Medical Cameras Market Size, Share & Trends Size by Camera Type (Endoscopy Cameras, Ophthalmology Cameras, Dermatology Cameras), Resolution (HD Cameras, SD Cameras), Sensor (CMOS, CCD), End Users (Hospitals & Ambulatory Surgery Centers, Specialty Clinics) & Region - Global Forecast to 2026

Medical Cameras Market Size, Share & Trends

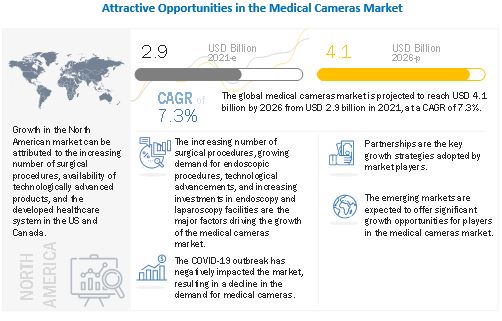

The global size of medical cameras market in terms of revenue was estimated to be worth USD 2.9 billion in 2021 and is poised to reach USD 4.1 billion by 2026, growing at a CAGR of 7.3% from 2021 to 2026. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

The market's growth is largely driven by the increasing number of surgical procedures, growing demand for endoscopic procedures, technological advancements, and increasing investments in endoscopy and laparoscopy facilities. However, the high cost of medical cameras is a major restraint on market growth. Product discontinuations, a shortage of trained medical professionals, and the availability of refurbished products are also major challenges limiting market growth to a certain extent.

Medical Cameras Market Trends

To know about the assumptions considered for the study, download the pdf brochure

Medical Cameras Market Dynamics

Driver: The increasing number of surgical procedures

An increasing number of surgical procedures require medical cameras, which have considerably grown in recent years. The growing number of surgeries can be attributed to the rapidly growing geriatric population worldwide and the increasing prevalence of chronic diseases, leading to an increased demand for medical equipment. Many countries across the world are facing the challenge of increasing senior populations. According to the United Nations (UN), there were 703 million people aged 65 and up in the world in 2019. The senior population is estimated to double to 1.5 billion in 2050. Non-invasive surgeries (mainly using endoscopy and microscopy surgery cameras) are preferred for older people due to fewer complications than conventional surgeries.

Restraint: High costs of medical cameras

Images captured using low-megapixel cameras have several drawbacks. The image quality of such pictures gets reduced while zooming in, cropping, or taking prints. Hence, there is a growing demand for high-megapixel cameras owing to the various advantages associated with them. Endoscopic cameras used in clinics (in India) cost ~ USD 1300, whereas endoscopic camera prices in hospitals vary from USD 500 to USD 9,000. Intraoral cameras range from USD 50 to USD 5,000. Camera prices vary depending on megapixel sizes, sensor types, and other features.

Opportunity: Emerging countries in the Asia Pacific market

The Asia Pacific region presents significant growth opportunities for the medical cameras market. Owing to its massive patient population, the rapid expansion of the healthcare industry, and the shifting focus of manufacturers towards developing countries in this region.

China and India, the two most populous countries globally, have a huge patient population, mainly due to the rapidly growing senior population and the subsequent increase in the prevalence of ophthalmological and dermatological diseases. Treatment for these diseases demands the use of endoscopes, retinal cameras, and intraoral cameras.

Challenge: The shortage of trained medical professionals

There is a significant shortage of endoscopy physicians and surgeons worldwide. According to the Association of American Medical Colleges (AAMC), by 2020, the US will face a shortfall of around 1,050 gastroenterologists. The demand for colonoscopies is expected to rise by 10% in the country. This shortage of trained professionals in endoscopy also extends to regions such as the Asia Pacific, Latin America, and Europe (excluding the UK, where training has been provided for nurse endoscopists for the last ten years by the United Kingdom Central Council for Nursing, Midwifery, and Health).

Endoscopy Cameras accounted for the larger share of the share of global medical cameras market

Based on type, the global market is segmented into surgical microscopy cameras, endoscopy cameras, dermatology cameras, ophthalmology cameras, dental cameras, and other medical cameras. The endoscopy cameras segment accounted for the largest share of the global market. This can be attributed to the increasing number of endoscopy procedures across the globe.

CMOS Sensor segment of medical cameras market, accounted for the highest CAGR

Based on sensor, the market is segmented into CMOS Sensor and CCD Sensor. CMOS sensors accounted for the highest growth rate. The major factors driving the growth of this is the observable shift in the preference for CMOS sensors over CCD sensors due to its various advantages over CCD sensors.

By Resolution, High-definition cameras accounted for largest market share of the medical cameras market

Based on resolution, the global market is segmented into standard-definition (SD) cameras and high-definition (HD) cameras. High-definition cameras accounted for the largest share of the global market. The large share of this segment can primarily be attributed to the greater demand for HD cameras among end users due to the significant requirement of high-quality images in medical specialties.

Hospitals & ambulatory surgery centers segment of medical cameras market, accounted for the highest CAGR

Based on end users, the global market is segmented into hospitals & ambulatory surgery centers and specialty clinics. The hospitals & ambulatory surgery centers segment accounted for the highest growth rate. This can be attributed to the rising number of hospitals coupled with large patient pool for target diseases, and increasing healthcare expenditure.

North America accounted for the largest share of the medical cameras market

The market is divided into five regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. North America dominated this market. The large share of the North American region is mainly attributed to the technological advancements in medical cameras, the implementation of favourable government initiatives, and the rise in the number of surgical procedures.

Some of the major players operating in this market are Olympus Corporation (Japan), Richard Wolf GmbH (Germany), and TOPCON CORPORATION (Japan). In 2020, Olympus Corporation held the leading position in the global market. The company offers camera heads widely used across various specialties, including general surgery, ENT, urology, and OR integration. Richard Wolf GmbH held the second position in this market in 2020.

Medical Cameras Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$2.9 billion |

|

Projected Revenue by 2026 |

$4.1 billion |

|

Revenue Growth Rate |

Poised to grow at a CAGR of 7.3% |

|

Market Segmentation |

Camera Type, Resolution, Sensor, End User And Regional Level |

|

Market Driver |

The increasing number of surgical procedures |

|

Market Opportunity |

Emerging countries in the Asia Pacific market |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

This research report categorizes the medical cameras market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Endoscopy Cameras

- Dermatology Cameras

- Ophthalmology Cameras

- Dental Cameras

- Surgical Microscopy Cameras

- Other Medical Cameras

By Sensor

- CMOS Sensors

- CCD Sensors

By Resolution

- Standard Definition (SD) Cameras

- High-definition (HD) Cameras

By End User

- Hospitals & Ambulatory Surgery Centers

- Specialty Clinics

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific (RoAPAC)

- Rest of the World

Recent Developments

- In 2020, Optomed Plc launched Aurora IQ camera with integrated AI for faster eye screening.

- In 2019, Carl Zeiss AG and the Christoffel Mission for the Blind (CBM) came together with a local partner, the Poona Blind Men Association, to open a new training center for the treatment of cataracts in Pune. The aim of this new center is to train ophthalmologists and medical personnel throughout the country in phacoemulsification, a modern surgical technique.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global medical cameras market?

The global medical cameras market boasts a total revenue value of $4.1 billion by 2026.

What is the estimated growth rate (CAGR) of the global medical cameras market?

The global market for medical cameras has an estimated compound annual growth rate (CAGR) of 7.3% and a revenue size in the region of $2.9 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET COVERED

FIGURE 1 GLOBAL MEDICAL CAMERAS MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

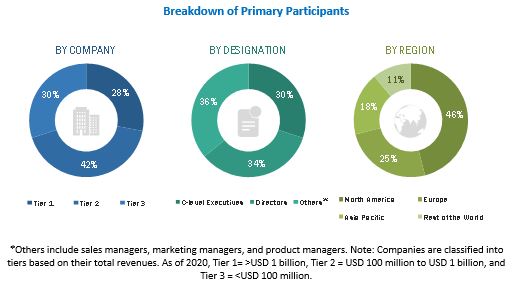

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 7 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 COVID-19 ECONOMIC ASSESSMENT

2.7 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 9 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 10 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 11 MEDICAL CAMERAS MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 12 GLOBAL MARKET, BY SENSOR, 2021 VS. 2026 (USD MILLION)

FIGURE 13 GLOBAL MARKET, BY RESOLUTION, 2021 VS. 2026 (USD MILLION)

FIGURE 14 GLOBAL MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 15 GEOGRAPHIC SNAPSHOT OF THE GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 MEDICAL CAMERAS MARKET OVERVIEW

FIGURE 16 INCREASING NUMBER OF SURGICAL PROCEDURES TODRIVE MARKET GROWTH

4.2 ASIA PACIFIC: MARKET, BY END USER & COUNTRY (2020)

FIGURE 17 HOSPITALS & AMBULATORY SURGERY CENTERS ACCOUNTED FOR THE LARGEST SHARE OF THE APAC MARKET IN 2020

4.3 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 18 CHINA TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 MEDICAL CAMERAS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 The increasing number of surgical procedures

TABLE 1 NUMBER OF SURGICAL PROCEDURES PERFORMED IN THE UNITED STATES EVERY YEAR

5.2.1.2 The growing demand for endoscopic procedures

5.2.1.3 Technological advancements in medical cameras

5.2.1.4 Increasing investments in endoscopy and laparoscopy facilities

5.2.2 RESTRAINTS

5.2.2.1 High costs of medical cameras

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging countries in the Asia Pacific market

5.2.4 CHALLENGES

5.2.4.1 Product discontinuation

5.2.4.2 The shortage of trained medical professionals

5.2.4.3 Availability of refurbished products

5.3 COVID-19 IMPACT ANALYSIS

5.4 VALUE CHAIN ANALYSIS

FIGURE 20 MAJOR VALUE IS ADDED DURING THE MANUFACTURING AND ASSEMBLY PHASE

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 21 DIRECT DISTRIBUTION—STRATEGY PREFERRED BY PROMINENT COMPANIES

5.6 ECOSYSTEM ANALYSIS OF THE GLOBAL MARKET.

FIGURE 22 ECOSYSTEM ANALYSIS OF THE GLOBAL MARKET

6 MEDICAL CAMERAS MARKET, BY TYPE (Page No. - 58)

6.1 INTRODUCTION

TABLE 2 GLOBAL MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 3 GLOBAL MARKET, BY TYPE, 2020–2026 (USD MILLION)

6.2 ENDOSCOPY CAMERAS

6.2.1 RISING NUMBER OF ENDOSCOPIC PROCEDURES TO PROPEL THE MARKET GROWTH FOR ENDOSCOPY CAMERAS

TABLE 4 TYPES OF ENDOSCOPIC PROCEDURES

TABLE 5 NUMBER OF DIAGNOSTIC BRONCHOSCOPY PROCEDURES PERFORMED (WITH OR WITHOUT BIOPSY), BY COUNTRY, 2014–2018

TABLE 6 NUMBER OF COLONOSCOPY PROCEDURES PERFORMED (WITH OR WITHOUT BIOPSY), BY COUNTRY, 2014–2018

TABLE 7 NUMBER OF LAPAROSCOPIC COLECTOMY PROCEDURES PERFORMED, BY COUNTRY, 2014–2018

TABLE 8 NUMBER OF LAPAROSCOPIC APPENDECTOMY PROCEDURES PERFORMED, BY COUNTRY, 2014–2018

TABLE 9 NUMBER OF LAPAROSCOPIC CHOLECYSTECTOMY PROCEDURES PERFORMED, BY COUNTRY, 2014–2018

TABLE 10 NUMBER OF LAPAROSCOPIC INGUINAL HERNIA REPAIR PROCEDURES PERFORMED, BY COUNTRY, 2014–2018

TABLE 11 NUMBER OF LAPAROSCOPIC HYSTERECTOMY PROCEDURES PERFORMED, BY COUNTRY, 2014–2018

TABLE 12 ENDOSCOPY CAMERAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 13 ENDOSCOPY CAMERAS MARKET, BY REGION, 2020–2026 (USD MILLION)

6.3 SURGICAL MICROSCOPY CAMERAS

6.3.1 INCREASING NUMBER OF SURGICAL PROCEDURES AND TECHNOLOGICAL ADVANCEMENTS TO SUPPORT MARKET GROWTH

TABLE 14 SURGICAL MICROSCOPY CAMERAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 15 SURGICAL MICROSCOPY CAMERAS MARKET, BY REGION, 2020–2026 (USD MILLION)

6.4 OPHTHALMOLOGY CAMERAS

6.4.1 RISING PREVALENCE OF EYE DISEASES TO SUPPORT THE GROWTH OF THE OPHTHALMOLOGY CAMERAS MARKET

TABLE 16 NUMBER OF GLAUCOMA PATIENTS, BY COUNTRY AND TYPE, 2013 VS. 2020 VS. 2040 (MILLION)

TABLE 17 POPULATION WITH OCULAR CONDITIONS IN THE US, 2000 VS. 2010 VS. 2020 (MILLION INDIVIDUALS)

TABLE 18 PROJECTED DISABILITY-ADJUSTED LIFE YEARS ACROSS VARIOUS REGIONS, BY DISEASE, 2015 VS. 2030 (MILLION YEARS)

TABLE 19 OPHTHALMOLOGY CAMERAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 OPHTHALMOLOGY CAMERAS MARKET, BY REGION, 2020–2026 (USD MILLION)

6.5 DERMATOLOGY CAMERAS

6.5.1 RISING NUMBER OF DERMATOLOGICAL PROCEDURES TO BOOST THE DERMATOLOGY CAMERAS MARKET

TABLE 21 NUMBER OF SURGICAL PROCEDURES PERFORMED BY PLASTIC SURGEONS GLOBALLY, 2015 VS. 2018 VS. 2019

TABLE 22 NUMBER OF NON-SURGICAL PROCEDURES PERFORMED GLOBALLY BY PLASTIC SURGEONS, 2015 VS. 2018 VS. 2019

TABLE 23 DERMATOLOGY CAMERAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 24 DERMATOLOGY CAMERAS MARKET, BY REGION, 2020–2026 (USD MILLION)

6.6 DENTAL CAMERAS

6.6.1 INCREASING INCIDENCE OF ORAL DISEASES TO SUPPORT THE DENTAL CAMERAS MARKET GROWTH

TABLE 25 DENTAL CAMERAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 26 DENTAL CAMERAS MARKET, BY REGION, 2020–2026 (USD MILLION)

6.7 OTHER MEDICAL CAMERAS

TABLE 27 OTHER MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 28 OTHER MARKET, BY REGION, 2020–2026 (USD MILLION)

7 MEDICAL CAMERAS MARKET, BY SENSOR (Page No. - 72)

7.1 INTRODUCTION

TABLE 29 CMOS SENSORS VS. CCD SENSORS IN MEDICAL CAMERAS

TABLE 30 GLOBAL MARKET, BY SENSOR, 2016–2019 (USD MILLION)

TABLE 31 GLOBAL MARKET, BY SENSOR, 2020–2026 (USD MILLION)

7.2 CMOS SENSORS

7.2.1 CMOS SENSORS TO LEAD THE GLOBAL MARKET DURING THE FORECAST PERIOD

TABLE 32 CMOS SENSOR-BASED MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 CMOS SENSOR-BASED MARKET, BY REGION, 2020–2026 (USD MILLION)

7.3 CCD SENSORS

7.3.1 DISCONTINUATION OF CCD SENSORS BY PLAYERS IN THE MARKET CAN HAMPER THE MARKET GROWTH

TABLE 34 CCD SENSOR-BASED MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 CCD SENSOR-BASED MARKET, BY REGION, 2020–2026 (USD MILLION)

8 MEDICAL CAMERAS MARKET, BY RESOLUTION (Page No. - 77)

8.1 INTRODUCTION

TABLE 36 GLOBAL MARKET, BY RESOLUTION, 2016–2019 (USD MILLION)

TABLE 37 GLOBAL MARKET, BY RESOLUTION, 2020–2026 (USD MILLION)

8.2 HIGH-DEFINITION CAMERAS

8.2.1 TECHNOLOGICAL ADVANCEMENTS IN HIGH-DEFINITION CAMERAS TO SUPPORT MARKET GROWTH

TABLE 38 HIGH-DEFINITION MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 HIGH-DEFINITION MARKET, BY REGION, 2020–2026 (USD MILLION)

8.3 STANDARD-DEFINITION CAMERAS

8.3.1 STANDARD-DEFINITION CAMERAS MAY BECOME OBSOLETE DUE TO THE AVAILABILITY OF BETTER-RESOLUTION CAMERAS IN THE MARKET

TABLE 40 STANDARD-DEFINITION MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 41 STANDARD-DEFINITION MARKET, BY REGION, 2020–2026 (USD MILLION)

9 MEDICAL CAMERAS MARKET, BY END USER (Page No. - 81)

9.1 INTRODUCTION

TABLE 42 GLOBAL MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 43 GLOBAL MARKET, BY END USER, 2020–2026 (USD MILLION)

9.2 HOSPITALS & AMBULATORY SURGERY CENTERS

9.2.1 LARGE POOL OF PATIENTS AND RISING NUMBER OF HOSPITALS TO DRIVE MARKET GROWTH

TABLE 44 GLOBAL MARKET FOR HOSPITALS & AMBULATORY SURGERY CENTERS, BY REGION, 2016–2019 (USD MILLION)

TABLE 45 GLOBAL MARKET FOR HOSPITALS & AMBULATORY SURGERY CENTERS, BY REGION, 2020–2026 (USD MILLION)

9.3 SPECIALTY CLINICS

9.3.1 SHORTER WAITING PERIODS AND THE INCREASING NUMBER OF SPECIALTY CLINICS TO SUPPORT MARKET GROWTH

TABLE 46 GLOBAL MARKET FOR SPECIALTY CLINICS, BY REGION, 2016–2019 (USD MILLION)

TABLE 47 GLOBAL MARKET FOR SPECIALTY CLINICS, BY REGION, 2020–2026 (USD MILLION)

10 MEDICAL CAMERAS MARKET, BY REGION (Page No. - 86)

10.1 INTRODUCTION

TABLE 48 GLOBAL MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 49 GLOBAL MARKET, BY REGION, 2020–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 23 NORTH AMERICA: MEDICAL CAMERAS MARKET SNAPSHOT

TABLE 50 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY SENSOR, 2016–2019 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY SENSOR, 2020–2026 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY RESOLUTION, 2016–2019 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY RESOLUTION, 2020–2026 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY END USER, 2020–2026 (USD MILLION)

10.2.1 US

10.2.1.1 The US dominates the North American medical cameras market

TABLE 60 US: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 61 US: MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 62 US: MARKET, BY SENSOR, 2016–2019 (USD MILLION)

TABLE 63 US: MARKET, BY SENSOR, 2020–2026 (USD MILLION)

TABLE 64 US: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 65 US: MARKET, BY END USER, 2020–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Rising prevalence of chronic diseases to drive market growth in Canada

TABLE 66 CANADA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 67 CANADA: MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 68 CANADA: MARKET, BY SENSOR, 2016–2019 (USD MILLION)

TABLE 69 CANADA: MARKET, BY SENSOR, 2020–2026 (USD MILLION)

TABLE 70 CANADA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 71 CANADA: MARKET, BY END USER, 2020–2026 (USD MILLION)

10.3 EUROPE

TABLE 72 EUROPE: MEDICAL CAMERAS MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 73 EUROPE: MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 74 EUROPE: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 75 EUROPE: MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 76 EUROPE: MARKET, BY SENSOR, 2016–2019 (USD MILLION)

TABLE 77 EUROPE: MARKET, BY SENSOR, 2020–2026 (USD MILLION)

TABLE 78 EUROPE: MARKET, BY RESOLUTION, 2016–2019 (USD MILLION)

TABLE 79 EUROPE: MARKET, BY RESOLUTION, 2020–2026 (USD MILLION)

TABLE 80 EUROPE: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY END USER, 2020–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Germany to dominate the European medical cameras market during the forecast period

TABLE 82 GERMANY: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 83 GERMANY: MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 84 GERMANY: MARKET, BY SENSOR, 2016–2019 (USD MILLION)

TABLE 85 GERMANY: MARKET, BY SENSOR, 2020–2026 (USD MILLION)

TABLE 86 GERMANY: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 87 GERMANY: MARKET, BY END USER, 2020–2026 (USD MILLION)

10.3.2 UK

10.3.2.1 Rising prevalence of chronic diseases along with favorable government policies supporting market growth

TABLE 88 UK: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 89 UK: MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 90 UK: MARKET, BY SENSOR, 2016–2019 (USD MILLION)

TABLE 91 UK: MARKET, BY SENSOR, 2020–2026 (USD MILLION)

TABLE 92 UK: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 93 UK: MARKET, BY END USER, 2020–2026 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Favorable government initiatives to support market growth in France

TABLE 94 FRANCE: MEDICAL CAMERAS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 95 FRANCE: MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 96 FRANCE: MARKET, BY SENSOR, 2016–2019 (USD MILLION)

TABLE 97 FRANCE: MARKET, BY SENSOR, 2020–2026 (USD MILLION)

TABLE 98 FRANCE: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 99 FRANCE: MARKET, BY END USER, 2020–2026 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Rising geriatric population to propel market growth in Italy

TABLE 100 ITALY: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 101 ITALY: MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 102 ITALY: MARKET, BY SENSOR, 2016–2019 (USD MILLION)

TABLE 103 ITALY: MARKET, BY SENSOR, 2020–2026 (USD MILLION)

TABLE 104 ITALY: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 105 ITALY: MARKET, BY END USER, 2020–2026 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 High efficiency in the healthcare industry and low-cost advantage make Spain a prominent medical tourism destination

TABLE 106 SPAIN: MEDICAL CAMERAS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 107 SPAIN: MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 108 SPAIN: MARKET, BY SENSOR, 2016–2019 (USD MILLION)

TABLE 109 SPAIN: MARKET, BY SENSOR, 2020–2026 (USD MILLION)

TABLE 110 SPAIN: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 111 SPAIN: MARKET, BY END USER, 2020–2026 (USD MILLION)

10.3.6 REST OF EUROPE (ROE)

TABLE 112 CANCER INCIDENCE IN ROE COUNTRIES, 2018 VS. 2025

TABLE 113 ROE: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 114 ROE: MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 115 ROE: MARKET, BY SENSOR, 2016–2019 (USD MILLION)

TABLE 116 ROE: MARKET, BY SENSOR, 2020–2026 (USD MILLION)

TABLE 117 ROE: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 118 ROE: MARKET, BY END USER, 2020–2026 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 24 ASIA PACIFIC: MEDICAL CAMERAS MARKET SNAPSHOT

TABLE 119 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY SENSOR, 2016–2019 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET, BY SENSOR, 2020–2026 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY RESOLUTION, 2016–2019 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY RESOLUTION, 2020–2026 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET, BY END USER, 2020–2026 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Japan is the largest market for medical cameras in the APAC

TABLE 129 JAPAN: MEDICAL CAMERAS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 130 JAPAN: MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 131 JAPAN: MARKET, BY SENSOR, 2016–2019 (USD MILLION)

TABLE 132 JAPAN: MARKET, BY SENSOR, 2020–2026 (USD MILLION)

TABLE 133 JAPAN: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 134 JAPAN: MARKET, BY END USER, 2020–2026 (USD MILLION)

10.4.2 CHINA

10.4.2.1 China to register highest growth rate during the forecast period

TABLE 135 CHINA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 136 CHINA: MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 137 CHINA: MARKET, BY SENSOR, 2016–2019 (USD MILLION)

TABLE 138 CHINA: MARKET, BY SENSOR, 2020–2026 (USD MILLION)

TABLE 139 CHINA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 140 CHINA: MARKET, BY END USER, 2020–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Healthcare infrastructure improvements and implementation of favorable government initiatives to support market growth in India

TABLE 141 INDIA: MEDICAL CAMERAS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 142 INDIA: MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 143 INDIA: MARKET, BY SENSOR, 2016–2019 (USD MILLION)

TABLE 144 INDIA: MARKET, BY SENSOR, 2020–2026 (USD MILLION)

TABLE 145 INDIA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 146 INDIA: MARKET, BY END USER, 2020–2026 (USD MILLION)

10.4.4 ROAPAC

TABLE 147 ROAPAC: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 148 ROAPAC: MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 149 ROAPAC: MARKET, BY SENSOR, 2016–2019 (USD MILLION)

TABLE 150 ROAPAC: MARKET, BY SENSOR, 2020–2026 (USD MILLION)

TABLE 151 ROAPAC: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 152 ROAPAC: MARKET, BY END USER, 2020–2026 (USD MILLION)

10.5 REST OF THE WORLD

TABLE 153 ROW: MEDICAL CAMERAS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 154 ROW: MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 155 ROW: MARKET, BY SENSOR, 2016–2019 (USD MILLION)

TABLE 156 ROW: MARKET, BY SENSOR, 2020–2026 (USD MILLION)

TABLE 157 ROW: MARKET, BY RESOLUTION, 2016–2019 (USD MILLION)

TABLE 158 ROW: MARKET, BY RESOLUTION, 2020–2026 (USD MILLION)

TABLE 159 ROW: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 160 ROW: MARKET, BY END USER, 2020–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 129)

11.1 OVERVIEW

FIGURE 25 KEY DEVELOPMENTS IN THE MEDICAL CAMERAS MARKET,JANUARY 2018–APRIL 2021

11.2 MARKET SHARE ANALYSIS

TABLE 161 GLOBAL MARKET SHARE, BY KEY PLAYER (2020)

11.3 COMPETITIVE SCENARIO

FIGURE 26 MARKET EVALUATION FRAMEWORK, 2018-2021

11.3.1 PRODUCT LAUNCHES & APPROVALS

TABLE 162 PRODUCT LAUNCHES & APPROVALS

11.3.2 AGREEMENTS AND COLLABORATIONS

TABLE 163 AGREEMENTS AND COLLABORATIONS

11.3.3 ACQUISITIONS

TABLE 164 ACQUISITIONS

11.3.4 EXPANSIONS

TABLE 165 EXPANSIONS

11.3.5 OTHER DEVELOPMENTS

TABLE 166 OTHER DEVELOPMENTS

11.4 COMPANY EVALUATION MATRIX

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

11.4.4 PARTICIPANTS

FIGURE 27 GLOBAL MARKET: VENDOR DIVE MATRIX, 2020

11.5 COMPETITIVE LEADERSHIP MAPPING (SMES/START-UPS)

11.5.1 PROGRESSIVE COMPANIES

11.5.2 STARTING BLOCKS

11.5.3 RESPONSIVE COMPANIES

11.5.4 DYNAMIC COMPANIES

FIGURE 28 GLOBAL MARKET: VENDOR DIVE MATRIX FOR SMES & START-UPS, 2020

12 COMPANY PROFILES (Page No. - 139)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 OLYMPUS CORPORATION

FIGURE 29 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2020)

12.2 RICHARD WOLF GMBH

12.3 TOPCON CORPORATION

FIGURE 30 TOPCON CORPORATION: COMPANY SNAPSHOT (2020)

12.4 SONY CORPORATION

FIGURE 31 SONY CORPORATION: COMPANY SNAPSHOT (2020)

12.5 STRYKER CORPORATION

FIGURE 32 STRYKER CORPORATION: COMPANY SNAPSHOT (2020)

12.6 DANAHER

FIGURE 33 DANAHER: COMPANY SNAPSHOT (2020)

12.7 CANON INC.

FIGURE 34 CANON INC.: COMPANY SNAPSHOT (2020)

12.8 CARL ZEISS AG

FIGURE 35 CARL ZEISS AG: COMPANY SNAPSHOT (2020)

12.9 SMITH & NEPHEW

FIGURE 36 SMITH & NEPHEW PLC: COMPANY SNAPSHOT (2020)

12.10 CARESTREAM DENTAL LLC

12.11 BASLER AG

FIGURE 37 BASLER AG: COMPANY SNAPSHOT (2020)

12.12 ATMOS MEDIZINTECHNIK GMBH & CO. KG

12.13 IMPERX, INC

12.14 IDS IMAGING DEVELOPMENT SYSTEMS GMBH

12.15 OPTOMED PLC

FIGURE 38 OPTOMED: COMPANY SNAPSHOT (2020)

12.16 HAAG-STREIT GROUP

12.17 CYMO B.V.

12.18 DIASPECTIVE VISION

12.19 DAGE-MTI

12.2 FUDE TECHNOLOGY GROUP LIMITED

12.21 HEALTHTECH ENGINEERS PRIVATE LIMITED

12.22 SCHÖLLY FIBEROPTIC GMBH

12.23 MEDICAM

12.24 ESC MEDICAMS

12.25 TONGLU KANGER MEDICAL INSTRUMENT CO., LTD

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 177)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the medical cameras market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the global market scenario through secondary research. Primary interviews were conducted from both the demand (Physicians, surgeons, and personnel from imaging centers) and supply sides (medical cameras manufacturers and distributors).

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the medical cameras market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the medical cameras industry.

Report Objectives

- To define, describe, and forecast the global medical cameras market based on type, sensor, resolution, end user, and region.

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall medical cameras market

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders.

- To forecast the size of the global medical cameras market with respect to four main regions (along with countries), namely, North America, Europe, the Asia Pacific, and the Rest of the World

- To strategically profile the key players in the global medical cameras market and to comprehensively analyze their core competencies and market shares.

- To track and analyze competitive developments such as agreements, partnerships, acquisitions, and product launches in the global medical cameras market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the medical cameras market into specific countries/regions in the Rest of the World, Rest of APAC, and Rest of Europe.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Cameras Market