Virtualized Evolved Packet Core (vEPC) Market by Offering (Solutions and Services (Professional and Managed)), Deployment Model (Cloud, On-premises), Network Typ (4G and 5G), End User (Telecom Operators, Enterprises) and Region - Global Forecast to 2028

Virtualized Evolved Packet Core (vEPC) Market Size, Share, Industry Growth, Latest Trends, Forecast - 2028

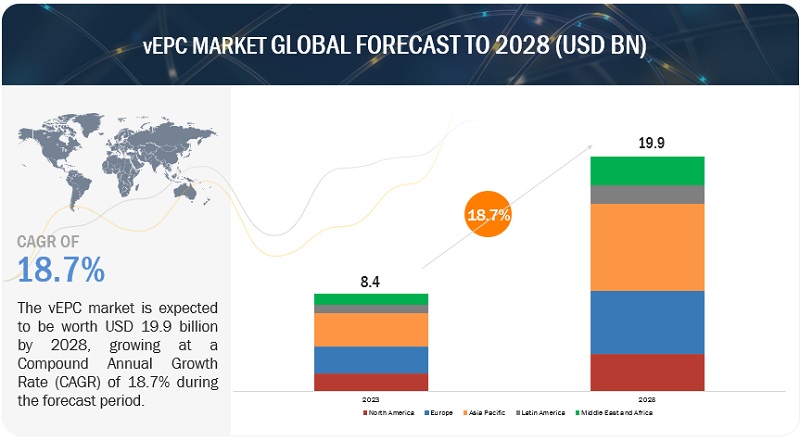

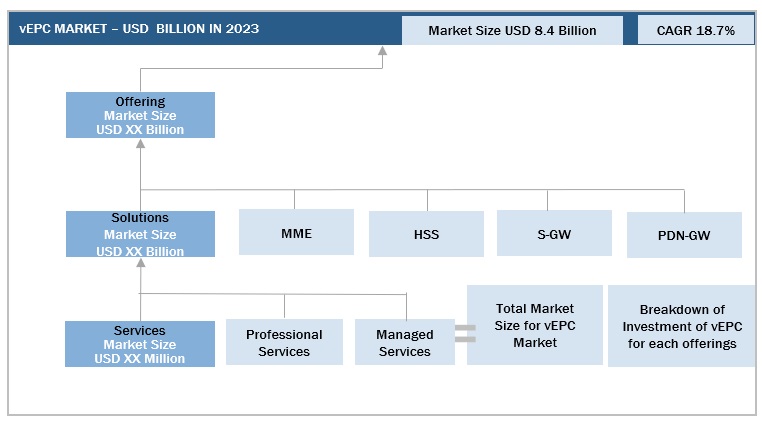

[280 Pages Report] The global vEPC market is USD 8.4 billion for the year 2023 and is expected to be worth USD 19.9 billion by 2028, growing at a CAGR of 18.7% during the forecast period. The rapid growth of mobile data traffic and the increasing number of connected devices create a demand for highly scalable and efficient network infrastructure. vEPC offers the flexibility and agility needed to handle this surge in data traffic and support the seamless connectivity of numerous devices.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

vEPC Market Dynamics

Driver: Increasing Demand for High-Speed and Reliable Connectivity

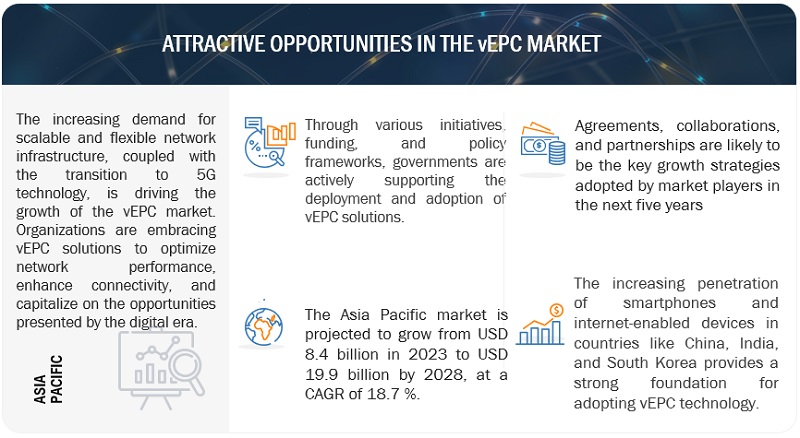

The growing adoption of data-intensive applications and emerging technologies like the Internet of Things (IoT) and 5G has created a significant demand for high-speed and reliable connectivity. Businesses and consumers require seamless connectivity to support bandwidth-intensive activities such as video streaming, online gaming, and real-time data transmission. vEPC solutions are crucial in meeting this demand by offering virtualized Evolved Packet Core functionality. These solutions provide efficient network management, scalability, and flexibility, enabling service providers to deliver fast and reliable customer connectivity.

Restraint: Complexity and Cost of Implementation and Management

Implementing and managing virtualized network infrastructure, including vEPC solutions, can be complex and costly for organizations. The deployment of vEPC requires skilled professionals who possess expertise in virtualization, network management, and security. Additionally, organizations need to invest in robust IT systems and infrastructure to support the virtualized environment. The complexity and cost of implementation and management can act as barriers to entry for smaller organizations or those with limited resources. Furthermore, data security and privacy concerns need to be effectively addressed to ensure the widespread adoption of vEPC solutions.

Opportunity: Adoption of Cloud Computing and Virtualization Technologies

The increasing adoption of cloud computing and virtualization technologies presents a significant opportunity for the vEPC market. Cloud-based vEPC deployments offer scalability, cost-efficiency, and easier management than traditional hardware-based solutions. By leveraging cloud infrastructure, organizations can dynamically scale their network resources based on demand, reducing operational costs and increasing flexibility. Additionally, virtualization technologies enable the decoupling of software from hardware, allowing for efficient resource utilization and simplified network management. Integrating vEPC with cloud computing and virtualization technologies opens up new possibilities for network optimization, service delivery, and enhanced user experiences.

Challenge: Interoperability and Standardization

Interoperability and standardization are major challenges in the vEPC market. As multiple vendors offer vEPC solutions, ensuring seamless interoperability between different components and networks becomes crucial. The lack of interoperability can lead to compatibility issues and limit the scalability of vEPC deployments. Additionally, the absence of standardized protocols and interfaces hinders the smooth integration of vEPC with other network elements and technologies. Establishing industry-wide standards and protocols for vEPC will promote interoperability, simplify deployment, and enhance the overall efficiency of virtualized networks.

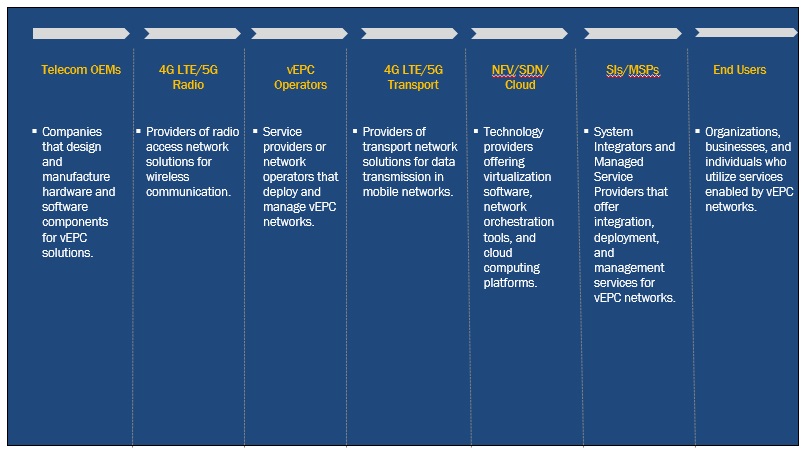

vEPC Market Ecosystem

The vEPC market is driven by prominent companies that have established themselves as leaders in the industry. These companies are well-established, financially stable, and have a proven track record in providing innovative solutions and services in the telecommunications sector. Their diverse product portfolio spans infrastructure, devices, applications, and services, enabling them to cater to the market's evolving needs. With state-of-the-art technologies and extensive research and development capabilities, these companies are at the forefront of driving the advancement of vEPC technology.

By offering, services segment to grow at a higher CAGR during the forecast period

As organizations increasingly adopt virtualized evolved packet core solutions, they require a range of services to support their deployment and operation. These services encompass consulting, system integration, customization, training, and ongoing technical support. With the complex nature of vEPC implementations and the need for seamless integration with existing network infrastructure, businesses rely on service providers to ensure a smooth transition and optimal performance.

By network type, the 5G network segment is expected to grow at a higher CAGR during the forecast period

With the rapid adoption of 5G technology worldwide, there is a surge in demand for virtualized evolved packet core (vEPC) solutions to support the advanced capabilities of 5G networks. The 5G network segment offers unprecedented speed, ultra-low latency, and massive device connectivity, enabling transformative applications across industries. As businesses and consumers increasingly embrace the benefits of 5G, the demand for vEPC solutions tailored for 5G networks is expected to witness substantial growth, driving the overall expansion of the vEPC market.

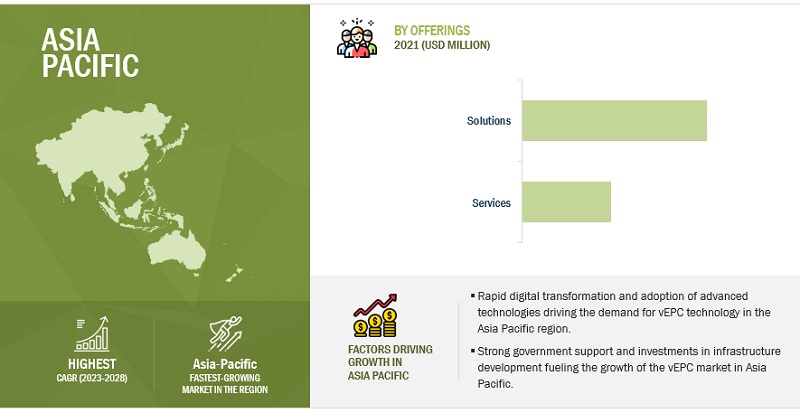

By region, Asia Pacific to grow at a higher CAGR during the forecast period

With its large population, rapid digital transformation, and increasing smartphone penetration, the region presents immense opportunities to adopt virtualized evolved packet core (vEPC) solutions. The Asia Pacific countries are actively investing in deploying 5G networks, driving the demand for vEPC infrastructure to support the next generation of wireless communication. Additionally, the region is witnessing the emergence of innovative applications and services that leverage the capabilities of vEPC, such as smart cities, industrial automation, and IoT deployments.

Virtualized Evolved Packet Core vEPC Market Companies:

The major players in the vEPC market are Nokia (Finland), Ericsson (Sweden), Cisco(US), Huawei (China), ZTE (China), Samsung (South Korea), Affirmed Networks(US), Mavenir(US), NEC(Japan), Athonet(Italy), Cumucore(Finland), Druid Software(Ireland), IPLook (China), Tech Mahindra (India), Parallel Wireless (US), Polaris Networks (US), Xingtera (US), Lemko (US), Tecore(US), and Telrad Networks (Israel). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, product launches and enhancements, and acquisitions to expand their footprint in the vEPC market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2023-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

Offering, solutions, services, network, deployment model, end-user, application, and regions |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

List of top Virtualized Evolved Packet Core (vEPC) Market Companies |

Nokia (Finland), Ericsson (Sweden), Cisco(US), Huawei (China), ZTE (China), Samsung (South Korea), Affirmed Networks(US), Mavenir(US), NEC(Japan), Athonet(Italy), Cumcore(Finland), Druid Software(Ireland), IPLook (China), Tech Mahindra (India), Parallel Wireless (US), Polaris Networks (US), Xingtera (US), Lemko (US), Tecore(US), and Telrad Networks (Israel). |

This research report categorizes the vEPC market to forecast revenues and analyze trends in each of the following submarkets:

Based on Offering:

- Solutions

- Services

Based on Solution:

- MME

- HSS

- S-GW

- PDN-GW

Based on Services:

- Professional Services

- Consulting

- Integration and Deployment

- Training and Support

- Managed Services

Based on Network

- 5G Network

- 4G Network

Based on End user:

- Telecom operators

- Enterprises

Based on Deployment mode:

- Cloud

- On-Premises

Based on Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Italy

- France

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia

- South Korea

- Rest Of Asia Pacific

-

Middle East and Africa

- KSA

- UAE

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- October 2022 - To support the development of 5G ecosystems and advance 6G research in Europe, the Smart Networks and Services Joint Undertaking (SNS JU) has chosen its initial portfolio of 35 research, innovation, and trial projects. The goal is to create a world-class European supply chain for cutting-edge 5G systems and expand Europe's 6G technology capacities with total funding for this new portfolio of about €250 million under Horizon Europe.

- September 2022 - Nokia announced its Software-as-a-Service (SaaS), AVA Charging, to support CSPs and enterprises to quickly commercialize new offerings for 5G and IoT use cases.

- October 2021 - The company launched a new set of 5G solutions to enable the evolution of all frequency bands to 5G.

- May 2019 - Ericsson cloud packet core will be employed by Vodafone Idea Limited to improve network performance. Ericsson's major network applications and features, like its Virtualization Infrastructure (NFVI), Service-Aware Policy Controller (VSAPC), and Virtual Evolved Packet Gateway (VEG) solutions, which facilitate seamless business continuity and quick rollout of new services, will be advantageous to VIL.

Frequently Asked Questions (FAQ):

What is vEPC?

vEPC, or virtual Evolved Packet Core, is a software-based implementation of the Evolved Packet Core (EPC) used in mobile networks. It replaces the traditional hardware-based EPC with virtualized network functions (VNFs) that run on standard servers or cloud infrastructure. This virtualization brings increased flexibility, scalability, and cost-efficiency to mobile network operations. vEPC enables network operators to allocate resources dynamically, scale their networks as needed, and introduce new services and applications quickly.

What is the market size of the vEPC market?

MarketsandMarkets forecasts the vEPC market size from USD 8.4 billion in 2023 to USD 19.9 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 18.7% during the forecast period.

What are the major drivers in the vEPC market?

The vEPC market is driven by the increasing demand for high-speed and reliable mobile data services, fueled by the exponential growth in data consumption and bandwidth-intensive applications. The adoption of advanced technologies such as 5G and IoT further contributes to the demand for vEPC, as it enables the deployment of these technologies with the necessary infrastructure. Cost-efficiency and scalability are additional drivers, as virtualizing network functions reduces expenses and allows for flexible resource allocation. The focus on network virtualization and SDN also drives the demand for vEPC solutions, providing operators with agility and flexibility in network operations. These drivers collectively shape the vEPC market, meeting the evolving needs of mobile networks in the digital era.

Who are the major players operating in the vEPC market?

The major players in the vEPC market are Nokia (Finland), Ericsson (Sweden), Cisco(US), Huawei (China), ZTE (China), Samsung (South Korea), Affirmed Networks(US), Mavenir(US), NEC(Japan), Athonet(Italy), Cumucore(Finland), Druid Software(Ireland), IPLook (China), Tech Mahindra (India), Parallel Wireless (US), Polaris Networks (US), Xingtera (US), Lemko (US), Tecore(US), and Telrad Networks (Israel).

Which are the key technology trends prevailing in the vEPC market?

With the increasing demand for higher data speeds, lower latency, and massive connectivity, vEPC solutions are being designed to support the requirements of 5G networks. Additionally, the integration of virtualization and software-defined networking (SDN) is another important trend. By leveraging virtualization technologies, vEPC deployments can achieve greater flexibility, scalability, and resource optimization. The convergence of vEPC with edge computing is also on the rise, enabling operators to deploy vEPC at the network edge for improved performance and reduced latency. Furthermore, the emphasis on security is a significant trend, with vEPC solutions incorporating advanced security measures to safeguard network assets and data.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing number of LTE mobile subscribers and penetration of smartphones- Growing mobile network data traffic- Need for low OPEX and CAPEX- Demand for cloud-native and service-based architecture- Differentiated 4G services via network slicingRESTRAINTS- Rising security concerns- Transition from legacy infrastructure to virtualized infrastructureOPPORTUNITIES- Growth of IoT market- Increasing adoption of 5G-ready mobile networksCHALLENGES- Lack of skilled workforce- Difficulty integrating vEPC with existing mobile core and back-office systems

- 5.3 EVOLUTION OF VEPC TECHNOLOGY

-

5.4 CASE STUDY ANALYSISGRUNDFOS ADOPTED ERICSSON’S AND TELENOR CONNEXION’S IOT SOLUTIONS TO MONITOR AND DIGITALIZE CONNECTED WATER PUMPSCASE STUDY 2: CSL ADOPTED VODAFONE MANAGED IOT CONNECTIVITY PLATFORM TO MANAGE CONNECTIVITY FROM SINGLE POINTCASE STUDY 3: ENERGYBOX ADOPTED CISCO’S INDUSTRIAL ROUTERS AND IOT OPERATIONS DASHBOARD SOLUTIONS TO HELP CUSTOMERS OPTIMIZE ENERGY USECASE STUDY 3: T-MOBILE AND SPACEX ADOPTED ADVANCED SOLUTIONS TO OFFER TEXT COVERAGE AND ‘NO DEAD ZONES’

-

5.5 TECHNOLOGY ANALYSISWI-FIWIMAXNETWORK SLICING IN RADIO ACCESS NETWORKNETWORK SLICING IN CORE NETWORKNETWORK SLICING IN TRANSPORT NETWORKLONG-TERM EVOLUTION NETWORKCITIZENS BROADBAND RADIO SERVICEMULTEFIRE

-

5.6 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America- Europe- Asia Pacific- Middle East & Africa- Latin America

-

5.7 VALUE CHAIN ANALYSISTELECOM ORIGINAL EQUIPMENT MANUFACTURERS4G LTE/5G RADIOVEPC4G LTE/5G TRANSPORTNETWORK FUNCTION VIRTUALIZATION/SOFTWARE-DEFINED NETWORKING/CLOUD SERVICE PROVIDERSSYSTEM INTEGRATORS/MANAGED SERVICE PROVIDERSEND USERS

-

5.8 ECOSYSTEM ANALYSISNETWORK INFRASTRUCTURE ENABLERSGOVERNMENT REGULATORY AUTHORITIESSYSTEM INTEGRATORSINDUSTRIAL PARTNERSSTRATEGIC CONSULTANTSORIGINAL EQUIPMENT MANUFACTURERSCUSTOMER PREMISES EQUIPMENTVIRTUALIZATION VENDORSCLOUD SERVICE PROVIDERSNEUTRAL HOST PROVIDERS

-

5.9 PATENT ANALYSIS

-

5.10 PRICING ANALYSISAVERAGE SELLING PRICE ANALYSIS FOR KEY PLAYERSPRICING ANALYSIS THROUGH VARIOUS PRICING MODELS

-

5.11 PORTER’S FIVE FORCES MODELTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY CONFERENCES & EVENTS, 2023–2024

-

5.13 TRENDS AND DISRUPTIONS IMPACTING BUYERSTRANSITION TO 5G NETWORKSNETWORK FUNCTION VIRTUALIZATION (NFV)CLOUD-NATIVE AND CONTAINERIZATIONMULTI-VENDOR INTEROPERABILITYEDGE COMPUTING AND DISTRIBUTED ARCHITECTURE

-

5.14 BEST PRACTICES IN VEPC MARKETDEFINE CLEAR OBJECTIVESCONDUCT COMPREHENSIVE PLANNINGCHOOSE RELIABLE VENDORSVALIDATE INTEROPERABILITYCONSIDER SCALABILITY AND PERFORMANCEFOCUS ON SECURITY AND PRIVACYOPTIMIZE RESOURCE UTILIZATIONIMPLEMENT REDUNDANCY AND HIGH AVAILABILITYTRAIN AND EDUCATE STAFFMONITOR AND OPTIMIZE

-

5.15 VEPC TOOLS, FRAMEWORKS, AND TECHNIQUESNETWORK FUNCTION VIRTUALIZATIONVIRTUALIZATION PLATFORMSORCHESTRATION AND MANAGEMENTSOFTWARE-DEFINED NETWORKINGCONTAINERIZATIONNETWORK SLICINGSERVICE-BASED ARCHITECTUREANALYTICS AND MONITORINGINTEGRATION AND APISSECURITY AND AUTHENTICATION

-

5.16 CURRENT AND EMERGING TRENDS OF VEPC MARKET LANDSCAPECURRENT TRENDSEMERGING TRENDS

-

5.17 FUTURE DIRECTION OF VEPC MARKET5G NETWORK EXPANSIONNETWORK SLICING AND CUSTOMIZATIONEDGE COMPUTING AND MEC INTEGRATIONCLOUD-NATIVE ARCHITECTURES AND MICROSERVICESNETWORK AUTOMATION AND AI-DRIVEN OPERATIONSENHANCED SECURITY AND PRIVACYECOSYSTEM COLLABORATION AND PARTNERSHIPSCONTINUED STANDARDIZATION EFFORTS

-

5.18 IMPACT OF VEPC MARKET ON ADJACENT NICHE TECHNOLOGIESOPEN-SOURCE SOFTWARENETWORK AUTOMATIONVIRTUAL NETWORK FUNCTIONSNETWORK MANAGEMENT AND ORCHESTRATION

-

5.19 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.1 INTRODUCTIONOFFERINGS: VEPC MARKET DRIVERS

-

6.2 SOLUTIONSRAPID EVOLUTION OF ADVANCED SOLUTIONS TO DRIVE GROWTH

-

6.3 SERVICESGROWING DEMAND FOR INTEGRATED SERVICES TO FUEL EXPANSION OF VEPC MARKET

-

7.1 INTRODUCTIONSOLUTIONS: VEPC MARKET DRIVERS

-

7.2 SOLUTIONSNEED FOR NETWORK AGILITY AND FLEXIBILITY TO DRIVE VEPC MARKETMOBILITY MANAGEMENT ENTITY (MME)HOME SUBSCRIBER SERVER (HMS)SERVING GATEWAY (SGW)PACKET DATA NETWORK GATEWAY (PDN GW)

-

8.1 INTRODUCTIONSERVICES: VEPC MARKET DRIVERS

-

8.2 PROFESSIONAL SERVICESNEED FOR OPTIMIZED NETWORK PERFORMANCE WITH SPECIALIZED VEPC SOLUTIONS TO DRIVE GROWTHCONSULTINGINTEGRATION & DEPLOYMENTTRAINING & SUPPORT

-

8.3 MANAGED SERVICESDEMAND FOR EFFICIENT NETWORK MANAGEMENT SOLUTIONS TO FUEL GROWTH

-

9.1 INTRODUCTIONDEPLOYMENT MODELS: VEPC MARKET DRIVERS

-

9.2 ON-PREMISESDEMAND FOR INCREASED LOCALIZED CONTROL TO DRIVE ADOPTION OF ON-PREMISES DEPLOYMENT MODEL

-

9.3 CLOUDNEED FOR SEAMLESS SCALABILITY AND AGILITY TO DRIVE ADOPTION OF CLOUD SOLUTIONS

-

10.1 INTRODUCTIONNETWORK TYPES: VEPC MARKET DRIVERS

-

10.2 4G NETWORKRAPID 4G ADOPTION TO PROPEL POPULARITY OF VEPC SOLUTIONS

-

10.3 5G NETWORKNEED FOR HIGH-SPEED 5G APPLICATIONS TO BOOST ADOPTION OF VEPC SOLUTIONS AND SERVICES

-

11.1 INTRODUCTIONEND USERS: VEPC MARKET DRIVERS

-

11.2 TELECOM OPERATORSINCREASED FOCUS ON LEVERAGING ADVANCED NETWORK CAPABILITIES TO DRIVE MARKET

-

11.3 ENTERPRISESRISING ADOPTION OF ADVANCED CONNECTIVITY SOLUTIONS TO ENCOURAGE GROWTH

-

12.1 INTRODUCTIONAPPLICATIONS: VEPC MARKET DRIVERS

-

12.2 LTE, VOLTE, AND VOWI-FINEED TO ENABLE SEAMLESS VOICE COMMUNICATION OVER WI-FI NETWORKS TO EXPAND MARKET

-

12.3 BROADBAND WIRELESS ACCESSPOPULARITY OF HIGH-SPEED WIRELESS CONNECTIVITY IN NEW MARKETS TO DRIVE GROWTH

-

12.4 IOT AND M2MGROWING FOCUS ON ACHIEVING CONNECTIVITY BETWEEN INTERCONNECTED DEVICES AND APPLICATIONS TO DRIVE MARKET

- 13.1 INTRODUCTION

-

13.2 NORTH AMERICANORTH AMERICA: VEPC MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Growing demand for advanced networking solutions and 5G infrastructure deployment to drive growth- US: Regulatory NormsCANADA- Growing need for advanced network capabilities to fuel vEPC market- Canada: Regulatory Norms

-

13.3 EUROPEEUROPE: VEPC MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Rising demand for seamless connectivity and advanced 5G networks to boost market- UK: Regulatory NormsGERMANY- Rising digital transformation to propel growth- Germany: Regulatory NormsITALY- Need for improved network performance and high-speed connectivity to drive growth- Italy: Regulatory NormsFRANCE- Robust growth of advanced connectivity solutions to propel market- France: Regulatory NormsSPAIN- Rising demand for high-speed and reliable connectivity to drive market- Spain: Regulatory NormsREST OF EUROPE

-

13.4 ASIA PACIFICASIA PACIFIC: VEPC MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Growth in government-led digital transformation to drive market expansion- China: Regulatory NormsJAPAN- Focus on technological advancements to drive adoption of vEPC solutions- Japan: Regulatory NormsAUSTRALIA- Need to leverage LTE networks and offer high-speed connectivity to propel growth- Australia: Regulatory NormsSOUTH KOREA- Country’s commitment to digital transformation to propel growth- South Korea: Regulatory NormsREST OF ASIA PACIFIC

-

13.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: VEPC MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTKSA- Growing demand for advanced network solutions to boost growth- KSA: Regulatory NormsUAE- Use of emerging technologies, such as IoT and big data, to propel demandSOUTH AFRICA- Need for digital infrastructure development and expansion of mobile networks to drive market- South Africa: Regulatory NormsREST OF MIDDLE EAST & AFRICA

-

13.6 LATIN AMERICALATIN AMERICA: VEPC MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Growth in country’s telecom industry to boost growth- Brazil: Regulatory NormsMEXICO- Government’s efforts to enhance digital connectivity to fuel vEPC market- Mexico: Regulatory NormsREST OF LATIN AMERICA

- 14.1 INTRODUCTION

- 14.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 14.3 REVENUE ANALYSIS OF KEY PLAYERS

-

14.4 MARKET SHARE ANALYSIS FOR KEY PLAYERSINTRODUCTION

-

14.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

14.6 COMPETITIVE BENCHMARKING FOR KEY PLAYERSPRODUCT PORTFOLIO AND BUSINESS STRATEGY ANALYSIS OF VEPC VENDORS

-

14.7 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

14.8 COMPETITIVE BENCHMARKING FOR STARTUPS/SMESPRODUCT PORTFOLIO AND BUSINESS STRATEGY ANALYSIS OF STARTUP VENDORS

-

14.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

- 15.1 INTRODUCTION

-

15.2 KEY PLAYERSERICSSON- Business overview- Solutions/Services offered- Recent developments- MnM viewHUAWEI- Business overview- Solutions/Services offered- Recent developments- MnM viewNOKIA- Business overview- Solutions/Services offered- Recent developments- MnM viewZTE- Business overview- Solutions/Services offered- Recent developments- MnM viewCISCO- Business overview- Solutions/Services offered- Recent developments- MnM viewAFFIRMED NETWORKS- Business overview- Solutions/Services offered- Recent developments- MnM viewMAVENIR- Business overview- Solutions/Services offered- Recent developmentsSAMSUNG- Business overview- Solutions/Services offered- Recent developmentsATHONET- Business overview- Solutions/Services offered- Recent developmentsNEC- Business overview- Solutions/Services offered- Recent developmentsCUMUCOREDRUID SOFTWAREIPLOOKTECH MAHINDRAPARALLEL WIRELESSPOLARIS NETWORKSXINGTERALEMKOTECORETELRAD NETWORKS

-

16.1 5G SERVICES MARKETMARKET DEFINITION5G SERVICES MARKET, BY END USER5G SERVICES MARKET, BY COMMUNICATION TYPE5G SERVICES MARKET, BY ENTERPRISE5G SERVICES MARKET, BY REGION

-

16.2 NANOSATELLITE AND MICROSATELLITE MARKETMARKET DEFINITIONNANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENTNANOSATELLITE AND MICROSATELLITE MARKET, BY TYPENANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZENANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATIONNANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICALNANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2019–2021

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 EMERGING USE CASES SUPPORTED BY NETWORK SLICING

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 TOP TWENTY 4G PATENT OWNERS (US)

- TABLE 9 LIST OF CONFERENCES & EVENTS, 2023–2024

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PROFESSIONAL SERVICES

- TABLE 11 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 12 VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 13 VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 14 SOLUTIONS: VEPC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 15 SOLUTIONS: VEPC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 16 SERVICES: VEPC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 17 SERVICES: VEPC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 19 VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 20 VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 21 VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 22 PROFESSIONAL SERVICES: VEPC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 23 PROFESSIONAL SERVICES: VEPC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 CONSULTING: VEPC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 25 CONSULTING: VEPC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 INTEGRATION & DEPLOYMENT: VEPC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 27 INTEGRATION & DEPLOYMENT: VEPC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 TRAINING & SUPPORT: VEPC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 29 TRAINING & SUPPORT: VEPC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 MANAGED SERVICES: VEPC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 31 MANAGED SERVICES: VEPC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 33 VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 34 ON-PREMISES: VEPC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 35 ON-PREMISES: VEPC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 CLOUD: VEPC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 37 CLOUD: VEPC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 39 VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 40 4G NETWORK: VEPC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 41 4G NETWORK: VEPC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 5G NETWORK: VEPC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 5G NETWORK: VEPC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 45 VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 46 TELECOM OPERATORS: VEPC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 47 TELECOM OPERATORS: VEPC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 ENTERPRISES: VEPC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 ENTERPRISES: VEPC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 VEPC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 51 VEPC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 53 NORTH AMERICA: VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 55 NORTH AMERICA: VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 57 NORTH AMERICA: VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 59 NORTH AMERICA: VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 61 NORTH AMERICA: VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: VEPC MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: VEPC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 66 US: VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 67 US: VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 68 US: VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 69 US: VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 70 US: VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 71 US: VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 72 US: VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 73 US: VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 74 US: VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 75 US: VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 76 US: VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 77 US: VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 78 CANADA: VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 79 CANADA: VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 80 CANADA: VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 81 CANADA: VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 82 CANADA: VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 83 CANADA: VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 84 CANADA: VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 85 CANADA: VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 86 CANADA: VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 87 CANADA: VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 88 CANADA: VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 89 CANADA: VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 91 EUROPE: VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 92 EUROPE: VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 93 EUROPE: VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 95 EUROPE: VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 96 EUROPE: VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 97 EUROPE: VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 99 EUROPE: VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 100 EUROPE: VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 101 EUROPE: VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 102 EUROPE: VEPC MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 103 EUROPE: VEPC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 104 UK: VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 105 UK: VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 106 UK: VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 107 UK: VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 108 UK: VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 109 UK: VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 110 UK: VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 111 UK: VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 112 UK: VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 113 UK: VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 114 UK: VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 115 UK: VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 116 GERMANY: VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 117 GERMANY: VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 118 GERMANY: VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 119 GERMANY: VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 120 GERMANY: VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 121 GERMANY: VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 122 GERMANY: VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 123 GERMANY: VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 124 GERMANY: VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 125 GERMANY: VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 126 GERMANY: VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 127 GERMANY: VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 128 ITALY: VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 129 ITALY: VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 130 ITALY: VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 131 ITALY: VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 132 ITALY: VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 133 ITALY: VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 134 ITALY: VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 135 ITALY: VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 136 ITALY: VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 137 ITALY: VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 138 ITALY: VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 139 ITALY: VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 140 FRANCE: VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 141 FRANCE: VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 142 FRANCE: VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 143 FRANCE: VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 144 FRANCE: VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 145 FRANCE: VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 146 FRANCE: VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 147 FRANCE: VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 148 FRANCE: VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 149 FRANCE: VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 150 FRANCE: VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 151 FRANCE: VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 152 SPAIN: VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 153 SPAIN: VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 154 SPAIN: VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 155 SPAIN: VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 156 SPAIN: VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 157 SPAIN: VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 158 SPAIN: VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 159 SPAIN: VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 160 SPAIN: VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 161 SPAIN: VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 162 SPAIN: VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 163 SPAIN: VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 164 ASIA PACIFIC: VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 165 ASIA PACIFIC: VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 166 ASIA PACIFIC: VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 167 ASIA PACIFIC: VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 168 ASIA PACIFIC: VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 169 ASIA PACIFIC: VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 170 ASIA PACIFIC: VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 171 ASIA PACIFIC: VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 172 ASIA PACIFIC: VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 173 ASIA PACIFIC: VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 174 ASIA PACIFIC: VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 175 ASIA PACIFIC: VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 176 ASIA PACIFIC: VEPC MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 177 ASIA PACIFIC: VEPC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 178 CHINA: VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 179 CHINA: VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 180 CHINA: VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 181 CHINA: VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 182 CHINA: VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 183 CHINA: VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 184 CHINA: VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 185 CHINA: VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 186 CHINA: VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 187 CHINA: VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 188 CHINA: VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 189 CHINA: VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 190 JAPAN: VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 191 JAPAN: VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 192 JAPAN: VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 193 JAPAN: VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 194 JAPAN: VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 195 JAPAN: VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 196 JAPAN: VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 197 JAPAN: VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 198 JAPAN: VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 199 JAPAN: VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 200 JAPAN: VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 201 JAPAN: VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 202 AUSTRALIA: VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 203 AUSTRALIA: VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 204 AUSTRALIA: VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 205 AUSTRALIA: VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 206 AUSTRALIA: VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 207 AUSTRALIA: VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 208 AUSTRALIA: VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 209 AUSTRALIA: VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 210 AUSTRALIA: VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 211 AUSTRALIA: VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 212 AUSTRALIA: VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 213 AUSTRALIA: VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 214 SOUTH KOREA: VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 215 SOUTH KOREA: VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 216 SOUTH KOREA: VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 217 SOUTH KOREA: VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 218 SOUTH KOREA: VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 219 SOUTH KOREA: VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 220 SOUTH KOREA: VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 221 SOUTH KOREA: VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 222 SOUTH KOREA: VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 223 SOUTH KOREA: VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 224 SOUTH KOREA: VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 225 SOUTH KOREA: VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: VEPC MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: VEPC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 240 KSA: VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 241 KSA: VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 242 KSA: VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 243 KSA: VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 244 KSA: VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 245 KSA: VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 246 KSA: VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 247 KSA: VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 248 KSA: VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 249 KSA: VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 250 KSA: VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 251 KSA: VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 252 UAE: VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 253 UAE: VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 254 UAE: VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 255 UAE: VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 256 UAE: VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 257 UAE: VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 258 UAE: VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 259 UAE: VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 260 UAE: VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 261 UAE: VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 262 UAE: VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 263 UAE: VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 264 SOUTH AFRICA: VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 265 SOUTH AFRICA: VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 266 SOUTH AFRICA: VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 267 SOUTH AFRICA: VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 268 SOUTH AFRICA: VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 269 SOUTH AFRICA: VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 270 SOUTH AFRICA: VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 271 SOUTH AFRICA: VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 272 SOUTH AFRICA: VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 273 SOUTH AFRICA: VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 274 SOUTH AFRICA: VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 275 SOUTH AFRICA: VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 276 LATIN AMERICA: VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 277 LATIN AMERICA: VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 278 LATIN AMERICA: VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 279 LATIN AMERICA: VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 280 LATIN AMERICA: VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 281 LATIN AMERICA: VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 282 LATIN AMERICA: VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 283 LATIN AMERICA: VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 284 LATIN AMERICA: VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 285 LATIN AMERICA: VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 286 LATIN AMERICA: VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 287 LATIN AMERICA: VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 288 LATIN AMERICA: VEPC MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 289 LATIN AMERICA: VEPC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 290 BRAZIL: VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 291 BRAZIL: VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 292 BRAZIL: VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 293 BRAZIL: VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 294 BRAZIL: VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 295 BRAZIL: VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 296 BRAZIL: VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 297 BRAZIL: VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 298 BRAZIL: VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 299 BRAZIL: VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 300 BRAZIL: VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 301 BRAZIL: VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 302 MEXICO: VEPC MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 303 MEXICO: VEPC MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 304 MEXICO: VEPC MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 305 MEXICO: VEPC MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 306 MEXICO: VEPC MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 307 MEXICO: VEPC MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 308 MEXICO: VEPC MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 309 MEXICO: VEPC MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 310 MEXICO: VEPC MARKET, BY NETWORK TYPE, 2018–2022 (USD MILLION)

- TABLE 311 MEXICO: VEPC MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 312 MEXICO: VEPC MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 313 MEXICO: VEPC MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 314 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 315 COMPETITIVE BENCHMARKING FOR KEY PLAYERS

- TABLE 316 BUSINESS STRATEGY ANALYSIS FOR KEY VEPC VENDORS

- TABLE 317 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES

- TABLE 318 BUSINESS STRATEGY ANALYSIS FOR STARTUPS/SMES

- TABLE 319 VEPC MARKET: PRODUCT LAUNCHES, 2019–2022

- TABLE 320 VEPC MARKET: DEALS, 2020–2022

- TABLE 321 ERICSSON: BUSINESS OVERVIEW

- TABLE 322 ERICSSON: SOLUTIONS/SERVICES OFFERED

- TABLE 323 ERICSSON: DEALS

- TABLE 324 HUAWEI: BUSINESS OVERVIEW

- TABLE 325 HUAWEI: SOLUTIONS/SERVICES OFFERED

- TABLE 326 HUAWEI: DEALS

- TABLE 327 HUAWEI: PRODUCT LAUNCHES

- TABLE 328 NOKIA: BUSINESS OVERVIEW

- TABLE 329 NOKIA: SOLUTIONS/SERVICES OFFERED

- TABLE 330 NOKIA: DEALS

- TABLE 331 ZTE: BUSINESS OVERVIEW

- TABLE 332 ZTE: SOLUTIONS/SERVICES OFFERED

- TABLE 333 ZTE: DEALS

- TABLE 334 CISCO: BUSINESS OVERVIEW

- TABLE 335 CISCO: SOLUTIONS/SERVICES OFFERED

- TABLE 336 CISCO: DEALS

- TABLE 337 AFFIRMED NETWORKS: BUSINESS OVERVIEW

- TABLE 338 AFFIRMED NETWORKS: SOLUTIONS/SERVICES OFFERED

- TABLE 339 AFFIRMED NETWORKS: DEALS

- TABLE 340 MAVENIR: BUSINESS OVERVIEW

- TABLE 341 MAVENIR: SOLUTIONS/SERVICES OFFERED

- TABLE 342 MAVENIR: DEALS

- TABLE 343 SAMSUNG: BUSINESS OVERVIEW

- TABLE 344 SAMSUNG: SOLUTIONS/SERVICES OFFERED

- TABLE 345 SAMSUNG: DEALS

- TABLE 346 ATHONET: BUSINESS OVERVIEW

- TABLE 347 ATHONET: SOLUTIONS/SERVICES OFFERED

- TABLE 348 ATHONET: DEALS

- TABLE 349 NEC: BUSINESS OVERVIEW

- TABLE 350 NEC: SOLUTIONS/SERVICES OFFERED

- TABLE 351 NEC: DEALS

- TABLE 352 5G SERVICES MARKET, BY END USER, 2020–2027 (USD BILLION)

- TABLE 353 CONSUMERS: 5G SERVICES MARKET, BY REGION, 2020–2027 (USD BILLION)

- TABLE 354 ENTERPRISES: 5G SERVICES MARKET, BY REGION, 2020–2027 (USD BILLION)

- TABLE 355 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

- TABLE 356 FIXED WIRELESS ACCESS: 5G SERVICES MARKET, BY REGION, 2020–2027 (USD BILLION)

- TABLE 357 ENHANCED MOBILE BROADBAND: 5G SERVICES MARKET, BY REGION, 2020–2027 (USD BILLION)

- TABLE 358 MASSIVE MACHINE-TYPE COMMUNICATIONS: 5G SERVICES MARKET, BY REGION, 2020–2027 (USD BILLION)

- TABLE 359 ULTRA-RELIABLE LOW LATENCY: 5G SERVICES MARKET, BY REGION, 2020–2027 (USD BILLION)

- TABLE 360 5G SERVICES MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

- TABLE 361 NORTH AMERICA: 5G SERVICES MARKET, BY END USER, 2020–2027 (USD BILLION)

- TABLE 362 NORTH AMERICA: 5G SERVICES MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

- TABLE 363 NORTH AMERICA: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

- TABLE 364 NORTH AMERICA: 5G SERVICES MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

- TABLE 365 EUROPE: 5G SERVICES MARKET, BY END USER, 2020–2027 (USD BILLION)

- TABLE 366 EUROPE: 5G SERVICES MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

- TABLE 367 EUROPE: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

- TABLE 368 EUROPE: 5G SERVICES MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

- TABLE 369 ASIA PACIFIC: 5G SERVICES MARKET, BY END USER, 2020–2027 (USD BILLION)

- TABLE 370 ASIA PACIFIC: 5G SERVICES MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

- TABLE 371 ASIA PACIFIC: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

- TABLE 372 ASIA PACIFIC: 5G SERVICES MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

- TABLE 373 MIDDLE EAST & AFRICA: 5G SERVICES MARKET, BY END USER, 2020–2027 (USD BILLION)

- TABLE 374 MIDDLE EAST & AFRICA: 5G SERVICES MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

- TABLE 375 MIDDLE EAST & AFRICA: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

- TABLE 376 MIDDLE EAST & AFRICA: 5G SERVICES MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

- TABLE 377 LATIN AMERICA: 5G SERVICES MARKET, BY END USER, 2020–2027 (USD BILLION)

- TABLE 378 LATIN AMERICA: 5G SERVICES MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

- TABLE 379 LATIN AMERICA: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

- TABLE 380 LATIN AMERICA: 5G SERVICES MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

- TABLE 381 NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 382 NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 383 NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 384 NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 385 NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 386 NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 387 NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 388 NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 389 NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 390 NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 391 NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2017–2021 (USD MILLION)

- TABLE 392 NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2022–2027 (USD MILLION)

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 VEPC MARKET: APPROACHES EMPLOYED

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1 (SUPPLY-SIDE) ANALYSIS: REVENUE FROM SOLUTIONS AND SERVICES OF VEPC MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE OF VEPC VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: ILLUSTRATION OF ERICSSON’S VEPC REVENUE ESTIMATION

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 2 (DEMAND-SIDE): MARKET ESTIMATION THROUGH END USERS

- FIGURE 8 VEPC MARKET: OVERVIEW SNAPSHOT

- FIGURE 9 VEPC MARKET: GROWTH TRENDS

- FIGURE 10 ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 11 INCREASING DEMAND FOR ENHANCED MOBILE BROADBAND SERVICES TO DRIVE MARKET

- FIGURE 12 SOLUTIONS AND CLOUD SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARE OF NORTH AMERICAN VEPC MARKET IN 2023

- FIGURE 13 SOLUTIONS AND CLOUD SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARE OF EUROPEAN VEPC MARKET IN 2023

- FIGURE 14 SOLUTIONS AND CLOUD SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARE OF ASIA PACIFIC VEPC MARKET IN 2023

- FIGURE 15 VEPC MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 VALUE CHAIN ANALYSIS

- FIGURE 17 ECOSYSTEM MAP

- FIGURE 18 TOP TEN COMPANIES WITH HIGHEST NUMBER OF 4G PATENT APPLICATIONS

- FIGURE 19 NUMBER OF 4G PATENTS GRANTED ANNUALLY, 2012–2021

- FIGURE 20 STANDARD ESSENTIAL 5G PATENTS GRANTED

- FIGURE 21 PORTER’S FIVE FORCES MODEL

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PROFESSIONAL SERVICES

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE PROFESSIONAL SERVICES

- FIGURE 24 SERVICES SEGMENT TO EXHIBIT HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 25 MANAGED SERVICES SEGMENT TO ACHIEVE HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 26 CLOUD SEGMENT TO EXHIBIT HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 27 5G NETWORK SEGMENT TO ACCOUNT FOR LARGER SHARE BY 2028

- FIGURE 28 ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 29 ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 30 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 32 REVENUE ANALYSIS FOR KEY PLAYERS

- FIGURE 33 MARKET SHARE ANALYSIS FOR KEY PLAYERS

- FIGURE 34 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023

- FIGURE 35 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2023

- FIGURE 36 ERICSSON: COMPANY SNAPSHOT

- FIGURE 37 HUAWEI: COMPANY SNAPSHOT

- FIGURE 38 NOKIA: COMPANY SNAPSHOT

- FIGURE 39 ZTE: COMPANY SNAPSHOT

- FIGURE 40 CISCO: COMPANY SNAPSHOT

- FIGURE 41 SAMSUNG: COMPANY SNAPSHOT

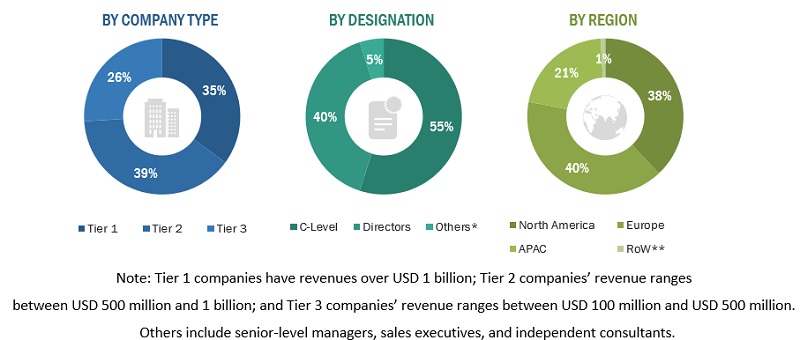

This research study involved extensive secondary sources, directories, and databases, such as D&B Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for this technical, market-oriented, and commercial study of the global vEPC market. The primary sources were several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, Service Providers (SPs), technology developers, alliances, and organizations related to all the segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information and assess prospects.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for the study. These included journals, annual reports, press releases, investor presentations of companies and white papers, certified publications, and articles from recognized associations and government publishing sources. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the vEPC market. The primary sources from the demand side included consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the vEPC market. The first approach involved estimating the market size by summating companies’ and countries investments through vEPC solutions.

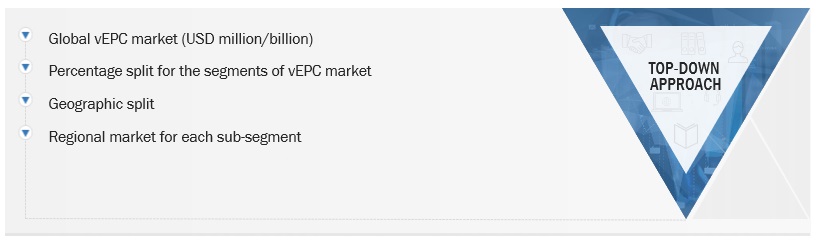

Both top-down and bottom-up approaches were used to estimate and validate the total size of the vEPC market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

vEPC Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

vEPC Market Size: Top-Down Approach

Data Triangulation

The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

vEPC, short for virtualized Evolved Packet Core, is a software-based network architecture that virtualizes the key functions of a traditional Evolved Packet Core (EPC) used in mobile networks. It is designed to provide the necessary packet switching, mobility management, and policy control functions to operate mobile networks efficiently. By virtualizing these functions, vEPC enables network operators to leverage cloud computing and virtualization technologies to achieve greater flexibility, scalability, and cost efficiency in deploying and managing their mobile networks. It allows for separating hardware and software, enabling network functions to be deployed on standard servers or cloud infrastructure.

Key Stakeholders

- Satellite Operators

- Mobile Operators

- Government Organizations

- Investors and Venture Capitalists

- Government and Financial Institutions

- Research Institutes and Organizations

Report Objectives

- To determine and forecast the global vEPC market based on offering, solutions, services, network, deployment model, end user, application and regions from 2023 to 2028.

- To forecast the size of the market’s segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, Middle East & Africa (MEA)

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

- To strategically analyze macro and micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze industry trends, regulatory landscape, and patents & innovations related to the market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the vEPC market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers and acquisitions, a new product launched and product developments, partnerships, agreements, and collaborations, business expansions, and Research & Development (R&D) activities, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Virtualized Evolved Packet Core (vEPC) Market