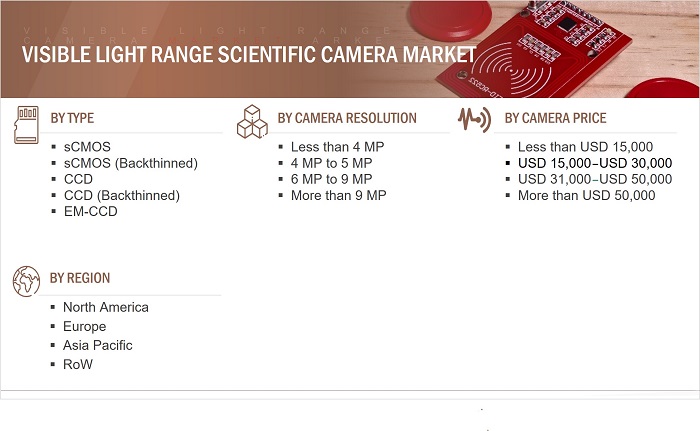

Visible Light Range Scientific Camera Market Size, Share, Statistics and Industry Growth Analysis Report by Type (sCMOS, sCMOS (Backthinned), CCD, CCD (Backthinned), EMCCD), Camera Resolution (Less than 4 MP, 4 MP to 5 MP, 6 MP to 9 MP, More than 9 MP), Camera Price and Region – Global Growth Driver and Industry Forecast to 2028

Updated on : Sep 12, 2024

Visible Light Range Scientific Camera Market Size, Share & Growth

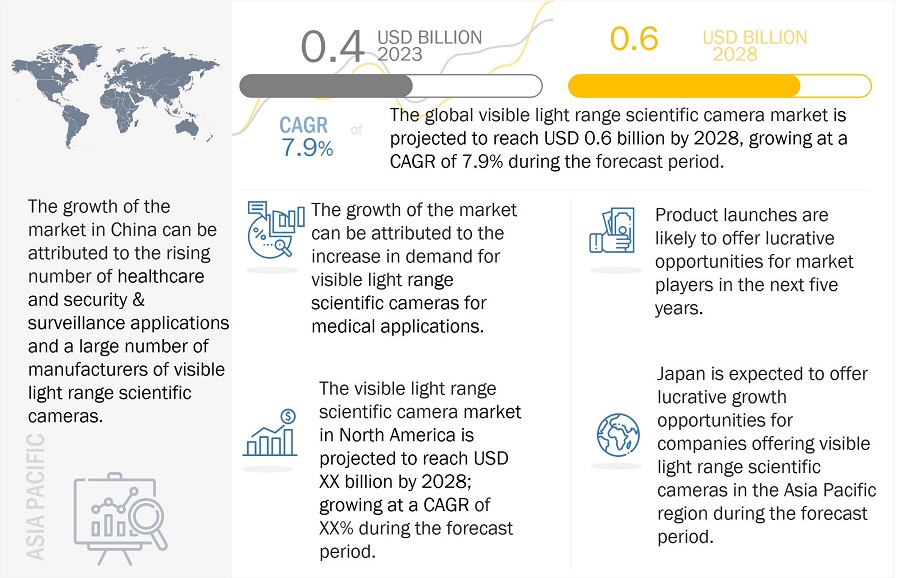

The visible light range scientific camera market size is projected to reach USD 0.6 billion by 2028 from USD 0.4 billion in 2023; it is expected to grow at a CAGR of 7.9% from 2023 to 2028.

A scientific camera is essential for any imaging system. These cameras are designed to quantitatively measure how many photons hit the camera sensor and in which location. The visible light range scientific camera market, by type, has been segmented into sCMOS, sCMOS (Backthinned), CCD, CCD (Backthinned), and EM-CCD cameras. The different cameras and their various architectures have inherent strengths and weaknesses and these are covered in depth in this chapter. The spectral response of a camera refers to the detected signal response as a function of the wavelength of light. This parameter is often expressed in terms of the quantum efficiency (hereinafter in this document referred to as QE), a measure of the detector's ability to produce an electronic charge as a percentage of the total number of incident photons that are detected. The sensitivity of a camera is the minimum light signal that can be detected and by convention, we equate that to the light level falling on the camera that produces a signal just equal to the camera's noise. Hence, the noise of a camera sets an ultimate limit on the camera sensitivity.

The report covers the demand and supply sides of the visible light range scientific camera market. The supply-side market segmentation includes type, camera resolution, and camera price. The demand-side market segmentation includes region.

Visible Light Range Scientific Camera Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Visible Light Range Scientific Camera Market Analysis:

The analysis of the visible light range scientific camera market indicates robust growth, driven by technological advancements and expanding application areas. Market reports highlight the increasing demand for high-performance imaging solutions in scientific research, healthcare, and industrial applications. The market is characterized by continuous innovation, with companies focusing on enhancing the sensitivity, resolution, and speed of their cameras to meet the evolving needs of end-users. Furthermore, strategic partnerships and collaborations are playing a vital role in market expansion, as they enable the sharing of expertise and resources to develop cutting-edge imaging technologies. The analysis also points to a growing global market, with significant contributions from North America, Europe, and Asia-Pacific regions, where research and development activities are particularly intensive.

Visible Light Range Scientific Camera Market Share:

The visible light range scientific camera market is seeing a significant distribution of market share across various segments, driven by increasing demand in diverse applications such as microscopy, spectroscopy, and astronomy. Leading companies in the market are capturing substantial shares by continually innovating and offering high-performance cameras with superior sensitivity and resolution. The academic and research sectors represent a major portion of the market, as these cameras are essential tools in scientific exploration and analysis. Additionally, the healthcare industry, particularly in medical imaging and diagnostics, is contributing to the market's expansion, further solidifying the position of key players.

Visible Light Range Scientific Camera Market Trends:

Several trends are currently shaping the visible light range scientific camera market. One prominent trend is the growing adoption of advanced imaging technologies, such as CMOS and CCD sensors, which provide higher resolution and faster processing capabilities. There is also a significant shift towards the miniaturization of scientific cameras, making them more versatile and easier to integrate into various research and industrial applications. Another notable trend is the increasing use of these cameras in emerging fields such as quantum computing and nanotechnology, where precise and detailed imaging is crucial. Moreover, there is a rising emphasis on developing user-friendly interfaces and software to enhance the accessibility and functionality of these cameras for a broader range of users.

Visible Light Range Scientific Camera Market Trends & Dynamics:

Driver: Increasing number of surgical procedures

Many surgical procedures require medical cameras, and recently, the volume of surgical procedures has considerably increased due to the rapidly expanding geriatric population worldwide and the growing prevalence of chronic diseases, leading to the increasing demand for advanced medical equipment. Many countries across the world are facing the challenge of significantly high senior populations. According to the United Nations (UN), in 2019, globally, there were 703 million persons aged 65 years or over. The senior population is estimated to double ()1.5 billion) by 2050. Non-invasive surgeries (mainly using highly advanced camera technology to carry out endoscopic and microscopic surgeries) are preferred for older people due to lesser complications and faster recovery than conventional surgeries.

Microscopy cameras are widely used in many surgical procedures, from spinal and neuro-surgery to cataract and dental procedures. Over time, the evolution of surgical microscopes from a traditional magnifying device to an information and communication center has adequately helped examine the condition of a patient while reducing morbidity rates. Therefore, medical cameras are widely used in endoscopy, surgical microscopy, dermatology, ophthalmology, and dentistry. With a growing number of surgical procedures in these fields, the demand for medical cameras is also expected to increase.

Restraint: Heavy maintenance and high costs of cutting-edge camera technologies

3D image sensors are susceptible to dust, microparticles, impurities, and shocks. A slight disturbance can cause a significant decrease in the quality of an image. Hence, these 3D sensors require special care. Technologies such as 3D depth sensing, 4K pixel, and ultra-HD cameras are costlier than the CCD and CMOS image sensor camera technologies. This limits the deployment of cameras to select places across a production/assembly line. The cost of these cameras has reduced significantly over the last few years; however, it is not low enough to attract small-scale companies.

For the consumer electronics segment, 3D image sensors used in the 3D depth sensing technology must be protected against dust and shocks by solid compact packaging. Thus, manufacturers are compelled to spend more on packaging the device, which incurs additional costs. 3D image sensing technologies, such as medical 3D imaging sensors, have a limited life. The cost incurred due to frequent maintenance or replacement may discourage potential buyers.

Furthermore, images captured using low-megapixel cameras have several drawbacks. The image quality of such pictures gets reduced while zooming in, cropping, or taking prints. Hence, high-megapixel cameras are preferred. Endoscopic cameras used in clinics (in India) cost ~USD 1,300, whereas endoscopic camera prices in hospitals vary from USD 500 to USD 9,000. Intraoral cameras range from USD 50 to USD 5,000. The prices vary depending on megapixel sizes, sensor types, and other features. To increase the number of pixels, manufacturers can either increase the chip size or shrink the pixel pitch. However, larger chip sizes increase the cost of manufacturing. The only way to produce a high-resolution image at a lower cost is to shrink the pixel pitch, which is a complex process. Thus, if the manufacturing cost increases, then the price of the medical camera also increases. Along these lines, the high costs associated with medical cameras could be an obstacle to overall market growth.

Opportunity: Strong focus on developing scientific cameras with improved storage capacity and high-throughput sensors

There is an increasing focus on developing cutting-edge image storage solutions and sensors employed in scientific cameras. The frame rate of the high-speed camera requires more storage capacity; moreover, the panoramic technologies used in video surveillance scientific cameras demand a higher data storing capacity. With further developments in the storage technologies in the scientific camera market, such cameras will be more suitable for video surveillance and astronomy applications.

Digital scientific camera technology is changing all the time. However, some recent developments indicate that the companies are entering into a period of exciting innovation, where advancements are apparent in the revolution occurring in autofocus technology. These developments focus on better storage capacity and the use of the throughput capabilities of the sensors in these scientific cameras.

Challenge: Availability of refurbished scientific medical camera products at lower costs

The availability of refurbished scientific medical camera products is a significant challenge to the growth of the market. Many end users (mainly small and medium-sized hospitals, ASCs (ambulatory surgery centers), and specialty clinics) look for cost-effectiveness and opt for refurbished systems, particularly in price-sensitive markets in developing countries. A few companies offering refurbished scientific medical cameras include Golden Nimbus International (India), Medicure Surgical Equipment (India), and Bimedis LLC (US). Considering these factors, the demand for refurbished scientific medical cameras is expected to increase in the coming years. These systems offer the same functionalities as new equipment but at lower costs. Therefore, introducing refurbished products in the market could hamper the growth of a company offering new scientific medical cameras, challenging overall market growth.

By Type Segment Analysis:

sCMOS type segment will continue to hold largest visible light range scientific camera market share during the forecast period

In recent years, there has also been an observable shift in the preference for sCMOS sensors over CCD sensors. sCMOS cameras have an updated technology than CCD cameras, which is increasing their popularity and acceptance in the market. sCMOS technology overcomes the trade-offs that are associated with conventional CMOS cameras. Unlike previous generations of CMOS and CCD-based sensors, sCMOS offers rapid frame rates, extremely low noise, large field of view. wide dynamic range, and high resolution. sCMOS has dual amplifiers and dual analog-to-digital converter readout, which leads to a high dynamic range. A low-gain channel and a high-gain channel are read simultaneously, and the information is combined. This produces an exceptional dynamic range. In 2009, scientific CMOS (sCMOS) technology was launched, with sCMOS cameras being commercially available from 2010 to 2011. sCMOS cameras can provide low noise, high speed, and a large field of view, making sCMOS cameras ideal for a wide range of applications, from astronomy to microscopy.

Visible Light Range Scientific Camera Market by Region

To know about the assumptions considered for the study, download the pdf brochure

By Regional Analysis Growth:

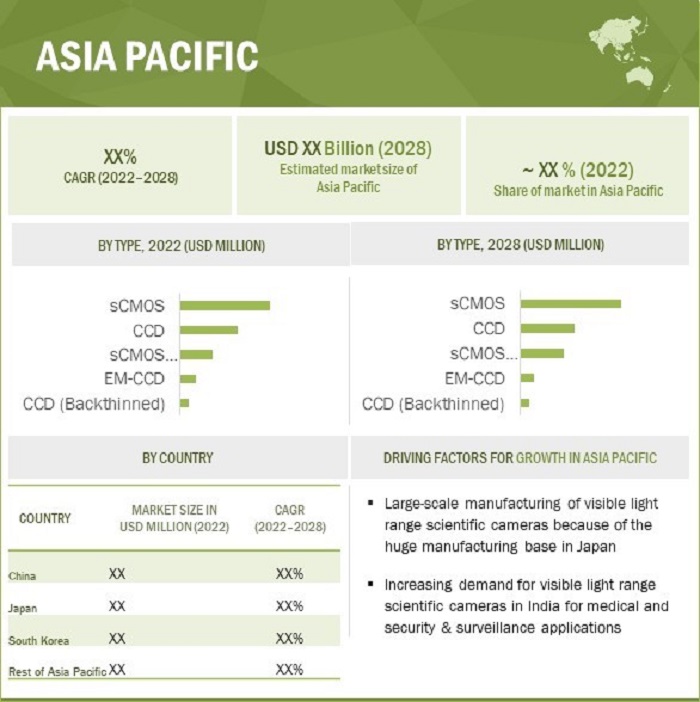

The visible light range scientific camera market in APAC is expected to grow at highest CAGR during the forecast period (2023-2028)

China is expected to offer significant opportunities for visible light range scientific camera manufacturers during the forecast period. The high growth in these markets can be attributed to the high demand for advanced technologies in this region. With developed economies reaching saturation, manufacturers, and suppliers are expected to focus on opportunities in the emerging Chinese market, supporting market growth in the coming years. Healthcare authorities in China are encouraging the private sector to build healthcare facilities by relaxing various policy controls. Improvements in the country’s healthcare infrastructure will serve to attract global medical device companies, including companies providing visible light range scientific cameras. Furthermore, technological advancements in the country are also supporting the growth of the visible light range scientific camera industry.

Top Visible Light Range Scientific Camera Companies - Key Players

The visible light range scientific camera companies operating in the market are Hamamatsu Photonics (Japan), Teledyne Technologies (US), Thorlabs, Inc. (US), XIMEA GmbH (Germany), Photonic Science (UK), Excelitas PCO GmbH (PCO-TECH Inc.) (Germany), Oxford Instruments (Andor Technology) (UK), Atik Cameras (UK), Diffraction Limited (Canada), and Spectral Instruments, Inc. (US).

Impact of Recession

The demand for visible light range scientific cameras is expected to experience a low negative impact of the recession. Medical device companies are expected to witness a mixed impact of the recession. The diagnostic imaging companies are expected to witness a slowdown led by tighter CAPEX by hospitals, which might refrain them from buying or investing and procuring equipment such as surgical robots, MRI/CT machines, etc. These will decrease the demand for visible light range scientific cameras as the major market is in the medical sector. The largest impact on this market could be from the demand side, as end-use industries face the pressure of rising costs of raw materials. The various end-use industries such as medicine, astronomy, research, and security & surveillance have witnessed reduced investments in their upcoming projects due to inflation. they are increasingly focusing on organic and inorganic growth strategies after and during the pandemic, but this inflationary period has slowed down the trend.

To counter the rising inflation, central banks across the world have increased their lending rates. But these counter-inflation measures could decrease the global GDP growth by 0.4%—settling down to 0.5% in 2023 (Source: World Bank)—which would meet the technical definition of a recession. This would impact manufacturers across the world, and thus affects visible light range scientific camera providers as well.

Visible Light Range Scientific Camera Market Report Scope

The report covers the demand- and supply-side segmentation of the visible light range scientific camera market. The supply-side market segmentation includes the type, camera resolution and camera price, whereas the demand-side market segmentation includes region.

The following are the years considered:

Scope of the Report

|

Report Metric |

Details |

| Estimated Market Size | USD 0.4 Billion |

| Projected Market Size | USD 0.6 Billion |

| Growth Rate | 7.9% |

|

Market Size Available for Years |

2018–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Type, Camera Resolution, Camera Price, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East, Africa, and South America |

|

Key Companies Covered |

Hamamatsu Photonics (Japan), Teledyne Technologies (US), Thorlabs, Inc. (US), XIMEA GmbH (Germany), Photonic Science (UK), Excelitas PCO GmbH (PCO-TECH Inc.) (Germany), Oxford Instruments (Andor Technology) (UK), Atik Cameras (UK), Diffraction Limited (Canada), and Spectral Instruments, Inc. (US). |

Visible Light Range Scientific Camera Market Highlights

In this report, the visible light range scientific camera market has been segmented into the following categories:

|

Aspect |

Details |

|

By Type:

|

|

|

By Camera Resolution: |

|

|

By Camera Price: |

|

|

By Region: |

|

Recent Developments

- In June 2021, Photonic Science announced the launch of HAWKeye sCMOS camera 4123. It features a state-of-the-art BAE Fairchild sCMOS 4123 sensor with 0.5 electron readout noise, low dark current, and a defective pixel count.

- In May 2021, Hamamatsu Photonics introduced a photon-number-resolving scientific camera with incredibly low noise and 9.4 megapixels. It reduces the photoelectric noise to a level below the signals generated by photons (particles of light), which are the minimum unit of light. This makes the ORCA-Quest the first camera in the world to achieve 2D photon-number-resolving measurement, which means that it accurately measures the number of photons to create an image

- In March 2021, Atik Cameras announced their collaboration with leading global OEMs of real-time polymerase chain reaction (PCR) DNA amplifiers, securing multiple new contracts to supply high-performing cameras for reliable COVID-19 testing. The commercially competitive VS series of scientific CCD cameras offer superior sensitivity and image quality and are now proven across thousands of PCR installations.

- In May 2020, Hamamatsu Photonics announced the next evolution in the market-leading ORCA brand of sCMOS cameras—the ORCA-Fusion BT. This camera takes the strict specifications of the ORCA-Fusion—ultra-low readout noise, CCD-like uniformity, fast frame rates—and combines that with back-thin enabled, high quantum efficiency to achieve the pinnacle of sCMOS performance.

Frequently Asked Questions (FAQ):

Which are the major companies in the visible light range scientific camera market? What are their major strategies to strengthen their market presence?

The major companies in visible light range scientific camera market are – Hamamatsu Photonics (Japan), Teledyne Technologies (US), Thorlabs, Inc. (US), XIMEA GmbH (Germany), Photonic Science (UK), Excelitas PCO GmbH (PCO-TECH Inc.) (Germany), Oxford Instruments (Andor Technology) (UK), Atik Cameras (UK), Diffraction Limited (Canada), and Spectral Instruments, Inc. (US). The major strategies adopted by these players are product launches, collaborations, and acquisitions.

Which is the potential market for visible light range scientific camera in terms of region?

North America is the largest market for visible light range scientific camera. North America, being one of the fastest-growing markets for technology solutions, provides attractive opportunities for players offering visible light range scientific camera; as a result, many companies are expanding their footprint in this region. US, Canada and Mexico are among the key hubs in North America that occupy the maximum share of the market of the region.

Which camera type holds the potential visible light range scientific camera market?

sCMOS camera type holds the largest market share in 2022 and is expected to hold the same during the forecast period.

Which range of resolution segment is expected to grow in the visible light range scientific camera market?

6 MP to 9 MP resolution range segment is expected to grow at the highest CAGR. The more megapixels, the higher resolution an image has. The larger an image is blown up, the more megapixels are required to maintain the visual fidelity of the image. Therefore, cameras with a resolution between 6 MP and 9 MP are of higher resolution and provide HD-quality images. Although, this range of megapixel cameras provides more noise than low-resolution cameras due to a higher number of pixels.

What is the major driver for visible light range scientific camera market?

Rising need for security and surveillance cameras and technological advancements in medical cameras are the two major drivers of this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing number of surgical procedures- Technological advancements in medical cameras- Rising need for security and surveillance cameras- High adoption of endoscopic procedures- High investments by US government in deployment of surveillance and scientific security camerasRESTRAINTS- Heavy maintenance and high cost of cutting-edge camera technologies- Requirement for higher bandwidth for 4K technologyOPPORTUNITIES- Strong focus on developing scientific cameras with improved storage capacity and high-throughput sensors- Growing medical camera market in Asia Pacific- Requirement for image fusion to ensure enhanced image qualityCHALLENGES- Availability of refurbished scientific medical camera products at lower costs

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM MAPPING

-

5.5 PRICE TREND ANALYSISCOST ANALYSIS

-

5.6 TECHNOLOGY ANALYSISVISIBLE LIGHT RANGE SCIENTIFIC CAMERA TECHNOLOGY COMPARISON

-

5.7 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.8 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.9 CASE STUDY ANALYSISVISIBLE LIGHT RANGE SCIENTIFIC CAMERA FOR X-RAY APPLICATIONSVISIBLE LIGHT RANGE SCIENTIFIC CAMERA FOR MEDICAL RESEARCH APPLICATIONSLUMENERA PROVIDES USB 2.0 CAMERAS FOR DISEASE DIAGNOSES

- 5.10 TRADE ANALYSIS

-

5.11 PATENT ANALYSISPATENTS REGISTEREDPUBLICATION TRENDJURISDICTION ANALYSISTOP PATENT OWNERS

-

5.12 TARIFF AND REGULATOR LANDSCAPETARIFFREGULATORY ANALYSIS

- 6.1 INTRODUCTION

-

6.2 SCMOSSCMOS TO HOLD LARGEST SHARE OF VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET IN 2028

-

6.3 SCMOS (BACK-THINNED)SCMOS (BACK-THINNED) TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

-

6.4 CCDCCD CAMERAS MOST COMMONLY USED SCIENTIFIC CAMERAS

-

6.5 CCD (BACK-THINNED)CCD (BACK-THINNED) CAMERA TYPE USES NOVEL ARRANGEMENT OF IMAGING ELEMENTS

-

6.6 EMCCDEMCCD CAMERAS TO EXPERIENCE LOWEST GROWTH RATE DURING FORECAST PERIOD

- 7.1 INTRODUCTION

-

7.2 LESS THAN 4 MPLESS THAN 4 MP SEGMENT HELD LARGEST MARKET SHARE IN 2022

-

7.3 4 MP TO 5 MPMARKET FOR 4 MP TO 5 MP SEGMENT TO GROW SIGNIFICANTLY

-

7.4 6 MP TO 9 MP6 MP TO 9 MP SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

-

7.5 MORE THAN 9 MPCAMERAS WITH HIGHEST MEGAPIXELS HAVE BETTER IMAGE QUALITY

- 8.1 INTRODUCTION

-

8.2 LESS THAN USD 15,000CAMERAS IN LESS THAN USD 15,000 SEGMENT TO HOLD LARGEST MARKET SHARE DUE TO COST EFFICIENCY

-

8.3 USD 15,000 TO USD 30,000CAMERAS IN USD 15,000 TO USD 30,000 SEGMENT TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

-

8.4 USD 31,000 TO USD 50,000CAMERAS IN USD 31,000 TO USD 50,000 SEGMENT TO EXPERIENCE SLOW GROWTH

-

8.5 MORE THAN USD 50,000CAMERAS IN MORE THAN USD 50,000 SEGMENT TO HOLD ONLY 5% OF TOTAL MARKET DUE TO HIGH PRICING

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- US to continue to dominate visible light range scientific camera market in North America during forecast periodCANADA- Rising prevalence of diseases to drive growth opportunities for visible light range scientific camera players in coming yearsMEXICO- Market in Mexico currently at nascent stage

-

9.3 EUROPEGERMANY- Market in Germany to grow at highest CAGR during forecast periodUK- UK to continue to hold largest market share during forecast periodFRANCE- Favorable government initiatives to support market growth in FranceREST OF EUROPE

-

9.4 CHINACHINA TO BE FASTEST-GROWING COUNTRY IN GLOBAL MARKET

-

9.5 ASIA PACIFICJAPAN- Japan to dominate market in Asia Pacific during forecast periodSOUTH KOREA- Market in South Korea to grow significantly in coming yearsREST OF ASIA PACIFIC

-

9.6 ROWSOUTH AMERICA- Brazil to continue to be largest healthcare market in South AmericaMIDDLE EAST & AFRICA- Market in Middle East & Africa currently at nascent stage

- 10.1 OVERVIEW

-

10.2 MARKET EVALUATION FRAMEWORKORGANIC/INORGANIC GROWTH STRATEGIESPRODUCT PORTFOLIOREGIONAL PRESENCEMANUFACTURING AND DISTRIBUTION FOOTPRINT

- 10.3 MARKET SHARE AND RANKING ANALYSIS

- 10.4 FIVE-YEAR COMPANY REVENUE ANALYSIS

-

10.5 COMPANY EVALUATION QUADRANT, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.6 COMPETITIVE BENCHMARKING

-

10.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

- 11.1 INTRODUCTION

-

11.2 KEY PLAYERSHAMAMATSU PHOTONICS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTELEDYNE TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHORLABS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewXIMEA GMBH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPHOTONIC SCIENCE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEXCELITAS PCO GMBH (PCO-TECH INC.)- Business overview- Products/Solutions/Services offered- Recent developmentsOXFORD INSTRUMENTS (ANDOR TECHNOLOGY)- Business overview- Products/Solutions/Services offered- Recent developmentsATIK CAMERAS- Business overview- Products/Solutions/Services offered- Recent developmentsDIFFRACTION LIMITED- Business overview- Products/Solutions/Services offered- Recent developmentsSPECTRAL INSTRUMENTS INC.- Business overview- Products/Solutions/Services offered- Recent developments

- 12.1 INSIGHTS OF INDUSTRY EXPERTS

- 12.2 QUESTIONNAIRE FOR VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 RISK FACTOR ANALYSIS

- TABLE 2 KEY COMPANIES AND THEIR ROLE IN VISIBLE LIGHT RANGE SCIENTIFIC CAMERA ECOSYSTEM

- TABLE 3 COMPARISON OF VISIBLE LIGHT RANGE SCIENTIFIC CAMERAS BASED ON TYPE

- TABLE 4 IMPACT OF PORTER'S FIVE FORCES ON VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR THREE APPLICATIONS (%)

- TABLE 6 KEY BUYING CRITERIA FOR THREE APPLICATIONS

- TABLE 7 X-RAY BEAM CHARACTERIZATION

- TABLE 8 WHOLE HEART LIGHT SHEET

- TABLE 9 SCIENTIFIC CAMERAS FOR DIAGNOSES

- TABLE 10 EXPORT SCENARIO FOR HS CODE 900630-COMPLIANT PRODUCTS, BY COUNTRY, 2017–2021 (USD THOUSAND)

- TABLE 11 IMPORT SCENARIO FOR HS CODE 900630-COMPLIANT PRODUCTS, BY COUNTRY, 2017–2021 (USD THOUSAND)

- TABLE 12 PATENTS FILED

- TABLE 13 TOP 20 PATENT OWNERS IN LAST 10 YEARS

- TABLE 14 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 15 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 16 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2019–2022 (THOUSAND UNITS)

- TABLE 17 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 18 SCMOS: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY CAMERA RESOLUTION, 2019–2022 (USD MILLION)

- TABLE 19 SCMOS: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY CAMERA RESOLUTION, 2023–2028 (USD MILLION)

- TABLE 20 SCMOS: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 21 SCMOS: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 NORTH AMERICA: SCMOS CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 23 NORTH AMERICA: SCMOS CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 24 EUROPE: SCMOS CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 25 EUROPE: SCMOS CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 26 ASIA PACIFIC: SCMOS CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 27 ASIA PACIFIC: SCMOS CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 28 ROW: SCMOS CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 ROW: SCMOS CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 SCMOS (BACK-THINNED): VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY CAMERA RESOLUTION, 2019–2022 (USD MILLION)

- TABLE 31 SCMOS (BACK-THINNED): VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY CAMERA RESOLUTION, 2023–2028 (USD MILLION)

- TABLE 32 SCMOS (BACK-THINNED): VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 33 SCMOS (BACK-THINNED): VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: SCMOS (BACK-THINNED) CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 35 NORTH AMERICA: SCMOS (BACK-THINNED) CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 36 EUROPE: SCMOS (BACK-THINNED) CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 37 EUROPE: SCMOS (BACK-THINNED): CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 38 ASIA PACIFIC: SCMOS (BACK-THINNED) CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 39 ASIA PACIFIC: SCMOS (BACK-THINNED) CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 40 ROW: SCMOS (BACK-THINNED) CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 41 ROW: SCMOS (BACK-THINNED) CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 CCD: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY CAMERA RESOLUTION, 2019–2022 (USD MILLION)

- TABLE 43 CCD: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY CAMERA RESOLUTION, 2023–2028 (USD MILLION)

- TABLE 44 CCD: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 45 CCD: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: CCD CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 47 NORTH AMERICA: CCD CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 48 EUROPE: CCD CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 49 EUROPE: CCD CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: CCD CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 51 ASIA PACIFIC: CCD CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 52 ROW: CCD CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 ROW CCD CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 CCD (BACK-THINNED): VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY CAMERA RESOLUTION, 2019–2022 (USD MILLION)

- TABLE 55 CCD (BACK-THINNED): VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY CAMERA RESOLUTION, 2023–2028 (USD MILLION)

- TABLE 56 CCD (BACK-THINNED): VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 57 CCD (BACK-THINNED): VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: CCD (BACK-THINNED) CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 59 NORTH AMERICA: CCD (BACK-THINNED) CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 60 EUROPE: CCD (BACK-THINNED) CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 61 EUROPE: CCD (BACK-THINNED) CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 62 ASIA PACIFIC: CCD (BACK-THINNED) CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 63 ASIA PACIFIC: CCD (BACK-THINNED) CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 64 ROW: CCD (BACK-THINNED) CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 ROW: CCD (BACK-THINNED) CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 EMCCD: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY CAMERA RESOLUTION, 2019–2022 (USD MILLION)

- TABLE 67 EMCCD: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY CAMERA RESOLUTION, 2023–2028 (USD MILLION)

- TABLE 68 EMCCD: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 69 EMCCD: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: EMCCD CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: EMCCD CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 72 EUROPE: EMCCD CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 73 EUROPE: EMCCD CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 74 ASIA PACIFIC: EMCCD CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 75 ASIA PACIFIC: EMCCD CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 76 ROW: EMCCD CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 77 ROW EMCCD CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY CAMERA RESOLUTION, 2019–2022 (USD MILLION)

- TABLE 79 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY CAMERA RESOLUTION, 2023–2028 (USD MILLION)

- TABLE 80 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY CAMERA RESOLUTION, 2019–2022 (THOUSAND UNITS)

- TABLE 81 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY CAMERA RESOLUTION, 2023–2028 (THOUSAND UNITS)

- TABLE 82 LESS THAN 4 MP: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 83 LESS THAN 4 MP: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 84 4 MP TO 5 MP: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 85 4 MP TO 5 MP: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 86 6 MP TO 9 MP: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 87 6 MP TO 9 MP: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 88 MORE THAN 9 MP: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 89 MORE THAN 9 MP: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 90 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY CAMERA PRICE, 2019–2022 (USD MILLION)

- TABLE 91 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY CAMERA PRICE, 2023–2028 (USD MILLION)

- TABLE 92 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY CAMERA PRICE, 2019–2022 (THOUSAND UNITS)

- TABLE 93 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY CAMERA PRICE, 2023–2028 (THOUSAND UNITS)

- TABLE 94 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 95 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 99 NORTH AMERICA: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 100 EUROPE: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 101 EUROPE: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 102 EUROPE: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 103 EUROPE: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 104 CHINA: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 105 CHINA: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 106 ASIA PACIFIC: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 107 ASIA PACIFIC: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 109 ASIA PACIFIC: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 110 ROW: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 111 ROW: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 112 ROW: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 113 ROW: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 114 KEY STRATEGIES UNDERTAKEN BY LEADING PLAYERS IN VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET FROM 2019 TO 2022

- TABLE 115 DEGREE OF COMPETITION

- TABLE 116 COMPANY FOOTPRINT (10 COMPANIES)

- TABLE 117 APPLICATION FOOTPRINT (10 COMPANIES)

- TABLE 118 REGION FOOTPRINT (10 COMPANIES)

- TABLE 119 PRODUCTS LAUNCHES, JANUARY 2019 TO JUNE 2021

- TABLE 120 DEALS, JANUARY 2019 TO MARCH 2021

- TABLE 121 HAMAMATSU PHOTONICS: BUSINESS OVERVIEW

- TABLE 122 HAMAMATSU PHOTONICS: PRODUCT OFFERED

- TABLE 123 HAMAMATSU PHOTONICS: PRODUCT LAUNCHES

- TABLE 124 TELEDYNE TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 125 TELEDYNE TECHNOLOGIES: PRODUCT OFFERED

- TABLE 126 TELEDYNE TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 127 TELEDYNE TECHNOLOGIES: DEALS

- TABLE 128 THORLABS, INC.: BUSINESS OVERVIEW

- TABLE 129 THORLABS, INC.: PRODUCTS OFFERED

- TABLE 130 XIMEA GMBH: BUSINESS OVERVIEW

- TABLE 131 XIMEA GMBH: PRODUCTS OFFERED

- TABLE 132 PHOTONIC SCIENCE: BUSINESS OVERVIEW

- TABLE 133 PHOTONIC SCIENCE: PRODUCTS OFFERED

- TABLE 134 PHOTONIC SCIENCE: PRODUCT LAUNCHES

- TABLE 135 EXCELITAS PCO GMBH (PCO-TECH INC.): BUSINESS OVERVIEW

- TABLE 136 EXCELITAS PCO GMBH (PCO-TECH INC.): PRODUCTS OFFERED

- TABLE 137 OXFORD INSTRUMENTS (ANDOR TECHNOLOGY): BUSINESS OVERVIEW

- TABLE 138 OXFORD INSTRUMENTS (ANDOR TECHNOLOGY): PRODUCTS OFFERED

- TABLE 139 ATIK CAMERAS: BUSINESS OVERVIEW

- TABLE 140 ATIK CAMERAS: PRODUCTS OFFERED

- TABLE 141 ATIK CAMERAS: DEALS

- TABLE 142 DIFFRACTION LIMITED: BUSINESS OVERVIEW

- TABLE 143 DIFFRACTION LIMITED: PRODUCTS OFFERED

- TABLE 144 SPECTRAL INSTRUMENTS INC.: BUSINESS OVERVIEW

- FIGURE 1 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET SEGMENTATION

- FIGURE 2 GEOGRAPHIC ANALYSIS

- FIGURE 3 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED BY KEY MARKET PLAYERS IN VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATION OF KEY PLAYERS IN VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIDE) —BOTTOM-UP ESTIMATION OF VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET, BY REGION

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 PRE- & POST-RECESSION IMPACT ON VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET

- FIGURE 11 SCMOS SEGMENT TO CONTINUE TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD (USD BILLION)

- FIGURE 12 LESS THAN 4 MP SEGMENT TO HOLD LARGEST MARKET SHARE IN 2022 (USD BILLION)

- FIGURE 13 CHINA TO REGISTER HIGHEST CAGR DURING 2023–2028

- FIGURE 14 CHINA TO EMERGE AS LUCRATIVE GROWTH AVENUE FOR VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET

- FIGURE 15 SCMOS SEGMENT TO LEAD VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET FROM 2023 TO 2028

- FIGURE 16 6 MP TO 9 MP SEGMENT IS EXPECTED TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 LESS THAN USD 15,000 SEGMENT TO HOLD LARGEST MARKET SIZE IN 2030

- FIGURE 18 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET TO RECORD HIGHEST CAGR IN CHINA FROM 2023 TO 2028

- FIGURE 19 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET DRIVERS: IMPACT ANALYSIS

- FIGURE 21 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET RESTRAINTS: IMPACT ANALYSIS

- FIGURE 22 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET OPPORTUNITIES: IMPACT ANALYSIS

- FIGURE 23 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET CHALLENGES: IMPACT ANALYSIS

- FIGURE 24 VALUE CHAIN ANALYSIS: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET

- FIGURE 25 KEY PLAYERS IN VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET

- FIGURE 26 ASP OF VISIBLE LIGHT RANGE SCIENTIFIC CAMERAS

- FIGURE 27 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR THREE APPLICATIONS

- FIGURE 29 COUNTRY-WISE EXPORT DATA FOR PRODUCTS CLASSIFIED UNDER HS CODE 900630, 2017–2021

- FIGURE 30 COUNTRY-WISE IMPORT DATA FOR PRODUCTS CLASSIFIED UNDER HS CODE 900630, 2017–2021

- FIGURE 31 PATENTS FILED FROM 2013 TO 2022

- FIGURE 32 NUMBER OF PATENTS FILED EACH YEAR FROM 2013 TO 2022

- FIGURE 33 JURISDICTION ANALYSIS

- FIGURE 34 TOP 10 COMPANIES PUBLISHED PATENT APPLICATIONS FROM 2013 TO 2022

- FIGURE 35 SCMOS SEGMENT TO HOLD LARGEST SHARE OF VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET IN 2028

- FIGURE 36 6 MP TO 9 MP RESOLUTION SEGMENT TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 37 USD 15,000 TO USD 30,000 PRICE SEGMENT TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 38 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 39 SNAPSHOT: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET IN NORTH AMERICA

- FIGURE 40 SNAPSHOT: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET IN EUROPE

- FIGURE 41 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET IN CHINA, BY TYPE

- FIGURE 42 SNAPSHOT: VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET IN ASIA PACIFIC

- FIGURE 43 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET IN ROW, BY REGION

- FIGURE 44 MARKET SHARE OF TOP FIVE PLAYERS OFFERING VISIBLE LIGHT RANGE SCIENTIFIC CAMERAS

- FIGURE 45 FIVE-YEAR REVENUE ANALYSIS OF KEY COMPANIES

- FIGURE 46 VISIBLE LIGHT RANGE SCIENTIFIC CAMERA MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2022

- FIGURE 47 HAMAMATSU PHOTONICS: COMPANY SNAPSHOT

- FIGURE 48 TELEDYNE TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 49 OXFORD INSTRUMENTS (ANDOR TECHNOLOGY): COMPANY SNAPSHOT

This study helps in understanding the methodology implemented for developing this report on the visible light range scientific camera market. Two basic sources of information—secondary sources and primary sources—have been used to identify and collect information for an extensive, technical, and commercial study of the visible light range scientific camera market. Secondary sources include company websites, magazines, associations, and databases (OneSource, Factiva, and Bloomberg). Primary sources such as key opinion leaders from various sectors, which include experts from different government organizations or associations, preferred suppliers, visible light range scientific camera developers, distributors, technology developers, subject matter experts (SMEs), C-level executives of key companies, and industry consultants have been interviewed to understand, obtain, and verify critical information, as well as to assess future trends in the visible light range scientific camera market and its growth prospects. Key players in the visible light range scientific camera market have been identified through secondary research, and their market ranking analysis has been determined through primary and secondary research. This research includes the study of the annual reports of the market players to identify the top players in the visible light range scientific camera market.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information relevant to this study on the visible light range scientific camera market. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases.

The global size of the visible light range scientific camera market has been obtained from the secondary data made available through paid and unpaid sources. It has also been determined by analyzing the product portfolios of the leading companies and rating them based on the quality of their offerings.

Secondary research has been used to gather key information about the industry’s supply chain, the market’s monetary chain, the total number of key players, and market segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both the market- and technology-oriented perspectives. It has also been conducted to identify and analyze the industry trends in the market and key developments that have been undertaken from both the market- and technology perspectives.

Primary Research

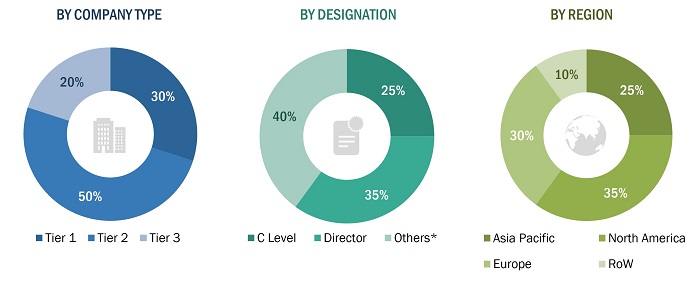

In the primary research process, various primary sources have been interviewed to obtain qualitative and quantitative information related to the market across four main regions— Asia Pacific, North America, Europe, and RoW (the Middle East, Africa, and South America). Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology directors, and a few other related key executives from major companies and organizations operating in the visible light range scientific camera market or related markets.

After the completion of market engineering, primary research has been conducted to gather information and verify and validate critical numbers obtained from other sources. Primary research has also been conducted to identify various market segments; industry trends; key players; competitive landscape; and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by market players. Most of the primary interviews have been conducted with the supply side of the market. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used extensively in the market engineering process. Several data triangulation methods have also been used to perform market forecasting and market estimation for the overall market segments and sub-segments in the report. Multiple qualitative and quantitative analyses have been performed on the market engineering process to gain key insights throughout the report.

Secondary research has been used to identify the key players offering visible light range scientific cameras . The revenues of those key players have been determined through both primary and secondary research. The revenues have been identified geographically as well as market segment-wise, using financial statements and analyzing annual reports of the key market players. Interviews with CEOs, VPs, directors, and marketing executives were also conducted to gain insights into the key players and the visible light range scientific camera market. All the market shares have been estimated using secondary and primary research. This data has been consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been then split into several segments and sub-segments. The data triangulation procedure has been employed to complete the market engineering process and arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Study Objectives

- To estimate, segment, and forecast the overall size of the visible light range scientific camera market, segmented by type, camera resolution, and camera price.

- To forecast the market size, in terms of value, for visible light range scientific cameras with regard to four main regions— North America, Europe, Asia Pacific , and RoW.

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To analyze the value chain of the visible light range scientific camera market.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market.

- To strategically profile the key players and comprehensively analyze their market position in terms of their ranking and core competencies2, and to provide detailed information about the competitive landscape of the market.

- To analyze competitive developments, such as product launches & developments, collaborations, contracts, partnerships, acquisitions, and expansions, in the visible light range scientific camera market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations based on the specific requirements of companies. The following customization options are available for the report:

Company Information

- Market size based on different subsegments of the visible light range scientific camera market.

- Detailed analysis and profiling of additional market players (up to five)

Future of Visible Light Range Scientific Cameras and the Scientific Camera Market

The visible light range scientific camera market refers to the market for scientific cameras that are capable of capturing images within the visible light spectrum, which is the range of electromagnetic radiation that human eyes can perceive. These cameras are used in a variety of scientific applications, such as microscopy, astronomy, and spectroscopy.

Growth Opportunities for scientific camera market:

Advancements in Camera Technology: The development of new camera technologies, such as high-speed cameras, ultra-high-resolution cameras, and specialized cameras for specific applications, presents growth opportunities in the scientific camera market.

Increasing Demand for Medical Imaging: The growing demand for medical imaging technologies for diagnosis and treatment presents opportunities for scientific camera manufacturers to develop cameras with high sensitivity, resolution, and imaging capabilities for medical applications.

Expansion of Aerospace and Defense Industry: The expansion of aerospace and defense industries presents growth opportunities for scientific camera manufacturers to develop specialized cameras for satellite imaging, remote sensing, and other aerospace applications.

Niche Threats for the scientific camera market:

Technological Disruptions: Technological disruptions in the form of new imaging technologies, such as artificial intelligence-based imaging and quantum imaging, may pose a threat to the growth of traditional scientific camera manufacturers.

Intense Competition: Intense competition from new market entrants and established players could impact the market share of existing scientific camera manufacturers.

Economic Uncertainty: Economic uncertainty and fluctuations in global markets could impact the demand for scientific cameras, especially in industrial sectors where investment in research and development is often the first to be cut during a recession.

Market Scope of Scientific Camera Market:

The market scope of scientific cameras includes various types of cameras with different specifications and features. Some of the popular types of scientific cameras are:

CCD (Charge-Coupled Device) Cameras: These cameras are widely used in microscopy and other imaging applications that require high resolution and sensitivity.

EMCCD (Electron Multiplying CCD) Cameras: These cameras are capable of detecting very low levels of light and are used in applications such as fluorescence microscopy and astronomy.

sCMOS (Scientific Complementary Metal-Oxide-Semiconductor) Cameras: These cameras are a newer technology that combines the benefits of both CCD and CMOS cameras, offering high sensitivity, speed, and low noise.

Infrared Cameras: These cameras are used in thermal imaging applications, such as in the defense, aerospace, and industrial sectors.

The market scope of scientific cameras also includes various applications such as:

Microscopy: Used in fields such as life sciences, material sciences, and nanotechnology to observe and study cells, tissues, and materials at the microscopic level.

Spectroscopy: Used in fields such as chemistry and physics to analyze the spectral properties of materials.

Astronomy: Used in astronomical observations, such as capturing images of celestial objects and studying their properties.

Industrial Imaging: Used in various industrial applications, such as quality control, non-destructive testing, and machine vision.

futuristic growth use-cases of Visible Light Range Scientific Camera Market?

The future growth use-cases of scientific cameras or visible light range scientific cameras are vast and exciting, with new applications emerging as camera technology advances. Here are some of the futuristic growth use-cases of these cameras:

Medical Imaging: Visible light range scientific cameras have a wide range of potential medical applications, including endoscopy, surgical imaging, and fluorescence-guided surgery. The cameras can capture high-quality images and provide real-time visualization of tissues and organs, helping doctors to make more accurate diagnoses and perform surgeries more effectively.

Autonomous Vehicles: The development of autonomous vehicles requires advanced imaging technologies to help the vehicles navigate and make decisions. Scientific cameras can be used to capture high-resolution images of the vehicle's surroundings, such as traffic, pedestrians, and obstacles, and provide real-time feedback to the vehicle's sensors.

Robotics: Robotics is another field that can benefit from advanced imaging technologies. Scientific cameras can be used in robotics for tasks such as object recognition, localization, and tracking. The cameras can provide high-resolution images of the robot's surroundings, enabling it to interact more effectively with its environment.

3D Printing: Visible light range scientific cameras can be used in 3D printing to capture images of the printing process and ensure that the final product meets the desired specifications. The cameras can provide real-time feedback to the printer's sensors, ensuring that the printing process is accurate and efficient.

Augmented Reality and Virtual Reality: Augmented reality and virtual reality require advanced imaging technologies to create immersive and interactive experiences. Scientific cameras can be used to capture high-resolution images and provide real-time feedback to the AR/VR systems, enabling users to interact more effectively with the virtual environment.

Top Companies in Visible light range scientific Camera market:

The scientific camera market is highly competitive, with many companies offering a variety of products and solutions to different applications. Some of the top companies in this market are Teledyne DALSA, Hamamatsu Photonics, FLIR Systems, Allied Vision Technologies, PCO AG, Andor Technology, Photometrics, Princeton Instruments, Point Grey Research, Basler AG, Olympus Corporation, Hitachi High-Tech Corporation, Coherent Inc., Sony Corporation, Roper Technologies, Carl Zeiss AG, Leica Microsystems, and Jenoptik AG.

These companies have established themselves as key players in the scientific camera market by developing innovative products and solutions that meet the needs of various applications. For example, Teledyne DALSA offers a range of high-performance cameras for applications such as life sciences, machine vision, and industrial inspection. Hamamatsu Photonics is a leading provider of cameras for scientific and industrial applications, offering solutions for fluorescence microscopy, high-speed imaging, and spectroscopy. FLIR Systems specializes in thermal imaging cameras for a variety of applications, including science and research.

These companies have a strong presence in different regions, with some having headquarters in North America, Europe, or APAC. For instance, Teledyne DALSA and FLIR Systems are headquartered in North America, while Carl Zeiss AG and Leica Microsystems are based in Europe. Hamamatsu Photonics and Olympus Corporation have their headquarters in APAC.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Visible Light Range Scientific Camera Market