - 197)

13.1 MAJOR PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

13.1.1 APPLE

TABLE 221 APPLE: BUSINESS OVERVIEW

FIGURE 41 APPLE: COMPANY SNAPSHOT

TABLE 222 APPLE: PRODUCTS OFFERED

TABLE 223 APPLE: PRODUCT LAUNCHES

TABLE 224 APPLE: DEALS

13.1.2 AWS

TABLE 225 AWS: BUSINESS OVERVIEW

FIGURE 42 AWS: COMPANY SNAPSHOT

TABLE 226 AWS: PRODUCTS OFFERED

TABLE 227 AWS: PRODUCT LAUNCHES

13.1.3 GOOGLE

TABLE 228 GOOGLE: BUSINESS OVERVIEW

FIGURE 43 GOOGLE: COMPANY SNAPSHOT

TABLE 229 GOOGLE: PRODUCTS OFFERED

TABLE 230 GOOGLE: PRODUCT LAUNCHES

TABLE 231 GOOGLE: DEALS

13.1.4 MICROSOFT

TABLE 232 MICROSOFT: BUSINESS OVERVIEW

FIGURE 44 MICROSOFT: COMPANY SNAPSHOT

TABLE 233 MICROSOFT: PRODUCTS OFFERED

TABLE 234 MICROSOFT: DEALS

13.1.5 IBM

TABLE 235 IBM: BUSINESS OVERVIEW

FIGURE 45 IBM: COMPANY SNAPSHOT

TABLE 236 IBM: PRODUCTS OFFERED

TABLE 237 IBM: PRODUCT LAUNCHES

TABLE 238 IBM: DEALS

13.1.6 CISCO

TABLE 239 CISCO: BUSINESS OVERVIEW

FIGURE 46 CISCO: COMPANY SNAPSHOT

TABLE 240 CISCO: PRODUCTS OFFERED

TABLE 241 CISCO: PRODUCT LAUNCHES

TABLE 242 CISCO: DEALS

13.1.7 SAMSUNG

TABLE 243 SAMSUNG: BUSINESS OVERVIEW

FIGURE 47 SAMSUNG: COMPANY SNAPSHOT

TABLE 244 SAMSUNG: PRODUCTS OFFERED

TABLE 245 SAMSUNG: PRODUCT LAUNCHES

TABLE 246 SAMSUNG: DEALS

13.1.8 ORACLE

TABLE 247 ORACLE: BUSINESS OVERVIEW

FIGURE 48 ORACLE: COMPANY SNAPSHOT

TABLE 248 ORACLE: PRODUCTS OFFERED

TABLE 249 ORACLE: PRODUCT LAUNCHES

13.1.9 SAP

TABLE 250 SAP: BUSINESS OVERVIEW

FIGURE 49 SAP: COMPANY SNAPSHOT

TABLE 251 SAP: PRODUCTS OFFERED

13.1.10 AVAYA

TABLE 252 AVAYA: BUSINESS OVERVIEW

FIGURE 50 AVAYA: COMPANY SNAPSHOT

TABLE 253 AVAYA: PRODUCTS OFFERED

TABLE 254 AVAYA: DEALS

TABLE 255 AVAYA: OTHERS

13.1.11 BAIDU

13.1.12 VERINT SYSTEMS

13.1.13 [24]7.AI

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13.2 START-UP/SME PLAYERS

13.2.1 HAPTIK

13.2.2 AIVO

13.2.3 SOUNDHOUND

13.2.4 CREATIVE VIRTUAL

13.2.5 ZAION

13.2.6 MINDSAY

13.2.7 VERBIO

13.2.8 SLANG LABS

13.2.9 KATA.AI

13.2.10 CLINC

13.2.11 RASA

13.2.12 INBENTA

13.2.13 AVAAMO

14 APPENDIX (Page No. - 245)

14.1 ADJACENT/RELATED MARKETS

14.1.1 LIMITATIONS

14.1.2 CHATBOT MARKET – GLOBAL FORECAST TO 2026

14.1.2.1 Market Definition

14.1.2.2 Chatbot Market, by Component

TABLE 256 CHATBOT MARKET SIZE BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 257 CHATBOT MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

14.1.2.3 Chatbot Market, by Type

TABLE 258 CHATBOT MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 259 CHATBOT MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

14.1.2.4 Chatbot Market, by Deployment Mode

TABLE 260 CHATBOT MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 261 CHATBOT MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

14.1.2.5 Chatbot Market, by Business Function

TABLE 262 CHATBOT MARKET SIZE, BY BUSINESS FUNCTION, 2015–2019 (USD MILLION)

TABLE 263 CHATBOT MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

14.1.3 CONVERSATIONAL AI MARKET– GLOBAL FORECAST TO 2025

14.1.3.1 Market definition

14.1.3.2 Conversational AI market, by component

TABLE 264 CONVERSATIONAL AI MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 265 CONVERSATIONAL AI MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

14.1.3.3 Conversational AI market, by type

TABLE 266 CONVERSATIONAL AI MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 267 CONVERSATIONAL AI MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

14.1.3.4 Conversational AI market, by technology

TABLE 268 CONVERSATIONAL AI MARKET SIZE, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 269 CONVERSATIONAL AI MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

14.1.3.5 Conversational AI market, by application

TABLE 270 CONVERSATIONAL AI MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 271 CONVERSATIONAL AI MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

14.1.4 VOICE CLONING MARKET – GLOBAL FORECAST TO 2023

14.1.4.1 Market definition

14.1.4.2 Voice cloning market, by component

TABLE 272 VOICE CLONING MARKET SIZE, BY COMPONENT, 2016–2023 (USD MILLION)

14.1.4.3 Voice cloning market, by application

TABLE 273 VOICE CLONING MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

14.1.4.4 Voice cloning market, by deployment mode

TABLE 274 VOICE CLONING MARKET SIZE, BY DEPLOYMENT MODE, 2016–2023 (USD MILLION)

14.1.4.5 Voice cloning market, by vertical

TABLE 275 VOICE CLONING MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

14.1.4.6 Voice cloning market, by region

TABLE 276 VOICE CLONING MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

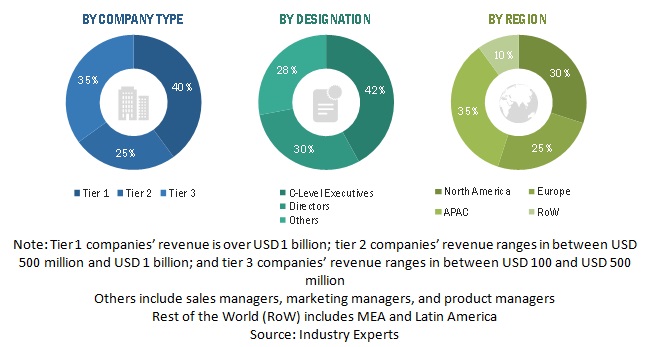

The study involved four major activities to estimate the current market size for the voice assistant application market. An exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the voice assistant application market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg Business Week, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies, whitepapers, and articles by recognized authors, gold standard, and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The voice assistant application market comprises several stakeholders, such as voice assistant application operators, voice assistant application service providers, venture capitalists, government organizations, regulatory authorities, policymakers and financial organizations, consulting firms, research organizations, academic institutions, resellers and distributors, and training providers. The demand side of the market consists of all the firms operating in several industry verticals. The supply side includes voice assistant application providers, offering voice assistant application solutions. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top Down Approach

In the top-down approach, an exhaustive list of all the vendors who offer solutions and services in the voice assistant application market was prepared. The revenue contribution for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on their offerings by solution and service. The aggregate of all companies’ revenue was extrapolated to reach the overall market size. Further, each sub segment was studied and analyzed for its global market size and regional penetration.

Bottom Up Approach

The bottom-up procedure was employed to arrive at the overall market size of the voice assistant application market from the revenues of the key players (companies) and their market shares. The calculation was done based on estimations and by verifying their revenues through extensive primary interviews. Calculations based on the revenues of the key companies identified in the market led to the overall market size. The overall market size was used in the top-down procedure to estimate the size of the other individual segments (component, channel integration, deployment mode, organization size, application area, and region) via percentage splits of market segments from the secondary and primary research. The bottom-up procedure was also implemented for the data extracted from the secondary research to validate the market segment revenues obtained.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To describe and forecast the size of the voice assistant application market by component, channel integration, deployment mode, organization size, application area, and region

- To describe and forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA)

- To provide detailed information related to drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze the impact of COVID-19 on the market

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall voice assistant application market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments

- To profile key market players, including top vendors and startups; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and offer a detailed competitive landscape of the market

- To analyze competitive developments, such as Mergers and Acquisitions (M&A); new product launches and product enhancements; agreements, partnerships, and collaborations; expansions; and Research and Development (R&D) activities in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the German voice assistant application market, by offering

- Further breakdown of the India market, by offering

- Further breakdown of Japan market, by offering

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Voice Assistant Application Market

Indepth understanding of Voice UI / voice assistant platforms based on NLP & IVR for Banking, Healthcare domains.